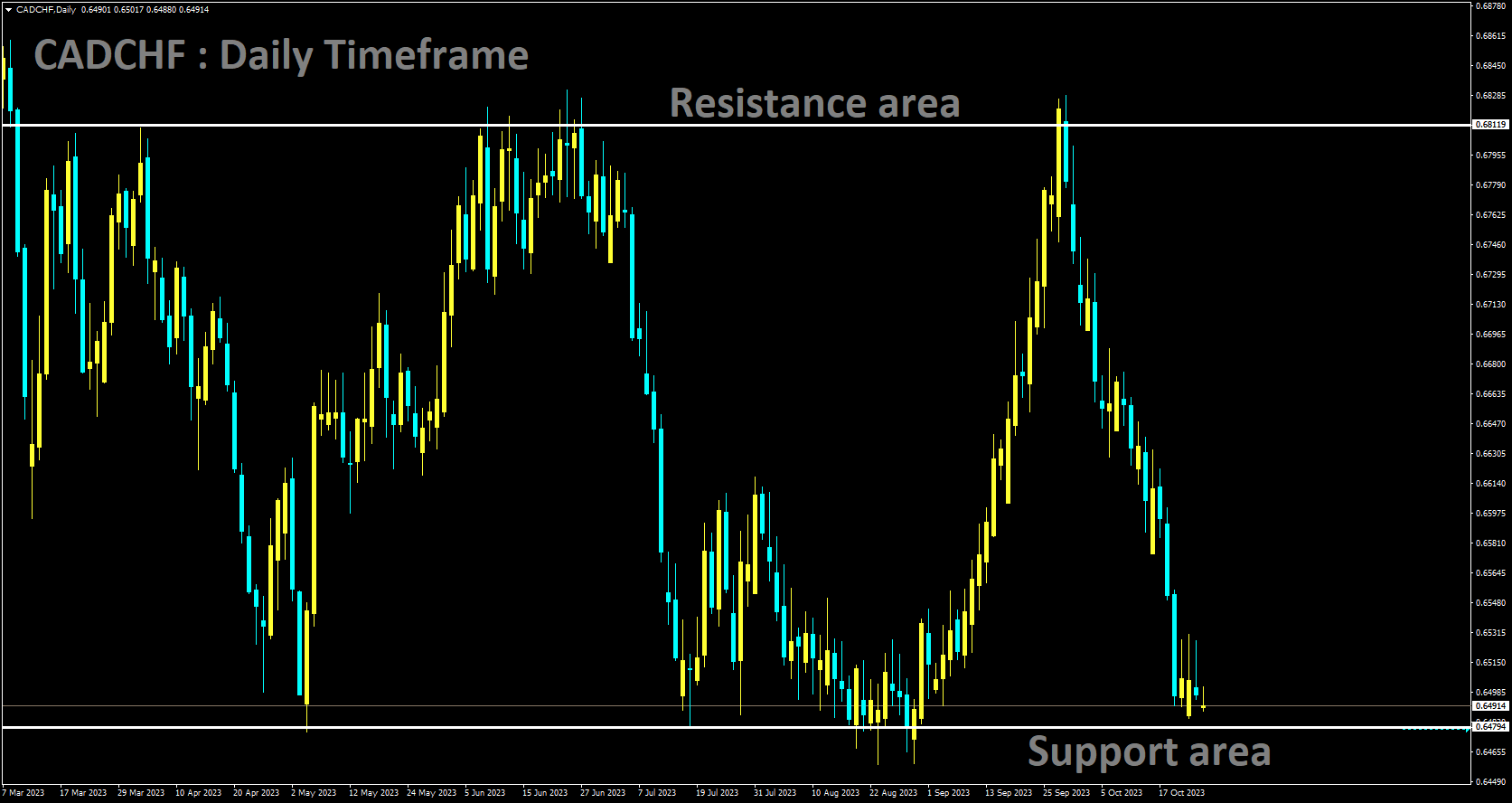

CADCHF is moving in box pattern and market has reached support area of the pattern

During this meeting, the Bank of Canada has chosen to maintain its existing interest rates. This decision has been shaped by two key factors: the recent deceleration in inflation, which fell to 3.8% in September, and the substantial surge in oil prices following the conflict in Israel. Consequently, the BoC has decided to leave interest rates unchanged at this time.

