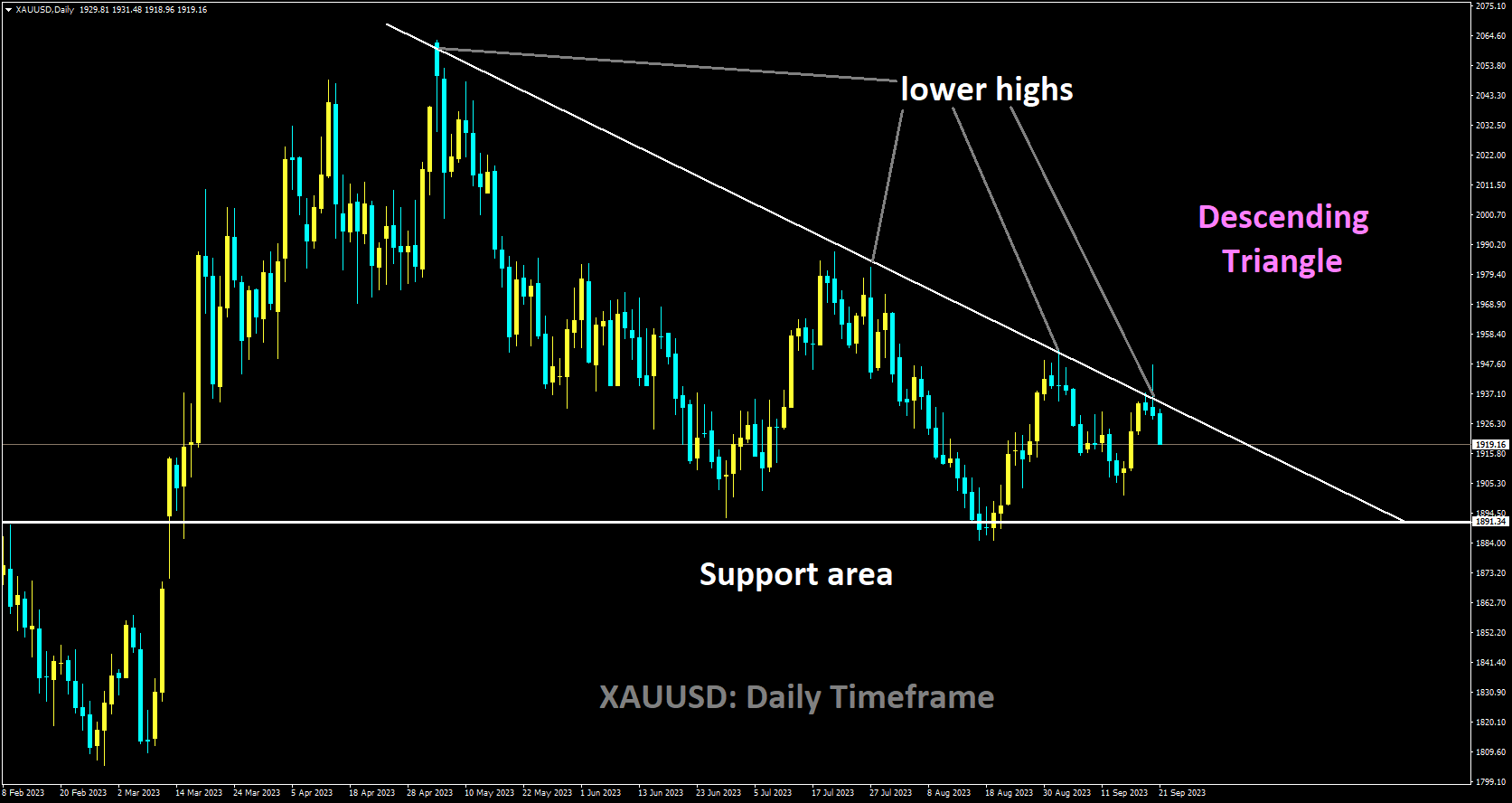

XAUUSD Analysis

XAUUSD is moving in Descending Triangle and market has fallen from the lower high area of the pattern

During Thursday’s Asian trading hours, the price of gold XAUUSD partially recovers from its recent decline of about $1,928. While the Federal Reserve maintained the benchmark policy rates at 5.5% while making the hawkish comments, the gold price is still under selling pressure. As was widely expected in the market, the Federal Reserve kept interest rates unchanged at the 5.25–5.50% range during its September meeting. Authorities are more hopeful that they can reduce inflation without hurting the economy or eliminating a large number of jobs. In a press conference, Fed Chairman Jerome Powell reiterated the Fed’s commitment to reaching 2% inflation. Powel also stated that the Fed is prepared to raise interest rates if needed.

