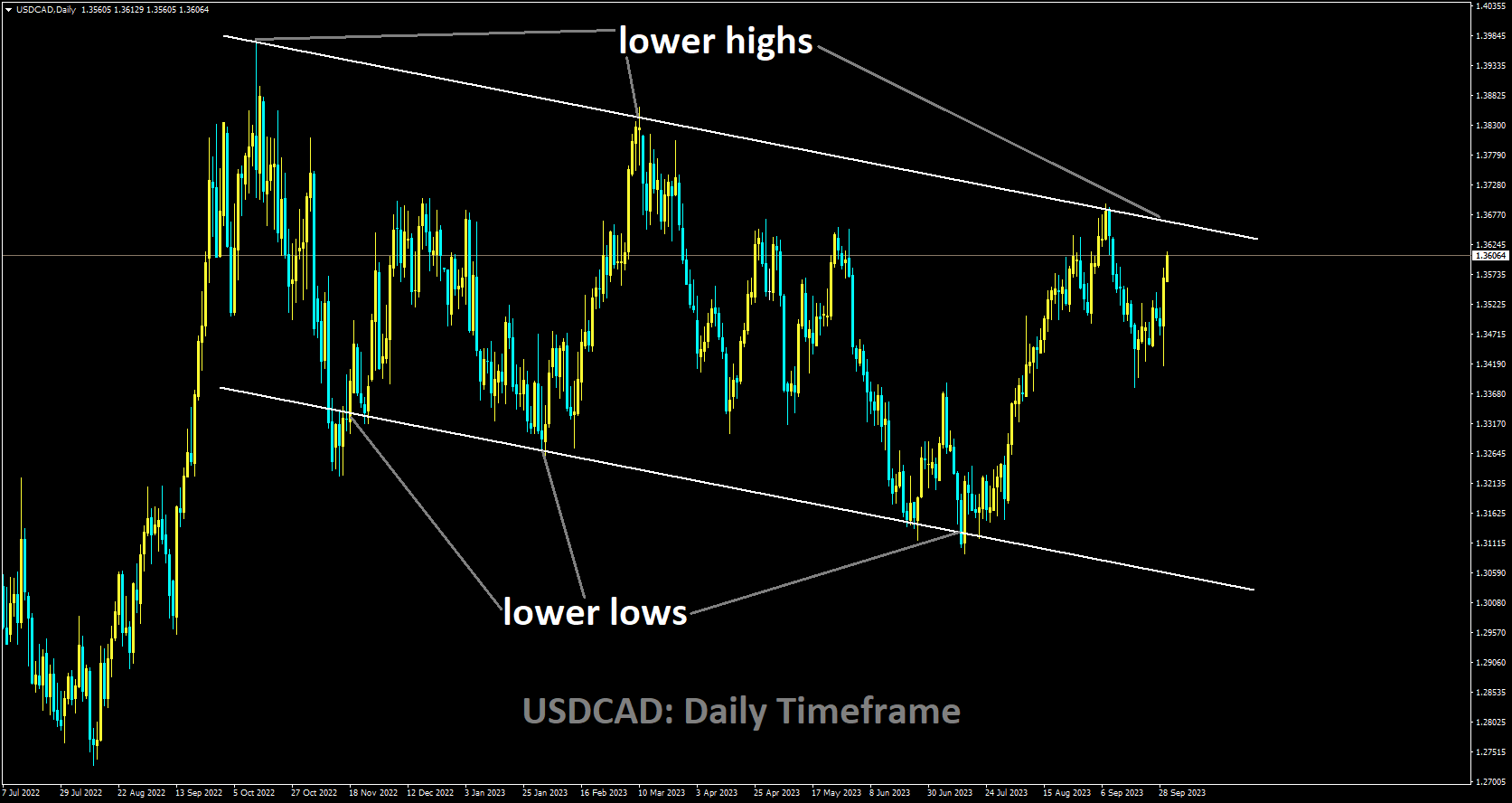

USDCAD Analysis

USDCAD is moving in Descending Triangle and market has reached lower high area of the channel.

