Gold Analysis:

XAUUSD is moving in box pattern and market has reached resistance area of the pattern

Gold is often considered a safe-haven asset, meaning that its value tends to rise during times of uncertainty, geopolitical tensions, and financial market volatility. In the provided analysis, the focus is on how recent developments, particularly those related to Israel’s actions in the Middle East, have affected gold prices.

Recovery of Hostages: The analysis begins by mentioning Israel’s successful recovery of hostages. Hostage situations are inherently tense and can have significant implications for geopolitical stability. In this case, the successful resolution of the hostage situation initially eased tensions in the region.

Israel’s Troop Deployment: The analysis then highlights Israel’s deployment of troops for an attack after the hostages were safely recovered. This action by Israel added a new layer of uncertainty to the situation, potentially leading to an escalation of conflict in the region.

Impact on Gold Prices: It is noted that these developments caused a slight decrease in gold prices. This may seem counterintuitive since gold is often seen as a safe-haven asset during times of conflict. However, gold prices can be influenced by various factors, including short-term market sentiment and traders’ reactions to news events.

Aid to Gaza and Hostage Returns: The analysis also mentions positive developments, such as agreements to provide aid to those affected in Gaza and the safe return of Israeli hostages. These developments, along with ongoing negotiations, temporarily reduced tensions in the region.

Gold Market Reaction: The gold market responded to these developments with panic buying, driving gold prices higher. Investors turned to gold as a safe-haven asset to reduce risk in their portfolios. This panic buying is a typical response during times of uncertainty.

Technical Analysis: The analysis provides some technical details related to gold prices, including potential support levels ($1937) in case of a pullback and the resistance level ($1985) that might come into focus if tensions resurge.

In summary, the Gold Analysis focuses on the interplay between geopolitical events, market sentiment, and gold prices. It highlights how gold, as a safe-haven asset, can experience price fluctuations in response to changing perceptions of risk and uncertainty.

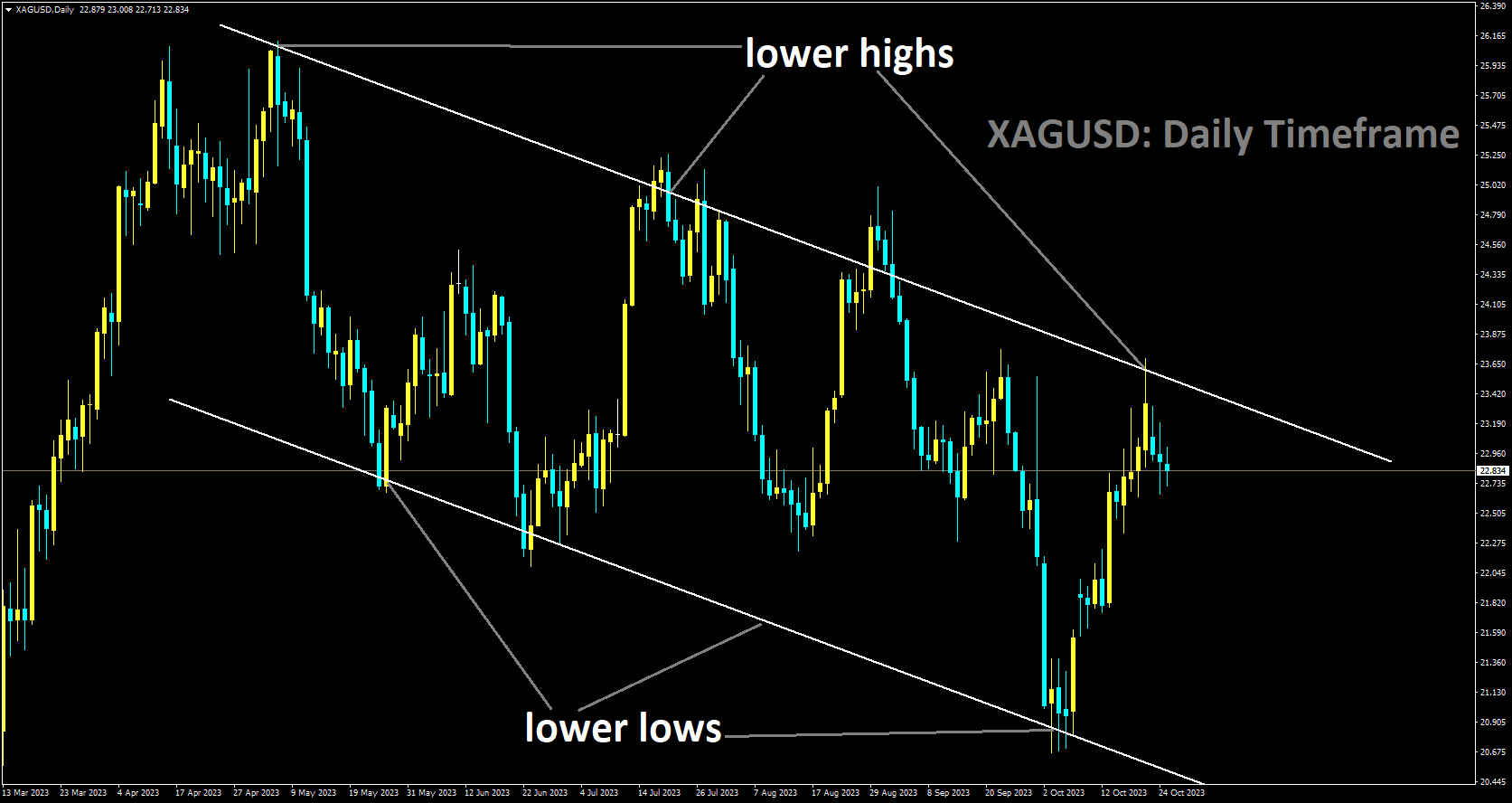

Silver Analysis:

XAGUSD is moving in Descending channel and market has fallen from the lower high area of the channel

Silver, like gold, is a precious metal often influenced by economic and geopolitical factors. The analysis delves into how the US Dollar’s performance, inflation concerns, and economic data affect silver prices.

