USDJPY Analysis

USDJPY is moving in Ascending channel and market has reached higher low area of the channel

Although it finds it difficult to profit from the slight uptick, the USD/JPY pair attracts some dip buying on Tuesday and continues to trade below its highest level since November 2022, which was touched last week. Spot prices are up less than 0.10% on the day, trading in the 147.70 region as traders watch with interest the main central bank event risks of the week. On Wednesday, the Federal Reserve (Fed) is expected to make an announcement regarding its decision, which is expected to keep things as they are. The US Federal Reserve will likely maintain its hawkish position and keep interest rates higher for an extended period of time, according to market participants. High US Treasury bond yields are expected to continue to be supportive, which helps the US Dollar (USD) maintain its support and prevents the currency from correcting its six-month peak decline. That said, traders are hesitant to make new bullish bets on the major due to rumours that the Bank of Japan (BoJ) will soon abandon its dovish stance. In an interview with the Yomiuri newspaper, BoJ Governor Kazuo Ueda stated that one option available to the central bank is to stop negative interest rates if it gains confidence in the sustainable growth of prices and wages. Consequently, this reduced wagers that the BoJ would abandon its extremely loose stance.

Therefore, the BoJ policy meeting on Friday will also be in the spotlight. Any forward guidance on when the Japanese central bank will end its negative interest rate policy will be closely watched by investors. This will therefore have a significant impact on the JPY and give the USD/JPY pair new direction. To seize short-term opportunities, traders on Tuesday may be inspired by the US housing market data, specifically Building Permits and Housing Starts. Technically speaking, given the recent run-up to a multi-month peak, the rangebound price movements of the last two weeks or so could still be classified as a bullish consolidation phase. Consequently, this implies that the USD/JPY pair’s path of least resistance is upward. It will still be wise to hold off on positioning for additional gains until there is a breakout through the trading range resistance, which is located just ahead of the 148.00 mark.