The benchmark overnight interest rate may be raised one more time this year to a peak range of 5.50% to 5.75%, per the Fed’s most recent quarterly projections. Additionally, rates may be considerably tighter through 2024 than previously projected. Furthermore, the Fed revised its Summary of Projections , which states that by the end of 2024, interest rates are expected to rise to 5.1% from 4.6%. It is important to remember that growing interest rates increase the opportunity cost of holding non-yielding investments, suggesting that precious metals are not likely to do well. Watched by gold traders this Thursday are the US weekly Jobless Claims, the Philadelphia Fed, and Existing Home Sales, which are all due later. The preliminary US S&P Global PMI for September will be made public on Friday. These numbers may indicate a clear trend for the price of gold.

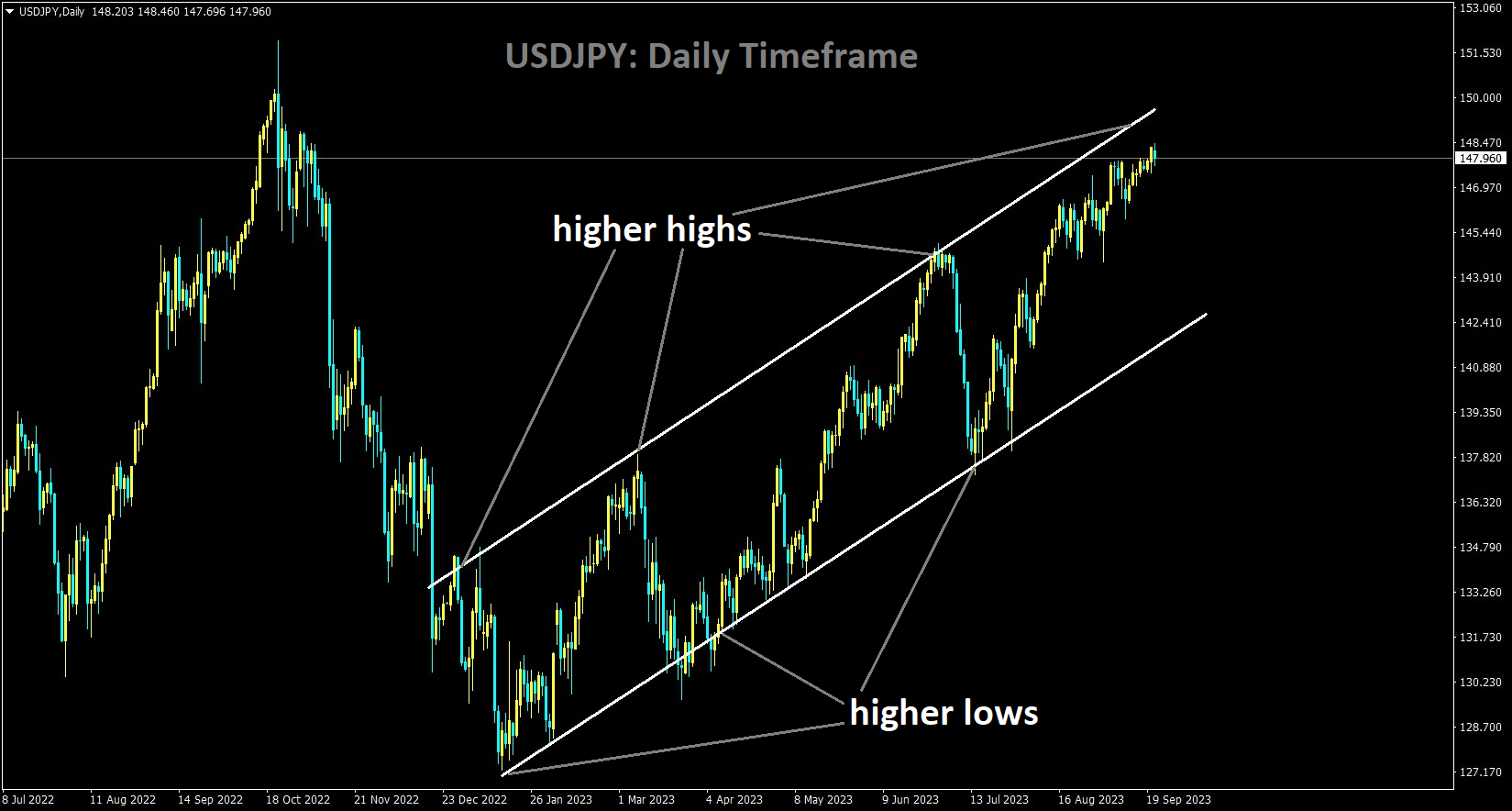

USDJPY Analysis

USDJPY is moving in an Ascending channel and the market has reached the higher high area of the channel

Hirokazu Matsuno, the Chief Cabinet Secretary of Japan, increases the possibility of government intervention to support the national currency by stating that he will not rule out any options for responding to foreign exchange movements. In addition, the Japanese Yen JPY is strengthened by rumours that the Bank of Japan BoJ may abandon its negative interest rate policy.