US Dollar and Consolidation: It mentions that the US Dollar typically undergoes a consolidation phase at a lower value before significant economic data releases. The US Dollar’s performance is essential for silver prices, as they often have an inverse relationship.

IMF’s Concerns: The analysis discusses concerns expressed by the Managing Director of the International Monetary Fund (IMF), Kristalina Georgieva. She highlights various global challenges, including the aftermath of the COVID-19 pandemic, geopolitical tensions, rising interest rates, and economic slowdowns.

US Dollar Strength: It notes that the US Dollar (as measured by the US Dollar Index, or DXY) experienced a notable increase due to strong US economic data. Factors contributing to the Dollar’s strength include weak European data compared to strong US figures and rising US Treasury yields.

Federal Reserve’s Policies: Despite the Federal Reserve’s contractionary (tightening) policies, the US economy appears resilient compared to other economies. Attention is drawn to upcoming events like Q3 GDP estimates and Fed Chair Powell’s speech, which are closely monitored for insights into future monetary policy decisions.

Technical Analysis: The analysis mentions specific technical aspects, such as the rise in the DXY Index and the impact of data like the S&P Global Manufacturing PMI on market sentiment.

In essence, the Silver Analysis explores the complex relationship between the US Dollar, global economic conditions, inflation concerns, and silver prices. It highlights how silver can be influenced by both safe-haven demand and industrial use.

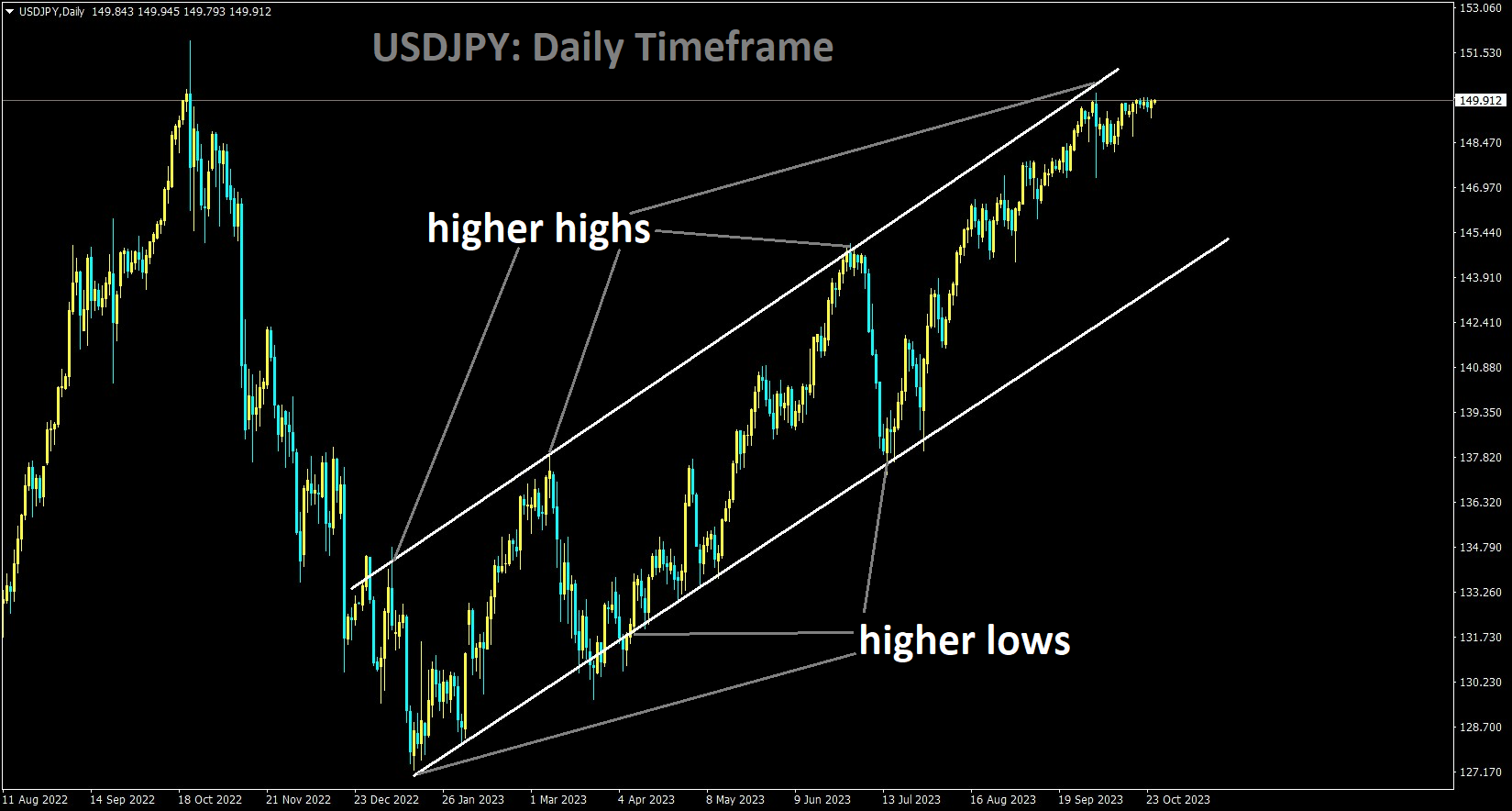

USDJPY Analysis:

USDJPY is moving in Ascending channel and market has reached higher high area of the channel

The analysis focuses on the currency pair involving the US Dollar (USD) and the Japanese Yen (JPY). It delves into how central bank actions, yield differentials, and economic data influence the USDJPY exchange rate.

