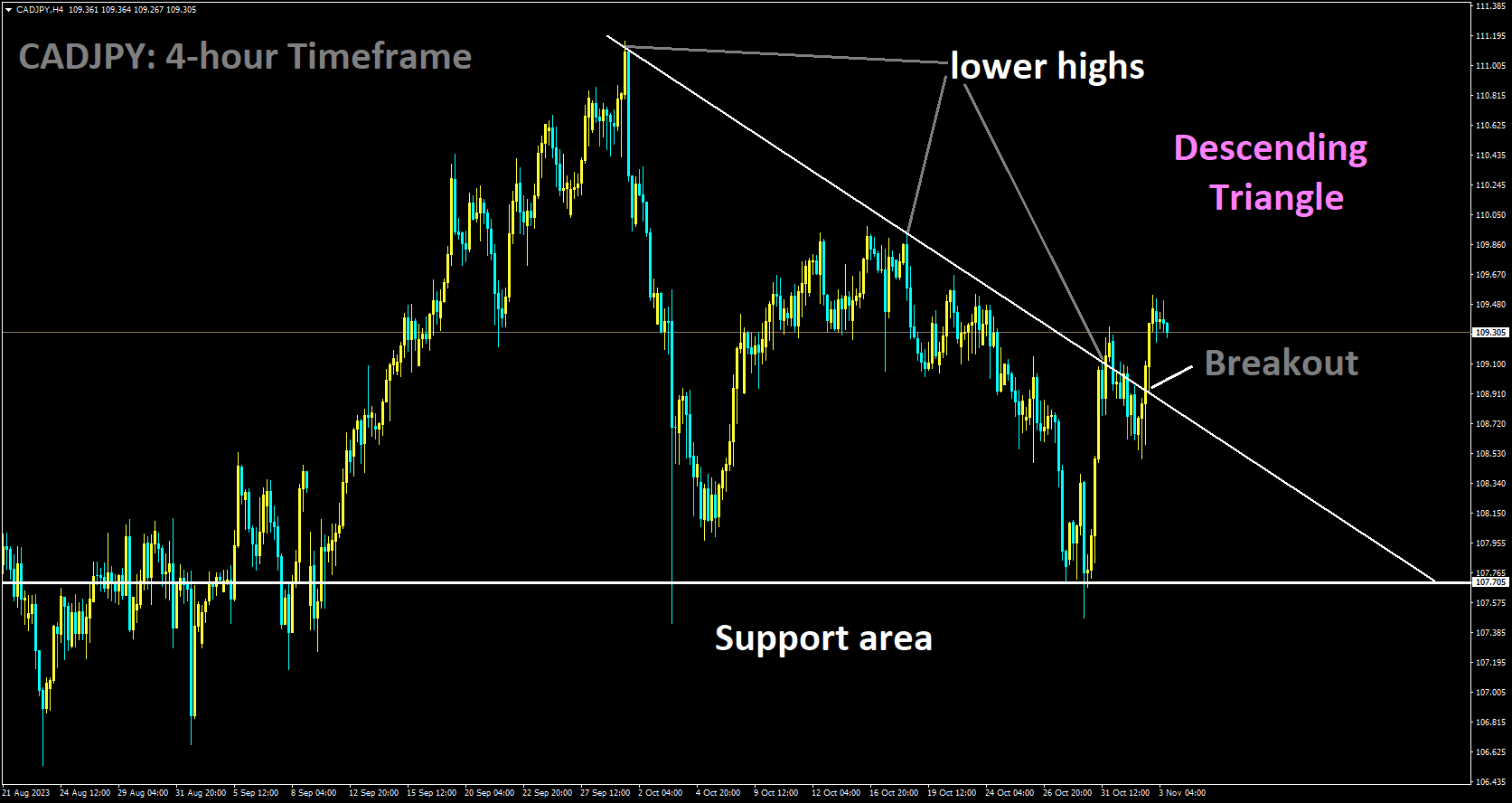

CADJPY Analysis:

CADJPY has broken Descending Triangle in upside

In anticipation of today’s release of Canadian employment data and the unemployment rate, the Canadian Dollar strengthened against its counterpart currencies.

The Canadian Dollar is experiencing a resurgence as overall market sentiment rebounds on Thursday, leading to a weakening of the US Dollar and providing some relief to riskier currencies. On Friday, Canada is set to release Unemployment and Average Hourly Wages data, although these figures are likely to be overshadowed by the significance of another US Nonfarm Payrolls report.

The broader recovery in market risk appetite has led to an uptick in equities and risk-related assets, while simultaneously pushing down the US Dollar and Treasury yields. The recent decision by the Federal Reserve to maintain interest rates, coupled with their statement, has signaled the possible conclusion of the current rate hike cycle, which had previously raised concerns in the market.

The focus on the US NFP report on Friday, relegating the Canadian Unemployment and Wages data to a lower priority on the calendar. It is expected that Canadian wage growth will moderate, with the Net Change in Employment projected to decrease from 63.8K to 22.5K for October. Additionally, the Canadian Unemployment Rate is anticipated to inch up from 5.5% to 5.6%.

Notably, Canadian home sales have experienced a widespread decline, with key areas witnessing sales activity dropping to levels only seen during the last two recessions. Meanwhile, the performance of the Oil-dependent Canadian Dollar is being restrained by WTI Crude Oil, which remains subdued below $82.00 per barrel, limiting potential upside gains.

Federal Reserve Chair Powell mentioned that the US economy is currently progressing at a healthy pace, and labor conditions are also performing strongly. As a result, the neutral interest rate is expected to be maintained for an extended period. This news has been favorable for the Japanese Yen against the US Dollar this week.

