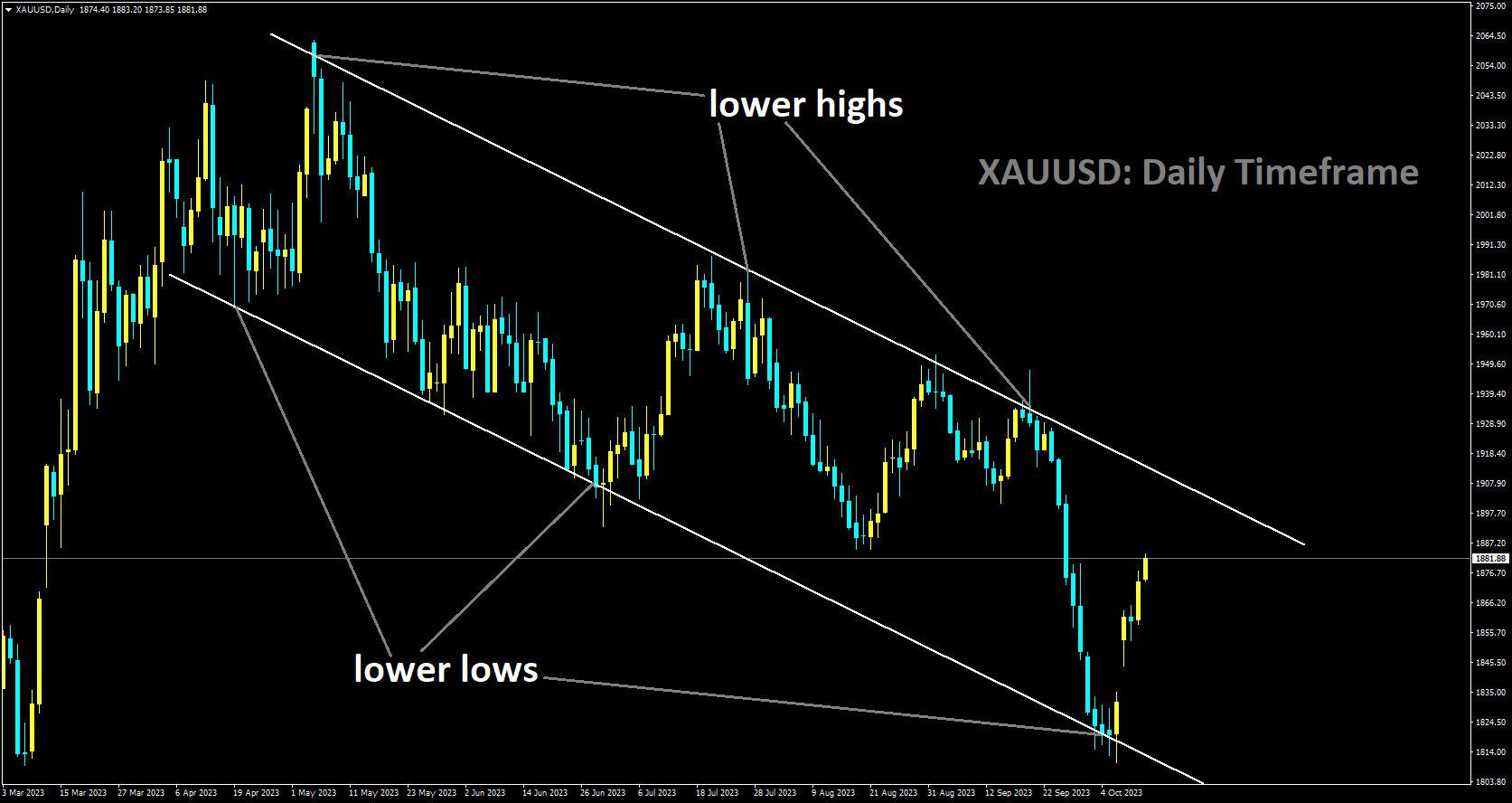

Gold Analysis

XAUUSD is moving in Descending channel and market has rebounded from the lower low area of the channel

The recent FOMC meeting minutes didn’t align with the expectations of those looking to invest in the US Dollar. Interest rates are set to remain unchanged, and it’s anticipated that inflation will reach its target in the coming year. As a consequence, Gold prices have seen a surge against the US Dollar. This surge in demand for the precious metal is also fueled by escalating geopolitical tensions in the Middle East, where Gold is once again proving to be the preferred safe haven amid a decline in the US Dollar (USD). Furthermore, the drop in global bond yields is adding to the allure of this non-yielding asset, contributing to its ongoing rally. With this recent surge, Gold has now recovered over 30% of the losses it incurred back in September. It’s worth noting that this positive momentum is holding strong even in the face of generally positive sentiments in the equity markets. Additionally, speculations are circulating that the Federal Reserve may be nearing the end of its current cycle of raising interest rates, indicating a favorable path ahead for XAUUSD, which seems to be upward.

However, traders should approach the situation with caution and await the release of the latest US consumer inflation figures later in the North American session. Any indications of a further slowdown in US inflationary pressures would strengthen market expectations of the Fed maintaining its current policy stance in November and could ignite speculation about a potential rate cut in Q2 2024. Such a scenario would set the stage for a further weakening of the US Dollar and an increased demand for Gold priced in USD. Conversely, a robust inflation report could leave room for at least one more Fed rate hike before year-end and might prompt some profit-taking among XAUUSD bulls, although any corrective decline is likely to be short-lived. The ongoing conflict between Israel and the Palestinian Islamist group, Hamas, continues to drive safe-haven flows towards Gold. Some Federal Reserve officials have hinted that the recent surge in Treasury yields might reduce the necessity for further rate hikes. For instance, Fed Governor Christopher Waller suggested that higher market rates could warrant a “watch and see” approach.

In September, the US Producer Price Index (PPI) exceeded expectations, but underlying inflationary pressures seemed to be easing. Investors increasingly believe that the Fed is approaching the end of its tightening cycle, with interest rates likely having peaked. The yield on the 10-year US Treasury note has pulled back from its recent 2007 highs. This pullback, coupled with the weakening US Dollar, has further bolstered XAU/USD. The minutes from the September FOMC meeting indicated that most Fed members supported the case for one more rate hike. Market participants are now closely monitoring the latest US consumer inflation figures for insights into the Fed’s future rate-hike trajectory. The headline Consumer Price Index (CPI) is expected to have slowed to 0.3% in September, with the yearly rate ticking down to 3.6%. The more closely watched Core CPI is forecasted to remain steady at a 0.3% monthly pace and come in at 4.1% year-on-year. The crucial CPI report will significantly impact the Fed’s next policy decision and provide fresh direction for the commodity.