Canada’s economic landscape is a complex terrain that demands meticulous attention, especially for the Bank of Canada as it steers the nation’s monetary policy. In this comprehensive exploration, we delve into various facets of Canada’s economy, dissect the intricacies of monetary policy, and examine the recent surge in long-term bond yields. This deep dive aims to provide a holistic understanding of the central bank’s challenges and strategies in maintaining economic stability.

Understanding Long-Term Bond Yields

Long-term bond yields are pivotal in shaping the Canadian economy. They represent the interest rates paid on long-dated government bonds, including Canada’s 10-year and 30-year bonds. These yields are influenced by a multitude of factors, such as expectations about future interest rates, inflation, and global economic conditions.

When long-term bond yields rise, it can signal growing expectations of higher inflation and increased confidence in economic growth. Conversely, falling yields may indicate economic uncertainty or a flight to safety.

The recent surge in long-term bond yields has sparked debates about whether they can replace conventional monetary policy tools. Bank of Canada Governor Tiff Macklem has been resolute in asserting that long-term bond yields are not a substitute for monetary policy and that the economy is not poised for a deep recession. Let’s unpack this perspective.

Governor Macklem’s assertion aligns with a fundamental principle of central banking. Central banks, like the Bank of Canada, primarily use short-term interest rates (e.g., the overnight rate) to influence economic conditions. These rates are adjusted to achieve specific policy objectives, such as managing inflation and fostering economic growth.

While rising long-term bond yields can influence borrowing costs and broader financial conditions, they are not the central bank’s direct target. Instead, the focus remains on guiding short-term interest rates to achieve policy goals, with the primary objective in Canada being to maintain inflation at a target rate of 2%.

Evaluating the Impact of Rising Long-Term Bond Yields

Governor Macklem’s acknowledgment of tighter financial conditions due to the surge in long-term bond yields underscores the interconnectedness of financial markets and monetary policy. This section explores the implications of these tighter conditions.

Rising long-term bond yields result in higher borrowing costs for businesses and consumers, potentially dampening economic activity as financing becomes more expensive. The central bank’s primary tool for managing such financial conditions is the overnight interest rate. By adjusting this rate, the Bank of Canada can influence the cost of borrowing for banks, which then affects the rates offered to consumers and businesses.

However, addressing financial conditions alone is not sufficient. The central bank’s primary mandate is to achieve its inflation target. Therefore, any adjustments to the overnight rate must consider the broader economic outlook.

Market Dynamics and Rate Hike Speculation

Market participants closely scrutinize central bank statements for hints about future policy actions. Following Governor Macklem’s comments on financial conditions and monetary policy, money markets adjusted their expectations. This section examines the market’s reaction and the speculation regarding future rate hikes.

