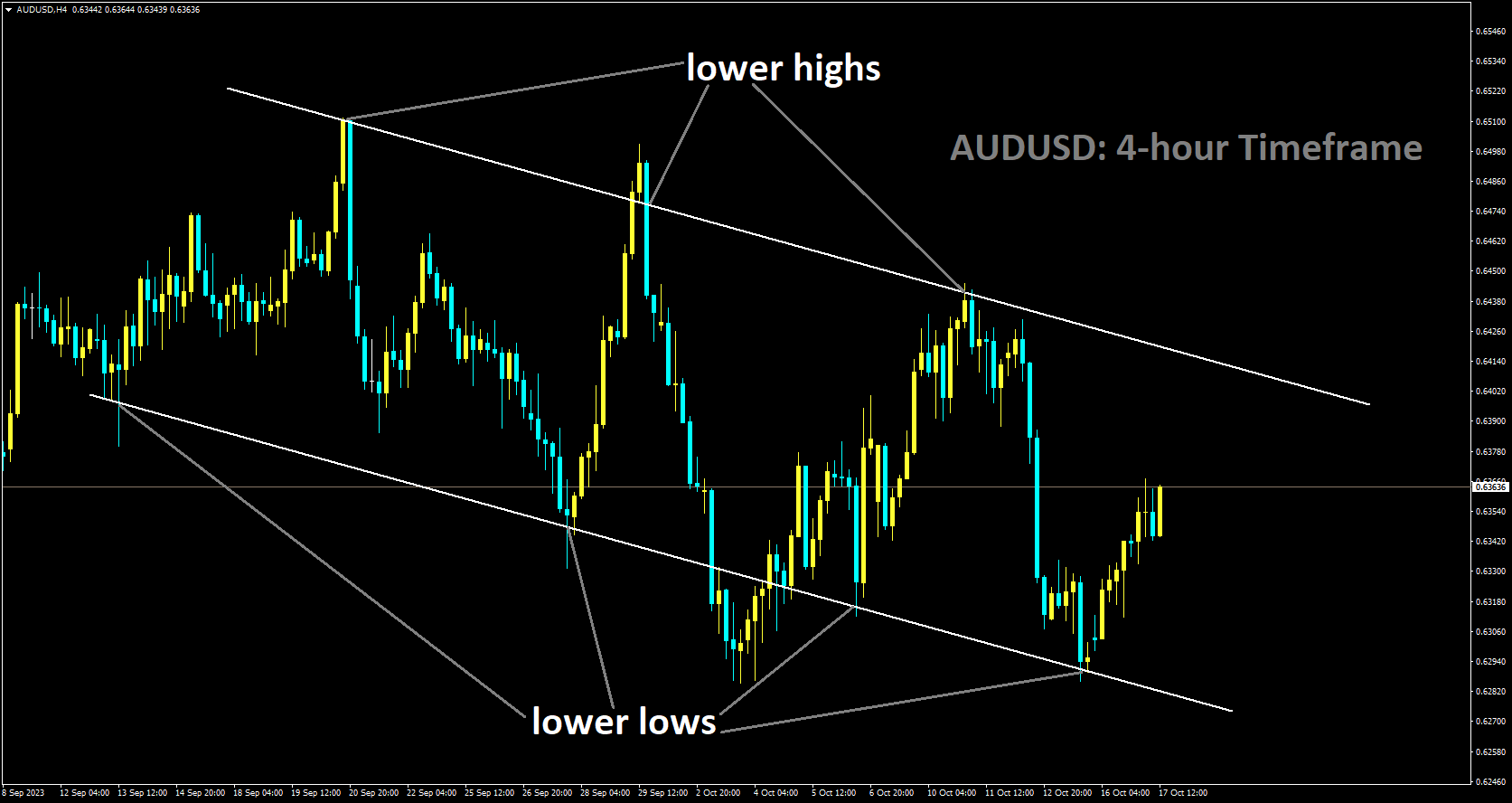

AUDUSD Analysis:

AUDUSD is moving in Descending channel and market has rebounded from the lower low area of the channel

The RBA Meeting Minutes indicate that interest rates will remain steady in the coming months due to a cooling trend in inflation data.

The RBA emphasized that the case for keeping interest rates unchanged has strengthened. The minutes also noted that more comprehensive data on inflation, employment, and forecasts will be available at the November meeting.

Members of the RBA expressed concerns about potential upside risks to inflation, particularly in the service sector.

They have limited tolerance for slower inflation return to the target range and mentioned the possibility of additional tightening if inflation remains high.

