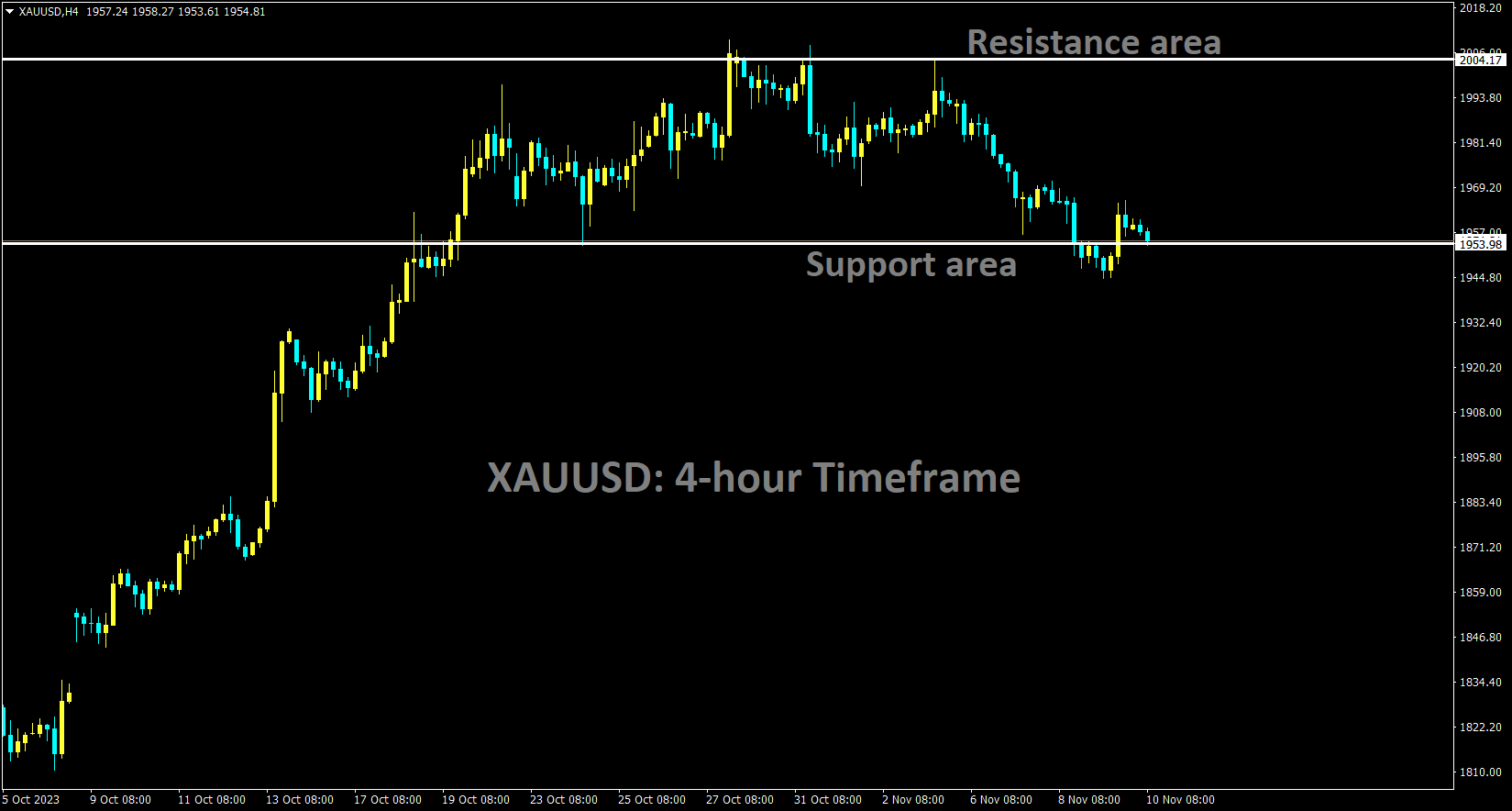

GOLD Analysis:

XAUUSD Gold Price is moving in the Box pattern and the market has reached the support area of the pattern

The persistent high gold prices are primarily driven by the ongoing conflict between Israel and Palestine. This geopolitical turmoil has kept investors seeking safety, and gold, considered a safe-haven asset, has been their preferred choice. Adding to this dynamic, the US White House recently announced a temporary ceasefire in Gaza for four hours each day, providing a brief respite from the hostilities. This de-escalation of the conflict has led to a consolidation of gold prices in the market.

Despite the rise in US Treasury bond yields, which typically competes with gold for investor interest, geopolitical tensions in the Middle East continue to bolster the appeal of gold. At the time of analysis, gold is trading at approximately $1,958 per ounce, reflecting a marginal 0.03% increase for the day.

Simultaneously, the US Dollar Index has surged to 105.90, driven by the hawkish remarks made by Federal Reserve (Fed) Chairman Jerome Powell. These remarks have heightened expectations of future interest rate hikes in the United States. In this environment, US Treasury bond yields have also risen, with the 10-year yield holding at 4.65% and the 2-year yield reaching 5%.

Late on Thursday, Fed Chair Jerome Powell expressed uncertainty regarding the adequacy of their current policy to effectively reduce inflation to the targeted 2 percent over time. Powell went on to state that if further tightening of policy becomes necessary, the Fed will not hesitate to do so. While the Fed has not yet made a definitive decision regarding significant bond tightening, it is not disregarding the possibility. Consequently, Powell’s hawkish comments could potentially bolster the US Dollar (USD) and place a limit on the gains of gold priced in US Dollars.

Conversely, heightened geopolitical risks in the Middle East may continue to drive demand for safe-haven gold. The White House reported on Thursday that Israel has agreed to a temporary suspension of military operations in certain areas of northern Gaza for four hours each day. However, there is scant evidence of a significant reduction in hostilities, leaving investors cautious.

In the coming days, investors will closely monitor Fed Chairman Logan’s speech, the preliminary US Michigan Consumer Sentiment Index for November, and the UoM 5-year Consumer Inflation Expectation. These events could provide clearer guidance for the trajectory of gold prices.