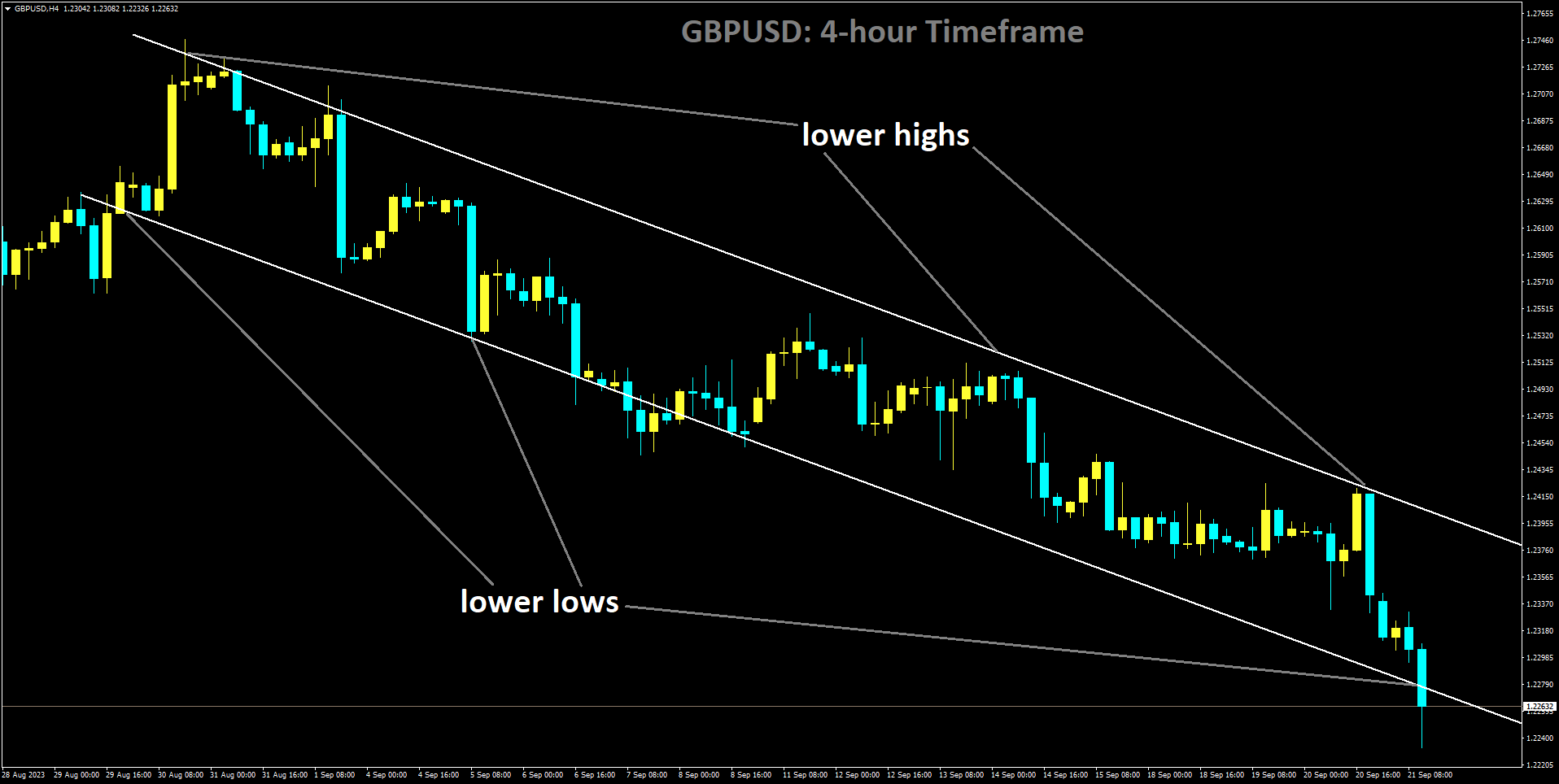

GBPUSD Analysis

GBPUSD is moving in Descending channel and market has reached lower low area of the channel

In recent weeks, the sharp reversal of the Bank of England tightening cycle has negatively impacted the value of sterling. The GBP outlook is examined by ING economists prior to the Interest Rate Decision. These days, the market is pricing in only a 47% chance of today’s 25 bps rate hike. Continued strong wage growth may be the swing factor that causes the BoE to deliver a 25 basis point hike after all, rather than being influenced by some of the erratic factors that caused the CPI to decline in August.