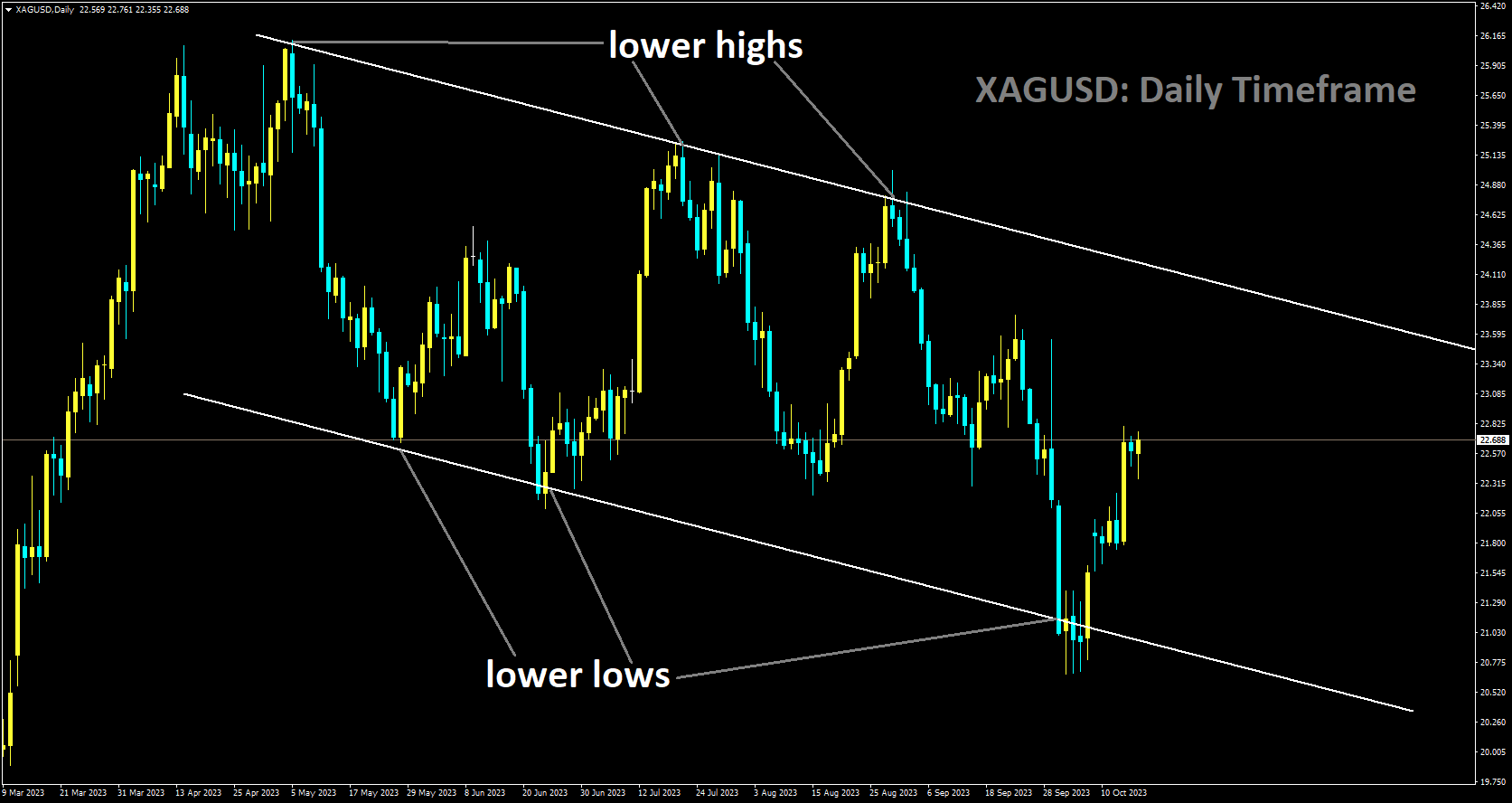

Gold Analysis:

XAUUSD is moving in Descending channel and market has reached lower high area of the channel

Amid escalating tensions in Israel, gold prices are holding steady, with the growing involvement of Iran in the conflict expected to reinforce this stability. The prevailing positive risk sentiment, which typically weakens demand for traditional safe-haven assets, is exerting downward pressure on the precious metal as we enter the European session. Additionally, the surge in US Treasury bond yields, driven by increasing expectations of further tightening in Fed policies, is another factor weighing on gold, which does not yield interest. However, the downside for gold is offset by the ongoing Israel conflict. This, coupled with the growing consensus that the Federal Reserve (Fed) is likely to keep interest rates unchanged for the second consecutive time in November, should offer some support to the XAU/USD pair.

Moreover, the dovish expectations surrounding the Fed are keeping USD bulls on the defensive, limiting losses for the US Dollar-denominated commodity. Before committing to directional trades, traders may opt to await clues regarding the Fed’s future rate-hike trajectory. Consequently, all eyes will be on Fed Chair Jerome Powell’s scheduled speech on Thursday, which will dictate the next move in gold prices. Meanwhile, the US economic calendar for Tuesday, featuring monthly Retail Sales and Industrial Production figures, will be closely scrutinized for potential market drivers.

In the aftermath of the ongoing Israel conflict, which has the potential to escalate into a broader proxy war involving Iran, gold may continue to attract safe-haven flows. The Chief of the Israel Defence Forces has declared their intention to enter Gaza and dismantle the terrorist group. Israel has advised Palestinians to evacuate to the southern enclave of Gaza City in anticipation of a large-scale ground offensive against the terrorist attacks. Contrary to reports, the office of Israeli Prime Minister Benjamin Netanyahu has denied the existence of a ceasefire to facilitate humanitarian aid and the departure of Gaza residents with international passports to Egypt. Secretary of State Antony Blinken announced President Biden’s visit to Israel on Wednesday, sending a clear message of support to a crucial US ally. In a bid to deter Iran and its proxies from expanding the conflict, the US military has deployed a second carrier strike group to the Eastern Mediterranean.

Iran has repeatedly cautioned that a ground invasion of the long-blockaded Gaza Strip would trigger retaliation on various fronts. Iran’s Foreign Minister, Hossein Amir-Abdollahian, remarked on Monday that “the possibility of pre-emptive action by the resistance axis is expected in the coming hours.” In the absence of data changes, Philadelphia Fed President Patrick Harker reiterated on Monday that the central bank should maintain interest rates at their current level. However, last week’s release of US consumer inflation figures left room for another Fed rate hike before year-end. The outlook for further tightening of Fed policies continues to support elevated US bond yields, acting as a tailwind for the US Dollar. Traders are now eagerly awaiting the US Retail Sales data for potential market cues, although the primary focus remains on Fed Chair Jerome Powell’s forthcoming speech. Market analysts anticipate a 0.3% increase in US retail sales for September, with sales excluding automobiles projected to rise by 0.2% in the same month.

