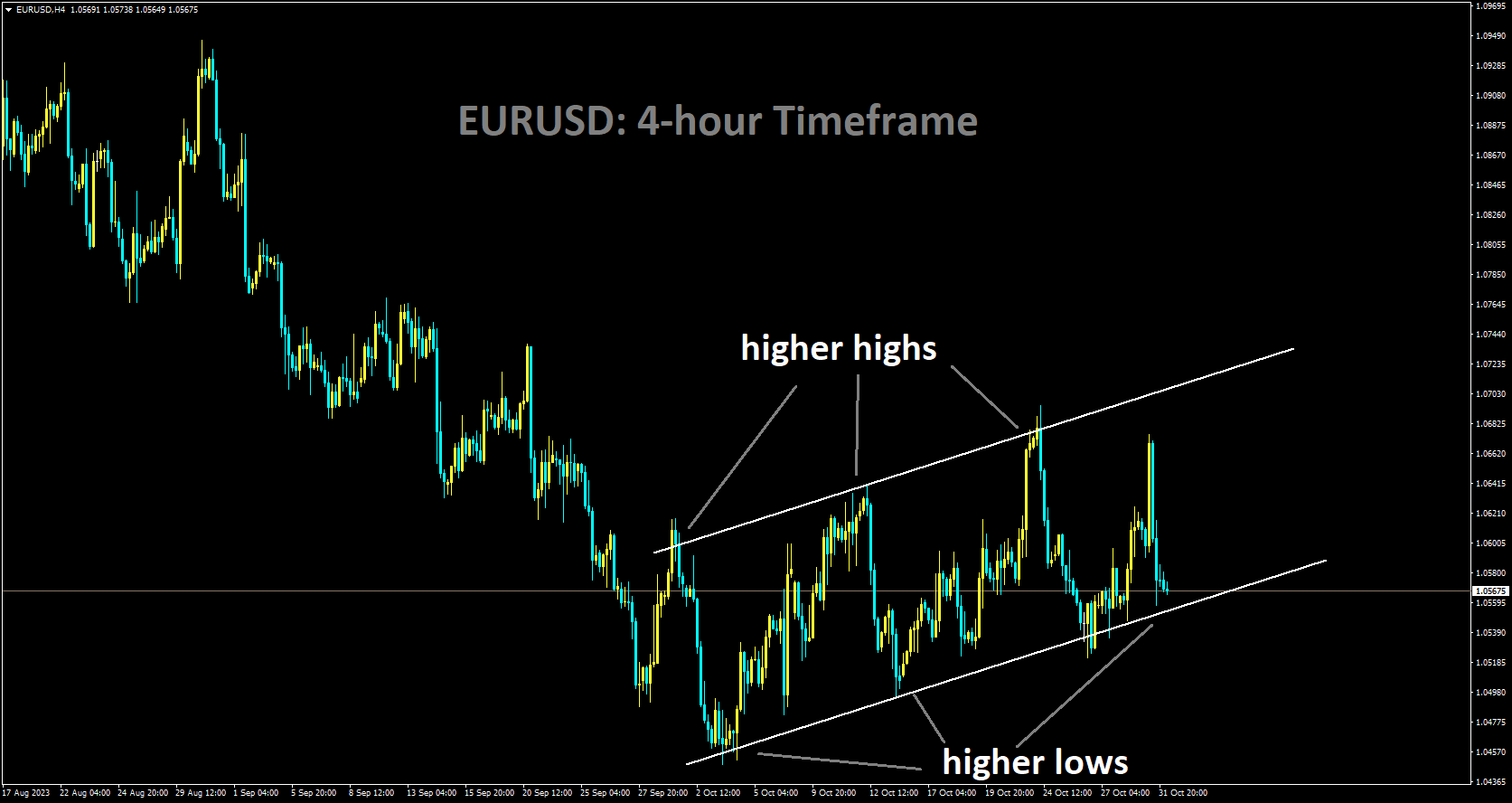

EURUSD moving in a Ascending channel and the market has reached higher low area of the channel

The Federal Reserve’s November 1 interest rate announcement holds significant implications for the U.S. economy and global financial markets. At the heart of this decision lies a complex interplay of factors, including war fears, economic rebound, and global monetary policy dynamics. In this comprehensive analysis, we delve into each of these aspects, providing an in-depth understanding of the Federal Reserve’s decision-making process, the global context of monetary policy adjustments, and the broader economic landscape.