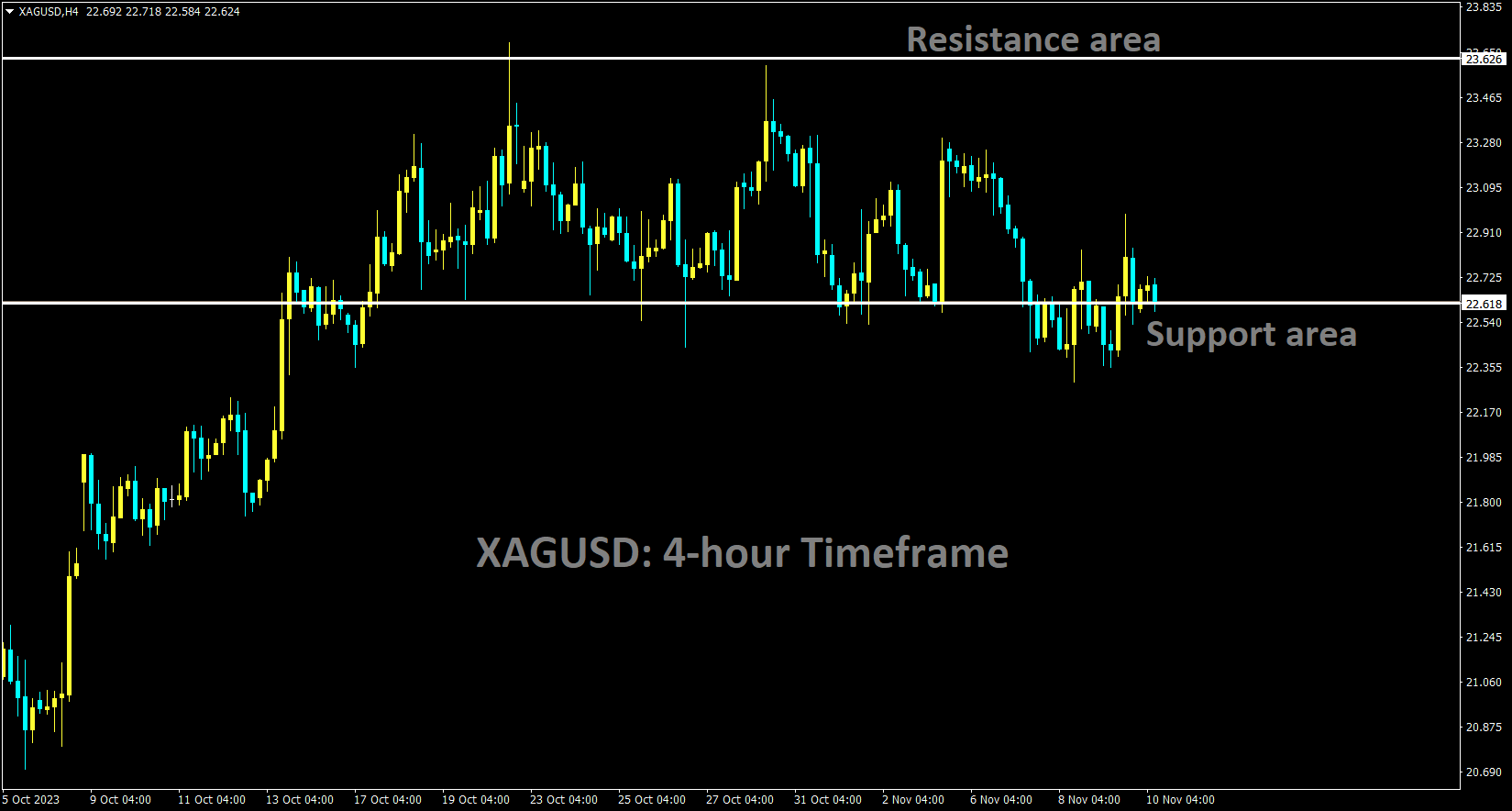

SILVER Analysis:

XAGUSD Silver Price is moving in the Box pattern and the market has reached the support area of the patternDuring his speech at the International Monetary Fund (IMF) Meeting, Federal Reserve (Fed) Chairman Powell indicated that there are rate hikes on the horizon in the upcoming meetings. Powell’s comments highlighted the Fed’s confidence in the economy, as he noted that both inflation and labor growth are holding steady within the expected ranges. As a result of these hawkish comments from the Fed, the US Dollar saw an increase in its value.

The broader US dollar initially had a subdued start to the trading session but gained momentum in afternoon trading. This surge was primarily driven by a sharp increase in yields, triggered by lackluster demand for US government securities at a significant Treasury auction. Furthermore, the greenback’s upward trajectory received a substantial boost from Federal Reserve Chair Powell’s hawkish statements during the IMF panel.

In his public remarks, Chair Powell expressed reservations about the Fed’s current policy stance, stating that policymakers are not confident they have implemented a sufficiently restrictive approach to consistently achieve the 2.0% inflation target. He also indicated that continued progress in curbing inflation is uncertain, and stronger economic growth could warrant higher interest rates. As a result, by the end of the day, the DXY index had gained nearly 0.4%.

Taken together, Powell’s comments suggest that the central bank is not entirely convinced that the hiking cycle has concluded. This leaves open the possibility of another rate hike in the upcoming month or in January, especially if financial conditions continue to ease, as they have been since late October.

For the time being, market expectations will remain in flux, fluctuating in response to the strength or weakness of economic data releases. It is crucial for traders to closely monitor the economic calendar in the coming days and weeks. One key report to watch is the October consumer price index survey, scheduled for release next Tuesday. According to analysts’ projections, the headline CPI is expected to have risen by 0.1% on a seasonally adjusted basis last month, bringing the annual rate down to 3.3% from the previous 3.7%. The core CPI is anticipated to increase by 0.3% on a monthly basis, resulting in a yearly reading of 4.3%, unchanged from September.

Given the Fed’s heightened sensitivity to incoming data and concerns about inflation risks, any deviation of official data from consensus estimates, particularly on the upside, could lead to higher bond yields and strengthen the case for prolonged higher interest rates. Such a scenario would be positive for the US dollar but negative for assets like gold, the euro, the Australian dollar, and the yen.

