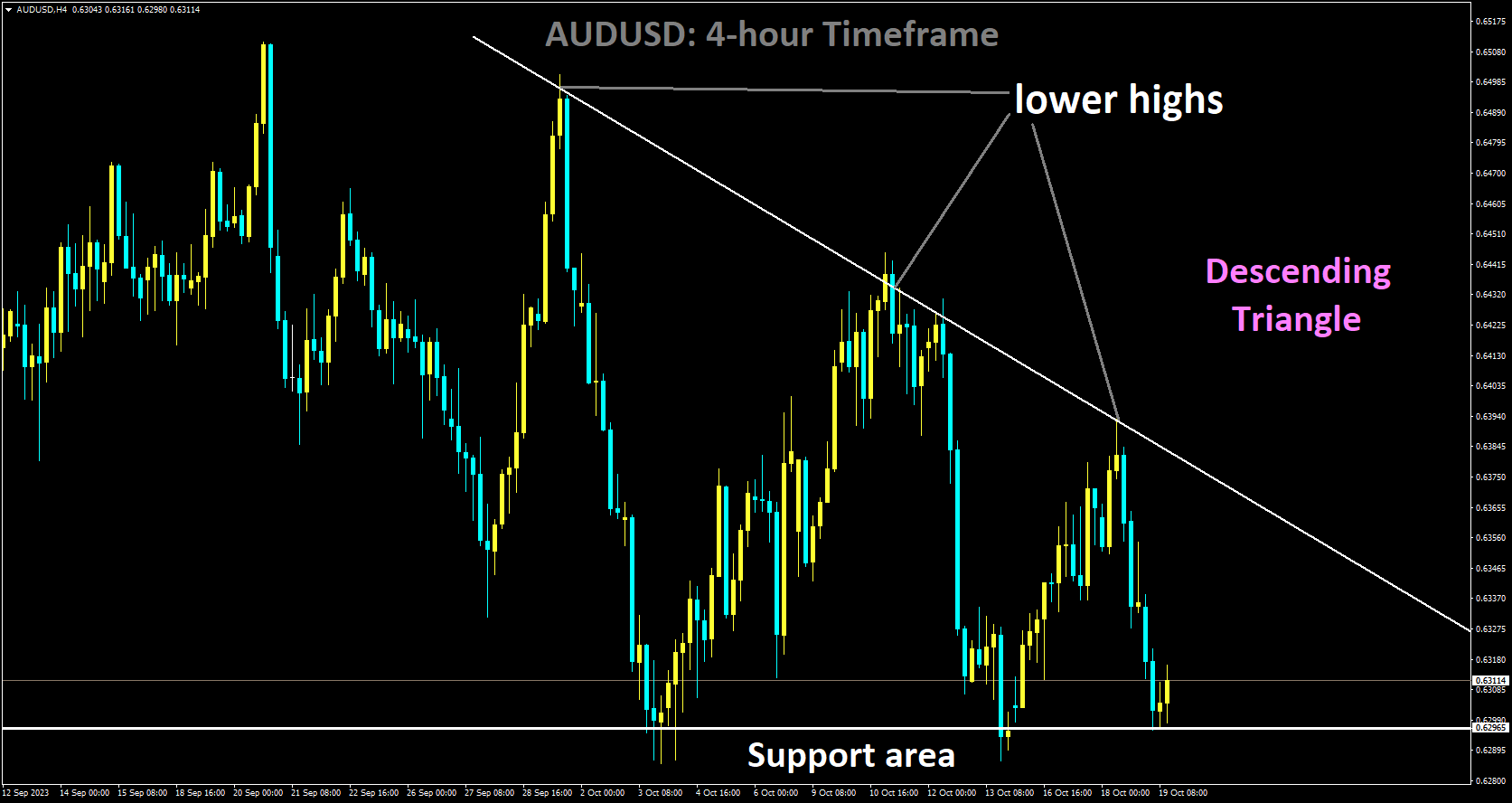

Analysis of AUDUSD:

AUDUSD is moving in Descending Triangle and market has reached support area of the pattern

The Australian unemployment rate was reported at 3.6% in September, which was slightly lower than the expected rate of 3.7%. However, only 6.7K jobs were added, far short of the expected 20K and far below the previous month’s figure of 64.9K. Following the publication of this data, the Australian Dollar fell.

The Australian Dollar fell today in response to the Australian Bureau of Statistics’ (ABS) mixed employment report. Prior to the release of this data, the currency had already shown signs of vulnerability. The unemployment rate in September was 3.6%, which was lower than the expected 3.7% and the previous rate. However, only 6.7k new jobs were created during the month, falling short of the expected 20k increase and the previous figure of 64.9k. Unfortunately, 39.9k full-time jobs were lost, while 46.5k part-time jobs were added. Furthermore, the participation rate fell from 67.0% to 66.7%, resulting in a marginal decrease in the headline unemployment rate.

The Reserve Bank of Australia decided earlier this month to keep interest rates at 4.10%. However, subsequent events have created uncertainty. Last week, RBA Assistant Governor Chris Kent expressed concern about the time it takes for monetary policy changes to take effect and suggested that further tightening may be required to combat persistently high inflation. Furthermore, the RBA meeting minutes released this week revealed a board that was closer to considering a rate hike than previously indicated. According to the minutes, the board had a limited tolerance for inflation taking longer than expected to return to target, with future interest rate adjustments contingent on incoming data and evolving risk assessments.

During a recent summit, RBA Governor Michele Bullock emphasised the challenges facing the Australian economy. She emphasised the impact of successive external shocks on inflation, as well as people’s tendency to adjust their inflation expectations in response. She warned that such changes could cement higher inflation levels. As a result, the release of third-quarter Australian CPI data, scheduled for next Wednesday, is crucial for the Australian Dollar. Bloomberg polled economists predict a year-on-year headline inflation rate of 5.2%, down from the previous 6.0% but still significantly higher than the RBA’s target range of 2-3%.

