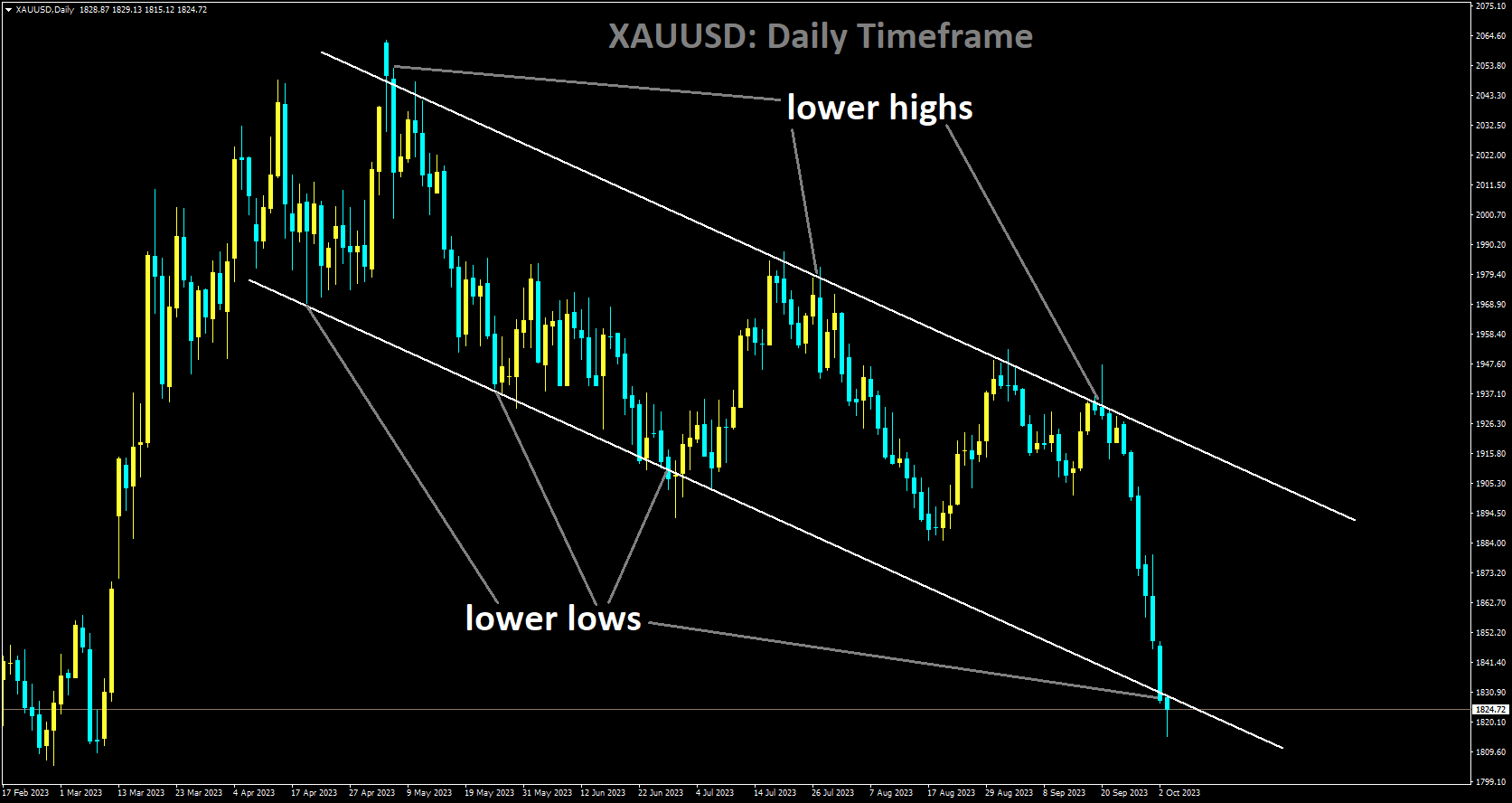

GOLD Analysis

XAUUSD is moving in Descending channel and market has reached lower low area of the channel

