AUDNZD is moving in an Ascending channel and the market has reached the higher low area of the channel

The Reserve Bank of New Zealand plays a pivotal role in the country’s economic stability and growth. One of the key events in the RBNZ’s calendar is the October Monetary Policy Review, where critical decisions regarding interest rates and monetary policy are made. This review is a reflection of the RBNZ’s ongoing efforts to manage the New Zealand economy effectively.

The primary tool the RBNZ uses to influence economic conditions is the Official Cash Rate (OCR). The OCR is the interest rate at which banks borrow funds from the RBNZ, and it has a direct impact on retail interest rates, including mortgage rates and savings account yields. Therefore, the OCR serves as a crucial lever in the RBNZ’s arsenal for controlling inflation, economic growth, and employment levels.

Shadow Board’s Recommendation: Maintaining the OCR at 5.50 Percent

During the October Monetary Policy Review, the RBNZ receives recommendations from the NZIER Shadow Board, a group of experts from various sectors of the economy. These experts provide their assessments and opinions on the appropriate course of action regarding the OCR.

In the most recent review, a notable consensus among the Shadow Board members was the recommendation to keep the OCR unchanged at 5.50 percent. This decision reflects a cautious approach, with the majority of members believing that the current OCR level remains appropriate for the economic conditions at hand.

Uncertainty Surrounding Interest Rate Impact

One of the primary factors influencing the Shadow Board’s recommendation to maintain the OCR was the uncertainty surrounding the full impact of recent interest rate increases on the broader New Zealand economy. Interest rate changes take time to permeate through the economy and have their intended effects. Therefore, the Shadow Board emphasized the importance of patience in assessing the outcomes of previous OCR hikes.

The Shadow Board recognized that monetary policy decisions have lag effects, and the full transmission of interest rate changes to the economy can take several months. This uncertainty about the timing and magnitude of these effects led to a cautious stance.

Differing Views within the Shadow Board

While the majority of the Shadow Board recommended holding the OCR steady, two members expressed a dissenting view. They advocated for a 25 basis-point increase in the OCR during the October review. This divergence in opinion underscores the complexity of the economic landscape and the range of factors that inform policy decisions.

The members in favor of an OCR hike cited specific concerns, including the crystallization of upside risks to inflation. These members believed that a preemptive move to increase the OCR would be prudent, given the recent developments in inflation and inflation expectations.