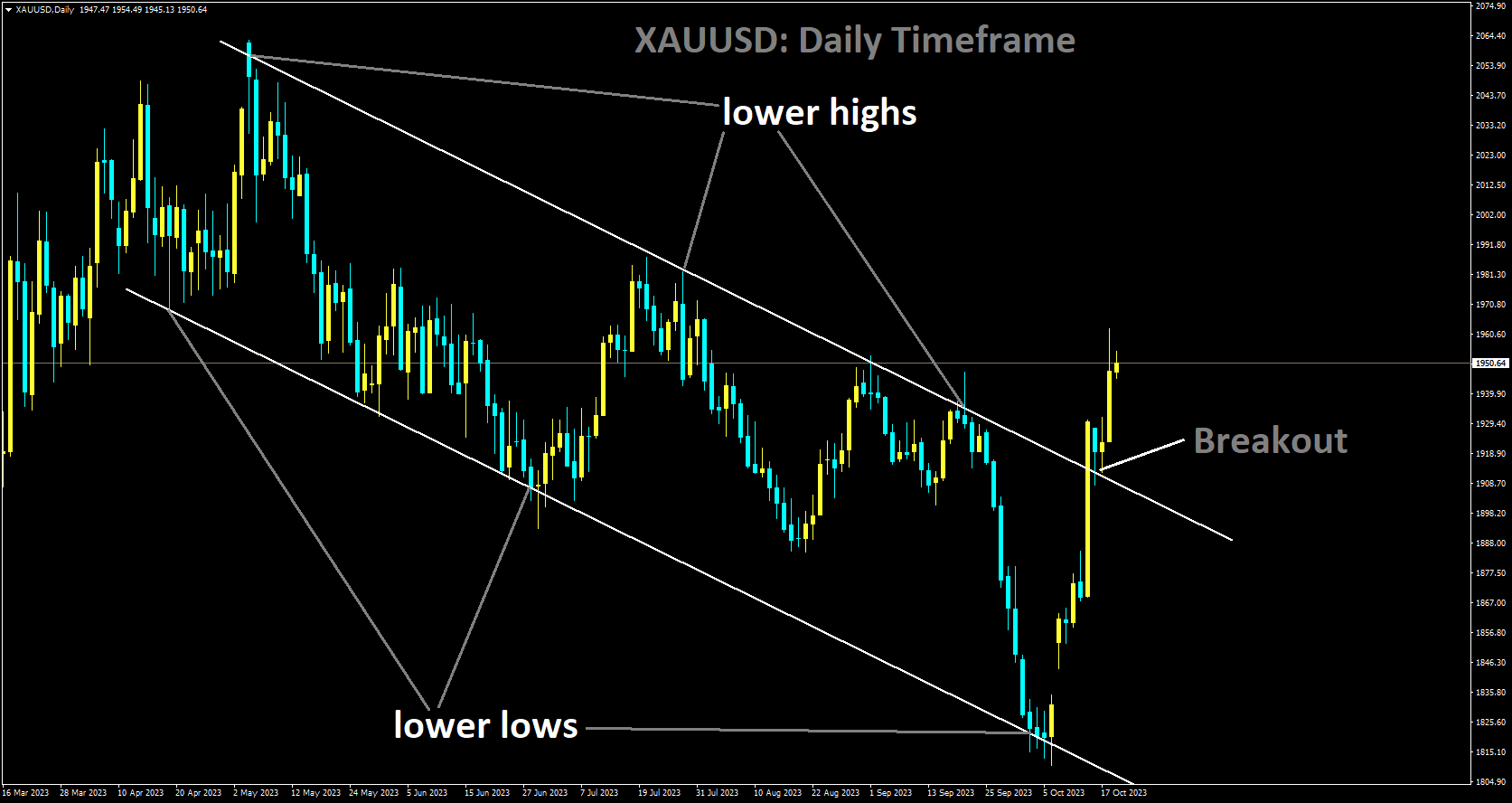

Analysis of Gold:

XAUUSD has broken descending channel in upside

The escalating tensions surrounding the Gaza Hospital attack, as well as the arrival of US Vice President Joe Biden in Israel, have raised concerns throughout the Middle East. This increased market uncertainty has increased demand for safe-haven assets such as gold.

Due to increased risk aversion among market participants, gold continued to rise throughout the day. The rise in risk aversion is the result of a tragic incident involving the explosion of a hospital in Gaza last night, which prompted Israel and Palestine to trade blame for the incident. This event had far-reaching consequences, reigniting fears of a larger conflict and propelling gold to $1950 per ounce.

The United States, on the other hand, experienced another week of positive economic data, with retail sales exceeding expectations. As a result, expectations for a rate hike by the Federal Reserve at their December meeting have risen slightly. Meanwhile, Federal Reserve policymakers have been actively sharing their perspectives this week, with many not ruling out further rate hikes but emphasising the importance of upcoming data. Waller, a Federal Reserve policymaker, stated today that if the real economy slows, the Fed may choose to keep interest rates steady.

The Fed singled out the rise in longer-dated US Treasuries as a noteworthy development. This week, the US 10-year yield reached multi-year highs, setting a new high for 2023. Fed policymakers believe that rising yields on longer-dated Treasuries will help them achieve their monetary policy objectives. The chart below shows that the 10-year US Treasury yield is currently at levels last seen in January 2007.

When it comes to the Middle East situation, it is critical to recognise the potential for escalation. Given its strained relations with Israel, Iran has been the most vocal country in the region, as has been mentioned several times in the last week. While no specific country is expected to intervene directly at this time, understanding the dynamics of the Middle East suggests that escalation through proxy actors remains a viable option. Groups such as Hezbollah and possibly other smaller organisations in the region could become involved with regional countries’ support, funding, or weapons. Any development that brings the United States more prominently into the conflict may cause gold prices to rise again. The $2000 price level will remain vulnerable as long as the conflict continues without a ceasefire or resolution, and it should be closely monitored in the coming days.

