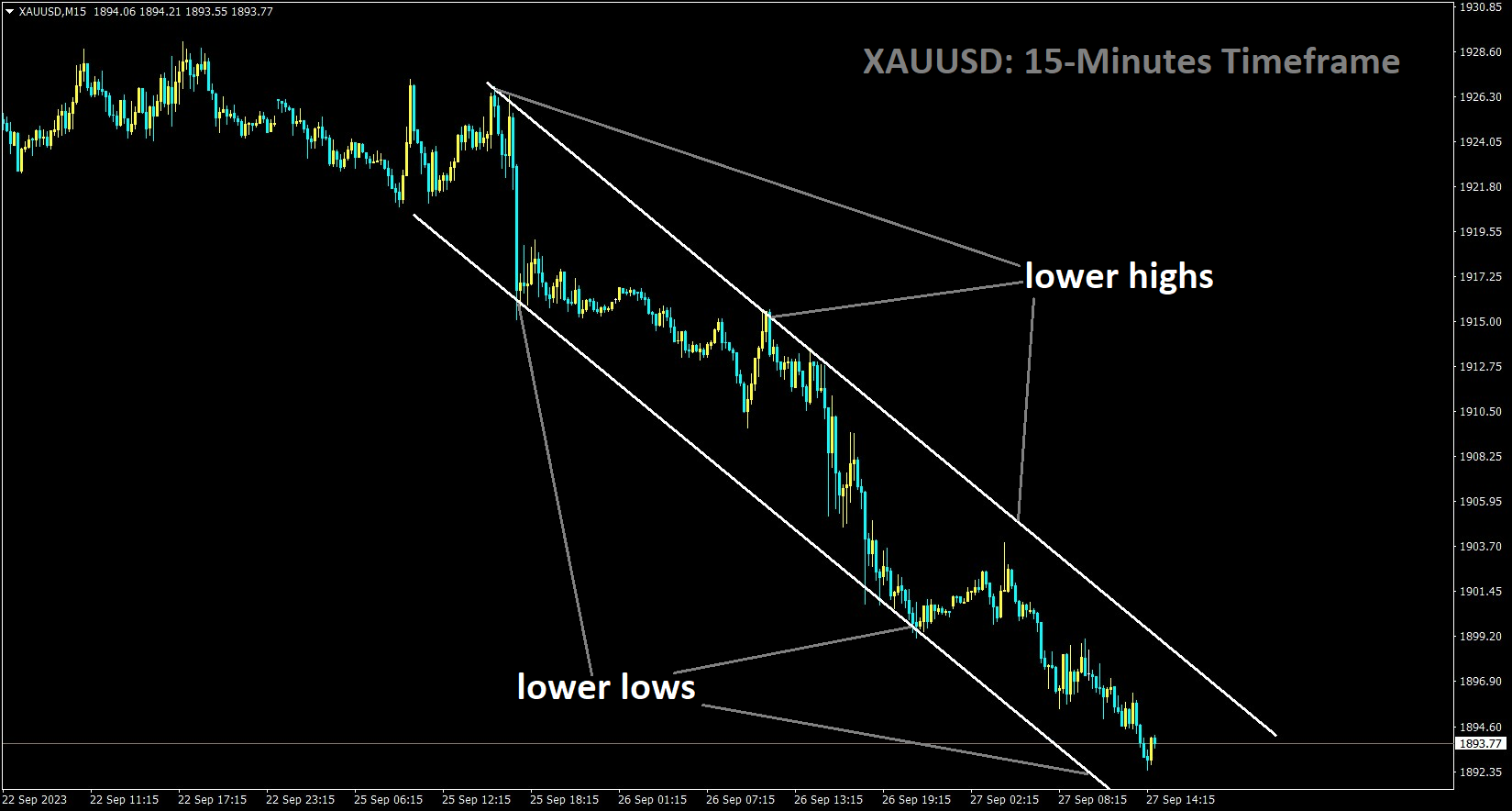

GOLD Analysis

XAUUSD is moving in the Descending channel and the market has reached the lower low area of the channel