Bank of Japan Meeting: The analysis starts by mentioning the Bank of Japan’s (BoJ) board meeting and speculations about the possibility of raising the Yield Curve Control (YCC) rate. The BoJ’s monetary policy decisions can significantly impact the JPY’s value.

Bond Purchases and YCC: It discusses reports that the BoJ may purchase 10-year and 25-year bonds and adjust its YCC program. These potential actions could have implications for the Japanese Yen’s strength.

Yield Differentials: The analysis highlights the widening yield differential between US Treasury bonds and Japanese bonds, which has contributed to a weaker JPY. This yield spread is closely monitored by currency traders.

US Economic Data: It notes that significant economic data releases from the United States, such as Q3 GDP figures and inflation indicators, could influence the USDJPY pair. Economic data can impact traders’ perceptions of the US economy.

In summary, the USDJPY Analysis focuses on the interplay between central bank actions, yield spreads, and economic data in determining the exchange rate between the US Dollar and Japanese Yen. It underscores the importance of staying informed about central bank policies and economic indicators when trading this currency pair.

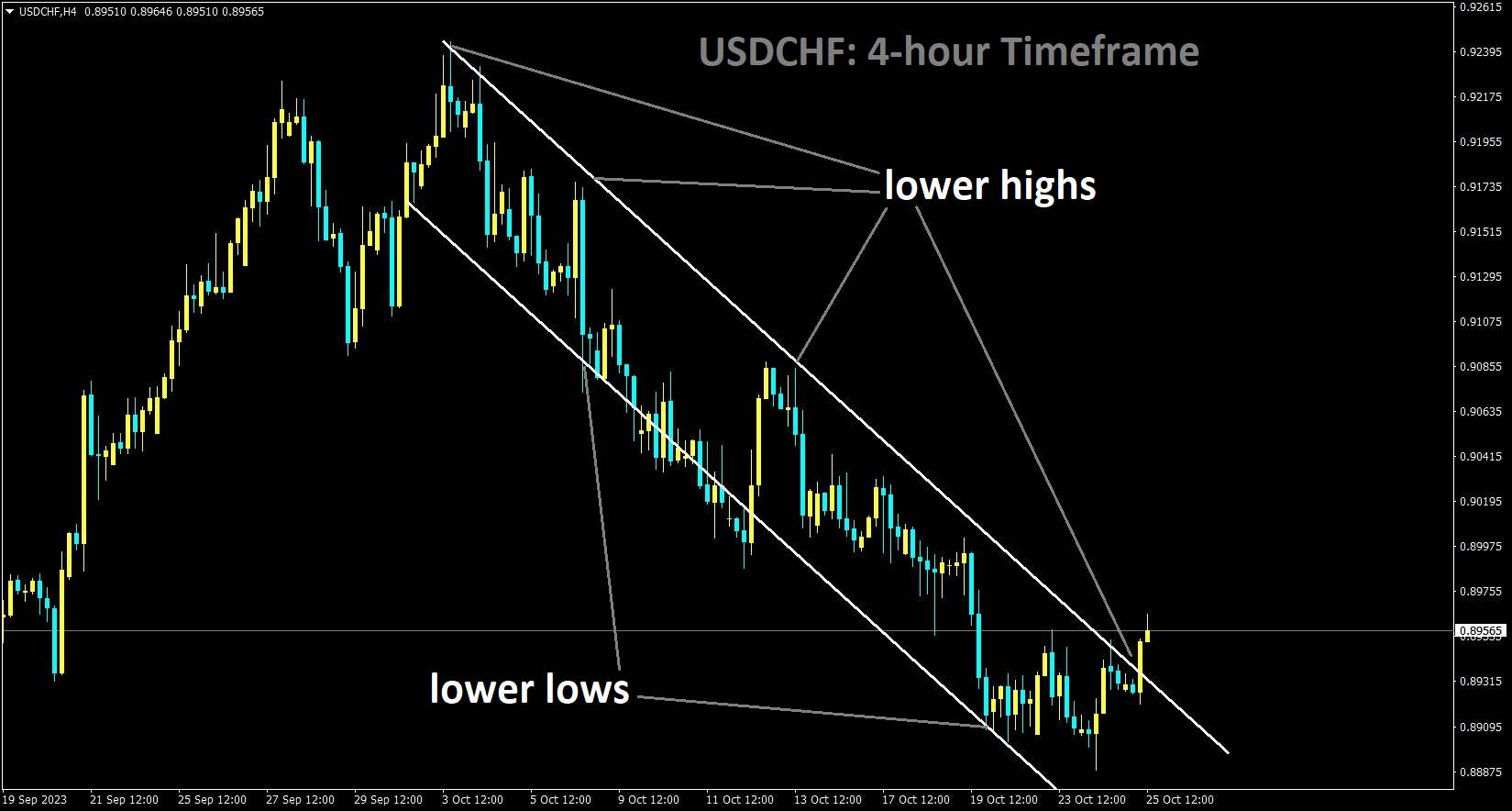

USDCHF Analysis:

USDCHF is moving in Descending channel and market has reached lower high area of the channel

This analysis revolves around the currency pair involving the US Dollar (USD) and the Swiss Franc (CHF). It discusses factors such as geopolitical tensions, economic data, and trade balances that affect the USDCHF exchange rate.

