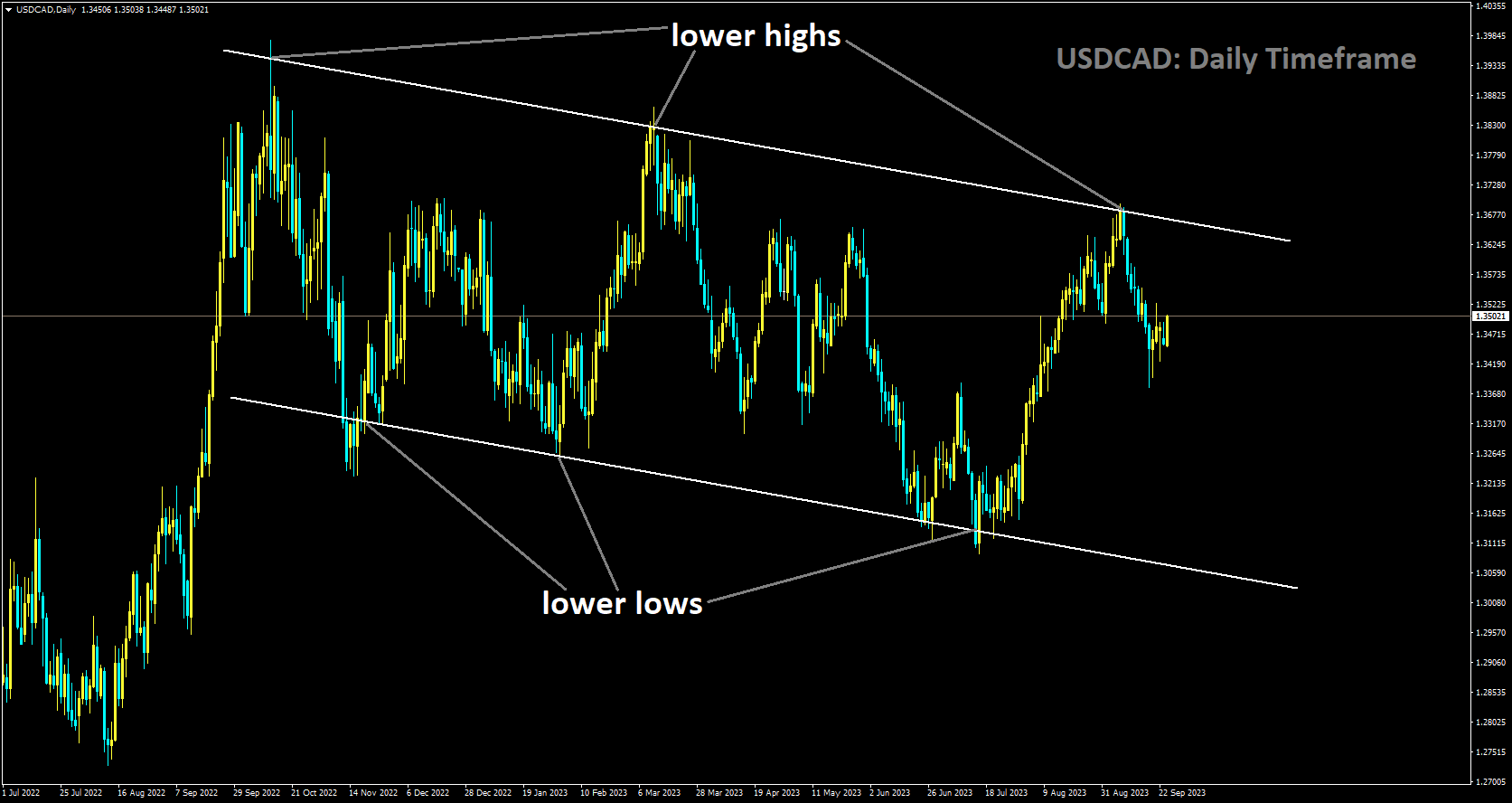

USDCAD Analysis

USDCAD is moving in Descending channel and market has fallen from the lower high area of the channel

The decline in oil prices weighs on the Loonie, while the US Dollar (USD) gains strength due to the US story’s upward trajectory. The USDCAD exchange rate is currently trading at 1.3457, up 0.02% for the day. The US Dollar Index, which shows how much the US dollar is worth in relation to a basket of foreign currencies, is currently trading at 105.95. This is a decline from November’s peak of 106.09, which was driven by demand for the USD and a rise in the US 10-year yield to its highest level since October 2007. Nevertheless, as the nation is the top oil exporter to the US, the oil price falls for the second day in a row on Tuesday, undermining the Loonie, which is correlated with commodities, and potentially capping the upside for the USDCAD pair.

