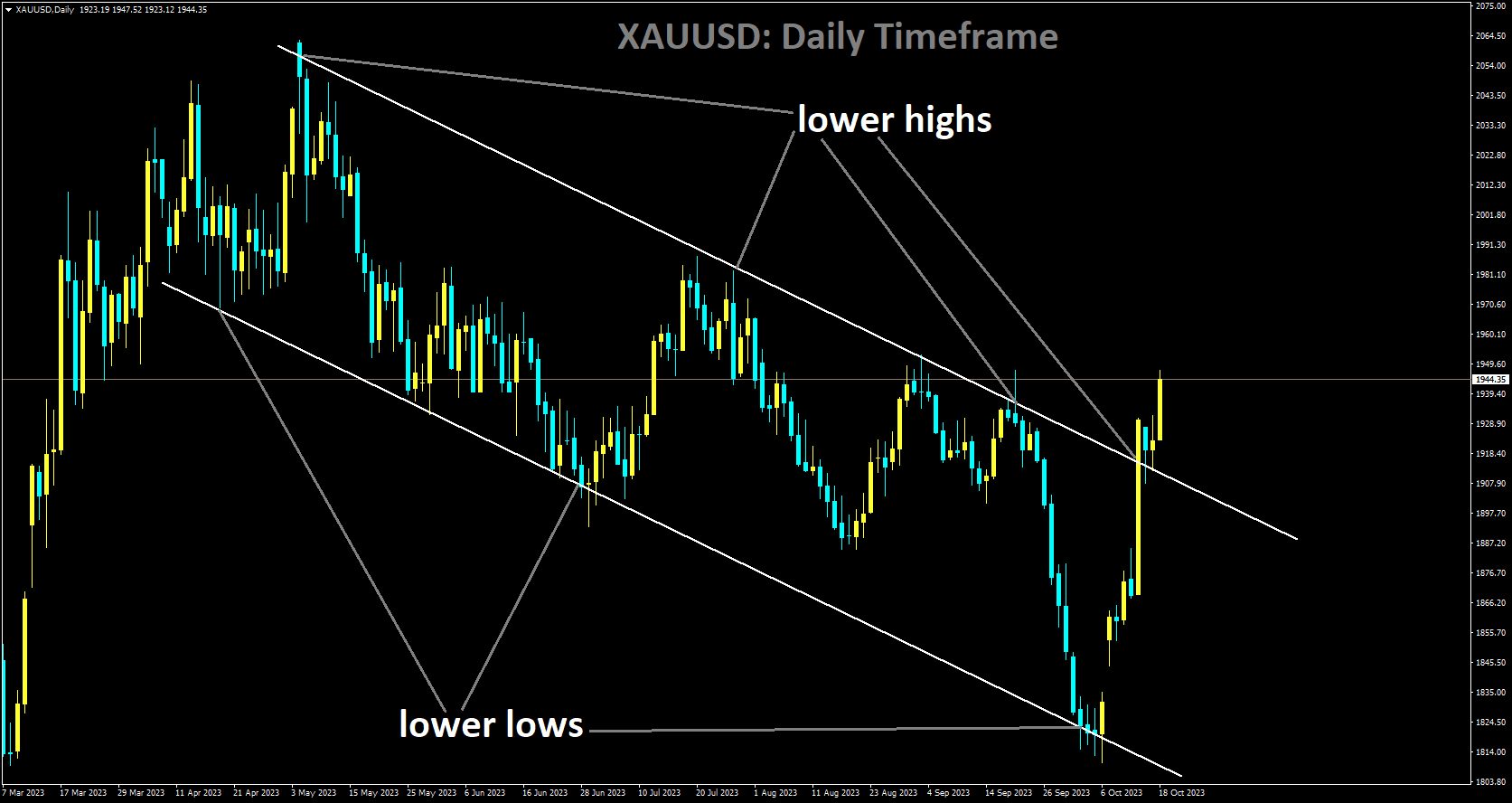

Gold Analysis:

XAUUSD is moving in Descending channel and market has reached lower high area of the channel

The ongoing conflict between Hamas and Israel, has led to a significant surge in gold prices, driven by both nations selling gold to meet the increased demand for cash. This heightened demand is primarily due to escalated weapon expenditures and increased consumption.

Currently, gold prices are on an upward trajectory, hovering around $1,940 per troy ounce during the Asian session on Wednesday. This surge in gold’s value can be attributed to mounting geopolitical tensions between Hamas and Israel, which have spurred a greater demand for gold as a traditional safe-haven asset. On Tuesday, conflicting reports emerged regarding an Israeli air attack in Gaza, with Gaza authorities reporting 500 casualties at a hospital, while Israel attributed the damage to a Palestinian attack, as reported by Reuters. Additionally, positive economic data from China is bolstering gold prices. In the third quarter, China’s Gross Domestic Product exceeded expectations, showing a growth rate of 1.3% compared to the anticipated 1.0%. The annual report for the same quarter revealed a 4.9% increase, surpassing the expected 4.4%. Furthermore, China’s Retail Sales (YoY) demonstrated a rise of 5.5%, surpassing both the previous figure of 4.6% and the expected 4.9%.

Turning to the US Dollar Index (DXY), it initially gained ground but then retreated after the release of Chinese economic figures, struggling to maintain its position near 106.10 at the time of this press release. However, US Treasury yields improved, with the 10-year US Treasury bond yield reaching 4.83%, which could provide support for the US dollar.

In terms of US economic data, the US Bureau of Economic Analysis (BEA) reported that Retail Sales exceeded expectations, rising to 0.7% in September, compared to the expected 0.3% MoM. The Retail Sales Control Group also recorded a significant increase of 0.6%, surpassing the previous rise of 0.2%. Moreover, the Federal Reserve noted that Industrial Production improved by 0.3%, contrary to the expected stagnation at 0.0%.

Thomas Barkin, the President of the Richmond Fed, emphasized that the current policy is already seen as restrictive. He highlighted uncertainty about the upcoming FOMC monetary policy meeting in November and underscored that the US central bank cannot rely solely on higher long-term bond yields to implement tightening measures in monetary conditions. Minneapolis Federal Reserve Bank President Neel Kashkari also noted that inflation has persisted for a longer period than initially expected and remains excessively high, aligning with the dovish stance maintained by several other Fed officials.