The price of gold XAUUSD has been declining since the Federal Reserve Fed reaffirmed the higher-for-longer thesis in September and issued a warning that sticky inflation would probably lead to at least one more interest rate hike in 2023. Furthermore, the United States’ US robust macrodata continues to support elevated US Treasury bond yields and the possibility of additional policy tightening by the Fed. Thus, flows away from the unyielding yellow metal and the US Dollar USD rise to their highest point since November 2022. Tuesday sees the Gold price continue its downward trend for the seventh day in a row, pushing it to $1,815—its lowest point since March 9 during the Asian session. Nevertheless, a generally down tone in the equity markets supports the precious metal, which serves as a safe haven, and helps contain losses when the daily chart is in extremely oversold territory. Therefore, any significant recovery attempt may still be viewed as a chance for bearish traders, given the fundamental backdrop’s indication that the XAUUSD is headed towards a downward path of least resistance.

Due to growing speculation that the Federal Reserve will hike interest rates further, the price of gold experiences its longest losing run since August 2022. In order to get inflation back down to the 2% target, Fed officials reiterate that restrictive monetary policy will be needed for a while. If the new data shows that the rate of inflation has either stopped growing or is growing too slowly, Fed Governor Michelle Bowman is prepared to support increasing interest rates even further. The key question right now, according to Fed Vice Chair Michael Barr, is how long to keep rates at a level that is sufficiently restrictive to meet the objectives. In addition, Cleveland Fed President Loretta Mester stated that higher rates are required to ensure that the deflation process continues and that risks to inflation are weighted towards the upside. September saw an improvement for the third consecutive month as the US ISM Manufacturing PMI rose to 49.0, its highest level since November 2022. Furthermore, rising consumer spending and rising petrol prices portend future price increases and increase the likelihood of additional policy tightening. The outlook drives the yield on the benchmark 10-year US government bond to a 16-year peak, and markets are currently pricing in a 45% chance of another 25 basis point bps rate hike this year. The US Dollar continues to depress the price of gold as it rises to its highest level since November 2022. There is no relief for bulls from a lower risk tone. Since risk-off sentiment is so strong, bearish traders take a break, which helps the traditional safe-haven XAUUSD.

USDCHF Analysis

USDCHF is moving in an Ascending channel and the market has reached the higher high area of the channel.

The USDCHF pair has gained ground for the past two days, but on Tuesday morning during the early Asian session, it is still capped below the 0.9200 barrier. The stronger US dollar USD, rising US Treasury yield, and the hawkish remarks made by Federal Reserve Fed officials all contribute to the pair’s upward movement. At the moment, the pair is up 0.02% for the day and is trading close to 0.9184. Loretta Mester, president of the Federal Reserve Fed Bank of Cleveland, said earlier on Tuesday that the Fed’s monetary policy path will depend on how the economy performs and that the Fed will probably need to raise interest rates again this year. Furthermore, Federal Reserve Governor Michelle Bowman said on Monday that it is probably going to be necessary to raise the policy rate even higher and keep it at restrictive levels for a long time. Michael Barr, the Fed’s Vice Chair for Supervision, said that monetary policy should be handled cautiously. According to him, the key question is not how much interest rates will increase but rather how long they will stay at a level that is sufficiently restrictive.

According to data released on Monday by the Institute for Supply Management ISM, the US manufacturing sector’s business environment continued to deteriorate in September. The US ISM Manufacturing PMI beat the market estimate of 47.7 points in September, coming in at 49.0 from 47.6 in August. The Prices Paid Index also decreased, going from 48.4 to 43.8. Through 51.2, the Employment Index increased from 48.4. The New Orders Index increased from 46.8 to 49.2 in the end. Conversely, later on Tuesday, the Swiss Consumer Price Index CPI will be made public. While the monthly figure is predicted to remain at 0% in September to 0.2% in August, the annual figure is predicted to increase to 1.8% in September from 1.6% in the previous reading.

Apart from that, according to Reuters, the Biden administration has alerted China to the impending arrival of new export limitations on artificial intelligence chips and chip-making equipment to China. On October 7, 2022, which is one year after the measures were first unveiled, this would be an update. Market optimism should be tempered by the growing tension between the two biggest economies in the world. This could therefore work against the USDCHF pair and favour the traditional safe-haven Swiss Franc. Next up for market watchers are the US JOLTS Job Openings for August, which are due on Tuesday, and the Swiss Consumer Price Index CPI for September. The US ADP report and ISM Services PMI will be released on Wednesday later this week. The US Nonfarm Payrolls on Friday will be the primary event of the week. These occurrences might offer the USDCHF pair a distinct direction.