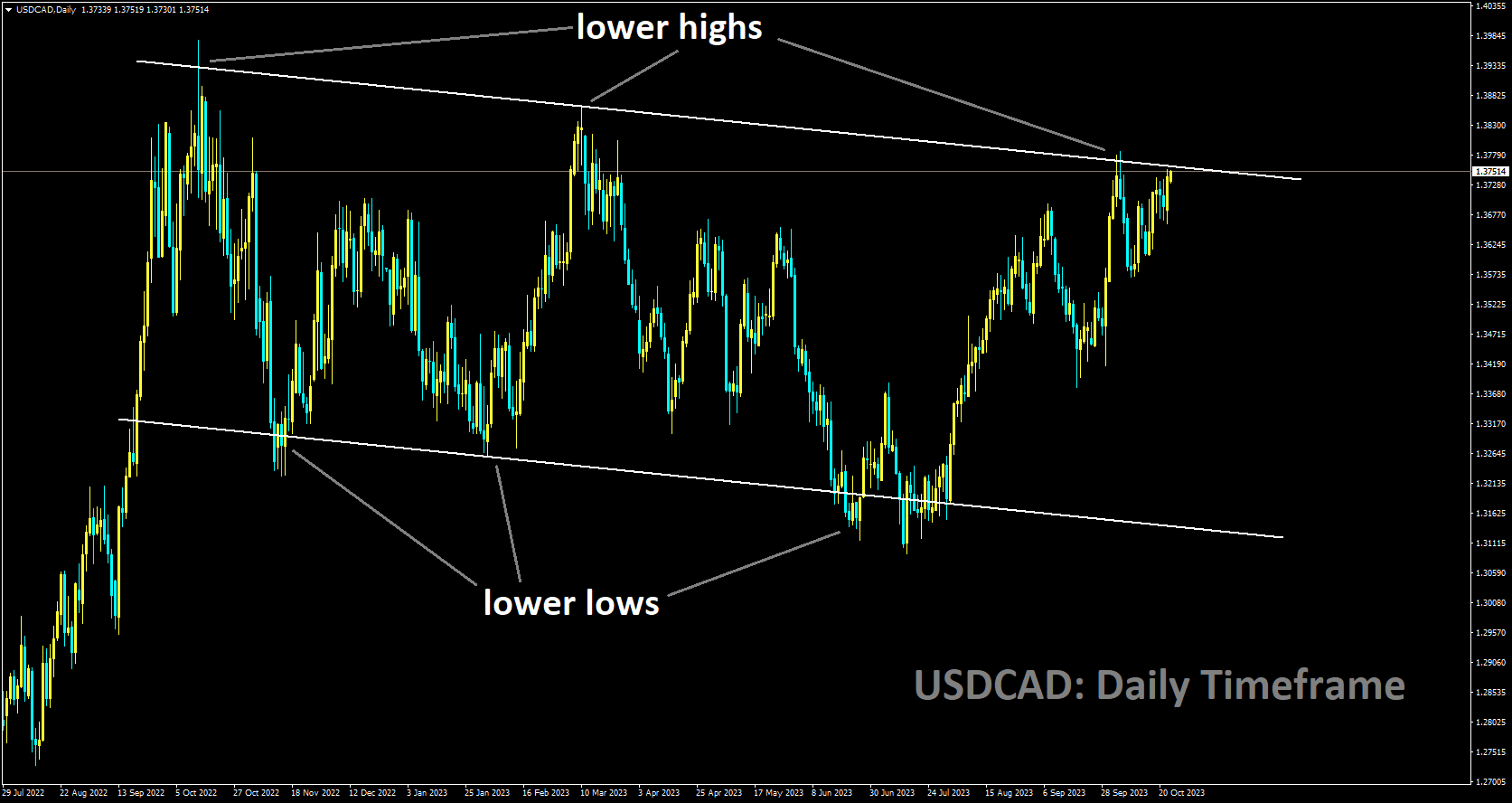

USDCAD is moving in Descending channel and market has reached lower high area of the channel

In the wake of Governor Macklem’s remarks, money markets increased their bets on another interest rate hike at the next Bank of Canada meeting. The probability of a rate increase rose from 27% to approximately 36%. This shift reflects the significance of central bank communication in shaping expectations.

Derek Holt, vice president of capital markets economics at Scotiabank, emphasized the importance of upcoming economic data, particularly September’s core inflation numbers. He also noted that, in his view, the case for an October rate hike is stronger than market pricing suggests. Market participants and economists continually evaluate economic indicators, central bank statements, and global developments to gauge the likelihood of policy changes.

The Canadian dollar also responded to these developments, trading 0.3% higher against the U.S. dollar. Currency markets are sensitive to interest rate expectations, as higher rates can attract foreign capital inflows and strengthen a nation’s currency. This market reaction underscores the significance of clear and effective communication by central banks and highlights the dynamic nature of monetary policy.

Analyzing Canada’s Economic Environment

To contextualize the Bank of Canada’s policy decisions, we must assess Canada’s current economic situation. Several key economic indicators shed light on this landscape.

Growth: Canada experienced unexpected contractions in the second quarter, followed by stalled growth in the first two months of the third quarter. These developments raised concerns about the economic recovery’s smoothness. Economic growth significantly influences the central bank’s policy calculus as it affects the outlook for employment and inflation.

Inflation: Inflation has been a central concern for the Bank of Canada. Central banks typically target a certain level of inflation. Recent spikes in consumer prices, however, raised alarm. Annual inflation unexpectedly slowed to 3.8% in September, lower than the 4.0% rate recorded in August. This moderation prompted market participants to reevaluate their rate hike expectations.