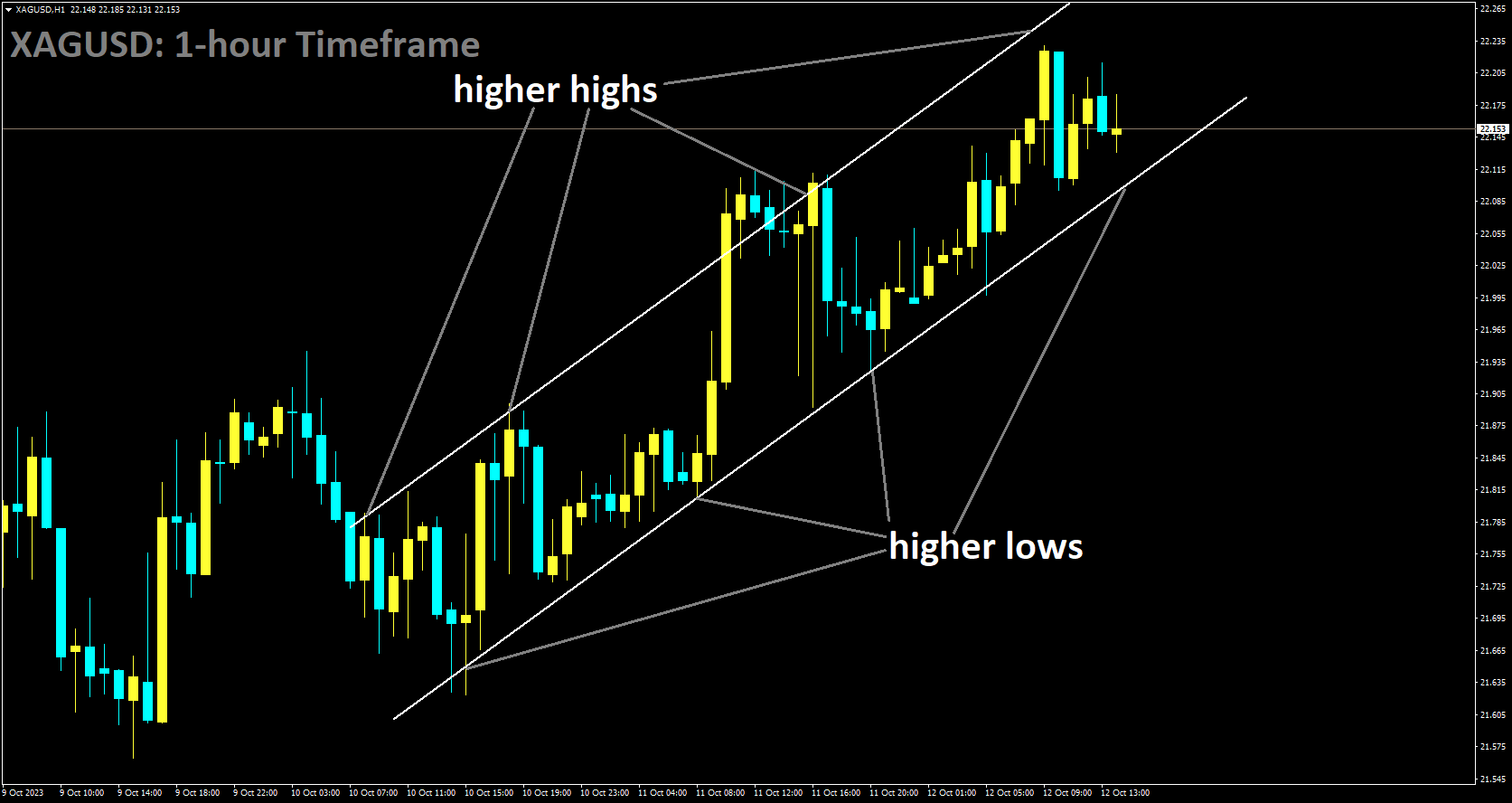

Silver Analysis

XAGUSD is moving in Ascending channel and market has reached higher low area of the channel.

In September, the US Producer Price Index (PPI) data surprised with a rise to 2.2% from the previous 2.0%, surpassing the anticipated rate of 1.6%. Following this data release, the US Dollar experienced a modest weakening. Investors are now eagerly awaiting the release of the US Consumer Price Index (CPI) data for September later today.

The US Dollar has had mixed performance this week, struggling against the Euro, Sterling, and Swiss Franc, while performing relatively better against the Yen and currencies linked to commodities. This shift in the US Dollar’s fortunes is primarily due to a notable change in the Federal Reserve’s stance, which has cast uncertainty over the outlook for the US currency. Until recently, the debate centered on the possibility of a rate hike at the upcoming Federal Open Market Committee (FOMC) meeting. However, recent comments from the Fed have shifted market sentiment towards a more balanced view of the risks associated with future monetary policy, including the potential for a rate cut down the road.

The less hawkish tone began with comments from several Fed speakers on Monday and persisted throughout the week. This culminated with the release of the FOMC meeting minutes from the September meeting, which underscored the Fed’s hesitancy to raise rates, especially with the rise in yields at the longer end of the Treasury yield curve effectively achieving some of the desired tightening without adjusting the short-end target rate. The benchmark 10-year bond yield had reached 4.88% last Friday, its highest level since 2007, but it has since fallen below 4.55%, potentially undoing some of the Fed’s intended tightening. The FOMC minutes explicitly mentioned that participants believed that, with monetary policy already in restrictive territory, the risks to the Committee’s goals had become more balanced.

With the Fed signaling reluctance to raise rates and Treasury yields declining, the US Dollar has struggled against most major currencies. The Swiss Franc has particularly benefited from these developments, reversing the gains seen last week when USD/CHF reached a seven-month high. The Swiss National Bank (SNB) has been able to maintain a more accommodative monetary policy due to benign inflation in Switzerland, with a target rate of 1.75%, considerably lower than that of other major central banks. Recent US Producer Price Index (PPI) data has come in hotter than expected, with a year-on-year increase of 2.2% up to the end of September, compared to the anticipated 1.6%. The market’s attention now turns to the US Consumer Price Index (CPI) data due later today, but it appears that a substantial deviation from expectations would be required to significantly alter the market’s outlook for the Fed’s interest rate trajectory. Economists surveyed by Bloomberg estimate that the year-on-year headline CPI will be 3.7% up to the end of September.