Even now, the majority of Fed officials still see more rate increases later in the year. The presidents of the Federal Reserve Banks of Boston and San Francisco, Susan Collins and Mary Daly, emphasised that rate increases are still likely even though inflation is slowing down. Even though Chicago Fed President Austan Goolsbee stated that there is a chance for a soft landing, the Fed should be fully committed to getting inflation down to 2%. Inflation risks are still high. These aggressive remarks from Fed members strengthen the USD and provide support for the USDCAD exchange rate. Next up on Tuesday’s schedule are the US Consumer Confidence report for September and the housing data. The US Gross Domestic Product Annualised for the second quarter is scheduled to be released on Thursday. The Fed’s preferred gauge of consumer inflation, the Core Personal Consumption Expenditure Price Index, is scheduled for release on Friday and will be the event of great interest. The yearly percentage is anticipated to decrease from 4.2% to 3.9%. On Friday, Canadian GDP figures are also expected. Market participants will use these numbers as a guide to determine the USDCAD pair’s clear direction.

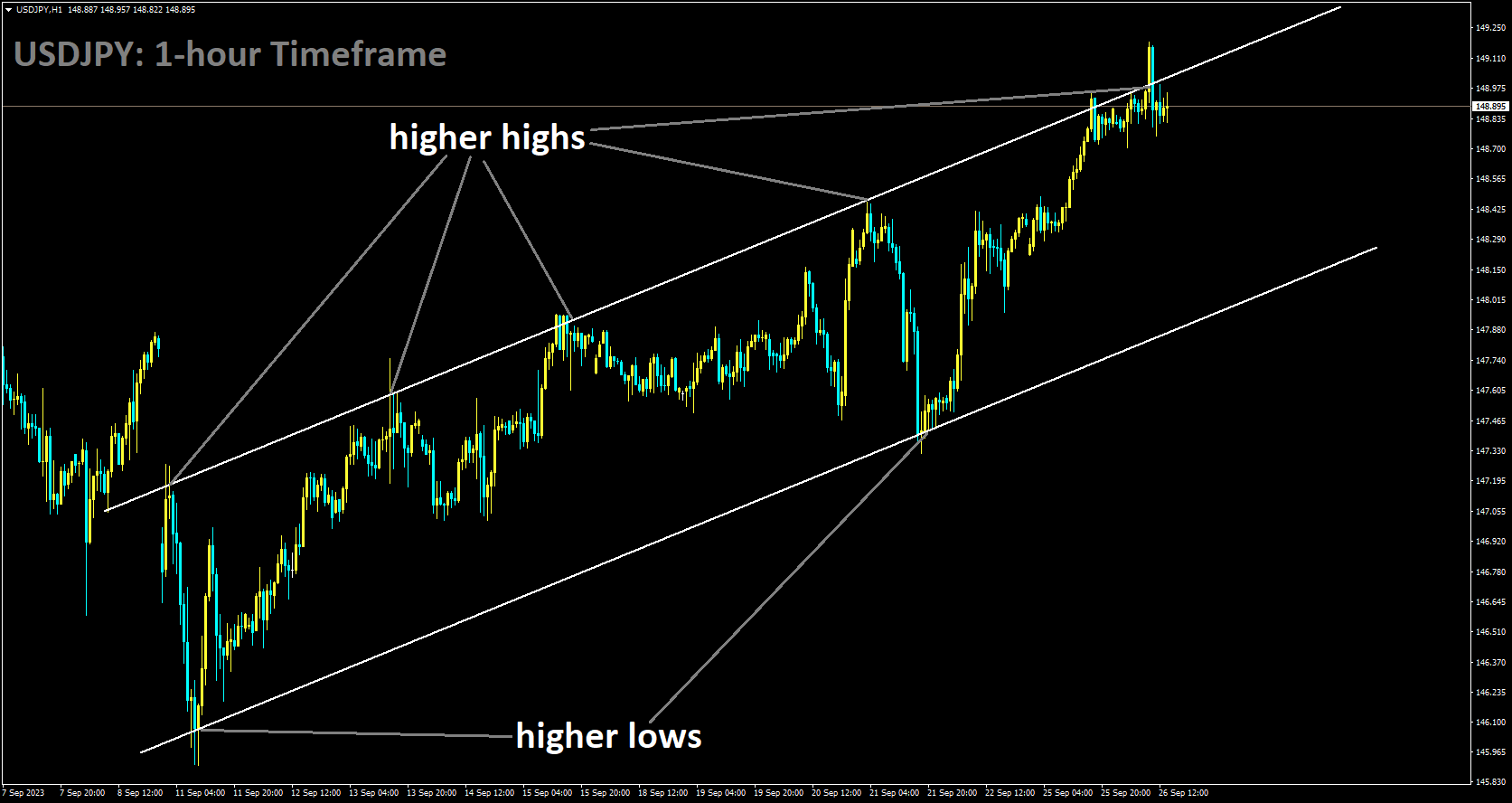

USDJPY Analysis

USDJPY is moving in Ascending channel and market has reached higher high area of the channel

The US Dollar Index reaches a new high of more than 106.00, the highest since November. The positive US Treasury yields contribute to the US dollar’s strength. As of the time of publication, the yield on the 10-year US bond note had increased to 4.56%, a level not seen since October 2007. The US economy’s resilience is the main factor driving the expectation that high interest rates will remain high for a long time. The US Federal Reserve Fed also hinted at potential future interest rate increases, which supported the buck’s strengthening. Concerns have also been raised regarding the possible repercussions of a federal government shutdown, since US President Joe Biden and a senior advisor have issued warnings about the many problems that could arise, such as the loss of food assistance for almost 7 million low-income women