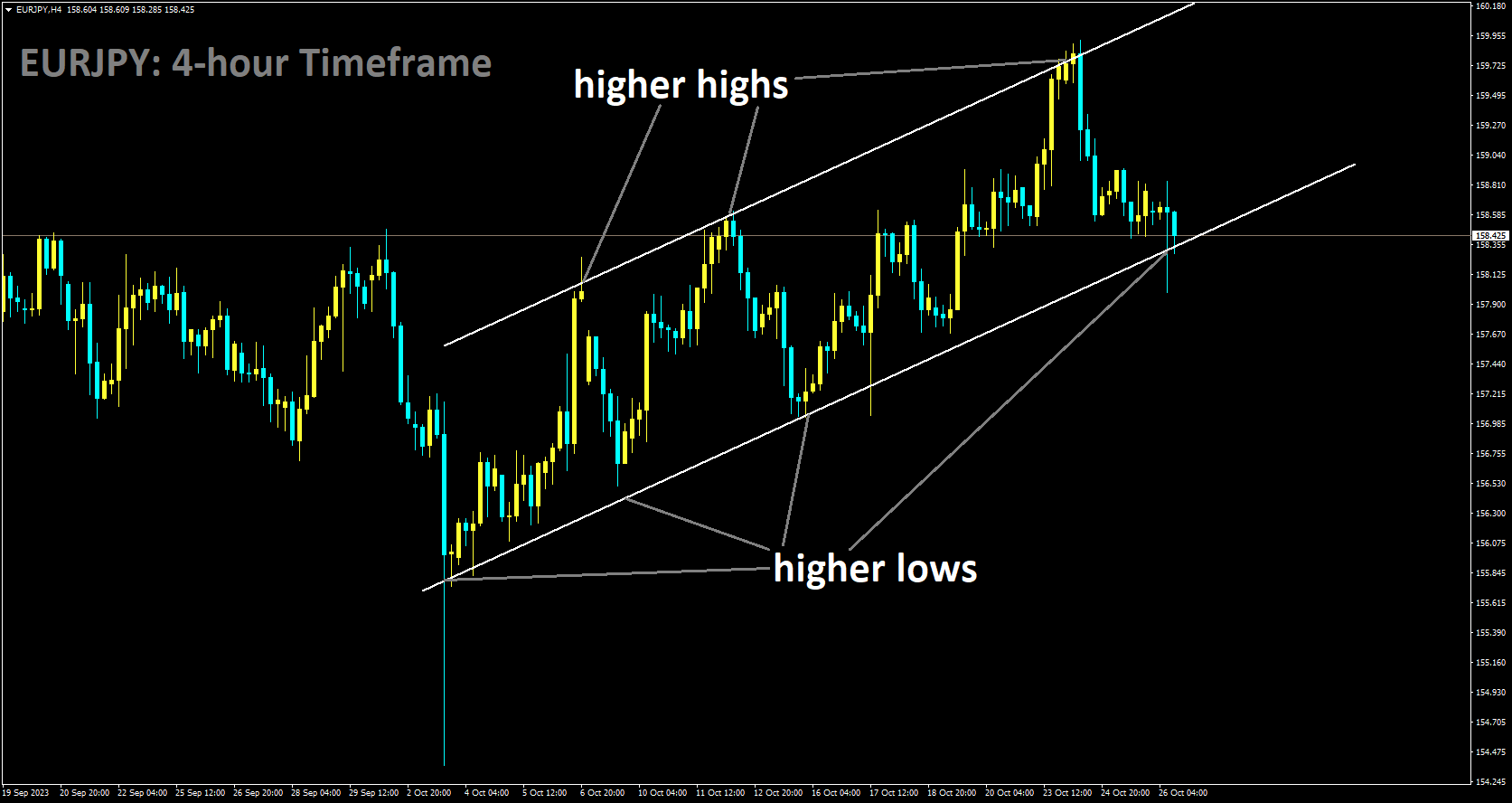

EURJPY Analysis:

EURJPY is moving in Ascending channel and market has reached higher low area of the channel

The Bank of Japan is currently deliberating measures to address the depreciation of the JPY against other currencies. Following an increase in the Yield Curve Control (YCC) rate two months ago, there is widespread anticipation among economists that similar strategies will be implemented to counter the JPY’s weakness in the market.

Japan’s Deputy Chief Cabinet Secretary, Murai Hideki, emphasized that currency movements are primarily driven by fundamental factors. He refrained from providing any definitive responses regarding foreign exchange intervention. He also expressed a preference for avoiding rapid fluctuations in the foreign exchange market and indicated that measures are taken to manage currency control in the market.

The Japanese yen is once again approaching the significant 150 mark against the US dollar as the Bank of Japan prepares for its policy meeting next week. USDJPY is currently in the same range that led to the BOJ’s intervention last year, a possibility that was highlighted back in September. Japanese Finance Minister Shunichi Suzuki emphasized on Thursday that authorities are closely monitoring these developments with a sense of urgency and cautioned investors against selling the yen.

The BOJ’s ultra-easy monetary policy stands in contrast to the approaches of other central banks, which have been rapidly tightening monetary policy in an unprecedented manner to combat inflation, resulting in downward pressure on the yen. As global yields and inflation rates rise, Japanese yields have also climbed, creating pressure on the BOJ to make adjustments to its yield curve control policy, which it uses to manage yields. The Japanese central bank recently made some modifications to the YCC policy to allow for greater flexibility, and further adjustments could be on the table when it convenes next week.

Japan’s Deputy Chief Cabinet Secretary, Murai Hideki, is currently making statements through Reuters, providing verbal intervention as the USDJPY pair continues to rise above the 150.00 level. He stressed the importance of currencies moving steadily in line with fundamental factors and expressed a disapproval of excessive foreign exchange volatility. Hideki refrained from commenting on specific foreign exchange levels and did not provide any remarks regarding currency intervention. He reiterated the commitment to taking fully appropriate actions concerning foreign exchange matters.