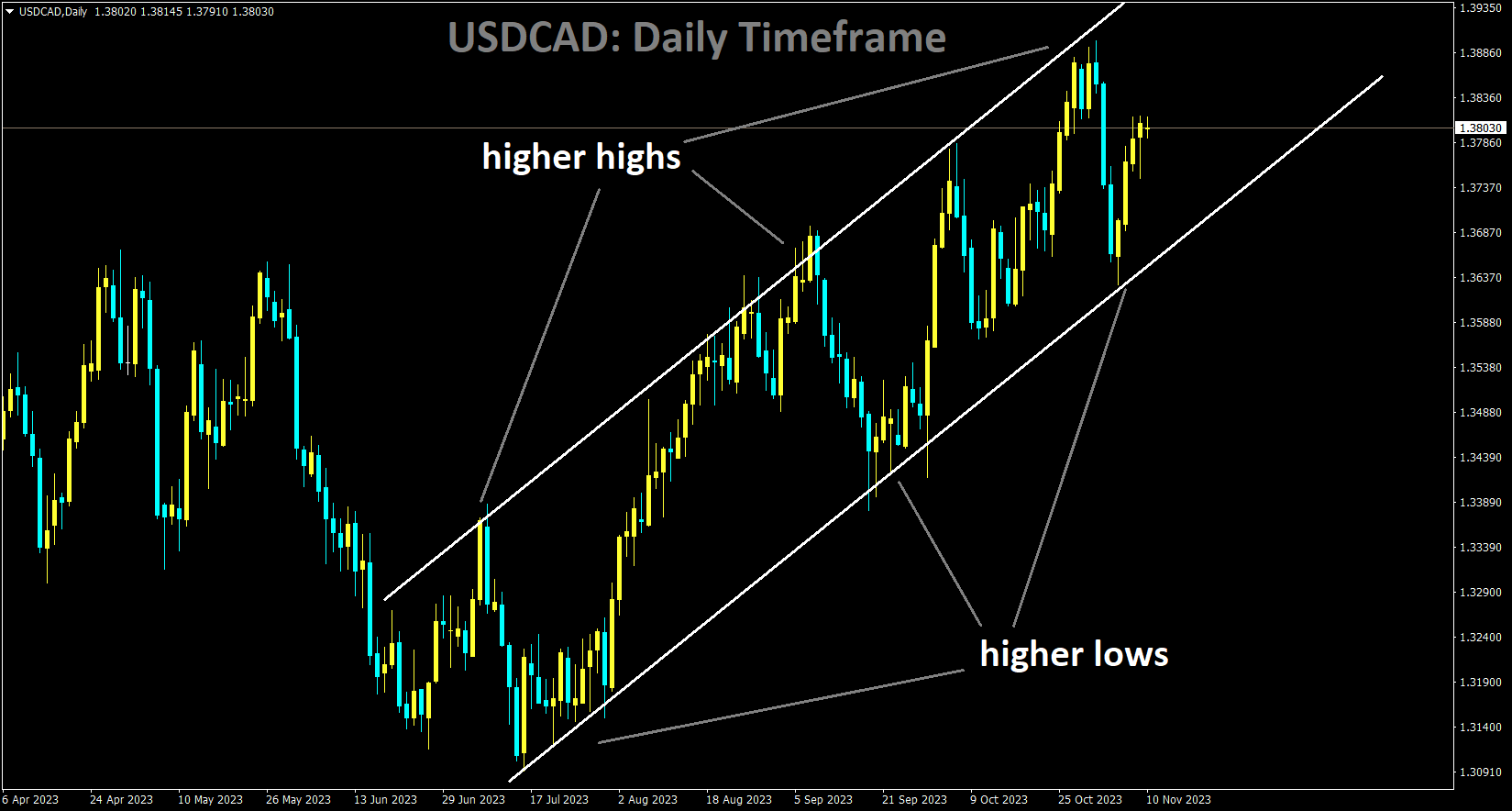

USDCAD Analysis:

USDCAD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel

Bank of Canada Governor Tiff Macklem has emphasized that if inflation continues to moderate, there will be no immediate interest rate increase. This moderation in inflation and GDP data can be attributed to the Bank of Canada’s proactive approach in implementing sufficient rate hikes.

The USDCAD pair faced limited upward movement due to a modest intraday decline in the US dollar and a rebound in oil prices. Federal Reserve (Fed) Chair Jerome Powell’s hawkish comments on Thursday had initially driven the US Dollar (USD) higher across the board. Powell stated that there remains uncertainty about whether interest rates are sufficiently elevated to effectively combat inflation and emphasized the Fed’s readiness to tighten policy further if necessary. Market expectations currently include a 20% likelihood of additional rate hikes at the January meeting, with Fed rate cuts anticipated in June 2024.

On the Canadian front, the Bank of Canada indicated that another rate hike may not be required if inflation aligns with the central bank’s projections. Furthermore, there is a 90% likelihood that the BoC will maintain interest rates unchanged at its December meeting. Additionally, the resurgence in oil prices could bolster the Canadian dollar (Loonie), given that Canada is a major oil exporter to the United States.

On the Canadian front, the Bank of Canada indicated that another rate hike may not be required if inflation aligns with the central bank’s projections. Furthermore, there is a 90% likelihood that the BoC will maintain interest rates unchanged at its December meeting. Additionally, the resurgence in oil prices could bolster the Canadian dollar (Loonie), given that Canada is a major oil exporter to the United States.

With no significant economic data released from the Canadian side on Friday, the USD/CAD pair remains sensitive to USD price movements. Investors will closely monitor Fed Chair Logan’s speech, along with key US data, including the preliminary Michigan Consumer Sentiment Index and UoM 5-year Consumer Inflation Expectation data. These events have the potential to provide clear direction for the USDCAD pair.

USDCHF Analysis:

Swiss inflation for October registered at 1.7%, while the unemployment rate remained at 2.1%. Analysts are increasingly anticipating a rate hike by the Swiss National Bank (SNB) in the upcoming December meeting.