Employment: The strength of the labor market is closely monitored, as it directly impacts consumer spending and overall economic activity. Governor Macklem emphasized the importance of job prospects and wage increases for Canadians. A robust labor market can help individuals manage the impact of higher interest rates when they renew their mortgages.

Mortgage Market Dynamics

The surge in long-term bond yields has implications for the Canadian mortgage market, which plays a vital role in the country’s housing sector and overall economic stability.

In Canada, mortgage rates tend to track long-term bond yields, though with a lag and at a premium. When long-term bond yields rise, Canadian banks may pass on these higher borrowing costs to mortgage borrowers, affecting affordability and influencing housing market dynamics.

EURCAD is moving in Descending Triangle and market has reached lower high area of the pattern

One concern is the high number of mortgages set to be renewed in the coming years. Given the recent surge in long-term bond yields, borrowers may face higher interest rates when renewing their mortgages. This has raised questions about the ability of Canadian households to absorb these higher costs.

Governor Macklem addressed these concerns, expressing confidence in the strength of the Canadian economy and labor market. He noted that individuals with good jobs and wage increases would be better equipped to handle the impact of higher mortgage rates. Nonetheless, the trajectory of the housing market remains a key consideration for the central bank.

Striking a Balance Between Rate Hikes and Inflation Management

The Bank of Canada faces the challenge of managing inflation while considering the impact of previous rate hikes and the potential need for further increases.

Governor Macklem emphasized that the central bank is looking for clear signs that core inflation, representing underlying inflation pressures, is easing and moving toward the bank’s target rate of 2%. Central banks aim to strike a balance between supporting economic growth and preventing inflation from spiraling out of control.

The central bank has already implemented ten rate hikes in the past 18 months, bringing the overnight rate to a 22-year high of 5%. These hikes aimed to tame inflation and ensure it does not persist above the target rate. However, the central bank’s projections suggest that inflation may not return to the 2% target until mid-2025.

The decision on whether to implement further rate hikes or allow previous ones to take effect is not taken lightly. It requires careful analysis of economic indicators, market conditions, and global developments. The central bank must assess whether the recent surge in long-term bond yields is a temporary phenomenon or a sustained trend that could impact inflation expectations.

Projections and Independent Outlook

To gain further insights into the central bank’s policy outlook, we can turn to forecasts provided by the Parliamentary Budget Officer (PBO). These projections offer an independent perspective on Canada’s economic prospects.

The PBO forecasted that the Bank of Canada would keep its key overnight rate at 5% through the first quarter of the next year. This projection reflects the PBO’s assessment of Canada’s economic performance and the central bank’s likely response.