The price of gold XAUUSD has been declining since last week, when it encountered resistance close to the crucial 200-day Simple Moving Average SMA. On Wednesday, it lost ground for the third day in a row. In the early European session, the commodity drops to its lowest level since August 22 at roughly the $1,895 region, marking the sixth day of a negative move in the previous seven. Gold is seen to be impacted by the US Dollar USD, which reaches a new 10-month high and keeps getting support from the Federal Reserve’s Fed higher-for-longer narrative. Moreover, bets on at least one more rate hike by the end of this year were strengthened by the recent remarks made by Fed officials. That being said, the USD bulls are not making any new wagers because of a significant decline in the yields on US Treasury bonds.

In addition, losses for the safe-haven Gold price are constrained by the general risk-off attitude. September saw a four-month low for the Conference Board’s Consumer Confidence Index, according to data released from the US on Tuesday. This heightened worries that the ongoing high rate of inflation and rising interest rates are putting pressure on consumers. This affects investors’ mood, along with worries about China. However, it still appears unlikely that the price of gold will make a significant comeback. Traders are now focusing on the US economic schedule, which includes the announcement of Durable Goods Orders later in the early North American trading session. After that, all eyes will be on Thursday’s speech by Fed Chair Jerome Powell and the final US Q2 GDP report. The US Core PCE Price Index, the Fed’s preferred inflation indicator, will, nevertheless, continue to be the centre of attention on Friday.