Investors are expected to closely follow housing data and speeches from Fed officials on Wednesday, as these events may provide insights into future monetary policy decisions.

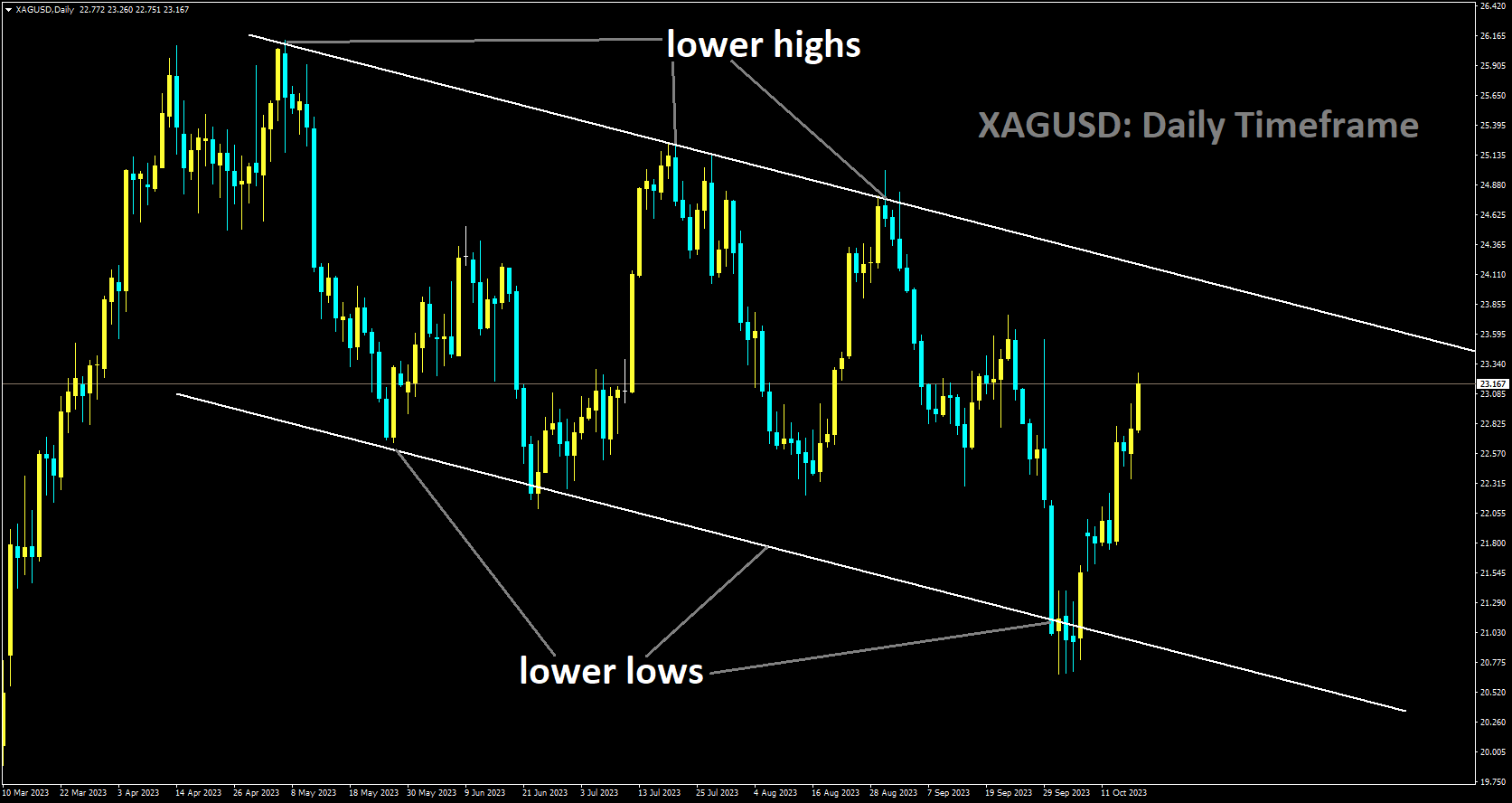

Silver Analysis:

XAGUSD is moving in Descending channel and market has rebounded from the lower low area channel

September’s retail sales figures exceeded expectations, leading to a strengthened USD against other currencies. The index is currently trading within the lower end of the weekly range, reflecting uncertainty in global markets. While stronger-than-expected Chinese data has boosted risk appetite, the deteriorating geopolitical situation in the Middle East favors a return to risk aversion. Simultaneously, the index is finding support around the 106.00 level amid growing speculation of a Federal Reserve stance that leans towards a more prolonged period of tightening. This sentiment is reinforced by Tuesday’s better-than-expected US Retail Sales and Industrial Production figures.

Later in the session, we anticipate the release of Housing Starts and Building Permits data, as well as the usual MBA Mortgage Applications, the Fed’s Beige Book, and TIC Flows. Additionally, investors will closely monitor speeches from FOMC members C. Waller, J. Williams, M. Bowman, and P. Harker.

