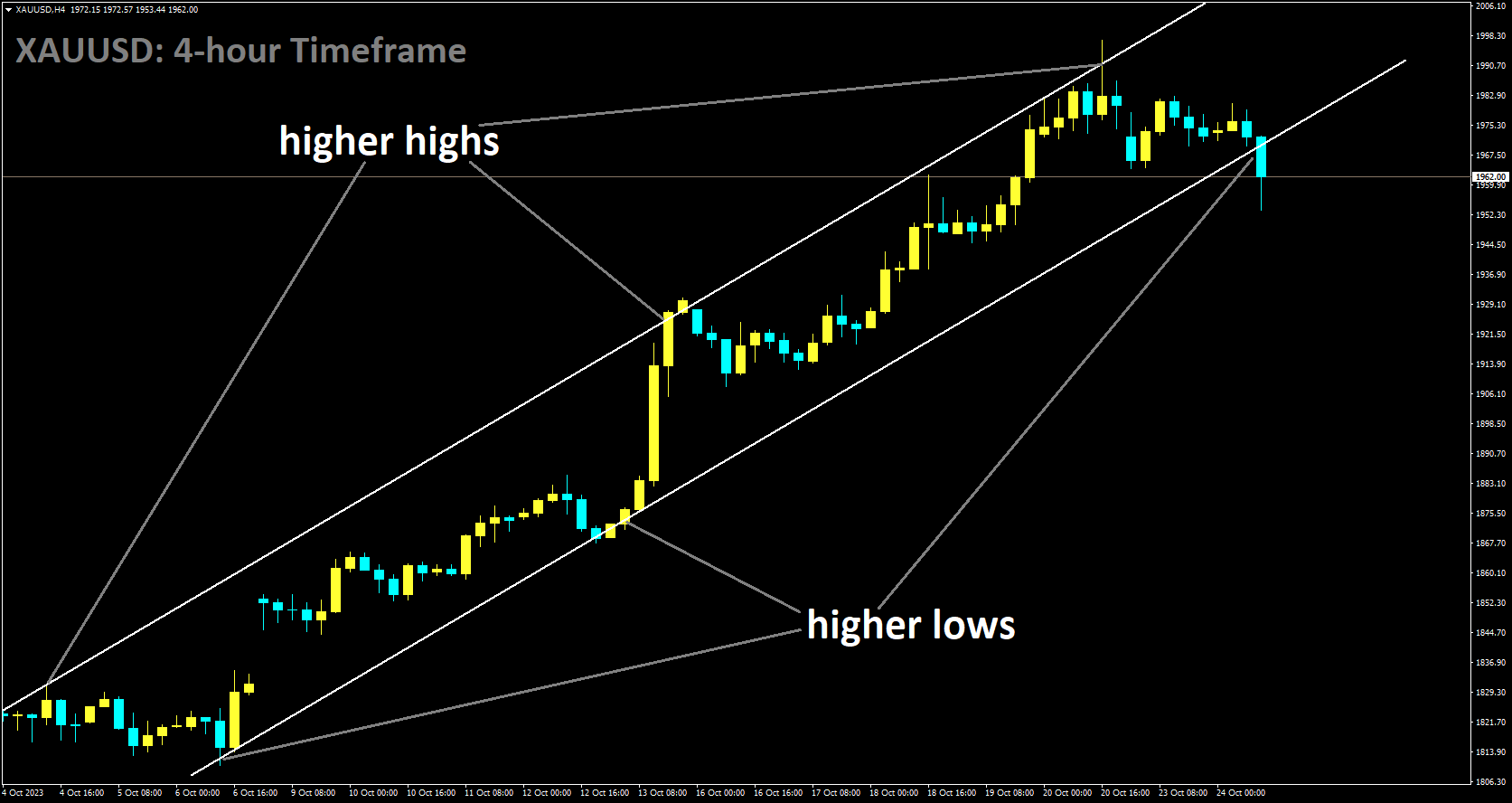

Gold Prices Rise Amid Falling US Dollar and Geopolitical Tensions

XAUUSD is moving in Ascending channel and market has reached higher low area of the channel

The conflict between Israel and Hamas briefly halted the typical market fluctuations in the price of gold. Whenever the threat of war arises, it tends to support higher gold prices.

Gold prices are experiencing an upward trend, and there are several factors contributing to this movement. One primary driver is a correction in the value of the US Dollar . This correction can be attributed to declining optimism surrounding US Treasury yields. The US Dollar Index , which measures the USD’s performance against a basket of other major currencies, has been on a four-day losing streak and is currently hovering around the 105.50 mark. The key reason behind this USD weakness is the sudden reversal in US Treasury yields, particularly the 10-year Treasury yield. After briefly reaching a peak of 5.02%, it has swiftly changed direction, dropping to 4.84% in the most recent update. One significant implication of declining US bond yields is that it tends to weaken the US Dollar. This, in turn, provides support for the price of gold to potentially reach the $2,000 per ounce mark. Gold has historically been considered a safe-haven asset, and when confidence in the US Dollar wanes, investors often turn to gold as a store of value.

Another factor contributing to the rise in gold prices is geopolitical tension in the Middle East, particularly in Israel. Geopolitical uncertainties and conflicts in the region tend to boost demand for gold as investors seek safe-haven assets during times of crisis. However, it’s worth noting that the current market sentiment, driven by diplomatic efforts aimed at reducing tensions in the Gaza Strip, might pose a challenge to gold prices. These diplomatic efforts have reduced overall market risk aversion. Despite the efforts to ease tensions, there remains a growing call within Israel to reassess the potential scope of a ground invasion of Gaza. This had been expected in the near term and could reignite market risk aversion, potentially further supporting gold prices.

USD Weakens as Fed Rate Hike Expectations Diminish

XAGUSD has broken Ascending channel in downside

The US Dollar is presently in a consolidation phase as we approach the release of Q3 GDP data and Federal Reserve Chair Powell’s upcoming speech this week. Simultaneously, the Israel-Hamas conflict has seen a temporary escalation amidst ongoing tensions, causing financial markets to become more cautious in anticipation of potential negotiations between the two sides.

The US Dollar (USD) is facing a period of weakness, primarily as reflected in the performance of the US Dollar Index (DXY), which currently stands at 105.55. One of the central factors behind this USD decline is the decreasing likelihood of a Federal Reserve (Fed) interest rate hike. Despite robust economic activity indicators from the US economy, there is growing speculation that the Fed might not raise interest rates as previously expected. This shift in sentiment is closely tied to the decline in US Treasury yields, which are considered a barometer of market expectations regarding future monetary policy actions by the Fed.