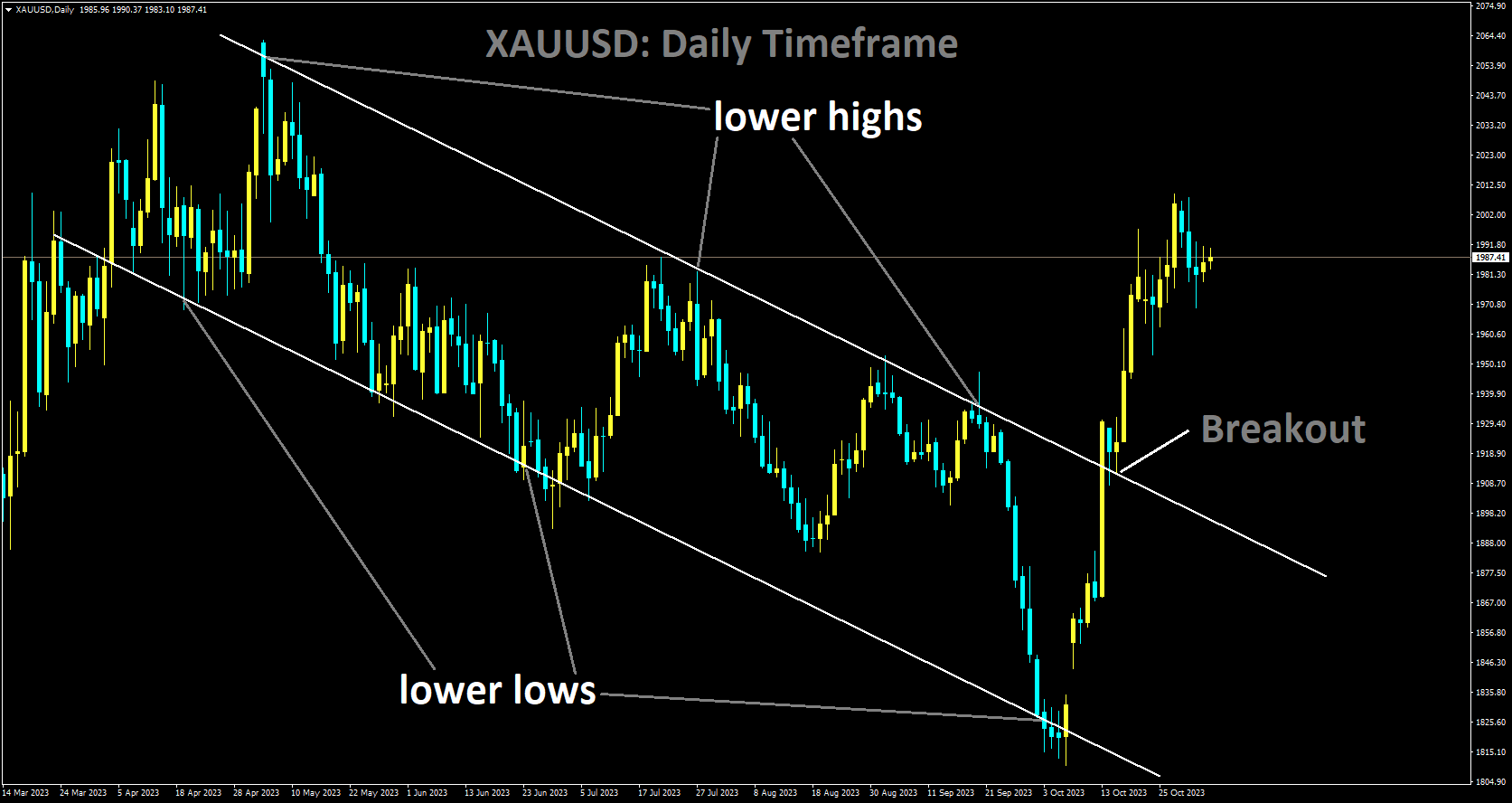

Gold Analysis:

XAUUSD has broken in Descending channel in upside

Gold prices are climbing, mainly due to the Federal Reserve (Fed) maintaining a dovish stance in this week’s meeting. The drop in 10-year US Treasury yields is further bolstering Gold’s appeal as a preferred investment among traders.

The XAUUSD Gold Spot price is showing limited upward momentum, reaching $1,985, driven primarily by lower US yields and a weakened US Dollar following the Federal Reserve’s (Fed) Wednesday decision. Market sentiment suggests that the Fed is nearing the end of its tightening cycle, especially after Chair Powell emphasized the substantial progress made and the consideration of tighter financial conditions and the cumulative effects of future policy decisions.

In response to this outlook, US yields, often seen as the opportunity cost of holding Gold, have notably declined. This decline has created a favorable environment for Gold to gain ground, with the 2-year, 5-year, and 10-year rates all hovering near monthly lows at 4.99%, 4.64%, and 4.66%, respectively. Furthermore, expectations for Fed actions in December have shifted from hawkish to dovish, with swaps markets now indicating only a 20% chance of a 25 basis point rate hike, further contributing to the US Dollar’s weakening.