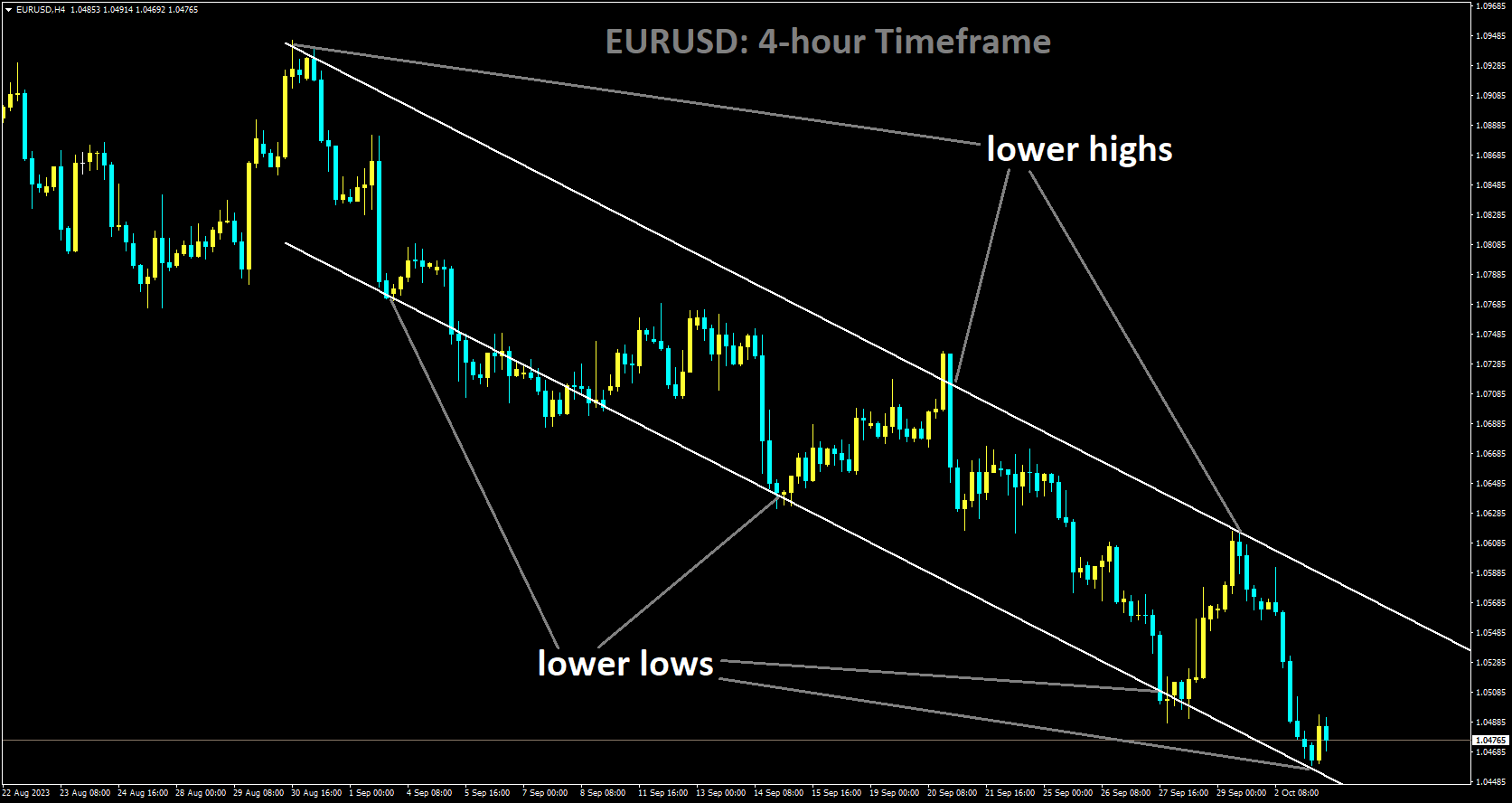

EURUSD Analysis

EURUSD is moving in Descending channel and market has reached lower low area of the channel.

Gediminas Šimkus, the Governing Council member of the European Central Bank ECB, stated on Tuesday that inflation is headed downward. Monetary policy responded quickly and effectively. There are still a lot of obstacles to inflation. In order to control prices, rates must remain strict.