Swiss Franc Strength: The analysis mentions the Swiss Franc’s recent strengthening, which is partly attributed to ongoing global conflicts. The Swiss Franc is considered a safe-haven currency during times of uncertainty.

Geopolitical Tensions: It underscores the influence of geopolitical tensions in the Middle East on the market. Such tensions can drive investors toward safe-haven assets like the Swiss Franc, impacting its value.

US Economic Data: The analysis notes the positive impact of strong US economic data, particularly in manufacturing, on the USDCHF pair. The strength of the US economy can support the US Dollar.

Switzerland’s Trade Surplus: It highlights Switzerland’s widening trade surplus, driven by strong export and import figures. Trade balances can affect a country’s currency value.

Market Sentiment: The analysis acknowledges the role of market sentiment in determining currency movements. Positive developments in the Middle East and China’s economic plans have contributed to optimistic market sentiment.

In summary, the USDCHF Analysis explores how geopolitical events, economic data, trade balances, and market sentiment collectively shape the exchange rate between the US Dollar and Swiss Franc. It emphasizes the Swiss Franc’s role as a safe-haven currency during times of uncertainty.

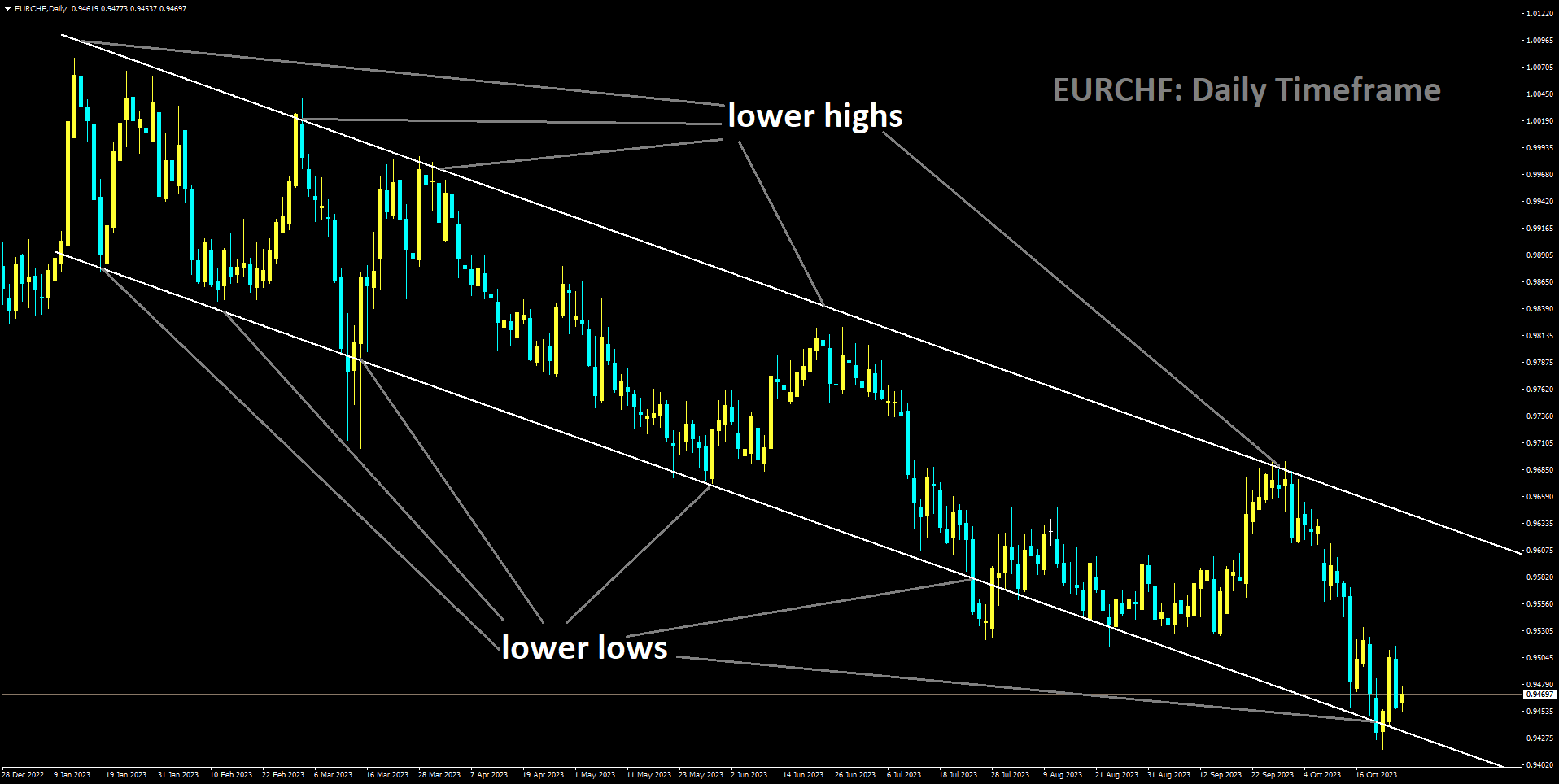

EURCHF Analysis:

EURCHF is moving in Descending channel and market has reached lower low area of the channel

This analysis revolves around the currency pair involving the Euro (EUR) and the Swiss Franc (CHF). It discusses economic data, central bank policies, and potential implications for the EURCHF exchange rate.

German Economic Data: The analysis mentions the decline in Germany’s business activity and Composite PMI data. Weaker economic data in Germany, the largest economy in the Eurozone, can impact the Euro.

European Central Bank (ECB): It anticipates a pause in the ECB’s tightening cycle under the leadership of Christine Lagarde. Central bank policies and communication can influence the Euro’s value.