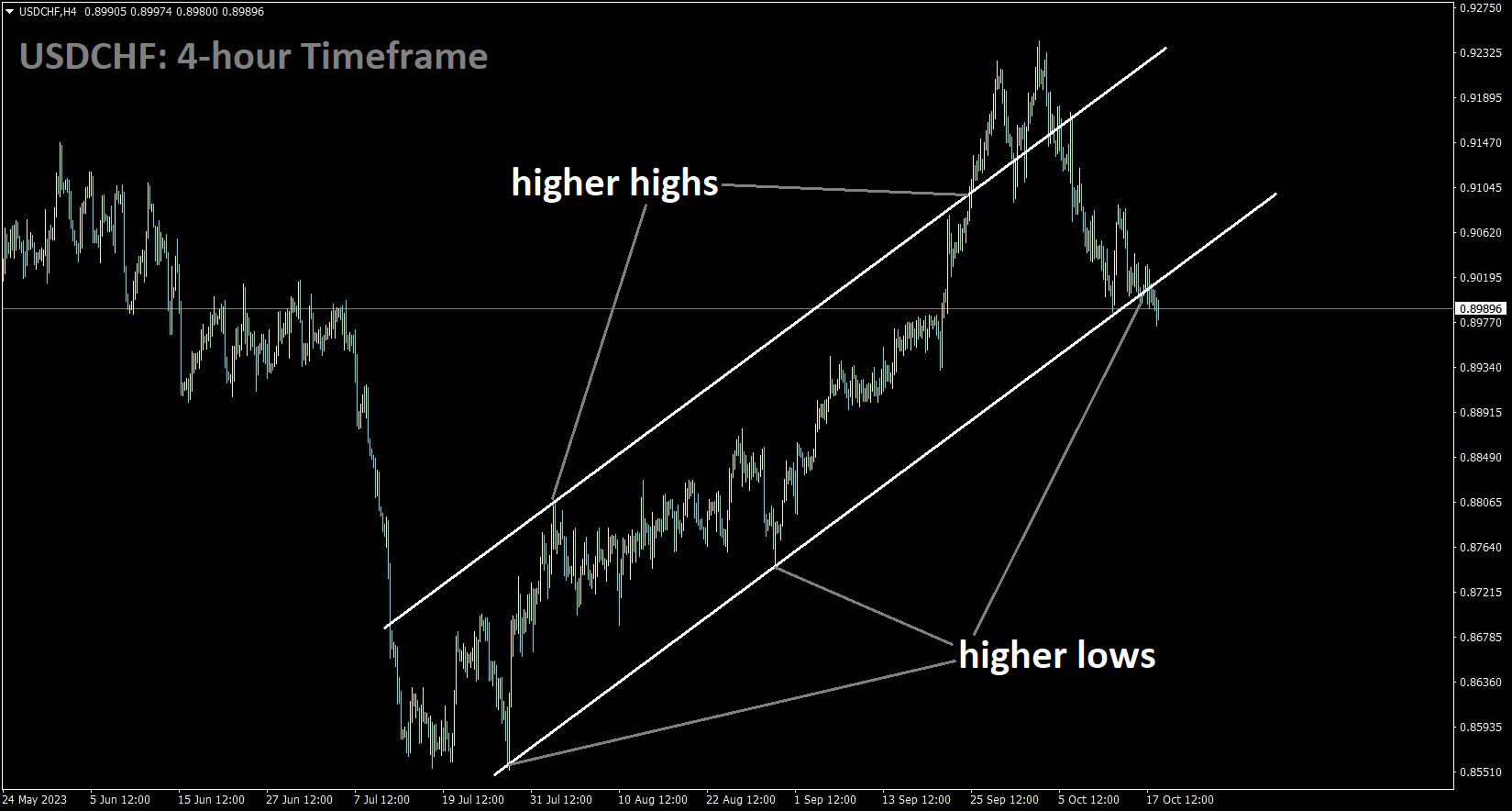

USDCHF Analysis:

USDCHF is moving in an Ascending channel and the market has reached the higher low area of the channel

The deployment of US warships to Israel, potentially advantageous in the event of conflicts, has strengthened the Swiss Franc while contrasting with the USD and JPY. The ongoing geopolitical tensions in Israel could potentially further bolster the Swiss Franc, a recognized safe-haven currency. This situation poses a challenge for the USD/CHF currency pair.

Additionally, the US Marine Rapid Response force is en route to waters near Israel, with 2,000 Marines and sailors being deployed. They are joining a growing fleet of US warships heading towards Israel, a strategic move aimed at deterring Iran and the Lebanese militant group Hezbollah, according to CNN reports.

Meanwhile, the US Dollar Index (DXY) is rebounding from recent losses and is currently trading higher at around 106.50. However, the US dollar has faced pressure due to several Federal Reserve officials expressing dovish views on the future trajectory of interest rates.

Federal Reserve Bank of Philadelphia President Patrick Harker echoed these sentiments, advising against increasing borrowing costs and emphasizing that the Fed should maintain interest rates at their current levels unless there is a significant shift in the data. Simultaneously, US Treasury yields are on the rise, with the 10-year US Treasury bond yield currently at 4.74%. Looking ahead, market participants are likely to closely monitor upcoming US Retail Sales data, along with the release of the Fed Beige Book report. Thursday’s Swiss Trade Balance for September will also be closely watched.

