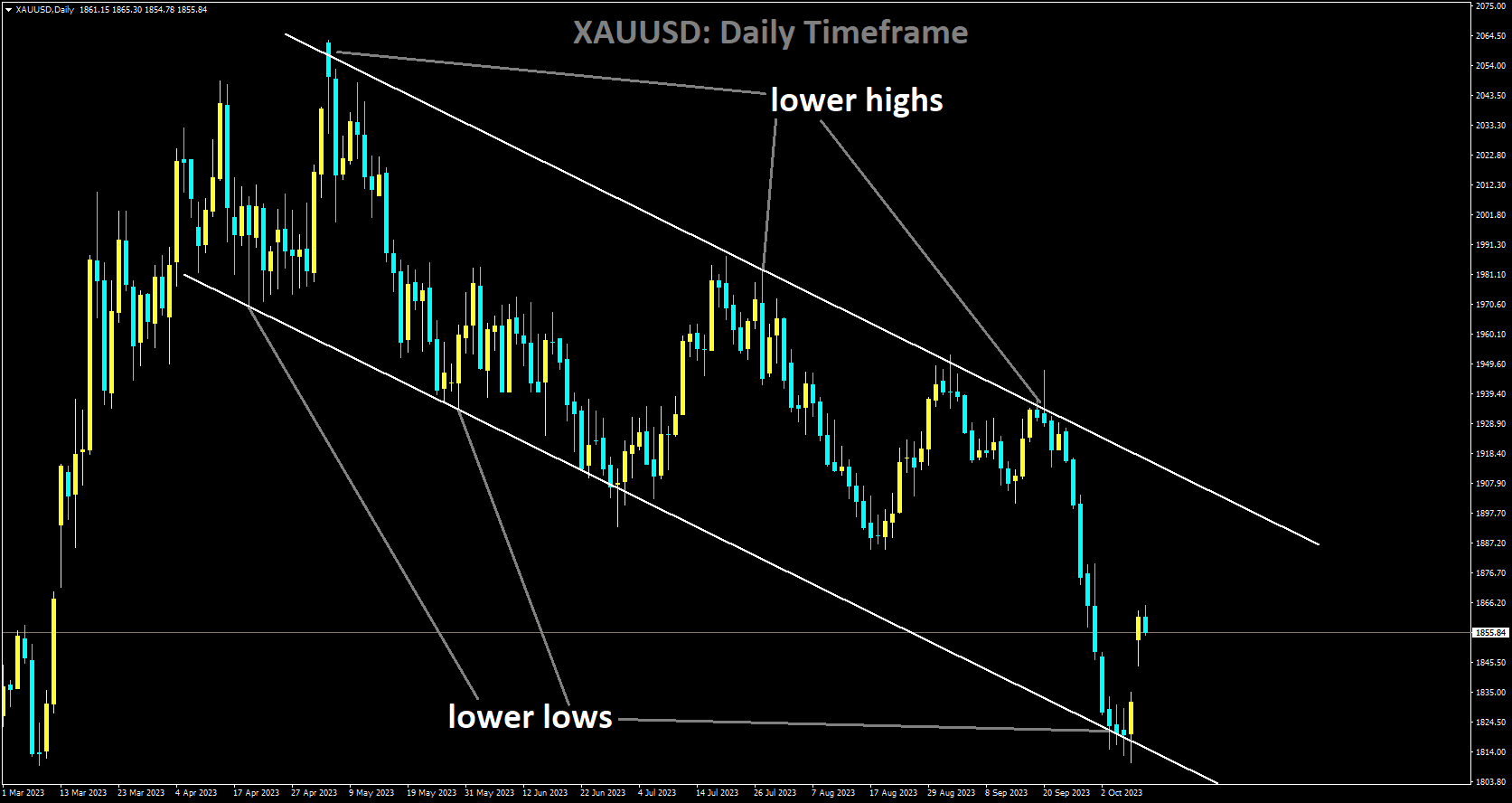

GOLD Analysis

XAUUSD is moving in Descending channel and market has rebounded from the lower low area of the channel

The conflict between Israel and the Palestinian Islamist group Hamas over the weekend caused geopolitical unrest in the financial markets, which increased demand for gold’s safe-haven status and helped the price of gold reach a weekly high of $1857. Investor sentiment is still pessimistic despite the ongoing conflict. Leading US Federal Reserve (Fed) officials, Vice-Chair Philip Jefferson and Dallas Fed President Lorie Logan, crossed newswires. While acknowledging that the current monetary policy is restrictive, Fed Vice-Chair Jefferson underlined that we need to do our work to reduce inflation. They must be agile with regards to what is happening in the economy, he continued. President Logan of the Dallas Fed had earlier said that she is paying attention to inflation risks and that they still have work to be done. She said that there are upside risks to inflation due to the economy’s unexpected strength.