The USD’s strength is being supported by the positive US Treasury Yields. As of the time of publication, the yield on a 10-year US Treasury bond has increased by 0.96% to 4.61%. The positive outlook for the US dollar following Friday’s release of moderate economic data is the main factor supporting the upward movement of the USDCAD pair. While it was predicted that the US Michigan Consumer Sentiment Index would remain unchanged, it improved to 68.1 from the previous reading of 67.7. As predicted, the US Core PCE – Price Index YoY increased by 3.9% in August, down from the previous reading of 4.3%. The Market Consensus was expecting Core PCE to remain consistent at 0.2%, but instead it displayed a soft reading of 0.1%. After Friday’s meeting, US lawmakers were able to pass legislation that prevented a government shutdown and extended funding through November 17. Due to this development, the US Dollar’s upward trajectory has resumed.

Conversely, the depressing July Gross Domestic Product data which came in flat at 0.0% compared to the market’s 0.1% growth estimate—put downward pressure on the CAD. In June, there was a 0.2% decline in the GDP. Due to market trepidation over the Fed’s expected interest rate trajectory, crude oil prices fell from their one-year highs during the final two trading sessions of the previous week. Given that Canada is the largest oil exporter to the US, this development made the Canadian dollar less valuable relative to the US dollar. On Monday, though, Western Texas Intermediate , the US benchmark for crude oil, aims to end the run of losses by trading at roughly $90.10 per barrel. Trades are awaiting the US ISM Manufacturing PMI for September in advance of Monday’s speech by Fed Chair Jerome Powell. We will also be watching Canada’s S&P Global Manufacturing PMI .