Silver Analysis:

XAGUSD is moving in Descending channel and market has rebounded from the lower low area of the channel

Economists at Commerz Bank have attributed the demand for US dollars primarily to the ongoing conflicts between Israel and Palestine. Furthermore, they suggest that continued positive economic data could further strengthen the US Dollar’s performance over an extended period.

Looking ahead, the market’s focus is on the upcoming release of US retail sales and industrial production figures, which are expected to draw significant attention. If economic data continues to point towards a soft landing, it may boost the USD by signaling reduced likelihood of Federal Reserve interest rate cuts in the near future.

Even in the face of potentially disappointing data, it’s unlikely to significantly dampen the optimism of economic observers, thus exerting limited downward pressure on the USD. Additionally, as long as tensions persist in the Middle East without signs of easing, the US Dollar is expected to maintain demand in the market.

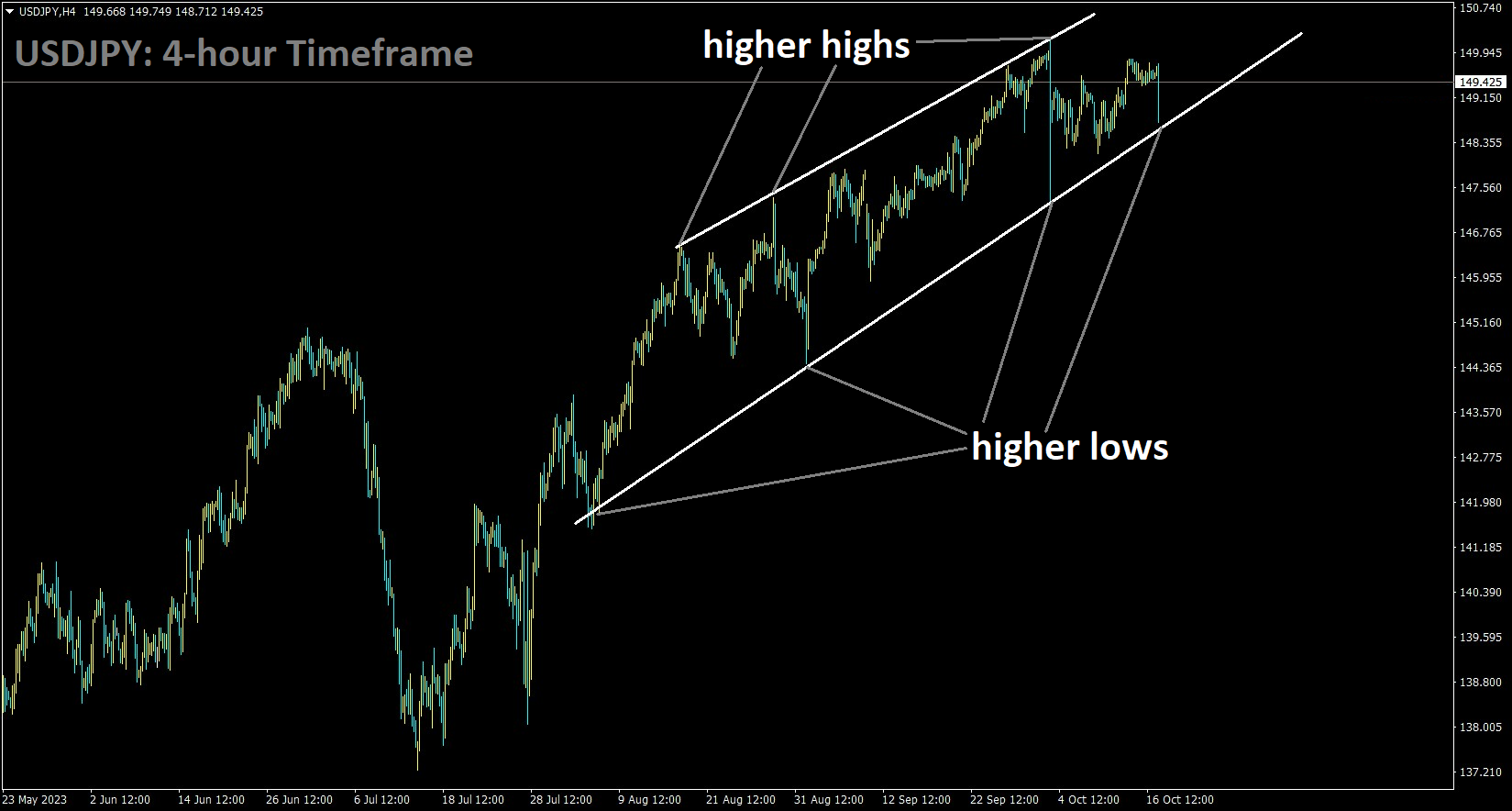

USDJPY Analysis:

USDJPY is moving in an Ascending channel and the market has reached the higher low area of the channel

The United States has deployed 2,000 Marines to Israel as a measure to enhance its readiness amid concerns of security threats from Iran and Lebanon. Japan’s Finance Minister, Shunichi Suzuki, has refrained from commenting on foreign exchange (FX) intervention and the International Monetary Fund’s (IMF) stance on the matter.

According to CNN reports, the United States is sending a rapid response force of 2,000 Marines and sailors to waters off the coast of Israel. This deployment is part of an increasing presence of US warships heading towards Israel, aimed at sending a strong deterrent message to Iran and the Lebanese militant group Hezbollah, as confirmed by a defense official familiar with the operation.

Regarding currency intervention, Japanese Finance Minister Shunichi Suzuki declined to provide further comments. However, he emphasized that there is currently no need for FX intervention. The IMF official had previously noted that the recent decline in the Yen was attributed to fundamental factors and did not meet the criteria for intervention.