The USDCHF pair has extended its gains for the second consecutive session, largely due to the hawkish remarks made by US Federal Reserve Chair Jerome Powell during the International Monetary Fund event on Thursday.

In Switzerland, the inflation rate held steady at 1.7% in October, and the seasonally adjusted unemployment rate remained at 2.1%. Market observers are closely watching upcoming data, including the ZEW Survey Expectations and Real Retail Sales, to assess the likelihood of the Swiss National Bank considering a 25 basis point interest rate hike in the December meeting, with expectations leaning in favor of such a move.

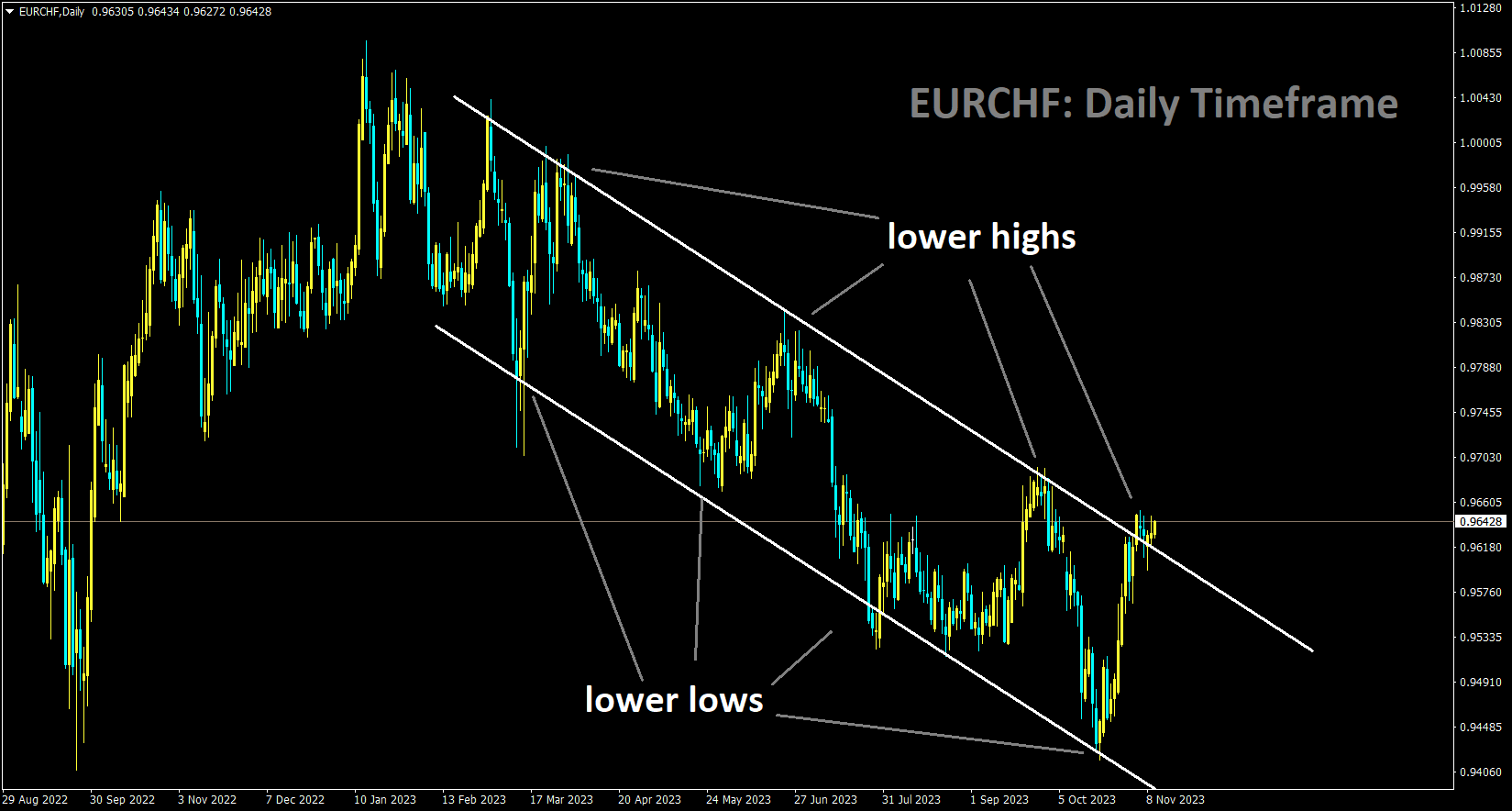

EURCHF Analysis:

EURCHF is moving in the Descending channel and the market has reached the lower high area of the channel

Chair Powell’s acknowledgment that current policies may not be sufficiently restrictive to rein in inflation has increased the probability of at least one more rate hike. This sentiment has driven up US Treasury yields, lending support to the US Dollar. Additionally, the US weekly Initial Jobless Claims came in at 217K, slightly below both the market forecast of 218K and the previous week’s figure of 220K, further bolstering the Greenback. In the absence of economic data from Switzerland, investors are closely monitoring the preliminary US Michigan Consumer Sentiment Index for November and the UoM 5-year Consumer Inflation Expectation. These indicators hold the potential to provide valuable insights and influence market sentiment.