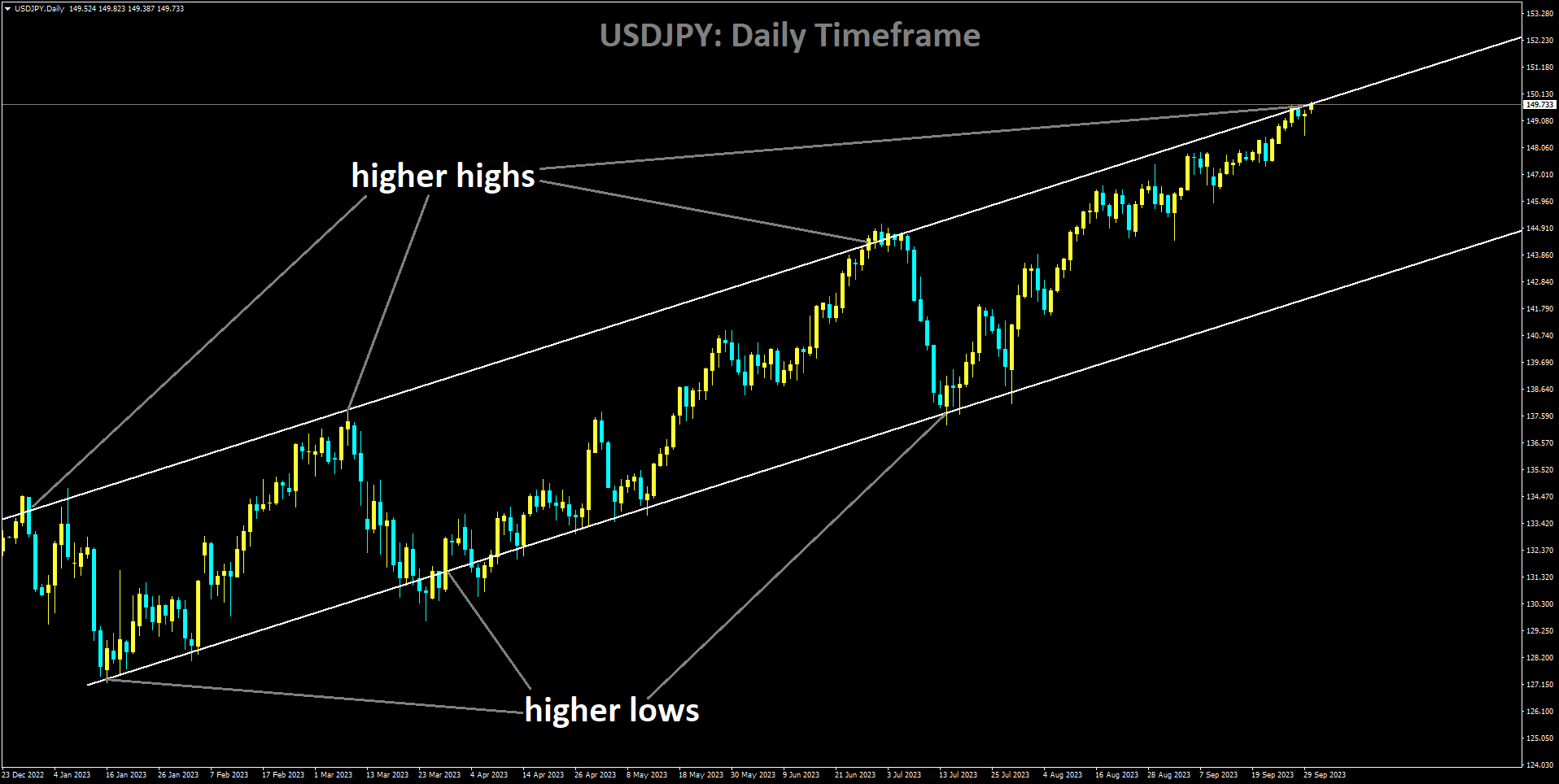

USDJPY Analysis

USDJPY is moving in Ascending channel and market has reached higher high area of the channel.

Before Monday’s US ISM PMI, which is scheduled later, the major pair is generally strengthened by the renewed US Dollar USD. But in light of the potential for FX intervention by Japanese authorities, traders may become wary. The US’s greater preference for longer narratives strengthens the currency overall. In the meantime, the US Dollar Index DXY, which gauges the worth of the US dollar in relation to a basket of other currencies, continued its upward trend and reached its highest level since November of last year at 106.28. While Fed Bank of Richmond President Thomas Barkin stated that the central bank holding steady at the September FOMC meeting was appropriate and that the Fed has time to see data before deciding what is next for rates, Federal Reserve Fed Bank of New York President John Williams stated on Friday that the Fed is at or near peak for the federal funds rate. Williams also mentioned that the Fed will need a restrictive policy stance for some time to achieve goals. The Personal Consumption Expenditures PCE Price Index increased 3.5% YoY in August from 3.4% in July on Friday, as anticipated by the market. In the meantime, as anticipated, the annual Core PCE Price Index the Federal Reserve’s favourite measure of inflation grew 3.9% from 4.3% in July.

The PCE Price Index increased by 0.4% and the Core PCE Price Index by 0.1% month over month, respectively. These two numbers were below the predictions of experts. Furthermore, as anticipated, personal spending and income increased by 0.4% each month. The Fed’s Chair Jerome Powell’s speech later in Monday’s American session will be watched by market participants for clues. The officials’ aggressive remarks may strengthen the US dollar USD and provide support for the USDJPY exchange rate. As the pair trades close to the psychological round number of 150.00, as well as the zone where the Bank of Japan intervened in the market the previous year, traders may be discouraged from placing a bullish bet due to the possibility of FX intervention by the Japanese authorities. Shunichi Suzuki, the finance minister of Japan, continued his verbal intervention early on Monday. Suzuki said he was keeping a “cautious” eye on currency movements. Governor of the Bank of Japan Kazuo Ueda stated on Saturday that the bank still had “a distance to go” before ending its extremely loose monetary policy. The BoJ stated in the Summary of Opinions from the Monetary Policy Meeting on September 21 and 22 that they do not need to make any more adjustments to the YCC because long-term rates are moving fairly steadily and that the removal of the negative rate must be contingent upon meeting the 2% inflation target. Following the Fed Chair Powell’s speech, market participants will be watching the US ISM Manufacturing PMI for September, which is due on Monday. The US ADP Employment Change and ISM Services PMI for September are scheduled to be released on Wednesday later this week. On Friday, the focus will be on the US Nonfarm Payrolls. These occurrences might offer the USD/JPY pair a distinct direction.