The economic calendar for the week ahead is noteworthy. On Thursday, there will be the release of the preliminary estimate of Q3 Gross Domestic Product (GDP), a crucial economic indicator. Additionally, on Friday, market participants will be closely monitoring the release of September’s headline and core measures of the Personal Consumption Expenditures (PCE), which is the Fed’s preferred indicator of inflation. These data points will provide valuable insights into the overall health of the US economy and have the potential to significantly influence expectations regarding the Fed’s decisions in its upcoming meetings on November 1 and in December. At the time of writing, the US Dollar Index (DXY) has slipped to 105.60, marking a nearly 0.50% decrease. The economic calendar for Monday is relatively uneventful, so market attention is shifting to high-impact economic figures scheduled for release later in the week. There is anticipation that the Q3 Gross Domestic Product data will indicate an acceleration in economic activity. Meanwhile, on Friday, the Core PCE Price Index is expected to register at 3.7% year-on-year, down slightly from the previous reading of 3.9%. Concurrently, US Treasury yields are on a downward trajectory, with rates for the 2-year, 5-year, and 10-year bonds standing at 5.07%, 4.80%, and 4.84%, respectively. According to the CME FedWatch Tool, the probability of a 25 basis points rate hike at the December meeting remains low, hovering near 30%.

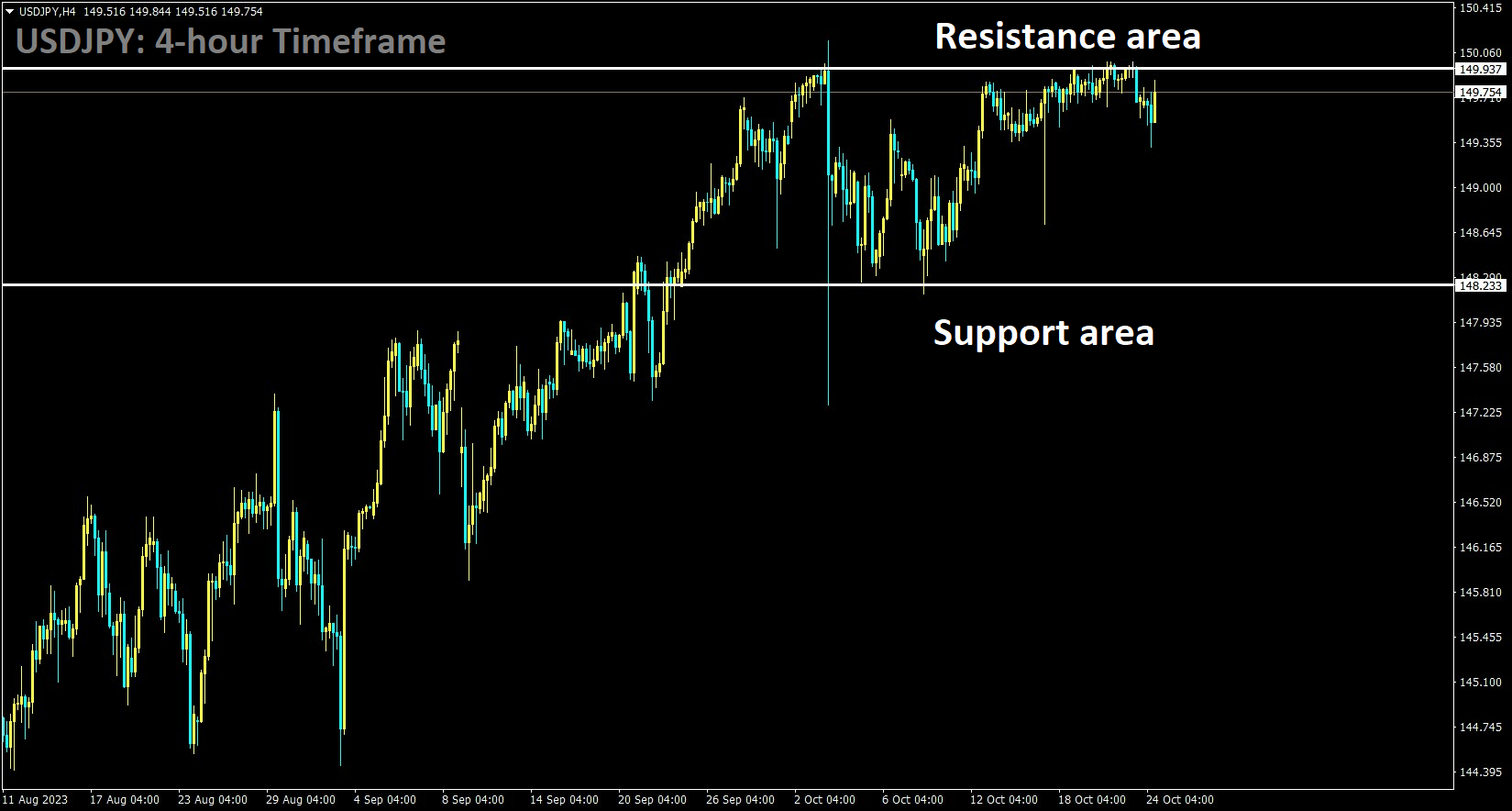

Bank of Japan Announces Unscheduled Bond Operation

USDJPY is moving in the Box pattern and the market has fallen from the resistance area of the pattern

The Bank of Japan has disclosed its intention to acquire Japanese Government Bonds (JGBs), allocating 300 billion JPY for bonds with maturities spanning 5 to 10 years and an additional 100 billion JPY for bonds with maturities ranging from 10 to 25 years.

The US Treasury Department disclosed that virtual meetings between the US and China have been effective in advancing discussions on macroeconomic developments in a productive and meaningful manner.

The Bank of Japan (BoJ) made an announcement on Tuesday, revealing plans for an unscheduled bond operation scheduled for Wednesday. During this operation, the BoJ intends to purchase Japanese government bonds with a total value of 300 billion yen. These bonds will have maturities ranging from five to 10 years. Additionally, the BoJ plans to acquire 100 billion yen worth of bonds with maturities falling in the range of 10 to 25 years.The US Dollar (USD), as measured by the US Dollar Index (DXY), continues to weaken, extending its four-day losing streak. The primary driver behind this trend is the subdued performance of US Treasury yields. Currently, the spot price of the US Dollar is hovering around 105.50. The recent market sentiment among US Federal Reserve officials is mixed, with varying opinions regarding the future direction of interest rates. For instance, Atlanta Federal Reserve President Raphael Bostic has expressed skepticism about the possibility of a US central bank rate cut before the middle of the next year. On the other hand, Fed Philadelphia President Patrick Harker seems inclined to maintain existing interest rates, while Fed Cleveland President Loretta Mester has suggested that the US central bank may be either at or very close to the peak of the rate hike cycle.