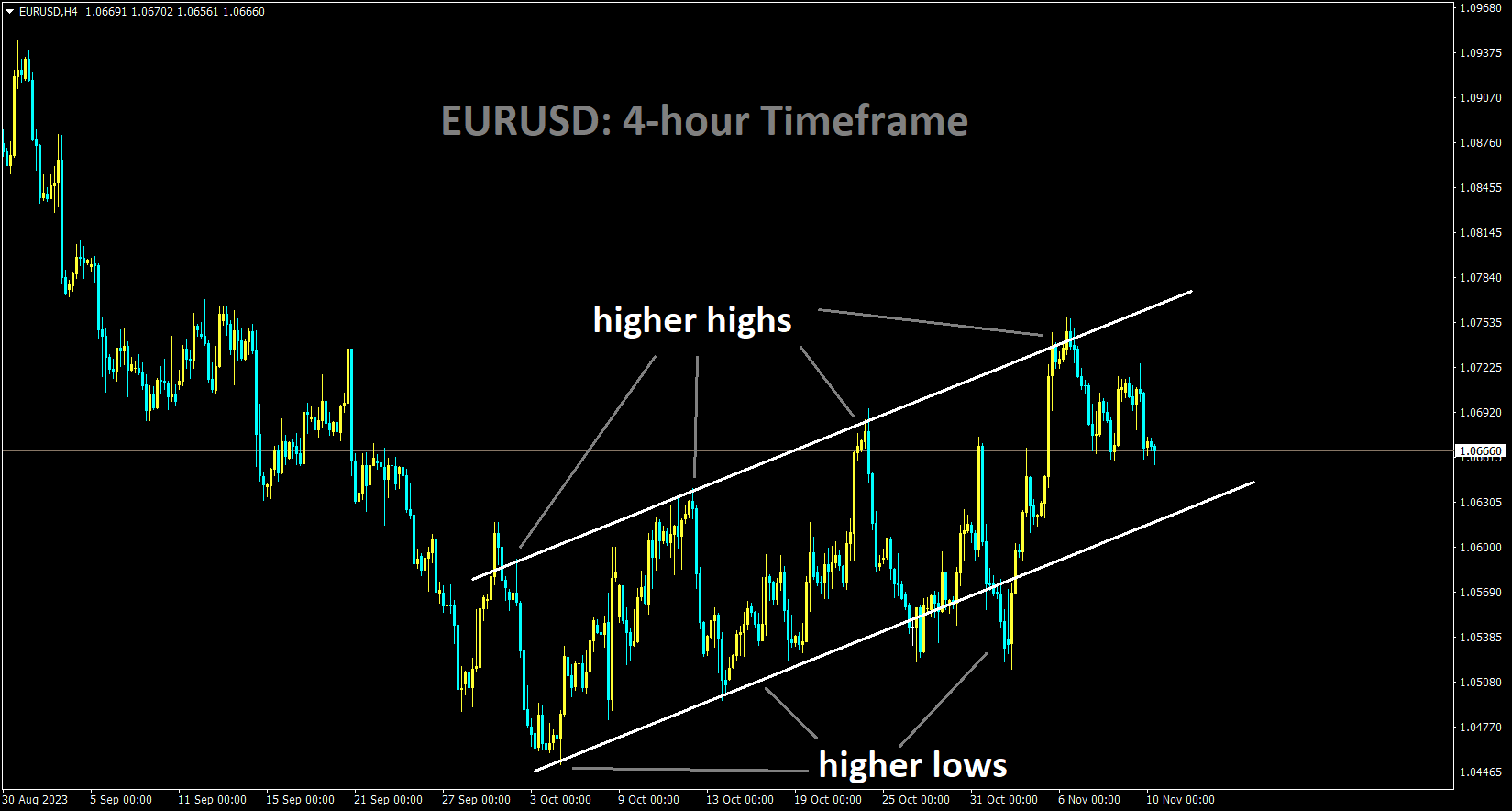

EURUSD Analysis:

EURUSD is moving in an Ascending channel and the market has fallen from the higher high area of the channel

ECB Governing Council member and Croatia’s Governor Boris Vujcic expressed confidence in the effective implementation of their monetary policy thus far. The primary focus remains on achieving a soft landing for inflation, along with reducing the significance of unemployment and preventing a recession. Decisions regarding rate hikes and rate cuts will continue to be driven by data and economic conditions throughout 2024.

Boris Vujčić, a member of the European Central Bank (ECB) Governing Council and the Governor of the Croatian National Bank, discussed the pursuit of a soft landing in the Eurozone during a recent interview on Friday. The objective is to achieve this without experiencing a recession or a substantial rise in unemployment.

He explained that if current projections materialize, the soft landing would come with a low sacrifice ratio, meaning it would occur without a recession and without a significant increase in unemployment. While there are no guarantees that this scenario will persist until the goal is reached, Vujčić emphasized that a soft landing remains a central scenario. However, he noted that they must remain prepared for the possibility of either rate increases or rate cuts, contingent on incoming data throughout 2024.