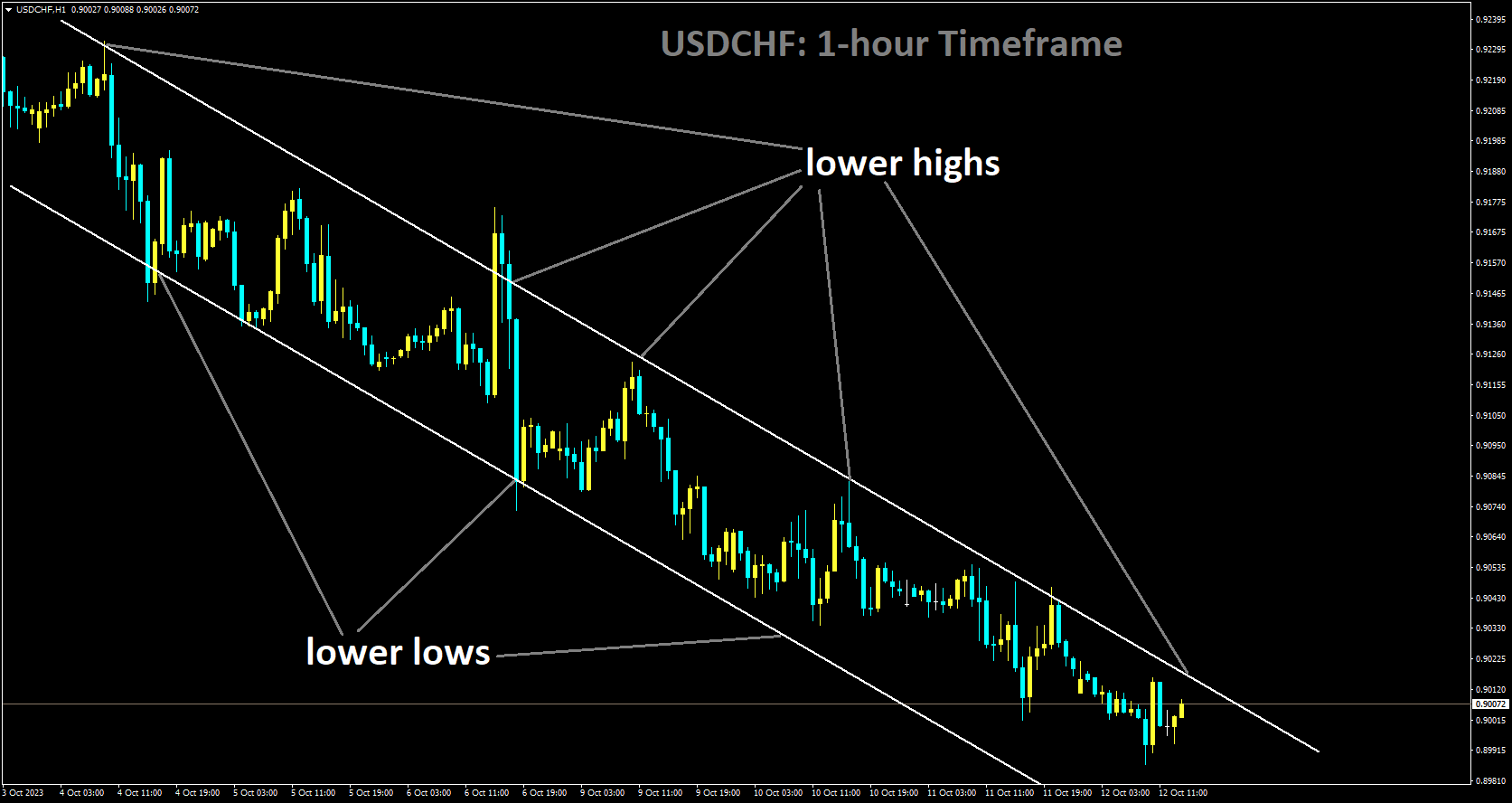

USDCHF Analysis

USDCHF is moving in Descending channel and market has reached lower high area of the channel

Inflation in Switzerland remains below target, leading the Swiss National Bank (SNB) to maintain its current monetary policy stance. USDCHF is currently trading near its three-week lows. Despite strong economic data coming out of the United States (US), the US Dollar (USD) is facing challenges due to uncertainty regarding the Federal Reserve’s (Fed) rate-hiking cycle. This divergence in perspectives is evident in the recently released Federal Open Market Committee (FOMC) minutes, which highlighted the importance of data dependence and suggested that consensus-building for monetary policy decisions would hinge on achieving a substantial increase in inflation.

In September, the US Producer Price Index (PPI) showed a notable uptick, rising from 2.0% to 2.2%, surpassing the expected rate of 1.6%. The market’s attention is now focused on Thursday’s release of the Consumer Price Index (CPI), with forecasts indicating a potential decrease in the annual rate from 3.7% to 3.6%. Additionally, investors are eagerly awaiting the upcoming weekly Jobless Claims report.

Amid dovish comments and neutral stances from Federal Reserve officials, there appears to be speculation that the Fed may abandon the idea of a rate hike. Fed Governor Christopher Waller advocates a cautious approach to rate developments, suggesting that tightening in financial markets “would do some of the work for us.” On the other hand, Fed Governor Michelle Bowman leans toward another rate hike.