The upcoming week is expected to be filled with economic data releases that will be closely watched by market observers. On Tuesday, there will be scrutiny of the US S&P Global PMI, providing insights into the manufacturing sector’s performance. Thursday will bring the release of Q3 Gross Domestic Product (GDP) figures, offering a comprehensive view of the US economy’s performance. The week will conclude with a focus on the Core Personal Consumption Expenditures (PCE) on Friday, which is of particular interest to the Fed as it is their preferred indicator of inflation. These data points will be instrumental in shaping expectations for the Fed’s future policy decisions. Additionally, it’s noteworthy that the US Dollar Index (DXY) has seen a decline to 105.60 at the time of writing, signifying a nearly 0.50% decrease. This decline in the USD Index can be attributed to the reversal in long-term US bond yields from their multi-year highs above 5%. Specifically, the 10-year US Treasury yields have retreated, and this pullback is attributed to anticipation of upcoming key US economic data scheduled for release later in the week. Investors are becoming increasingly concerned about deteriorating financial conditions, driven by higher yields and geopolitical tensions in the Middle East, particularly the potential for Israeli military action in Gaza.

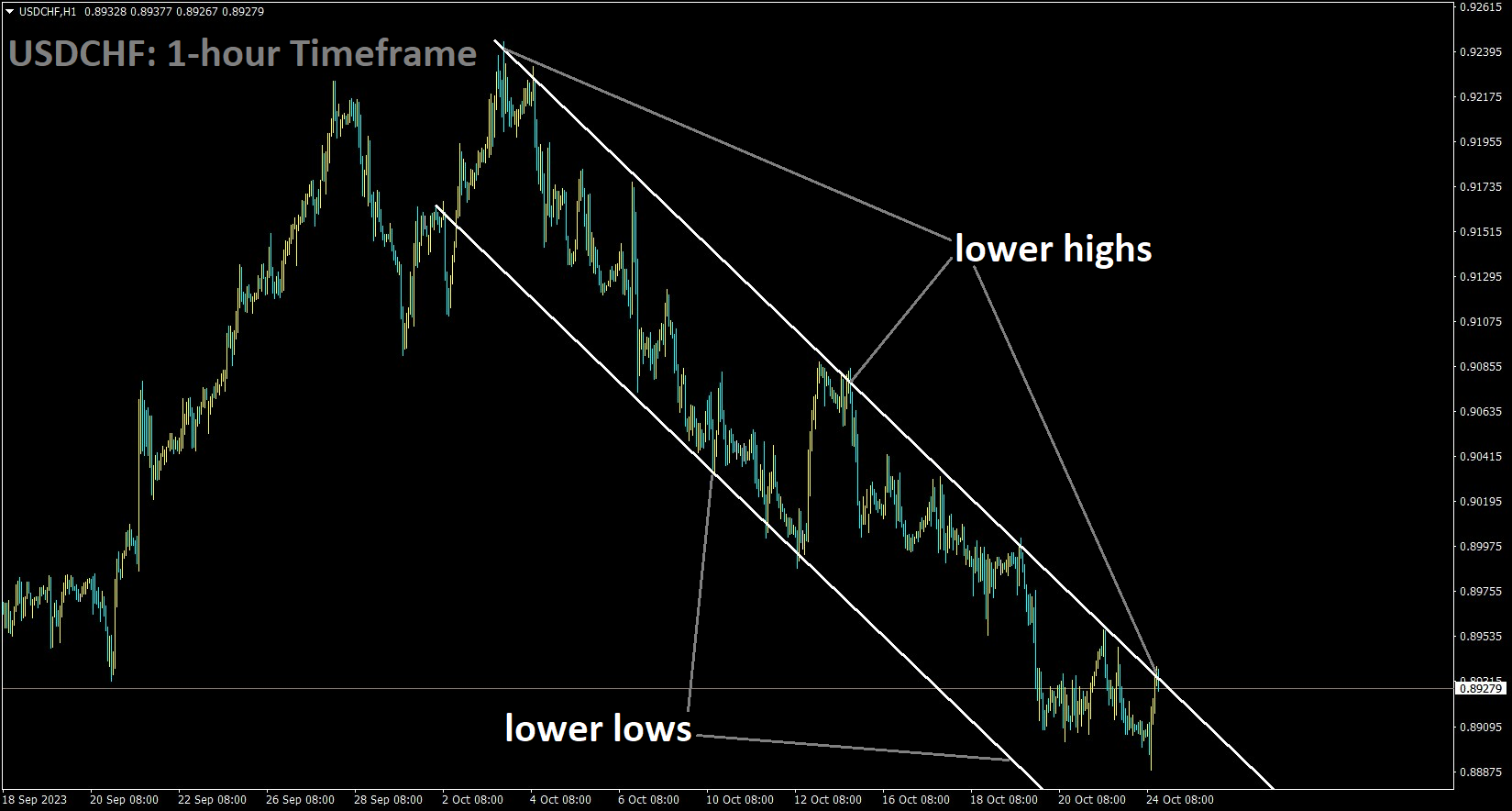

Swiss Franc Challenges and US Dollar Index Decline

USDCHF is moving in the Descending channel and the market has reached the lower high area of the channel

The Israel-Gaza conflict has sparked concerns throughout the Middle East, leading to daily appreciation of safe-haven currencies such as the Swiss Franc due to increased demand. In September, the Swiss ZEW Economic Survey is expected to report a reading of -27.6. If these numbers continue to decline, Switzerland may encounter deteriorating labor and business conditions.