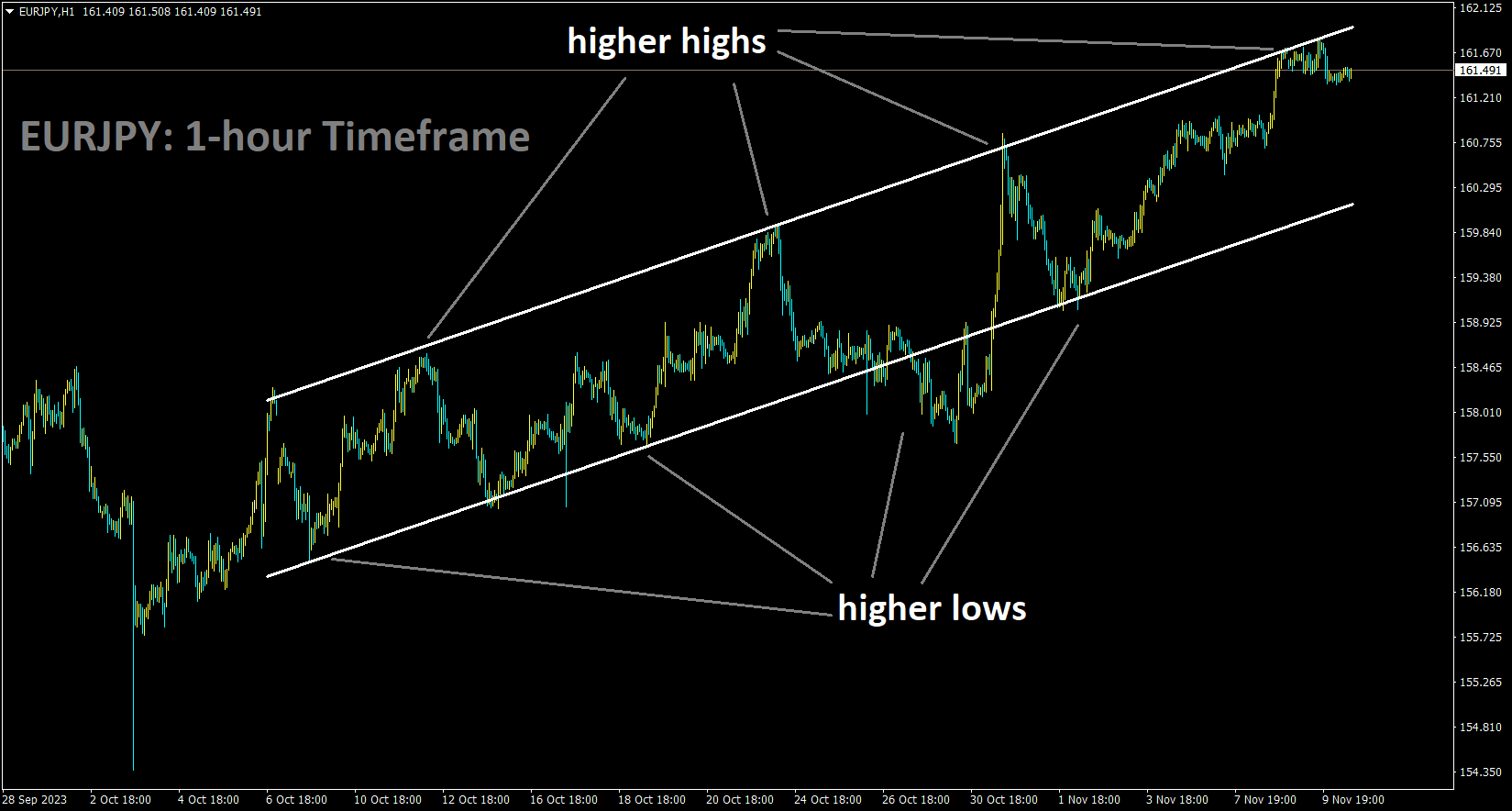

EURJPY Analysis:

EURJPY is moving in an Ascending channel and the market has reached the higher high area of the channel

Governor Ueda of the Bank of Japan has stated that he anticipates inflation and wage growth aligning, emphasizing the need for demand-pull inflation as the target, rather than cost-pull inflation. He further indicated that they expect to achieve their target in a sustainable manner, which would lead to the closure of the door on negative interest rates in 2024.

The minutes from the Bank of Japan’s October meeting acknowledged that current conditions are making significant progress towards achieving the 2% inflation target in a sustainable manner. The updated October forecast also indicated an increase in the expected level of inflation through the forecast period, extending into the end of 2025. The central bank has outlined specific preconditions for a significant policy shift, including the stable and sustainable achievement of the 2% inflation target and the observation of rising wage growth. It is essential to note that the inflation condition stipulates that the inflation should result from ‘demand-pull’ factors driven by increased local economic activity, rather than ‘cost-push’ inflation, as seen in the aftermath of the energy crisis.

Despite the progress in wages and inflation, Governor Ueda of the Bank of Japan has remarked that there is still some distance to go before reaching their objectives. He had previously hinted that the bank would have sufficient data by the year-end to make a decision regarding a shift away from negative interest rates. In the interim, the bank is taking steps to normalize the local bond market, allowing for more flexibility in yields. This approach aims to create greater tolerance around the 1% mark, ultimately reducing volatility when the bank eventually decides to normalize interest rates.