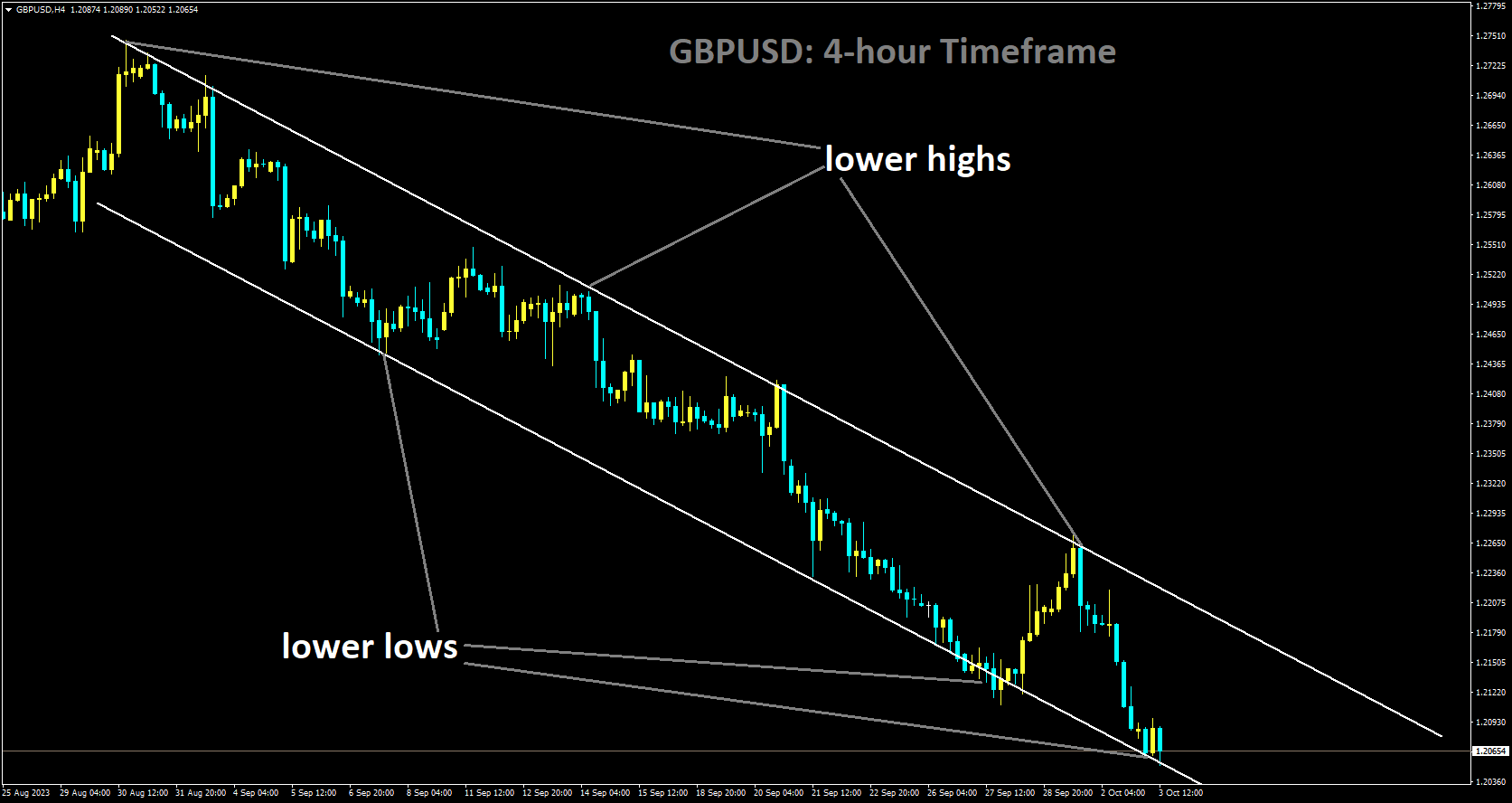

GBPUSD Analysis

GBPUSD is moving in Descending channel and market has reached lower low area of the channel