Forward-Looking Views on the OCR

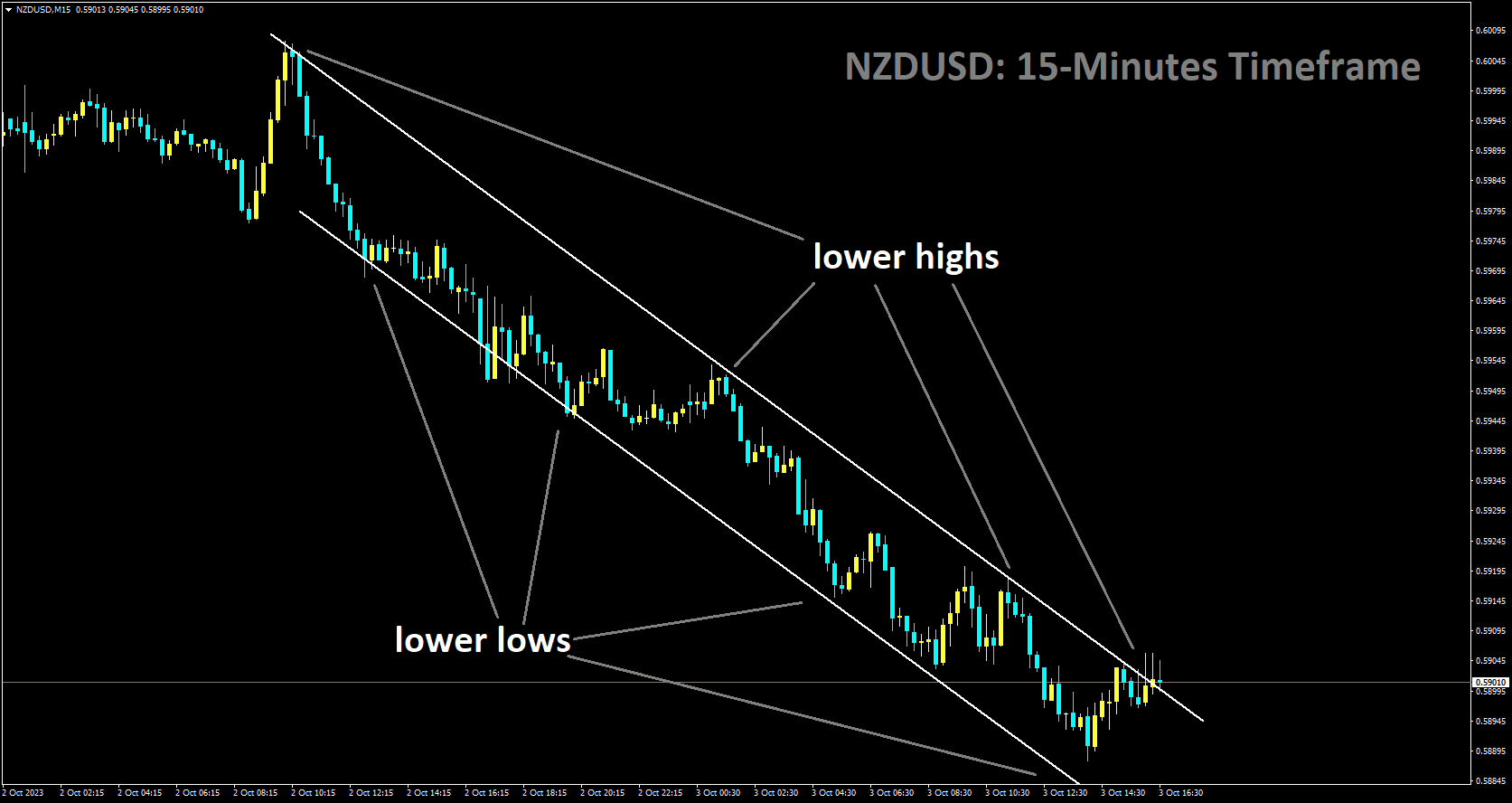

NZDUSD is moving in Descending channel and market has reached in lower high area of the channel.

The Shadow Board’s recommendations are not confined to the current OCR level; they also consider the OCR’s likely trajectory in the future. In the October review, the Shadow Board’s core view on the OCR’s level one year from now ranged from 4.50 percent to 5.75 percent, centered on an OCR of 5.50 percent. This represents a shift from the August NZIER Shadow Board’s view, which centered on an OCR of 5.25 percent.

The change in the central view reflects an increased sense among members that further OCR increases may be necessary. The persistence of inflationary pressures and elevated inflation expectations played a significant role in shaping this outlook. However, there was also a member who recommended maintaining the status quo and adopting a wait-and-see approach.

Expert Opinions on RBNZ’s Decision

Prominent economists and analysts offered their perspectives on the RBNZ’s decision following the October review. Stephen Toplis emphasized the uncertainty inherent in such decisions, acknowledging that determining the “right” action is challenging. He highlighted the potential consequences of both lower and higher interest rates and the need for adaptability in economic policy.

Jarrod Kerr provided an alternative viewpoint, suggesting that the next move from the RBNZ would be a rate cut but not until May 2024. This indicates his belief in a measured approach, allowing for a period of observation and data analysis before considering further adjustments.

Kelly Eckhold expressed concerns about upside risks to inflation and their impact on the timing of future rate cuts. She argued that an earlier rise in the OCR might be necessary to mitigate these risks, potentially accelerating the schedule for rate cuts.

Dennis Wesselbaum highlighted the contrasting inflation trends between the United States and New Zealand. With U.S. inflation at around 3% and New Zealand’s core inflation hovering at approximately 5.8%, he suggested that higher inflation expectations might warrant another OCR increase, especially if past OCR hikes were not aggressive enough.

Impact of Chinese Economic News on Currency Markets

EURNZD is moving in the Rising wedge pattern and the market has reached the higher low area of the pattern

Currency markets are highly sensitive to global economic developments, and news out of China can have a profound effect on currencies like the New Zealand dollar (NZD) and the Australian dollar (AUD). Both New Zealand and Australia have strong economic ties with China, making their currencies susceptible to changes in the Chinese economic landscape.

In recent weeks, there has been a significant shift in sentiment and the direction of the Kiwi dollar. Initially, the NZD was underperforming against the Euro and the UK Pound in comparison to the US dollar. However, this sentiment reversed as the Chinese economy stabilized and speculative fears about its potential collapse subsided.