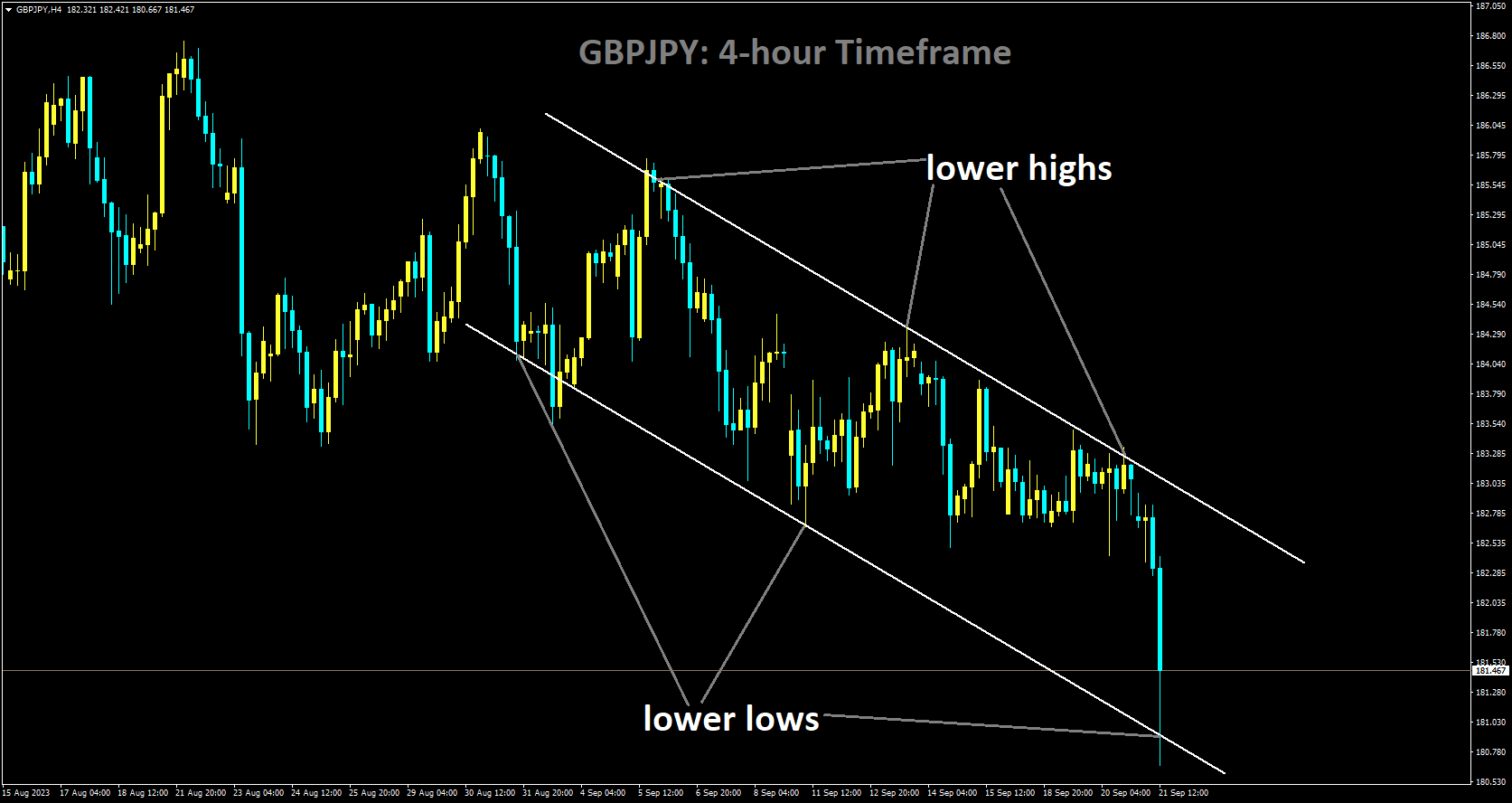

GBPJPY Analysis

GBPJPY is moving in Descending channel and market has reached lower low area of the channel

Expectations for an impending pause in the Bank of England’s BoE rate-hiking cycle have led to the British Pound’s GBP continued relative underperformance, which is seen to be weighing on the GBPJPY cross. The yearly headline CPI defied expectations and dropped to 6.7% in August from 6.8% in July, according to data from the UK released on Wednesday. Importantly, the core CPI, which does not include volatile prices for food, energy, alcohol, and tobacco, decreased from 6.9% in July to 6.2% at the end of August. In response, the markets quickly reduced their expectations of a BOE rate hike, reflecting a 50:50 likelihood of a hold. However, in response to remarks made by Japan’s Chief Cabinet Secretary Hirokazu Matsuno, who stated that he would not rule out any options for responding to FX movements, the Japanese yen JPY sees a slight increase. This increases the possibility that government intervention to support the national currency will occur. Aside from this, there are rumours that the Bank of Japan BoJ may abandon its ultra-loose policy and adopt a more dovish stance, which would strengthen the safe-haven value of the Japanese yen and put more pressure on the GBPJPY cross. Ending negative interest rates is one of the options available if the central bank gains confidence that prices and wages will continue to rise sustainably, according to remarks made by Bank of Japan Governor Kazuo Ueda.

But it is still unclear if bearish traders will be able to hold onto their strong position or decide to reduce their bets in front of the two most important central bank event risks: the highly anticipated BoJ meeting on Friday and the critical BoE policy decision on Thursday. However, the previously mentioned fundamental environment appears to be biassed towards bearish traders. Furthermore, it appears that the path of least resistance for the GBPJPY cross is to the downside given this week’s repeated failures close to the 50-day Simple Moving Average SMA support breakpoint, which has since turned into resistance. Therefore, any attempt at a recovery may still be viewed as a chance to sell and end rather quickly.