The Swiss Franc is encountering challenges attributed to the weakening US Dollar (USD), primarily due to dovish comments from US Federal Reserve (Fed) officials. Traditionally viewed as a safe haven currency, the Swiss Franc had initially found support amidst rising geopolitical tensions in Israel. However, recent diplomatic efforts aimed at reducing tensions in the Israel-Gaza Strip have lessened market risk aversion. Consequently, investor appetite for risk has increased. Market participants are closely monitoring the ZEW Survey Expectations for October, scheduled for release on Wednesday. In September, this sentiment data registered at -27.6. Should the forthcoming data reveal a further decline, it could signal deteriorating business conditions and labor market conditions in Switzerland.Meanwhile, the US Dollar Index (DXY) continues its four-day losing streak, possibly influenced by the subdued performance of US Treasury yields. The spot price of the US Dollar hovers around 105.50. Although the 10-year Treasury yield briefly surged to its highest level since 2007, reaching 5.02%, it rapidly reversed direction, declining to 4.85% in the latest update.

In terms of US Federal Reserve officials’ perspectives, Atlanta Federal Reserve President Raphael Bostic has expressed skepticism regarding a rate cut by the US central bank before the middle of the next year. Fed Philadelphia President Patrick Harker, on the other hand, favors maintaining existing interest rates. Fed Cleveland President Loretta Mester has suggested that the US central bank is either at or very close to reaching the peak of the rate hike cycle.Market observers are gearing up for a week filled with significant economic data releases. Tuesday involves a thorough examination of the US S&P Global PMI, followed by close scrutiny of Q3 Gross Domestic Product (GDP) figures on Thursday. The week concludes with a particular focus on the Core Personal Consumption Expenditures (PCE) data on Friday.

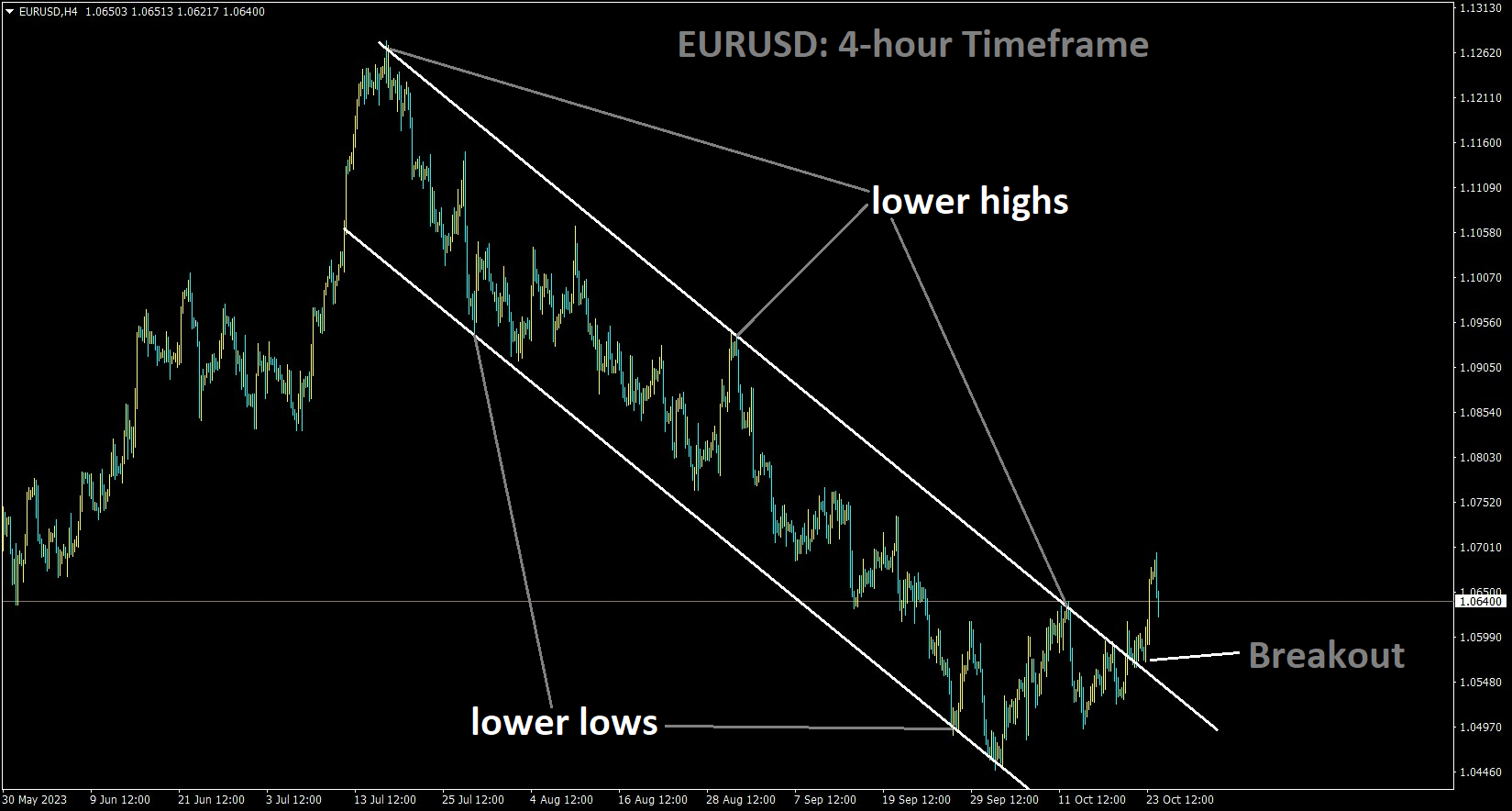

Euro Faces Challenges Amid Weakening Economic Data

EURUSD has broken the Descending channel in upside

Today, the Eurozone PMI data is on the agenda, and economists will assess whether the Eurozone economy is poised for a second-half recovery based on this data.

The Euro (EUR) is currently facing a set of challenges, largely driven by deteriorating economic data. One of the significant events in the Eurozone is the release of Eurozone PMIs (Purchasing Managers’ Index), which is anticipated to confirm the ongoing economic contraction. These indicators are likely to validate the forecasts made by experts, who anticipate a contraction in the Eurozone economy during the latter part of this year.One of the central questions in the minds of market participants revolves around the duration for which key interest rates will remain at their current levels before potentially undergoing further easing. The market perceives the likelihood of further easing occurring as early as the spring. Should the PMIs corroborate this expectation by showing continued economic weakness, it might lead to downward pressure on the Euro today.

Furthermore, the Euro’s performance is expected to be influenced by the European Central Bank (ECB) and its tone regarding the future economic outlook. If the ECB adopts a cautious tone on Thursday, expressing concerns about the economic landscape, the Euro could face additional challenges.On the contrary, experts do not anticipate the ECB to reduce its key interest rates in 2024. This expectation, if proven correct, could bolster the Euro if the market needs to adjust its projections. However, this adjustment may take some time, and in the interim, the Euro could experience downward pressure due to growing expectations of interest rate cuts stemming from weaker economic data.