Impact on Bond Yields: The analysis suggests that economic fragility in the Eurozone could affect regional bond yields. Bond yields are closely monitored by investors and can impact currency movements.

Impact on Bond Yields: The analysis suggests that economic fragility in the Eurozone could affect regional bond yields. Bond yields are closely monitored by investors and can impact currency movements.

Depreciation of the Euro: It notes that if the ECB signals that the pause in tightening is more permanent, it could lead to a significant depreciation of the Euro. The communication from central bank officials is crucial for currency traders.

In summary, the EURCHF Analysis explores the relationship between economic data, central bank policies, and the exchange rate between the Euro and Swiss Franc. It underscores the importance of monitoring central bank statements for potential shifts in currency values.

EURCAD Analysis:

EURCAD is moving in Ascending channel and market has reached higher low area of the channel

The analysis focuses on the currency pair involving the Euro (EUR) and the Canadian Dollar (CAD). It discusses economic indicators, central bank policies, and their impact on the EURCAD exchange rate.

Bank of Canada Meeting: The analysis mentions the Bank of Canada’s upcoming monetary policy meeting and the expectation of unchanged interest rates. Central bank decisions can have a significant impact on a currency’s value.

Economic Indicators: It notes that over the past three months, Canada has experienced declines in GDP, retail sales, and job growth. These economic indicators are closely monitored by traders to gauge a country’s economic health.

Central Bank Communication: The analysis anticipates that the Bank of Canada may express a willingness to consider further tightening of policy to combat inflation. Central bank communication can provide insights into future policy actions.

Central Bank Communication: The analysis anticipates that the Bank of Canada may express a willingness to consider further tightening of policy to combat inflation. Central bank communication can provide insights into future policy actions.

Economic Challenges: It highlights the challenges facing the Canadian economy, including weaker growth and rising inflation. These challenges can influence central bank decisions and currency values.

In summary, the EURCAD Analysis explores how economic indicators, central bank policies, and economic challenges in Canada and Europe collectively affect the exchange rate between the Euro and Canadian Dollar. It emphasizes the importance of central bank communication in currency trading.

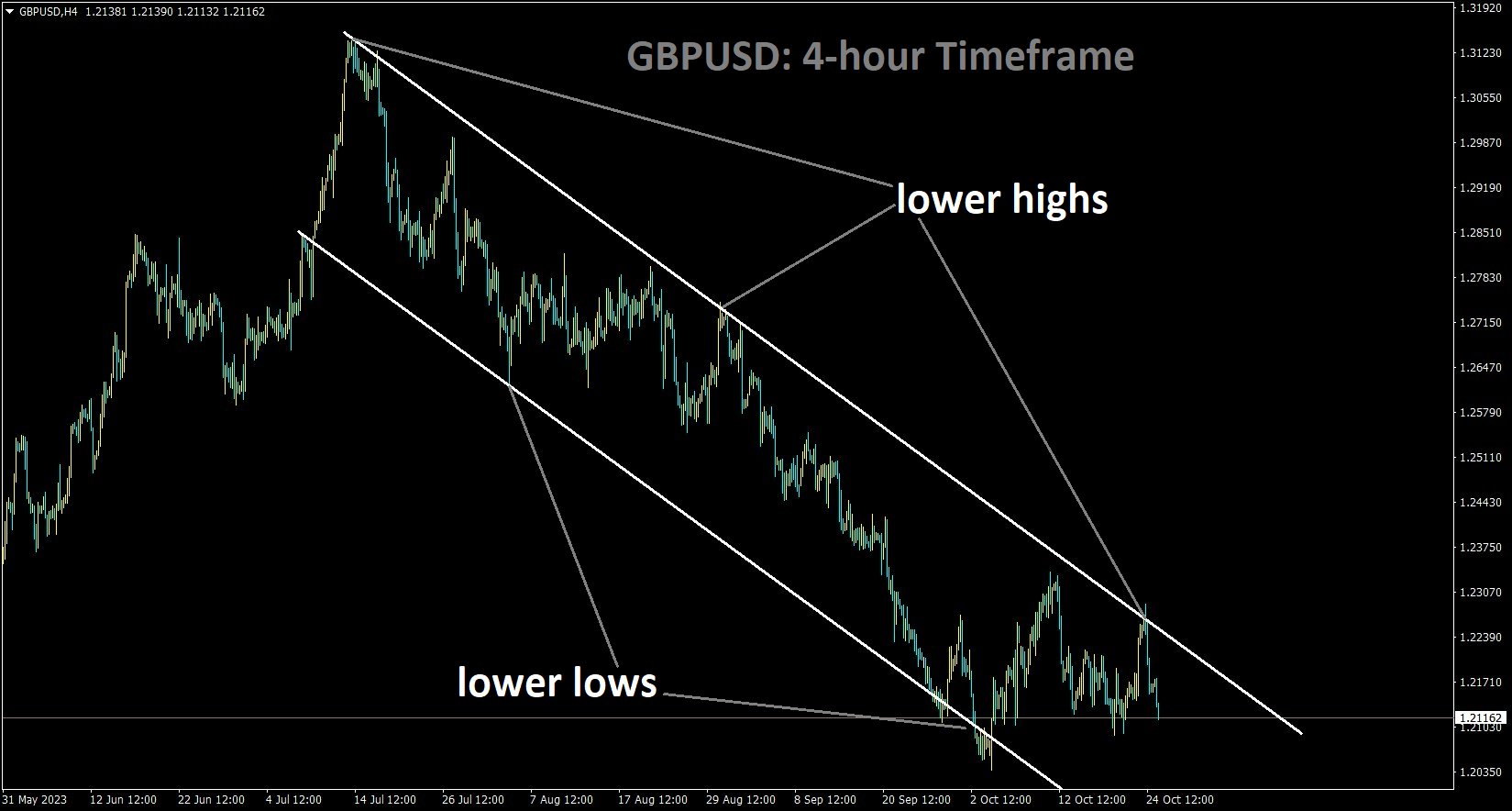

GBPUSD Analysis:

GBPUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel

This analysis centers on the currency pair involving the British Pound (GBP) and the US Dollar (USD). It discusses economic data, central bank policies, and their impact on the GBPUSD exchange rate.