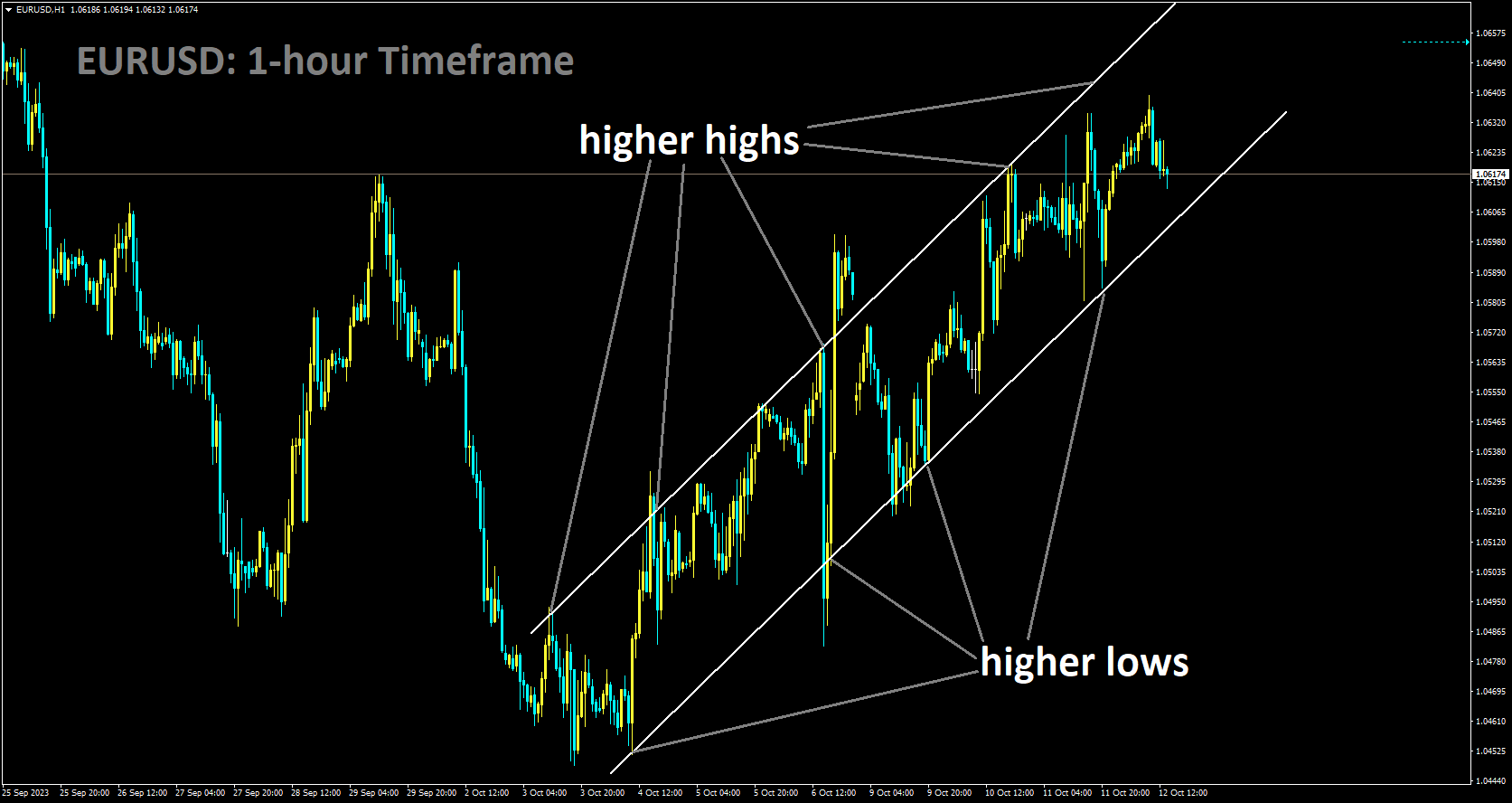

EURUSD Analysis

EURUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

Yannis Stournaras, a key figure at the European Central Bank (ECB), has expressed his endorsement for the ECB’s decision not to prematurely cease its bond-buying program. He firmly believes that this choice was the correct one. Furthermore, he downplays the impact of the Israel-Hamas conflict on the Eurozone’s economic stability, suggesting that it was not substantial enough to warrant a change in monetary policy. As a result, the ECB will persist with its bond purchasing initiative until inflation levels align with the central bank’s targeted benchmarks.

Stournaras is an advocate for adopting a cautious and flexible stance concerning the ECB’s emergency bond-buying program, also known as the PEPP (Pandemic Emergency Purchase Program). He emphasizes that abruptly terminating bond acquisitions might not be in the best interest of the European economy. His cautious approach is rooted in the recognition of ongoing uncertainties, particularly in light of recent geopolitical events in Israel and Palestine.

The policymaker underscores the significance of maintaining monetary flexibility and remaining ready to take prompt actions if changing circumstances demand such interventions. Stournaras’s perspective echoes the broader ECB commitment to respond adeptly to evolving economic and geopolitical developments, aligning with the central bank’s overarching goal of maintaining stability and promoting economic recovery with a measured and adaptable monetary policy approach.

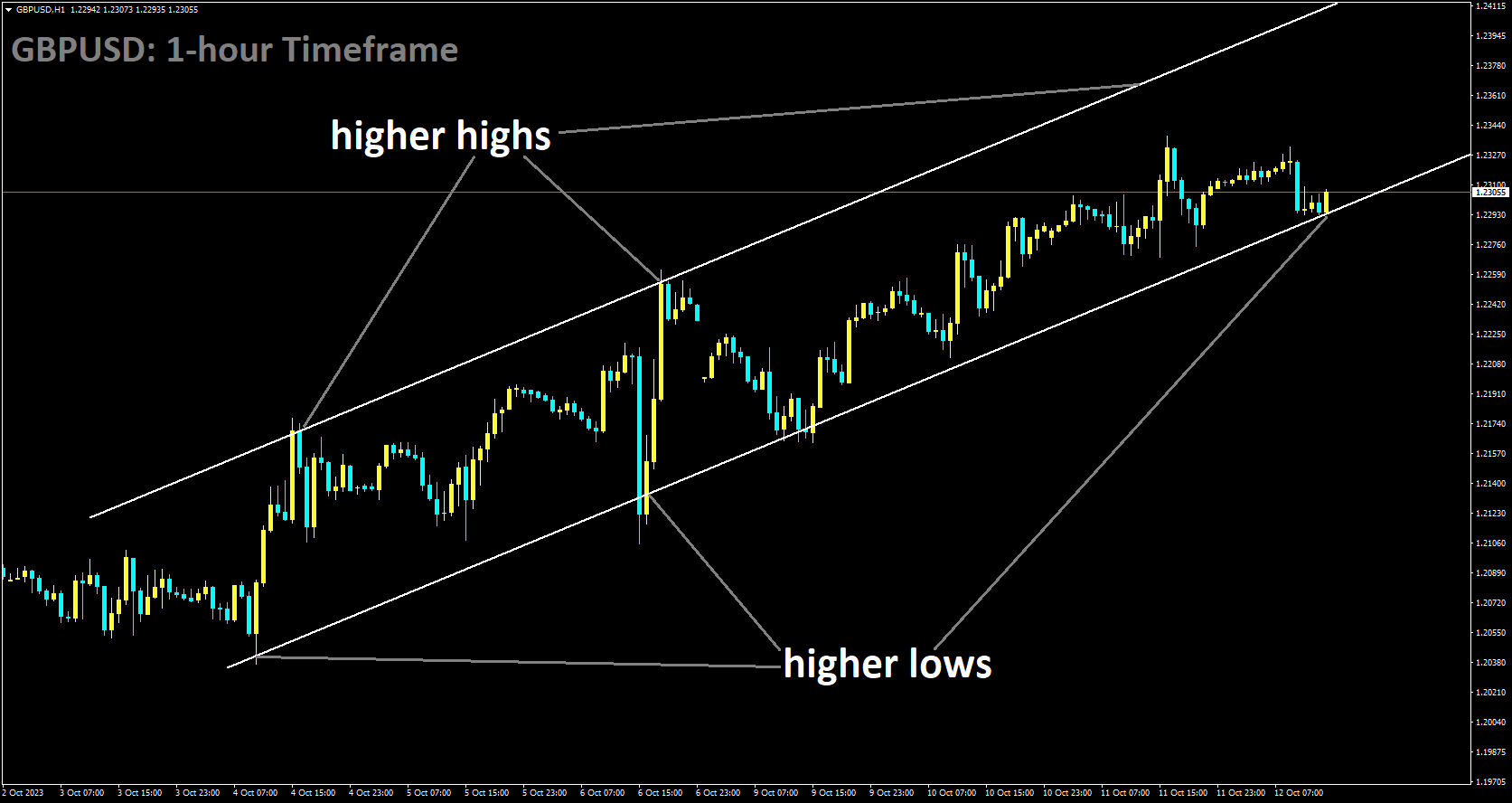

GBPUSD Analysis:

GBPUSD is moving in Ascending channel and market has reached higher low area of the channel

In the realm of GBPUSD analysis, the economic landscape for the United Kingdom reveals notable developments in recent months. The standout data point is the August monthly GDP figures, which surpassed expectations. These figures demonstrated a 3-month average growth rate of 0.30%, exceeding the projected 0.20%. Similarly, the year-on-year (YoY) reading showed strength, coming in at 0.50%, outperforming the anticipated 0.30%. Of particular significance is the robust performance of the services sector, which expanded by 0.40% in August.

However, amidst these positive signs, there are potential concerns in the production and construction sectors, where indications of a slowdown have emerged. This hints at a nuanced economic recovery for the UK.

It’s worth noting that the UK’s GDP rebounded positively in August, recuperating from an unexpected contraction in July, which was subsequently revised lower from an initial estimate of -0.5% to -0.6%. In August, GDP registered a 0.2% increase, in line with expectations. The three-month average, a more smoothed measure of GDP performance, also rose by 0.3%, consistent with forecasts.

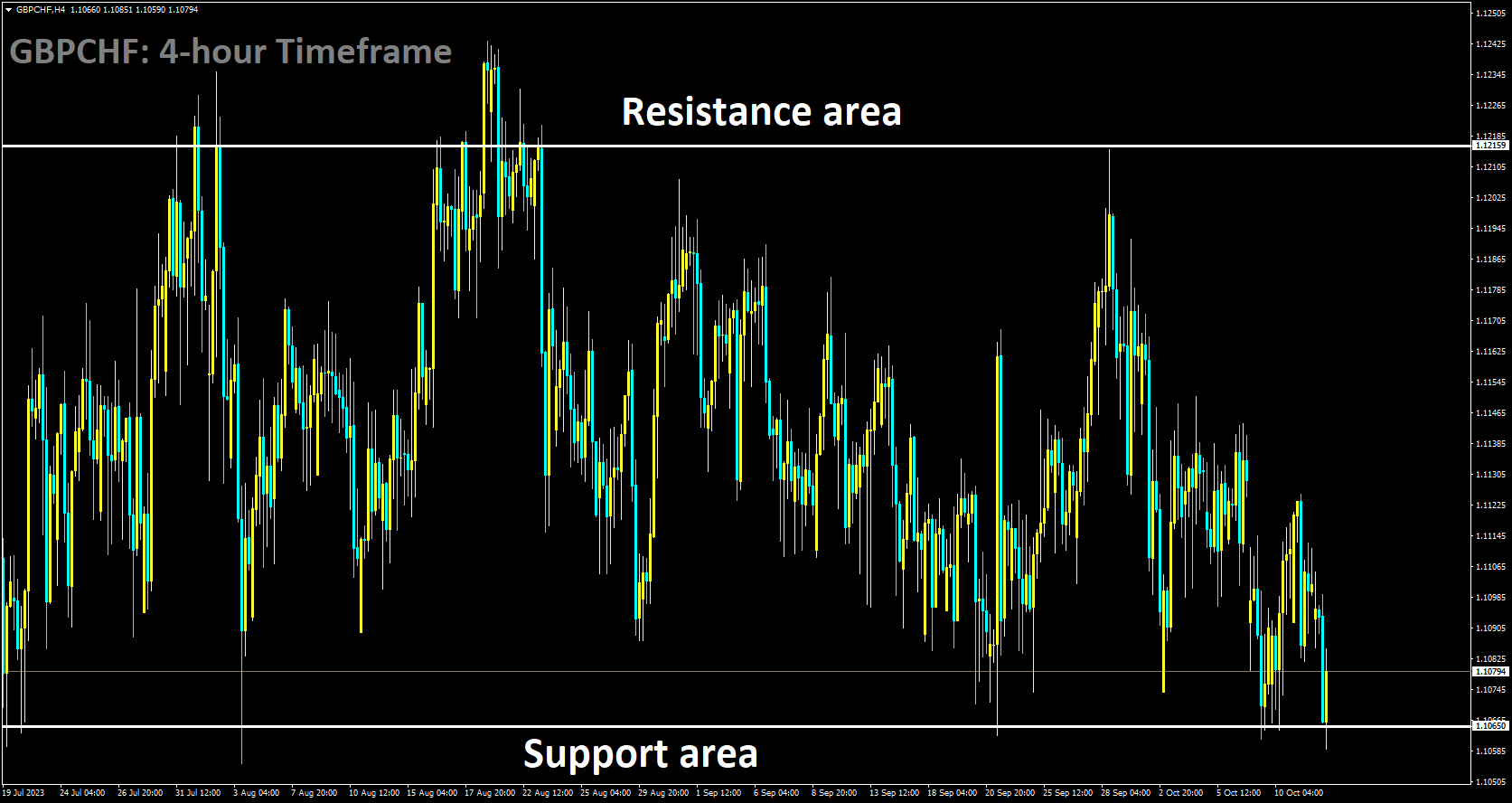

GBPCHF Analysis:

GBPCHF is moving in box pattern and market has reached support area of the pattern

Delving into the GBPCHF analysis, we find that the services sector experienced notable growth, clocking in at 0.4% in August. However, there were contrasting contractions in both the production and construction sectors. This data underlines the economic fluctuations characterizing the UK’s GDP trajectory in 2023.

These fluctuations are emblematic of the broader uncertainties that prevail in both the domestic and international economic landscapes. These uncertainties have been amplified by the ongoing global economic slowdown, which has necessitated a cautious approach to economic policymaking.

Despite some progress in tackling inflation, it remains relatively elevated when compared to other developed economies. Consequently, the Bank of England is keeping a watchful eye on forthcoming unemployment data and average earnings figures. The job market has exhibited positive developments, albeit at a moderate pace. However, concerns have arisen as wage data recently breached the 8% mark, causing some consternation for the central bank.

The intricate interplay between these economic factors underscores the delicate balance that the Bank of England must maintain in its pursuit of stable economic growth and inflation control.