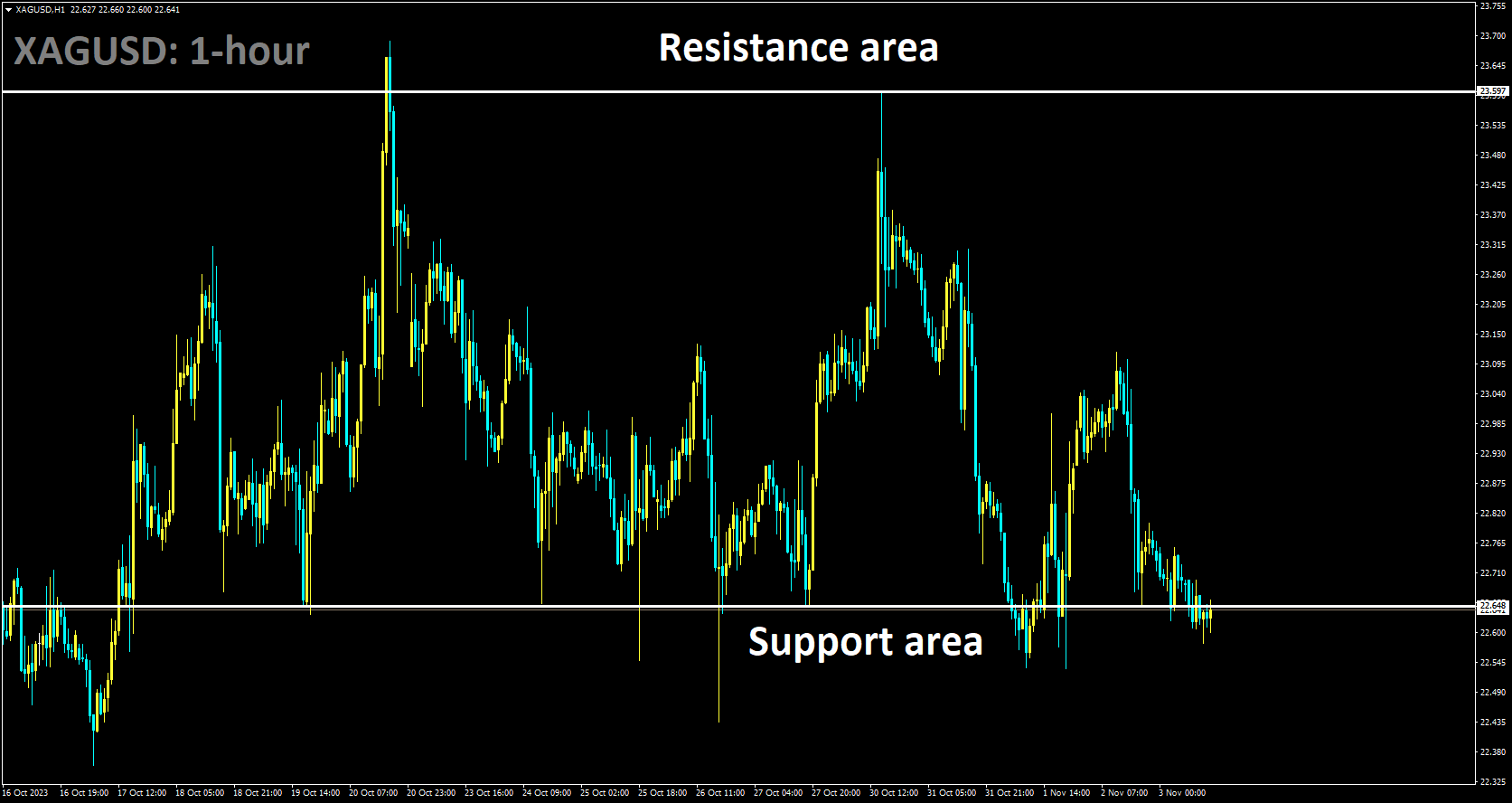

Silver Analysis:

XAGUSD is moving in box pattern and market has reached support area of the pattern

Today, the US Non-Farm Payroll data is set to be released after the Federal Reserve’s dovish stance in this week’s meeting. The performance of the US dollar may vary depending on the results of today’s NFP data release.

In September, US factory orders saw a notable increase of 2.8%, surpassing the expected 2.3% figure. This growth follows a 1% rise observed in August.

The US Dollar experienced a significant decline on Thursday, with the DXY index dropping to 106.15. This downward movement was driven by increasing expectations of a dovish stance from the Federal Reserve and a decrease in US bond yields following the recent decision and the tone set by Chair Powell. All eyes are now on the upcoming release of the October Nonfarm Payrolls report on Friday, as it has the potential to further influence the short-term direction of the USD and potentially extend its losses.

Chair Jerome Powell and the Federal Reserve expressed their satisfaction with the latest economic data, which highlighted the continued strength of the US economy. However, they also noted a deceleration in both job creation and inflation. Powell hinted that the central bank has already implemented substantial tightening measures and that, in future decisions, they will carefully consider the impact of tighter financial conditions and the cumulative effects of monetary policy.

The DXY index has fallen below the 20-day Simple Moving Average (SMA) and is currently at 106.15, representing a 0.50% decline. Leading up to the October NFP release on Friday, the US reported softer labor market data. Unit Labor Costs for the third quarter decreased by 0.8% quarter-on-quarter (QoQ), contrary to market expectations of a 0.7% expansion. Additionally, the US Department of Labor reported that Initial Jobless Claims for the week ending October 28 came in higher than anticipated, with 217,000 individuals filing for unemployment benefits compared to the consensus forecast of 210,000 and a rise from the previous reading of 212,000.

Furthermore, US Treasury yields have experienced a sharp decline, with the 2-year rate falling to 4.99%, and the longer-term 5-year and 10-year rates retreating to approximately 4.63% and 4.67%, respectively. These falling yields have hindered the demand for the US Dollar. According to the CME FedWatch Tool, the likelihood of a 25-basis-point rate hike in December remains low, at around 20%, adding additional downward pressure on the USD.

In September, Factory Orders in the United States surged by 2.8%, surpassing market expectations of a 2.3% increase. This followed a revised 1% rise in United States Factory Orders in August, which was slightly higher than the previously estimated 1.2% increase.

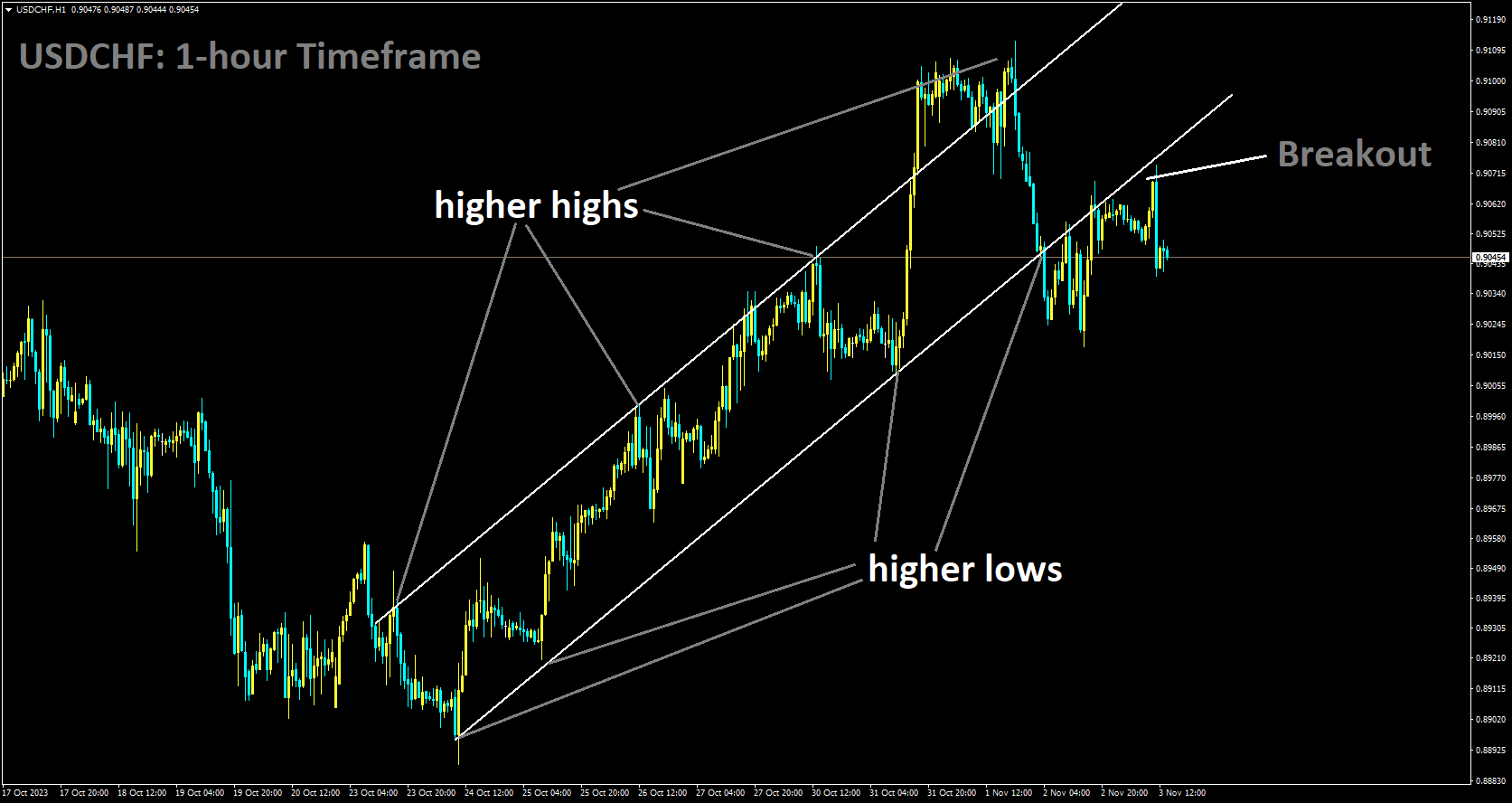

USDCHF Analysis:

USDCHF has broken Ascending channel in downside

In October, Swiss inflation data came in at 1.7% year-on-year, aligning with the expected reading. However, the Swiss economy has shown signs of weaker growth in areas such as GDP, the labor market, sales, and consumer spending, primarily due to interest rates having increased beyond initial expectations.