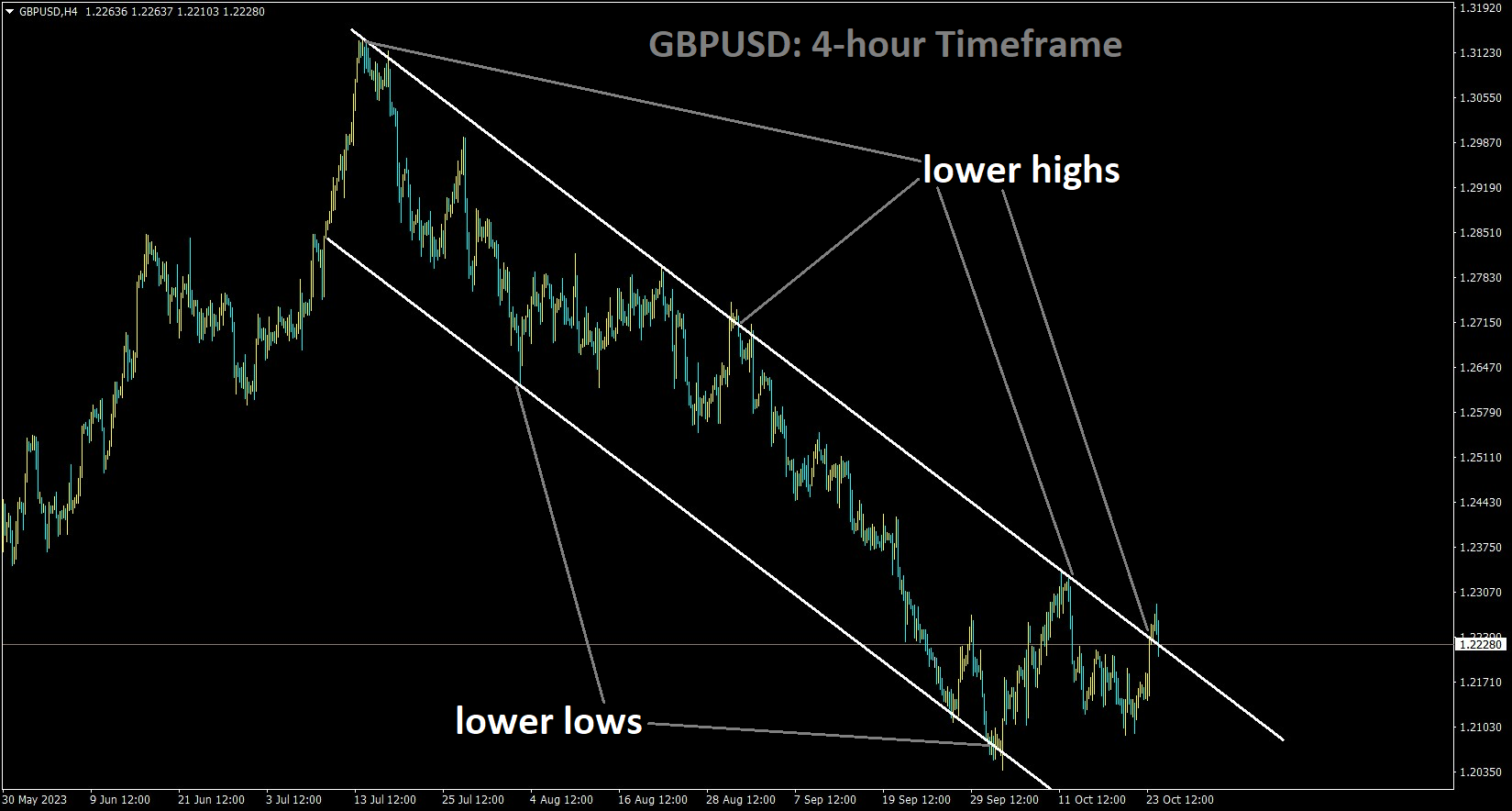

Pound Strengthens on Positive Employment Data

GBPUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel

The UK’s Q3 employment data surprised with fewer job losses than anticipated, showing a decline of 82,000 compared to the expected 198,000 layoffs. Additionally, the unemployment rate decreased to 4.2% during the June-August period, beating the expected 4.3%. Slower job demand in the UK may contribute to future reductions in inflation.

The Pound Sterling (GBP) is exhibiting a notable increase in strength, and it’s currently approaching a critical resistance level of 1.2300. This upward momentum is being fueled by improved market sentiment and better-than-expected employment data from the UK.According to data from the UK Office for National Statistics (ONS), the labor market recorded its third consecutive quarter of job losses up to August. However, what’s particularly encouraging is that the number of job losses was lower than initially anticipated. Moreover, the Unemployment Rate has decreased and remained below expectations, indicating a relatively stable labor market situation.The demand for labor in the UK has significantly slowed down, partly driven by the efforts of the Bank of England (BoE) to combat consumer inflation by raising interest rates. The upcoming BoE interest rate decision, scheduled for November 2, has become a focal point for investors. The market widely expects the BoE to maintain its interest rates at the current level of 5.25%, given the emerging signs of economic weakness.

The UK ONS reported a decrease of 82,000 jobs in the June-August period, which was significantly lower than the expected 198,000 layoffs. Over the three-month period ending in July, employment declined by 207,000. This sustained reduction in employment over three consecutive months suggests that businesses have been cutting their workforce due to weak demand.Notably, the Unemployment Rate fell to 4.2% for the three months ending in August, surpassing expectations and the previous reading of 4.3%.

However, in September, the Claimant Count Change increased by 20,400, well above economists’ projections of a marginal increase of 2,300.A Reuters poll indicates that the Bank of England is likely to keep interest rates unchanged at 5.25% on November 2. This decision is influenced by the absence of supportive economic indicators and the confidence expressed by BoE Governor Andrew Bailey that inflation will significantly decrease in the coming month.