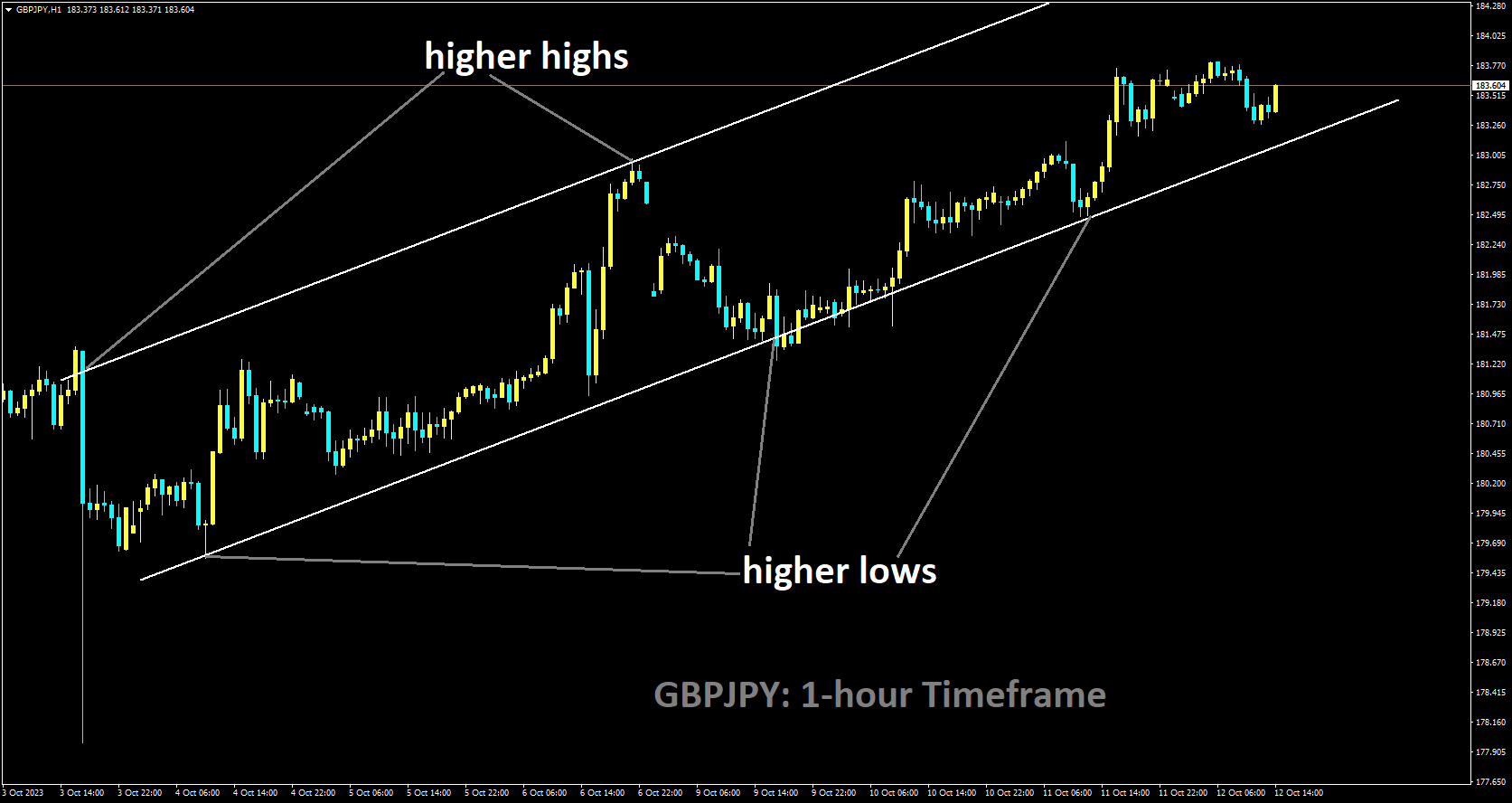

GBPJPY Analysis

GBPJPY is moving in Ascending channel and market has rebounded from the higher low area of the channel

Turning our attention to GBPJPY analysis, we encounter insights from Bank of Japan Board member Asahi Noguchi. Noguchi’s statements shed light on the Japanese economic landscape and its monetary policy considerations.

Noguchi’s remarks revolve around the pivotal issue of wage growth and inflation. He anticipates that wage prices in Japan will see a rise of 3.0%, and inflation will reach the coveted 2% target. However, Noguchi maintains that these conditions must be met before any contemplation of refraining from the implementation of loose monetary policy measures in Japan. This stance reflects the caution exercised by the Bank of Japan in navigating the complex terrain of monetary policy.

Noguchi acknowledges the persistent pressure on the Japanese Yen, primarily attributable to the prolonged ultra-easy monetary policy stance. He attributes inflation primarily to price hikes in imports, a phenomenon influenced by currency-related factors. Noguchi openly acknowledges that there remains a significant gap in achieving the Bank of Japan’s 2% inflation target, indicating that any shift in policy should be gradual and carefully considered.

The central banker emphasizes that, at present, there is no immediate imperative to adjust the Yield Curve Control policy, reaffirming the Bank of Japan’s commitment to its existing framework. Noguchi places a strong emphasis on turning real wages positive, aspiring to bring wage growth closer to 3%, although he refrains from specifying a concrete timeline for this endeavor.

Noguchi’s perspectives extend to the broader economic landscape, where he posits that central banks should exercise caution in raising interest rates to mitigate the risk of a severe economic downturn. He observes gradual signs of recovery in Japan’s economy, a context where inflation expectations are on the rise. As such, he advocates for maintaining some flexibility in maintaining an accommodative policy under the framework of Yield Curve Control (YCC). This strategic approach seeks to strike an equilibrium between stimulating economic recovery and effectively managing inflation expectations.