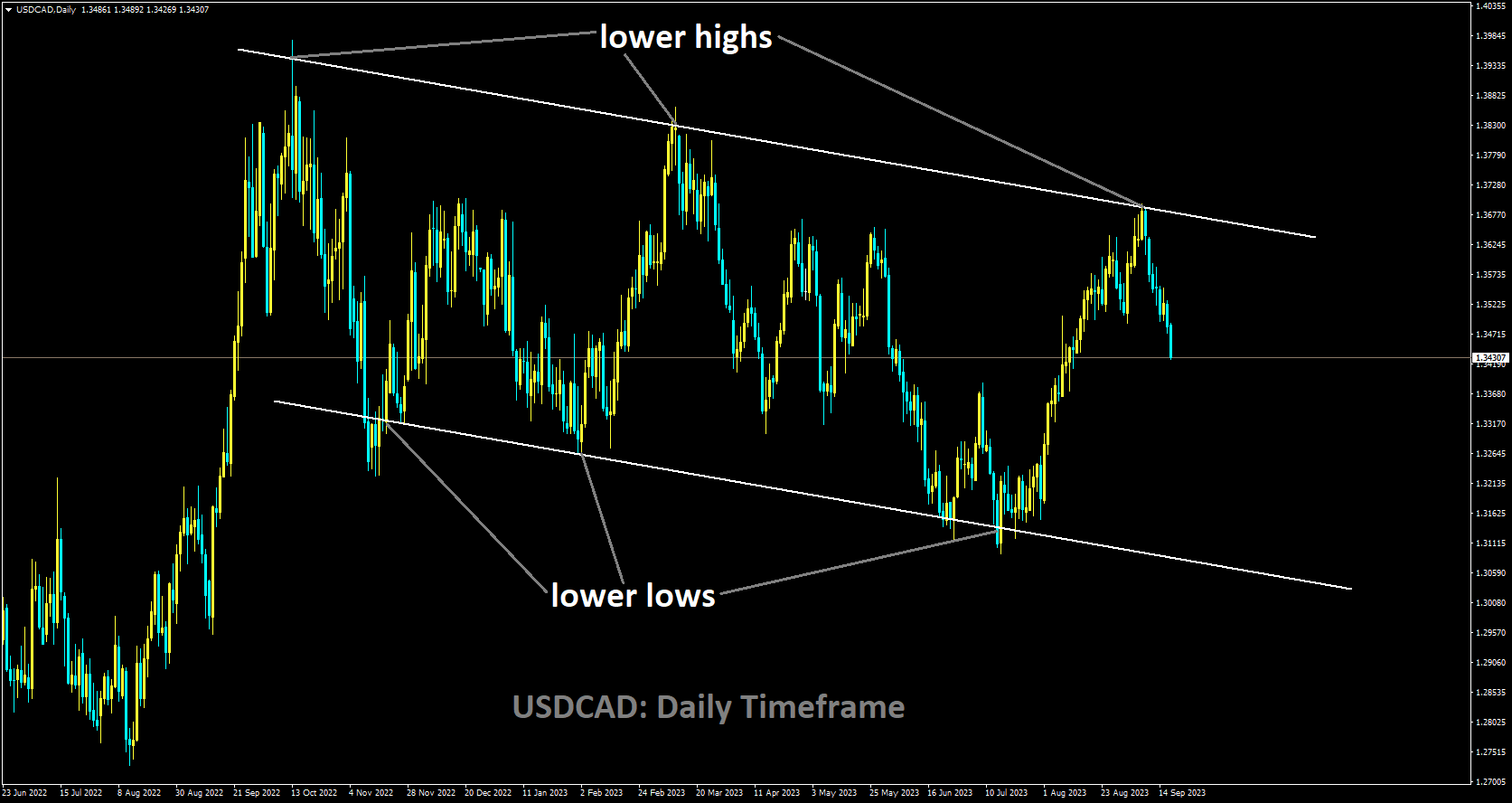

USDCAD Analysis

USDCAD is moving in Descending channel and market has fallen from the lower high area of the channel

During Tuesday’s Asian session, the USD/CAD pair moves in a narrow range and consolidates its recent losses to surpass a one-month low, which was touched the day before in the 1.3470 region. Spot prices, however, hold above a 200-day Simple Moving Average (SMA) that is technically significant and is currently positioned in the 1.3460–1.3455 range as traders eagerly await the outcome of the much-awaited FOMC monetary policy meeting. Wednesday is the Federal Reserve’s (Fed) scheduled announcement date. It is widely expected that the Fed will stick with its current course, which keeps the US Dollar (USD) weaker than it was six months ago. Meanwhile, worries about reduced global supplies and optimism for a rebound in fuel demand in China, the world’s largest oil importer, have helped drive crude oil prices to their highest level since November 2022. This therefore serves as support for the Loonie, which is correlated with commodities, and a drag on the USD/CAD pair.

Nonetheless, there is growing consensus that the Fed will maintain its aggressive stance and raise interest rates for an extended period of time in response to persistently high inflation. The outlook helps prevent any significant downside for the dollar and continues to be supportive of high US Treasury bond yields. Investors may also decide to hold off on making any moves regarding the Fed’s potential rate-hike schedule. Thus, the “dot plot” and inflation forecasts will continue to be the main topics of discussion, in addition to Fed Chair Jerome Powell’s remarks made during the press conference on Wednesday following the meeting. The most recent Canadian consumer inflation data, which are scheduled for release later in the early North American session, will be of interest to traders on Tuesday. Building Permits and Housing Starts are two housing market statistics that are included in the US economic docket. This combined with the dynamics of oil prices may enable traders to seize short-term opportunities before the crucial central bank event risk materialises. This event will be crucial in propelling the demand for USD in the near run and identifying the next leg of a directional move for the USD/CAD pair.