The decline in US Treasury bond rates, especially real yields, is another factor driving up the price of gold. With the US bond markets closed, the yield on the 10-year Treasury Inflation-Protected Securities (TIPS) is unchanged at 2.47%, but the 10-year yield has dropped 15 basis points, from 4.797% to 4.657%. Apart from this, there was no mention of the US economy during Columbus Day celebrations. The US Federal Reserve’s next move would be determined by producer and consumer inflation data later in the week.

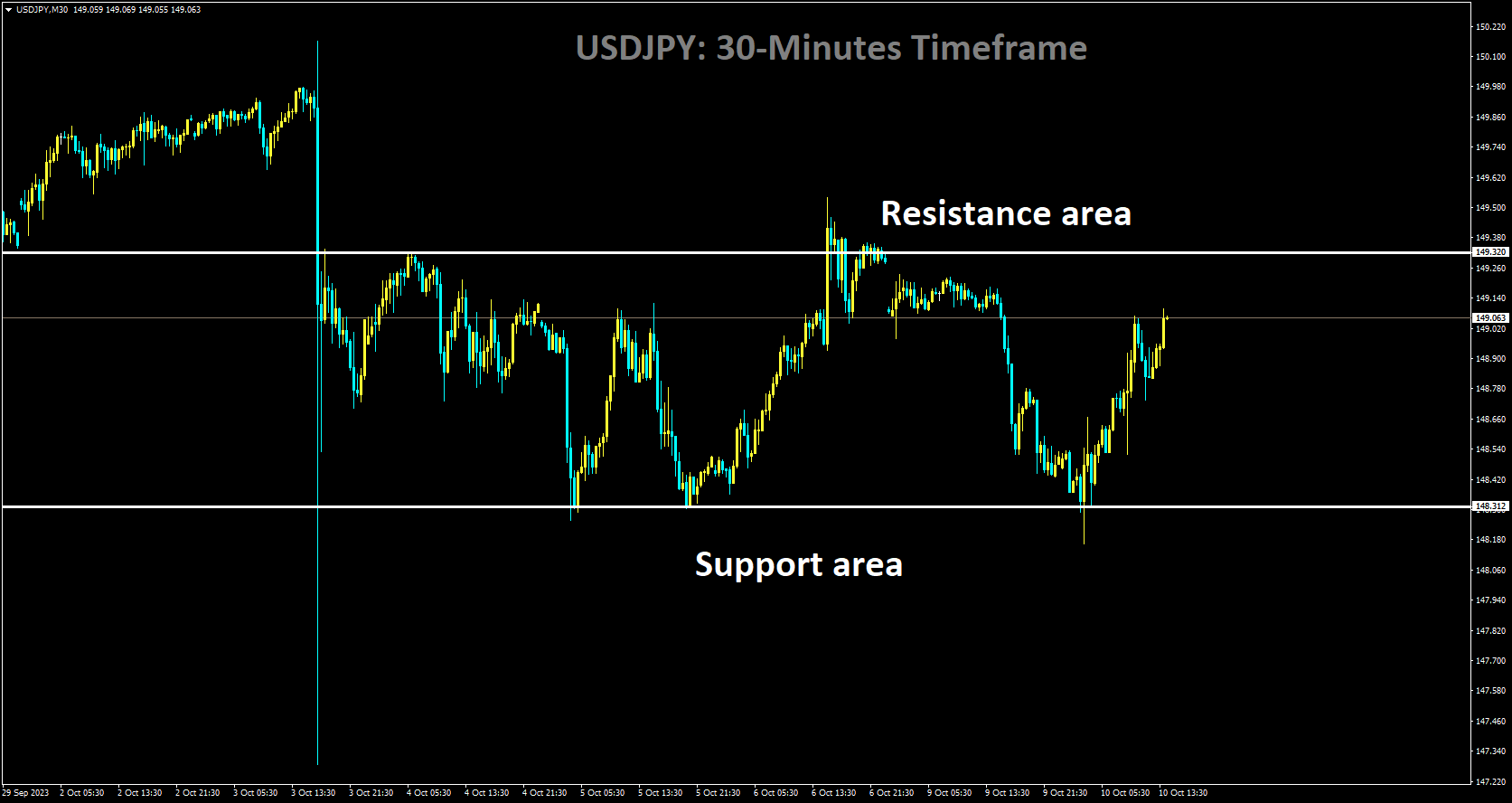

USDJPY Analysis

USDJPY is moving in box pattern and market has rebounded from the support area of the pattern