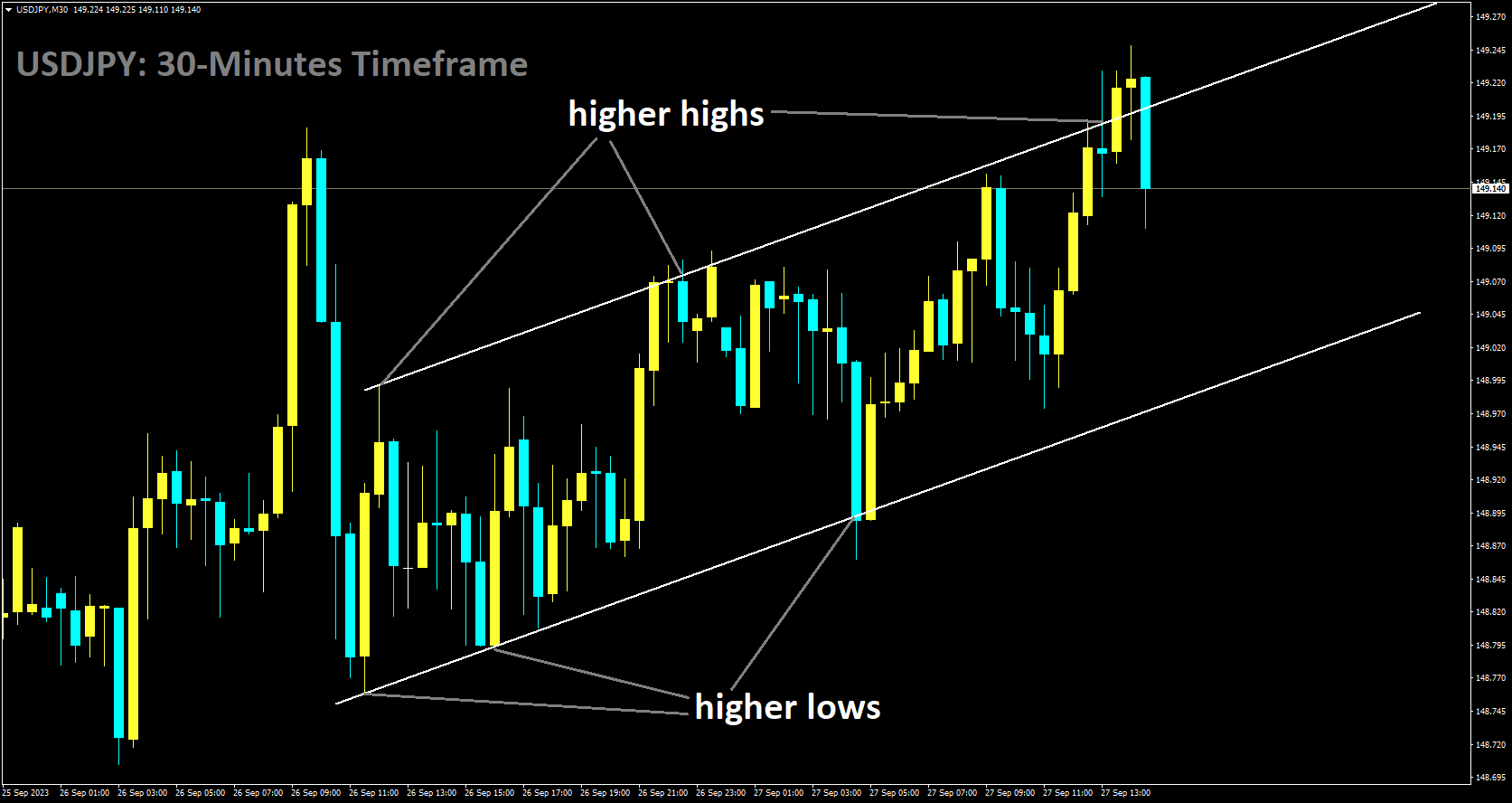

USDJPY Analysis

USDJPY is moving in Ascending channel and market has reached higher high area of the channel

The US Treasury yields are rising due to market caution, the US Dollar (USD) is stronger than the Japanese Yen (JPY). The minutes of the Bank of Japan (BoJ) policy meeting indicated that while some members underlined the negative risks to Japan’s economy, policymakers were in favour of continuing the current monetary easing to meet the price target.