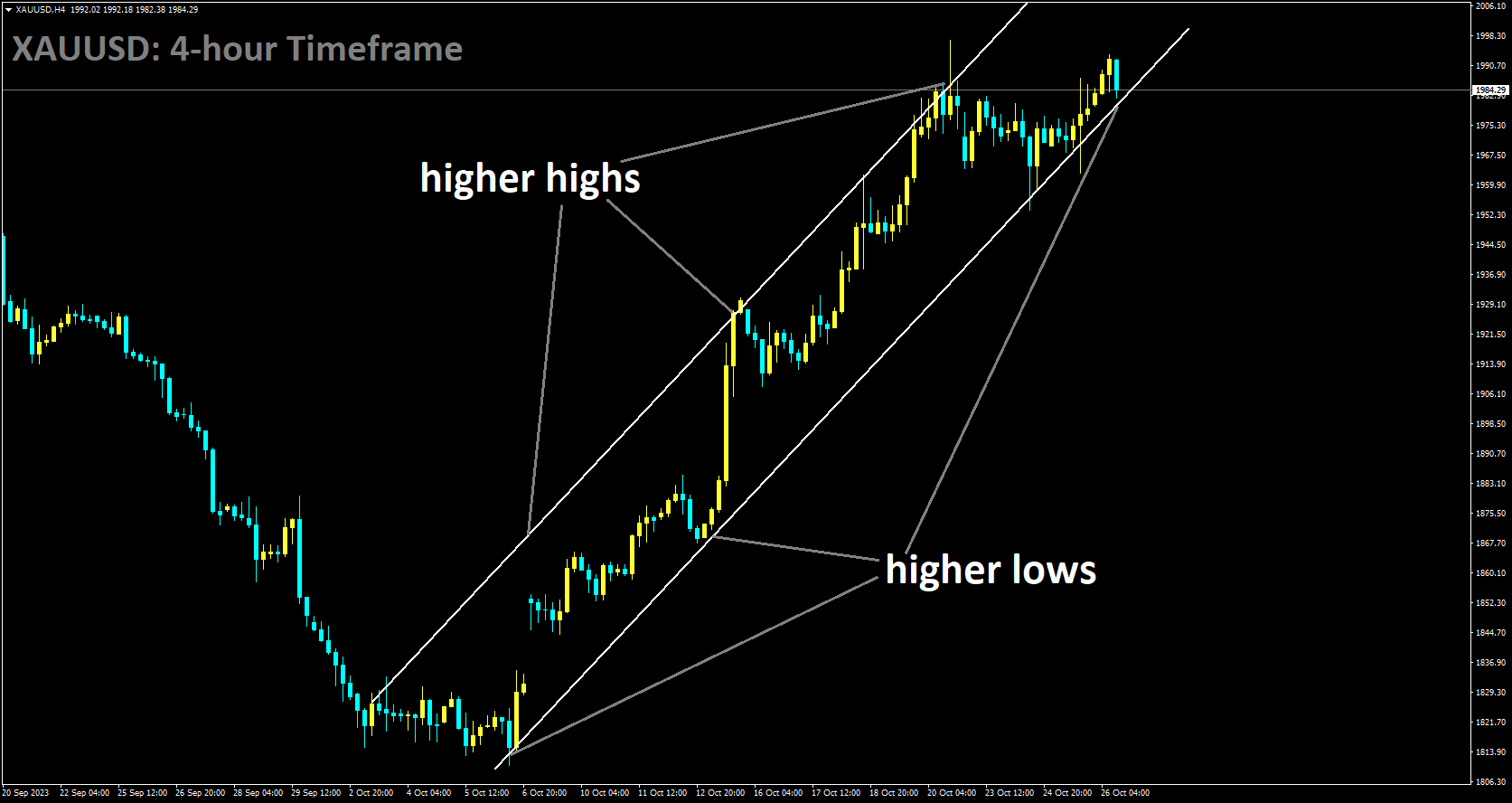

Gold Analysis:

XAUUSD is moving in Ascending channel and market has reached higher low area of the channel

In recent developments, Israel’s Prime Minister has made a significant announcement regarding an imminent ground invasion in Gaza. This declaration is poised to have substantial repercussions in the gold market, as it is expected to ignite increased demand among gold buyers, consequently causing prices to surge. Additionally, today marks the release of the Q3 GDP data, which is anticipated to influence gold prices based on the market’s response.

Over the past two days, the XAUUSD (Gold price) has exhibited a persistent upward trend during the early European session, holding steadfastly near its weekly peak. The precious metal remains tantalizingly close to its highest level since May 16, a pinnacle it reached just last Friday. This sustained strength can be attributed to heightened safe-haven demand driven by mounting concerns over the escalating conflict in Israel. Notably, despite the surge in US Treasury bond yields due to hawkish Federal Reserve (Fed) expectations, which have pushed the US Dollar (USD) to a three-week high, gold has managed to retain its support.

In the immediate future, investors are closely monitoring key economic releases from the United States, seeking insights into the Fed’s prospective interest rate policies, which will significantly impact the short-term trajectory of gold prices. The US economic calendar for Thursday encompasses pivotal data such as the Advance Q3 GDP figures, Durable Goods Orders, the customary Weekly Initial Jobless Claims, and Pending Home Sales data. Furthermore, a scheduled address by Fed Governor Christopher Waller and developments in US bond yields may influence USD price dynamics, generating short-term trading opportunities for XAUUSD traders.

Remarkably, despite the ascent of US Treasury bond yields and renewed interest in the US Dollar, geopolitical concerns remain a bulwark supporting gold prices. The intensified military actions by Israel in Gaza, coupled with the specter of a ground invasion, have elevated the risk of broader instability in the Middle East. International endeavors to de-escalate the conflict between Israel and Palestinian militant groups persist. Moreover, the anticipation of a hawkish stance by the Federal Reserve has contributed to the 10-year US Treasury yield hovering near a 16-year high, flirting with the 5% threshold breached earlier this week. Notably, XAUUSD bulls have exhibited resilience, even in the face of the US Dollar’s recent robust recovery from a one-month low experienced on Tuesday.

In terms of market expectations, preliminary estimates for US GDP in Q3 suggest an annualized expansion of 4.2%, in contrast to the 2.1% growth witnessed in Q2. The spotlight will then shift to the US PCE Price Index, which is expected to provide substantive insights ahead of the forthcoming FOMC meeting next week.