Shunichi Suzuki, the finance minister of Japan, stated on Tuesday that interest rate differentials are a contributing factor in the current yen’s depreciation. According to Suzuki, the Group of Seven G7 advanced nations’ finance ministers and central bank governors will convene in Japan on October 12 to deliberate on the ongoing conflict in Ukraine and the global economy.

Additionally, as part of its routine daily business on Tuesday, the Bank of Japan BoJ made an offer to purchase Japanese Government Bonds JGB valued at JPY1.40 trillion.

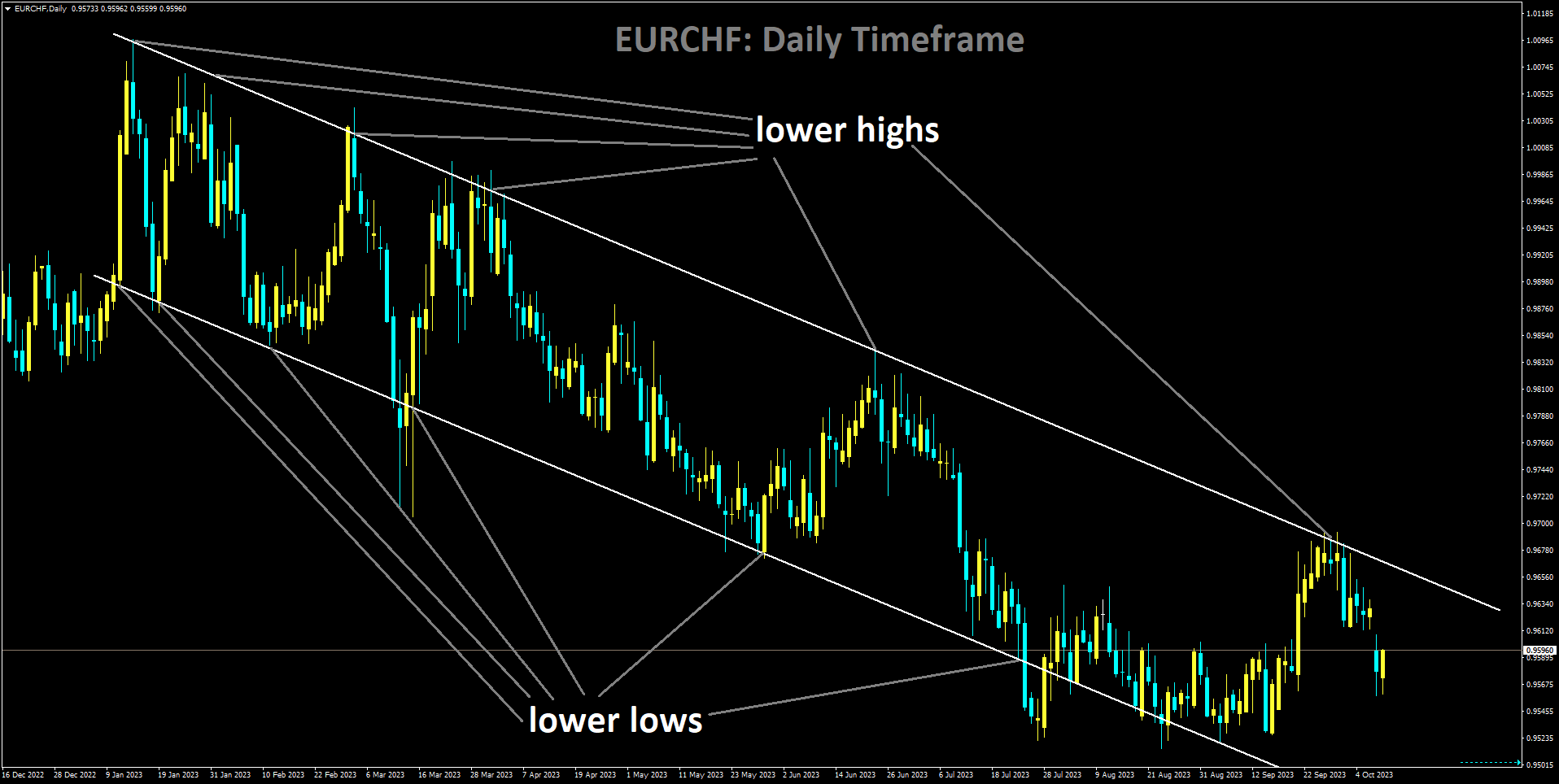

EURCHF Analysis

EURCHF is moving in Descending channel and market has fallen from the lower high area of the channel

Francois Villeroy de Galhau, President of the Bank of France and member of the Governing Council of the European Central Bank (ECB), stated on Tuesday that “at this stage further rate hikes not right thing to do.” Economic uncertainty will be exacerbated by events in Israel. Because of the Israeli situation, we are especially cautious about changes in the price of oil. Despite the circumstances in Israel, there is a noticeable tendency for inflation to decline. We see no need to adjust our inflation forecasts for Israel at this time; it is still expected to hover around 2 percent by 2025. Right now, interest rates are at a decent place.

