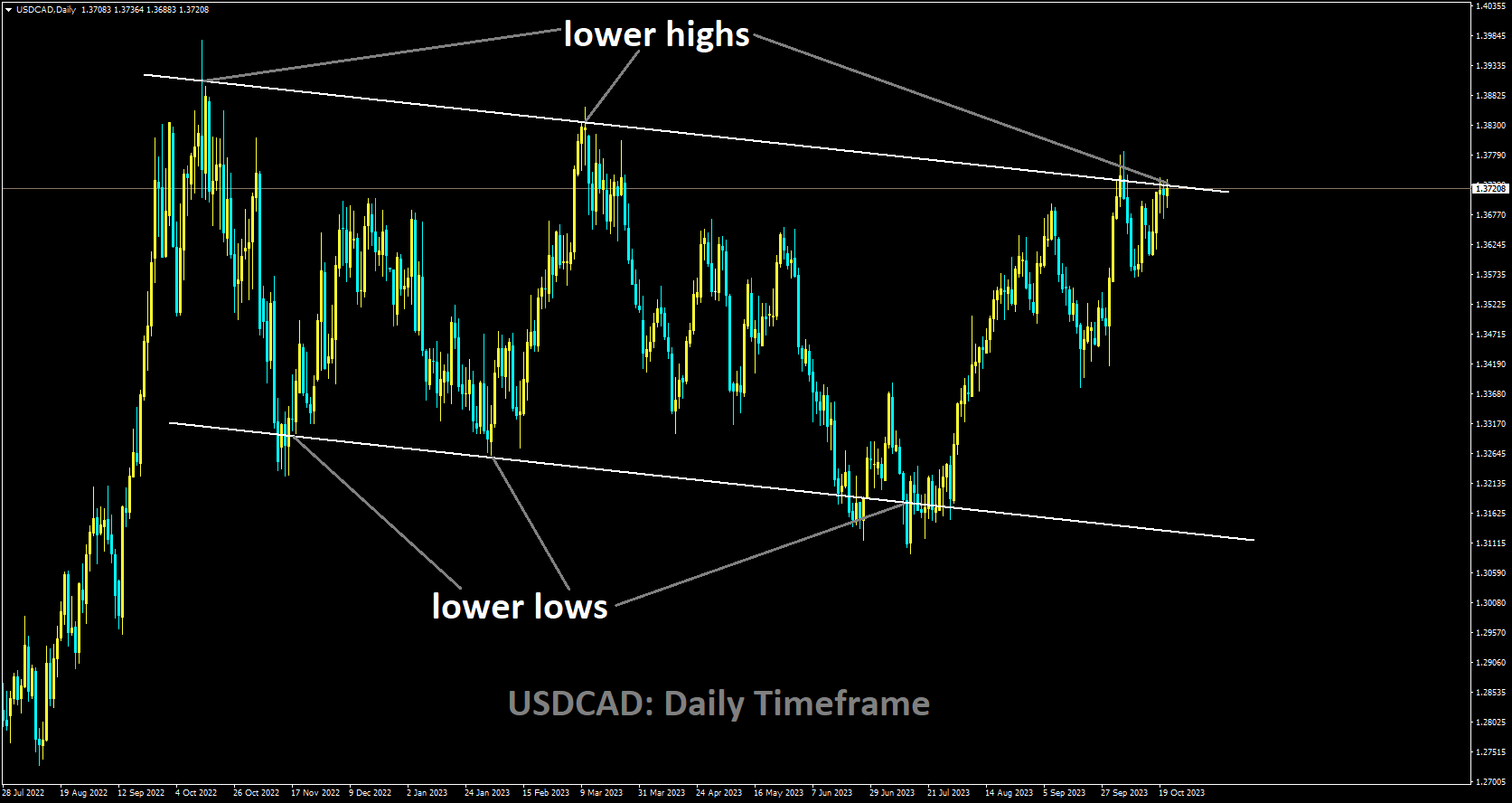

USDCAD Analysis:

USDCAD is moving in Descending channel and market has reached lower high area of the channel

There is an 84.1% probability that the Bank of Canada will opt to maintain the current interest rate in this week’s meeting. One contributing factor to this decision is the recent retail sales data for September, which showed a decrease of -0.10%. This decline follows a -0.30% decrease recorded in August, further influencing the likelihood of a rate pause.

In September, Canadian Retail Sales appeared to stall, and there was a revision in the August figure from a previous -0.3% to a new reading of -0.1%. However, it’s important to note that the August retail performance should be interpreted cautiously due to the disruptions caused by port strikes in British Columbia. Approximately 12% of surveyors reported reduced business activity as a result of supply chain logistics issues stemming from these strikes.

Interestingly, there’s a positive aspect for the Bank of Canada (BoC) in the data. Despite the rise in fuel prices, Canadian inflation slowed down in September. Both the Core and Headline inflation rates came in below expectations, which contrasts with the pessimistic tone we recently heard from Deputy Governor Vincent.

Considering the inflation release and the sluggish Retail Sales performance, it seems likely that the Bank of Canada will opt for a pause at its upcoming meeting next week. Market participants are currently pricing in an 84.1% probability of rates remaining unchanged, with only a 15.9% chance of a 25bps rate hike. The BoC’s meeting is scheduled for the following week.