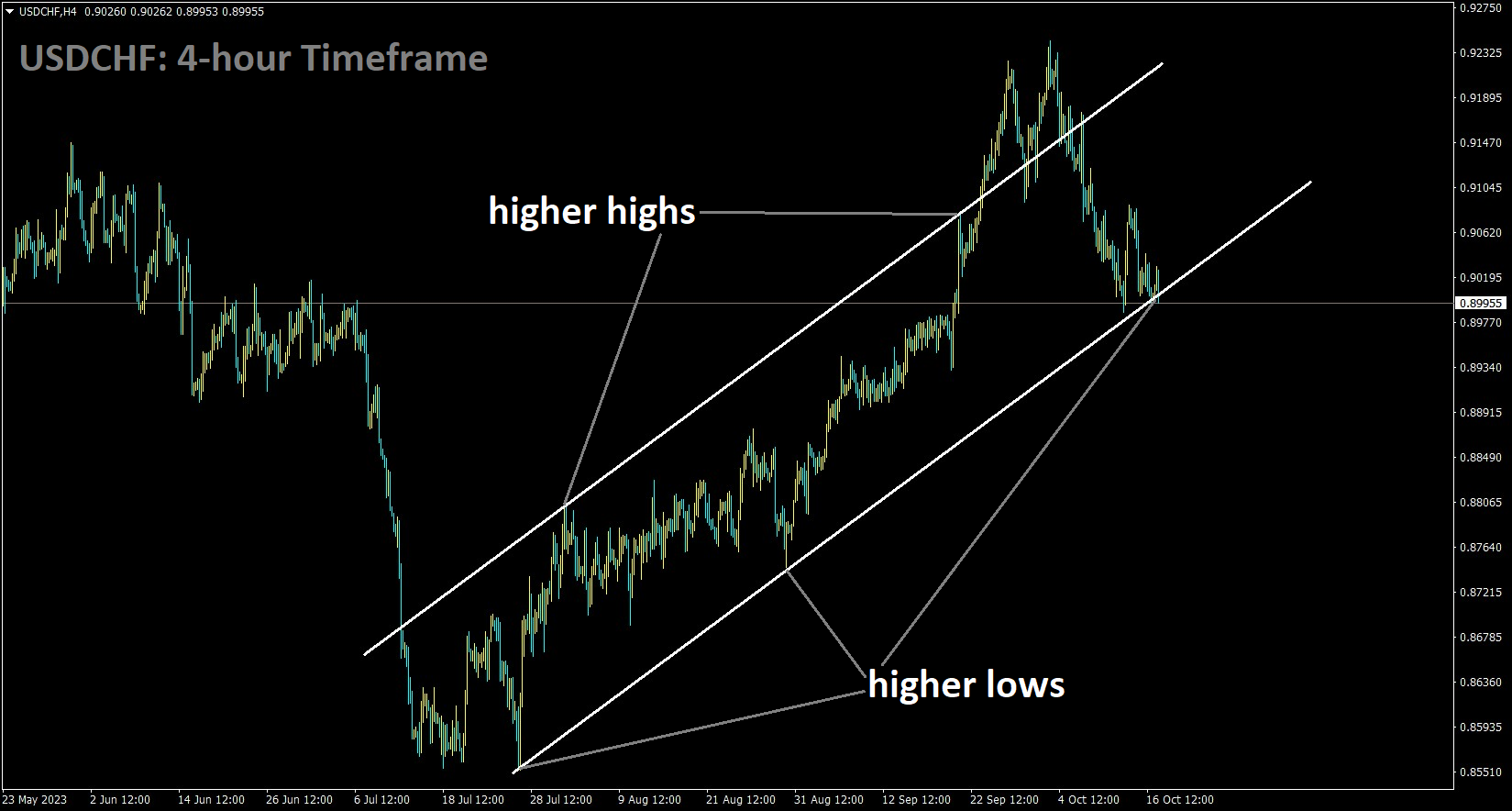

USDCHF Analysis:

USDCHF is moving in an Ascending channel and the market has reached the higher low area of the channel

Safe-haven currencies like the Swiss Franc have appreciated due to concerns about potential conflicts. Additionally, the US NY Manufacturing index has declined, raising concerns. Nonetheless, the recovery in US Treasury yields is providing some support to the pair.

The US Dollar Index DXY, which measures the USD against a basket of foreign currencies, is finding buyers around the 106.32 level. The US Treasury yield has rebounded, with the 10-year yield holding at 4.746% as of the current press time. The US NY Empire State Manufacturing Index for October fell to 4.6 from 1.9 the previous month, exceeding market expectations of a 7.0 decline. Despite this low-tier US economic data, the Greenback hasn’t gained much strength, as the Fed’s dovish comments continue to weigh on the pair.

US Federal Reserve speakers, including Williams, Bowman, Barkin, and Kashkari, are expected to offer insights into future monetary policy paths, which will likely influence market sentiment.

The arrival of the US Marine Rapid Response Force in Israeli waters is expected to further elevate geopolitical tensions, potentially boosting the Swiss Franc’s status as a safe-haven currency while acting as a headwind for the USDCHF pair. Additionally, the Swiss Trade Balance for September and US Retail Sales for September are upcoming data releases to watch for directional cues.