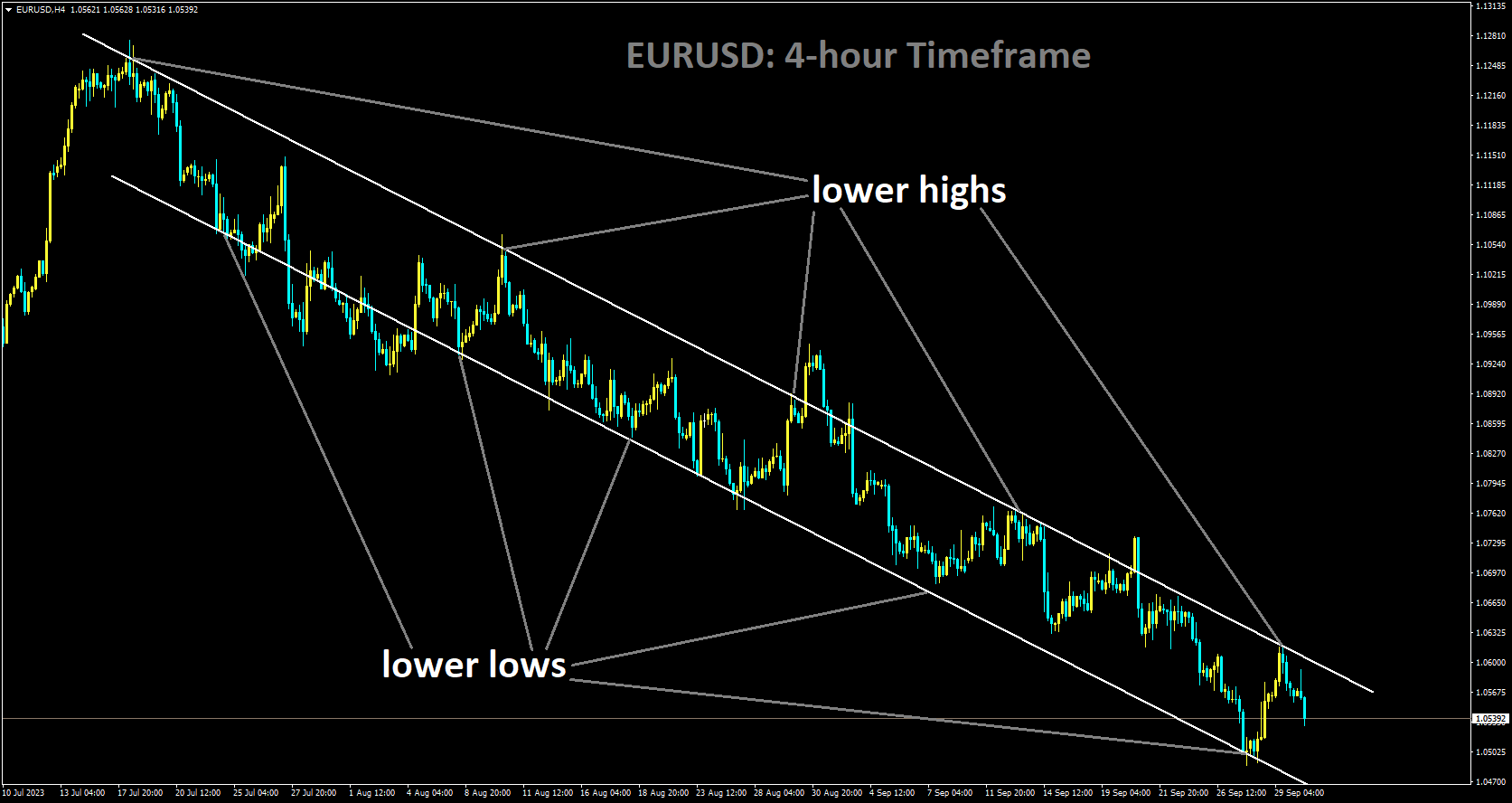

EURUSD Analysis

EURUSD is moving in Descending channel and market has fallen from the lower high area of the channel.

Investors continue to predict that the Federal Reserve will raise interest rates by 25 basis points before the year is out, consistent with the monetary policy forecast. Despite inflation rates above the bank’s target and growing concerns about a possible recession, market discussions about a likely impasse in policy changes at the European Central Bank persist.

The US is expected to focus entirely on the release of the ISM Manufacturing PMI, followed by Construction Spending, the final S&P Global Manufacturing PMI, and speeches by Patrick Harker, the president of the Federal Reserve Bank of Philadelphia, FOMC Governor Michael Barr, a centrist permanent voter, and John Williams, the president of the Federal Reserve Bank of New York.