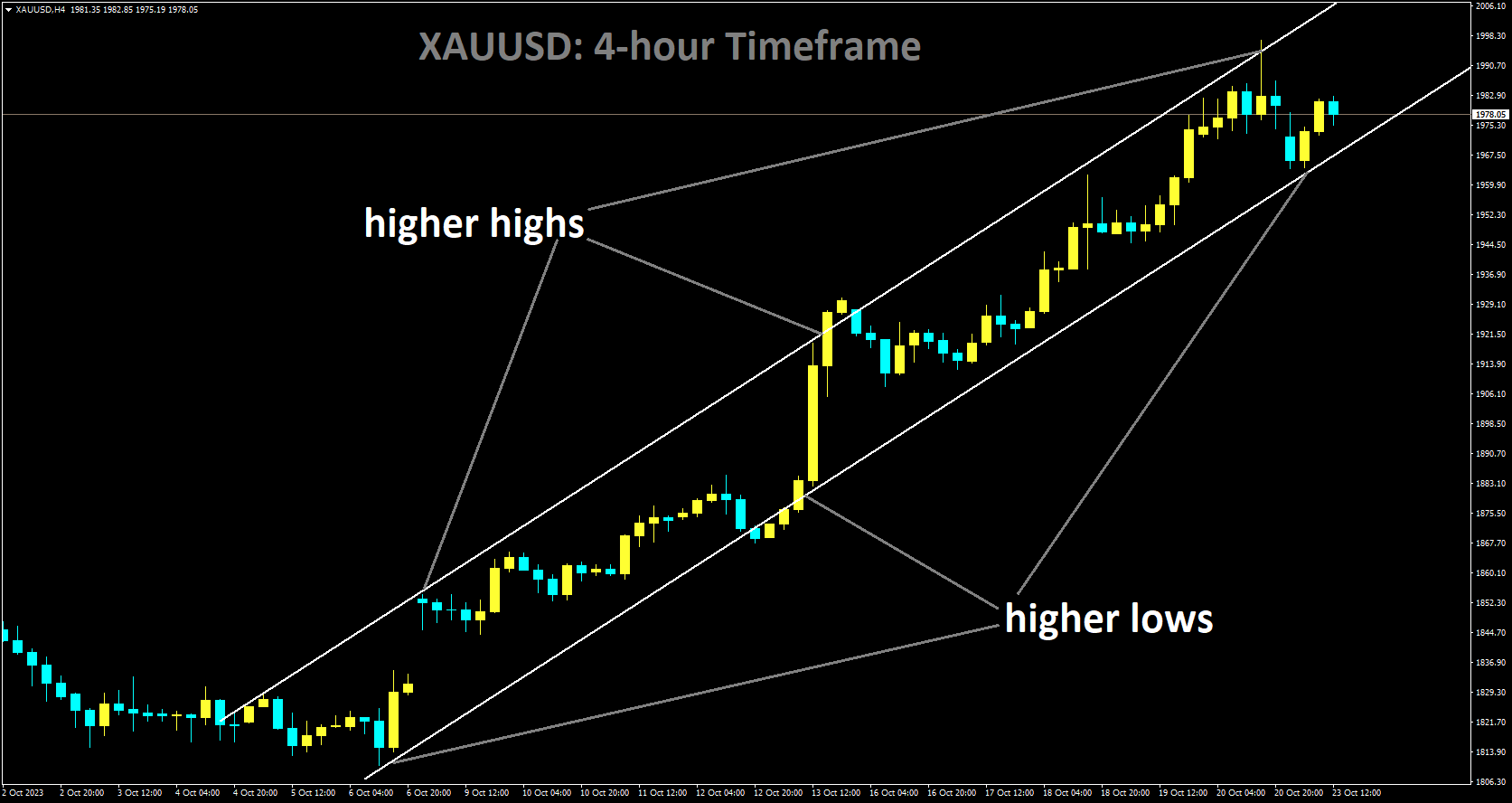

Gold Analysis:

XAUUSD is moving in Ascending channel and market has reached higher low area of the channel

The situation in the Middle East remains unresolved, with an increase in injuries and growing concerns about the escalation of war. Gold prices have surged at a rate higher than usual, reflecting the underlying anxieties about the situation.

The week began with a slight easing in gold prices, despite recent gains driven by a preference for safe-haven assets over the higher yields offered by government bonds in many parts of the world. This shift in investor sentiment was primarily influenced by ongoing geopolitical tensions in the Middle East, which had a dampening effect on economic growth and risk-associated assets like equities. However, it’s important to note that other macroeconomic factors also contributed to the precious metal’s rally.

One such factor was the deteriorating outlook for corporate bonds, which can be observed through the performance of the iShares iBoxx High Yield Corporate Bond Fund Exchange Traded Fund (ETF). The ETF’s decline brought it to levels reminiscent of the aftermath of the Silicon Valley Bank collapse, underscoring the tightening credit conditions in the market. This credit squeeze also had a negative impact on Wall Street equity indices and likely added to the appeal of gold as a safe-haven asset.

Unfortunately, the ongoing Middle East crisis shows no signs of a peaceful resolution in the near future. This persistent instability is expected to maintain the demand for gold, despite the rise in Treasury yields.

Notably, the 2-year Treasury note, which is sensitive to monetary policy changes, traded at 5.25% last Thursday for the first time since 2006, before retreating to approximately 5.10% by the end of the week. Similarly, the benchmark 10-year note reached its highest level since 2007, briefly surpassing 5.0% before settling around 4.95%.

At present, the elevated yields in the 10-year Treasury and the strength of the U.S. dollar (DXY index) have yet to exert a significant downward pressure on gold prices. However, it would be prudent to keep a close eye on these markets in case they experience sudden and dramatic movements.

Additionally, the sell-off in the iShares high-yield ETF could have wider implications for equities, as increasing debt financing costs for companies might affect their profitability and overall market performance.