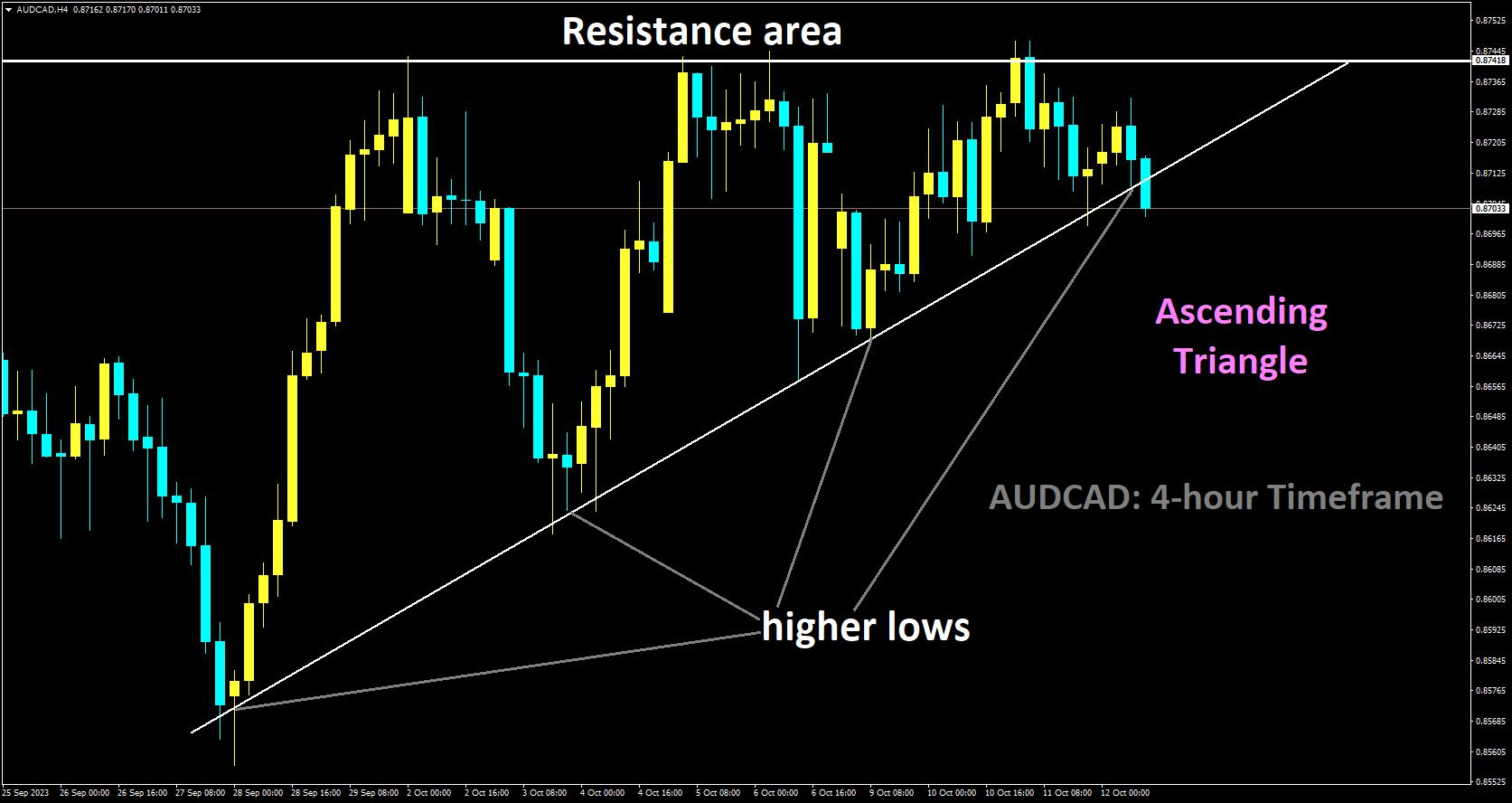

AUDCAD Analysis

AUDCAD is moving in Ascending Triangle and market has reached higher low area of the channel

Moving on to AUDCAD analysis, we encounter a multifaceted scenario in the Canadian economic landscape. In August, Canadian building permits exhibited strength, surpassing expectations with a notable 3.4% increase compared to the anticipated 0.50%. However, despite this positive economic data, the Canadian Dollar finds itself under downward pressure vis-à-vis other currencies. This depreciation can be attributed to the cooling down of oil prices, a crucial factor influencing the Canadian Dollar’s performance.

Of particular significance is the announcement from Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman. He declared the extension of voluntary cuts in oil production through the remainder of the year. This decision underscores a commitment to maintaining stability in the oil market and mitigating the inherent volatility in oil prices. The objective here is to provide a steady and predictable environment in the oil industry.

Currently, the primary focal point in the market revolves around inflation expectations. With only a limited number of Canadian economic data releases scheduled, the direction of currency charts is likely to be significantly influenced by market reactions to US inflation data for the remaining period. In terms of Canadian economic data, there are only a few low-impact releases. Notably, Canadian Building Permits for August exceeded expectations, registering a 3.4% increase compared to the anticipated 0.5%. It’s noteworthy, however, that the previous reading for Building Permits saw a significant revision downward, moving from -1.5% to -3.8%. Additionally, Crude Oil prices have experienced a softening trend, retracting from their initial surge earlier in the week, which was prompted by escalating tensions in the Gaza Strip between Israel and Palestinian Hamas over the weekend.

Prince Abdulaziz bin Salman, Saudi Arabia’s Energy Minister, stressed on Thursday that the extension of voluntary production cuts aims to bring stability to the oil market and reduce the volatility in oil prices. This strategic approach emphasizes the imperative of prudence and proactive measures in addressing the numerous challenges confronting the oil market. The overarching goal remains the achievement and maintenance of stability in the oil market to ensure the sustainability of the industry and global economic balance.