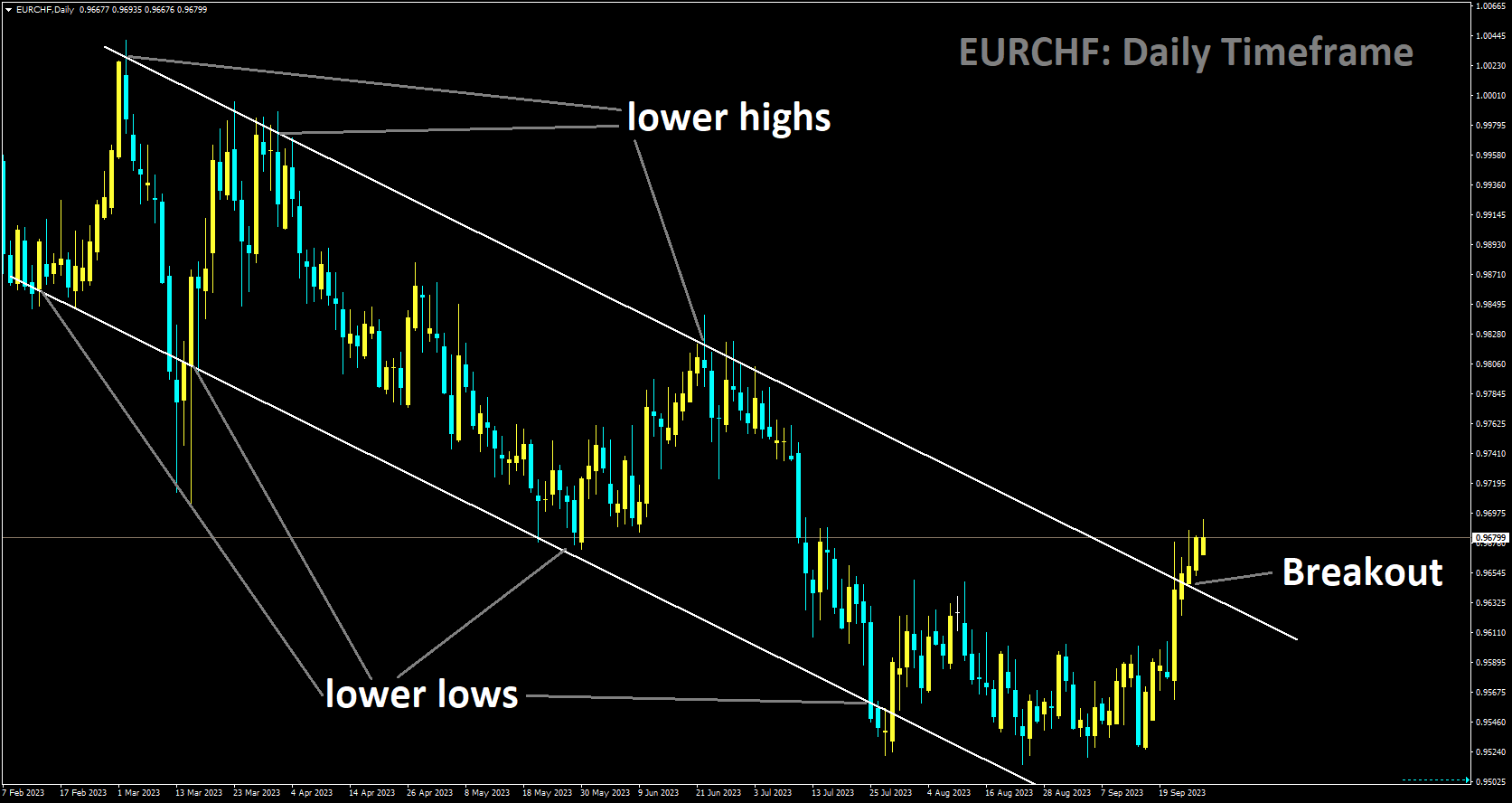

EURCHF Analysis

EURCHF has broken Descending channel in upside

Frank Elderson, a board member of the European Central Bank (ECB), stated that interest rates could still rise if needed. Does this indicate a peak in policy rates? Not invariably. What we are witnessing is a slower growth period that is longer than anticipated. It is also true that achieving price stability is our main responsibility, and I believe we have shown that we are adamant about pursuing that goal.