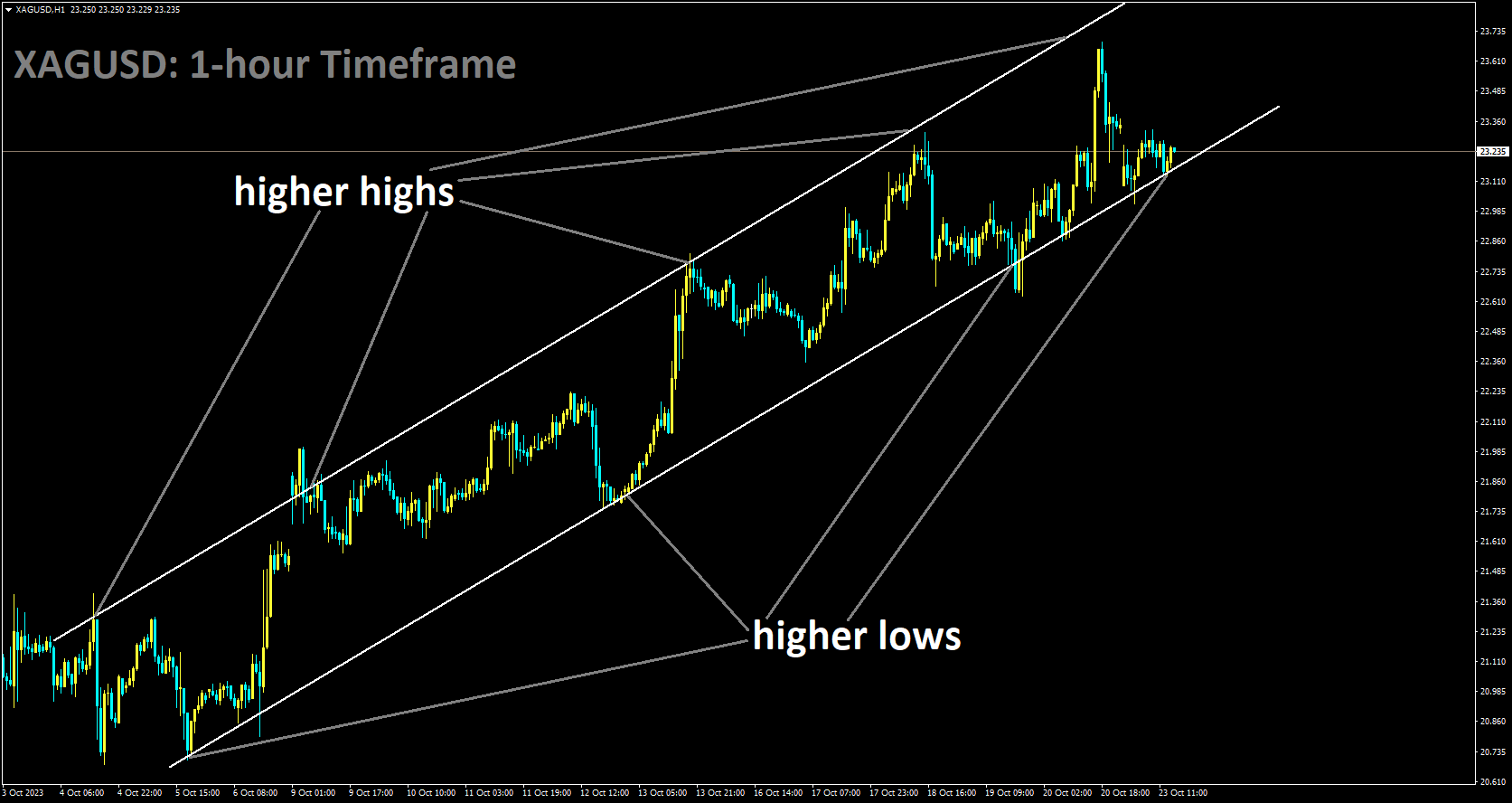

Silver Analysis:

XAGUSD is moving in Ascending channel and market has reached higher low area of the channel

The US Dollar is currently in a consolidation phase as market participants anticipate the release of Q3 GDP data scheduled for later this week. Additionally, the 10-year US Treasury yield has reached the 5.0% mark, a notable level, in response to signals from Federal Reserve officials indicating a likelihood of higher interest rates being maintained for an extended period.

Among the extensively tracked benchmarks, the US 10-year yield garnered significant attention as it crossed the psychologically significant threshold of 5% yesterday. This development followed the consistent messaging from prominent Federal Reserve Bank officials, aligning with the broadly supported policy stance of maintaining higher interest rates for an extended duration. Traditionally, yields have a notable impact on the strength of the US dollar. However, the absence of a sustained continuation of the previous upward trend hints that the dollar might be approaching a peak. Unless there is a substantial catalyst, such as the upcoming US Q3 GDP data release on Thursday, to reignite upward momentum, this trend could persist.

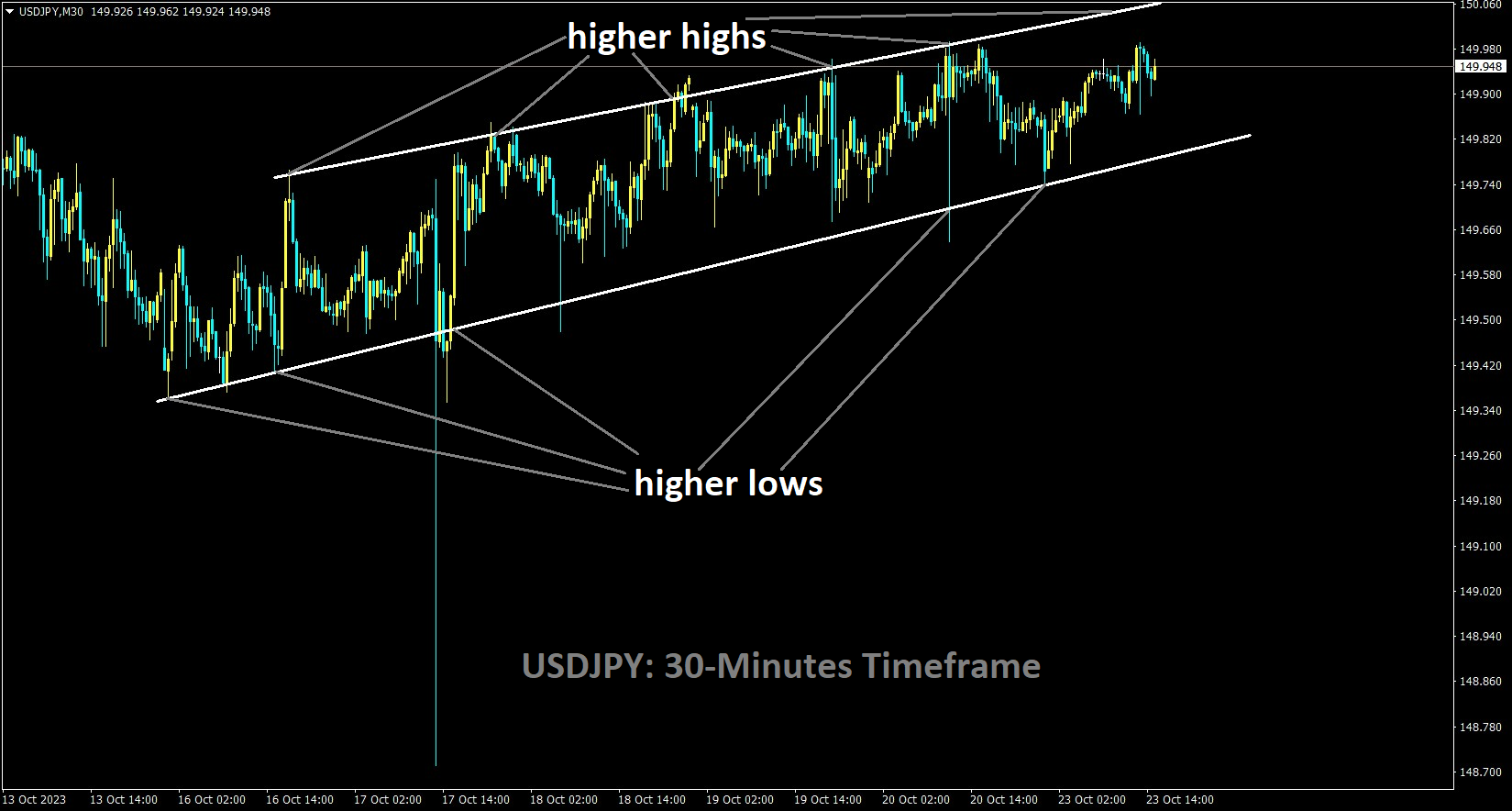

USDJPY Analysis:

USDJPY is moving in an Ascending channel and the market has reached the higher high area of the channel

In a recent morning report by Nikkei News, it has been revealed that the Bank of Japan is contemplating modifications to its Yield Curve Control level. This decision comes in response to the 10-year Japanese Government Bond (JGB) Yield surpassing the notable threshold of 0.86%, signifying a substantial uptick. Furthermore, the USDJPY currency pair has reached a 33-year pinnacle, attaining a value of 150.00 USDJPY.