and children. Although President Biden and House Speaker Kevin McCarthy had previously reached an agreement on government spending levels, the Republican-controlled House of Representatives may try to enact large budget cuts, which would need Senate support from Democrats. The Senate, which is controlled by Democrats, would have to approve these proposed cuts; it is anticipated that it will reject them. By the following Sunday, there may be a partial government shutdown if the two houses are unable to come to an agreement on spending.

Later in the week, investors should keep an eye on a number of important data releases, such as the Core Personal Consumption Expenditures Price Index the Federal Reserve’s preferred inflation indicator US Consumer Confidence, Durable Goods Orders, and Initial Jobless Claims. These datasets may have an impact on US dollar trading decisions and offer crucial insights into inflationary pressures in the US economy. On the other hand, because the Bank of Japan did not modify its ultra-low monetary policy on Friday, the Japanese Yen is under pressure to decline. The BoJ has decided to keep boosting the economy until inflation steadily approaches its target of 2%. This move implies that the central bank is taking its time winding down its enormous stimulus programme. When speaking about Japan’s economic predicament on Tuesday, Finance Minister Shunichi Suzuki emphasised that the nation is at a turning point where it must choose between fostering wage growth and increasing consumption. Furthermore, Suzuki pointed out that it is difficult to forecast whether fiscal spending on its own will raise prices.

Furthermore, Yoshitaka Shindo, Japan’s recently appointed Minister of Economy, has said that stable currency movements are essential for expressing the underlying economic fundamentals. BoJ Governor Ueda emphasised on Monday the significance of giving data more time to be evaluated before considering an interest rate hike. Furthermore, the necessity for the central bank to carefully monitor changes in the currency market and maintain a patient monetary easing programme has been underlined by Deputy Governor Shinichi Uchida.