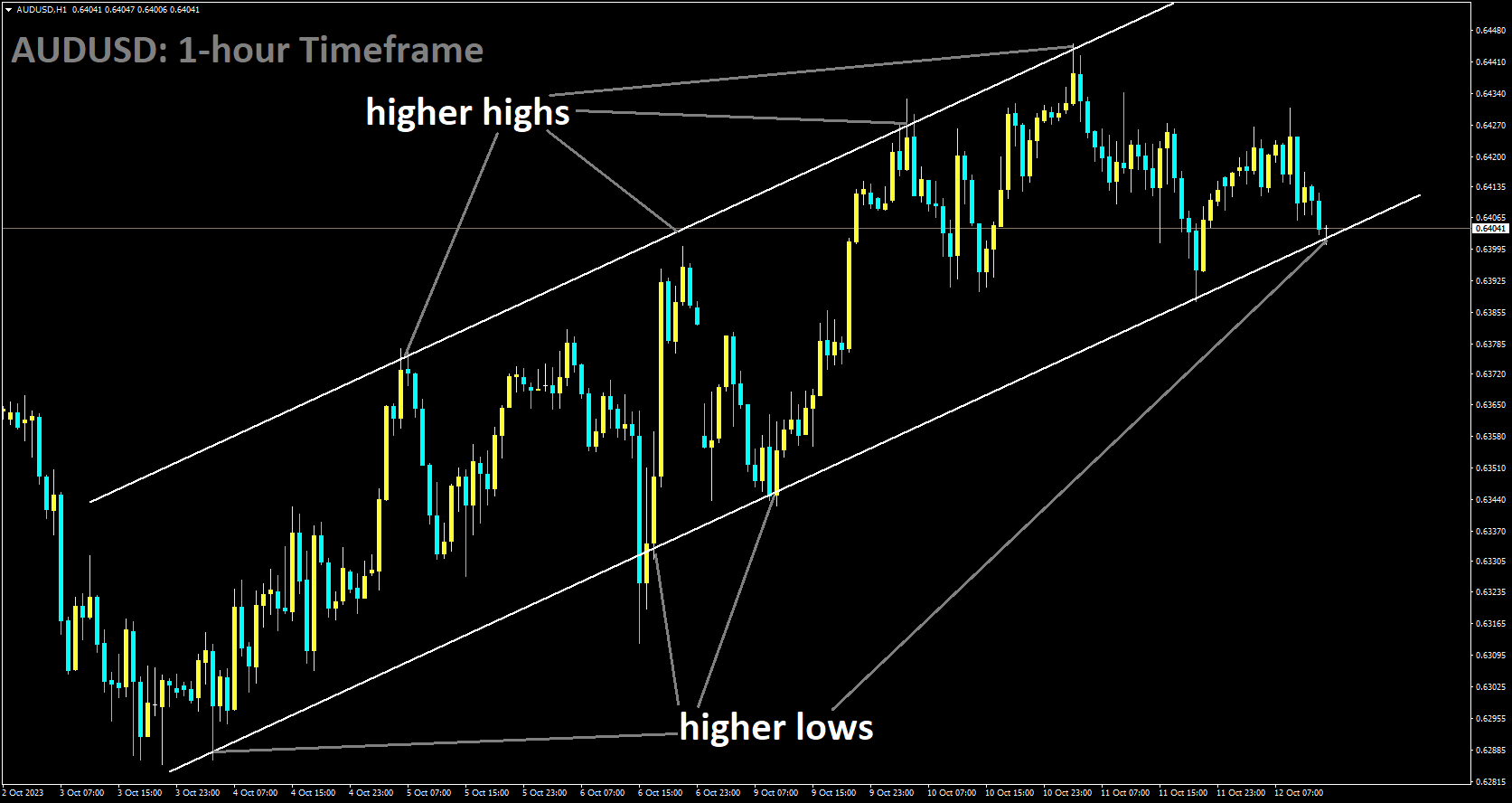

AUDUSD Analysis

AUDUSD is moving in Ascending channel and market has reached higher low area of the channel

Shifting our focus to AUDUSD analysis, we encounter a dynamic situation in the foreign exchange market. The Melbourne Institute’s consumer inflation expectations have experienced an uptick, rising to 4.85% from the previous estimate of 4.6%. This increase is likely influenced by the global surge in oil prices, which could potentially impact Australian consumer spending on oil-related products.

Interestingly, despite this uptick in Australian Consumer Inflation Expectations, the Australian Dollar has faced losses in the forex market. This apparent paradox can be attributed to a variety of factors, including broader market sentiment, interest rate differentials, and geopolitical developments. The complex interplay of these factors often leads to nuanced movements in currency pairs.

The AUDUSD pair may have the potential to strengthen further, primarily due to the growing likelihood of another interest rate hike by the Reserve Bank of Australia (RBA). Meanwhile, the US Dollar Index is grappling with maintaining its position around 105.70, largely due to the subdued performance of US Treasury yields.

Speculation is mounting regarding the US Federal Reserve (Fed) potentially reconsidering its stance on interest rate hikes. This speculation has been fueled by dovish comments and neutral stances from key officials within the Fed, introducing an element of uncertainty into the currency’s outlook. In contrast, Australia has witnessed an uptick in inflation in August, primarily attributed to elevated oil prices. This uptick increases the likelihood of another interest rate hike by the RBA.

The ongoing conflict in the Middle East further complicates the situation, potentially prompting the RBA to implement a 25 basis points interest rate hike, bringing it to 4.35% by year-end. The heightened geopolitical tension has driven increased demand for commodities, particularly energy and gold, which, in turn, positively affects the performance of the AUDUSD pair. Additionally, Australia’s Westpac Consumer Confidence data for October indicates an improvement in current buying conditions, with the index rising by 2.9% following a 1.5% decline in September.

In the United States, the Producer Price Index (PPI) surged in September on a yearly basis, surpassing expectations and jumping from 2.0% to 2.2%, exceeding the expected 1.6%. Core PPI also experienced an increase, rising to 2.7% from the anticipated easing to 2.3%. However, despite robust economic data in the United States, particularly in wholesale inflation, and the release of the Federal Open Market Committee meeting minutes, the US Dollar is facing challenges in maintaining its strength.

There is growing speculation regarding the US Federal Reserve (Fed) potentially reevaluating its stance on raising interest rates. This speculation has been fueled by dovish comments and neutral positions adopted by key Fed officials, creating an element of uncertainty in the currency’s trajectory.

In contrast, Australia has witnessed an uptick in inflation, driven primarily by elevated oil prices. This uptick in inflation increases the probability of another interest rate hike by the Reserve Bank of Australia (RBA). The ongoing conflict in the Middle East further adds complexity to the situation, potentially prompting the RBA to implement a 25 basis points interest rate hike, which would bring the rate to 4.35% by the end of the year.

The heightened geopolitical tension is also contributing to increased demand for commodities, particularly energy and gold. This heightened demand positively affects the performance of the AUDUSD pair in the forex market. Furthermore, Australia’s Westpac Consumer Confidence data for October suggests an improvement in current buying conditions, with the index rebounding by 2.9% following a 1.5% decline in September.

NZDUSD Analysis

NZDUSD has broken Ascending channel in downside

In the domain of NZDUSD analysis, the focus turns to expectations regarding New Zealand’s inflation data for the third quarter, scheduled for release next week. Analysts at ANZ bank anticipate a year-on-year inflation rate of 6.1%, slightly exceeding the Reserve Bank of New Zealand’s August Monetary Policy Statement forecast of 6.0%. This forecast is based on several specific drivers contributing to the anticipated inflation increase.

One of the significant drivers is the cessation of the fuel excise, road-user charges, and public transport subsidies. These policy changes collectively add approximately 0.6 percentage points to the headline inflation rate. Additionally, higher oil prices have led to increased fuel costs, and there has been a significant rise in local authority rates bills.

Overall, ANZ’s assessment suggests that the upcoming Consumer Price Index (CPI) report will raise questions about whether the Official Cash Rate of 5.50% will be sufficient to address persistent domestic inflation in a timely manner.

However, it remains uncertain whether the Reserve Bank of New Zealand (RBNZ) will feel an immediate need to raise interest rates in November or whether they will choose to wait for more evidence before making a decision. The next opportunity for a rate adjustment would be in February.

In summary, the AUDUSD and NZDUSD analyses highlight the intricate dynamics in the foreign exchange market, where a multitude of factors, including inflation, interest rates, geopolitical events, and broader market sentiment, interact to shape the movements of currency pairs. These analyses underscore the importance of a comprehensive understanding of these factors for effective decision-making in the world of forex trading.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/