Stabilization of the Chinese Economy

The shift in sentiment surrounding the NZD can be attributed to developments in the Chinese economy. A month prior to the NZD’s resurgence, the financial media speculated that China was facing significant economic challenges and potential implosion. Historically, when news from China turns negative, it tends to put downward pressure on antipodean currencies like the NZD and AUD, as these economies are seen as heavily reliant on China.

However, the Chinese government responded swiftly by implementing measures to stabilize its economy. This reassured global markets, causing attention to shift away from China and towards economic concerns in the UK and Europe. This change in focus had implications for currency markets, impacting exchange rates.

RBNZ Interest Rate Review in the Context of Upcoming Elections

The timing of the RBNZ’s interest rate review coincided with the lead-up to New Zealand’s general election. While the RBNZ’s primary mandate is to maintain price stability and support maximum sustainable employment, political events can influence economic conditions and market sentiment.

The consensus among experts was that the RBNZ would not increase the OCR from its current level of 5.50 percent. However, there was a recognition that the RBNZ might not be entirely satisfied with the persistently high inflation levels, given 12 months of tightening monetary policy.

In addition to economic factors, the rebound of the Kiwi dollar may also reflect the “smart money” anticipating a change in government to a more business-friendly center-right coalition. While the New Zealand economy wasn’t experiencing robust expansion at the time, an increase in business confidence was noted.

Speculation and Currency Positions

Speculation plays a significant role in currency markets, and the short-selling of the NZ dollar positions is a notable example. The charts indicate a substantial increase in the number of open futures contracts over a short period, transitioning from near zero to around -20,000 open short-sold positions.

What’s intriguing is that despite the heavy speculative selling volumes, the NZD/USD exchange rate did not decline; instead, it appreciated to 0.6000. This phenomenon suggests the presence of large Kiwi dollar buyers elsewhere in the world, potentially offsetting the sellers’ positions.