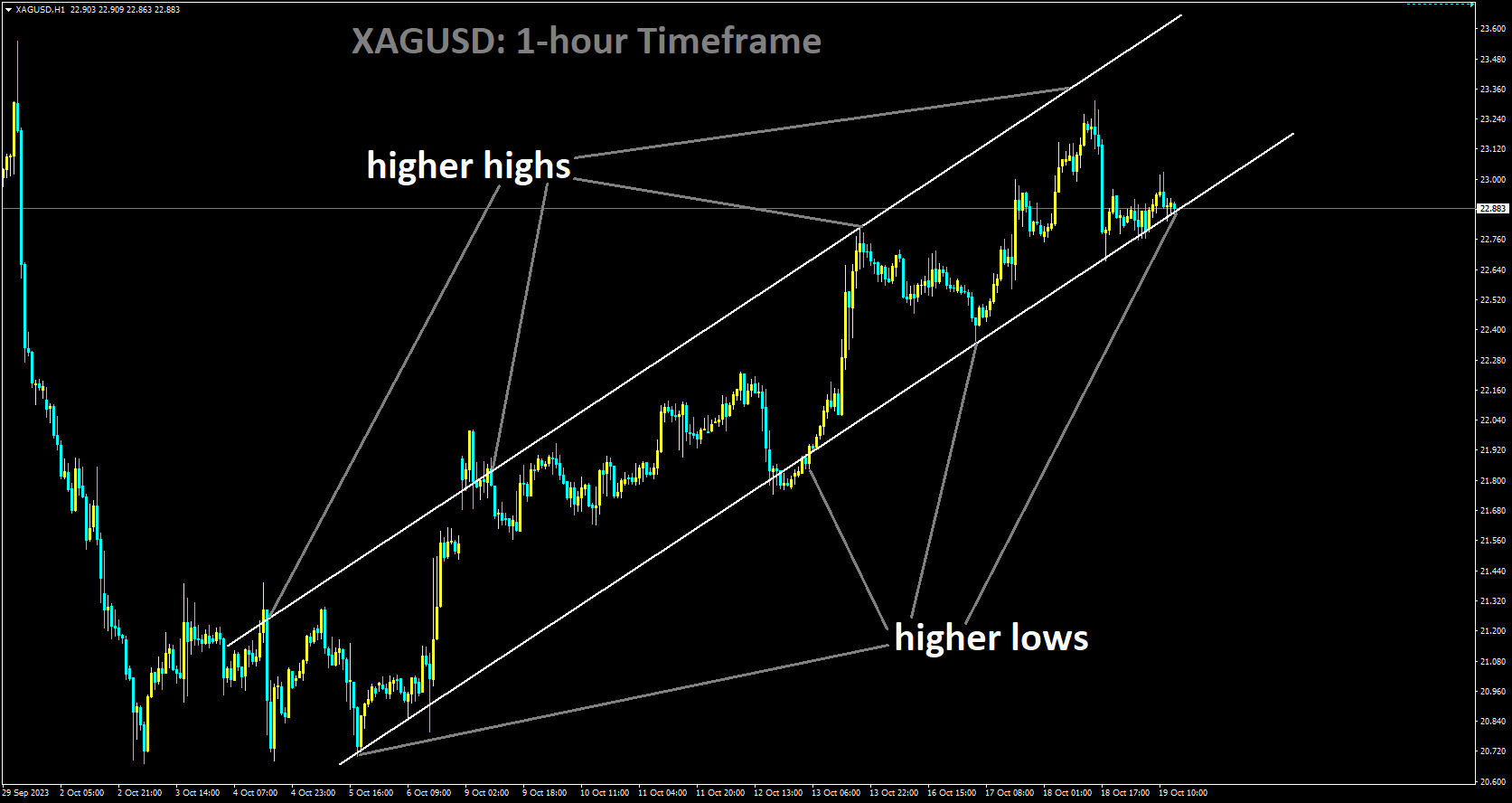

Analysis of Silver:

XAGUSD is moving in Ascending channel and market has reached higher low area of the channel

The release of the Federal Reserve’s Beige Book did not surprise the markets. Economic activity in the United States is increasing, owing to increased consumer spending and wage growth.

The US Dollar (USD), as measured by the US Dollar Index (DXY), rose to a high near 106.60 before settling around 106.55, indicating the formation of strong support near the 20-day Simple Moving Average (SMA). In comparison to the September report on economic activity, the release of the Federal Reserve (Fed) Beige Book revealed no surprises. Furthermore, the USD was little affected by mixed housing data released earlier in the session.

Recent reports, such as S&P Global PMIs, Industrial Production, and Retail Sales, show that the United States is still experiencing strong economic activity. The Beige Book described the near-term economic outlook as “stable” with a hint of slightly slower growth. It also noted mixed trends in consumer spending and a nationwide easing of labour market tightness.

The US Dollar DXY is currently trading at 106.55, representing a 0.35% daily gain. Global stock indexes have suffered significant losses, prompting investors to seek refuge in the US dollar.

Building Permits for September were 1.475 million, exceeding the 1.450 million forecast but remaining lower than the previous figure of 1.541 million. Housing starts increased in September, but fell short of expectations, registering at 1.358 million, lower than the forecasted 1.380 million but higher than the previous reading of 1.269 million.

Meanwhile, US yields are slightly higher, with 2-year, 5-year, and 10-year rates rising to around 5.20%, 4.92%, and 4.91%, respectively. The likelihood of a 25 basis point rate hike at the December meeting has risen to nearly 42%, according to the CME FedWatch tool.

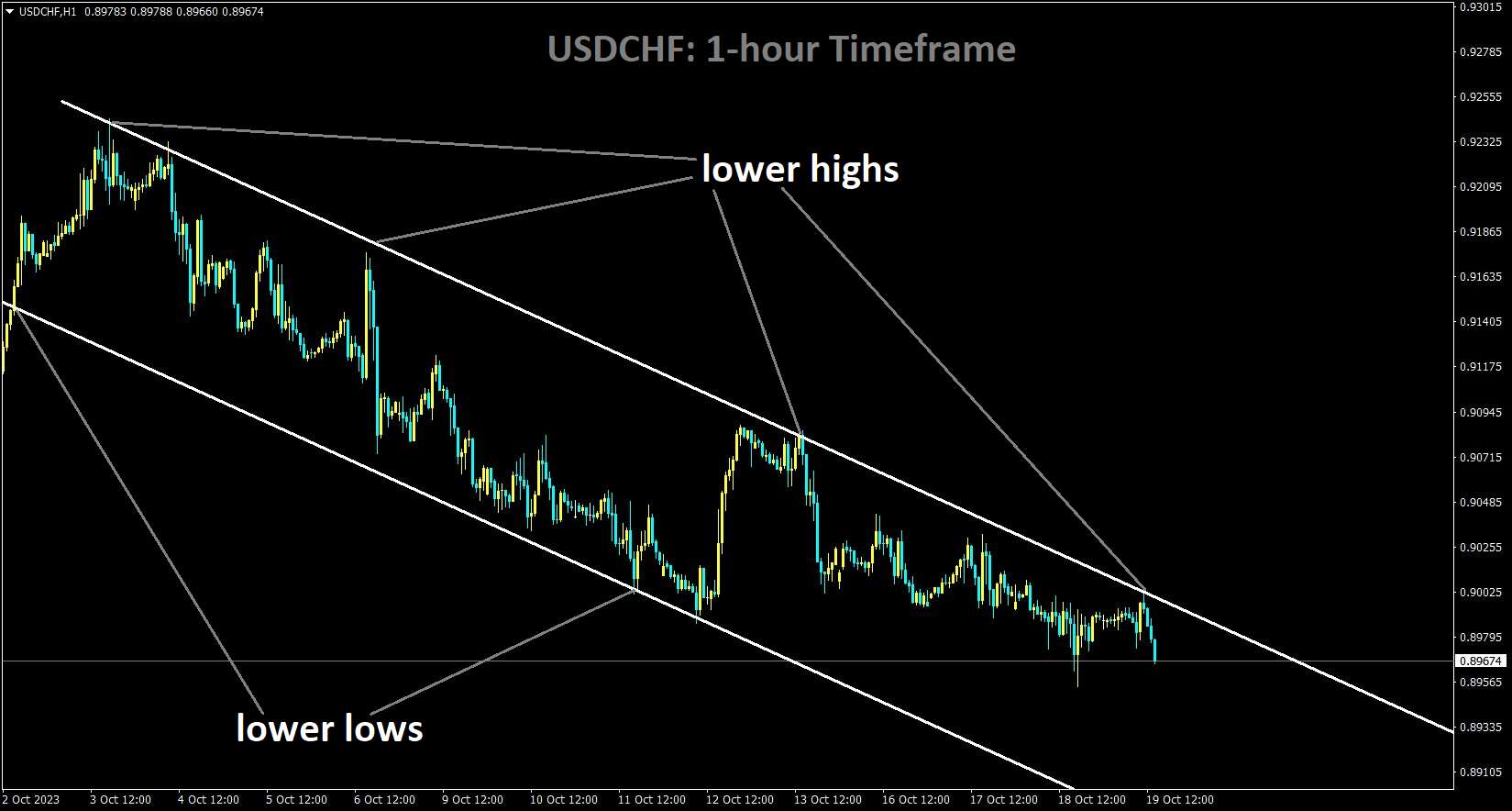

Analysis of USDCHF:

USDCHF is moving in the Descending channel and the market has fallen from the lower high area of the channel

Historically, during times of conflict, the Swiss Franc has been regarded as a safe-haven currency. Recent events, such as Israel’s bombing of a Gaza hospital, which resulted in numerous civilian casualties and escalating Middle Eastern tensions, have bolstered support for the Swiss Franc as a refuge currency.