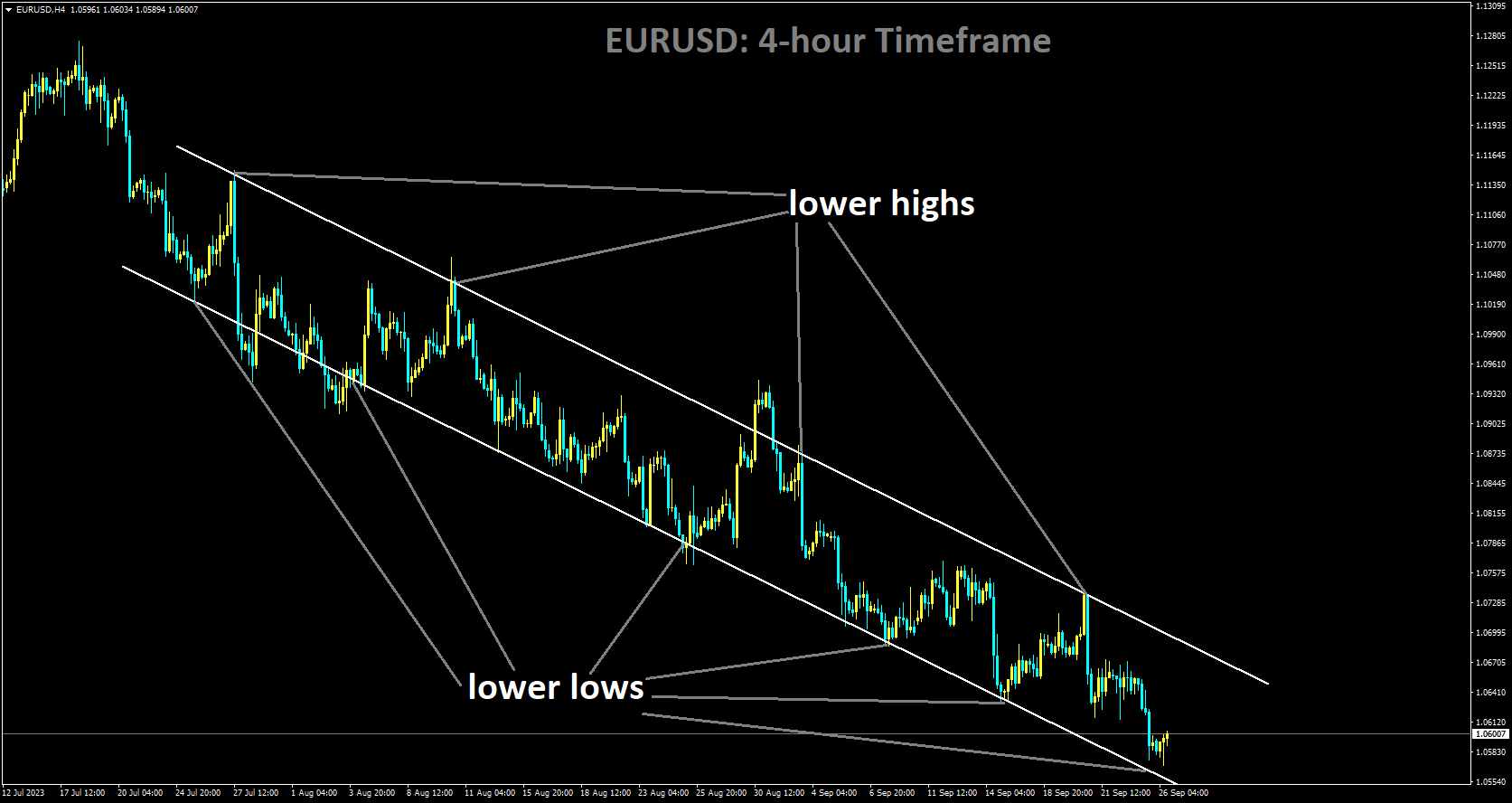

EURUSD Analysis

EURUSD is moving in Descending channel and market has rebounded from the lower low area of the channel

During Tuesday’s Asian trading session, the EURUSD pair recovers some of its intraday losses and is currently trading at 1.0590. Christine Lagarde, the president of the European Central Bank (ECB), stated that interest rates will remain low for a long time, but this pair still faced difficulties. Lagarde did, however, also point out that inflation is anticipated to remain “too high for too long.” But the ECB is in a tough spot as it tries to strike a balance between the need to deal with rising inflation and the need to avoid negatively impacting the uneven domestic economy of the Eurozone. This delicate balancing act is likely contributing to the downward pressure on the euro against the US dollar . Near 106.00, the US Dollar Index maintains its position, though it is getting close to its highest level since November. Rising US Treasury yields and cautious market sentiment are contributing factors to the US Dollar’s ongoing strength. At 4.55%, the yield on the US Treasury note maturing in 10 years is the highest it has been since October 2007. Based on how resilient the US economy is, higher interest rates are anticipated to remain in place for a considerable amount of time. The US Federal Reserve (Fed) also hinted at potential future interest rate increases, which supported the buck’s strengthening.