I. Current Interest Rate Landscape

A. Rising Treasury Bond Yields

One of the pivotal factors shaping the Federal Reserve’s monetary policy decisions is the recent surge in 10-year U.S. Treasury Bond yields. In September 2023, the yield stood at 4.5%, but it has since soared to nearly 4.9%. This abrupt increase in long-term rates has had profound implications for monetary policy.

1. Equivalency to Rate Hike

The Federal Reserve has emphasized that the surge in long-term bond yields is broadly equivalent to another interest rate hike.

In essence, the bond market’s actions have done significant work in tightening monetary policy, even in the absence of a formal rate hike. This understanding underscores the importance of closely monitoring bond market dynamics as a barometer of monetary policy.

B. Encouraging Economic Data

Another critical factor informing the Federal Reserve’s stance is the state of the U.S. economy. Key economic indicators have been sending mixed signals, contributing to the Fed’s cautious approach.

1. Core Inflation

Core Personal Consumption Expenditures (PCE) inflation, a primary metric for the Fed, has continued to cool. In September 2023, it was reported at a 3.7% annual rate, marking an extension of the disinflationary trend observed throughout the year. The moderation in core inflation is viewed as a positive development, as it aligns with the Fed’s inflation control objectives.

2. Job Market Dynamics

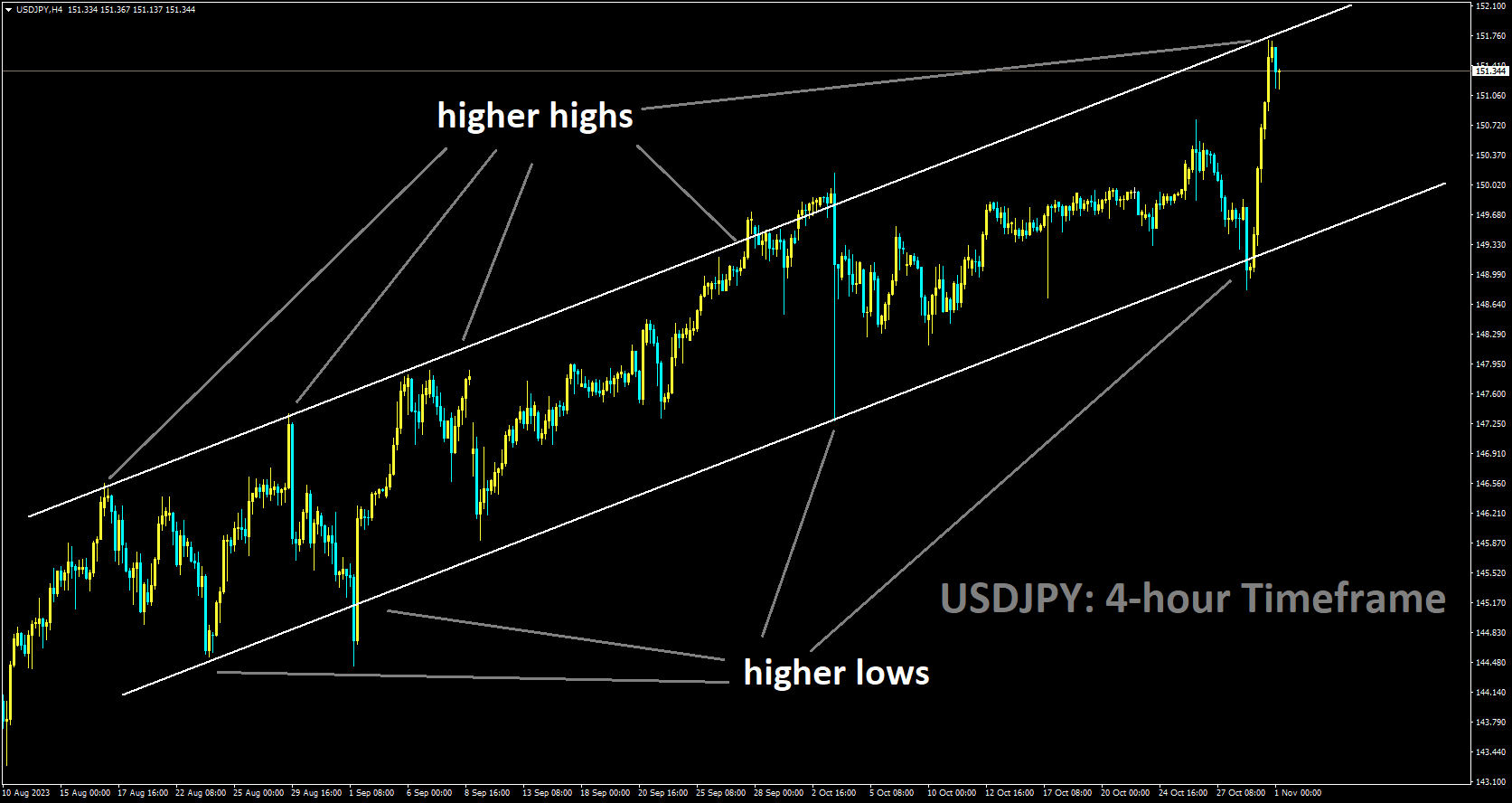

USDJPY moving in a Ascending channel and the market has reached higher high area of the channel

The labor market remains a critical focus for the Federal Reserve. While the job market has continued to run relatively hot, it has exhibited signs of balance between supply and demand. Of particular note is the slowing pace of wage growth, which suggests that the labor market may be evolving towards a more stable state.

3. Economic Performance