Switzerland’s inflation rate remained steady at 1.7% year-on-year, aligning with market expectations. On a monthly basis, inflation increased by 0.1%, in contrast to the -0.1% reading observed in September, and this result also matched market consensus. The core inflation rate, which excludes certain volatile components, rose from 1.3% to 1.5% y/y. Switzerland’s inflation rate currently falls within the target range of 0%-2% set by the Swiss National Bank. However, the SNB has expressed concerns about the potential breach of the 2% ceiling due to rising costs in areas such as electricity, rent, and public transport. Switzerland’s economic growth has been sluggish, with GDP remaining flat in the second quarter, and the manufacturing sector has been impacted by weak global demand.

One contributing factor to the SNB’s ability to maintain inflation below target has been the strength of the Swiss franc, which has acted as a dampening force on inflation. The central bank has not hesitated to intervene in currency markets to boost the Swiss franc, aiming to lower the costs of imports and mitigate inflationary pressures.

On Thursday, the US dollar weakened against major currencies following the Federal Reserve’s decision to keep interest rates unchanged. Fed Chair Powell reiterated the Fed’s readiness to raise rates as a measure to control inflation, but market sentiment suggested skepticism regarding further tightening, with many believing that the Fed has completed its tightening cycle. This sentiment could shift if the US reports strong data, such as a better-than-expected nonfarm payrolls report on Friday. The market consensus for the report currently stands at 180,000, following a substantial increase of 336,000 in September.

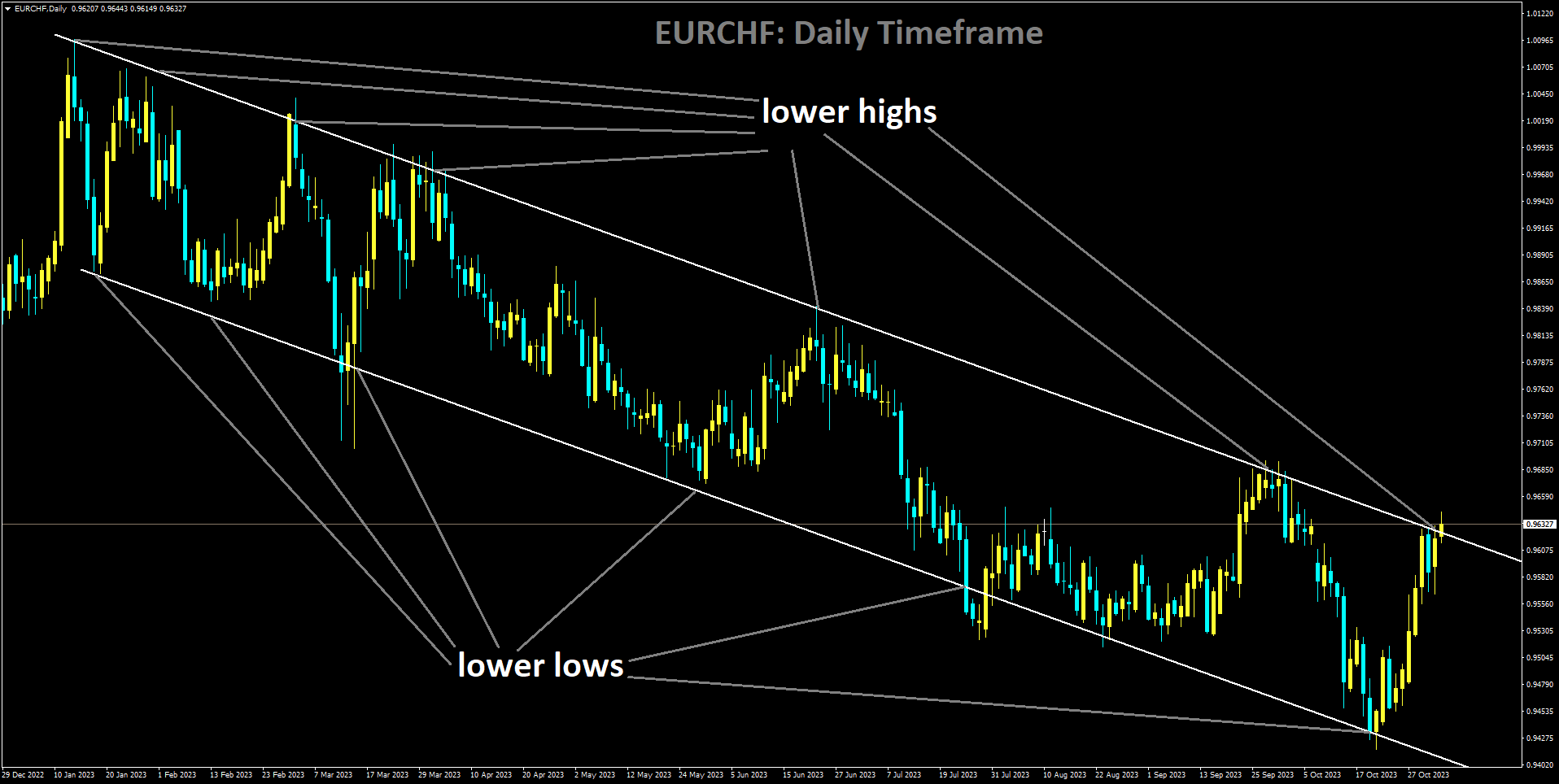

EURCHF Analysis:

EURCHF is moving in Descending channel and market has reached lower high area of the channel

Isabel Schnabel, a member of the ECB Board, stated that the ECB aims to bring inflation back down to its 2% target by 2025. She also acknowledged that the conflict in the Middle East has led to increasing energy prices in the Eurozone. Schnabel emphasized that considering these factors, rate cuts may not be a viable option in future ECB meetings.