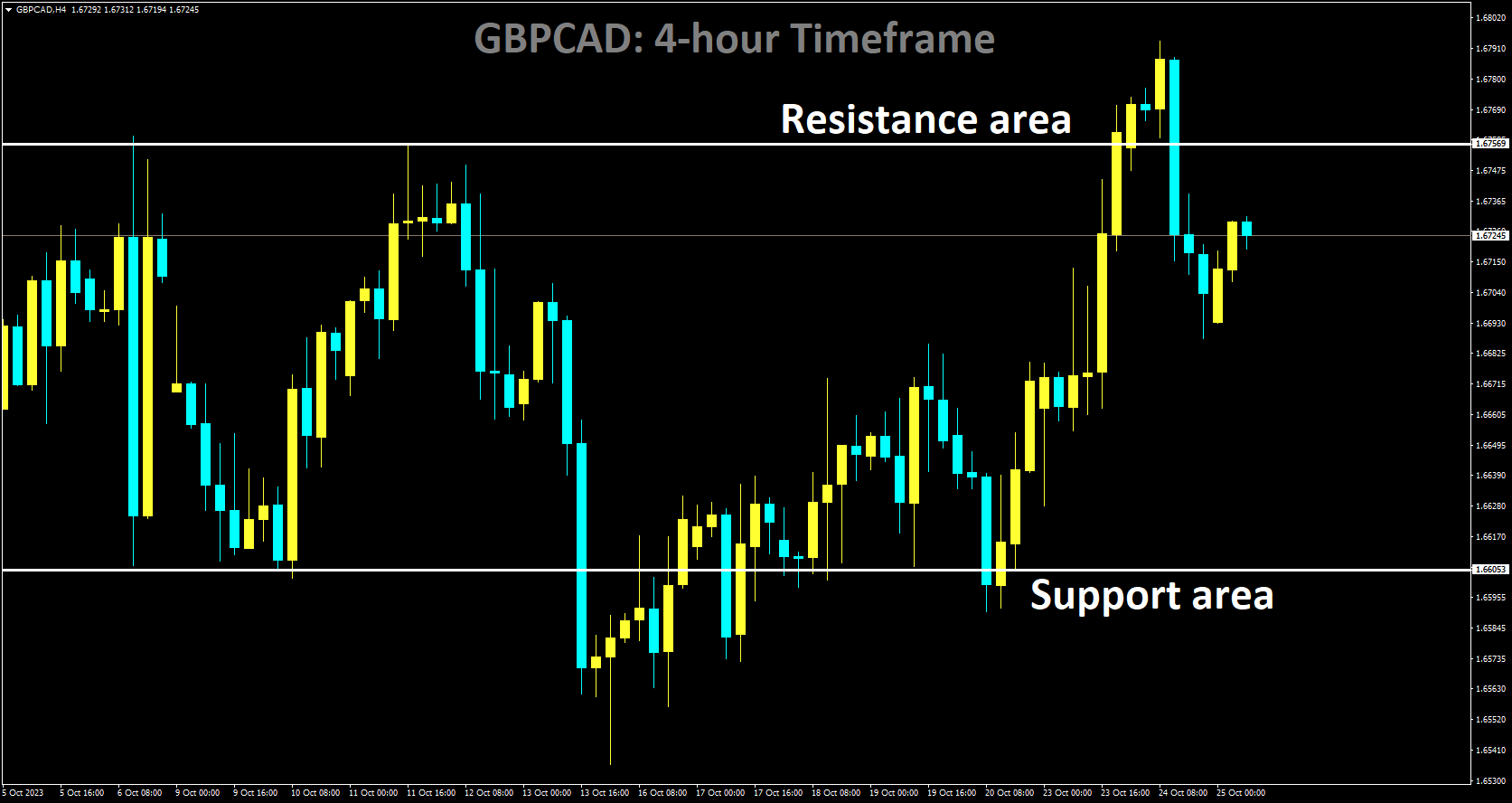

GBPCAD is moving in box pattern and market has fallen from the resistance area of the pattern

GBPCAD is moving in box pattern and market has fallen from the resistance area of the pattern

The PBO’s outlook considers various economic factors, including GDP growth, inflation, and employment. It provides a valuable reference point for policymakers and market participants, helping them assess the trajectory of interest rates and the broader economy.

Central Bank’s Response and Market Sentiment

The central bank’s response to unexpected economic developments plays a crucial role in shaping market sentiment and investor confidence. In the aftermath of the inflation data release, market participants closely watched for any signals from the Bank of Canada.

Governor Macklem’s statements reassured markets that the central bank was carefully monitoring the situation and would adjust policy as necessary to achieve its inflation target. This communication is an essential tool in central banking, as it helps manage expectations and reduce uncertainty.

Effective central bank communication can mitigate market volatility and prevent abrupt shifts in investor sentiment. It also allows the central bank to convey its policy intentions and objectives clearly.

Effective central bank communication can mitigate market volatility and prevent abrupt shifts in investor sentiment. It also allows the central bank to convey its policy intentions and objectives clearly.

OSFI’s Proposal and Its Impact on Banks

Regulatory changes in the banking sector can have far-reaching effects on financial institutions and the broader economy. The recent proposal by the Office of Superintendent of Financial Institutions (OSFI) regarding capital charges for banks with negative amortization mortgage balances is a case in point.

The OSFI proposal, effective in early 2024, introduces stricter regulations for banks with negative amortization mortgages above 65% loan-to-values (LTVs). These mortgages will be treated as exposures that do not meet B-20 mortgage underwriting standards, which limit mortgage origination terms to a maximum of 30 years.