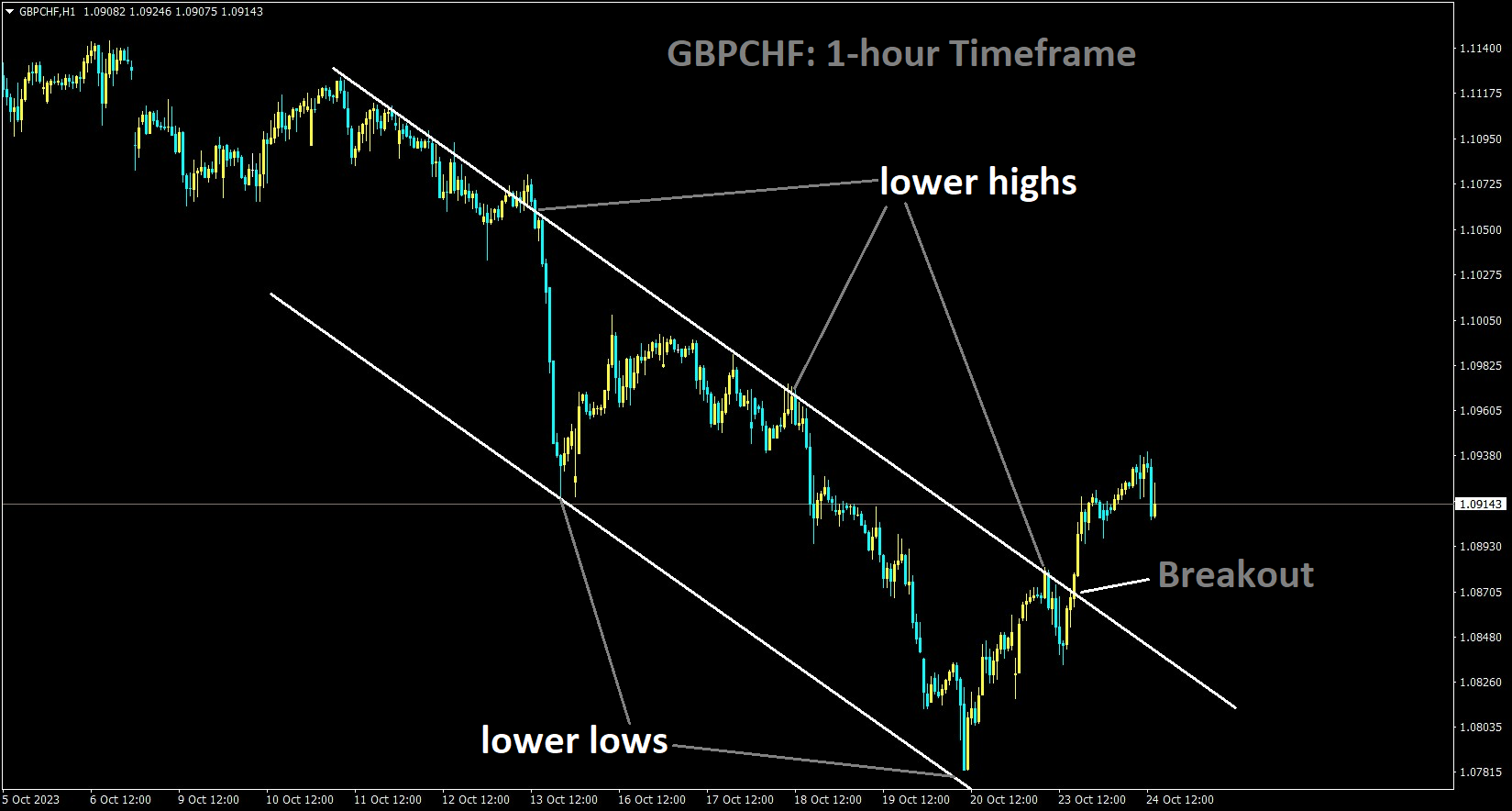

GBPCHF has broken the Descending channel in upside

Key economic indicators, such as UK Manufacturing and Services PMI, currently signal weak economic activity. Additionally, labor demand has slowed, and Retail Sales have contracted, which may dampen consumer inflation expectations. Overall, the market sentiment remains subdued, primarily due to ongoing tensions in the Middle East, where Israeli military troops are considering a ground assault in Gaza. Gaza health authorities have reported 5,000 deaths and over 15,000 civilian injuries.On Monday, the GBPUSD pair staged a strong recovery, largely in response to a sell-off in the US Dollar Index (DXY), which retreated sharply to around 105.50. This drop in the USD Index was driven by a decline in long-term US Bond yields from their multi-year highs above 5%. The 10-year US Treasury yields have retreated in anticipation of upcoming key US economic data scheduled for release later in the week. Investors are closely monitoring data such as Q3 Gross Domestic Product (GDP), the Federal Reserve’s preferred inflation gauge, and Durable Goods Orders. Concerns are mounting among investors about deteriorating financial conditions, driven by higher yields and Middle East tensions, which could potentially lead to a slowdown in the US economy.