US Treasury yields have risen, as has the US Dollar (USD). The US Dollar Index (DXY) has risen to 106.63 points. The 10-year Treasury yield has risen to 4.965%, the highest level since 2007, while the 2-year Treasury yield remains at 5.251%.

Officials from the Federal Reserve (Fed) reiterated their commitment to maintaining current interest rates in a statement issued on Wednesday. Fed Governor Christopher Waller stated that determining whether further policy rate adjustments are required is premature, emphasising the importance of data in shaping their decisions. Meanwhile, Fed Bank of New York President John Williams stated that the central bank must maintain a restrictive monetary policy for a period of time in order to combat inflation, driving up US bond yields amid robust US economic growth.

In terms of economic data, the number of US building permits issued in September was 1.475 million, exceeding the expected 1.45 million. The US Census Bureau reported on Wednesday that housing starts totaled 1.35 million, falling short of the market consensus of 1.38 million. The Fed Beige Book update showed little to no change in the US economic outlook between September and early October, implying that the data will not cause the Federal Open Market Committee (FOMC) to depart from its current guidance.

The Swiss Franc (CHF) is gaining popularity as geopolitical tensions in the Middle East escalate, driving demand for traditional safe-haven assets such as the Swiss Franc. Furthermore, Swiss producer and import prices fell 1.0% year on year in September, following a 0.8% drop the previous month. Monthly, the figures fell by 0.1%, compared to a 0.8% drop the previous month.

Traders are keeping a close eye on upcoming events such as US Jobless Claims, the Philly Fed index, and Existing Home Sales, which are scheduled for later on Thursday. All eyes will be on Fed Chair Jerome Powell’s speech during the North American session; any hawkish remarks about the policy outlook could attract buyers to the US Dollar. Furthermore, Swiss trade data for September will be released on Thursday, which could provide some direction for the USD/CHF pair. These developments may provide clarity on the currency pair’s direction.

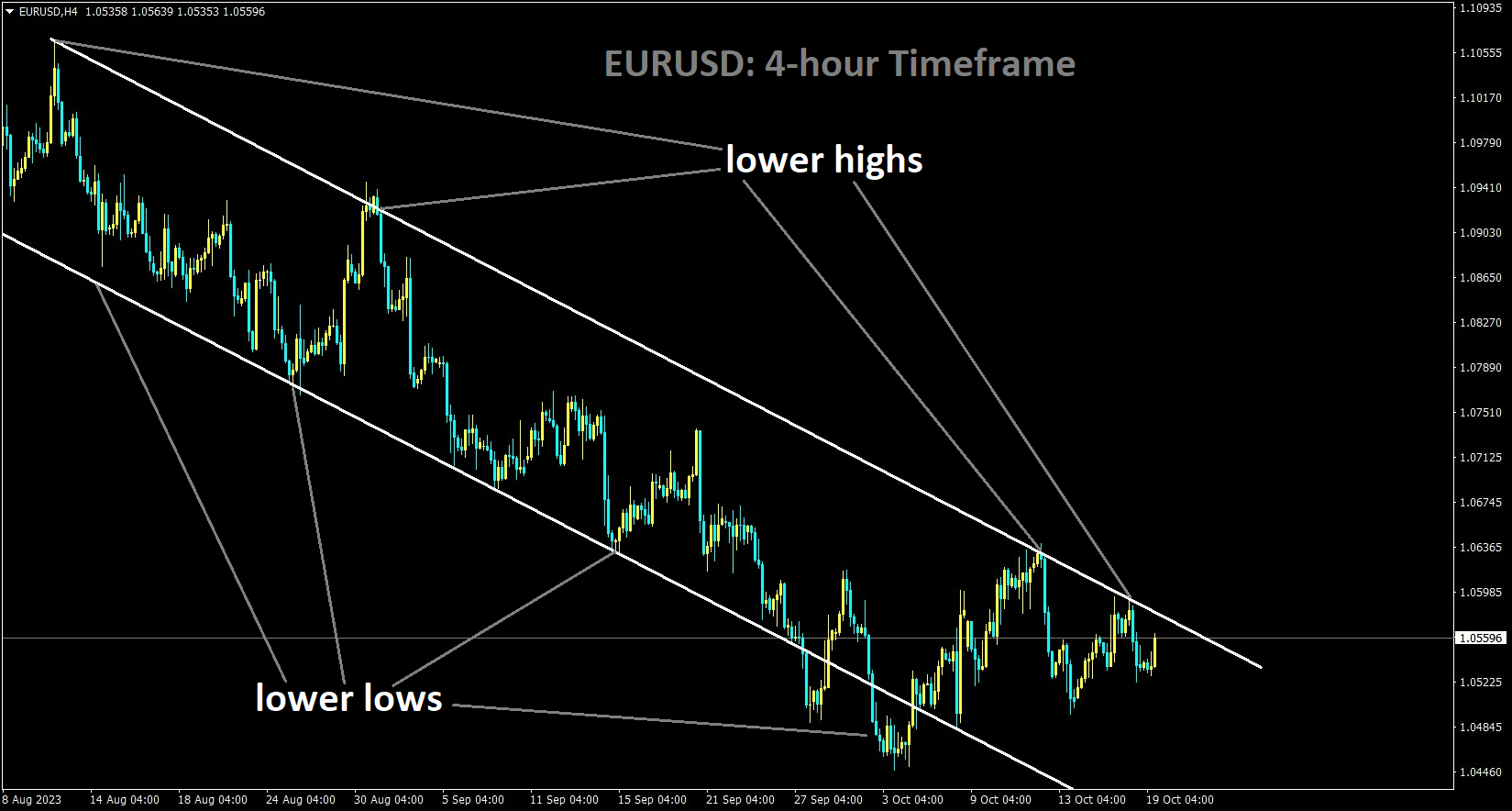

Analysis of EURUSD:

EURUSD is moving in the Descending channel and the market has reached the lower high area of the channel

The September Eurozone Consumer Price Index (CPI) inflation rate was 0.30%, which was in line with expectations. Both inflation and wage growth have exceeded initial expectations, according to European Central Bank (ECB) President Lagarde.

As the conflict between Israel and Hamas in the Gaza Strip escalates, global tensions rise. One of the highest civilian death tolls in recent history occurred in a recent rocket attack on a hospital in Gaza, with over 500 people seeking refuge in the hospital tragically losing their lives. Both Israel and Hamas have blamed each other for the strike, further complicating matters.