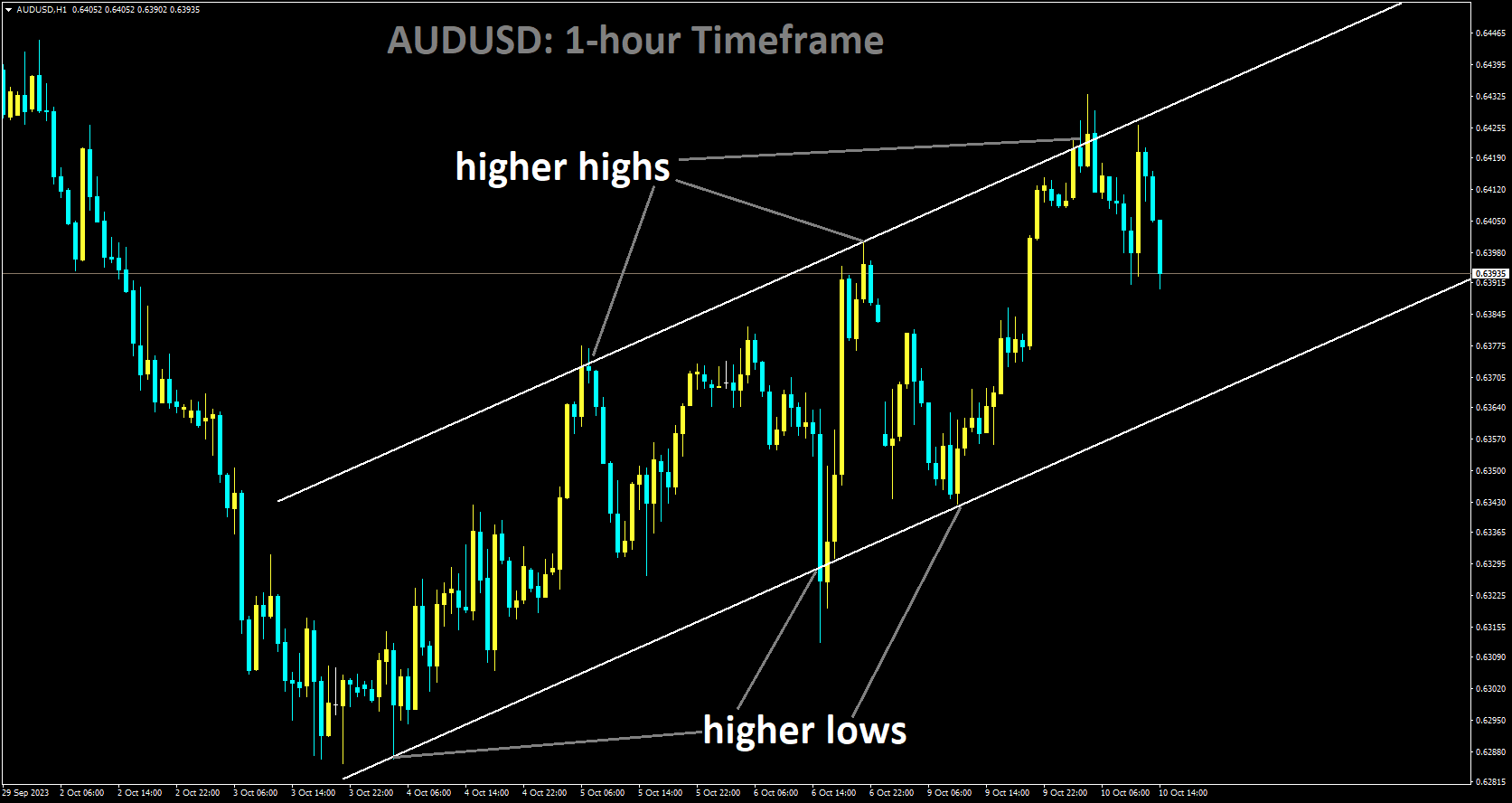

AUDUSD Analysis

AUDUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

This is the fifth day in a row that the Australian dollar AUD has been rising. Because of the ongoing conflict in the Middle East and the strong underlying commodity prices, the Australian dollar is beginning to strengthen. Additionally, October saw an improvement in individual confidence according to Westpac Consumer Confidence. August saw a rise in inflation in Australia, which was mostly caused by rising oil prices. The Reserve Bank of Australia RBA is more likely to raise interest rates again as a result of this development. Should the Middle East’s tensions continue, they may lead to additional rises in oil prices, which could increase inflationary pressures on the Australian economy. The RBA may raise interest rates by 25 basis points bps in response to this scenario, making them 4.35% by the end of the year. China’s Commerce Minister, Wang Wentao, stated that “both sides had rational and pragmatic discussions” following talks with US Senators on Tuesday, highlighting the importance of the US-China economic and trade relationship. China is dedicated to fair competition based on international law, according to Minister Wang. He urged against politicising and oversimplifying security issues and expressed the hope that the US would appropriately define security boundaries.

The US Nonfarm Payroll data, which was released on Friday, was strong, but the US Dollar USD did not see any notable gains. The reason for this lack of appreciation is that US Treasury yields fell on Monday. Furthermore, investors discounted the possibility of additional rate hikes as a result of the remarks made by Federal Reserve Fed officials overnight, which further lowered the yield on US bonds. This is thought to be a sign that the Greenback is losing strength and that the Aussie pair is strengthening. According to Australia’s Westpac Consumer Confidence, things are getting better right now for purchases in October. The index increased 2.9% after declining 1.5% in September.