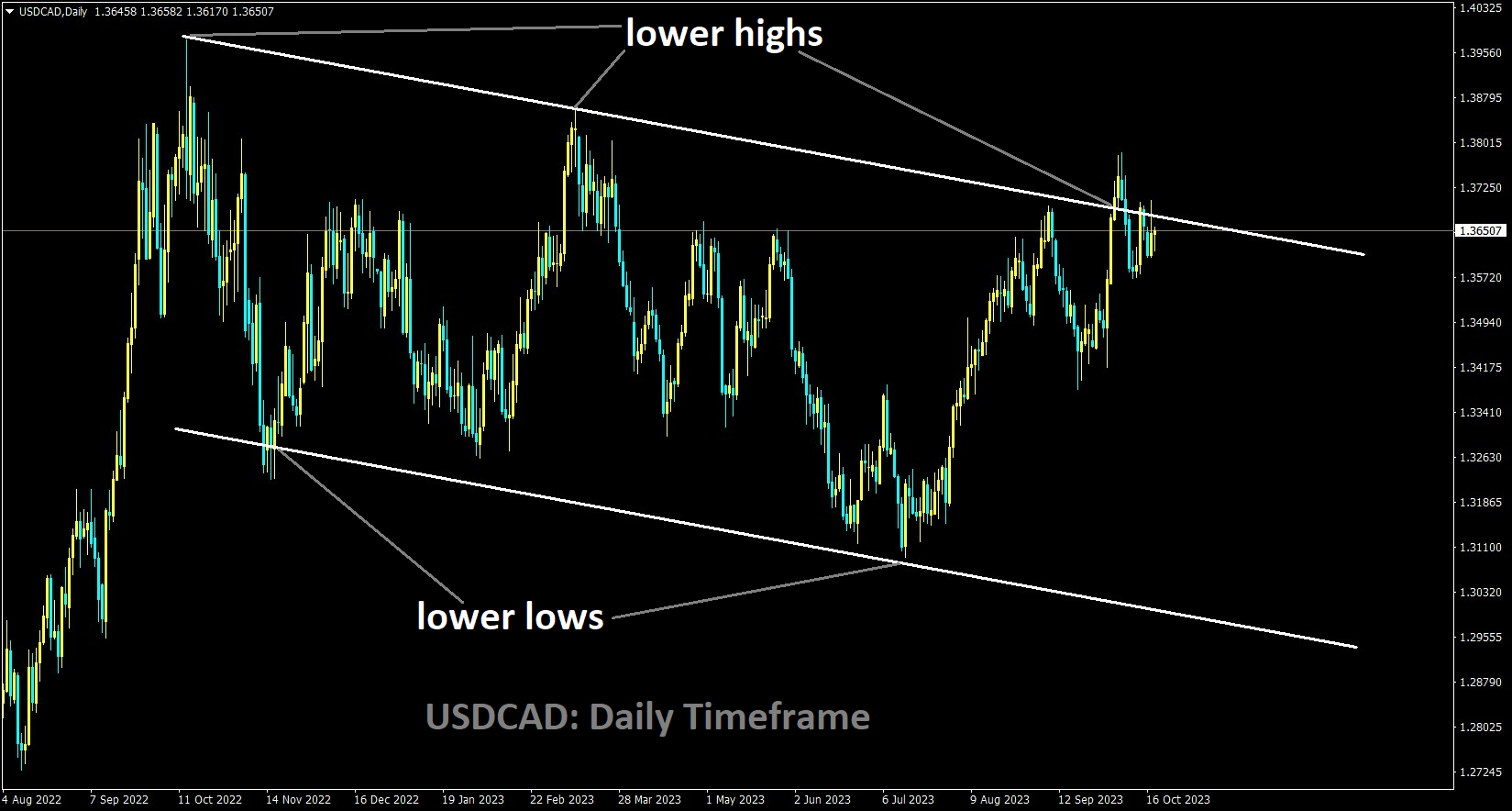

USDCAD Analysis:

USDCAD is moving in the Descending channel and the market has reached the lower high area of the channel

The Canadian Consumer Price Index (CPI) data for September revealed a rate of 3.8%, a decrease from the previous month’s rate of 4%. This drop in inflationary pressures suggests that the Bank of Canada will maintain its current policy stance at its upcoming meeting.

In response to market dynamics, the Canadian Dollar (CAD) formed a V-shaped pattern. The US Dollar (USD) initially rose significantly ahead of the release of US Retail Sales data on Tuesday. However, because the actual figure exceeded expectations, overall market sentiment improved, causing the USD to fall in value against other currencies. Notably, the CAD survived a drop in the Canadian Consumer Price Index (CPI) figures. Although Canadian CPI inflation was lower than expected in September, the CAD regained strength as investors shifted away from the US dollar, indicating a preference for riskier assets. Furthermore, crude oil prices remained relatively low on Tuesday, limiting support for the CAD and limiting its potential for further gains. The robust performance of US Retail Sales on Tuesday was a key driver for market dynamics, with the headline figure for September exceeding expectations at 0.7%, well above the forecasted 0.3%, and the previous figure revised from 0.6% to 0.8%.

While Canadian CPI inflation fell short of expectations, printing at 3.8% for the year to September, well below the forecasted steady rate of 4%, the strong US Retail Sales data prompted risk-seeking investors to flee the USD, causing its value to fall across the board. The CAD’s gains against the USD were somewhat limited by the Canadian CPI inflation miss, especially in the context of lower Crude Oil prices on Tuesday, which acted as a counterbalance and restrained the CAD’s upward momentum.

CAD traders will be looking forward to Friday’s Canadian Retail Sales data to assess potential opportunities for the currency to regain lost ground. United Nations (UN) Secretary-General António Guterres made the following statements during his speech at the Belt and Road Forum:

I have urged Hamas to release the hostages unconditionally, and I have also urged Israel to allow Gaza immediate access to humanitarian aid.

I am deeply disturbed by the tragic incident on Sunday, in which hundreds of people were killed in a strike on a Gaza hospital. While acknowledging the security challenges, it is important to note that the Hamas attacks on October 7 do not justify collective punishment. I am a strong supporter of an immediate humanitarian ceasefire.