Market worries have also increased in response to recent cautions regarding the possible repercussions of a federal government shutdown issued by US President Joe Biden and a senior adviser. They emphasised the potential for wide-ranging issues resulting from a shutdown, such as the loss of food assistance for approximately 7 million low-income women and children. President Biden and House Speaker Kevin McCarthy had previously reached an agreement on government spending caps, but this week the Republican-controlled House of Representatives might try to enact large budget cuts. The Senate, which is controlled by Democrats, would have to approve these proposed cuts; it is anticipated that it will reject them. If the two houses are unable to come to an agreement, there may be a partial government shutdown by the following Sunday. Investors will probably be watching Friday’s release of important economic data, which includes the Core Personal Consumption Expenditures (PCE) Price Index—the preferred inflation measure of the US Federal Reserve and the Core Harmonised Index of Consumer Prices (HICP) for the Eurozone. These datasets could have an impact on trading choices in the EUR/USD pair and are anticipated to offer vital insights into inflationary pressures in both economies.

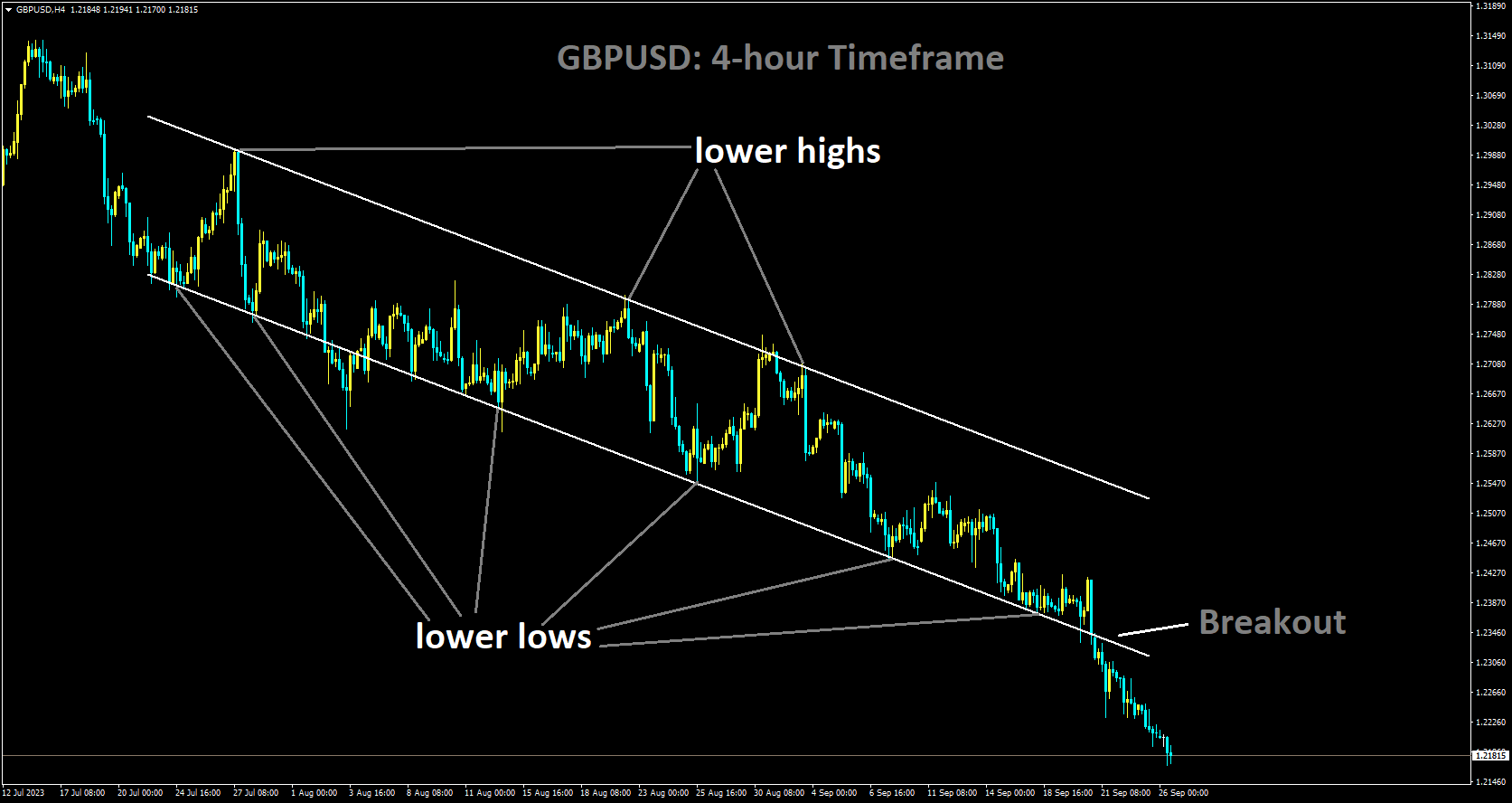

GBPUSD Analysis

GBPUSD has broken Descending channel in downside

During the early European session on Tuesday, the GBPUSD pair trades in negative territory for the fourth consecutive week, continuing to be under selling pressure. The major pair has lost 0.07% on the day and is presently trading close to 1.2203. The Bank of England BoE decided to end a string of 14 consecutive rate hikes that