The overarching concern for the Fed is that the U.S. economy is performing remarkably well. While this is generally a positive development, the risk of the economy running too hot and exerting upward pressure on inflation cannot be ignored. For instance, the robust 4.9% GDP growth in the third quarter of 2023 may signal an overheating economy, which the Fed seeks to avoid.

4. Potential Inflationary Pressure

The strong economic performance, if sustained, may create additional inflationary pressure. The Fed has explicitly stated that if the economy does not exhibit signs of easing from its current state of robust growth, incremental interest rate hikes may become necessary.

II. Looking Ahead

A. Consensus Among Policymakers

In evaluating the Federal Reserve’s future actions, it is essential to consider the level of consensus among its policymakers. The dynamics of policymaker voting can offer valuable insights into the likelihood of future rate adjustments.

1. Achieving Consensus

Historically, Federal Reserve Chair Jerome Powell has demonstrated an ability to build consensus among policymakers. However, as the Fed fine-tunes its policy approach, achieving unanimous agreement may prove more challenging.

B. Jerome Powell’s Guidance

Federal Reserve Chair Jerome Powell plays a pivotal role in shaping the central bank’s messaging and policy direction. His statements during the November 1 press conference will provide crucial guidance on the Fed’s future actions.

1. Recent Shift in Base Case

In recent weeks, the Fed’s base case has appeared to shift towards maintaining current interest rate levels, with higher rates being treated as more of a contingency plan. Previously, the opposite was true, with a rate increase being the more likely outcome. The nuances of how Powell articulates these various scenarios will be of great interest to market observers.

C. Discussion of Interest Rate Cuts

While the Federal Reserve has signaled its intention to maintain elevated interest rates until the second half of 2024, there is growing interest in understanding when and under what criteria the central bank might consider rate cuts. This topic, while not at the forefront of current Fed messaging, may gain prominence in the future.