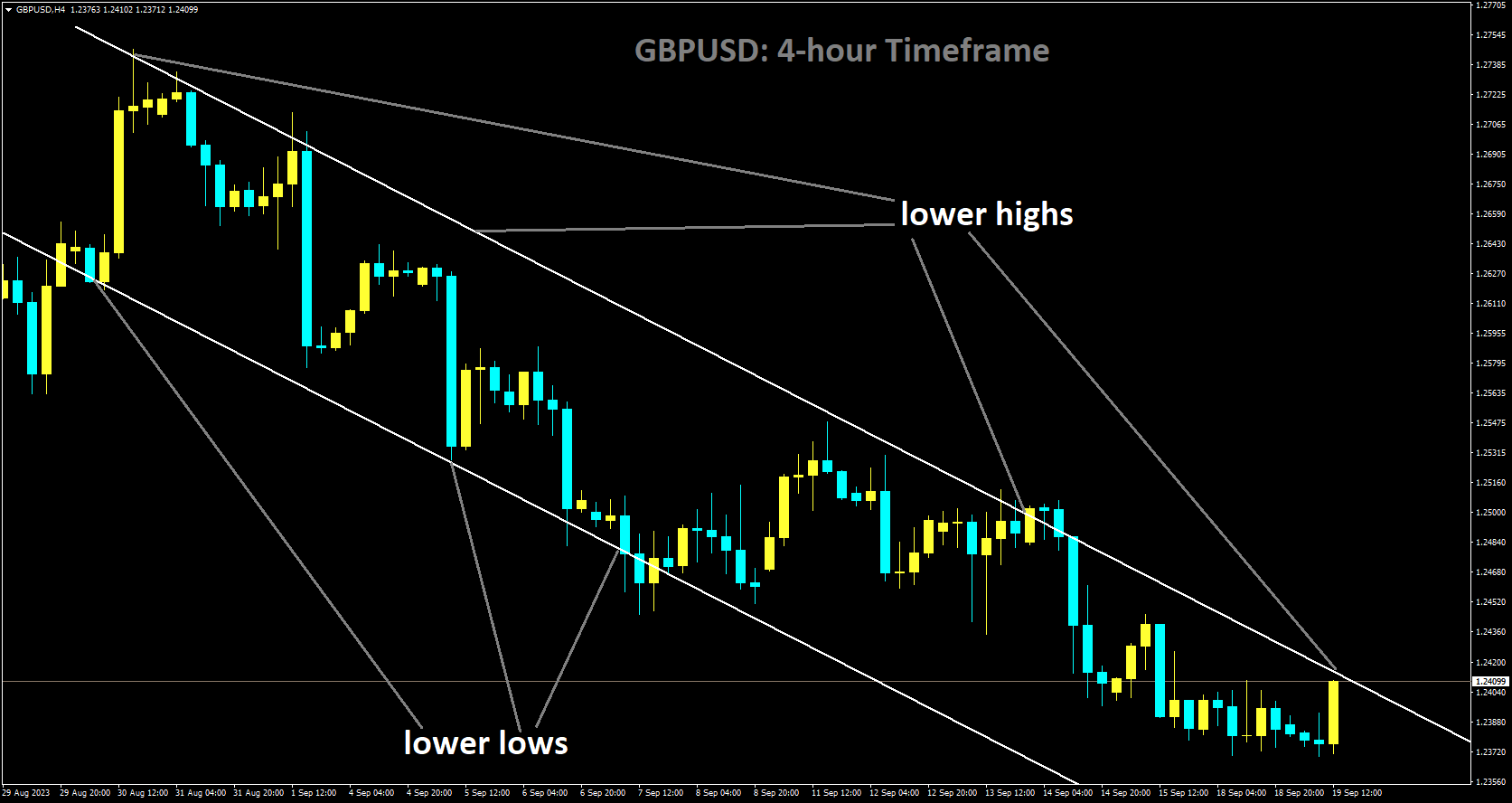

GBPUSD Analysis

GBPUSD is moving in Descending channel and market has reached lower high area of the channel

We are seeking a pick-up in impairments across the financial sector from a very low base, stated Bank of England Deputy Governor Sam Woods on Tuesday. We are keeping an eye on the commercial real estate market, especially in China. The way that banks are exposed to China’s real estate market interests us.