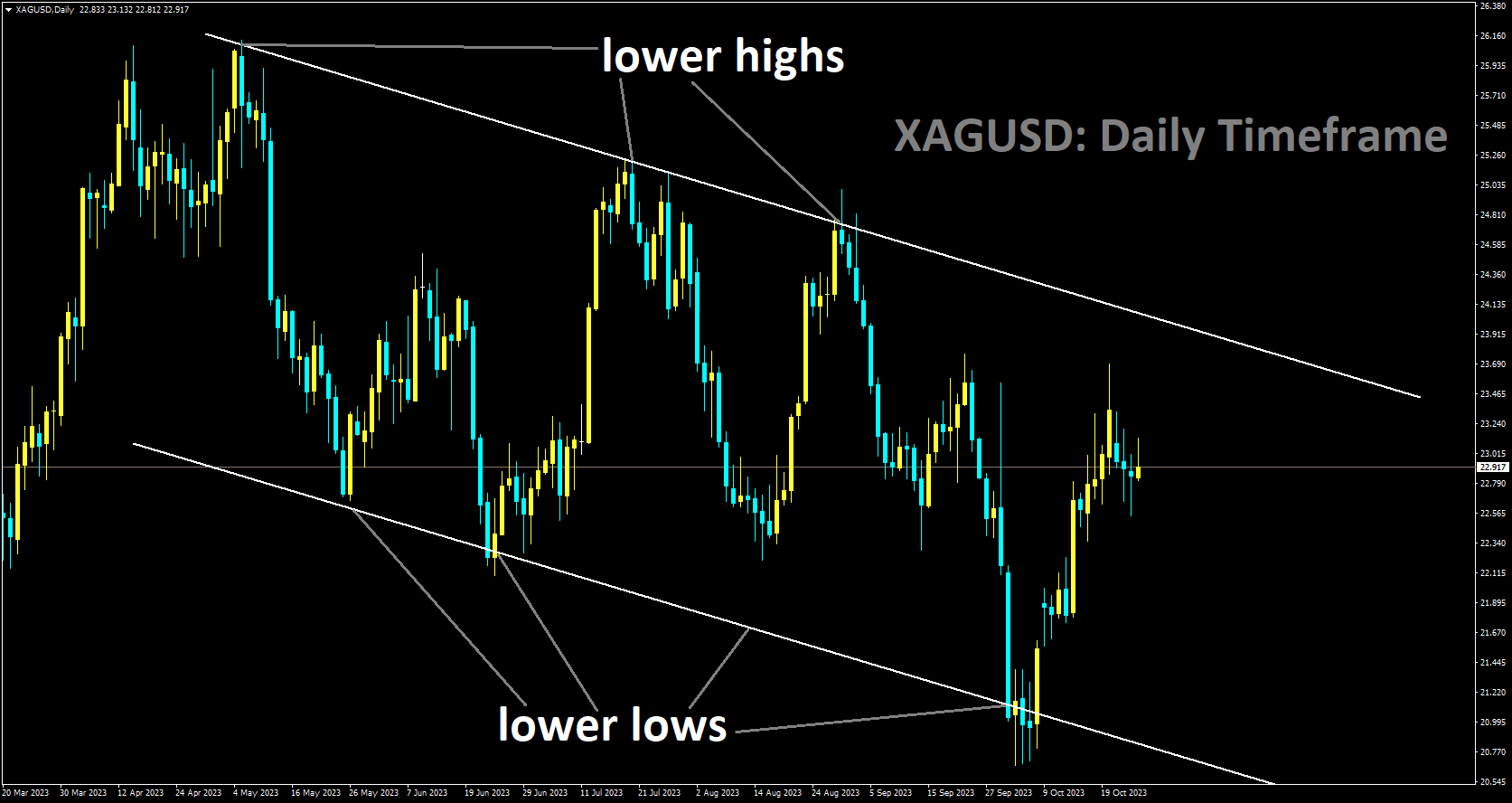

Silver Analysis:

XAGUSD is moving in Descending channel and market has rebounded from the lower low area of the channel

The US Dollar is currently asserting its dominance in the market, propelled both by the ongoing Israel conflict and strengthened domestic economic data.

On the previous day, the US Dollar, as gauged by the US Dollar Index, sustained its upward trajectory, surpassing the 20-day Simple Moving Average and attaining a six-day high at 106.52. This upswing in the Greenback’s strength can be ascribed to the resurgence in US yields and favorable housing market data, which have bolstered demand for the currency.

Market focus remains firmly entrenched in the economic landscape of the United States, with investors eagerly awaiting data releases that will help shape their expectations regarding the future decisions of the Federal Reserve. Presently, the prevailing consensus is that the central bank is unlikely to implement any additional interest rate hikes in 2023. Nevertheless, preliminary estimates for Gross Domestic Product (GDP) in Q3, set for release on Thursday, and Personal Consumption Expenditures (PCE) figures for September, scheduled for Friday, possess the potential to reshape these expectations.

The DXY index has made a noteworthy advance toward the 106.50 level, eclipsing the 20-day Simple Moving Average (SMA). Encouragingly, the US Census Bureau reported that New Home Sales in September exceeded expectations. The headline figure indicated 0.759 million new home sales, surpassing the consensus estimate of 0.68 million and demonstrating an increase from the previous reading of 0.676 million. Furthermore, both the 5-year and 10-year US Treasury yields experienced significant upward movements, reaching 4.91% and 4.95%, respectively.

The DXY index has made a noteworthy advance toward the 106.50 level, eclipsing the 20-day Simple Moving Average (SMA). Encouragingly, the US Census Bureau reported that New Home Sales in September exceeded expectations. The headline figure indicated 0.759 million new home sales, surpassing the consensus estimate of 0.68 million and demonstrating an increase from the previous reading of 0.676 million. Furthermore, both the 5-year and 10-year US Treasury yields experienced significant upward movements, reaching 4.91% and 4.95%, respectively.

Market attention has now shifted to high-impact data releases scheduled for Thursday and Friday. The US Q3 GDP growth is anticipated to have accelerated, while PCE inflation is expected to have moderated in September. According to the CME FedWatch Tool, the likelihood of a 25 basis point rate hike in December remains relatively low, at around 25%. Additionally, the tool suggests that a pause in November is nearly priced into the market.

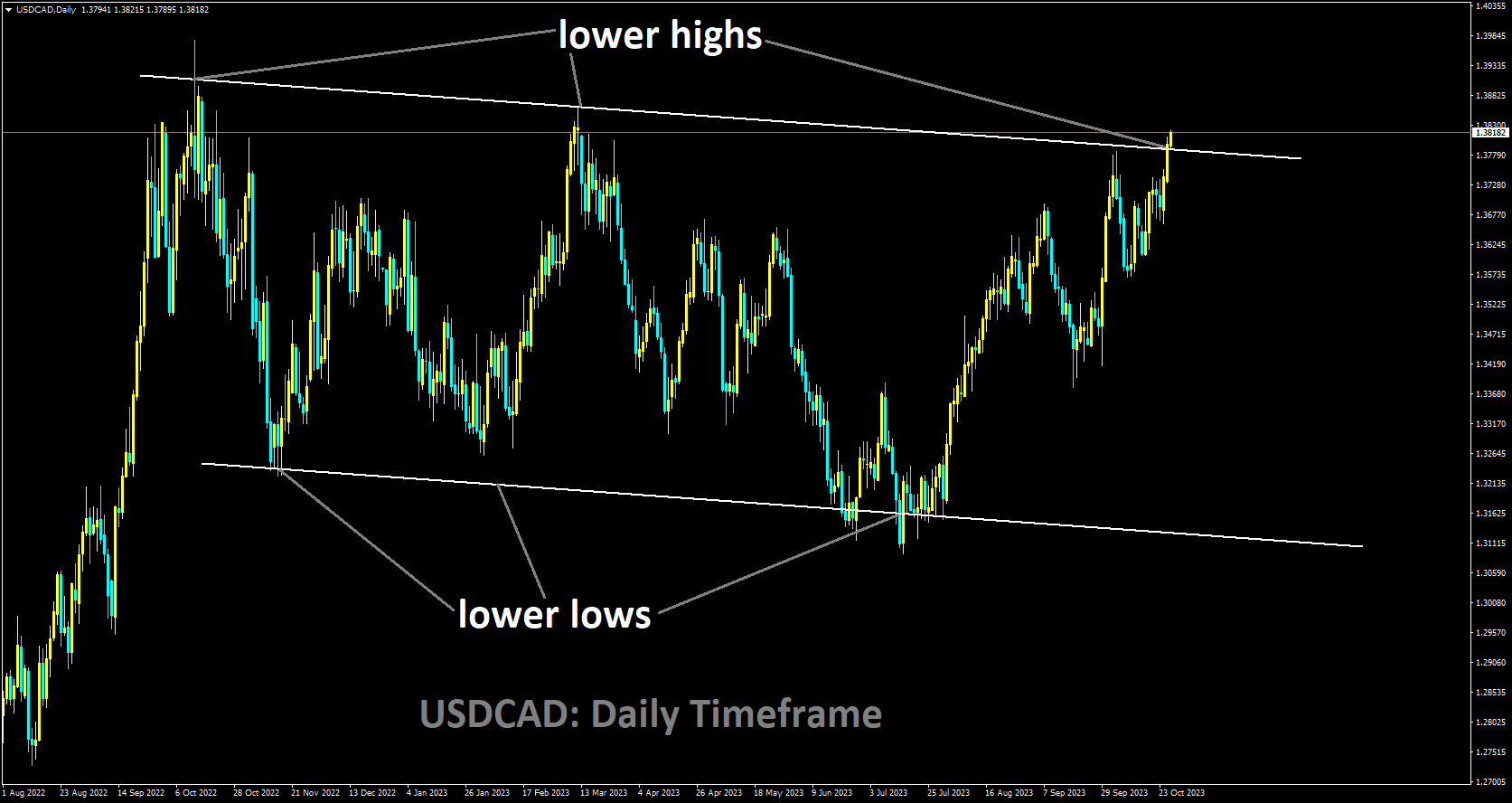

USDCAD Analysis:

USDCAD is moving in Descending channel and market has reached lower high area of the channel

The Bank of Canada has just announced its decision to maintain the interest rate at 5.00%, aligning precisely with the widely anticipated predictions from the previous day. As a result of this announcement, the Canadian Dollar has depreciated against its counterpart currencies.