The 10-year Japanese Government Bond has approached a significant threshold at 0.86%, a level not witnessed since 2013. Nikkei News has reported that the Bank of Japan is currently deliberating potential adjustments to its yield curve control program . This development follows speculations from the previous week, suggesting that the bank might entertain the idea of raising its policy rate from its current level, which is below -0.10%. If the USDJPY currency pair convincingly breaches the 150 level, it could bring into focus the 33-year high of 151.95, potentially prompting the Bank of Japan to intervene in currency markets. Traditionally, such central bank interventions are most effective when they align with supportive fundamental factors. Hence, any modifications made by the BoJ to the policy rate or YCC are of paramount importance to market sentiment.

In other financial news, Treasury yields have seen a modest uptick at the beginning of the week, following a slight retreat over the weekend. The Federal Reserve has entered a blackout period as it prepares for its Federal Open Market Committee (FOMC) meeting scheduled to commence on October 31st. The benchmark 10-year note has reached its highest level since 2007, briefly surpassing the 5.0% mark on Friday and remaining close to that level as Monday’s trading session begins. Prior to the communication blackout, Cleveland Federal Reserve President Loretta Mester contributed to the growing chorus of board members hinting at a potential peak in the policy rate, stating, We are likely near or at a holding point on the funds rate.

Across the Asia-Pacific region, equity indices have mirrored the negative sentiment observed on Wall Street from Friday, with major markets experiencing declines. India’s stock exchanges have demonstrated relatively better performance, trading nearly flat for the day. Spot gold has experienced a minor dip at the start of the week, failing to breach the $2,000 mark on Friday. Crude oil prices have also retraced some of their recent gains, as energy markets assess the geopolitical situation in the Middle East.Looking ahead to this week, the Bank of Canada (BoC) and the European Central Bank (ECB) are scheduled to make monetary policy decisions on Tuesday and Thursday, respectively. Additionally, Australia will release crucial 3Q CPI data on Wednesday, followed by US GDP data on Thursday.

USDCHF Analysis:

USDCHF is moving in the Descending channel and the market has fallen from the lower high area of the channel

In September, the trade balance stood at 6,316 million, showing a significant increase compared to the previous month’s figure of 3,814 million. This surge was primarily driven by a substantial rise in exports, which reached 24,795 million in September, up from 20,932 million. Imports also saw an increase, coming in at 18,480 million compared to the previous reading of 17,118 million. As a result of these developments, the Swiss Franc has displayed steady growth, moving in an upward direction after the release of these figures.

During the early stages of the European trading session on Monday, the USD/CHF pair remained relatively stable around the 0.8935 mark. A renewed demand for the US Dollar (USD) has lent some support to this currency pair. However, the prevailing geopolitical tensions are casting a pall over the market, potentially capping the Greenback’s ascent.

Apprehensions have emerged that the Israel-Hamas conflict might escalate into a larger and more widespread Middle East confrontation. Washington has sounded alarms, highlighting significant risks to US interests in the region. Furthermore, Chinese state media, in reports on Monday, characterized the situation in Gaza as “very serious,” with mounting concerns of a large-scale ground conflict and an increasingly worrisome overall outlook, particularly as armed conflicts appear to be spreading along neighboring borders.

In light of these escalating geopolitical tensions in the Middle East, safe-haven assets like the Swiss Franc could find increased appeal, acting as a counterbalance for the USD/CHF pair. Reflecting on the past week, Switzerland’s trade surplus for September surpassed expectations. The Trade Balance figures came in at 6,316 million, exceeding the previous month’s 3,814 million and surpassing the market consensus of 3,770 million. Exports witnessed a noteworthy surge in September, reaching 24,795 million compared to the previous reading of 20,932 million, while import figures also showed an increase, totaling 18,480 million compared to the prior reading of 17,118 million.

On the other side of the Atlantic, various Federal Reserve officials made notable statements regarding monetary policy. Atlanta Fed President Raphael Bostic expressed the belief on Friday that the US central bank is unlikely to cut interest rates before the middle of next year. Fed Philadelphia President Patrick Harker reiterated his preference for maintaining unchanged interest rates. Meanwhile, Fed Cleveland President Loretta Mester indicated that the US central bank is currently “at or near the peak of the rate hike cycle.” Nevertheless, the data to be released in the coming week could influence the central bank’s outlook. Stronger-than-expected data might bolster the US Dollar, potentially limiting the downside potential of the USD/CHF pair.

Regarding economic data, the US budget deficit for September was reported as $170 billion by the Treasury Department on Friday. The overall 2023 budget deficit has reached $1.695 trillion, marking a 23% increase compared to the previous year and surpassing all pre-COVID deficits. Looking ahead, market participants will closely monitor the release of US S&P Global PMI data on Tuesday. Additionally, Thursday will see the release of the first reading of Q3 US Gross Domestic Product (GDP) growth, and Friday will bring the Core Personal Consumption Expenditures (PCE) data. On the Swiss front, the Swiss ZEW Survey for October is expected to be published on Wednesday. These data points could provide valuable insights into the future trajectory of the USD/CHF pair.