The tensions in the Middle East may lead to additional rises in oil prices, which could increase inflationary pressures on the Australian economy. The performance of the AUDUSD pair is positively impacted by the elevated demand for commodities like gold and energy as a result of the heightened geopolitical tensions in the Middle East.During their fifth Ministerial Economic Dialogue, Australia pledged to guarantee Japan a steady supply of energy resources. This accord signifies a strategic alliance between the two nations, stressing the significance of a steady and dependable supply of energy resources, most likely including coal and LNG. The Reserve Bank of Australia may decide to raise interest rates, with a peak of 4.35% anticipated by year’s end. This estimate is consistent with inflation continuing to rise above the objective.

The September Nonfarm Payrolls report for the United States showed a noteworthy increase of 336,000 jobs, above the 170,000 market expectation. The updated August figure was 227,000.US Average Hourly Earnings MoM for September were unchanged at 0.2%, below the forecasted 0.3%. The report showed an annual increase of 4.2%, which was less than the 4.3% consistent figure that was expected. On Monday, US Treasury bond yields decreased; currently, the yield on a 10-year US Treasury bond is 4.64%.Fed Vice Chair Philip Jefferson stressed the need for the central bank to proceed cautiously with any further increases in the policy rate, while Dallas Fed President Lori Logan suggested that there might be less need to raise the Fed funds rate. The International Monetary Fund IMF meeting, which is scheduled to discuss tactics for stabilising foreign exchange rates and promoting development, is expected to be watched by investors. In order to evaluate inflationary trends and economic conditions in both countries, traders will be closely observing the US Core Producer Price Index PPI on Wednesday, the Consumer Price Index CPI on Thursday, and Australia’s Consumer Inflation Expectations.