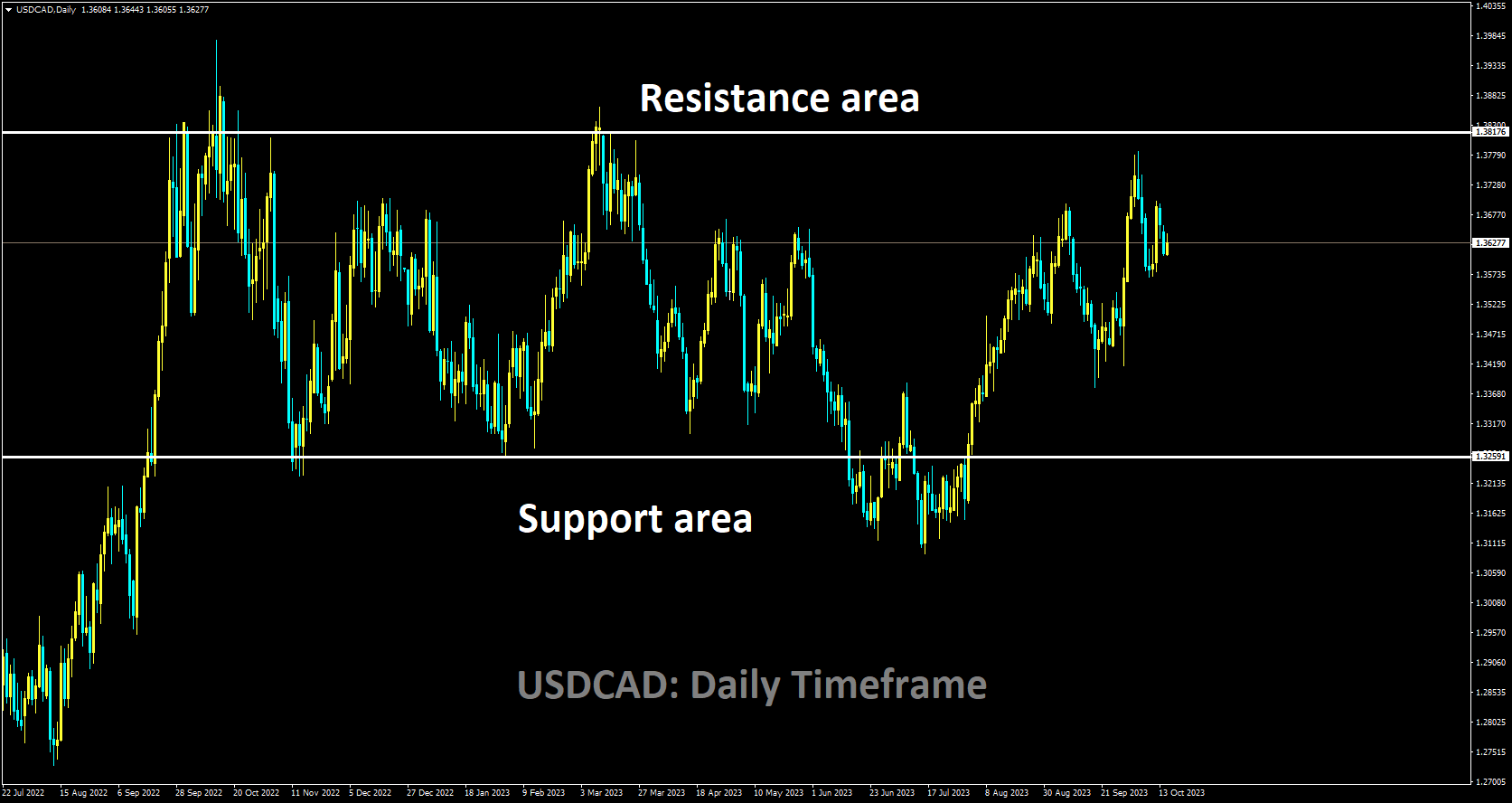

USDCAD Analysis:

USDCAD is moving in box pattern and market has fallen from the resistance area of the pattern

Bank of Canada Deputy Governor Vincent has highlighted the Israel conflict’s impact, causing supply shocks and increased oil demand. Canadian CPI data set to be released tomorrow will be a key factor in the Bank of Canada’s decision-making in its upcoming meeting.

USDCAD has extended its decline, distancing itself from the 1.3700 level. This development coincides with oil prices struggling after a 5% surge last Friday. The Bank of Canada (BoC) is closely monitoring geopolitical events, such as the Israel conflict, which could potentially affect inflation.

Deputy Governor Nicolas Vincent warned about supply disruptions, limited competition, and technological changes altering pricing dynamics. He also expressed concerns about companies raising prices at a faster pace.

Canadian inflation data is scheduled for release, with a consensus expectation of 4% for year-on-year headline inflation. A higher reading could lead to a reevaluation of rate hike expectations for the BoC.