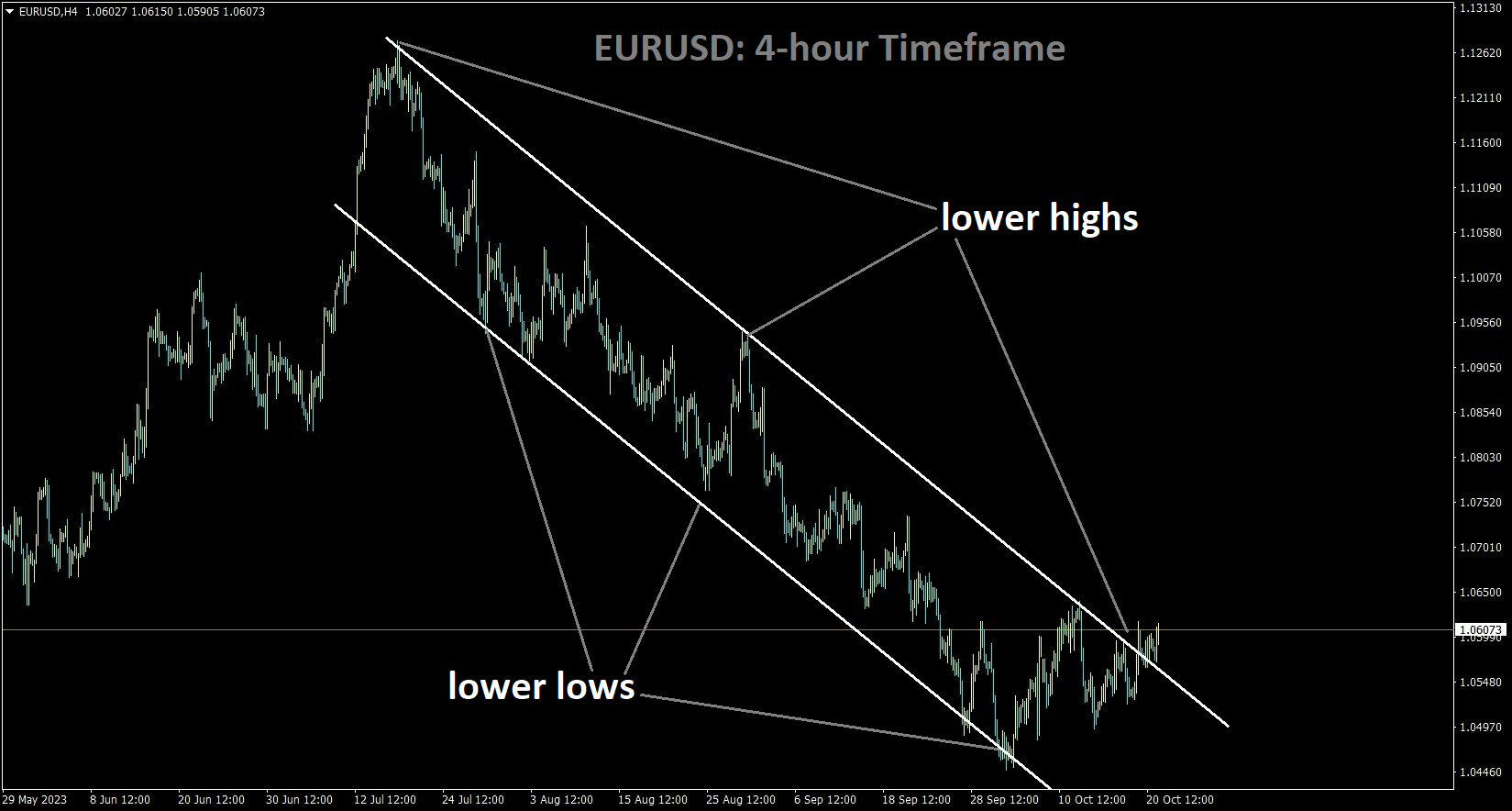

EURUSD Analysis:

EURUSD is is moving in the Descending channel and the market has reached the lower high area of the channel

The ECB is inclined to halt any rate hikes in the upcoming meeting. It is estimated that inflation will reach the 2% target by 2026. Additionally, the European Commission has extended the price cap for gasoline prices until the end of this year in response to the Middle East crisis. This adjustment has had no adverse impact since its implementation in February.

In the coming week, all eyes will be on the European Central Bank and its impending monetary policy decision. This attention comes at a time when the Federal Reserve is entering a blackout period ahead of its November 1 announcement. The prevalent expectation in the market is that the ECB will opt to keep its current borrowing costs unchanged. This comes after the ECB has already executed a series of rate hikes totaling 450 basis points over the past 10 meetings. This anticipated decision is in line with the ECB’s demonstrated readiness to apply the brakes when deemed necessary. Furthermore, the recent uptick in bond yields across the region has provided further validation for the efficacy of the bank’s tightening strategy, thus reducing the immediate urgency for additional measures.

Despite the apparent need for a more cautious monetary policy stance based on the Eurozone’s growth outlook, the inflation dynamics present a contrasting scenario. Brent oil prices have been on a bullish trajectory, consistently exceeding the ECB’s September staff projections, which were based on an average oil price of $82.00 per barrel. As a result, the Consumer Price Index (CPI) inflation rate may not align with the 2.0% target until 2026, which is a year later than initially anticipated by the ECB. Given this backdrop, it may be imperative for the central bank to adopt a more hawkish posture and commit resolutely to sustaining the fight against inflation, refraining from any premature easing measures.

Additionally, the European Union (EU) is deliberating an extension of the emergency gas price cap that was implemented back in February. This consideration arises from concerns surrounding the ongoing Middle East crisis and the potential disruptions to a Baltic pipeline, which could lead to increased energy prices during the approaching winter season. Notably, the European Commission has affirmed that there have been “no indications of negative effects” resulting from the policy’s implementation, with current natural gas prices standing at approximately 90% lower than the previous year.