UK PMI Data: The analysis notes that UK PMI data has declined for three consecutive months. This indicates economic challenges in the UK, which can influence the Pound’s value.

US Dollar Resilience: It mentions that despite a rebound in the US Dollar, economic challenges in the UK have held back bullish movements in GBPUSD. The US economy’s resilience, even amid rising interest rates, supports the US Dollar.

US Economic Data: The analysis highlights the positive impact of strong US economic data, including the manufacturing sector’s performance, on the GBPUSD pair. Economic data releases can influence currency movements.

Central Bank Communication: It notes that the focus remains on Fed Chair Jerome Powell’s speech and US inflation data for insights into future interest rate hikes. Central bank communication is closely watched by traders.

In summary, the GBPUSD Analysis explores how economic data, central bank policies, and economic challenges in the UK and US collectively shape the exchange rate between the British Pound and US Dollar. It underscores the importance of central bank communication and economic indicators in currency trading.

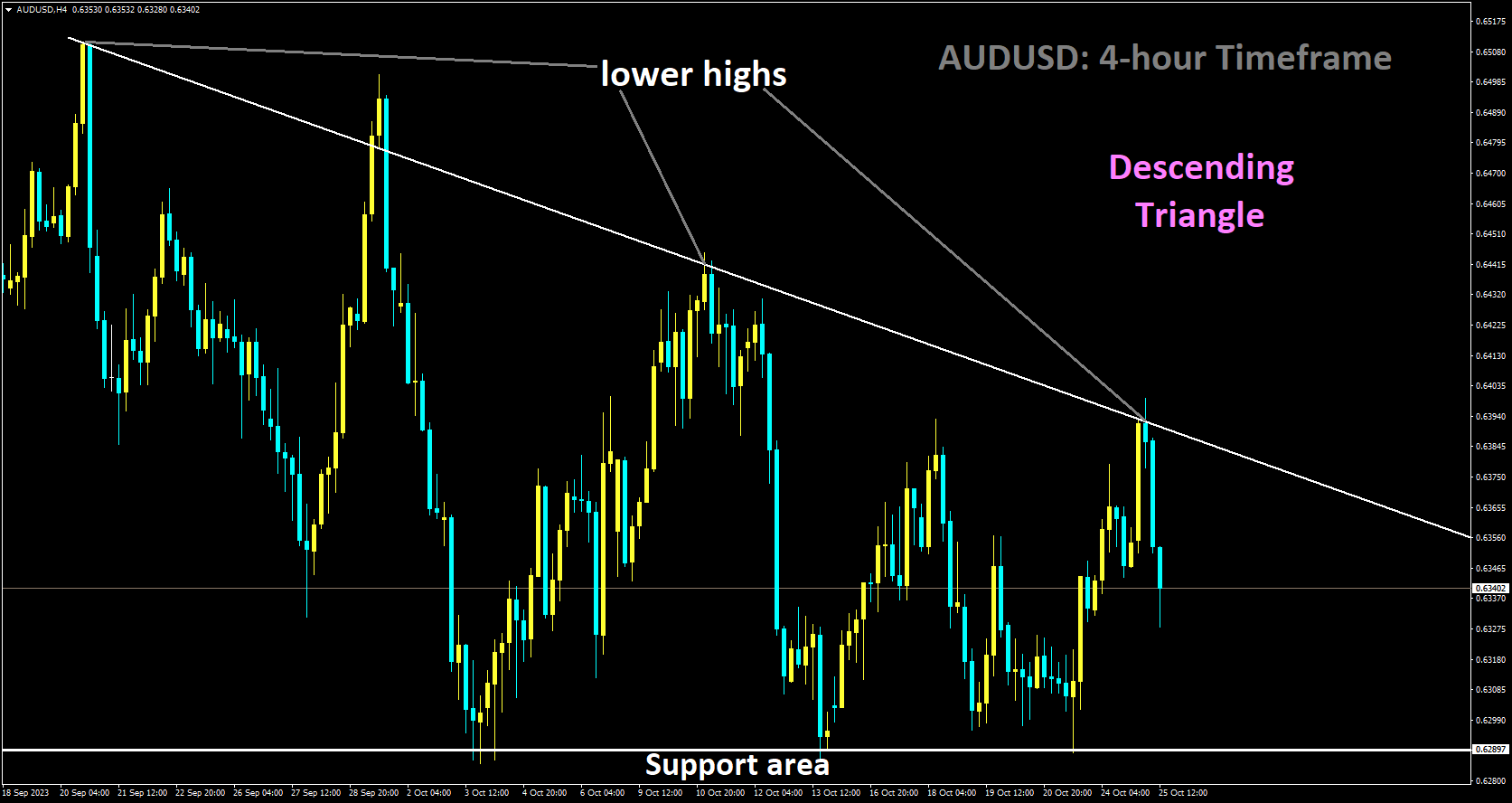

AUDUSD Analysis:

AUDUSD is moving in Descending Triangle and market has fallen from the lower high area of the pattern

This analysis focuses on the currency pair involving the Australian Dollar (AUD) and the US Dollar (USD). It discusses inflation data, central bank statements, and their impact on the AUDUSD exchange rate.