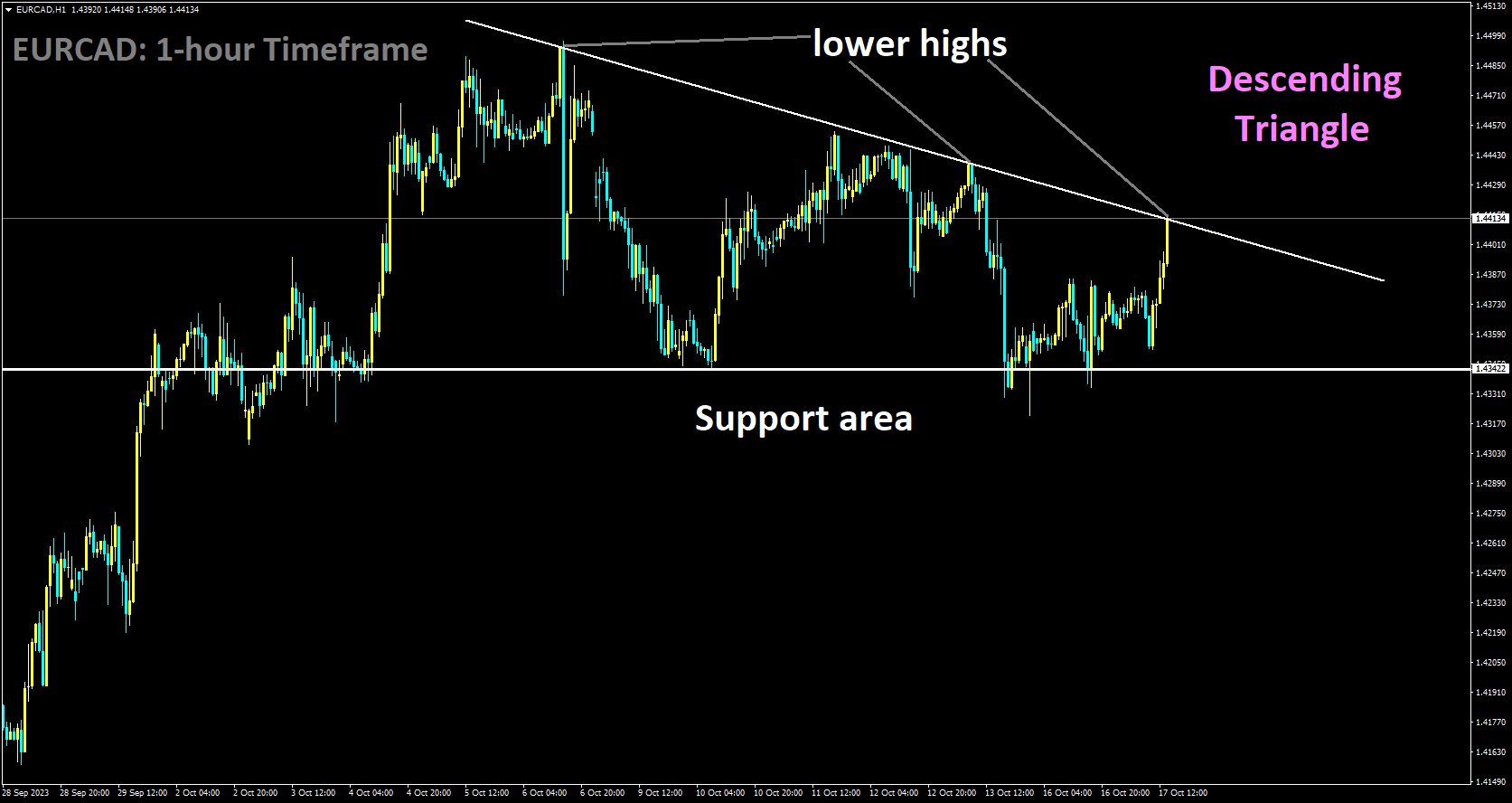

EURCAD Analysis:

EURCAD is moving in Descending Triangle and market has reached lower high area of the pattern

The German wholesale price index for September showed a slight increase below expectations, and the decline in oil prices may put pressure on Euro pairs. The ZEW Economic Sentiment Survey for October is anticipated to improve, and European Central Bank (ECB) officials continue to monitor energy prices and the Israel conflict for inflation risks.

German Wholesale Prices increased by 0.2% on a month-on-month basis in September, slightly below the market consensus. On an annual basis, the figure declined, suggesting potential downward pressure on Euro pairs due to the rising oil prices.

ECB President Christine Lagarde has conveyed the ECB’s vigilance regarding energy prices and the Israel conflict’s potential impact on inflation. ECB Chief Economist Philip Lane discussed the ECB’s decision-making process and its intention to maintain high interest rates until inflation returns to 2%.

The ZEW Economic Sentiment Survey for October will be closely watched for further insights into economic sentiment.