The conclusion of the October monetary policy meeting by the Bank of Canada, led by Tiff Macklem, has reaffirmed the central bank’s decision to keep its benchmark interest rate steady at 5.0% for the second consecutive month. This decision to maintain the status quo had been widely expected.

In their official statement, the Bank of Canada acknowledged that previous rate hikes have exerted a dampening effect on economic activity and have contributed to a slowdown in inflation. They emphasized that both consumer spending and business investment are displaying signs of weakening. Additionally, policymakers observed that supply and demand in the economy are gradually moving toward a more balanced state, indicating the gradual closure of the output gap. Although theoretically expected to alleviate future price pressures, it may take some time for these effects to materialize.

With respect to forward guidance, the central bank has maintained a hawkish stance, emphasizing its readiness to implement further interest rate increases, especially in light of the slow progress towards achieving price stability and the presence of inflationary risks. Despite this tone in the communication, many traders harbor skepticism regarding the possibility of additional monetary tightening in the near future. They believe that policymakers may prioritize economic growth over the fight against inflation in the long run. The notable downward revisions in GDP forecasts for 2023 and 2024 have reinforced this viewpoint, increasing the likelihood of a more cautious approach by the central bank.

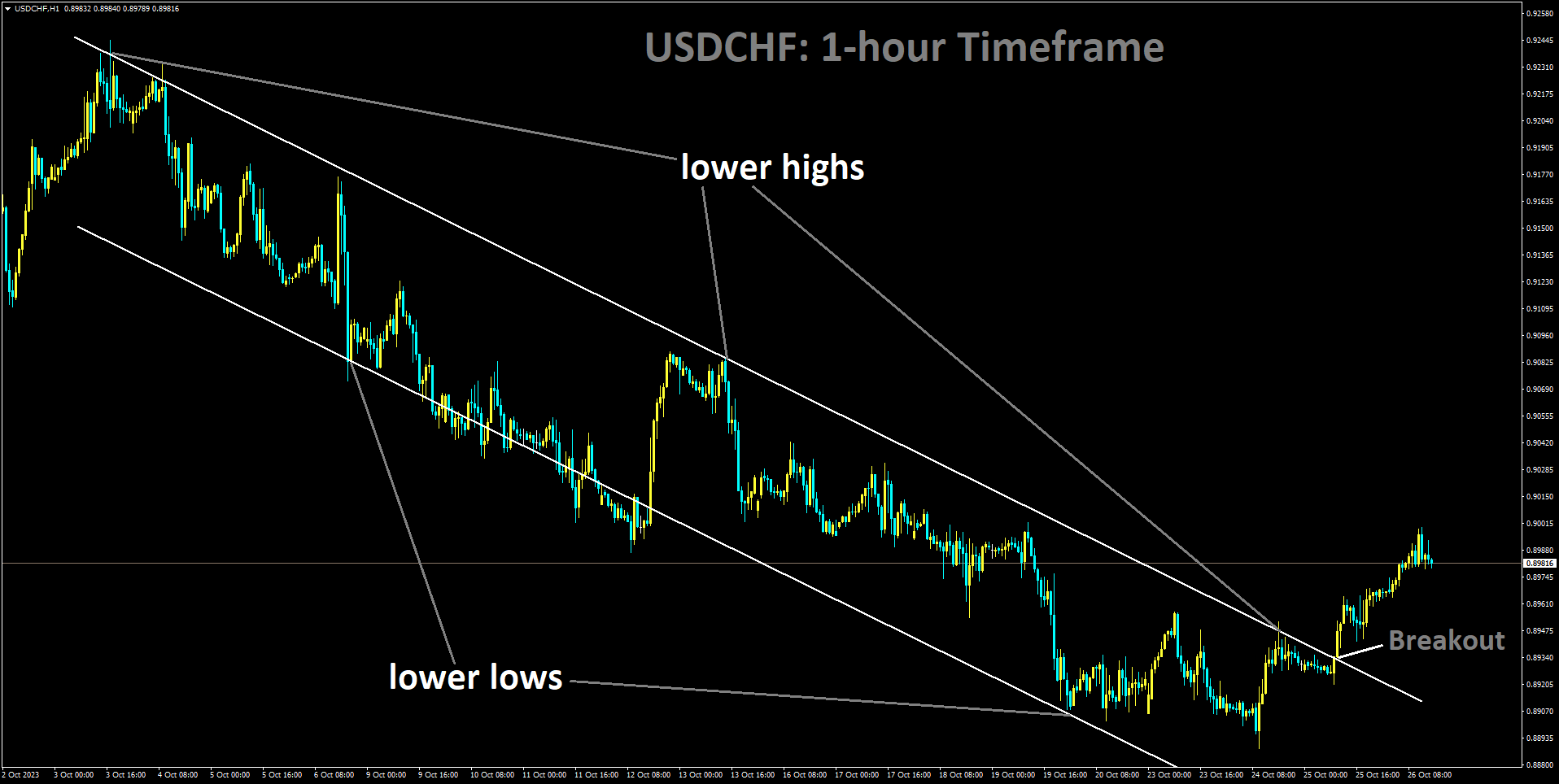

USDCHF Analysis:

USDCHF has broken Descending channel in upside

The ZEW Survey for the Swiss region has witnessed a sharp decline to -37, indicating a pessimistic outlook for the Swiss economy. Consequently, this has led to a slight weakening of the Swiss Franc against other currencies.

Regarding the USD, the currency has benefited from favorable Housing Market data and higher US yields, resulting in increased demand for the greenback. Conversely, weak expectations data from Switzerland appears to be exerting downward pressure on the CHF. In line with this, the US Census Bureau has reported that New Home Sales for September met expectations, with the headline figure coming in at 0.759 million, surpassing the consensus of 0.68 million and showing an increase compared to the previous reading of 0.676 million. Furthermore, both the 5-year and 10-year Treasury bond yields have seen significant upward movements, rising by over 1%, reaching 4.91% and 4.95%, respectively. These developments are contributing to heightened interest in the USD.

However, it’s worth noting that hawkish expectations for the Federal Reserve’s actions for the remainder of 2023 remain subdued, limiting the upside potential for US interest rates in the short term.

Looking ahead, the preliminary Gross Domestic Product (GDP) estimates for Q3 on Thursday and the Personal Consumption Expenditures figures for September on Friday will provide investors with additional insights into the US economy, potentially influencing expectations regarding the Fed’s future decisions. Conversely, in Switzerland, the ZEW Expectations survey for October has dropped to -37, in line with expectations, reflecting a pessimistic outlook for the Swiss economy, which appears to be weighing on the CHF.