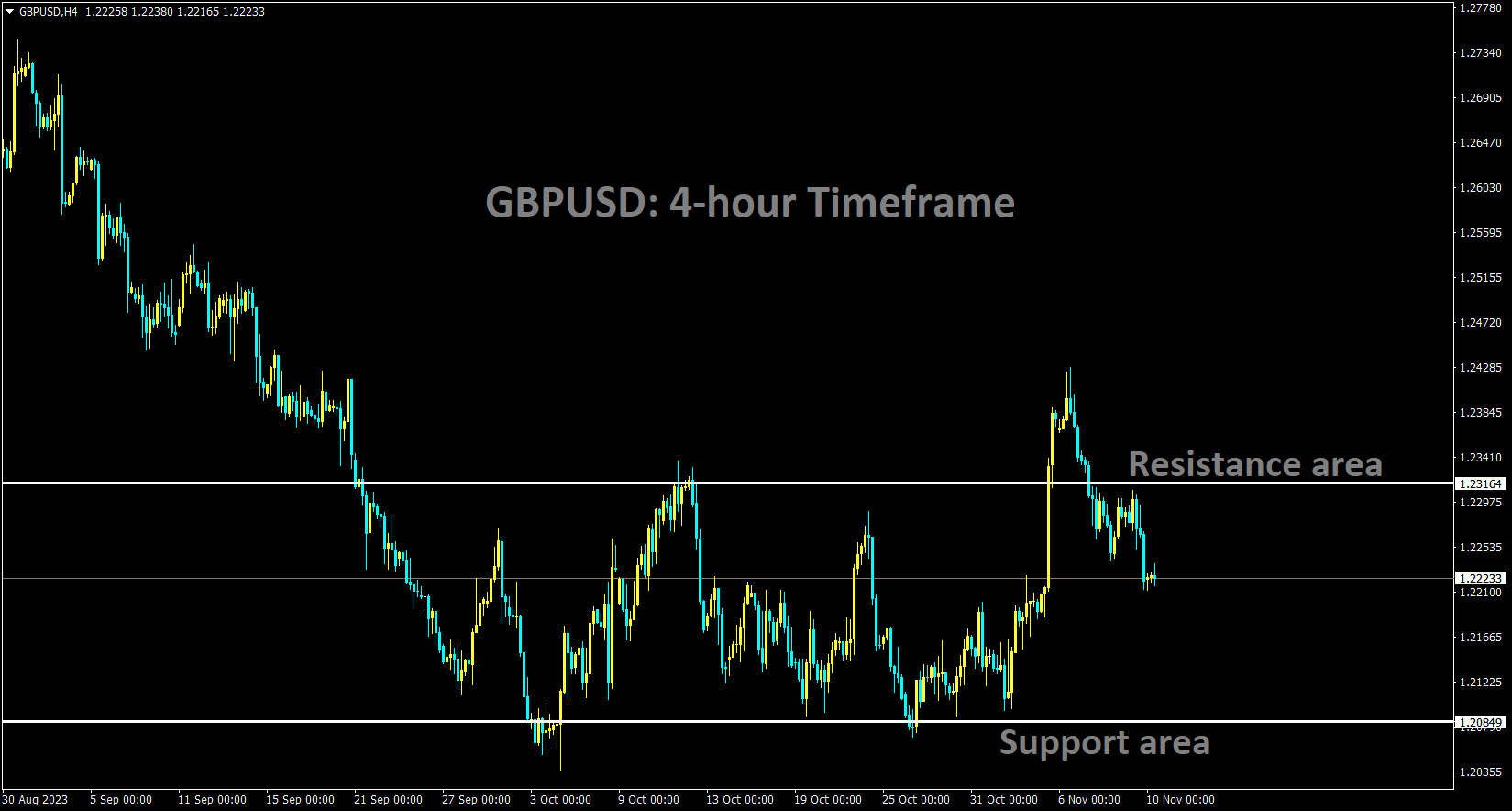

GBPUSD Analysis:

GBPUSD is moving in the Box pattern and the market has fallen from the resistance area of the pattern

The UK’s GDP growth for the third quarter exceeded expectations, registering at 0.60%, up from the anticipated 0.50%. This growth rate aligns with the previous reading. However, it’s worth noting that total business investment experienced a contraction of 4.2% in the third quarter of this year.

According to the Office for National Statistics, the UK’s Gross Domestic Product (GDP) expanded at an annual rate of 0.6% in the third quarter. This growth rate matched the second quarter’s performance and surpassed market expectations of 0.5%. On a monthly basis, the UK’s GDP grew by 0.2%, while on a quarterly basis, it remained unchanged.

Additional data from the UK revealed that Industrial Production and Manufacturing Production saw year-on-year increases of 1.5% and 3%, respectively, in September. However, Total Business Investment contracted by 4.2% on a quarterly basis in the third quarter.

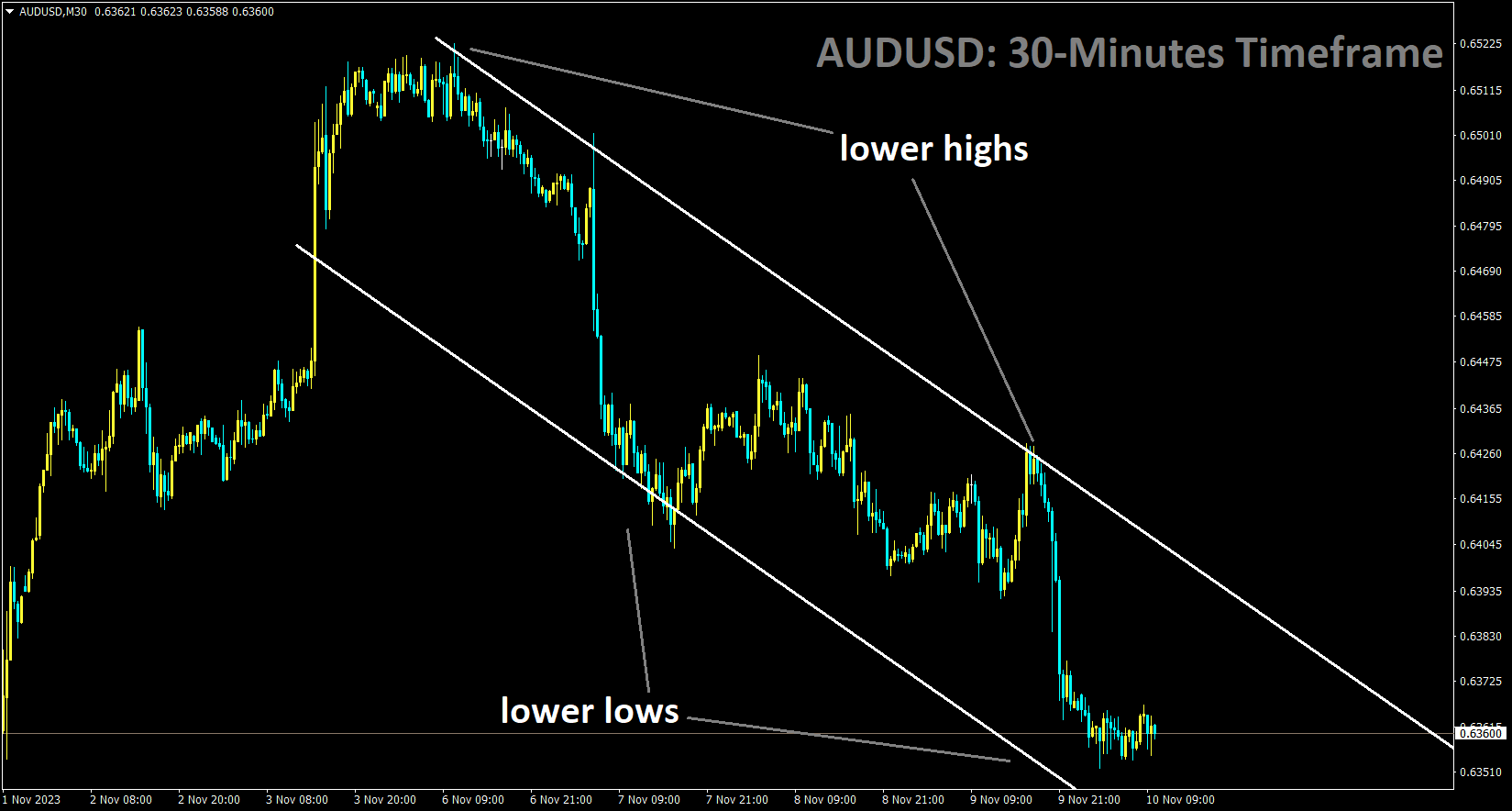

AUDUSD Analysis:

AUDUSD is moving in the Descending channel and the market has reached the lower low area of the channel

In its recent monetary policy meeting, the Reserve Bank of Australia (RBA) acknowledged the persistent inflationary pressures within the Australian economy. As a response, the RBA decided to implement a rate hike this month to manage and control inflation. It’s essential to recognize that raising interest rates can add financial strain to households and business activities.