Meanwhile, in the United States, political uncertainty is growing as the US Congress faces difficulties in selecting a new Speaker of the House. Two votes in two days have not resulted in a nominee. This stalemate in Congress comes at a critical time, as the United States is only 30 days away from the expiration of a short-term funding stopgap that was secured at the last minute earlier this month.

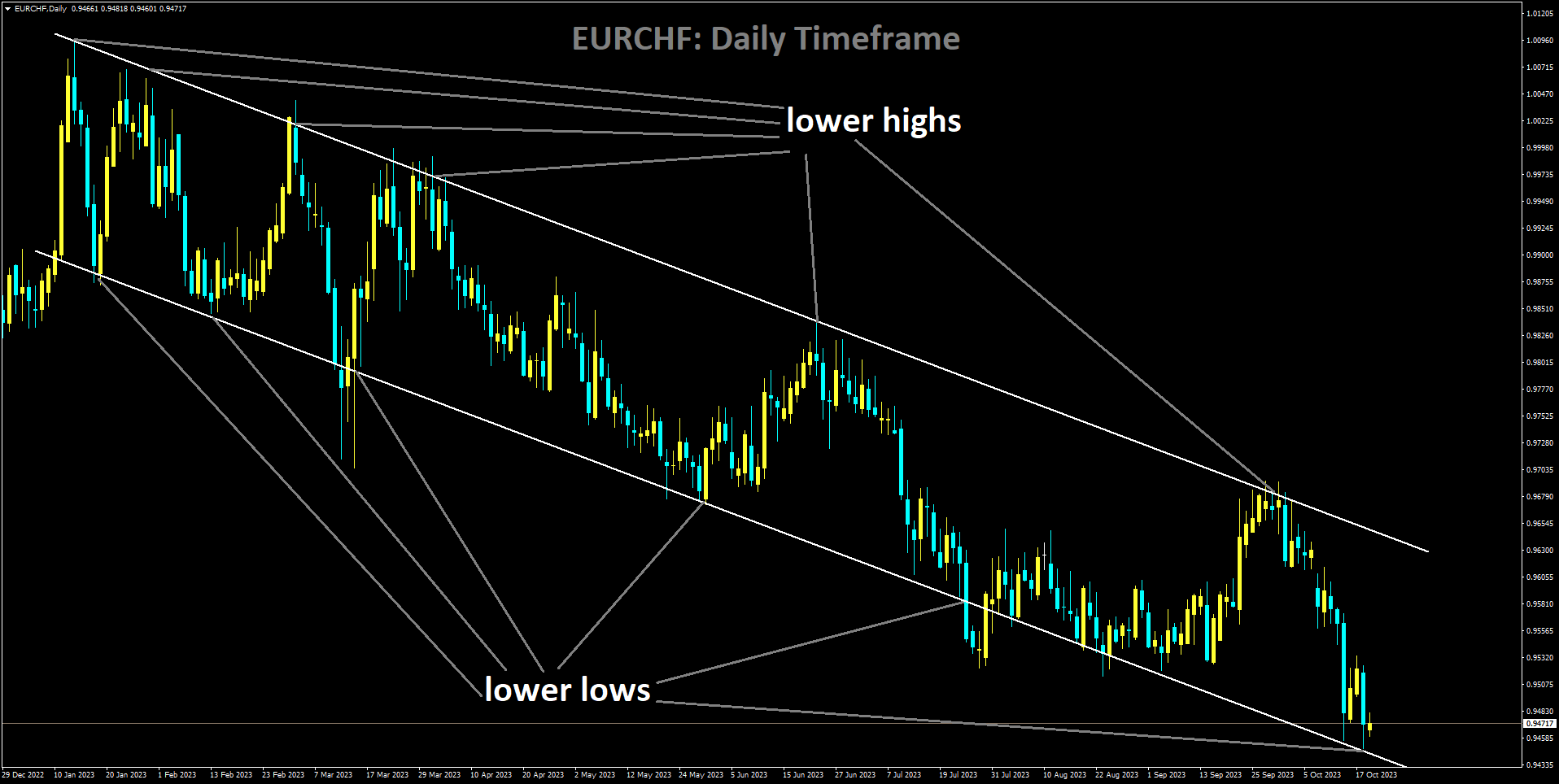

Analysis of EURCHF:

EURCHF is moving in Descending channel and market has reached lower low area of the channel

Uncertainty is growing as the United States approaches another potential partisan funding clash in mid-November. Investors are becoming more cautious and turning to safe-haven assets, causing the US Dollar (USD) to strengthen and US Treasury yields to reach multi-year highs. On Wednesday, the 10-year Treasury yield reached 4.928%, its highest level since 2007.

On the economic front, the European Union’s Index of Consumer Prices (CPI) for September came in at 0.3%, as expected. Christine Lagarde, President of the European Central Bank (ECB), stated that underlying inflation remains strong and wage growth remains historically high.