The pound sterling GBP is still performing relatively poorly following the Bank of England’s BoE unexpected decision to halt its rat-hiking cycle in September. For the first time since December 2021, interest rates were not raised by the BoE. Furthermore, the UK central bank gave no indication that it intended to raise interest rates further and reduced its estimate for economic growth in the July–September period from 0.4% to just 0.1%. The GBP/USD pair is hampered by this as well as the general strong bullish sentiment surrounding the US Dollar USD. The growing consensus that the Federal Reserve Fed will maintain its hawkish stance is helping to support the USD Index DXY, which measures the Greenback against a basket of currencies, as it rises to its highest level since November 2022. The likelihood of at least one more rate increase by year’s end has actually been priced in by the markets. Furthermore, according to Cleveland Fed President Loretta Meste, in order to bring inflation back to the 2% target, the US central bank will need to maintain restrictive interest rates. This maintains the USD’s support and drives the yield on US Treasury bonds to a new multi-decade high.

pound sterling GBP is still performing relatively poorly following the Bank of England’s BoE unexpected decision

A generally weaker risk tone is perceived as another factor supporting the Greenback’s relative safe-haven status and weighing on the GBPUSD pair, in addition to the Fed’s higher-for-longer interest rate narrative. The market’s initial outburst following the mixed Chinese PMIs and the US stopgap funding bill’s passage over the weekend proved to be transient as concerns about economic headwinds resulting from quickly increasing borrowing costs surfaced. This supports the USD bulls and pushes investors towards more conventional safe-haven assets, validating the major’s near-term negative outlook. Going forward, the UK is not scheduled to release any economic data that could significantly impact the market, so the GBP/USD pair will be at the mercy of the dynamics of the USD price. Traders will be watching the US JOLTS Job Openings data later in the early North American session. This will affect the dynamics of the USD price and give it some impetus, along with the US bond yields and the general risk sentiment. But the US NFP report, which is due on Friday, will continue to be the main focus.