The Australian Dollar (AUD) has been on a downward trajectory since the beginning of the week. This decline in the AUDUSD pair can be largely attributed to the hawkish comments made by US Federal Reserve Chair Jerome Powell on Thursday. Powell’s statements led to a surge in the US Dollar and US Treasury yields, impacting the currency pair’s performance. In Australia, the central bank released its Monetary Policy Statement on Friday, suggesting that inflation in the country may have peaked. However, the statement also acknowledged that inflation remains elevated and more persistent than previously expected a few months ago. The primary goal of the Reserve Bank of Australia is to bring inflation back to its target. After careful consideration, they initially considered a pause in November but ultimately opted for a rate hike to provide greater confidence in addressing inflation concerns. There is potential for further surprises in inflation, driven by both domestic and external factors. Nevertheless, the RBA board is mindful of the financial challenges faced by many households, which are under significant pressure.

Despite delivering a 25 basis point rate hike, the RBA maintained a dovish tone in its latest meeting. The RBA is adopting a data-dependent approach to address ongoing challenges related to inflation and a slowing Australian economy. Meanwhile, Fed Chair Powell has expressed concerns that the Fed may not have implemented a sufficiently restrictive policy to bring inflation down to the 2% target over time. However, the market widely believes that the Fed has completed its tightening cycle. Additionally, the US weekly Initial Jobless Claims for the week ending November 4 came in lower than expected, potentially reinforcing confidence in a robust US labor market and providing additional support for the US Dollar. Investors are eagerly awaiting the preliminary US Michigan Consumer Sentiment Index for November, along with the UoM 5-year Consumer Inflation Expectation, for further trading cues in the AUDUSD pair.

In response to the latest Monthly Consumer Price Index for September, which showed a notable increase of 5.6% compared to the expected 5.4% growth, the RBA raised the Official Cash Rate to a 12-year high of 4.35% from 4.10%. Australia’s TD Securities Inflation eased to 5.1% in September from 5.7% previously, and Australia’s Retail Sales grew by 0.2% in the third quarter after a 0.6% contraction in the previous quarter. Economists at the National Australia Bank anticipate another 25 basis point hike in February following the release of Q4 inflation data. Furthermore, NAB believes that rate cuts are unlikely to commence until November 2024. In China, the Consumer Price Index for October showed an annual decline of 0.2%, which was slightly below the expected 0.1% decrease. The monthly CPI also dipped by 0.1%, contrasting with the earlier 0.2% growth. Governor Pan Gongsheng of the People’s Bank of China expressed optimism about China’s economy, indicating a positive trajectory and an anticipated achievement of the 5% growth target.

Additionally, the International Monetary Fund has revised its outlook for China’s Gross Domestic Product, now projecting a 5.4% growth rate in 2023, up from the initial forecast of 5.0%, and 4.6% in 2024, surpassing the previous estimate of 4.2%. In the United States, Fed Governor Michelle Bowman has reinforced the notion that the US Fed is considering future increases in short-term interest rates. Moreover, Neil Kashkari, President of the Minnesota Fed, questioned whether the central bank has raised rates sufficiently, citing the resilience of the economy as a factor influencing his perspective.

The US weekly Initial Jobless Claims for the week ending November 4 totaled 217K, slightly below the market forecast of 218K and the previous week’s figure of 220K. The US Bureau of Labor Statistics recently released the Nonfarm Payrolls (NFP) data for October, which showed an increase of 150K jobs, missing the expected 180K and marking a significant decline from September’s figure of 297K.

AUDNZD Analysis:

AUDNZD is moving in the Descending channel and the market has fallen from the lower high area of the channel

China has grappled with reduced inflation and even instances of deflation due to the impact of the COVID-19 pandemic. Manufacturers have had to maintain or even lower prices at the factory gate to stimulate consumer demand. This combination of lower demand and decreased production has weakened China’s economy, with repercussions extending to the export sector in New Zealand.

The New Zealand Dollar (NZD) manufacturing Purchasing Managers’ Index (PMI) for October recorded a reading of 42.5, down from September’s figure of 45.3. Following the release of this data, the NZD experienced a modest weakening against the USD.

The New Zealand Dollar (Kiwi) saw a significant decline, primarily driven by the anticipation of more interest rate hikes by the Federal Reserve. This expectation is poised to further widen the policy divergence between the Federal Reserve and the Reserve Bank of New Zealand. Simultaneously, global economic concerns stemming from Middle East tensions and deflationary pressures in China have diminished the attractiveness of the New Zealand Dollar.

The Chinese economy has been grappling with weak consumer spending, primarily due to a decrease in employment, pushing it into a deflationary phase. Chinese producers have responded by reducing the prices of goods and services at the factory gate due to the challenging demand environment. It’s worth noting that New Zealand holds a significant position as one of China’s key trading partners. Consequently, any economic slowdown in China inevitably impacts the value of the New Zealand Dollar.

In October, the New Zealand Dollar’s manufacturing Purchasing Managers’ Index (PMI) recorded a reading of 42.5, showing a decrease from September’s figure of 45.3. As a result of this data release, the NZD experienced a modest weakening against the USD. The Business NZ Performance of Manufacturing Index, also referred to as the New Zealand Manufacturing PMI, exhibited a similar decline, registering 42.5 in October compared to September’s reading of 45.3.

This PMI reading does not bode well for both GDP and employment growth. It’s worth noting that our GDP forecasts have already factored in a decline in the manufacturing sector during the latter half of 2023. However, there is a possibility that this decline could be more significant than initially anticipated if the PMI does not show signs of improvement in the remaining months of the year, as stated by BNZ Senior Economist Doug Steel.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/