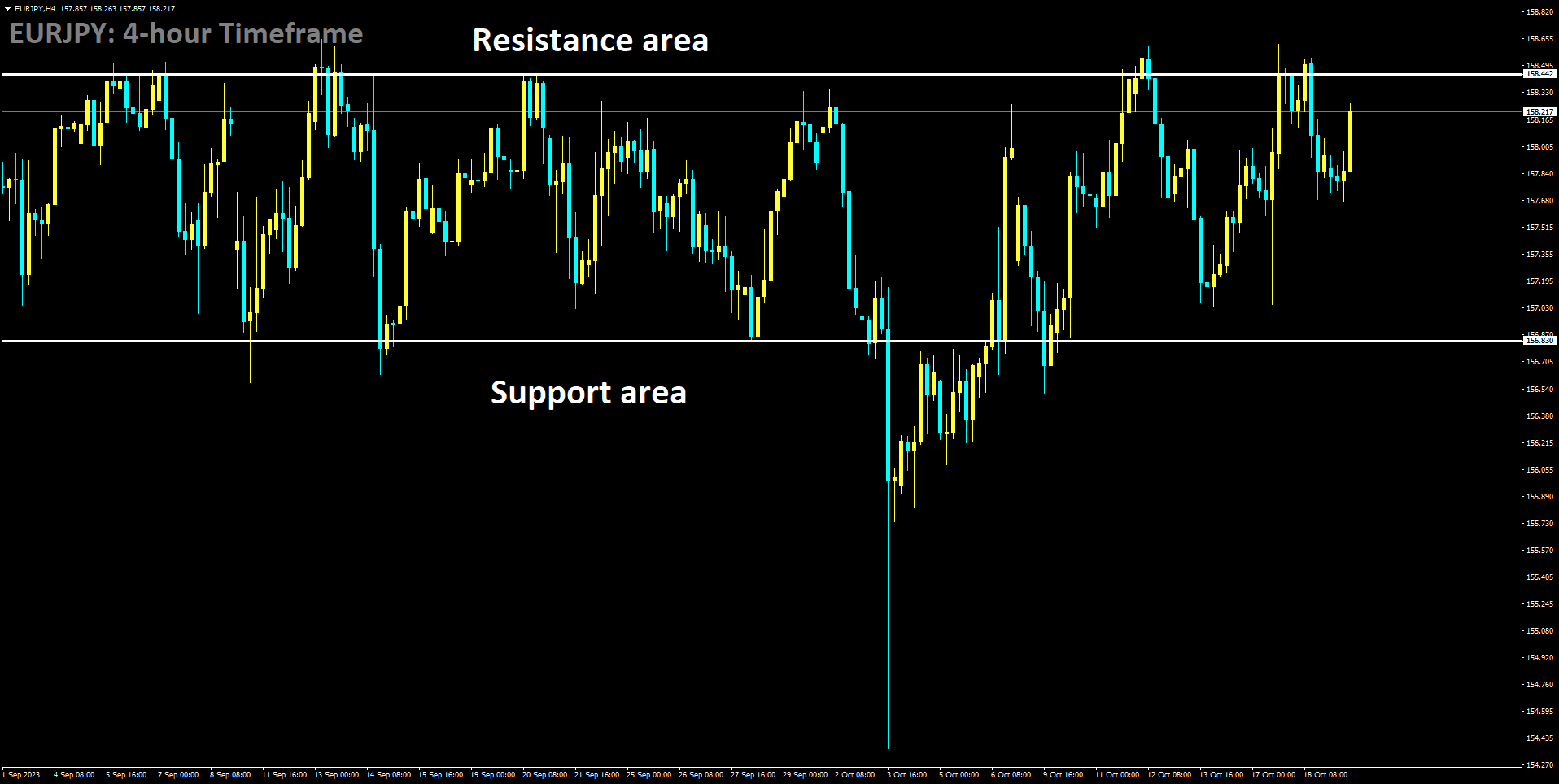

Analysis of EURJPY:

EURJPY is moving in box pattern and market has reached resistance area of the pattern

The Bank of Japan has upgraded its assessment report for six of nine regions, indicating improved performance. This upgrade comes against the backdrop of rising inflation and a general trend of moderate growth in business and wages.

Investors are looking forward to the release of Japanese inflation data on Friday in the hopes of gaining new insights. The National Consumer Price Index (CPI) in Japan, excluding fresh food, is expected to rise 2.7% year on year, down from 3.1% previously.

The Bank of Japan (BoJ) raised its assessment for six of Japan’s nine economic regions in a quarterly report. According to the report, Japan’s economy has recovered moderately across all regions. However, it also notes that exports and output have remained relatively stable in several areas, with no significant growth.

Japanese Finance Minister Shunichi Suzuki declined to comment on potential currency intervention earlier this week. Japan’s top financial diplomat, Masato Kanda, emphasised that the Japanese Yen remains a safe-haven asset, benefiting from an influx of funds seeking safety amid escalating geopolitical tensions in the Middle East. Kanda reaffirmed that if the currency market experienced excessive fluctuations, authorities would not hesitate to take measures such as adjusting interest rates or intervening in the market. This raises the prospect of future Japanese government intervention in the foreign exchange market.

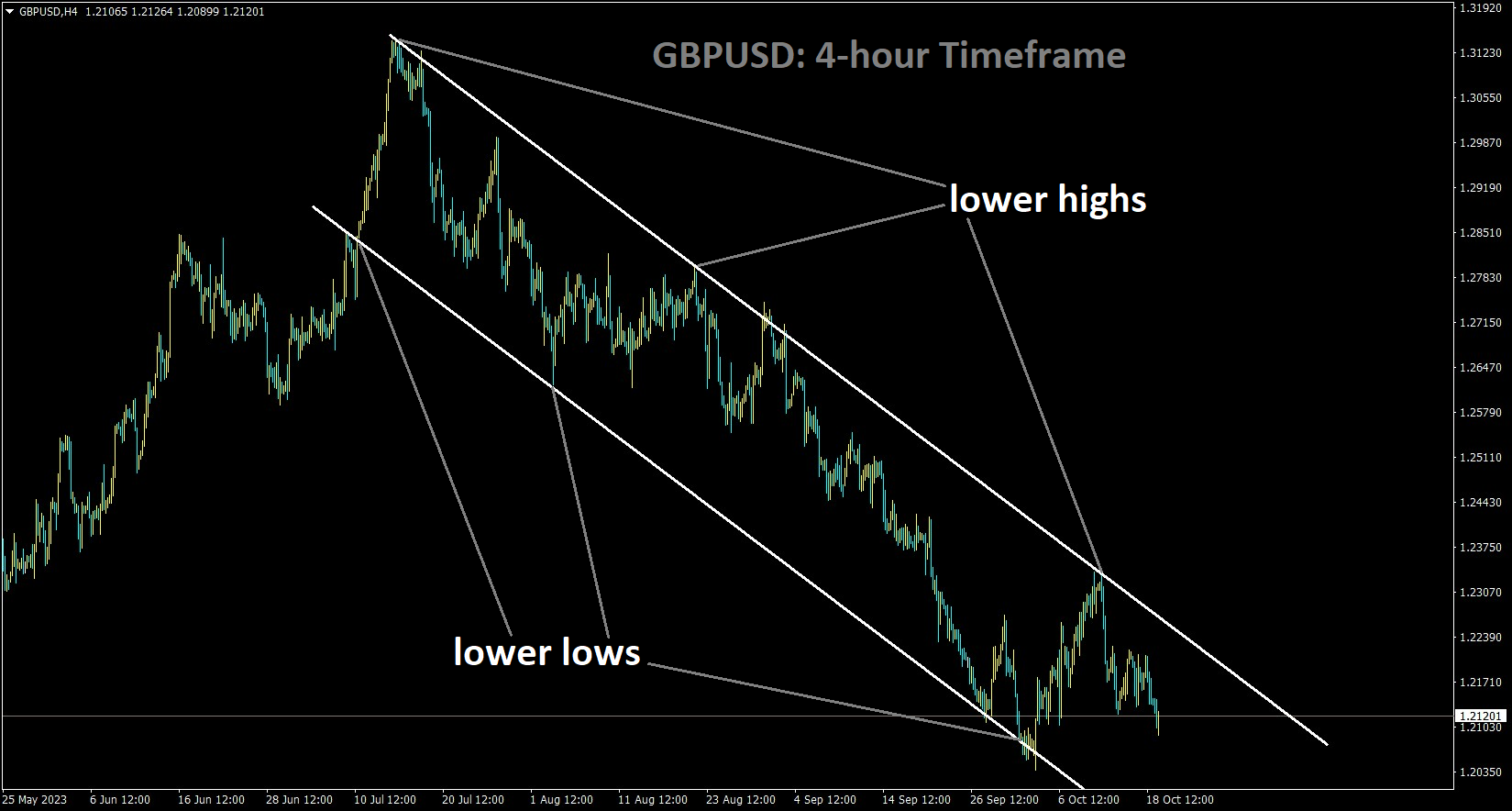

Analysis of GBPUSD:

GBPUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel

The UK inflation rate is currently 6.7%, exceeding the 5.5% target set by UK Prime Minister Rishi Sunak. As a result of the elevated inflation, the Bank of England may need to consider raising interest rates in upcoming meetings as a means of containing inflationary pressures.