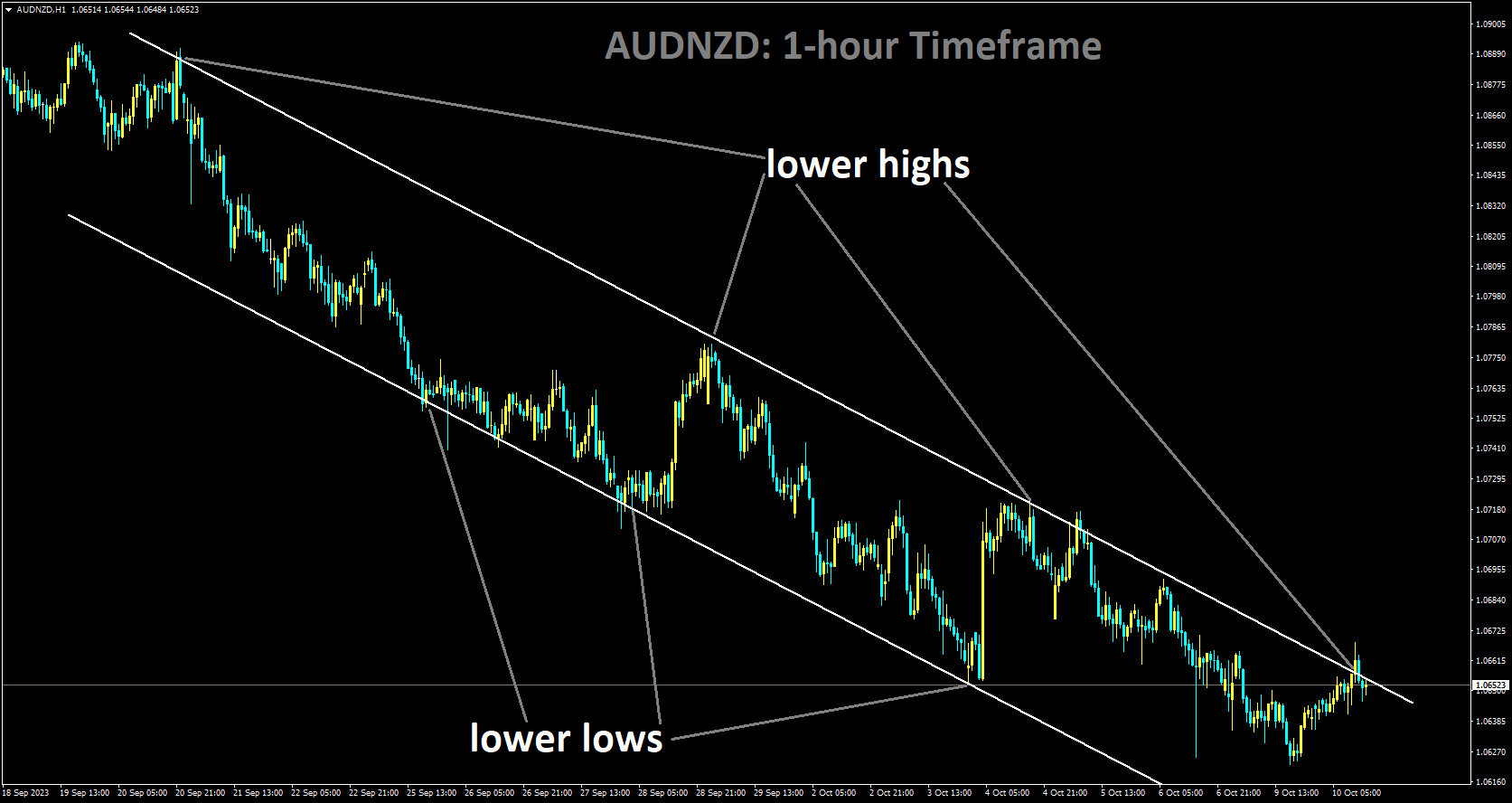

AUDNZD Analysis

AUDNZD is moving in Descending channel and market has reached lower high area of the channel

The Australian and New Zealand Banking Group economists present the salient features of their Roy Morgan Australian Consumer Confidence report. The four-week moving average increased by 0.6 points, while consumer confidence increased by 1.9 points.

While the four-week moving average remained at 5.2%, weekly inflation expectations decreased by 0.1 percentage points to 5.1%. For the first time since April, the current state of finances increased by 3.2 points, hitting the 70 mark. Future financial conditions saw a point increase of 1.7. After dropping for two weeks in a row, the current economic conditions increased by 1.0 points.Future economic conditions increased by one point.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/