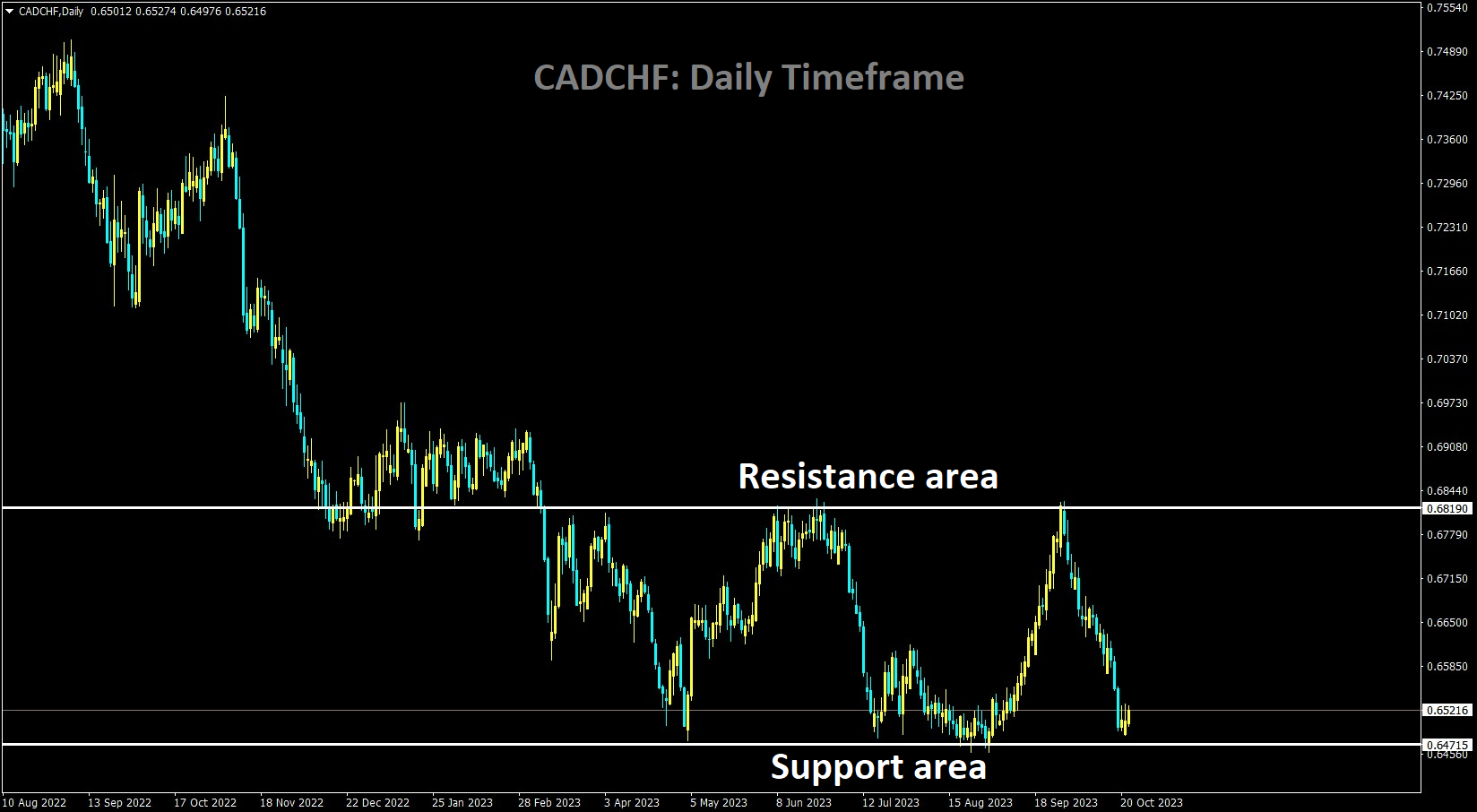

Canadian Dollar Strength Amidst Risk Appetite and Rate Decision

CADCHF is moving in the Box pattern and the market has reached the horizontal support area of the pattern

It’s widely expected that the Bank of Canada will maintain its current interest rates this week. This expectation arises from the ongoing concerns surrounding consistently low inflation and the recent three-month decline in retail sales.The Canadian Dollar (CAD) is gaining strength as the new trading week begins, primarily driven by a resurgence in investor risk appetite during early trading. The upcoming week holds significant data releases, including the US Purchasing Manager Index (PMI), US Gross Domestic Product (GDP), and US Personal Consumption Expenditure (PCE) Index. These events are expected to generate substantial market activity around the US Dollar (USD). On Wednesday, the Bank of Canada (BoC) is scheduled to announce its latest rate decision, followed by a press conference. It is widely expected that the BoC will maintain its reference rate at 5%. However, market participants will closely scrutinize any hints regarding the central bank’s future considerations regarding rate cuts.

Despite the CAD’s strength, it faces certain limitations due to declines in Crude Oil prices on Monday. The Canadian Dollar is closely tied to the oil market, and a drop in oil prices can curtail the potential upside in the currency. Tuesday’s economic calendar will bring the release of US PMI figures, potentially overshadowing the low-impact Canadian housing price data. The Canadian New Housing Price Index is anticipated to show a 0.1% increase in September. Meanwhile, US PMI components are expected to decline slightly, with Manufacturing forecasted at 49.5 and Services projected at 49.9. The BoC’s upcoming rate decision is widely anticipated to keep the rate at 5%, but investors are eagerly watching for any indications that the Canadian central bank may start considering rate cuts in the near future. Additionally, the easing of potential supply constraints arising from the Gaza Strip conflict, as diplomatic efforts aim to reduce Middle East tensions, has contributed to a decline in oil prices, thereby affecting the CAD’s performance.

Australian Dollar Gains on USD Correction and Economic Data

AUDUSD is moving in the Symmetrical triangle pattern and the market has reached the support area of the pattern

In anticipation of the upcoming release of Q3 CPI data tomorrow, the Australian Dollar has strengthened against its counterparts. Additionally, there is positive news that the Chinese government is considering issuing 1 trillion Yuan worth of Sovereign debt to stimulate the economy in the wake of the COVID-19 pandemic.

The Australian Dollar is trading positively for the second consecutive day, buoyed by a correction in the US Dollar . This correction can be attributed to weakening US Treasury yields. The upcoming week is expected to be active in terms of market activity involving the US Dollar, with the release of the US Purchasing Manager Index, US Gross Domestic Product (GDP), and US Personal Consumption Expenditure Index. In Australia, the preliminary S&P Global Manufacturing and Services PMI for October showed a decrease, indicating contraction in both the manufacturing and services sectors. Despite this, market expectations are leaning towards the Reserve Bank of Australia (RBA) adopting a more hawkish stance. RBA Governor Michele Bullock has suggested that if inflation persists above projected levels, the RBA is ready to implement appropriate policy measures. This has led to speculation that the RBA may consider tightening monetary policy in the future, potentially supporting the Australian Dollar.

In other news, the US Treasury Department has officially confirmed that the first meeting of the economic working group between the United States and China has taken place. This working group serves as a platform for discussions on bilateral economic policy matters. During the virtual meeting, both US and Chinese delegations engaged in productive and substantive discussions concerning domestic and global macroeconomic developments. China is reportedly planning to approve an additional sovereign debt issuance of slightly over 1 trillion yuan.

This issuance is part of the Chinese Communist Party’s efforts to boost infrastructure spending and stimulate economic growth. The National People’s Congress (NPC) is expected to approve this extra debt issuance during its meeting.The US Dollar Index is poised to extend its four-day losing streak, possibly influenced by declining US Treasury yields. After briefly reaching its highest level since 2007, the 10-year Treasury yield reversed course, resulting in some selling pressure on the US Dollar (USD). The markets currently do not perceive a likelihood of a November interest rate hike, but the odds for January 2024 remain above 30%.