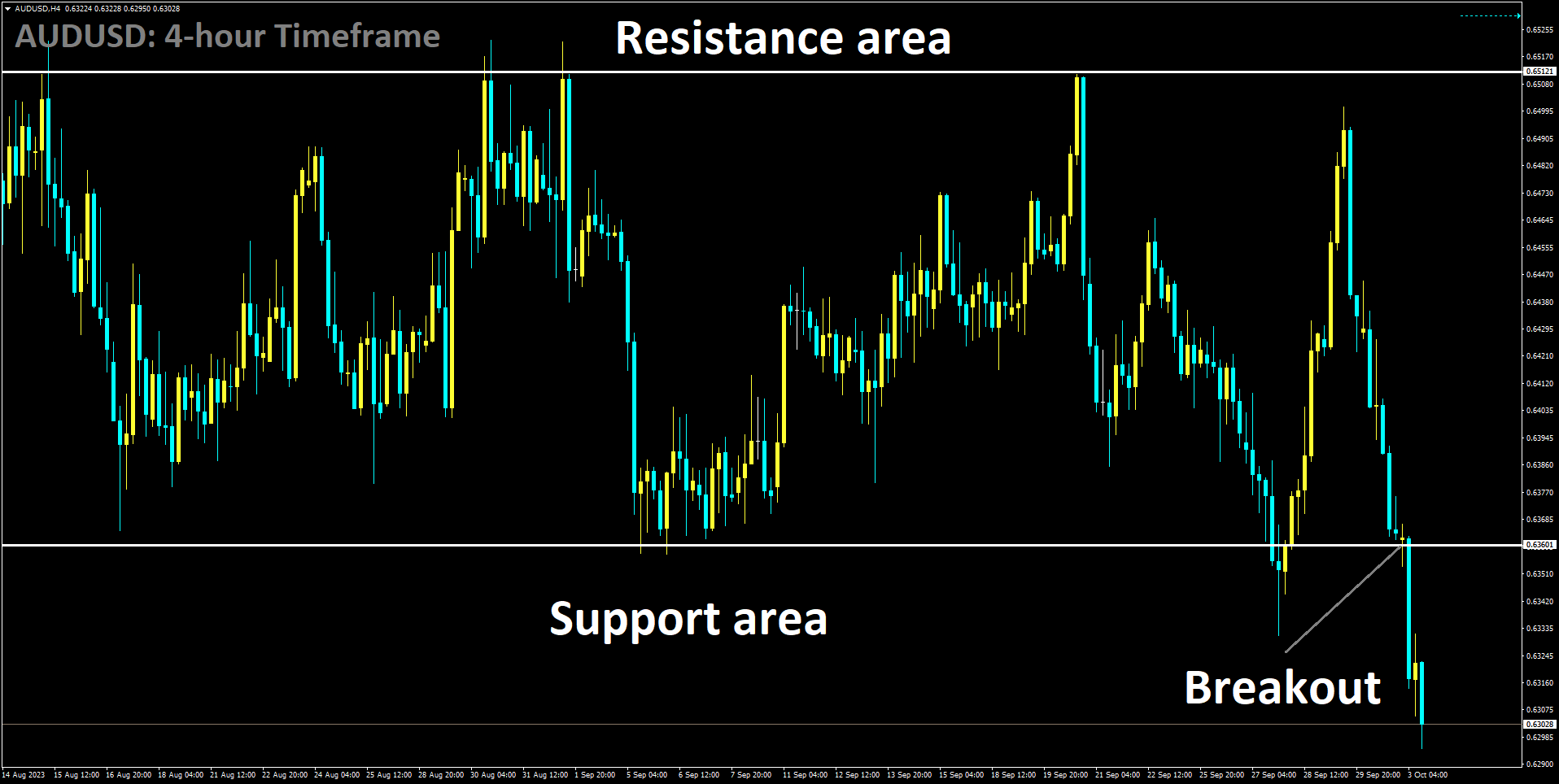

AUDUSD Analysis

AUDUSD has broken box pattern in downside

Due to a further increase in the US dollar USD and US Treasury yields, the Australian dollar AUD is still declining on Tuesday. In addition, the Reserve Bank of Australia’s RBA interest rate decision has put pressure on the AUDUSD pair. The Australian dollar may face pressure if the central bank of Australia sticks to its current course and keeps the interest rate at 4.10% during its policy meeting on Tuesday. A Reuters poll indicates that if inflation stays above target, rates may be raised to a maximum of 4.35% by the end of the year. According to the Australian Bureau of Statistics, August saw an increase in the number of permits for new construction projects. According to the ANZ Job Advertisements data, September saw a decline from August. With the dollar reaching an 11-month high and the 10-year U.S. Treasury yield rising above its highest level since 2007, the US Dollar Index DXY continues to rise following mixed data released by the US on Monday. September’s US ISM Manufacturing PMI reading was better than August’s. While Manufacturing Prices Paid fell in that same month, the Manufacturing Employment Index Sep also showed improvement. At the time of writing on Tuesday, the AUDUSD exchange rate was down, continuing its downward trend.

Ahead of the RBA’s interest rate announcement, the Australian dollar is under pressure. Although the RBA chose to maintain the current interest rate at 4.1%, rates could rise to a maximum of 4.35% by the end of the year. Australia’s Building Permits MoM reversed from the previous 8.1% decline and increased to 7% from the 2.5% predicted in August. September saw a 0.1% decrease in ANZ Job Advertisements, following a 1.9% increase in August. The Manufacturing PMI data for China came out of the red. China’s NBS Manufacturing PMI for August increased to 50.2 from 49.7 previous readings, which was higher than the anticipated 50.0. On Monday, the yield on the US Treasury 10-year note increased to 4.70%, the highest since 2007. The US ISM Manufacturing PMI increased to 49.0 in September from 47.6 in August, surpassing the 47.7 market estimate. Manufacturing Prices Paid dropped from 48.4 to 43.8, a significant decline. The Employment Index increased to 51.2 from 48.4. In the US, legislation to prevent a government shutdown was successfully passed on Friday, ensuring funding through November 17. This event has caused the US Dollar Index DXY to resume its upward trend.

Governor of the Federal Reserve Fed, Michelle Bowman, stated on Monday that she believed it would be appropriate to raise the policy rate even further and keep it at restrictive levels for a longer period of time. Fed Vice Chair for Supervision Michael Barr stressed the need for monetary policy to be implemented cautiously. According to Barr, the central bank needs to consider how long interest rates will remain at a level that is sufficiently restrictive as well as how much they will rise. Barr, though, thinks the Fed can control inflation without seriously hurting the labour market. With the release of the ADP report on Wednesday and the Nonfarm Payrolls on Friday, traders are anticipating the release of US employment data.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/