This rule change is particularly relevant to certain banks that offer fixed-payment variable rate mortgages, including Bank of Montreal (BMO), Canadian Imperial Bank of Commerce (CIBC), Royal Bank of Canada (RY), and Toronto Dominion (TD). Conversely, banks like Bank of Nova Scotia (BNS) and National Bank of Canada (NBC) are less affected because their variable-rate offerings adjust payments upward with rates, avoiding extended amortization periods.

Mortgage Market Dynamics Revisited

The OSFI rule change has raised questions about its potential impact on Canadian banks and the mortgage market. Let’s delve deeper into the implications for lenders and borrowers.

The rule change is expected to increase risk weights for affected mortgages, potentially requiring banks to allocate additional capital against these exposures. This could impact capital ratios, a critical measure of a bank’s financial strength and stability.

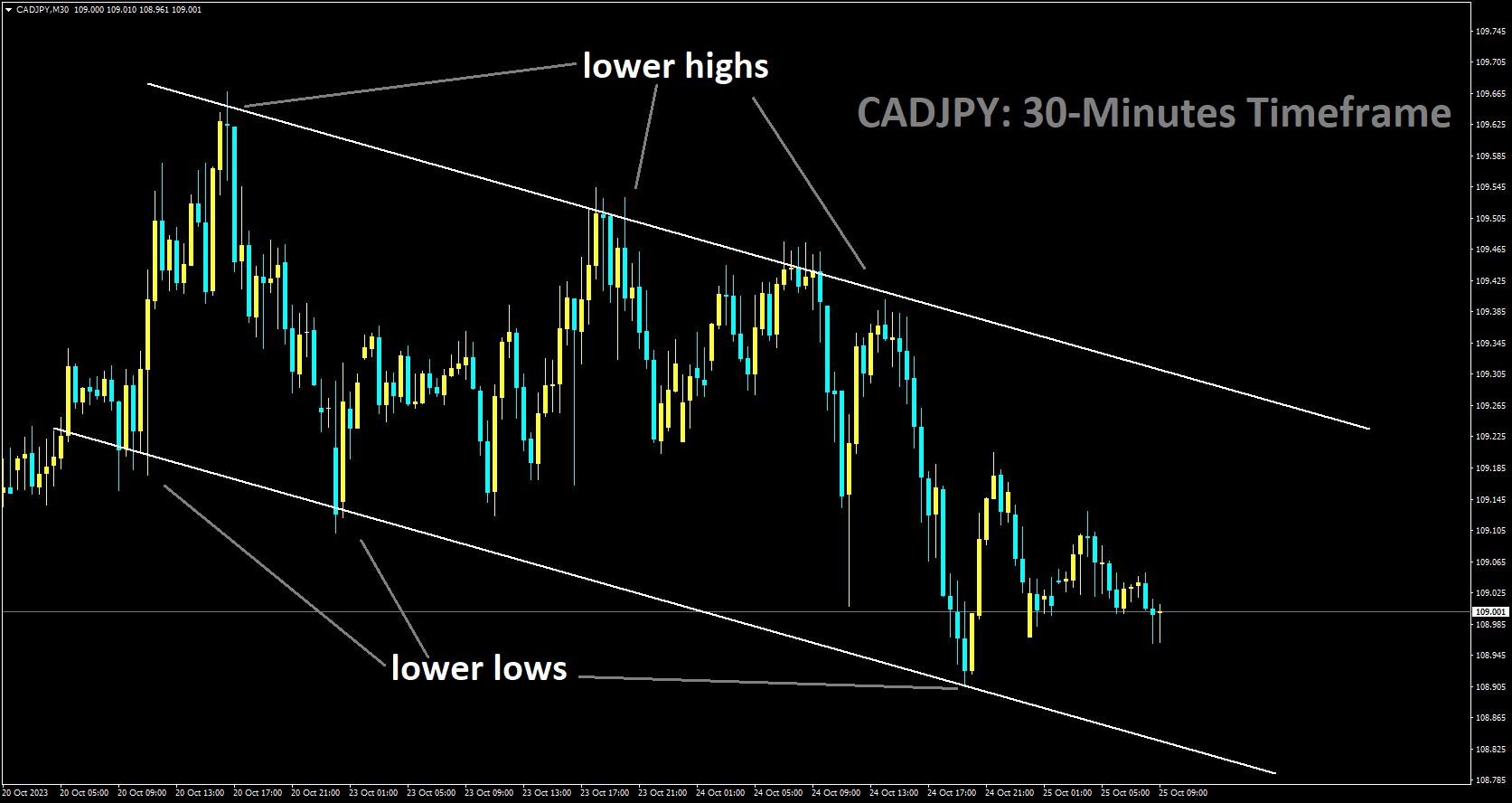

CADJPY is moving in Descending channel and market has fallen from the lower high area of the channel