In Australia, the S&P Global Composite PMI for October declined to 47.3 from the previous reading of 51.5. Manufacturing PMI eased to 48.0, down from the previous figure of 48.7, while the Services PMI dropped back into contraction territory, falling to 47.6 from the previous month’s reading of 51.8. Westpac’s Chief Economist, Luci Ellis, has stated that the Consumer Price Index (CPI) is expected to continue decreasing, returning to the RBA’s target band of 2-3% in 2025, aligning with the central bank’s expectations. Ellis has also highlighted several broader economic risks, including rising housing prices, global bond yield increases, and China’s slower-than-anticipated recovery from COVID-related lockdowns. In the US, the weekly Initial Jobless Claims fell to 198K, below market expectations and reaching its lowest level since January. However, Existing Home Sales Change declined by 2.0% MoM in September, while Existing Home Sales improved to 3.96 million. The 10-year Treasury yield briefly surged to 5.02%, its first time at such levels since 2007, before reversing course and declining to 4.84%. Key data releases for the upcoming week include the US S&P Global PMI on Tuesday, Q3 Gross Domestic Product (GDP) on Thursday, and the Core Personal Consumption Expenditures (PCE) on Friday. Additionally, market participants will closely follow RBA Governor Bullock’s speech and the Consumer Price Index (CPI).

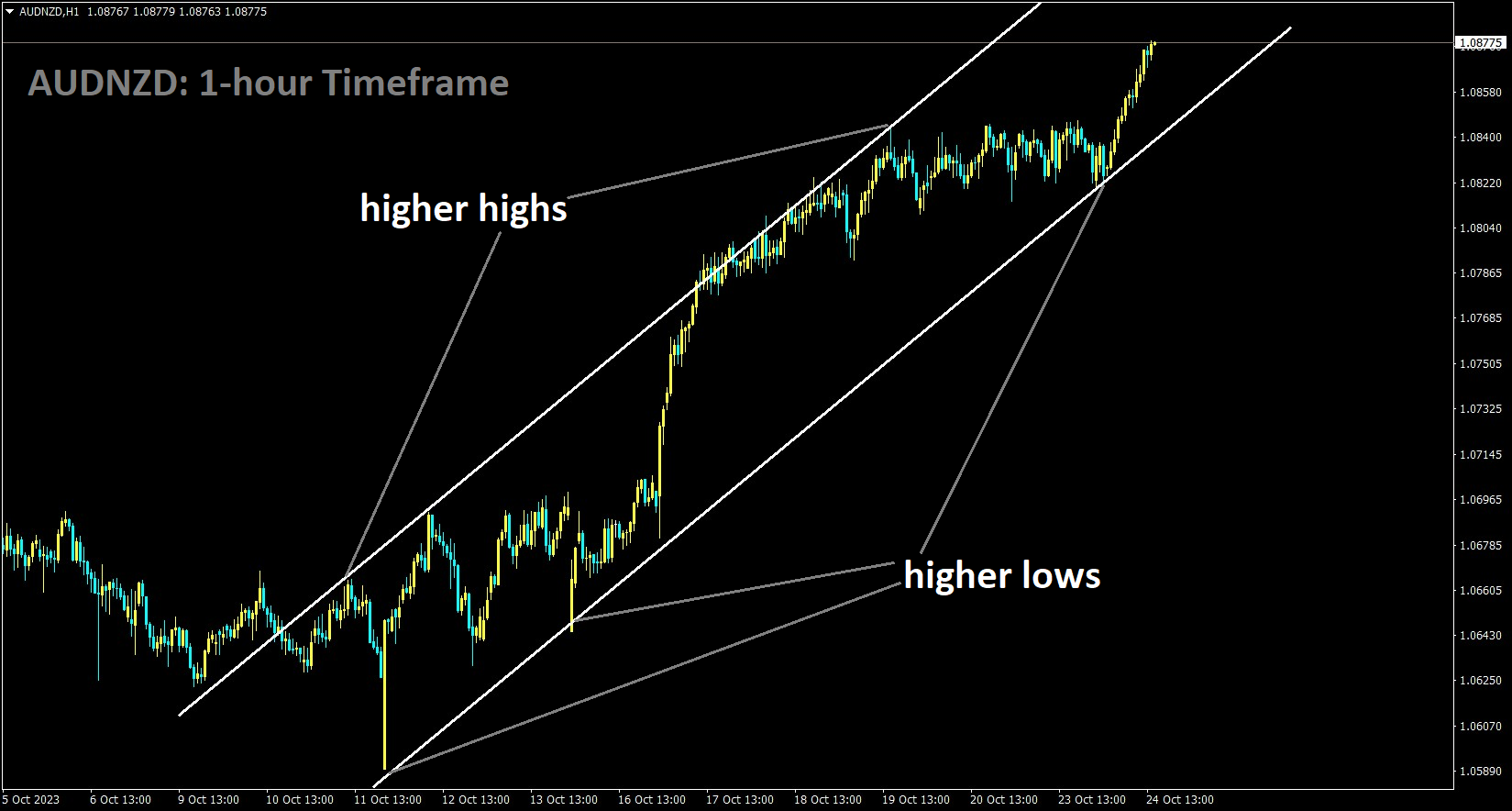

NZD Steadies Amidst Market Sentiment Fluctuations

AUDNZD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel

The New Zealand Dollar has weakened against the US Dollar in anticipation of this week’s scheduled events, including the release of US Q3 GDP data and a speech by Fed Chair Powell.

The NZDUSD currency pair is experiencing some buying interest around the 0.5850 level as overall market risk sentiment stabilizes in anticipation of a busy week of key US economic data releases. The economic calendar lacks significant New Zealand-specific data, leaving the NZDUSD vulnerable to shifts driven by market reactions to US growth and inflation figures. On Tuesday, market attention will turn to the US Purchasing Manager Index (PMI) data for October. Both components of the PMI are expected to show slight declines: the Manufacturing PMI is forecasted to drop from 49.8 to 49.5, while the Services PMI is anticipated to fall from 50.1 to 49.9. These projections indicate a potential return to contraction territory for the services sector.

Wednesday brings a speech by Federal Reserve (Fed) Chairman Jerome Powell, followed by US Gross Domestic Product figures on Thursday. US GDP is expected to show an acceleration in the third quarter, rising from 2.1% to 4.2% on an annualized basis for the third quarter. The week concludes with another important US inflation indicator: the Personal Consumption Expenditure Index data for September. It is expected to increase from 0.1% to 0.3%. Rising underlying inflation figures pose a challenge for overall market sentiment, as investors hope for a shift in Fed interest rate expectations. However, stubborn inflation is likely to be a significant hurdle for the US central bank to overcome before considering rate cuts. The current dot plot from the Fed doesn’t indicate any rate cuts until the latter half of 2024 as it stands.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/