began in December 2021 by keeping the benchmark rate at its 15-year high of 5.25%. The British Pound GBP may then suffer as a result of this in relation to the US Dollar. The BoE representative hinted that additional meetings might be held and that the BoE might decide to raise or lower interest rates as needed. However, the Federal Reserve’s Fed aggressive stance strengthens the US Dollar and works against the GBPUSD pair.

Neel Kashkari, the president of the Minneapolis Federal Reserve Bank, said early on Tuesday that he agrees with other Fed policymakers that there should be one more rate increase this year. In order to calm things down, he continued, US interest rates most likely need to rise slightly and stay there for a longer period of time. The presidents of the Federal Reserve Banks of Boston and San Francisco, Susan Collins and Mary Daly, had earlier emphasised that rate increases are expected even though inflation is slowing down. Even though Chicago Fed President Austan Goolsbee stated that there is a chance for a soft landing, the Fed should be fully committed to getting inflation down to 2%. Inflation risks are still high.

In the meantime, the US Dollar Index DXY, which gauges how much the USD is worth in relation to a basket of other currencies, continues to rise above 106.00, almost to its highest point since November. And the yield on the 10-year increased to 4.546%, the highest since October 2007. Due later on Tuesday, market participants will be watching the US CB Consumer Confidence for September and the new home sales data. The US Core Personal Consumption Expenditure PCE Price Index, which was released on Friday, and the UK GDP for the second quarter will garner more attention.