Following an attempted recovery fueled by the release of UK inflation data, the Pound Sterling (GBP) encountered selling pressure around the 1.2200 level. According to the Office for National Statistics (ONS), September’s inflation figures were slightly higher than expected. This development could have an impact on the GBPUSD pair, as the stalled inflation report raises the possibility that the Bank of England (BoE) will consider additional tightening measures at their November monetary policy meeting.

The persistence of a higher Consumer Price Index raises concerns about UK Prime Minister Rishi Sunak’s ability to meet his commitment to reduce inflation to 5.5% by year’s end. The consequences of increased inflationary pressures are expected to have a further impact on the UK housing sector, which has been dealing with high borrowing costs.

The Office for National Statistics in the United Kingdom reported a steady inflation report for September, with monthly headline inflation rising at a faster rate of 0.5%, exceeding expectations of 0.4% and the previous rate of 0.3%. Annual headline CPI data also showed consistent growth, reaching 6.7%, which was higher than the estimated 6.5%. Core inflation, which excludes volatile food and oil prices, increased by 6.1%, slightly exceeding the consensus of 6.0% but slowing from the 6.2% recorded in August. Producers raised factory gate prices by 0.4%, falling short of expectations and the previous release of 0.9% and 0.8%, respectively.

A persistent inflation report is expected to present difficulties for BoE policymakers, who are working hard to reduce inflation to the target level of 2%. On a related note, the Pound Sterling was under pressure as the ONS reported soft wage data while employment figures were delayed until October 24.

Average earnings, excluding bonuses, fell to 7.8% in the three months leading up to August, as predicted, from 7.9% previously. Average Earnings, including bonuses, fell to 8.1% during the same period, compared to the consensus of 8.3% and the prior release of 8.5%. Wage growth has slowed due to weakening labour demand in both domestic and international markets.

Swati Dhingra, a policymaker at the Bank of England, commented on the soft wage report, indicating that the labour market is loosening and that she does not expect further wage growth momentum. Dhingra stated last week that if growth remains below expectations, the central bank may consider rate cuts. The Bank of England’s high interest rates have had a significant impact on the property sector, as evidenced by Rightmove’s report that home asking prices rose at the slowest rate since 2008, reflecting a slowdown in housing demand due to higher mortgage rates.

Concerns about the outcome of US President Joe Biden’s visit to Israel continue to dominate market sentiment. Discussions with Israeli Prime Minister Benjamin Netanyahu about a possible ground assault on Gaza have the potential to attract more Middle-Eastern players and escalate conflicts. Despite strong September Retail Sales data, the US Dollar Index (DXY) has remained relatively stable near 106.00.

Retail sales in the United States increased by 0.7%, owing to increased demand for automobiles and dining out. Economic data excluding automobiles increased by 0.6%, more than doubling expectations. Investors are now looking forward to Federal Reserve (Fed) Chair Jerome Powell’s speech on Thursday. Powell’s remarks will be closely watched to see if he agrees with his colleagues on keeping interest rates unchanged or provides more hawkish guidance.

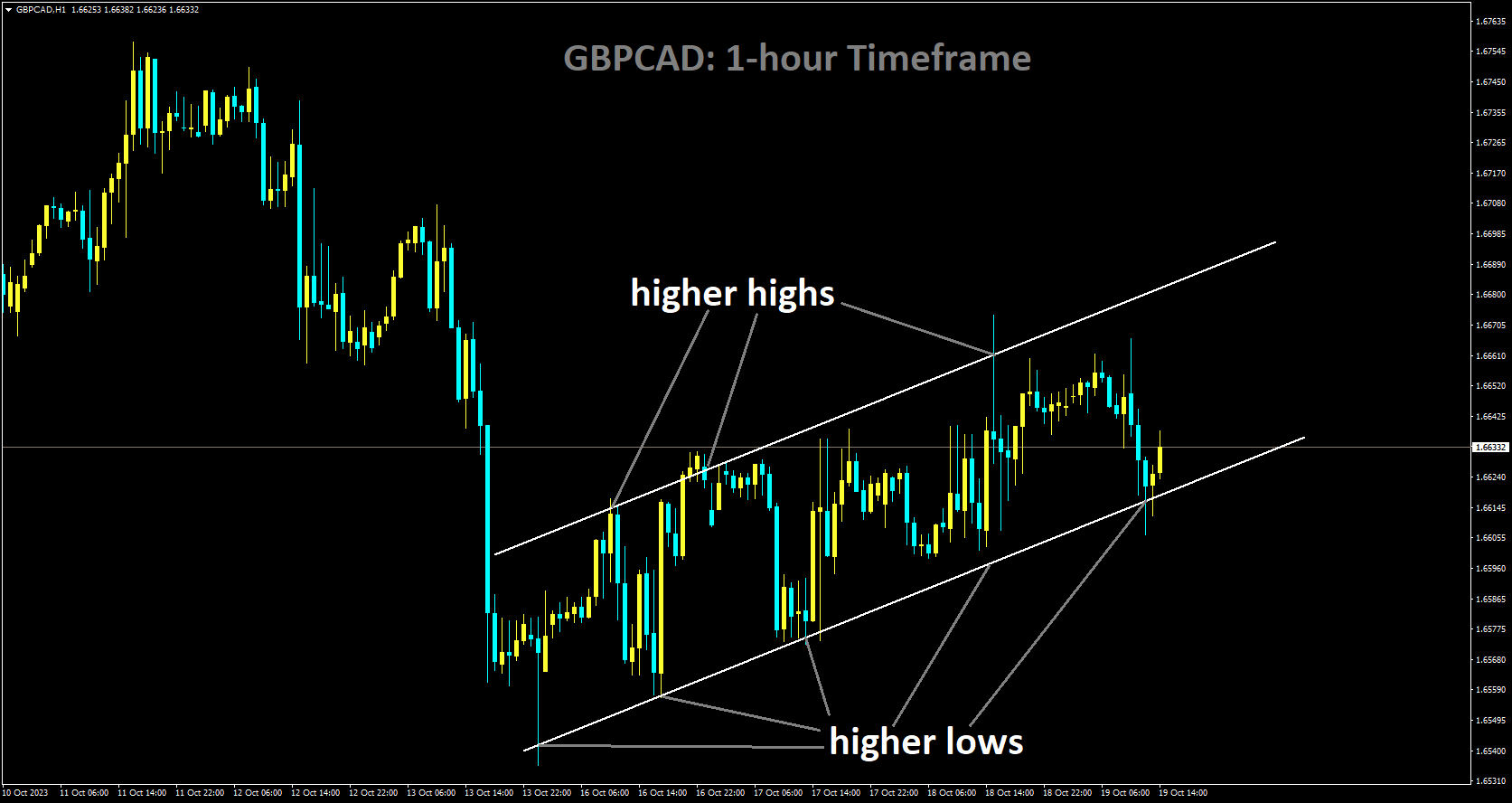

Analysis of GBPCAD:

GBPCAD is moving in Ascending channel and market has rebounded from the higher low area of the channel

The Canada Housing Corporation has released data for September housing starts, which show a figure of 270,000, exceeding the expected 240,000 and the previous reading of 250,000. However, the Canadian Dollar has fallen slightly, owing primarily to the drop in oil prices.