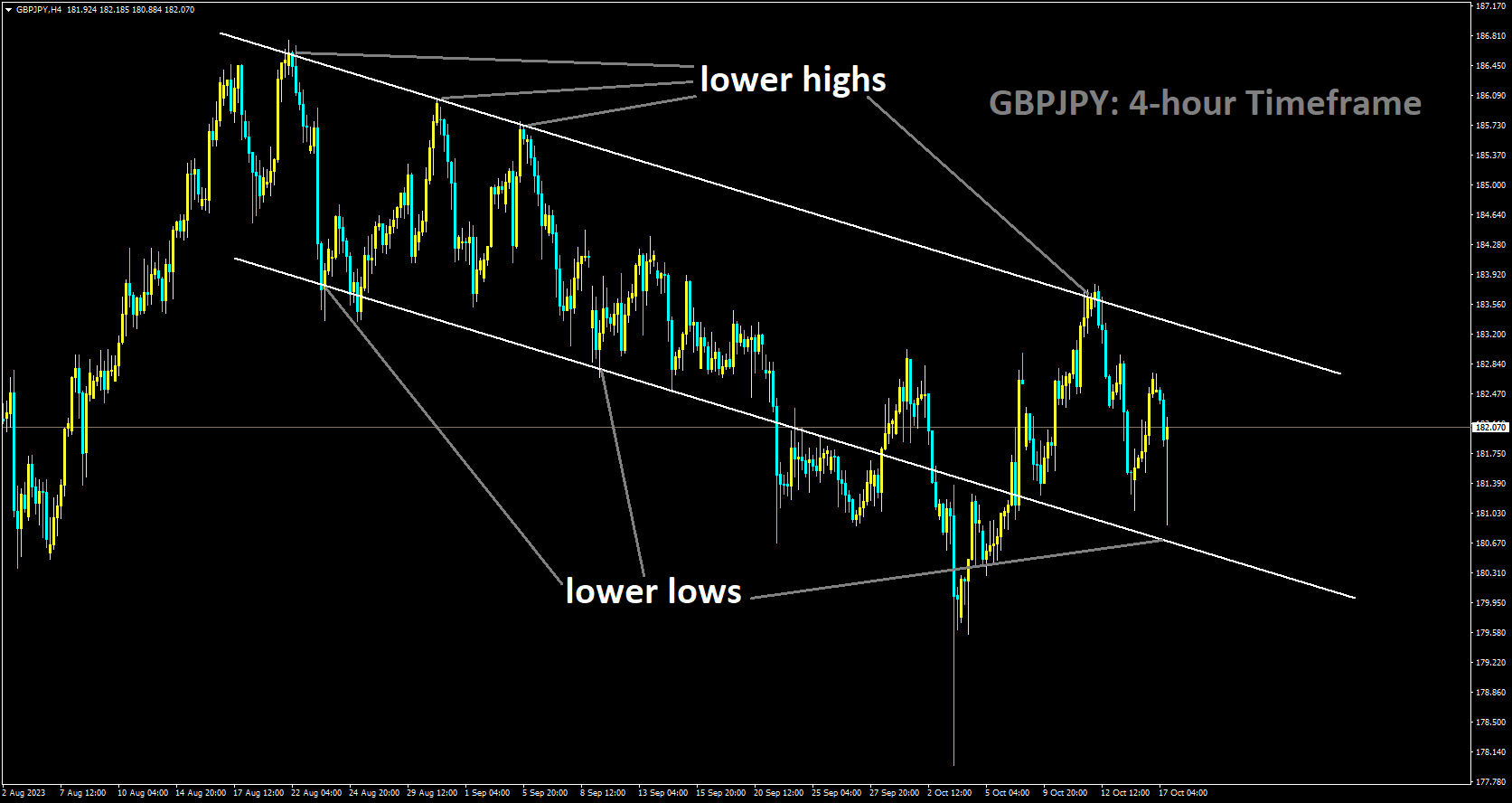

GBPJPY Analysis:

GBPJPY is moving in Descending channel and market has rebounded from the lower low area of the channel

The upcoming release of the UK’s Consumer Price Index (CPI) data for the third quarter is expected to reflect the recent increase in oil prices, potentially impacting inflation. The Bank of England has signaled its intention to keep interest rates unchanged until inflation moderates.

Wednesday’s UK inflation data is expected to show decreases in both headline and core inflation. However, the recent surge in oil prices presents a risk of an upside surprise in the headline measure, which includes volatile items like food and fuel.

The Bank of England is concerned about the pace of average earnings growth, which currently stands at 8.5% year-on-year. Despite strong earnings growth, the bank maintains its stance on keeping interest rates unchanged.

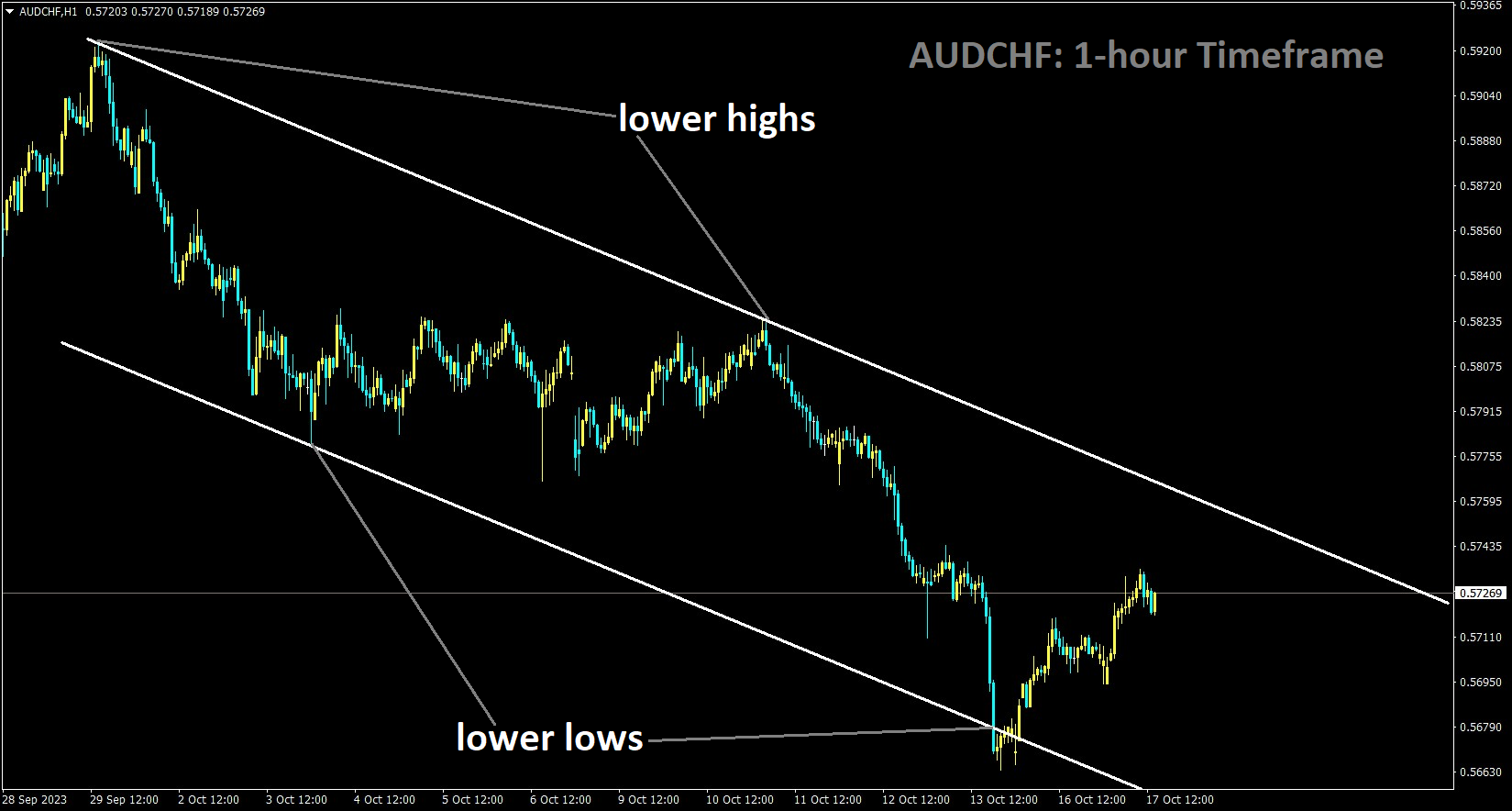

AUDCHF Analysis:

AUDCHF is moving in the Descending channel and the market has rebounded from the lower low area of the channel

Rising house prices could support consumption and indicate less restrictive monetary policy. However, the full effects of previous interest rate hikes may take several months to manifest in economic data.