III. Global Monetary Policy Landscape

The Federal Reserve’s monetary policy stance is part of a broader global context of central banks adjusting their policies to address unique economic conditions.

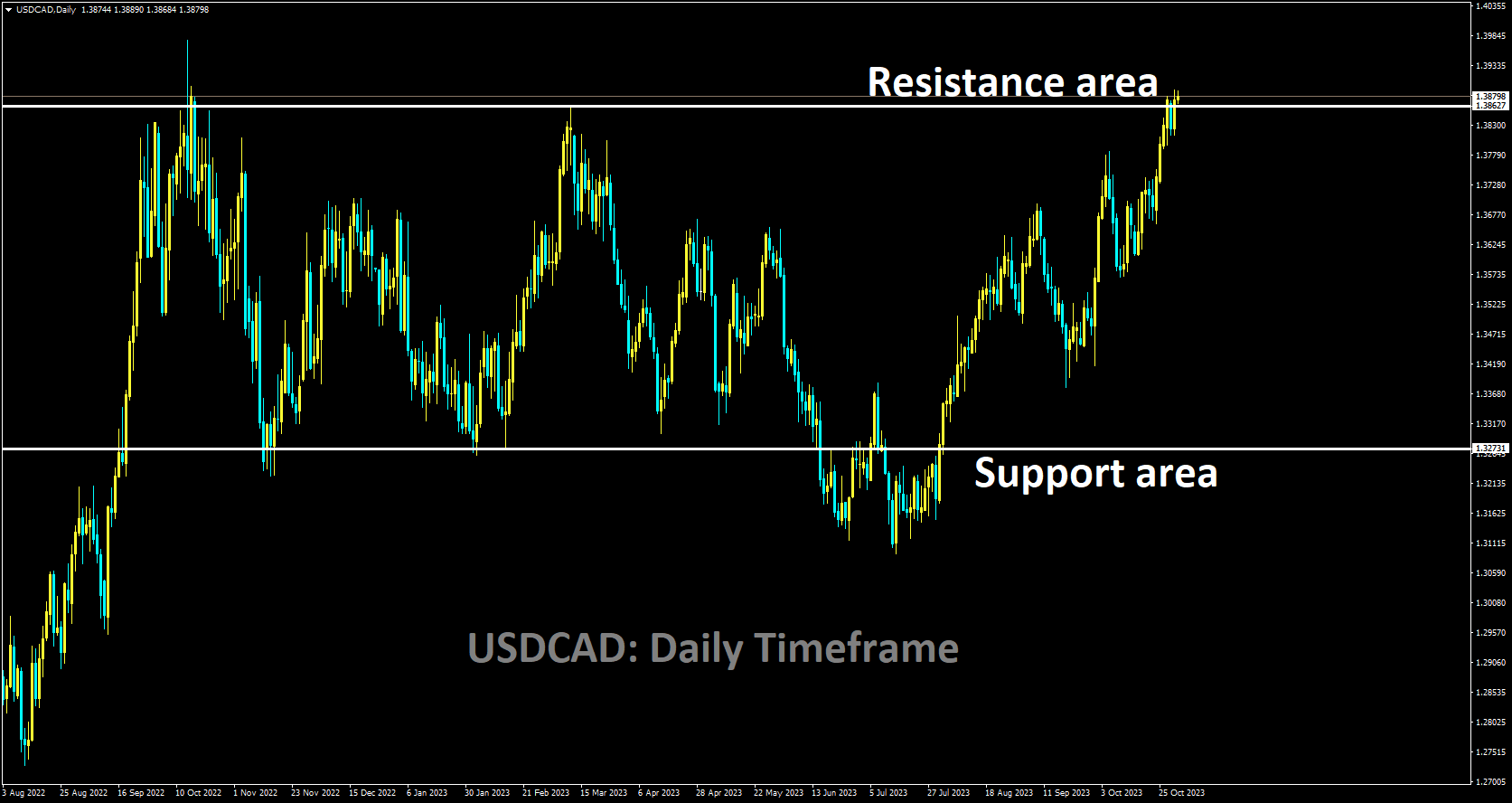

USDCAD is moving a box pattern and the market has reached the resistance area of the pattern

A survey of major central banks worldwide offers insight into their respective positions.