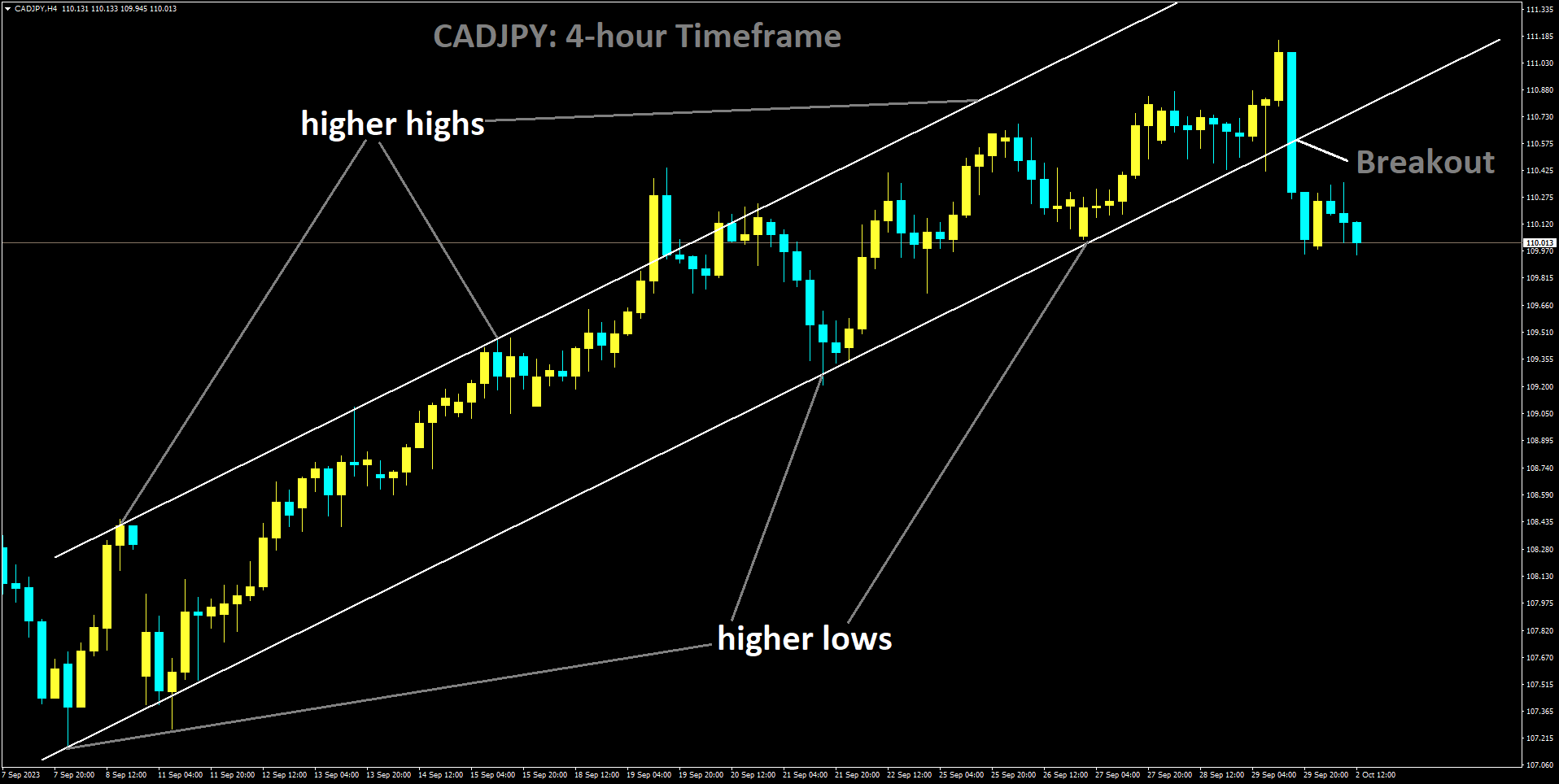

CADJPY Analysis

CADJPY has broken Ascending channel in downside.

On Monday, Hirokazu Matsuno, the Chief Cabinet Secretary of Japan, declared that he was closely watching FX moves with a high sense of urgency. It is crucial for currencies to move in a stable manner reflecting fundamentals, he continued.