Q3 CPI Data: The analysis highlights the release of Q3 CPI data in Australia, which exceeded expectations at 5.4%. Higher-than-expected inflation can have implications for central bank policies and currency values.

RBA Governor’s Statement: It mentions RBA Governor Michelle Bullock’s statement emphasizing the importance of managing inflation effectively. The suggestion of potential interest rate hikes is a key factor influencing currency movements.

USD and Safe-Haven Status: The analysis notes that the Australian Dollar surged following the CPI data release. It also mentions that despite a decrease in the annual inflation rate, there is a resurgence in inflationary pressures.

Central Bank Commitment: It underscores the Reserve Bank of Australia’s (RBA) commitment to preventing a prolonged deviation from the inflation target. Central bank statements play a crucial role in currency trading.

In summary, the AUDUSD Analysis explores how inflation data, central bank statements, and currency status as a safe-haven asset collectively shape the exchange rate between the Australian Dollar and US Dollar. It highlights the impact of central bank communication on currency values.

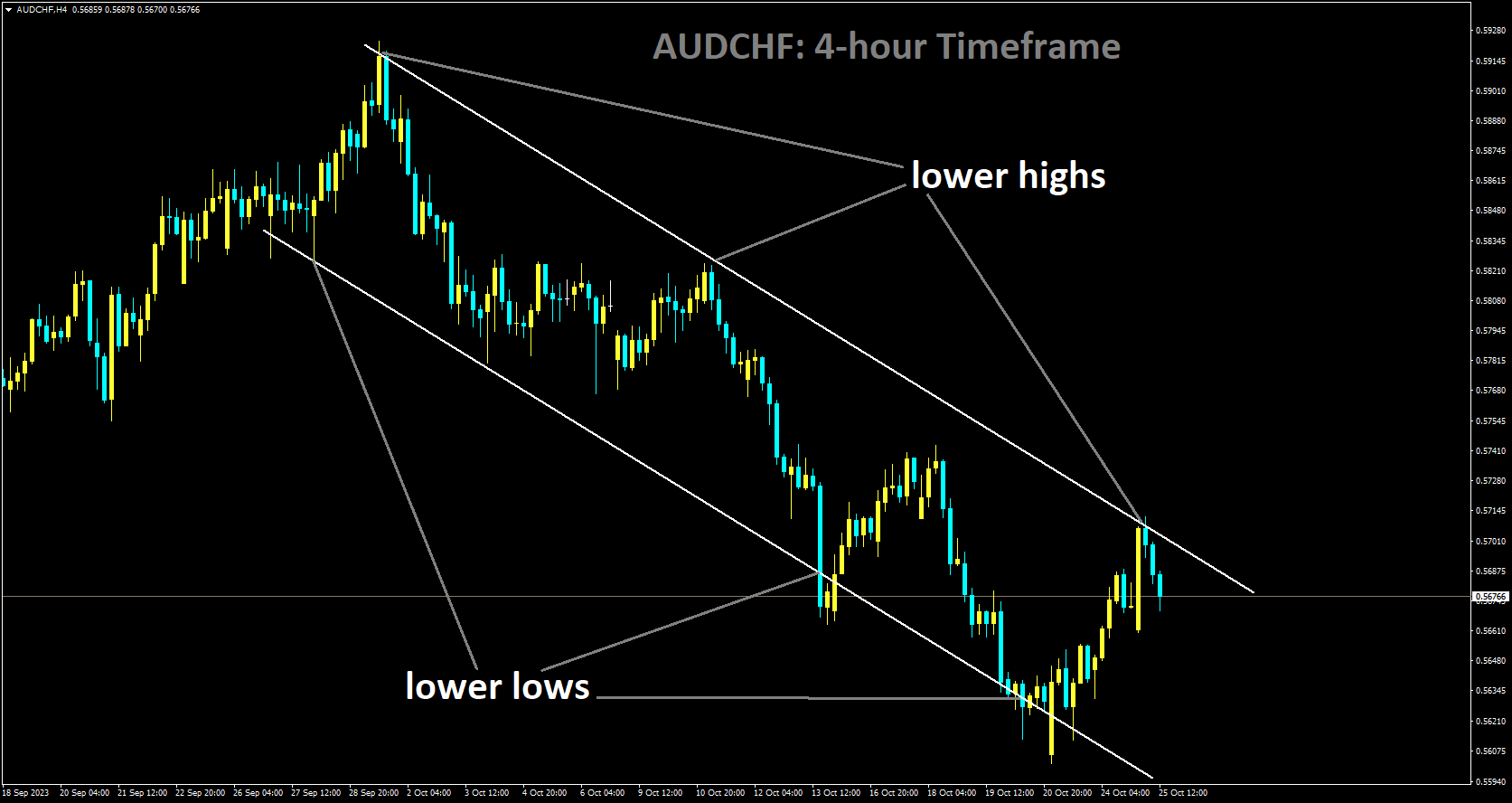

AUDCHF Analysis:

AUDCHF is moving in Descending channel and market has fallen from the lower high area of the channel

This analysis focuses on the currency pair involving the Australian Dollar (AUD) and the Swiss Franc (CHF). It discusses inflation data, geopolitical tensions, and their impact on the AUDCHF exchange rate.

Inflation Data: The analysis highlights the Q3 CPI data in Australia, which exceeded expectations and re-accelerated inflationary pressures. Inflation data can influence central bank policies and currency values.

Geopolitical Tensions: It notes the influence of ongoing global conflicts on market sentiment. Geopolitical tensions can drive investors toward safe-haven currencies like the Swiss Franc, affecting the AUDCHF pair.