A. The Swiss National Bank (SNB)

The SNB faces a unique challenge, as the Swiss franc reached its highest level against the euro since 2015 due to geopolitical tensions. The strong franc has helped control inflation, which remains comfortably within target at 1.7% year-on-year in September. However, it poses a threat to Swiss exports, a concern for an economy that is stagnating.

B. The Bank of Canada

With inflation declining to 3.8% in September, the Bank of Canada has held its key overnight rate at 5%. Market pricing indicates limited expectations for further hikes or cuts. The central bank anticipates that price increases will not return to its 2% target until the end of 2025.

C. The European Central Bank (ECB)

The ECB has chosen to keep its key interest rate at 4%. The central bank emphasizes a data-dependent approach, focusing on incoming data for future decisions. The ECB’s strategy centers on gradual adjustments to address inflationary concerns.

The ECB has chosen to keep its key interest rate at 4%. The central bank emphasizes a data-dependent approach, focusing on incoming data for future decisions. The ECB’s strategy centers on gradual adjustments to address inflationary concerns.

D. The Bank of England

The Bank of England faces a delicate balancing act, given a weak economy, high domestic inflation, and the potential for geopolitical conflicts to disrupt energy prices. Interest rate futures suggest that rate cuts are unlikely until at least June 2024.

E. Sweden

Sweden faces a unique economic challenge, with economists projecting a 0.7% economic contraction in 2023. Inflation, excluding volatile energy costs, reached 6.9% in September, presenting policymakers with a difficult decision regarding its 4% interest rate.

F. The Reserve Bank of Australia

The Reserve Bank of Australia has maintained its rates at 4.1% for a fourth consecutive meeting in October. Surprisingly robust inflation figures in the third quarter have led markets to price in a 60% chance of a quarter-point hike in the near future. Governor Michele Bullock has also issued warnings about further tightening if the inflation outlook deteriorates.

G. The Bank of Japan (BOJ)

The BOJ, which has maintained a dovish stance, is under increasing pressure to adjust its policy of suppressing domestic borrowing costs. The central bank has faced challenges in keeping yields below its 1% cap, leading to speculation about potential policy tweaks.

I. The Reserve Bank of New Zealand

New Zealand, with a cash rate at a 15-year high of 5.5%, is seen as unlikely to cut rates in November. Despite this, inflation remains well above the Reserve Bank of New Zealand’s 1% to 3% target, adding complexity to its policy decisions.

I. The Norges Bank

Norway’s Norges Bank raised its key rate to 4.25% in late September, hinting at another hike in December.