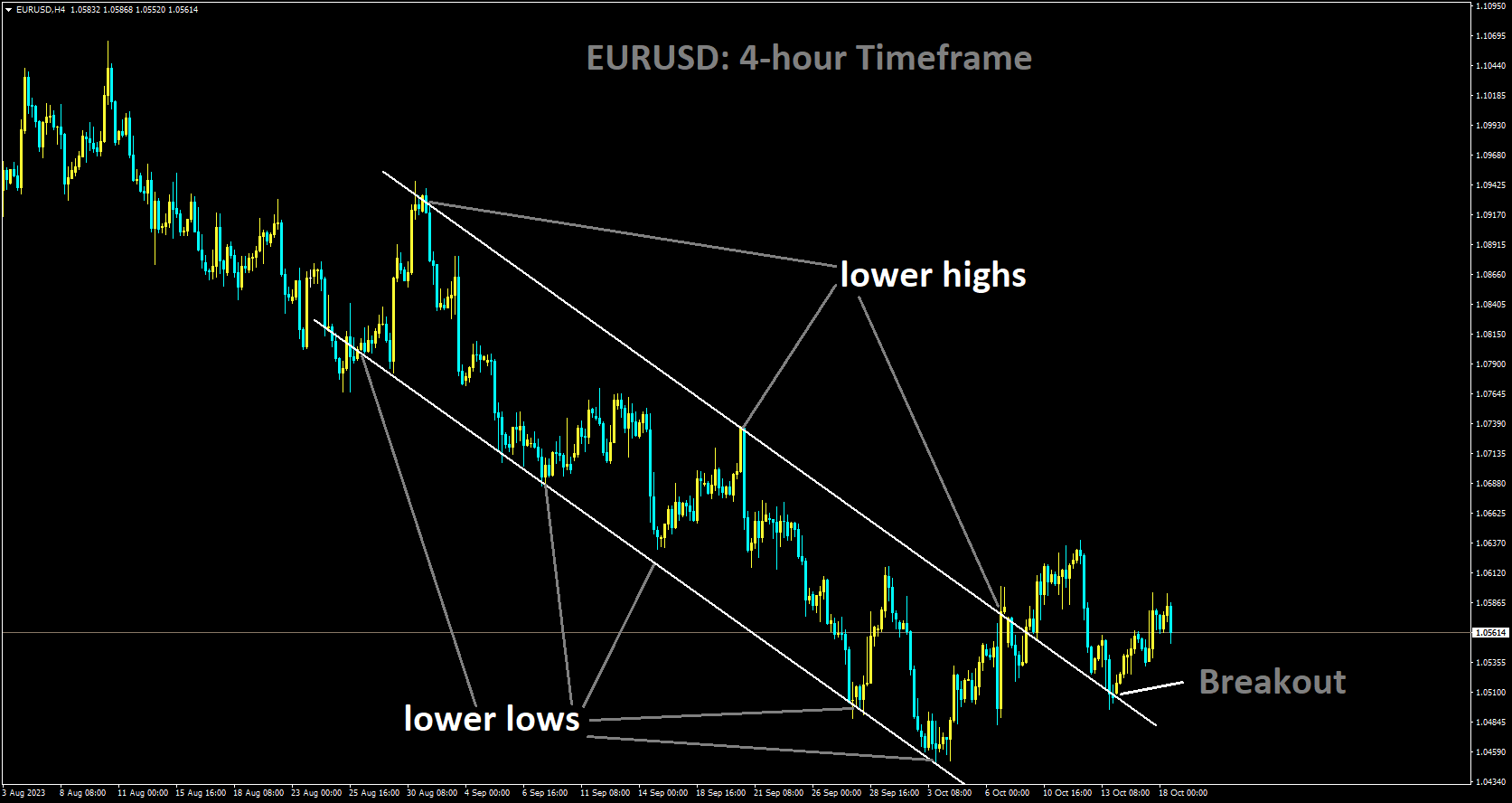

EURUSD Analysis:

EURUSD has broken in descending channel in upside

The ongoing conflict between Israel and Palestine is expected to exert downward pressure on the region’s economy in 2023, particularly due to the anticipated rise in oil prices, according to analysis from Commerzbank.

The market is currently in a state of readiness, with economists at Commerzbank closely analyzing how developments in the Middle East are influencing currency movements. It’s not just the positioning of the Israeli army’s ground forces that are significant; the financial markets are also poised for potential changes.

There is relatively little activity in the US Dollar, as market participants await news on whether, and if so, when the offensive in the region will commence. Monetary policy considerations for the Federal Reserve (Fed) and the European Central Bank (ECB) may take a backseat to geopolitical developments amid escalating conflict or increased tensions, which are expected to continue weighing on the EUR/USD currency pair.