CADJPY is moving in Descending channel and market has fallen from the lower high area of the channel

However, the magnitude of this impact varies among banks. Projections suggest that the change may affect common equity tier 1 (CET1) ratios by 7 to 22 basis points for banks with exposure to negative amortization mortgages. This represents less than 2% of the average CET1 capital for the four banks with such exposure.

In essence, while the rule change introduces regulatory adjustments, its overall impact on the stability of Canadian banks appears manageable. This reflects the prudential approach of regulators in ensuring that banks can withstand potential shocks.

Banks’ Ability to Withstand Economic Pressures

Stress testing is a crucial component of banking regulation, assessing a bank’s ability to withstand adverse economic scenarios. Canadian banks’ mortgage portfolios have come under scrutiny in this context.

Despite concerns about rising interest rates and higher delinquencies, Canadian banks are expected to weather these challenges. Several factors contribute to their resilience:

Homeowners’ Equity: High levels of homeowners’ equity provide a buffer against mortgage defaults. Many Canadians have substantial equity in their homes, reducing the risk of underwater mortgages.

Low Unemployment: Low unemployment rates contribute to borrowers’ ability to meet their mortgage obligations. Employment stability is a key determinant of mortgage delinquencies.

High Immigration Levels: Canada’s robust immigration levels bolster housing demand and support property values, further reducing mortgage risk.

Supply-Demand Imbalances: Supply and demand imbalances in the housing market have contributed to price appreciation, which enhances the collateral value of mortgage loans.

Banks have also proactively worked with borrowers to minimize delinquencies and foreclosures. Measures such as increasing monthly payments, switching to fixed-rate products, refinancing, and extending amortization periods have helped borrowers manage their mortgage obligations.

The combination of these factors and prudent risk management practices positions Canadian banks to withstand the pressures arising from rising rates and higher delinquency levels.

Housing Market and Mortgage Rate Projections

Given the dynamics of the mortgage market and the broader economic landscape, projections for housing prices and mortgage rates are of paramount importance.

Mortgage Rates: Mortgage rates in Canada doubled to an average of nearly 6.5% in 2022. Projections suggest that these rates are likely to average between 6% and 7% in 2023 before experiencing a slight decline in 2024. The expectation for a decline in rates aligns with Fitch’s projection that policy rates will decrease to 4%.

Housing Prices: Nominal housing prices are expected to experience a modest decline of 0% to 5% in 2023 from their record highs. Several factors contribute to this outlook, including a slowing economy, rising rates, and declining affordability. However, a rebound is anticipated in 2024, driven by supply and demand imbalances in the housing market.

Mortgage Delinquencies: Mortgage delinquencies, which reached record lows of 0.14% in 2022, are projected to increase slightly to a range of 0.20% to 0.25% in 2023. This level of delinquency is expected to persist in 2024. It reflects the challenges posed by rising interest rates and higher mortgage costs.

Conclusion

the Bank of Canada’s role in managing the economy and monetary policy is a delicate balancing act. It must consider a myriad of factors, including inflation, economic growth, financial conditions, and market sentiment. The recent surge in long-term bond yields has added complexity to this task.

Governor Macklem’s insistence on the primacy of short-term interest rates as a policy tool underscores the central bank’s commitment to its primary mandate of maintaining inflation at the target rate of 2%. While market reactions and economic data may sway expectations, the central bank’s actions are guided by its long-term objectives.

The central bank’s communication with financial markets and the public plays a crucial role in shaping expectations and reducing uncertainty. This clear and transparent communication is essential for maintaining stability and confidence in the Canadian economy.

As the central bank continues to navigate the evolving economic landscape, it must strike a balance between addressing immediate challenges and adhering to its long-term policy objectives. The path ahead is uncertain, but the central bank’s commitment to maintaining economic stability remains unwavering.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/