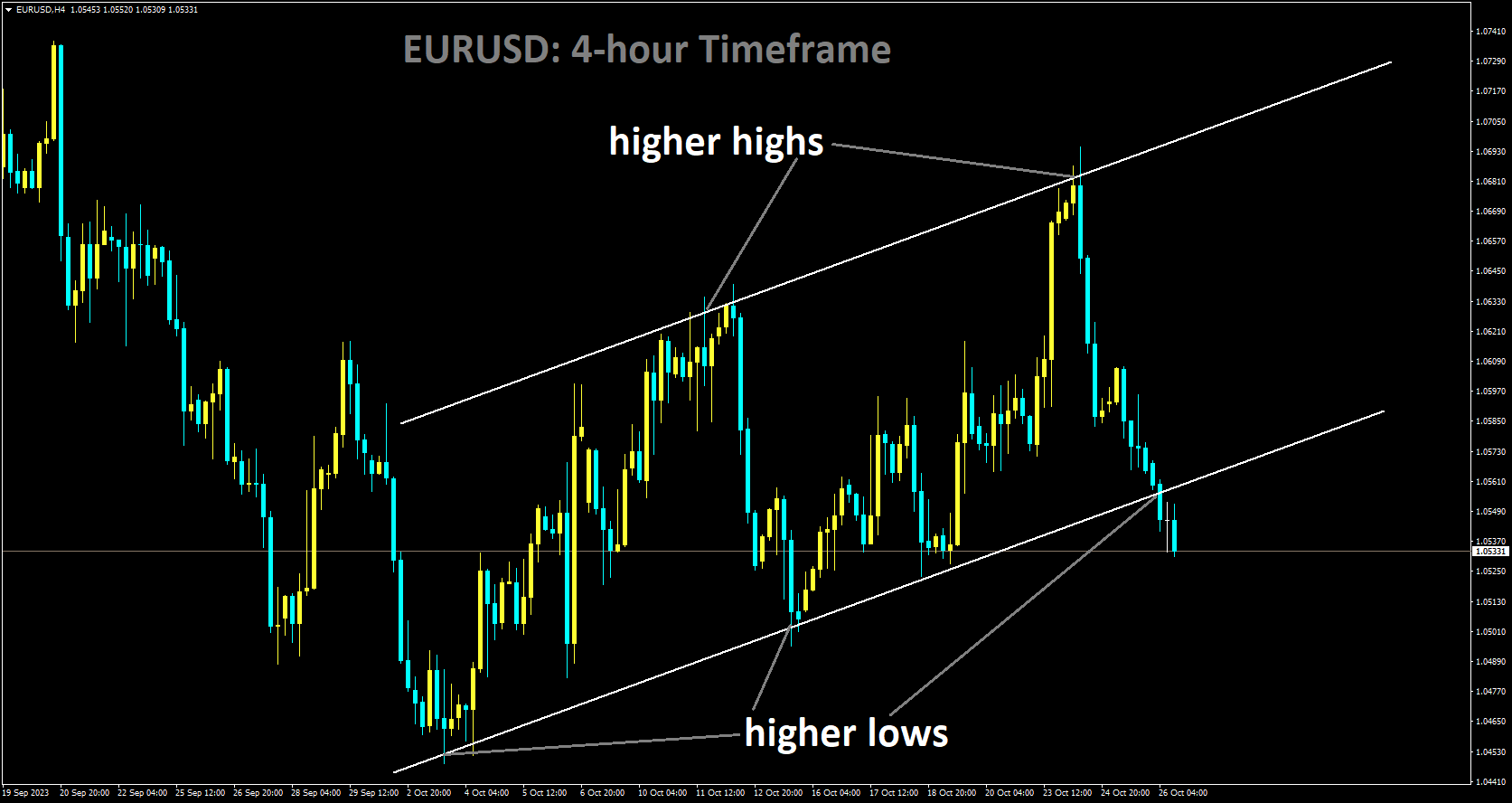

EURUSD Analysis:

EURUSD is moving in Ascending channel and market has reached higher low area of the channel

Today marks the European Central Bank (ECB) convening for its interest rate meeting, and it is widely anticipated that they will maintain the current interest rate. This expectation is rooted in the fact that the Consumer Price Index (CPI) data for September indicated a cooling down to 4.3%, a more substantial drop than initially projected. Consequently, analysts are predicting that the ECB will opt to keep the interest rate unchanged.

After ten consecutive meetings and a remarkable increase of 450 basis points in interest rates over less than two years, the European Central Bank (ECB) is poised to maintain its current borrowing costs on Thursday. The official announcement will be made during ECB President Christine Lagarde’s press conference. It’s important to note that there will be no release of updated staff projections during this meeting.

EURUSD is currently hovering near its lowest level of the week, around 1.0550. This decline is attributed to risk aversion driven by tensions in the Middle East and surging yields of US Treasury bonds. The yield on the benchmark 10-year US Treasury bond is once again approaching the 5.0% mark. In a televised statement late on Wednesday, Israeli Prime Minister Benjamin Netanyahu announced preparations for a ground invasion of Gaza.

US S&P 500 futures are trading with notable losses, reflecting a global flight to safety. Germany’s IFO Business Climate Index for October exceeded expectations by registering a reading of 86.9 on Wednesday, surpassing the market’s forecast of 85.9. This marked the first monthly increase following five consecutive declines. Conversely, on Tuesday, HCOB’s flash Eurozone Composite Purchasing Managers’ Index, compiled by S&P Global, declined to 46.5 in October from September’s 47.2, reaching its lowest point since November 2020.

The upcoming ECB event is expected to inject fresh directional momentum into the EURUSD pair, with market attention shifting to next week’s Federal Reserve policy announcements.