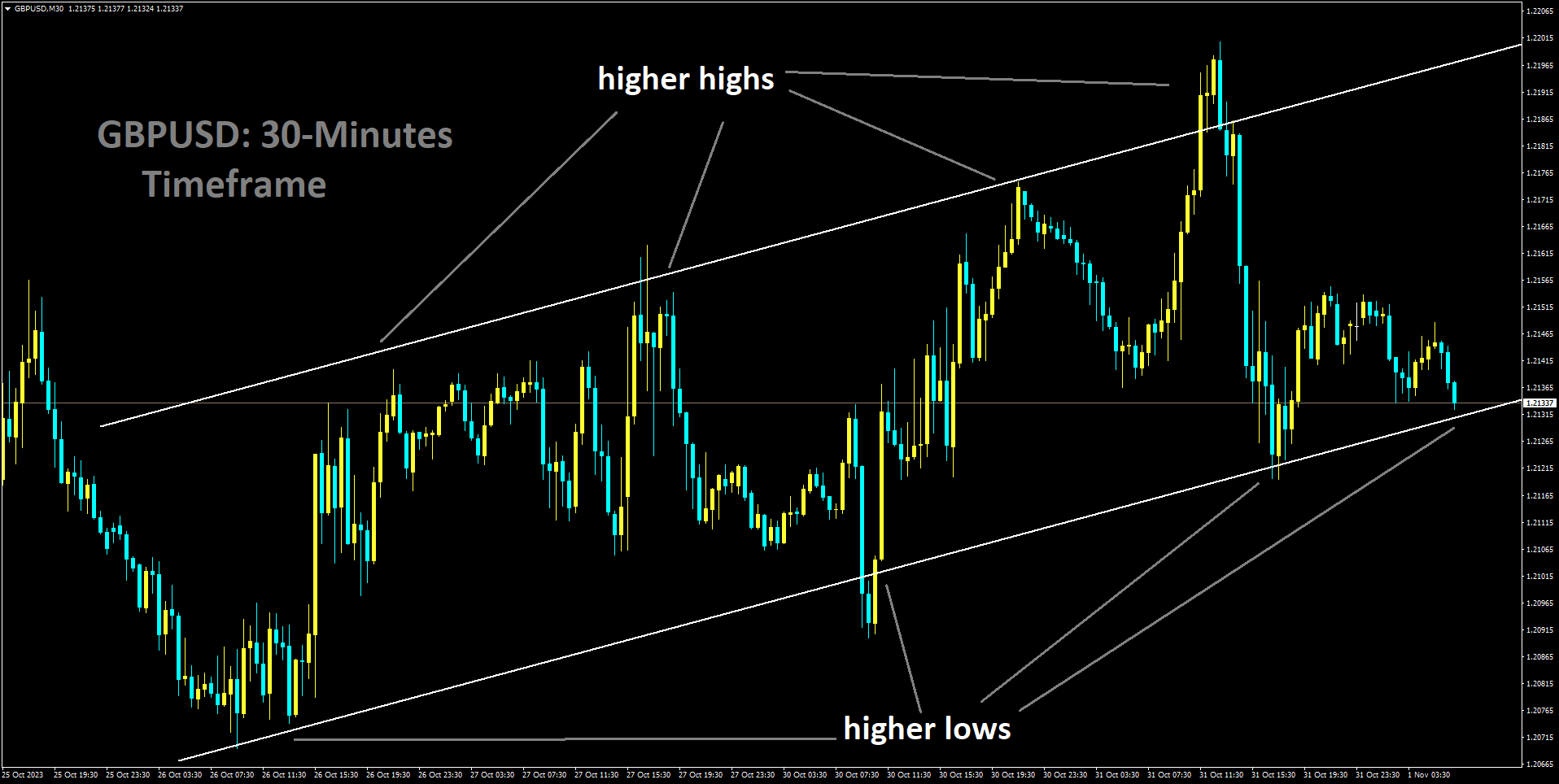

GBPUSD is moving in a Ascending channel and the market has reached higher low area of the channel

However, lower-than-expected inflation data after September’s rate decision adds uncertainty to future rate adjustments.

IV. U.S. Economic Strength

While the Federal Reserve’s series of interest rate hikes since early 2022 has made headlines, the underlying strength of the U.S. economy has remained a defining feature. Understanding this strength is essential in evaluating the Fed’s decisions.

A. Robust Growth

The U.S. economy surged to a robust 4.9% growth rate in the last quarter. This acceleration has been driven primarily by consumer spending, which has remained resilient despite the Fed’s efforts to curb inflation by raising interest rates.

B. Consumer Spending Dynamics

Consumer spending is a linchpin of the U.S. economy. Several factors are fueling this spending, including wage growth and enhanced financial positions for many Americans.

1. Wage Growth

Wages and salaries have been on the rise, outpacing price increases. In the April-June quarter, wages and salaries rose by 1.7% after adjusting for inflation, marking the fastest quarterly increase in three years.

2. Household Net Worth

A report from the Fed highlights that the net worth of a typical household increased by 37% from 2019 through 2022. Home prices and stock market performance have been key drivers of this wealth growth.