Isabel Schnabel, a board member of the European Central Bank, stated on Thursday that the ECB remains committed to the goal of bringing inflation back to 2% by 2025. However, she emphasized that the final phase of disinflation could prove to be the most challenging, making it necessary for the central bank to consider the possibility of additional interest rate increases.

Schnabel noted, “With our current monetary policy stance, we anticipate that inflation will align with our target by 2025. Nevertheless, the process of disinflation in the final stretch is expected to be marked by increased uncertainty, slower progress, and potential bumps along the way. We cannot rule out the option of implementing further rate hikes.” She also mentioned that if the situation in the Middle East remains stable, the impact of energy prices on inflation is likely to be limited.

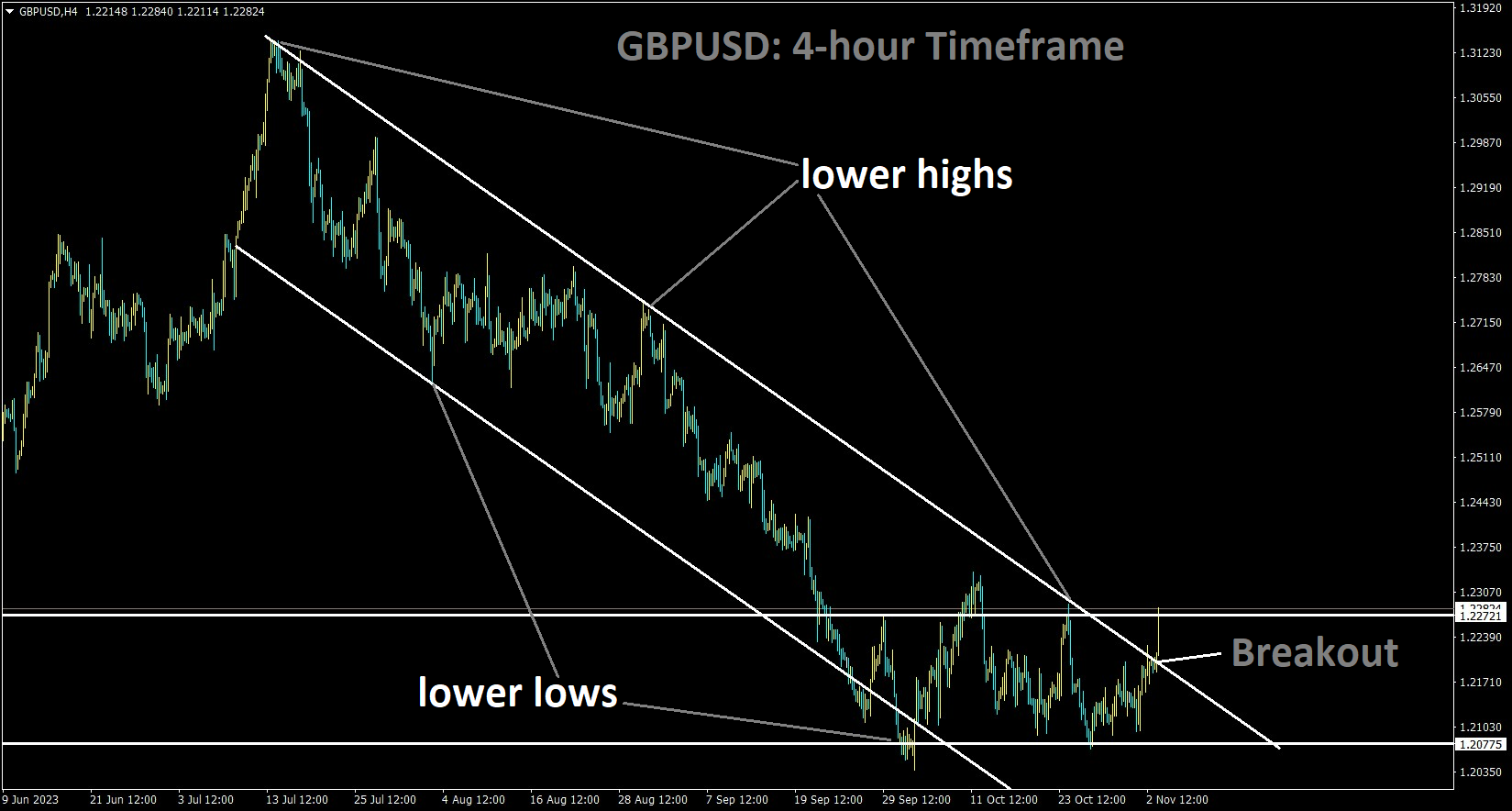

GBPUSD Analysis:

GBPUSD has broken the Descending channel in upside

The Bank of England opted to maintain interest rates at 5.25% in its recent decision. Economic activity has been subdued, and the labor market has displayed ongoing signs of deceleration during the latter part of 2023. The Bank of England anticipates a decrease in inflation, with forecasts indicating a cooling to 4.75% in the fourth quarter of 2023, followed by a decline to 4.25% in the first quarter of 2024 and further moderation to 3.75% in the second quarter of 2024.

Today, the Bank of England decided to maintain the Bank Rate at 5.25%, marking the second consecutive meeting with no change. Among the members of the MPC, six voted in favor of keeping rates stable, while three advocated for a 25 basis point increase. The central bank’s primary objective remains curbing inflation to reach its target, and it stands ready to raise interest rates if deemed necessary.

The Bank of England also highlighted concerning indications of weakness in the UK labor market. The MPC continues to analyze a broad spectrum of data to gauge labor market trends, avoiding reliance on a single indicator. The increasing uncertainties surrounding the Labour Force Survey underscore the importance of this comprehensive approach. Given the backdrop of subdued economic activity, it is expected that employment growth has softened more than initially projected in the August Report. Decreasing job vacancies and surveys indicating reduced recruitment challenges further suggest a loosening labor market. While some sectors still face persistent skills shortages, reports from the Bank’s Agents indicate an easing of hiring constraints.