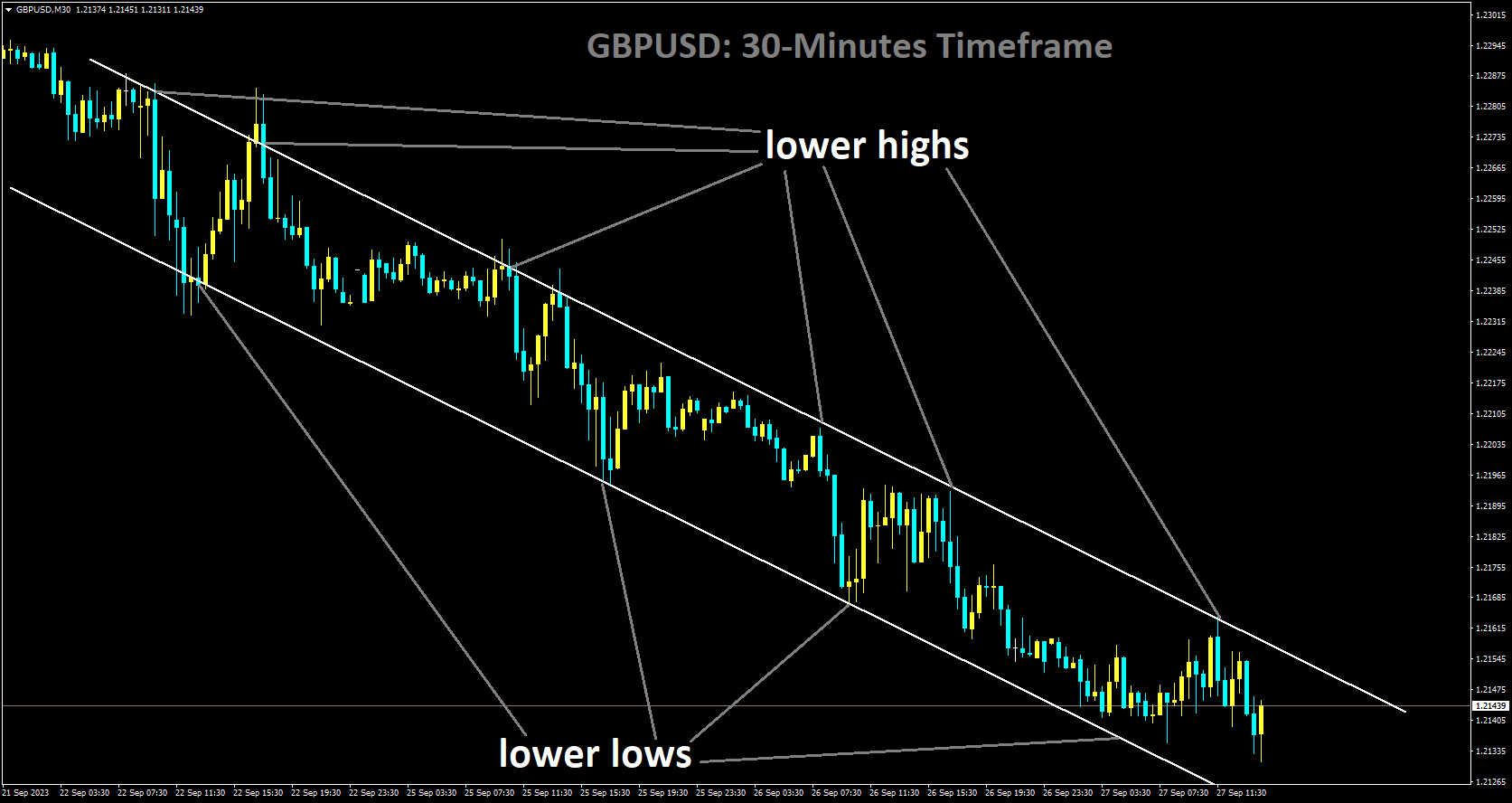

GBPUSD Analysis

GBPUSD is moving in Descending channel and market has fallen from the lower high area of the channel

As investors predict that the UK economy will enter a recession as a result of worsening labour market conditions and a bleak demand outlook, the pound sterling (GBP) continues its five-day losing streak. More losses are anticipated for the GBPUSD pair as expectations for consumer inflation would rise in the event that the Bank of England BoE decided to pause its cycle of rate-tightening. In addition to bringing attention to policymakers’ concerns regarding the UK’s economic unrest, the Bank of England’s unexpected halt in its historically aggressive rate cycle has also increased uncertainty regarding the inflation outlook. The global oil rally has driven up energy prices in Britain, which is expected to drive up inflation once more. A scenario of high inflation and low labour demand could lead to the possibility of stagflation in the future. Due to growing concerns about the global economy brought on by the increasing risks of higher interest rates, investors are still discounting the pound sterling and are punishing it for it. The global economy is still having difficulty adjusting to the consequences of central bankers’ restrictive monetary policy, which is causing investors’ anxiety to persist. Economic activity and the state of the labour market are being impacted by the effects of rising interest rates on the UK economy. In the last two months, employers in the UK laid off workers as their priorities shifted to cost control as a result of the weakening demand environment. Even though there is less of a need for labour, wage growth is still robust enough to keep inflation in check.

For the second consecutive month, the UK Services PMI fell below the 50.0 mark, following in the footsteps of the declining UK Manufacturing PMI. This suggests that rising inflation and a rebound in petrol prices are putting pressure on households’ real income. A stubborn consumer inflation outlook and robust wage growth led the Bank of England to decide last week to pause its policy tightening. This suggests that rather than being concerned about sustained inflation, BoE policymakers are more concerned about upside risks to economic turmoil.

Due to expectations that the BoE will stop raising interest rates, investors are selling the pound sterling. On the other hand, following a break in the Federal Reserve’s policy-tightening phase, the US Dollar has held strong. The Fed’s pause in tightening policy is the result of declining inflation and promising economic growth. In the US economy, there is a high demand for labour, robust consumer spending, and steady wage growth.