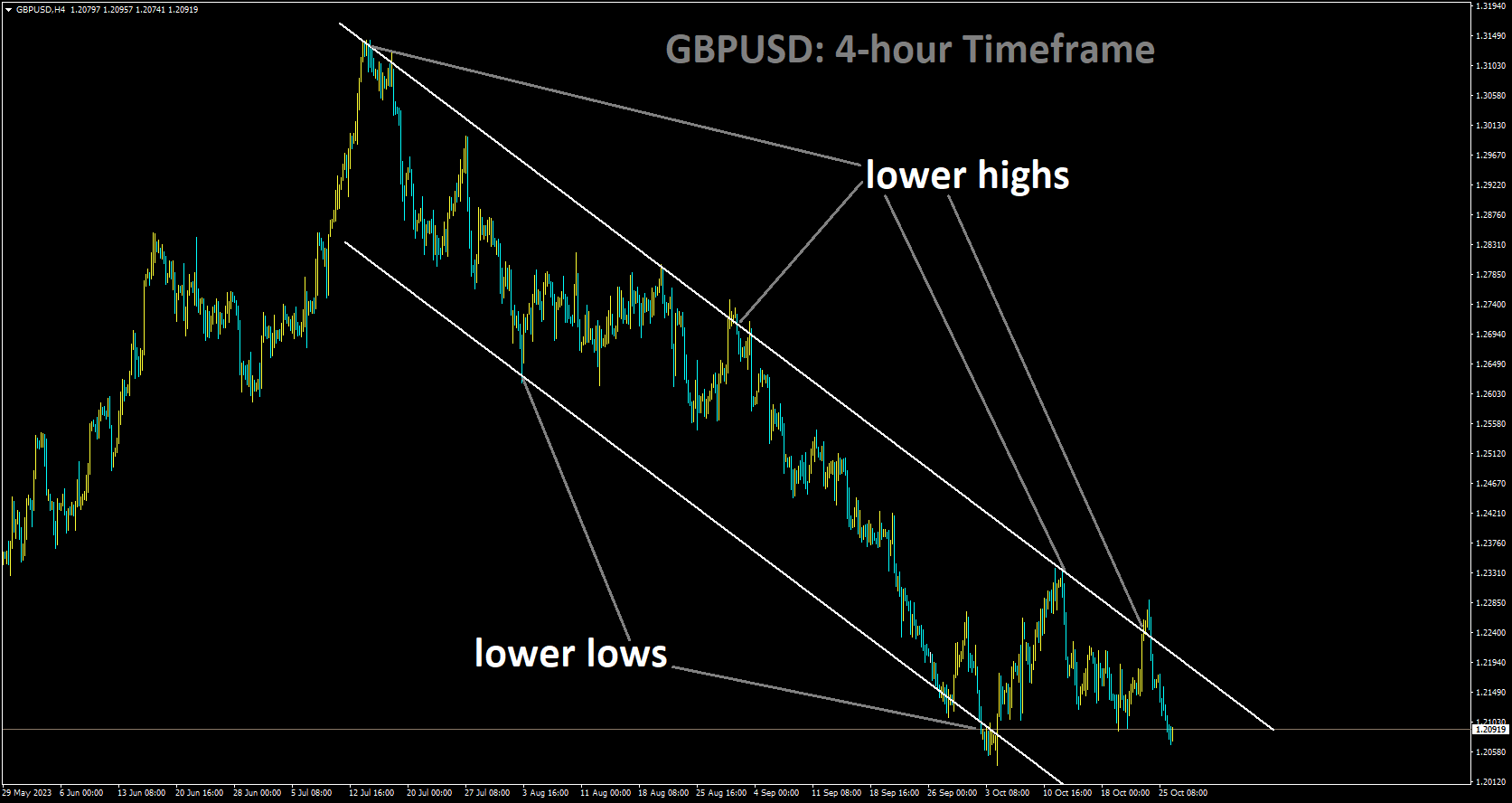

GBPUSD Analysis:

GBPUSD is moving in Descending channel and market has fallen from the lower high area of the channel

The GBP has displayed weakness against other currencies this week, and this trend is expected to persist as the market anticipates further signs of weakness in the US Q3 GDP data. Economists widely anticipate that the Bank of England will maintain the current interest rate at its November 02 meeting. The cooling down of business and labor data, along with the prospect of additional rate hikes, has contributed to economic challenges in the UK.

The GBPUSD pair is experiencing a continued decline this week, extending its retracement slide from around the 1.2300 level. For the third consecutive day, it remains under selling pressure on Thursday. The pair has dipped below the key 1.2100 round figure, reaching a three-week low during the Asian session. This downward trend is driven by sustained buying interest in the US Dollar.

The prevailing sentiment in the market suggests a growing belief that the Federal Reserve will maintain its hawkish stance. This belief is contributing to the persistence of elevated US Treasury bond yields, providing support for the US Dollar. Market expectations still include the possibility of another Fed rate hike before the end of the year. As a result, the yield on the benchmark 10-year US government bond is holding steady, close to a 16-year peak, hovering around the psychologically significant 5% mark that was reached earlier this week. Additionally, a generally weaker risk sentiment is benefiting the safe-haven status of the US Dollar, which, in turn, is exerting pressure on the GBPUSD pair.

On the other hand, the British Pound is burdened by the anticipation that the Bank of England (BoE) will maintain its interest rates at a 15-year high of 5.25% during its meeting on November 2 due to looming recession risks. This expectation was reinforced by softer labor market data and flash PMI figures in the UK, which provide the BoE with justification to keep rates unchanged. This adds to the bearish sentiment surrounding the GBPUSD pair and supports the potential for further near-term depreciation.

In the absence of significant economic releases from the UK, traders are turning their attention to US macroeconomic data for potential market-moving catalysts. Thursday’s US economic calendar includes the release of the initial estimate (Advance) of US GDP for Q3, as well as Durable Goods Orders, scheduled for later in the early North American session. These releases, along with a scheduled speech by Fed Governor Christopher Waller and developments in US bond yields, are expected to influence the direction of the US Dollar.

Furthermore, the post-ECB market volatility is likely to generate short-term trading opportunities in the GBPUSD pair. However, the overall fundamental backdrop favors bearish sentiment and suggests that the path of least resistance for spot prices remains to the downside.

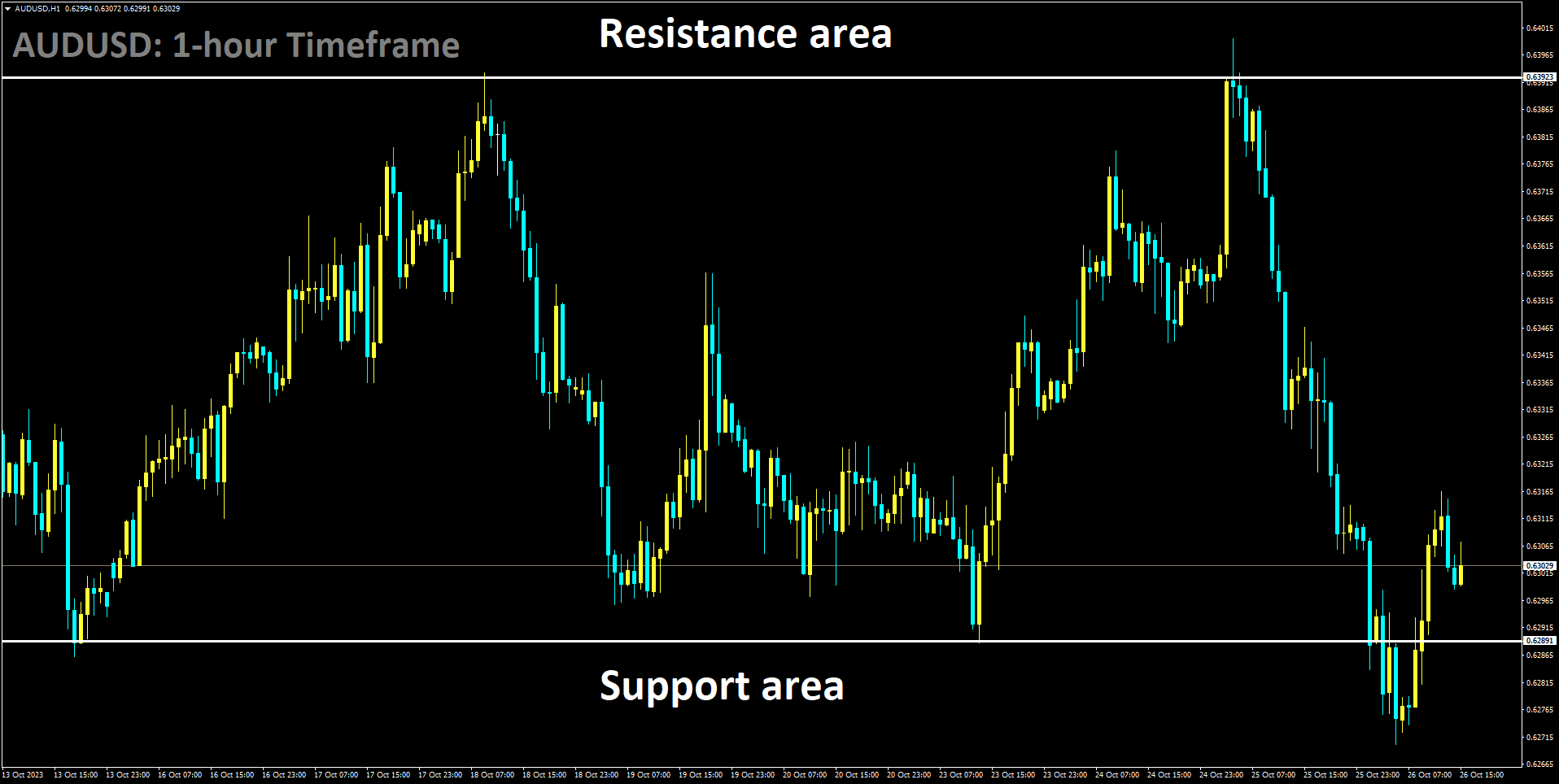

AUDUSD Analysis:

AUDUSD is moving in box pattern and market has rebounded from the support area of the pattern

The Australian Dollar has faced significant downward pressure recently, largely driven by an uptick in Australian Consumer Price Index (CPI) data reported in the last . quarterly reading released yesterday. In response to this CPI increase, the Reserve Bank of Australia (RBA) Governor indicated that a potential interest rate hike is under consideration to manage the CPI figures. However, surprisingly, the Australian Dollar moved lower following this announcement.

The Australian Dollar is continuing its decline for the second consecutive session, trading at levels close to its yearly lows against the US Dollar on Thursday. The weakness in the AUDUSD pair can be attributed to the strength of the US Dollar, which is supported by rising US Treasury yields.

The recent inflation data from Australia has raised the possibility of a 25 basis point interest rate hike by the Reserve Bank of Australia (RBA) at its upcoming November meeting. The Australian Bureau of Statistics reported that the Consumer Price Index (CPI) experienced an increase in the third quarter of 2023. RBA Governor Michele Bullock confirmed on Thursday that the CPI had indeed ticked slightly higher, slightly exceeding expectations but remaining comfortably within the anticipated range. Bullock emphasized the RBA’s careful approach, aiming to manage the pace of the economy without triggering a recession.

Meanwhile, the US Dollar Index (DXY) continues its winning streak, supported by robust US Treasury yields and more favorable preliminary S&P Global PMI figures from the United States released on Tuesday. Additionally, geopolitical uncertainties are fueling demand for safe-haven assets. Israeli Prime Minister Benjamin Netanyahu announced the readiness for a ground assault in Gaza, with the timing of the invasion yet to be determined through consensus. Moreover, Iranian Foreign Minister Hossein Amir-Abdollahian has arrived in the USA for talks regarding the situation in Israel, as reported by Iranian media.

In economic data, Australia’s Consumer Price Index (CPI) for the third quarter of 2023 reached 1.2%, surpassing the 0.8% increase seen in the previous quarter and exceeding the market consensus of 1.1% for the same period. However, Australia’s S&P Global Composite PMI for October declined to 47.3 from the previous reading of 51.5. The Manufacturing PMI also saw a slight decline to 48.0 compared to the previous figure of 48.7, and the Services PMI contracted, dropping to 47.6 from the previous month’s reading of 51.8.

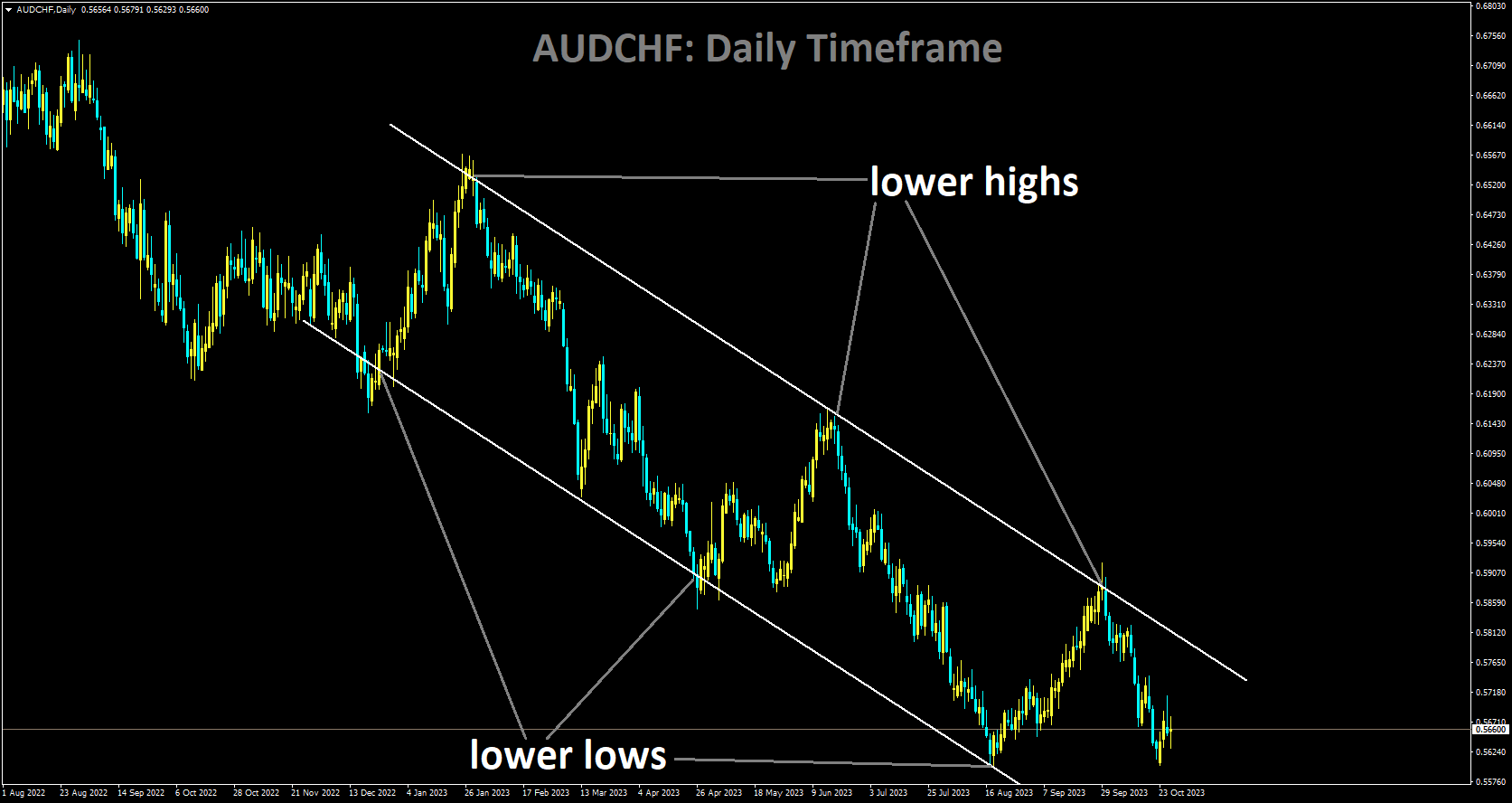

AUDCHF Analysis:

AUDCHF is moving in Descending channel and market has fallen from the lower high area of the channel

The RBA has expressed heightened concern about the inflationary impact resulting from supply disruptions. Governor Michele Bullock stated that if inflation remains above projections, the RBA is prepared to take appropriate policy measures. There is also a noticeable slowdown in demand, with per capita consumption on the decline.