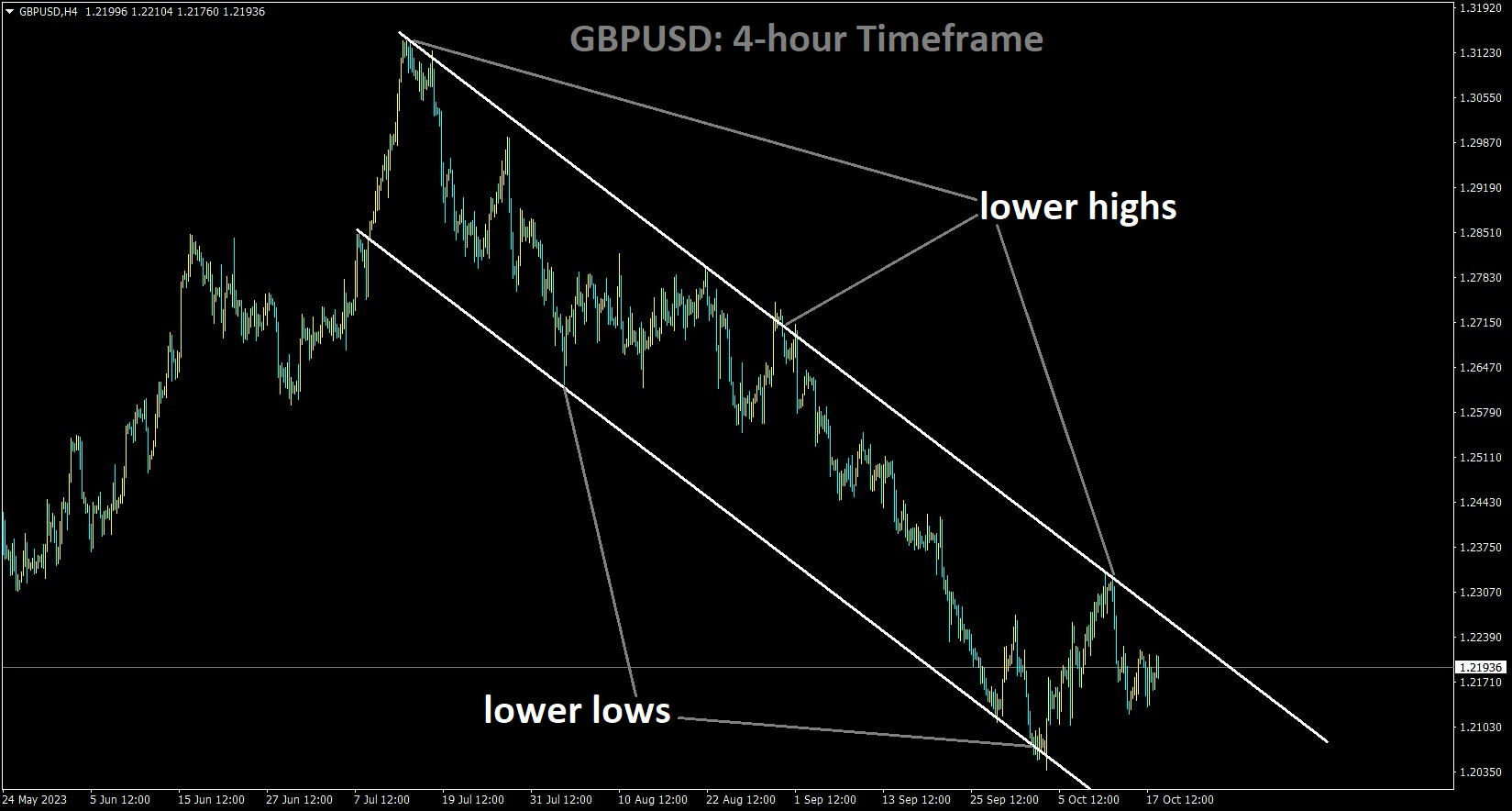

GBPUSD Analysis:

GBPUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel

The UK Consumer Price Index (CPI) data for September remained consistent at 6.7%, matching the previous reading. The surge in oil prices is contributing to the perception of elevated inflation levels.

UK CPI data displayed a persistent decrease in both headline and core inflation figures, even though the actual numbers slightly exceeded expectations. Overall, the report largely aligns with forecasts but indicates some resilience in inflationary pressures within the UK economy. The surge in crude oil prices had the most significant upward impact on annual rates, driven by motor fuel prices, while dampening pressures came from categories like food and non-alcoholic beverages, as well as furniture and household goods.

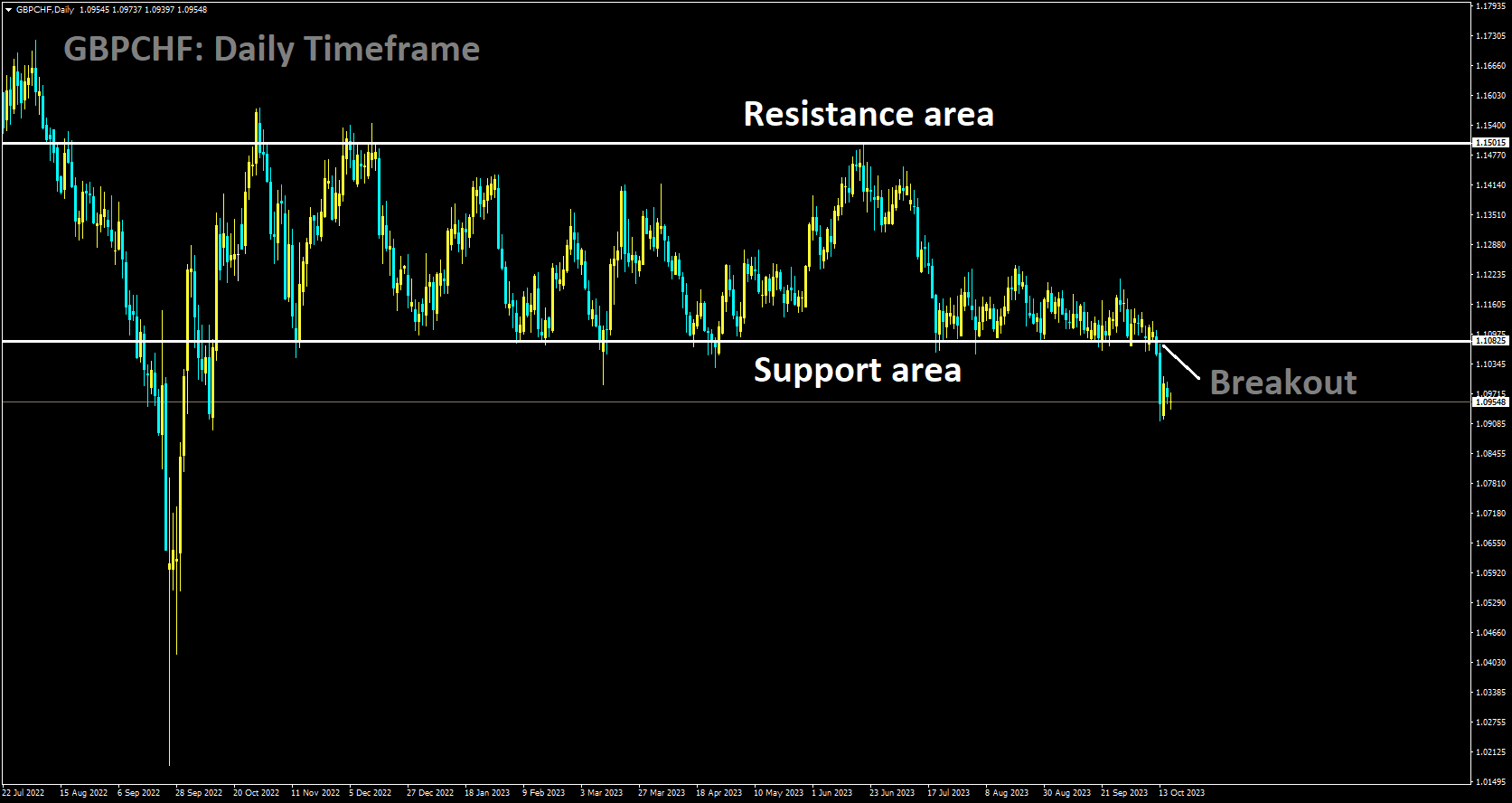

GBPCHF Analysis:

GBPCHF has broken in box pattern in downside

The decline in the Producer Price Index (PPI) is promising and could potentially lead to lower CPI figures in the future, making it a leading indicator for the Bank of England (BoE). The BoE will closely monitor this development in preparation for the November meeting. Following the announcement, the British pound received a modest boost against the US dollar, although money market pricing expectations remained largely unchanged.

The BoE’s rate projections continue to lean toward maintaining the status quo in the November meeting, aligning with global central banks, considering the escalating geopolitical tensions in the Middle East. The focus will now be on incoming data, with jobs data scheduled for release on October 24, which will be closely scrutinized to determine the BoE’s next course of action.