Investor attention will be focused on the UK’s Gross Domestic Product GDP data for the April–June quarter, which is scheduled to be released on Friday. Data on the annualised and quarterly GDP are expected to grow at consistent rates of 0.4% and 0.2%, respectively. The US Dollar Index DXY is trading close to 106.30, which is a new 10-month high, as Fed policymakers continue to support tightening policy to maintain price stability. Given how well the US economy has been doing in relation to the other G7 economies, inflationary pressures above the targeted 2% rate will not go away quickly. Because of this, Fed policymakers are still expected to keep a hawkish view on the outlook for interest rates. Investors will be closely monitoring the US Durable Goods Orders for August on Wednesday, August 21, at 12:30 GMT. Orders are predicted to decline by 0.4%, which is slower than the 5.2% drop that occurred in July.

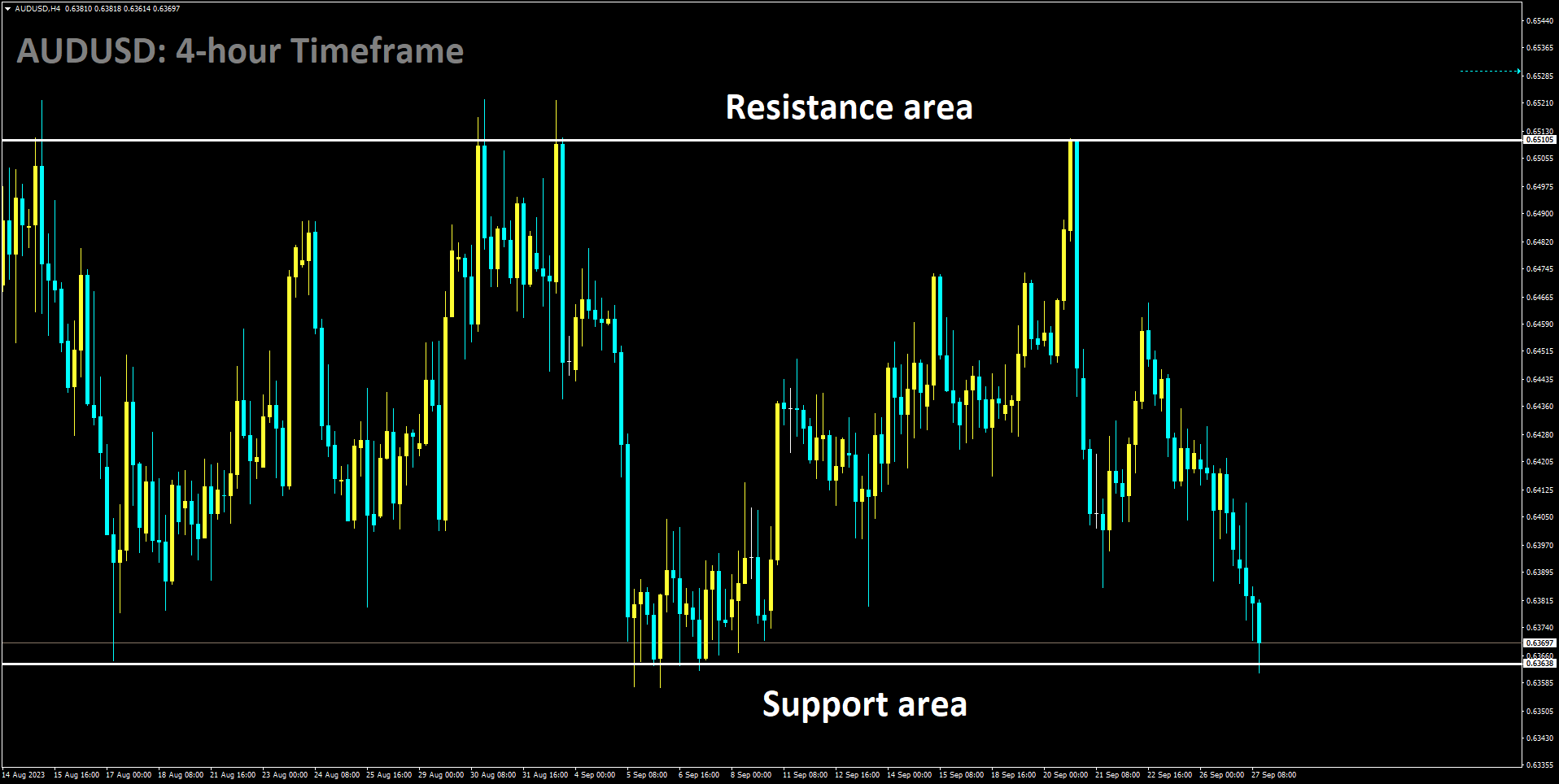

AUDUSD Analysis

AUDUSD is moving in Box pattern and market has reached support area of the pattern

With respect to the US dollar USD, the Australian dollar AUD is heading towards its monthly low despite strong inflation data from Australia. Risk aversion prevented the AUD/USD pair from benefiting from the positive Australian Consumer Price Index CPI data. The AUD’s increase is being restrained by the drop in commodity prices. The minutes of the September monetary policy meeting of the Reserve Bank of Australia RBA hinted that additional tightening might be required if inflation turns out to be more persistent than anticipated. An increase in inflation may have an impact on the RBA’s decision to conclude the rate-hike cycle. However, it seemed that there was a stronger case to be made for maintaining the status quo policy. Consequently, this may also restrict the AUD/USD pair’s upside potential. The US Dollar Index DXY is currently trading close to the peak it reached in December. The positive US Treasury yields contribute to the US dollar’s strength. Since October 2007, the yield on the US 10-year bond note has increased to a level never before seen. The moderate data from the United States US that was released on Tuesday might strengthen the dollar. While building permits and consumer confidence declined, the US Housing Price Index increased.