Looking ahead, China is preparing to host a crucial financial policy meeting early next week, which occurs once every five years. The primary objectives of this gathering include addressing and mitigating risks and setting medium-term priorities for the extensive $61 trillion financial industry.

On the international front, the US Treasury Department confirmed the first meeting of the economic working group between the United States and China, serving as a platform for discussions on bilateral economic policy matters. In terms of economic data, the US S&P Global Composite PMI reported growth in October, reaching 51.0 from 50.2. The Services PMI also expanded, reaching 50.9, while the Manufacturing PMI rose to 50.0.

Investor focus is likely to shift to the release of US Q3 Gross Domestic Product on Thursday, with further attention on the US Core Personal Consumption Expenditures and Australia’s Producer Price Index to be observed on Friday.

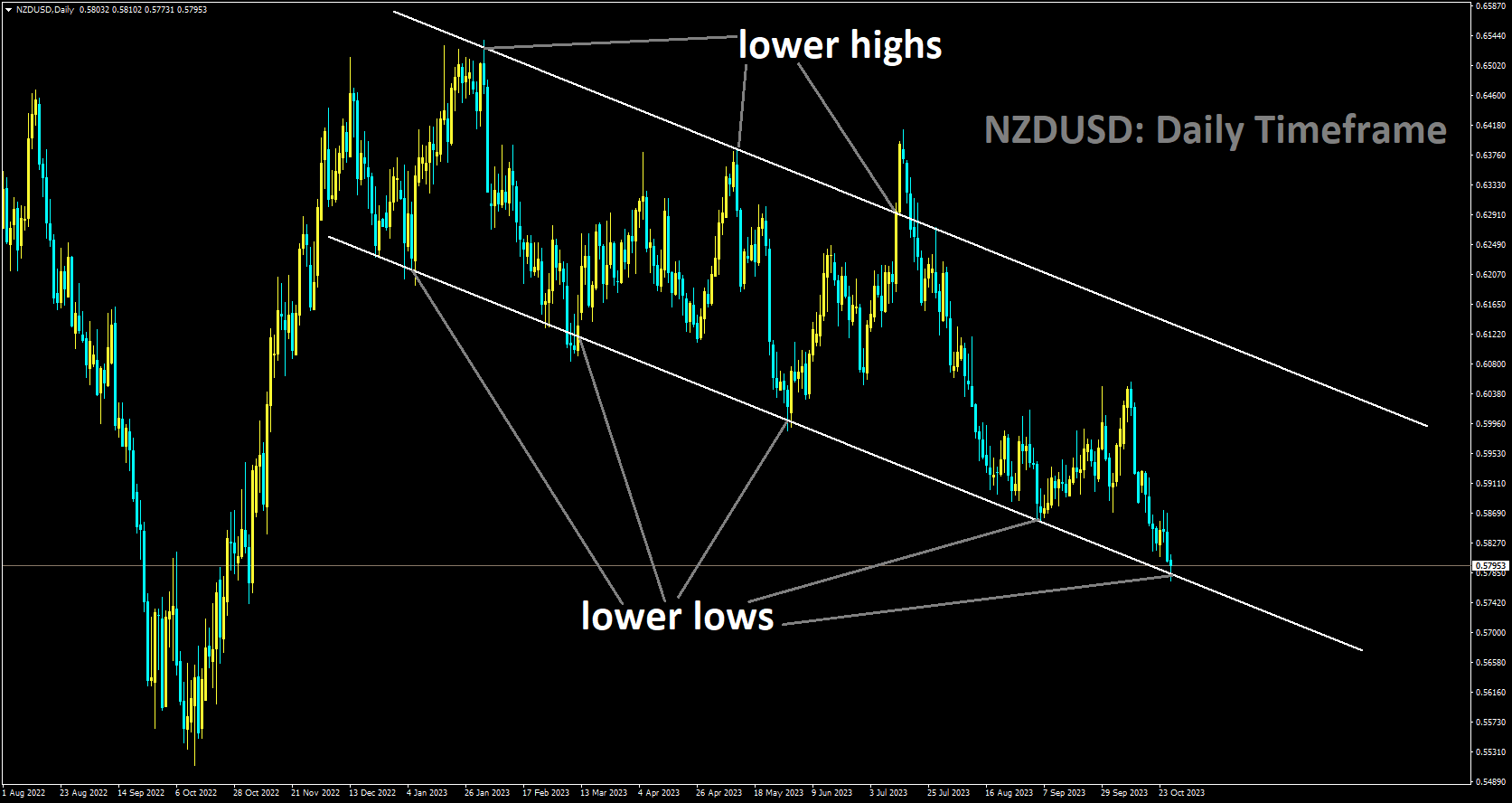

NZDUSD Analysis:

NZDUSD is moving in Descending channel and market has reached lower low area of the channel

New Zealand’s Q3 CPI data has been reported at 1.8%, falling short of the anticipated 2.0%. This lower-than-expected figure suggests that the Reserve Bank of New Zealand (RBNZ) is likely to keep interest rates unchanged in the upcoming meeting. Consequently, the New Zealand Dollar has weakened against other currencies. The annual rate has also decreased, dropping from 6.0% in the previous quarter to 5.6%.

The New Zealand Dollar is currently facing considerable pressure, with recent developments in the Consumer Price Index data exacerbating this situation. Investors are now adjusting their expectations for a potential interest rate hike by the Reserve Bank of New Zealand (RBNZ). New Zealand’s CPI for the third quarter has risen to 1.8%, falling short of the expected 2.0%. Moreover, the annual inflation rate has slowed down, dropping from 6.0% in the previous quarter to 5.6%, which is below consensus estimates of 5.9%.

Geopolitical uncertainties have cast a shadow over the New Zealand Dollar as global risk sentiment takes a hit. Recent triggers include Israel’s Prime Minister Benjamin Netanyahu’s statement regarding a potential ground assault in Gaza, with the timing contingent on consensus. This has reinforced the prevailing risk-off sentiment, adding to the downward pressure on the NZDUSD pair. Additionally, Iran’s Foreign Minister Hossein Amir-Abdollahian visited the US to discuss the Israel conflict, as reported by Iranian media.

Conversely, the US Dollar Index continues to strengthen, currently trading around 106.80. The US Dollar is buoyed by the recent surge in US Treasury yields, which are aiming to surpass the 5.0% threshold. At the time of writing, the 10-year Treasury note stands at 4.97%. However, it’s worth noting that the NZDUSD pair’s losses may be somewhat limited due to the mixed comments from US Federal Reserve (Fed) officials in recent days regarding the trajectory of interest rates. Atlanta Fed President Raphael Bostic suggested that a rate cut before the middle of next year is unlikely, and Fed Philadelphia President Patrick Harker expressed a preference for maintaining interest rates at their current levels.

Looking ahead, the release of US Q3 Gross Domestic Product (GDP) figures later in the North American session could provide a significant snapshot of economic performance. Following that, attention will shift to Friday’s release of Core Personal Consumption Expenditures data, which offers insights into changes in the prices of goods and services in the United States. In the realm of the New Zealand Dollar, all eyes will be on Friday’s Consumer Confidence data, which serves as a crucial indicator for assessing sentiment and economic outlook.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/