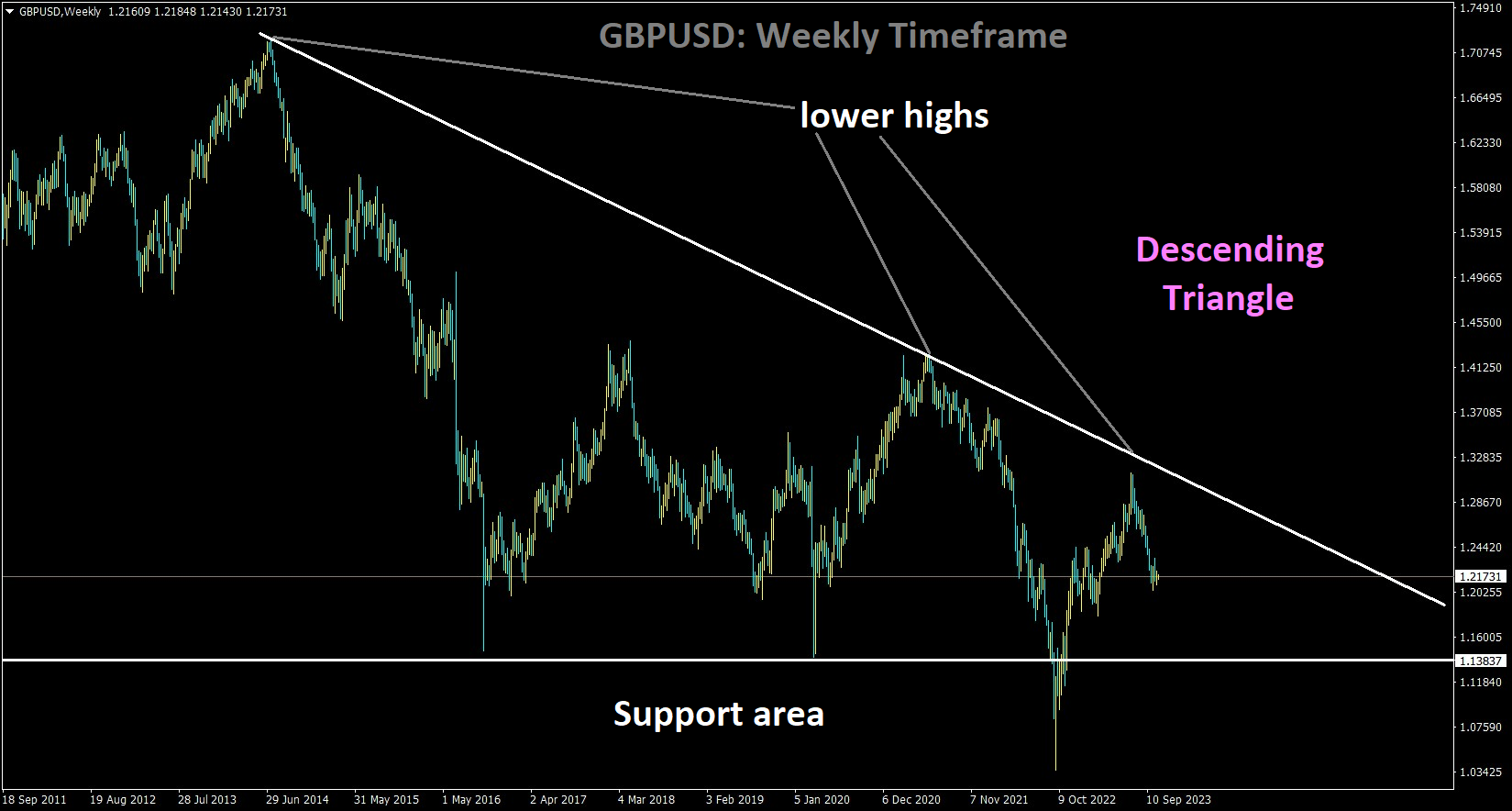

GBPUSD Analysis:

GBPUSD is moving in the Descending triangle pattern and the market has fallen from the lower high area of the pattern

Inflation remains persistently elevated in the UK, prompting expectations of an impending interest rate hike by the Bank of England at its upcoming meeting on November 7th. This week, the focus will be on key economic indicators, including employment change and the unemployment rate.

The upcoming week in the UK offers a rather quiet data schedule, with the delayed release of unemployment figures and the unveiling of flash services and manufacturing PMIs on Tuesday capturing traders’ attention. Recent data from the UK has shown a mix of mediocre to weaker-than-expected results, with the most recent inflation figures falling short of expectations. Despite official indications that inflationary pressures will ease as the year draws to a close, UK inflation remains stubbornly high. Economic growth in the UK remains lackluster at best, setting the stage for another challenging decision for Governor Andrew Bailey.

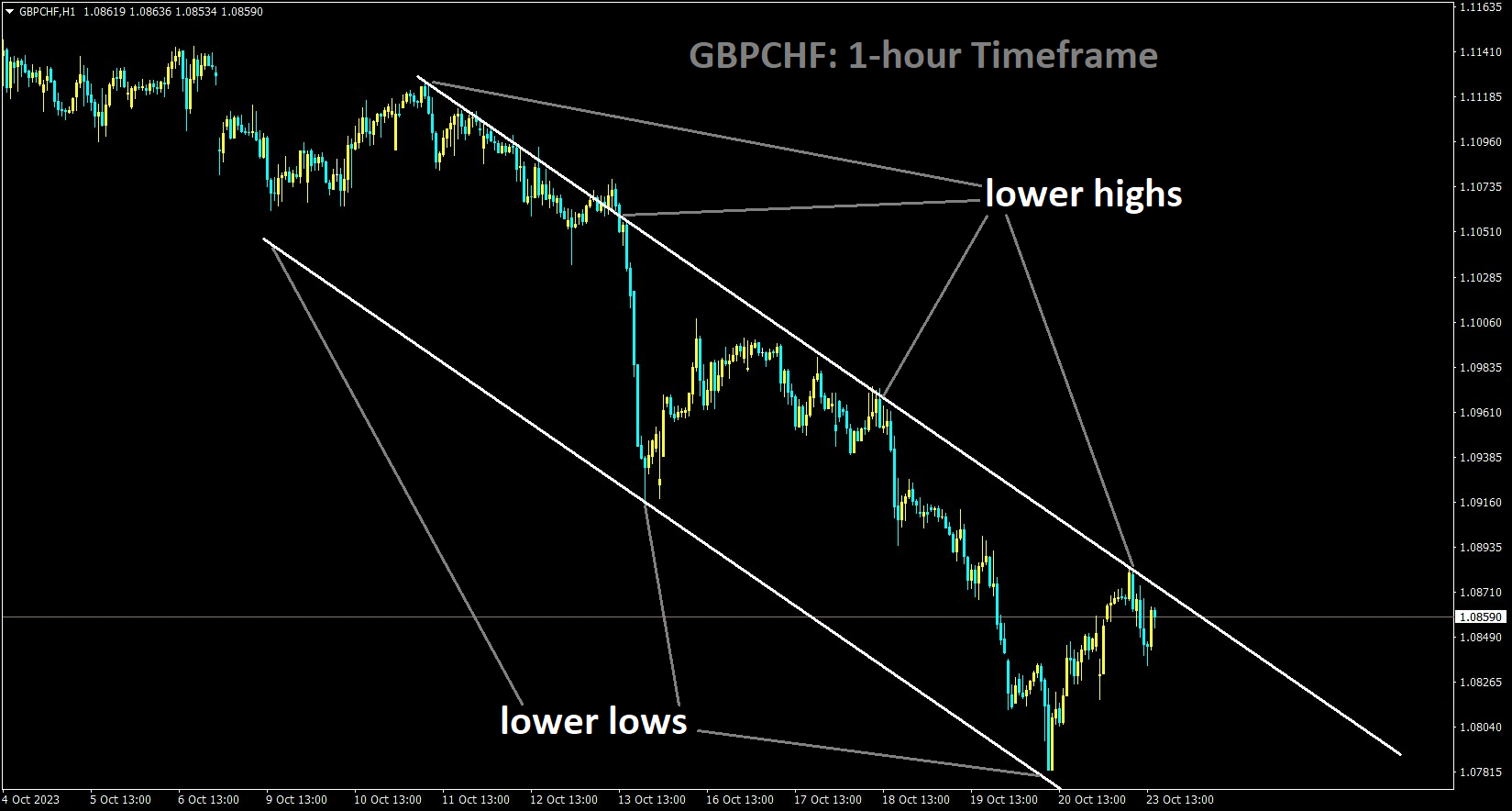

GBPCHF Analysis:

GBPCHF is moving in the Descending channel and the market has fallen from the lower high area of the channel

And the Monetary Policy Committee (MPC) at the upcoming Bank of England (BoE) meeting on November 2nd. This prevailing uncertainty places the British Pound at risk of a potential decline.

Traders will also be closely monitoring their screens next Thursday, as the European Central Bank (ECB) is set to announce its latest policy decision. Market expectations point to the ECB leaving all policy instruments unchanged.

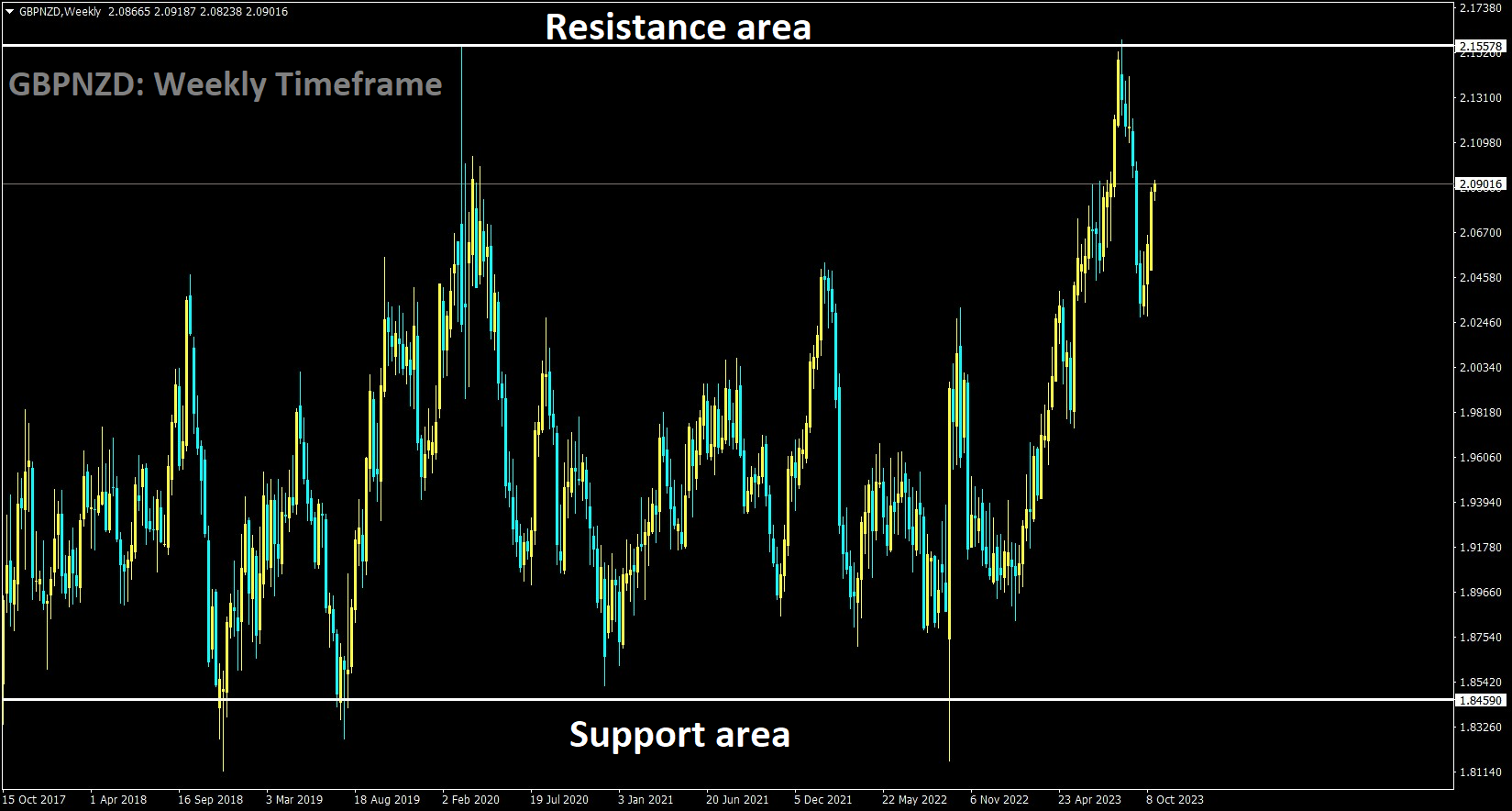

GBPNZD Analysis:

GBPNZD is moving in the Box pattern and the market has fallen from the resistance area of the pattern

The New Zealand Dollar trade balance for September reveals a deficit of $-15.33 billion, a slight improvement from the previous month’s figure of $-15.52 billion in August. The NZD has been influenced by the slowdown in the Chinese economy and the peak interest rates that have been implemented.

New Zealand’s Trade Balance figures, released on Thursday, failed to instill confidence in the New Zealand Dollar , as the broader market attention remains fixated on the Federal Reserve’s (Fed) communication. The data portrayed minimal alteration in the trade balance dynamics of the small Antipodean nation, with the annualized Trade Balance for September registering at -$15.33 billion, slightly improved from August’s -$15.52 billion.

Within the report, New Zealand’s exports recorded a dip to $4.87 billion, with a marginal downward revision from the previous reading of $4.99 billion, which had initially stood at $4.97 billion. Concurrently, New Zealand’s imports also exhibited a decrease, coupled with a revision; September’s imports figure amounted to $7.2 billion, compared to August’s $7.24 billion which was revised from $7.28 billion.