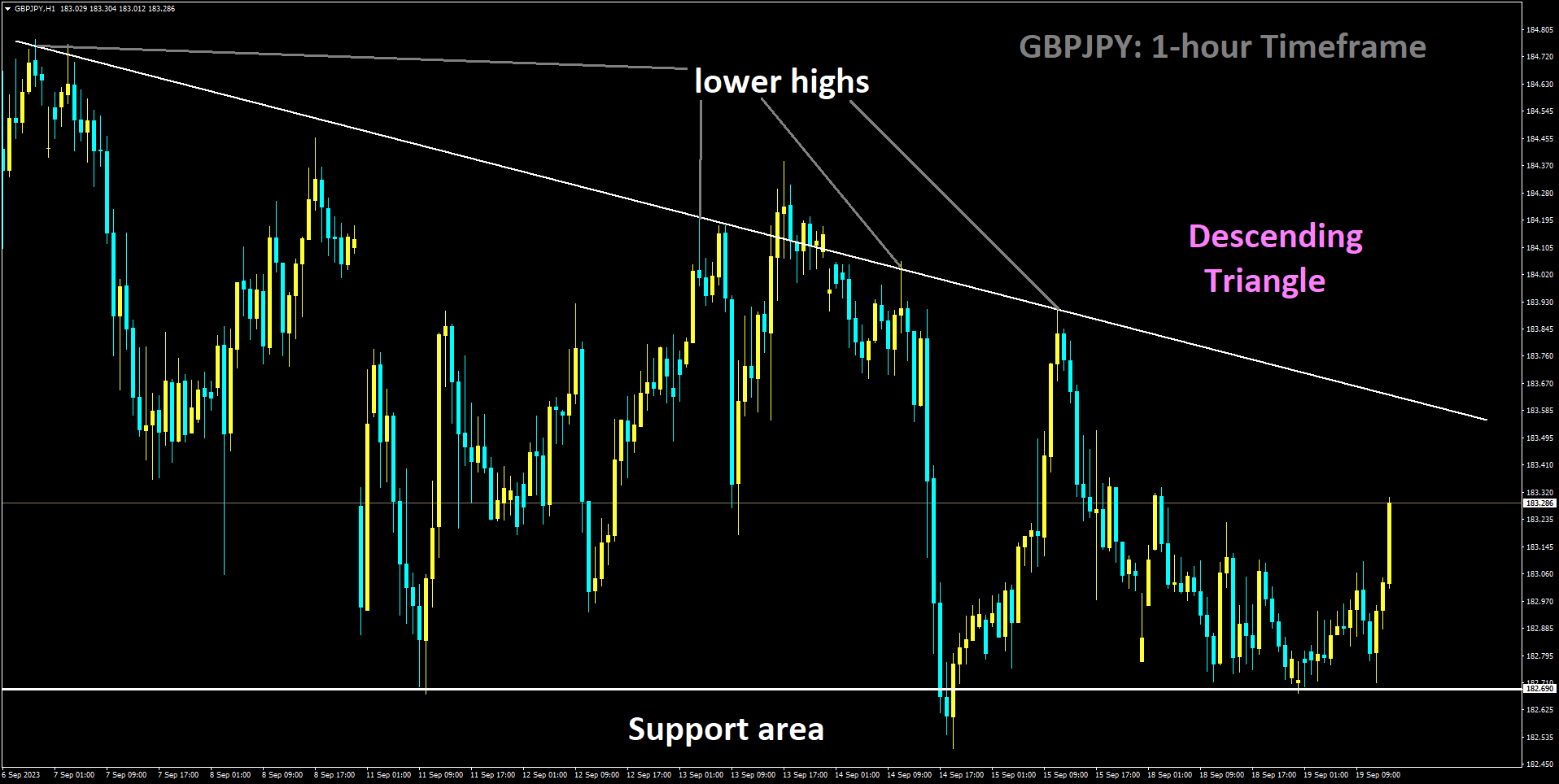

GBPJPY Analysis

GBPJPY is moving in Descending Triangle and market has rebounded from the support area of the pattern