The latest Canadian housing data exceeded expectations, with the Canada Mortgage and Housing Corporation reporting a year-on-year (YoY) figure of 270.5K for September. This was higher than the market’s expectation of 240.0K and the previous reading of 250.4K. The Canadian Dollar (CAD) has, on the other hand, declined, which is closely related to the drop in Crude Oil prices.

Meanwhile, tensions in the Gaza Strip have risen following a rocket attack on a hospital, which killed over 500 civilians. Accusations and blame-shifting between Israel and Hamas over the building explosion have heightened the conflict.

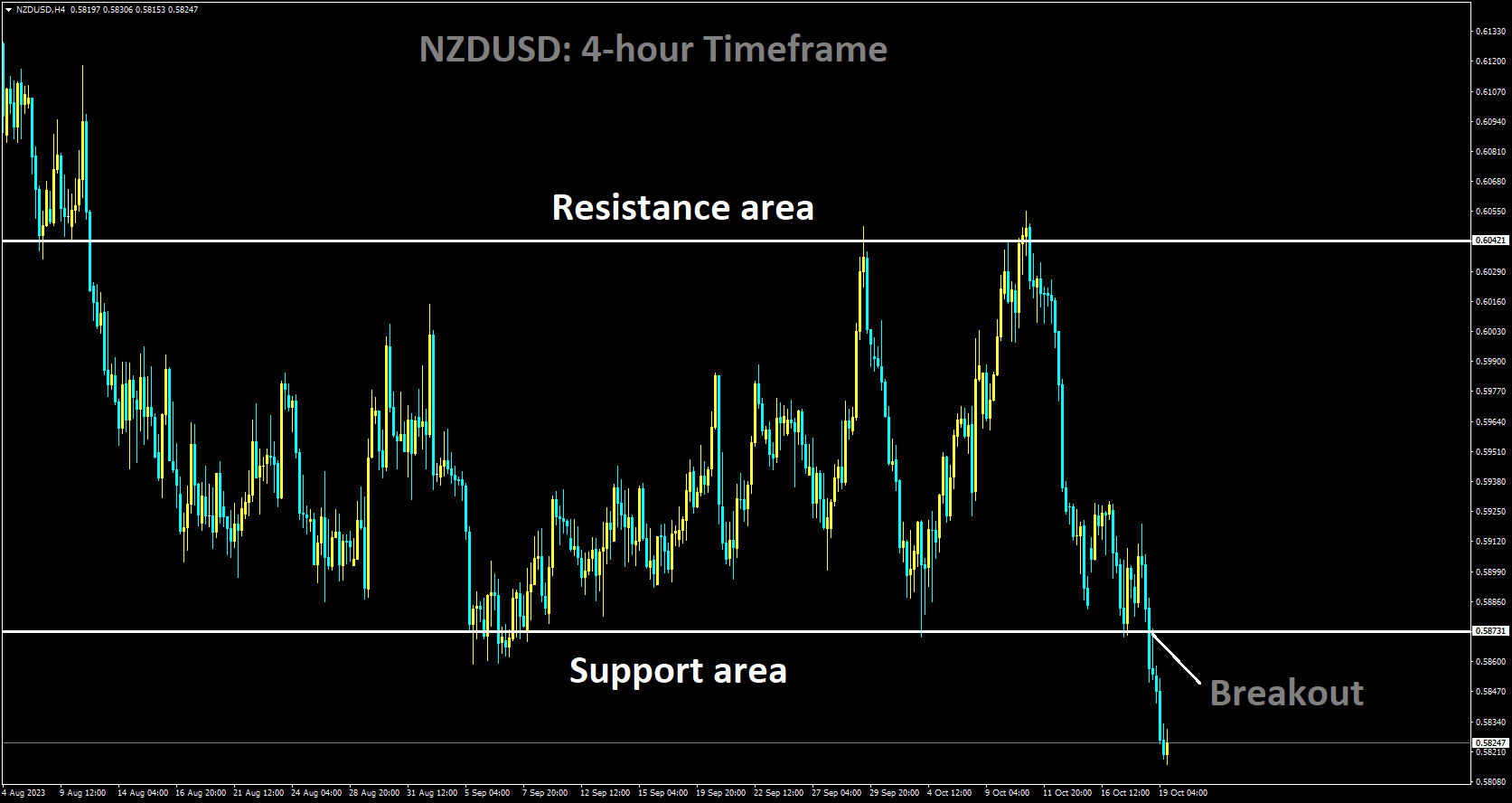

Analysis of NZDUSD:

NZDUSD has broken box pattern in downside

The recent Consumer Price Index (CPI) report from New Zealand fell short of expectations, indicating that the Reserve Bank of New Zealand (RBNZ) is likely to maintain its current interest rates at its upcoming meeting. Furthermore, the most recent data indicate that China’s economic growth is slowing.

On Wednesday, the New Zealand Dollar (NZD) fell to a new year-to-date low of 0.5851 against the US Dollar (USD), owing to a surge in risk aversion and rising US Treasury bond yields. Geopolitical tensions have bolstered the US Dollar’s position at the expense of riskier currencies such as the New Zealand Dollar. The NZD/USD pair is currently trading around 0.5855, representing a 0.69% decrease. Market sentiment is still shaky, with Wall Street losing ground.

The visit of US Vice President Joe Biden to the Middle East has done nothing to alleviate concerns about a potential escalation in the region. Iran has stepped up its rhetoric against Israel, escalating geopolitical tensions. An explosion at a Gaza hospital has reignited traders’ fears, causing global bond yields to rise.

Data from the United States’ Retail Sales and Industrial Production showed a healthy economy on Tuesday. Despite inflation running nearly twice as high as the Fed’s target, this data did not change the latest US Federal Reserve (Fed) officials’ dovish stance. There was a mix of positive and negative indicators in today’s US data. Housing starts increased by 7% in September, exceeding expectations, while building permits fell by -4.4%. Given this backdrop, one might expect the Fed to reconsider its more hawkish stance. Nonetheless, money market futures have largely discounted the possibility of a 25-basis-point rate hike in November, though expectations for rate hikes in December and January remain at 51.65%.

In New Zealand, the most recent Consumer Price Index (CPI) report showed that inflation remains high, implying that the Reserve Bank of New Zealand (RBNZ) will likely maintain its policy of keeping interest rates higher for an extended period of time. Despite data from China indicating that the economy is growing faster than expected, a deterioration in sentiment has prompted capital outflows from risky currencies and into safe-haven alternatives.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/