3. Low Interest Rates

Low-interest rates, which prevailed from the pandemic recession of 2020 until late 2021, have also contributed to robust consumer spending. The low cost of borrowing has kept the proportion of income spent on interest payments at record lows.

C. Challenges Ahead

While the U.S. economy’s strength is evident, several challenges and uncertainties loom on the horizon.

1. Potential Economic Slowdown

The high growth observed in the last quarter may represent a peak before a gradual slowdown takes hold, especially with rising long-term borrowing rates and the Fed’s continued short-term rate hikes.

2. Government Spending and Stockpiling

Government spending and businesses stockpiling goods have driven recent growth figures. Whether this momentum can be sustained remains uncertain.

3. Consumer Spending and Debt

Consumer spending may be constrained in the final quarter of the year, with factors such as rising student loan repayments and high mortgage rates limiting spending capacity.

4. Housing Market Challenges

The sluggish housing market, driven in part by soaring mortgage rates, poses challenges to the overall economy.

5. Government Shutdown and Interest Rates

The possibility of a government shutdown next month and a spike in longer-term interest rates since July adds to the economic uncertainty. The average 30-year mortgage rate is nearing 8%, a 23-year high, which could make home buying less accessible for many Americans.

D. Jerome Powell’s Perspective

Federal Reserve Chair Jerome Powell has expressed satisfaction with the evolving economic landscape. Inflation has moderated from its four-decade high of 9.1% in June 2022 to 3.7%.