During Tuesday’s early European session, the GBP/JPY cross oscillates in a narrow range below the 183.00 region. Ahead of the Bank of Japan (BoJ) meeting on Friday, market participants are awaiting the Bank of England’s (BoE) interest rate decision on Thursday. These important occurrences might be the cause of the market’s volatility. At the moment, the cross is trading at about 182.91, up 0.07% for the day. At its meeting on Thursday, traders expect the Bank of England (BoE) to hike interest rates from 5.25% to 5.5%. Governor Andrew Bailey’s claim earlier this month that the BoE is getting closer to ending its tightening cycle was validated by the UK economic data released last week. Moreover, the BoE may face pressure to end its rate-hiking cycle due to concerns about a recession brought on by aggressive rate hikes.

Regarding the Japanese Yen, the Bank of Japan would prefer to hold off until further information is available regarding Japan’s ability to weather the effects of slowing demand from the US and China. The governor of the Bank of Japan, Kazuo Ueda, said last week that the central bank may decide to end its negative interest rate policy when it approaches its 2% inflation target and that by year’s end, they would have enough data to determine whether or not interest rates should remain negative. The BOJ is expected to keep its 10-year bond yield target of approximately 0% and its short-term interest rate target of -0.1% at its meeting on Friday. At his press conference following the meeting, Governor Kazuo Ueda is expected to provide fresh clues to the market about when a policy change may be made. Wednesday will see the release of the UK Consumer Price Index for August later this week. Investors’ focus will be directed towards the monetary policy meetings of the BoE and BoJ, which are scheduled for this Thursday and Friday, respectively. These developments will serve as indicators for traders, who will look for trading opportunities near the GBP/JPY cross.