RBA’s Response: The analysis mentions RBA officials’ statements about potential tightening to manage inflation. Central bank communication is a key factor in currency trading.

Market Sentiment: It acknowledges the role of market sentiment influenced by various factors, including geopolitical developments and economic plans from countries like China.

In summary, the AUDCHF Analysis explores how inflation data, central bank statements, geopolitical tensions, and market sentiment collectively shape the exchange rate between the Australian Dollar and Swiss Franc. It underscores the importance of staying informed about central bank policies and global events in currency trading.

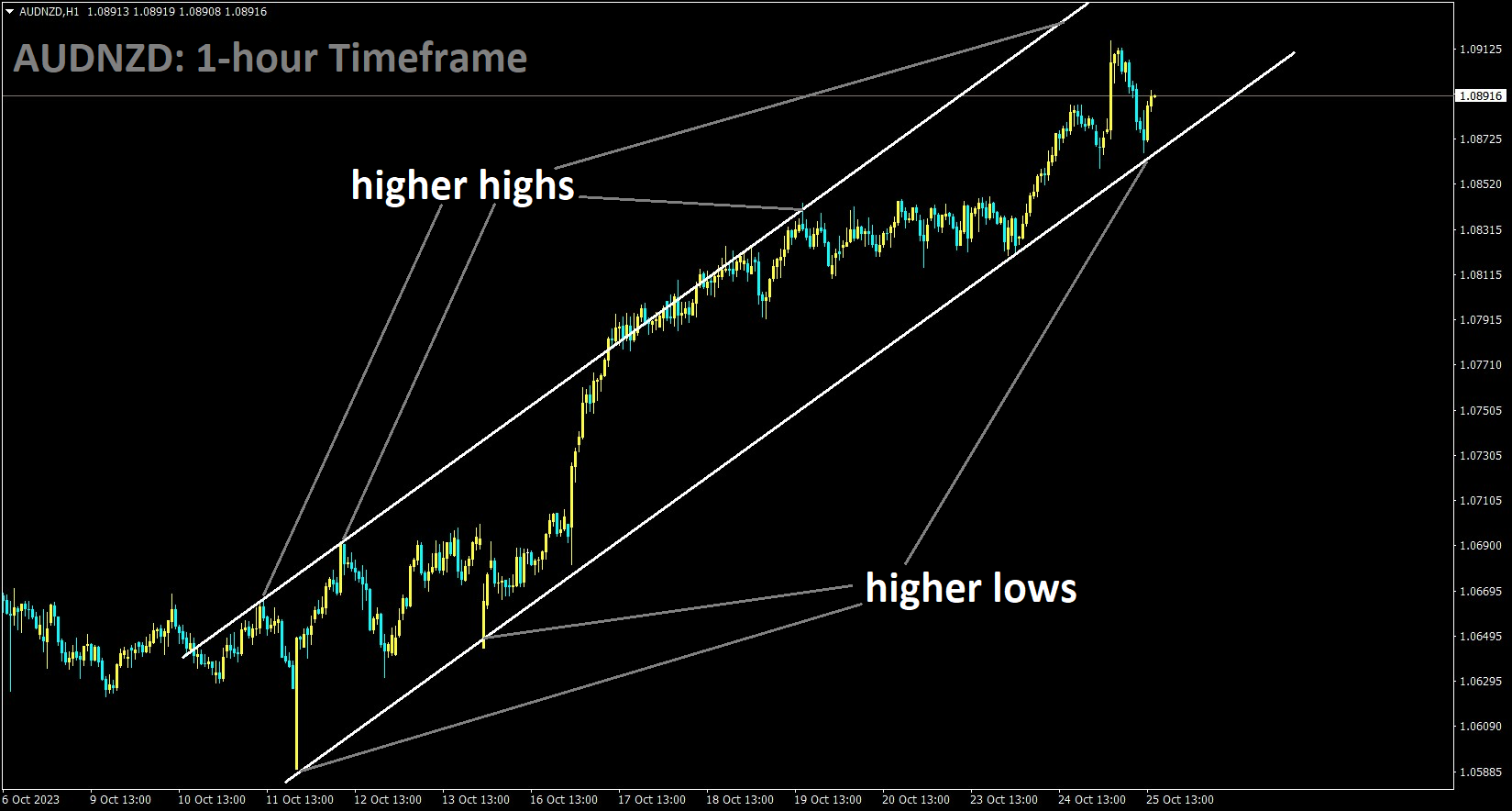

AUDNZD Analysis:

AUDNZD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel

This analysis focuses on the currency pair involving the Australian Dollar (AUD) and the New Zealand Dollar (NZD). It discusses economic data, geopolitical tensions, and their impact on the AUDNZD exchange rate.

US Composite PMI Data: The analysis mentions an increase in US Composite PMI data, which strengthened the US Dollar. Economic data releases can impact currency values.

Easing Tensions: It notes signs of easing tensions in the Israel-Gaza conflict, which supported the New Zealand Dollar. Geopolitical developments can influence market sentiment and currency movements.

Market Sentiment: The analysis highlights various factors contributing to rising market sentiment, including diplomatic efforts in the Middle East and positive developments in US-China economic relations.

In summary, the AUDNZD Analysis explores how economic data, geopolitical developments, and market sentiment collectively shape the exchange rate between the Australian Dollar and New Zealand Dollar. It underscores the importance of monitoring global events and their impact on currencies.

These detailed explanations provide a deeper understanding of the factors influencing the various currency pairs and precious metals discussed in the original analysis. Currency and commodity markets are complex and dynamic, making it crucial for traders and investors to stay informed about a wide range of economic, geopolitical, and central bank-related factors when making trading decisions.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/