The BoE’s rate projections continue to lean toward maintaining the status quo in the November meeting, aligning with global central banks, considering the escalating geopolitical tensions in the Middle East. The focus will now be on incoming data, with jobs data scheduled for release on October 24, which will be closely scrutinized to determine the BoE’s next course of action.

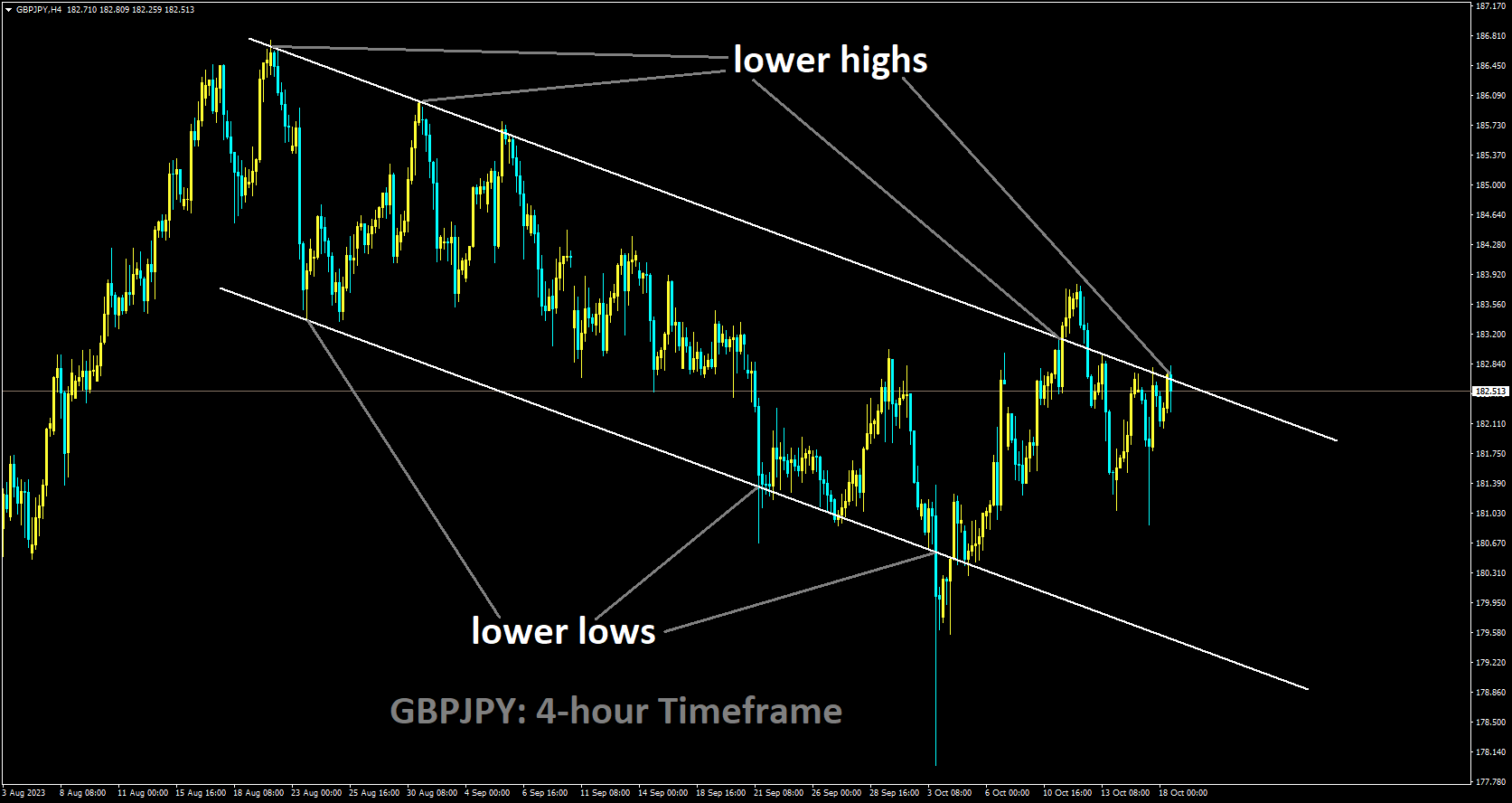

GBPJPY Analysis:

GBPJPY is moving in Descending channel and market has reached lower high area of the channel

Masato Kanda, Japan’s senior diplomat, emphasized the importance of the JPY currency during times of conflict, likening it to the Swiss Franc and USD as valuable in wartime scenarios. To date, there has been no intervention in this regard.

Japanese Finance Minister Shunichi Suzuki declined to comment on currency intervention in response to remarks made by an International Monetary Fund official on Tuesday. Suzuki expressed the view that there was no need to delve into the specifics of factors influencing the currency. Investors are eagerly awaiting Japanese inflation data scheduled for release on Friday, which could provide fresh momentum. The National Consumer Price Index, excluding Fresh Food, is expected to show a year-on-year increase of 2.7% for September, down from the previous reading of 3.1%.

Additionally, Japan’s leading financial diplomat, Masato Kanda, affirmed on Monday that the Japanese Yen (JPY) continues to be considered a safe-haven asset, akin to the Swiss Franc and US Dollar. It has been benefiting from safe-haven flows due to ongoing geopolitical uncertainties. Kanda also emphasized that if there were excessive movements in the currency market, authorities would not hesitate to take measures such as adjusting interest rates or intervening in the market. On Tuesday, there were media reports suggesting that the Bank of Japan was considering revising its core Consumer Price Index (CPI) forecast for the fiscal years 2023 and 2024 while maintaining its inflation projection for 2025.

Additionally, Japan’s leading financial diplomat, Masato Kanda, affirmed on Monday that the Japanese Yen (JPY) continues to be considered a safe-haven asset, akin to the Swiss Franc and US Dollar. It has been benefiting from safe-haven flows due to ongoing geopolitical uncertainties. Kanda also emphasized that if there were excessive movements in the currency market, authorities would not hesitate to take measures such as adjusting interest rates or intervening in the market. On Tuesday, there were media reports suggesting that the Bank of Japan was considering revising its core Consumer Price Index (CPI) forecast for the fiscal years 2023 and 2024 while maintaining its inflation projection for 2025.