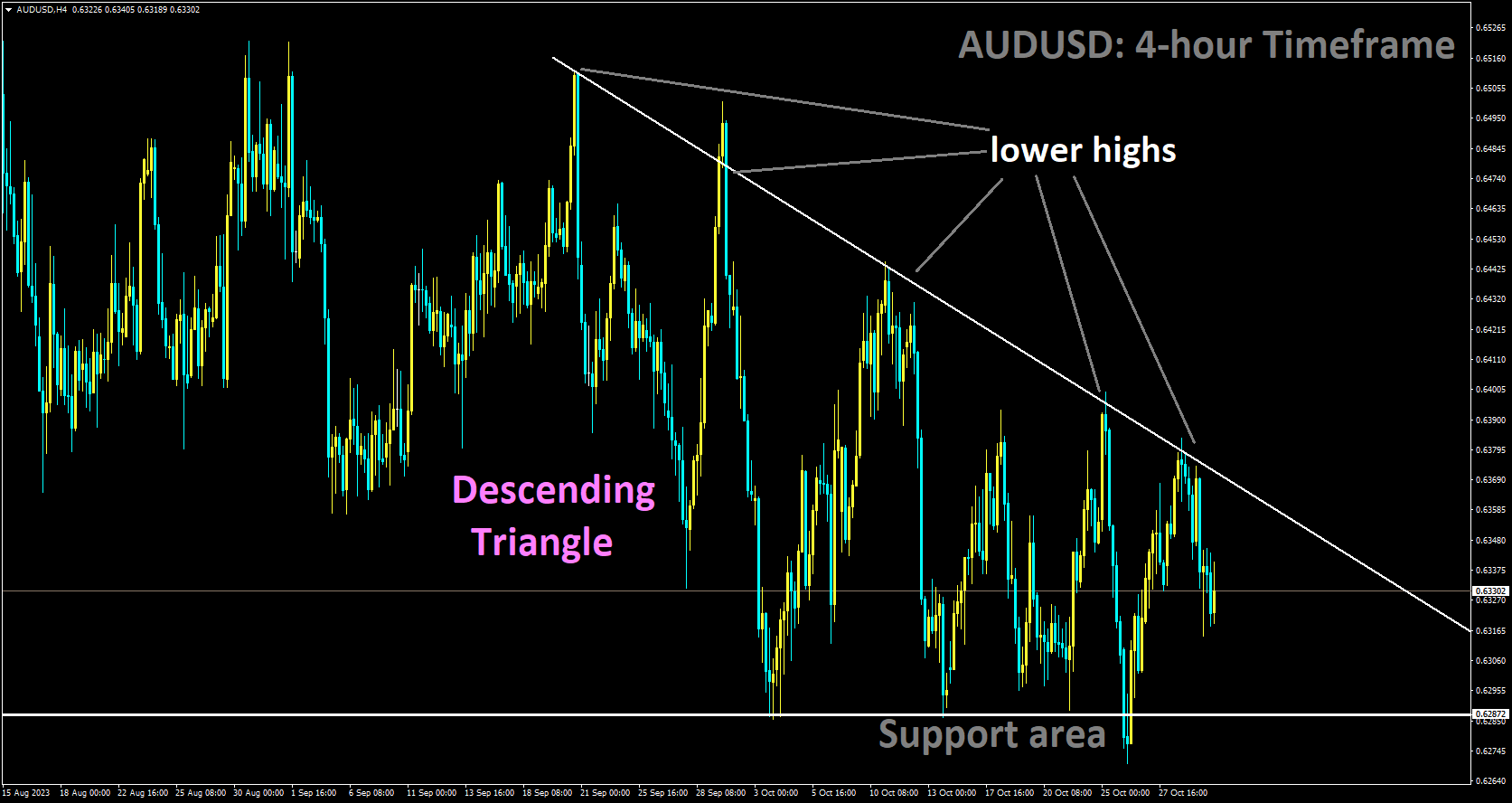

AUDUSD is moving in a Descending Triangle and the market has fallen from the lower high area of the pattern

Steady growth and robust employment have thus far averted the recession that was widely predicted at the end of the previous year.

1. A Delicate Balancing Act

Powell acknowledges the need to balance the management of inflation with the promotion of economic growth. The benchmark short-term interest rate, now at approximately 5.4%, represents a 22-year high. Powell has not ruled out further rate hikes if economic strength persists.

2. Unforeseen Data Impact

A recent government report on retail sales surprised Fed officials, indicating stronger consumer spending than expected. This data reinforced the idea that Americans were willing to spend on both necessities and discretionary items despite inflation concerns.

3. Housing Market Dynamics

While high mortgage rates have dampened sales of existing homes, the majority of homeowners benefit from fixed-rate mortgages, which have kept their housing costs relatively low. This contrasts with homeowners in some other regions, such as the United Kingdom and Europe, who often hold floating-rate mortgages.

E. Expectations for the Fed’s Future Actions

With inflation showing signs of moderation and consumer spending remaining resilient, it is widely expected that the Federal Reserve will keep its short-term rate unchanged at the next meeting. Many economists increasingly anticipate that the central bank will maintain this stance in December as well.

1. Powell’s Guidance

All eyes will be on Jerome Powell’s press conference, where he may provide insights into the Fed’s next steps. Any hints regarding future rate hikes or cuts will be closely scrutinized, as the central bank continues to navigate economic stability amid uncertainties.

Conclusion

The Federal Reserve’s monetary policy decisions are complex and multifaceted, shaped by a combination of domestic and global factors.Rising Treasury Bond yields, encouraging economic data, and the Federal Reserve’s careful evaluation of the U.S. economy have all contributed to the expected decision to maintain current interest rates. As the central bank navigates a delicate balance between addressing inflationary pressures and promoting economic growth, the guidance provided by Jerome Powell will be instrumental in understanding the path forward.

Furthermore, the global monetary policy landscape, with central banks across the world making their own adjustments, adds another layer of complexity to the Federal Reserve’s decisions. Each central bank faces unique economic challenges and must tailor its policies accordingly.

In conclusion, the November 1 Federal Reserve meeting holds significant implications for the U.S. economy and beyond. Understanding the intricate web of factors that inform the central bank’s decisions is crucial for investors, policymakers, and the broader public as they assess the future trajectory of monetary policy and its impact on the global financial landscape.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/