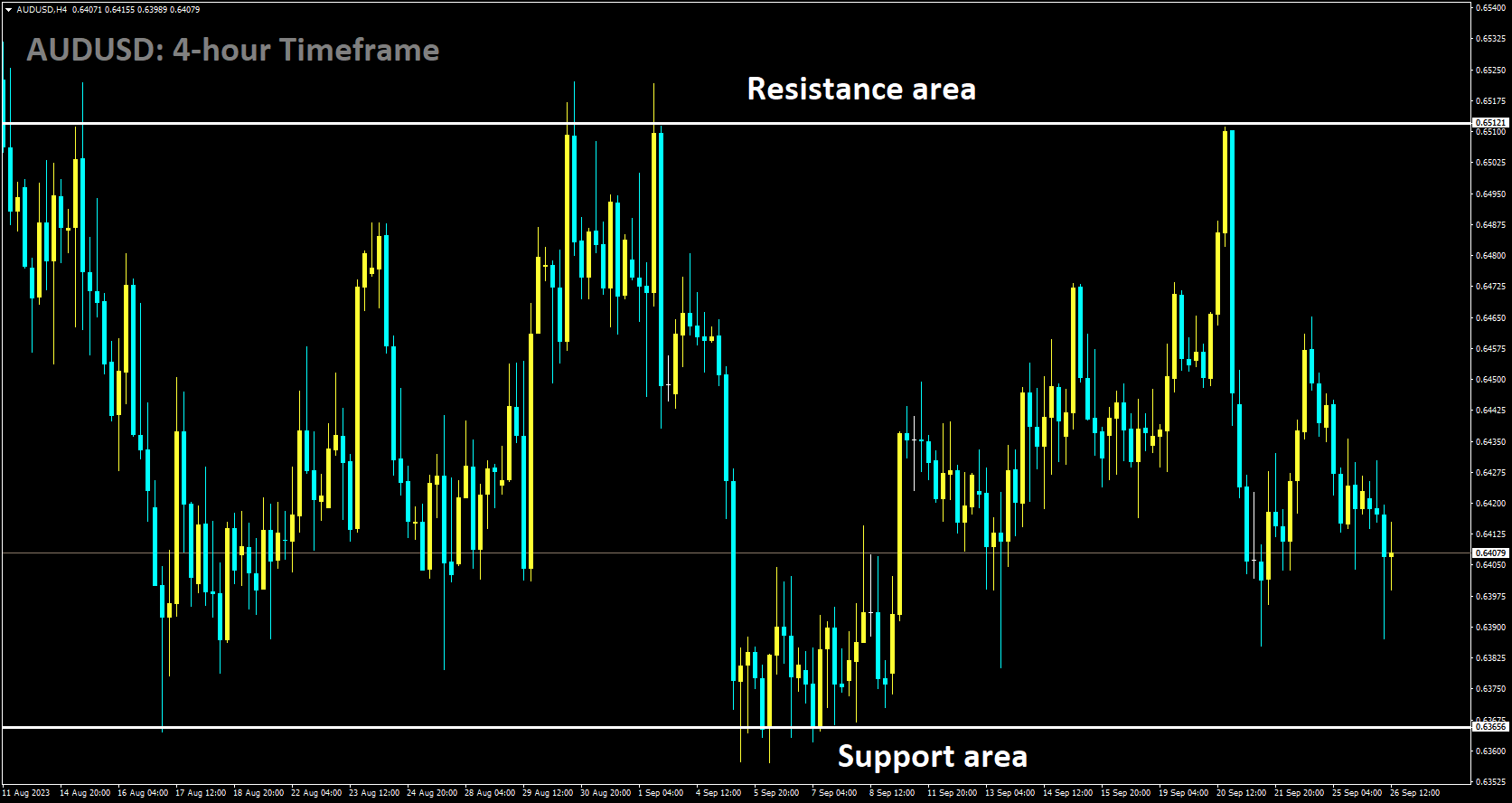

AUDUSD Analysis

AUDUSD is moving in Box pattern and market has fallen from the resistance area of the pattern

After recently rising to its highest level since December 2022, the US Dollar USD pauses for a short while. This turns out to be a significant factor providing some support for the AUDUSD pair. Nevertheless, the hawkish outlook of the Federal Reserve Fed benefits the USD bulls, and this, along with worries about a Chinese real estate crisis, should limit any significant recovery for the major. The US Federal Reserve supported the idea of at least one more 25 basis point rate hike by the end of this year and reaffirmed last week that interest rates will stay higher for an extended period of time.

Australia currency

Prominent FOMC members’ remarks, which stated that borrowing costs would need to stay high for a long time in order to bring inflation back to the 2% target, confirmed the bets. Moreover, investors are becoming more and more cautious due to concerns about the possible inflationary effect of growing oil prices. Furthermore, the Fed should be able to maintain its hawkish stance given the robust US macro data that is coming in. In the meantime, officials continue to drive up the yields on US Treasury bonds, seeing only two rate cuts in 2024 as opposed to the four previously anticipated. The benchmark yield on the 10-year Treasury bond surpasses the 4.50% mark for the first time since 2007 as the yield on the rate-sensitive US government bond soars to a 17-year high.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/