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher low area of the channel

The inflation data for the third quarter is set to be released next Wednesday. According to Commerzbank’s perspective, if the inflation figure surpasses expectations, the Reserve Bank of Australia (RBA) may consider another interest rate hike as an option.

There is a divergence of opinions regarding whether the Reserve Bank of Australia (RBA) will opt for another interest rate hike. Economists at Commerzbank are closely examining the conditions necessary for an appreciation of the Australian Dollar (AUD).

If the September labor market data demonstrates reasonable resilience and if inflation moderates less than anticipated, especially when the Q3 data is released next Wednesday, it is likely that the RBA will proceed with another key rate hike in early November. This expectation is further bolstered by recent indications of economic stabilization in China.

The potential for an additional interest rate hike and the signs of stability in the Chinese economy should lend support to the AUD. However, it must also contend with the prevailing strength of the US Dollar.

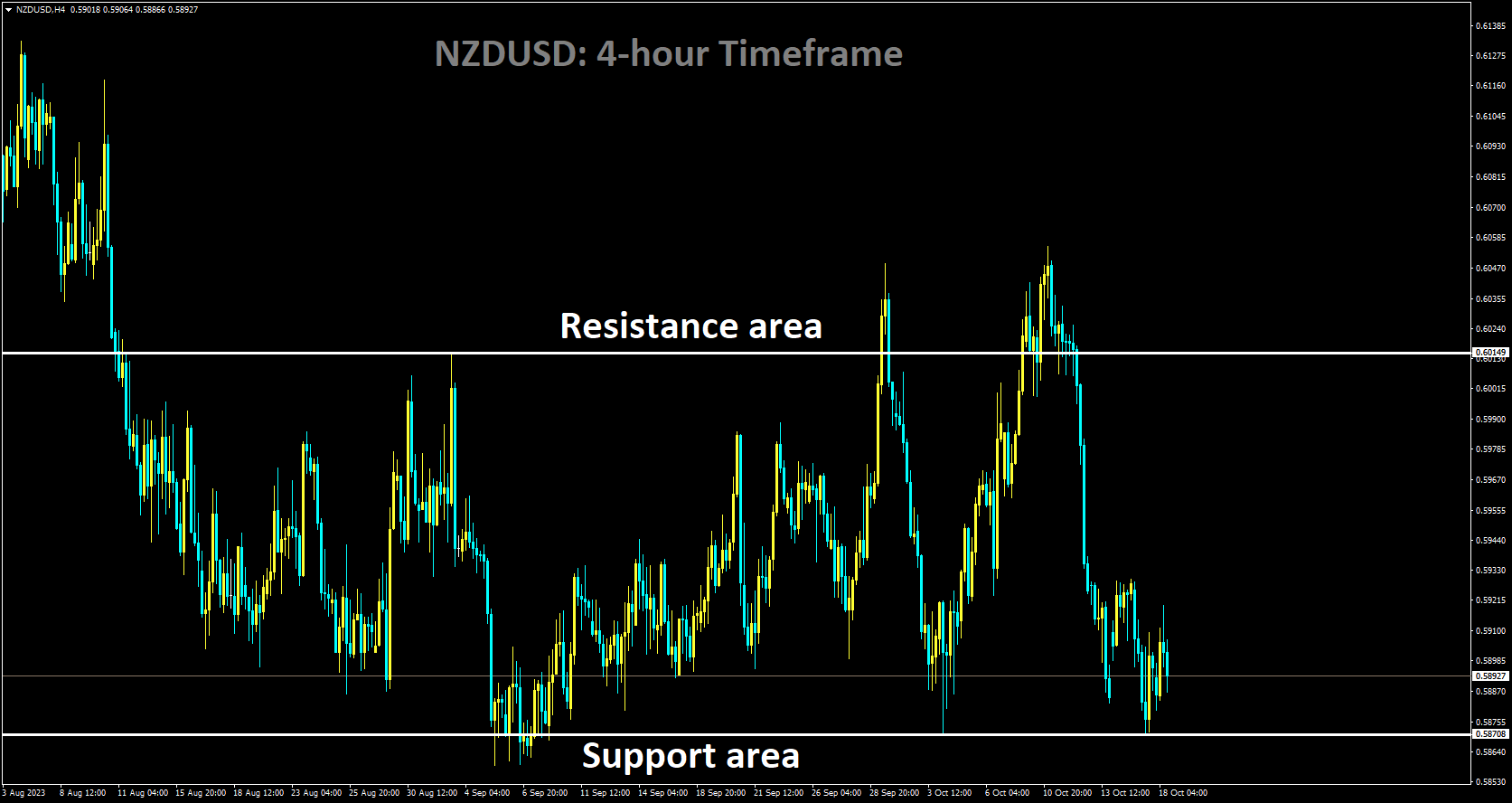

NZDUSD Analysis:

NZDUSD is moving in box pattern and market has reached support area of the pattern

China’s third-quarter GDP data exceeded expectations today, with both industrial and retail sales figures also surpassing forecasts. This positive economic performance in China has contributed to a boost in the New Zealand Dollar (NZD).

The New Zealand dollar initially experienced losses against the US dollar on Wednesday but later recovered ground following stronger-than-expected growth in the Chinese economy. Chinese industrial output and retail sales also outperformed expectations, fostering optimism that the world’s second-largest economy may be stabilizing in its growth trajectory.

The NZD is striving to regain some of the substantial losses it incurred on Tuesday. These losses were prompted by a larger-than-anticipated moderation in New Zealand’s inflation during the third quarter, which reduced the immediate need for further tightening of monetary policy. Despite this, inflation in New Zealand remains significantly above the Reserve Bank of New Zealand’s target range of 1% to 3%, implying that interest rates might need to stay elevated for an extended period to steer inflation back into the desired range.

Additionally, heightened tensions in the Middle East have tempered risk appetite, putting downward pressure on the NZD, given its sensitivity to risk-related factors.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/