The Australian economy continued to experience modest growth in the September quarter. While the labor market reached a turning point, there were limited signs of a wage-price spiral.

The decline in the Australian dollar against the US dollar has eased monetary conditions slightly, though its impact on imported inflation remains limited.

The board expressed concerns about potential challenges in the Chinese economy and their potential spillover effects on Australia.

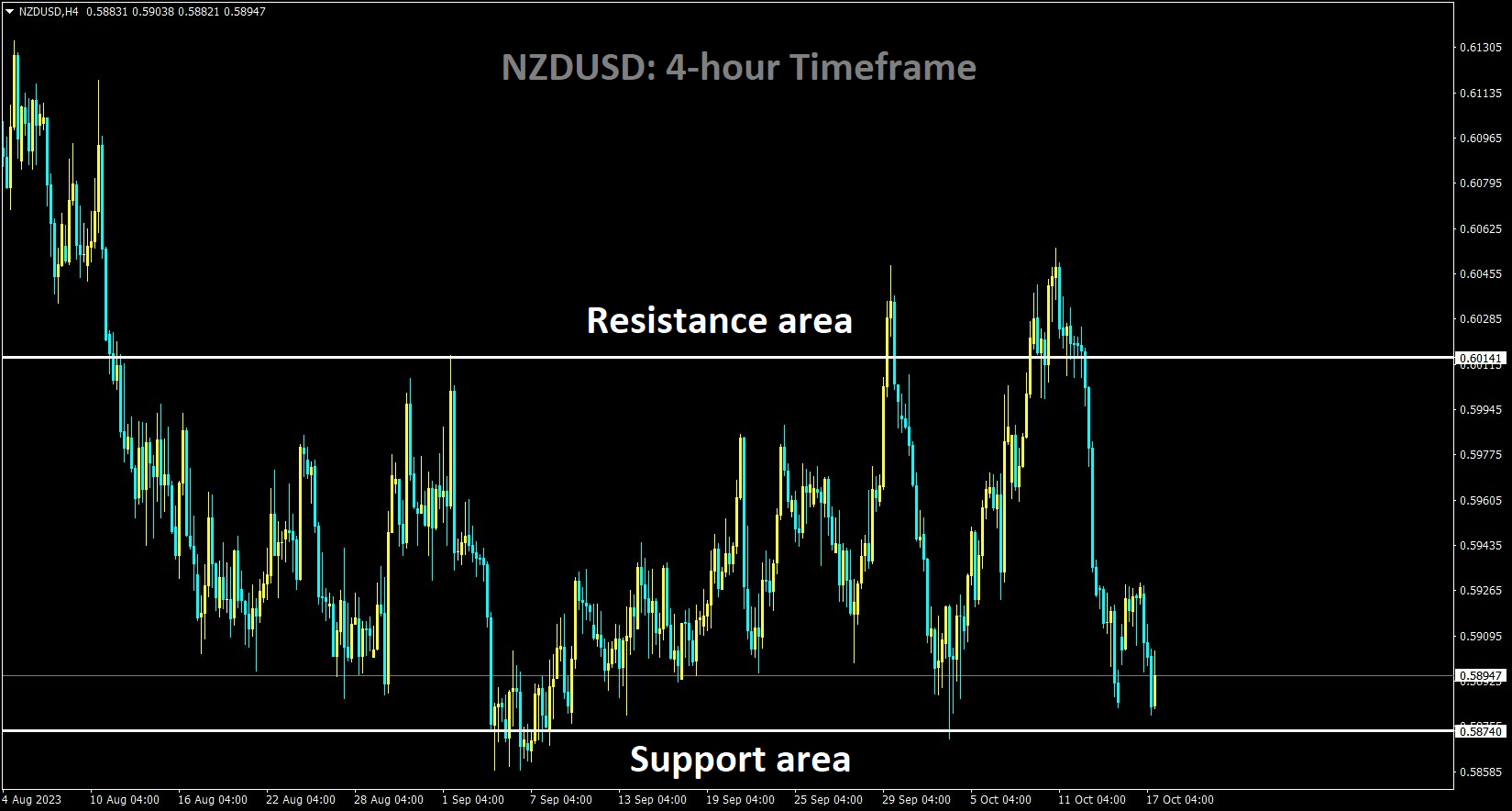

NZDUSD Analysis:

NZDUSD is moving in the Box pattern and the market has reached the support area of the pattern

New Zealand’s third-quarter inflation data came in lower than expected at 5.6%, leading to a decline in NZD currency pairs.

The Consumer Price Index (CPI) for the third quarter recorded a 5.6% increase compared to the previous year, falling short of expectations. This softer-than-anticipated inflation report has implications for the Reserve Bank of New Zealand (RBNZ).

The RBNZ uses interest rate adjustments to influence inflation and economic growth. Given the CPI figures, the central bank may approach its policy decisions with caution, potentially signaling a shorter duration of restrictive rates. This has led to a demand for the New Zealand Dollar, as reflected in the decline of NZDUSD following the CPI report. These developments make the Kiwi Dollar susceptible to near-term vulnerabilities, warranting close monitoring of price action.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/