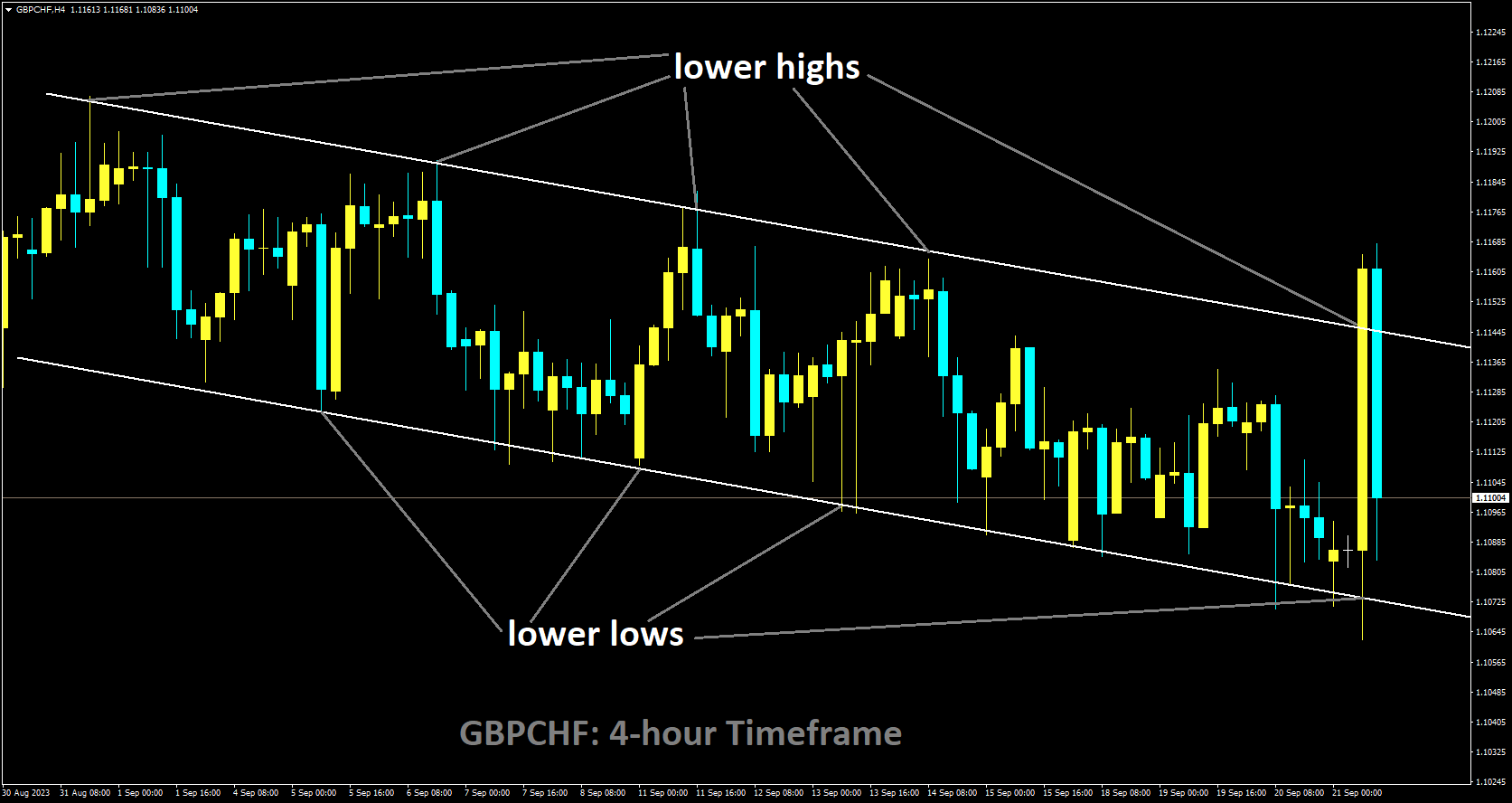

GBPCHF Analysis

GBPCHF is moving in Descending channel and market has fallen lower high area of the channel

Today is the Bank of England’s (BoE) monetary policy meeting. Commerzbank economists assess the GBP prior to the Interest Rate Decision. Over the past few months, the BoE has frequently appeared hesitant and has only responded to inflationary pressures.

Because of this, it is highly likely that it will declare an unexpected rate pause while leaving open the prospect of a rate step later in the year. On the other hand, we believe that the BoE is more likely to sound more dovish and take another rate step. For instance, it might imply that interest rates have reached their peak. In the event that inflation proves to be more obstinate than anticipated, sterling would face additional pressure.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: https://forexfib.com/discount/