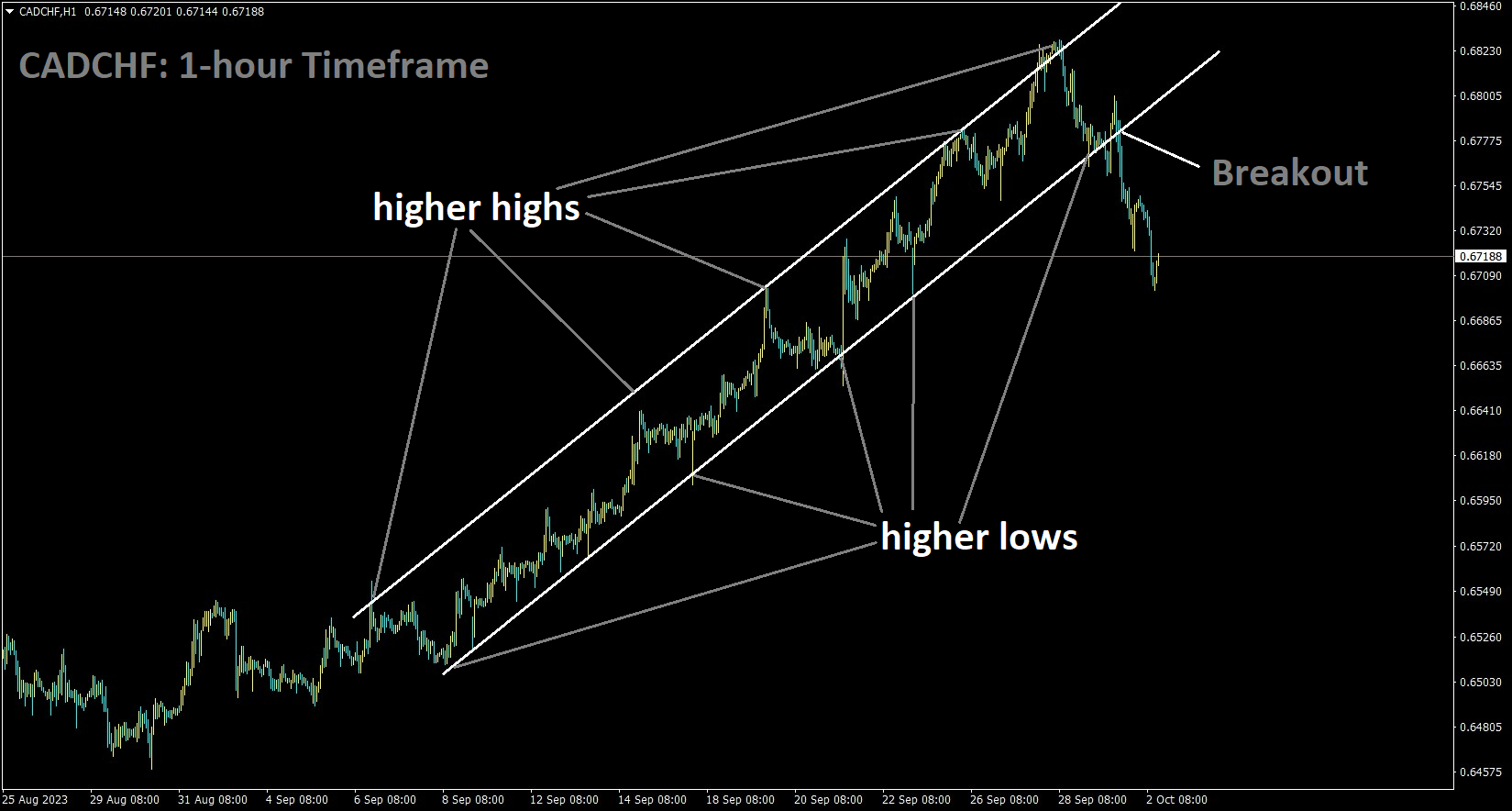

CADCHF Analysis

CADCHF has broken the Ascending channel in downside.

The headline GDP number for July in Canada was flat at 0.0%, compared to a 0.2% contraction in the previous month. These figures fell short of market expectations.

The markets were predicting a pitiful 0.1% increase in the GDP of Canada. Slack oil prices on Friday after being tightly wound and supporting the Canadian dollar.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/