Furthermore, the majority of US Federal Reserve Fed members continue to predict additional interest rate increases later in the year, which may be related to the country’s thriving economy. The Fed recently decided to maintain the current state of affairs by holding the interest rate between 5.25% and 5.50%. Around 0.6380, the AUD/USD exchange rate is down, continuing its decline towards the monthly low during Wednesday’s early European trading hours. As anticipated, Australia’s Monthly Consumer Price Index CPI increased 5.2% year over year in August, surpassing the previous rate of 4.9%.

Consumer Price Index

The market does not currently expect a rate hike following the meeting on October 3, which will be Michele Bullock’s first as an RBA governor. There is growing expectation that the RBA will raise interest rates at its meetings in November and December. For the first quarter of the next year, Bloomberg’s World Interest Rate Probability WIRP indicates that there is an 85% chance of another rate hike. On Thursday, investors will be watching Australia’s retail sales for August, which are predicted to increase by 0.3% less than the previous rate of 0.5%. The founder and billionaire chairman of China Evergrande Group, Hui Ka Yan, has been placed under police control, according to a report by Bloomberg that cited anonymous sources. These sources claim that he was arrested earlier this month and is being watched at a designated location.

The US Dollar USD has strengthened broadly as a result of the Fed officials’ hawkish comments, which has hurt the AUD/USD pair. US Consumer Confidence for September dropped to 103.0 from the previous reading of 108.7 in August, according to data released on Tuesday. Building Permits increased from 1.443M to 1.541M in August. After growing by 0.4% in June, the House Price Index MoM increased by 0.8% in July, exceeding market expectations of a 0.5% growth. Neel Kashkari, the president of the Minneapolis Fed, said on Tuesday that one more rate increase is anticipated through the end of 2023. Investors are waiting for the release of the US Durable Goods Orders report on Wednesday. Furthermore, the Fed’s preferred gauge of consumer inflation, the Core Personal Consumption Expenditure PCE Price Index, is due on Friday. It is anticipated that the annual rate will drop from 4.2% to 3.9%.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/