Global Hedge Funds and Currency Opportunities

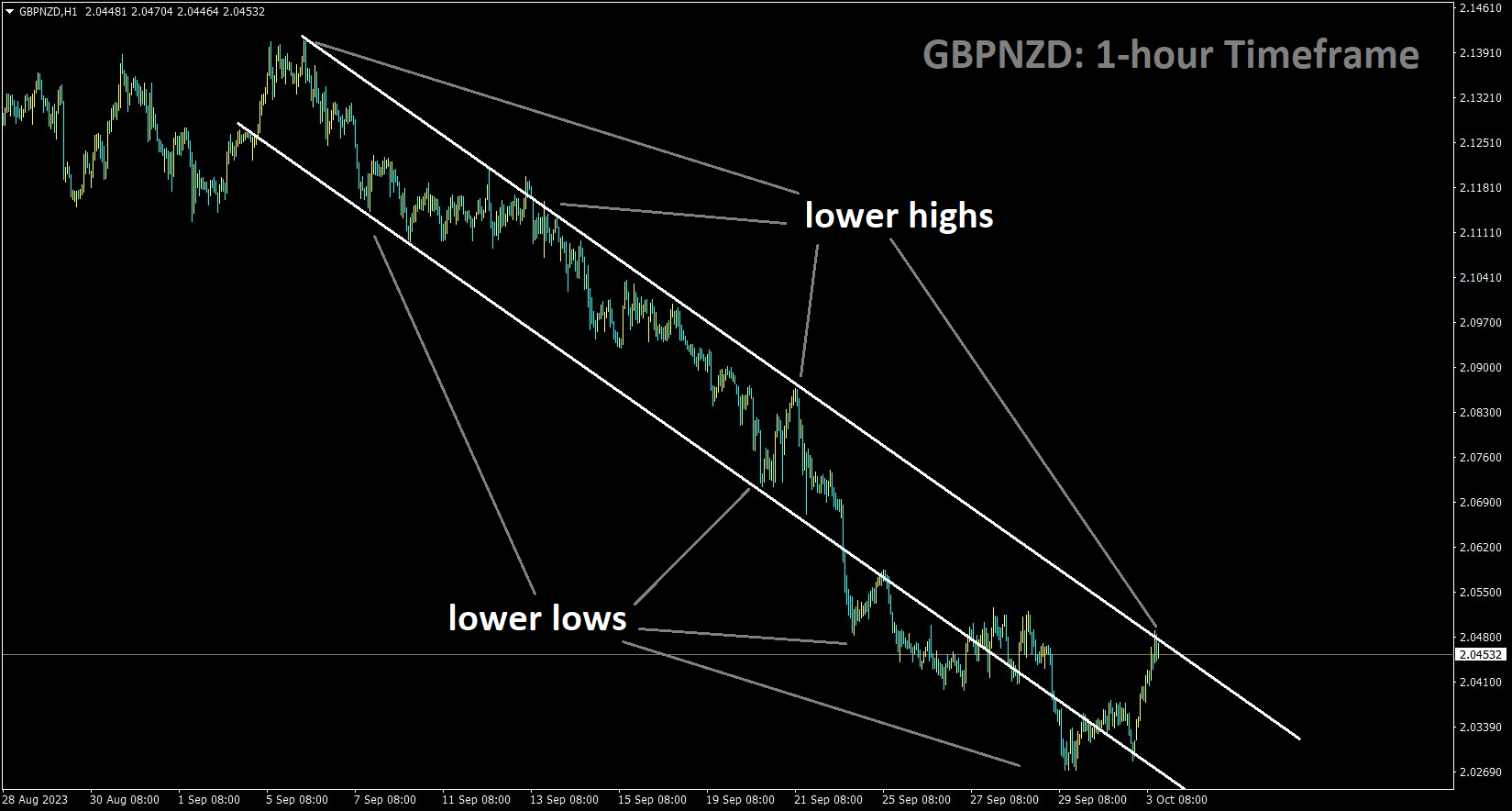

GBPNZD is moving in the Descending channel and the market has reached the lower high area of the channel

The attractiveness of the NZ dollar as an investment opportunity is highlighted, particularly for London-based hedge funds seeking undervalued currencies. Currency movements are influenced by various factors, and one of the key drivers is interest rate differentials.

At the time, it was noted that the NZD and AUD had lost ground in recent months, largely due to market expectations that their interest rates would not rise further. In contrast, U.S. market interest rates had increased, with Federal Reserve members projecting higher rates for longer in the upcoming year.

However, there was a growing sentiment in FX markets that the NZD and AUD might appreciate as market participants considered the possibility of further interest rate hikes. This potential divergence in interest rate expectations was an important factor influencing currency movements.

FX Market Pricing and Interest Rate Expectations

The dynamics of FX market pricing and its relationship with interest rate expectations are explored further. Currency values are influenced by the relative interest rates in different countries, making currencies with higher rates more attractive to investors.

At the time, the Australian interest rate markets were forward-pricing a 40% chance of a 0.25% hike by the Reserve Bank of Australia (RBA) in October and a 65% chance by December. The introduction of a new RBA Governor, Michelle Bullock, was anticipated to potentially affect these odds, reinforcing the idea that interest rate expectations were in flux.

Factors Affecting US Dollar Strength

The factors contributing to the recent strength of the US dollar are explored. There were suggestions that the US dollar’s appreciation was driven by the belief that the U.S. economy was better equipped to handle high interest rates compared to other economies.

However, the upcoming release of economic data, including US CPI (Consumer Price Index) and PCE (Personal Consumption Expenditures) core inflation measures, was expected to provide insights into the direction of the US dollar. A softer economic outlook and weaker data could potentially lead to a reversal of the US dollar’s recent strength.

RBNZ’s Foreign Currency Intervention

The RBNZ’s foreign currency intervention, involving the selling of the NZ dollar to buy US dollars, is an intriguing development. This significant move was made to bolster the RBNZ’s foreign currency intervention reserves.

While the RBNZ’s actions were intended to achieve specific objectives, they also had unintended consequences on the NZD/USD exchange rate. The NZ dollar’s value was influenced by these transactions, leading to fluctuations that had implications for various sectors of the economy, including the petrol market.

Calls for Review of RBNZ’s Operations

NZDCAD has broken Descending channel in upside

The public discussion surrounding the RBNZ’s foreign currency transactions and calls for a review of its mandate and operations is a notable development. The actions of the central bank and their potential impact on the economy and financial markets have raised questions about the appropriateness of its approach.

It is worth considering how the new government, following the upcoming general election, may address this issue. Motorists, in particular, have been affected by the RBNZ’s actions, as they have contributed to higher petrol prices.

In conclusion, the October Monetary Policy Review conducted by the Reserve Bank of New Zealand is a critical event that shapes the country’s economic landscape. The recommendations provided by the NZIER Shadow Board, along with the insights of experts, offer valuable perspectives on the state of the economy and the potential future direction of monetary policy. Additionally, external factors, such as developments in the Chinese economy and global investment strategies, illustrate the interconnected nature of currency markets and their sensitivity to global events.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/