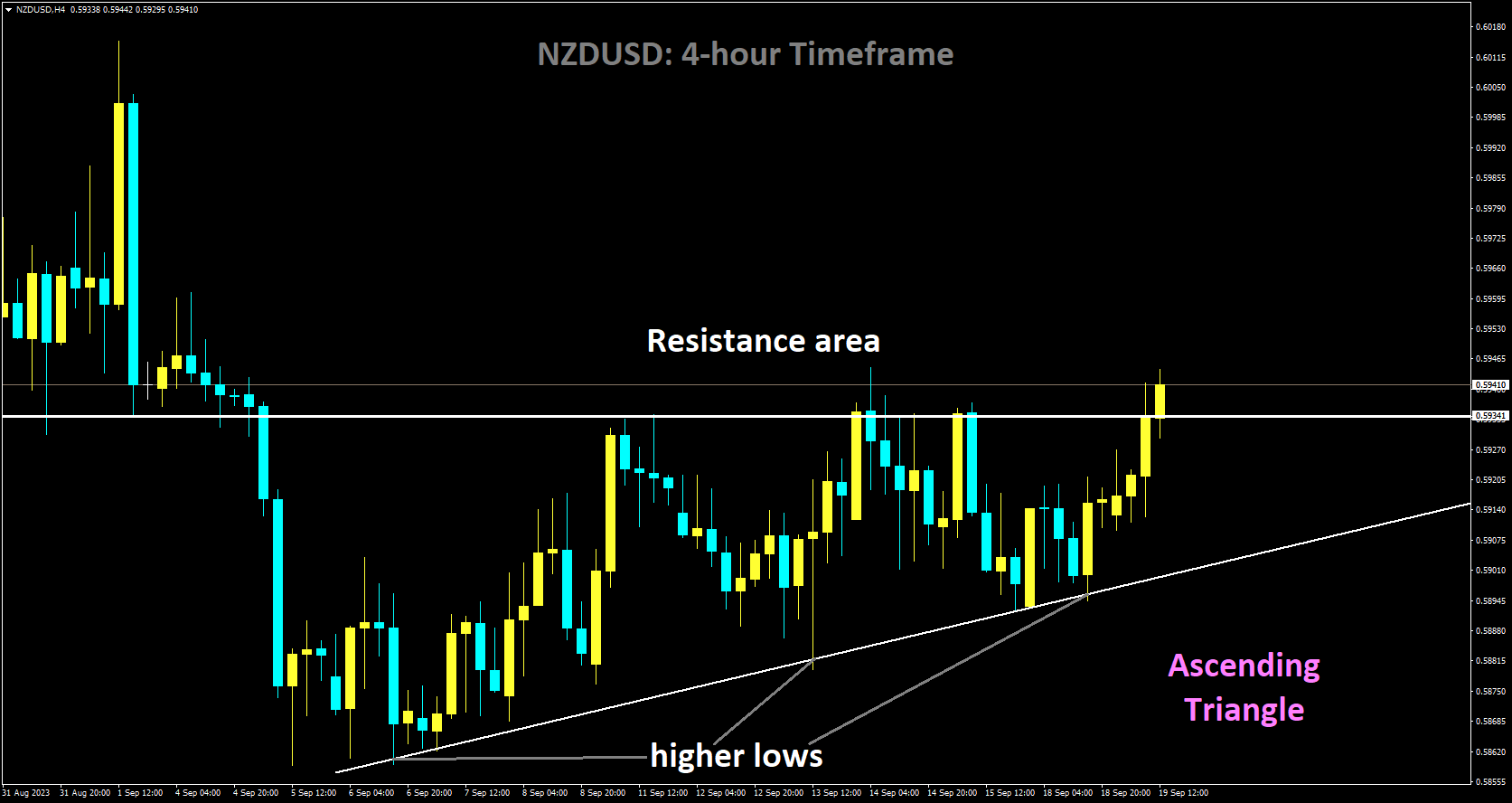

NZDUSD Analysis

NZDUSD is moving in Ascending Triangle and market has reached resistance area of the pattern

Tuesday’s early Asian session sees the NZD/USD pair post modest gains and move into positive territory for the second straight day. The US dollar (USD) is depreciating, which helps the Kiwi (NZD) slightly as markets expect the Federal Reserve (Fed) to keep interest rates unchanged at its meeting on Wednesday. The story about China’s economic problems continues to dominate New Zealand’s economic agenda on this calm day. Any indications of a slowing Chinese economy could cause the Kiwi, which is a stand-in for the US dollar, to fall against the US dollar and hurt the NZD/USD exchange rate. Figures The Gross Domestic Product (GDP) for the second quarter of New Zealand will be announced on Thursday. In terms of quarterly and annual growth, the prior growth figures were -0.1% and 2.2%, respectively.

new zealand

However, a Fed pause is widely anticipated, meaning that one more rate hike is still possible. The likelihood of the Fed holding rates steady at 99% indicates that the markets are not expected to be surprised by the Fed. This is according to the CME Fedwatch tools. Fed Chairman Jerome Powell’s press conference may provide clues about the direction of interest rates in the future. Any official dovishness could lead to a drop in the US dollar (USD). Moving forward, it is anticipated that the Fed will maintain interest rates at 5.5% during its policy meeting on Wednesday at 18:00 GMT, which will be closely watched by market participants. The focus will switch to Fed Chairman Jerome Powell’s press conference at 18:30 GMT in hopes of learning more about inflation expectations and the “dot plot.” The Gross Domestic Product (GDP) for the second quarter (Q2) in New Zealand is due on Thursday of this week. These numbers may provide the NZD/USD pair with a clear direction.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: https://forexfib.com/discount/