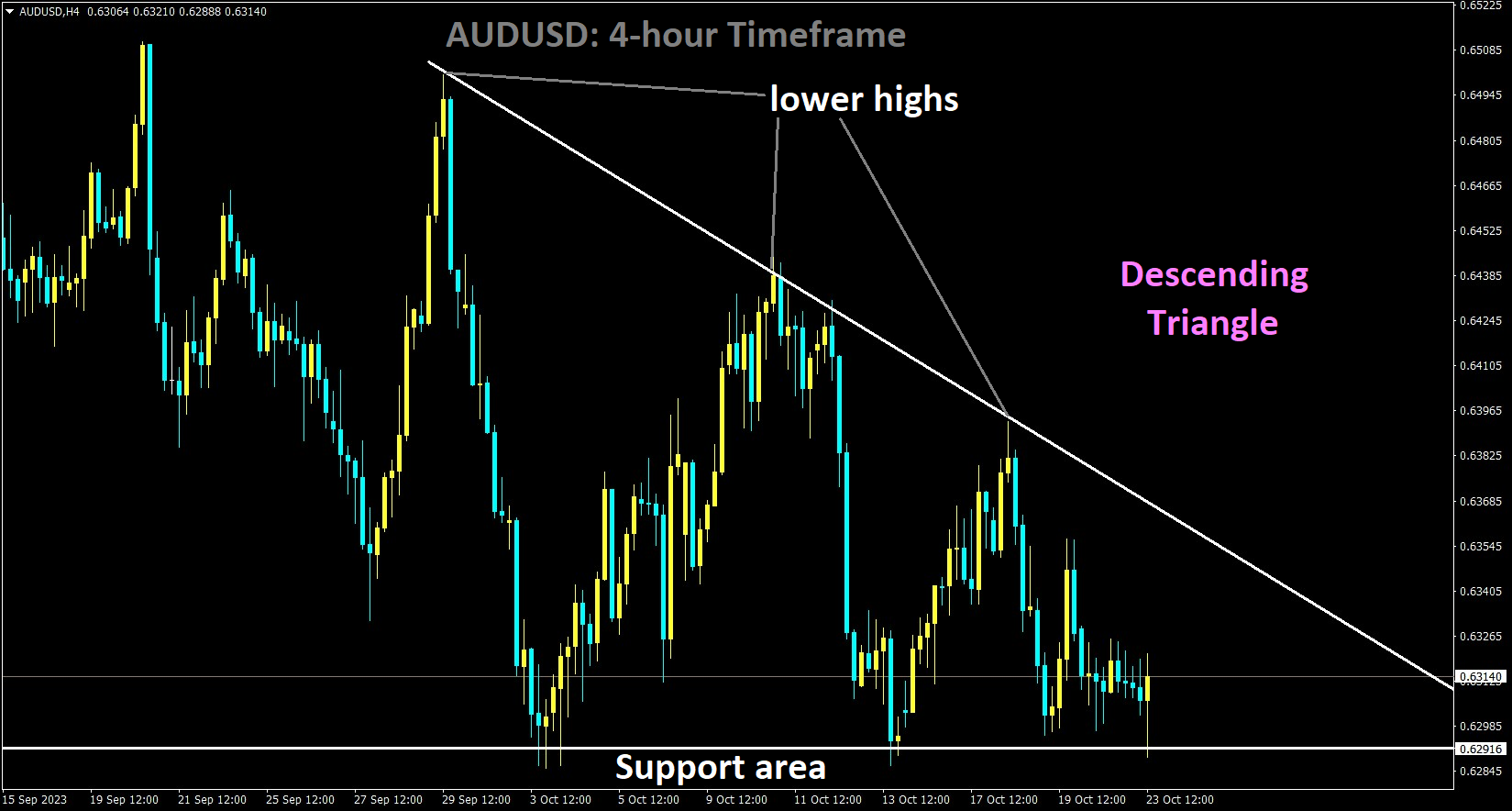

AUDUSD Analysis:

AUDUSD is moving in the Descending triangle pattern and the market has rebounded from the support area of the pattern

RBA Governor Bullock has indicated that there will be no interest rate hike until December 2023. This decision is supported by the ongoing trend of inflation slowing down as anticipated each month. This week, on Thursday, the release of the Q3 CPI data is scheduled. The RBA’s future rate stance will depend on the outcome of this reading. If the CPI data aligns favorably with expectations, the RBA is likely to maintain the current interest rate in the next meeting. Conversely, if the data falls short or shows negative trends, the RBA may consider a different course of action.

The Australian Dollar has been heavily influenced by fluctuations in the US Dollar recently, but this dynamic could be poised for change if the Reserve Bank of Australia (RBA) diverges from the path of other central banks. There has been a noticeable shift in tone and messaging from the RBA over the past week and a bit, following the decision to keep interest rates at 4.10% during the October meeting.

In the statement accompanying the policy decision, the RBA left the door open for a potential rate hike, maintaining language that had been consistent in prior communications. This suggested to the market that further tightening might be on the horizon. This interpretation was reasonable given that the RBA had left rates unchanged for four consecutive meetings. The shift in tone began with comments from RBA Assistant Governor Chris Kent on October 11th when he indicated that additional tightening might be necessary to bring down inflation, which was still running too high.

The minutes of the RBA meeting released the following Tuesday stood out, as they indicated that the bank was closer to a rate hike than the initial statement had conveyed. Specifically, the minutes mentioned that the RBA had a low tolerance for inflation returning to target more slowly than expected, and the decision on whether to raise interest rates would depend on incoming data and the evolving economic outlook.

The minutes of the RBA meeting released the following Tuesday stood out, as they indicated that the bank was closer to a rate hike than the initial statement had conveyed. Specifically, the minutes mentioned that the RBA had a low tolerance for inflation returning to target more slowly than expected, and the decision on whether to raise interest rates would depend on incoming data and the evolving economic outlook.

RBA Governor Michele Bullock further added to the evolving narrative by highlighting the challenges posed by successive external events driving inflation. She emphasized that persistent inflation, even if driven by supply shocks, can lead to adjustments in people’s inflation expectations, thereby entrenching inflationary pressures.

The market currently assigns only around a 45% probability of a rate hike by the end of the year. If the RBA does not raise rates in either the November or December meetings, the next opportunity will not arise until February. Therefore, the release of the quarterly CPI data this coming Wednesday will be closely watched. Ms. Bullock is scheduled to speak the following day, which could provide further clarity. Unlike her predecessor, she may not be hindered by commentary that would discourage aggressive inflation-fighting measures. The RBA has raised rates by 400 basis points since the pandemic lows, while the Federal Reserve has raised rates by 525 basis points. This suggests that there is room for the RBA to catch up, and if a rate hike occurs at the November 7th meeting, the Australian Dollar could see a resurgence.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/