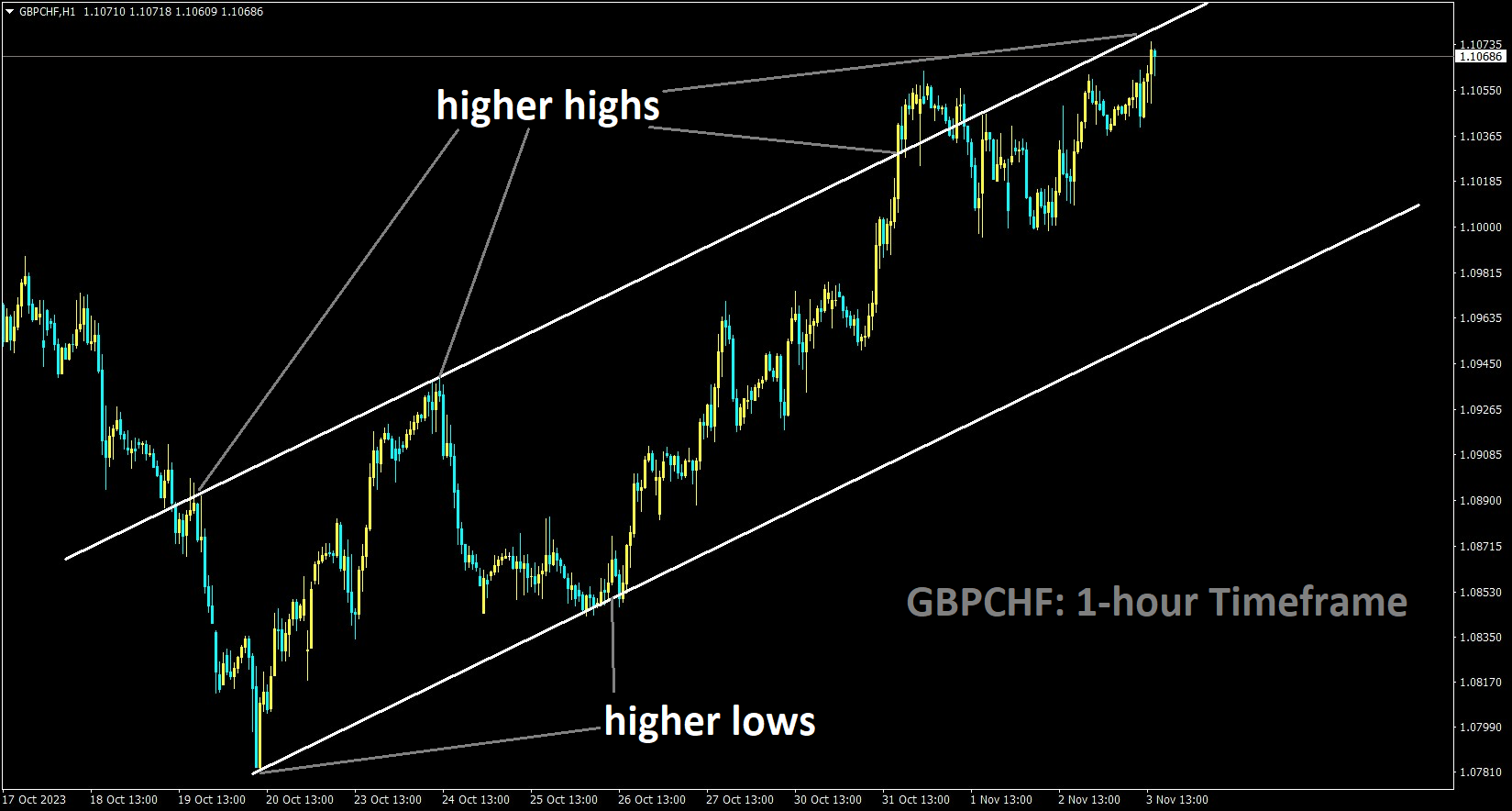

GBPCHF Analysis

GBPCHF is moving in an Ascending channel and the market has reached the higher high area of the channel

Additionally, the central bank anticipates a significant decline in headline inflation, with forecasts of 4¾% in 2023 Q4, 4½% in 2024 Q1, and 3¾% in 2024 Q2. This decrease is attributed to lower energy, core goods, and food price inflation, as well as a subsequent drop in services inflation after January.

In the currency markets, the British pound (GBP) is currently trading at a one-week high, as traders incorporate a slightly hawkish tone from the central bank meeting. The GBPUSD pair is currently situated within a range defined by the 78.6% Fibonacci retracement at 1.2089 and the 61.8% retracement at 1.2313. The key driver for GBPUSD’s movements will be the upcoming US Labor Report (NFP) scheduled for release at 12:30 UK time on Friday.

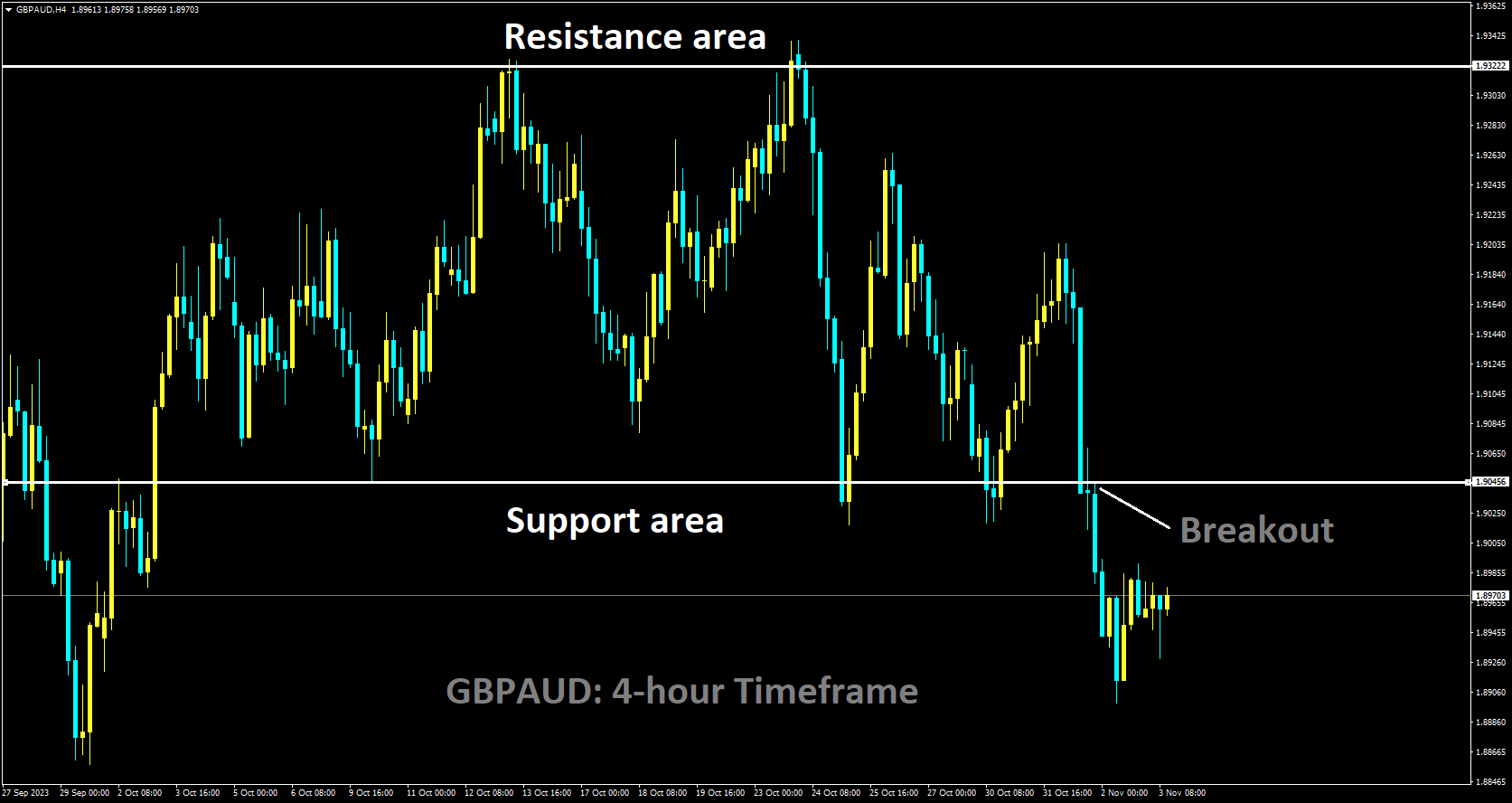

GBPAUD Analysis:

GBPAUD has broken box pattern in downside

RBA is expected to hike the 25bps interest rate in next week’s meeting based on the data points of Retail sales improved to 0.20% in Q3 from -0.60% decline in the previous quarter. The Upbeat economic data of Australia makes RBA lift the rates to higher in upcoming meetings.

Market expectations revolve around the Reserve Bank of Australia (RBA) preparing to raise the cash rate by 25 basis points in the coming week while maintaining a hawkish stance. Earlier on Friday, Australian Retail Sales for the third quarter posted a 0.2% quarter-on-quarter improvement, contrasting with the 0.6% decline seen in the previous reading. Additionally, the Judo Bank Composite PMI for October registered at 47.6, a slight improvement from the previous reading of 47.3, while the Services PMI grew to 47.9 in October, up from 47.6 in September. These positive indicators, combined with the overall risk-on sentiment, have propelled the Australian Dollar (AUD) against the US Dollar (USD).

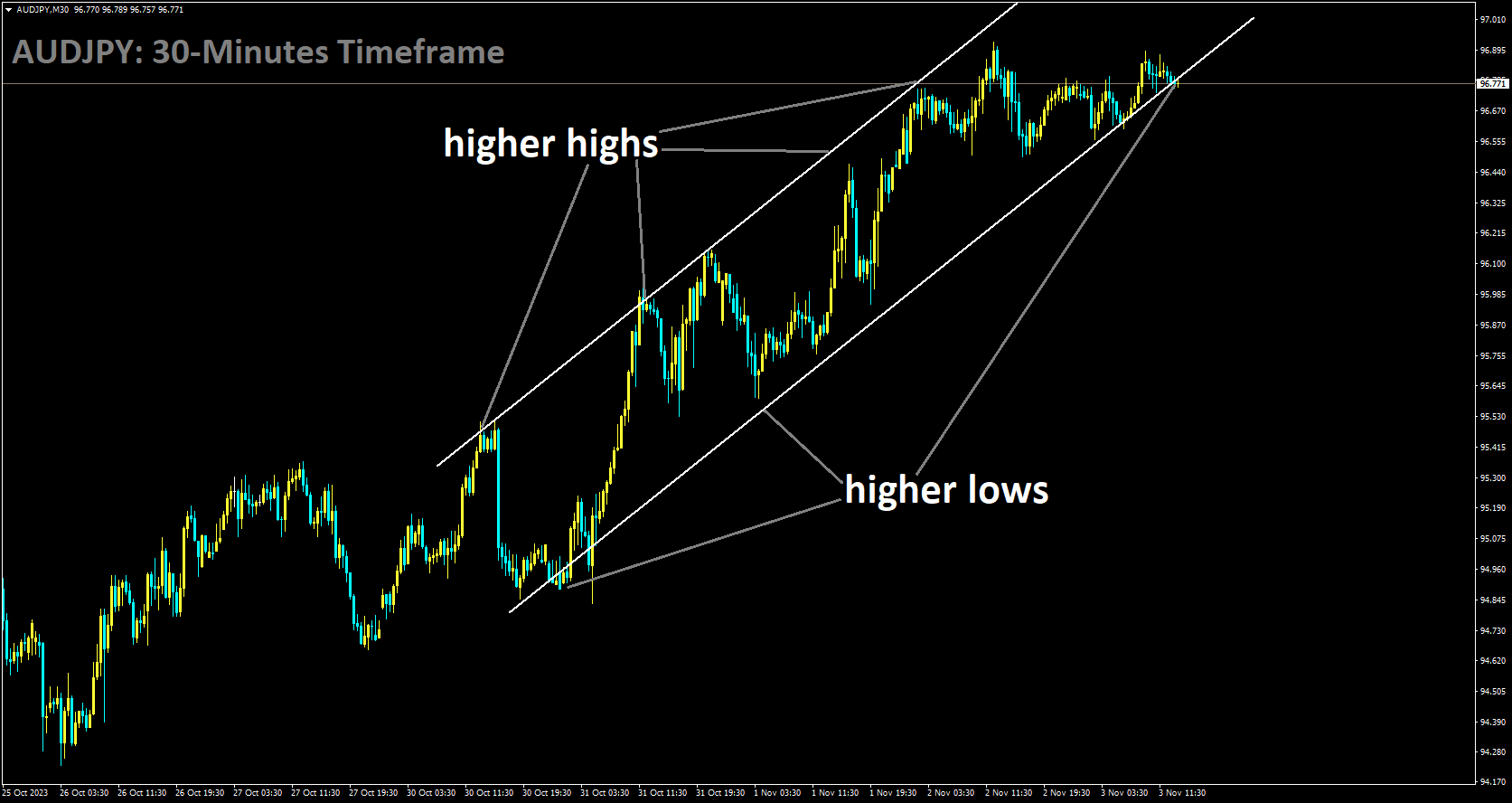

AUDJPY Analysis

AUDJPY is moving in Ascending channel and market has reached higher low area of the channel

The Japanese Yen is in the process of recovering from the significant sell-off it experienced following the Bank of Japan’s Halloween day meeting, during which it depreciated by over 1% against the US Dollar. Subsequently, the market retraced its steps on Wednesday and Thursday, aiming to fill the gap created by Tuesday’s substantial drop, marking the largest decline recorded this year.

The Yen’s resurgence can be attributed in part to a weaker US Dollar, which declined in response to the market’s interpretation of Federal Reserve Chairman Jerome Powell’s comments during the press conference that followed the Fed’s own meeting the day after. Powell’s remarks indicated that progress had been made in addressing inflation concerns, and there was now a reduced likelihood of another interest rate hike. He assessed the risks as more balanced compared to before, prompting a positive response from the stock market and a corresponding weakening of the Greenback.

The Yen is gradually recovering from the setback it experienced on October 31, triggered by the Bank of Japan’s policy meeting. During the post-meeting press conference, Bank of Japan Governor Kazuo Ueda downplayed inflationary risks, attributing most of the inflation to rising input costs, particularly in commodities like oil, rather than driven by increased demand. This perspective suggests that the BoJ will need to maintain its accommodating monetary policy and low interest rates, which is generally unfavorable for the Yen, as global investors tend to favor currencies that offer higher returns.

Midway through the week, the Japanese Yen managed to recoup losses against most major currencies, especially against the US Dollar, following the Federal Reserve’s meeting. Fed Chair Jerome Powell indicated that another rate hike was now less probable, emphasizing that while not completely ruled out, the Fed was no longer firmly committed to the idea. Powell also noted progress in addressing inflation concerns, leading to a decreased likelihood of further rate increases. This lower probability of interest rate hikes put pressure on the USD, given its sensitivity to interest rate differentials in the currency market.

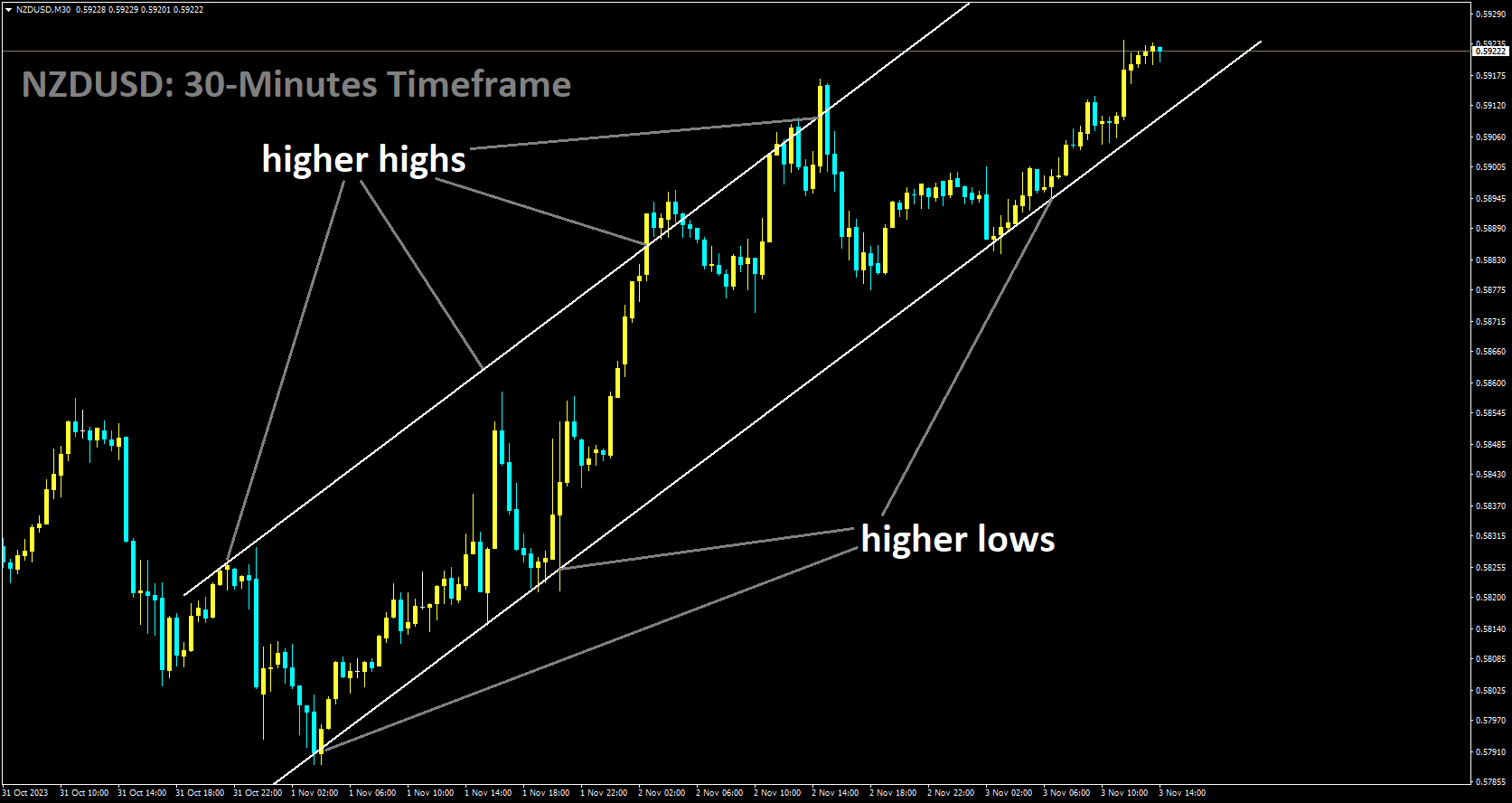

NZDUSD Analysis:

NZDUSD is moving in Ascending channel and market has reached higher low area of the channel

New Zealand’s job market showed signs of weakness as the unemployment rate increased from 3.6% in Q3 to 3.9%, bolstering the New Zealand Dollar’s strength against other currencies this week. The Reserve Bank of New Zealand seems inclined to discuss a potential rate hike in their upcoming meeting, with a 10% probability estimated based on available data. The NZDUSD pair is benefiting from a decline in US Treasury bond yields and a weakening US Dollar. However, many market participants are adopting a cautious stance as they await the eagerly anticipated US Nonfarm Payrolls report scheduled for Friday. In contrast, New Zealand’s third-quarter Unemployment Rate has climbed from 3.6% to 3.9%, suggesting that the country’s employment situation is reaching a sustainable level without exerting significant strain on the economy.

Current market expectations assign a 10% probability to an additional rate hike during the Reserve Bank of New Zealand’s policy meeting later in November. However, the likelihood of a rate cut could be considered more probable around August of the following year. Turning to the US Dollar, the weekly Initial Jobless Claims data has exceeded expectations, rising to 217K from the previous 212K reading. Nevertheless, the Unit Labor Cost for Q3 has declined by 0.8% following a 2.2% increase in the previous reading, falling short of forecasts. Additionally, September’s Factory Orders have surged by 2.8% month-on-month, surpassing market consensus.

Despite this encouraging US economic data, the USD has not experienced a significant boost, as market participants increasingly believe that the Federal Reserve has completed its tightening cycle. According to the CME Fed Watch Tool, the probability of a rate hike at the December meeting is less than 20%, which is exerting downward pressure on the USD.Looking ahead, traders will closely monitor upcoming data releases, with a particular focus on the US employment data, especially the US Nonfarm Payrolls report. The NFP report is anticipated to show an increase of 180,000 jobs in October, while the unemployment rate is expected to remain stable at 3.8%.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/