Bitcoin Price Takes a Sudden Dive

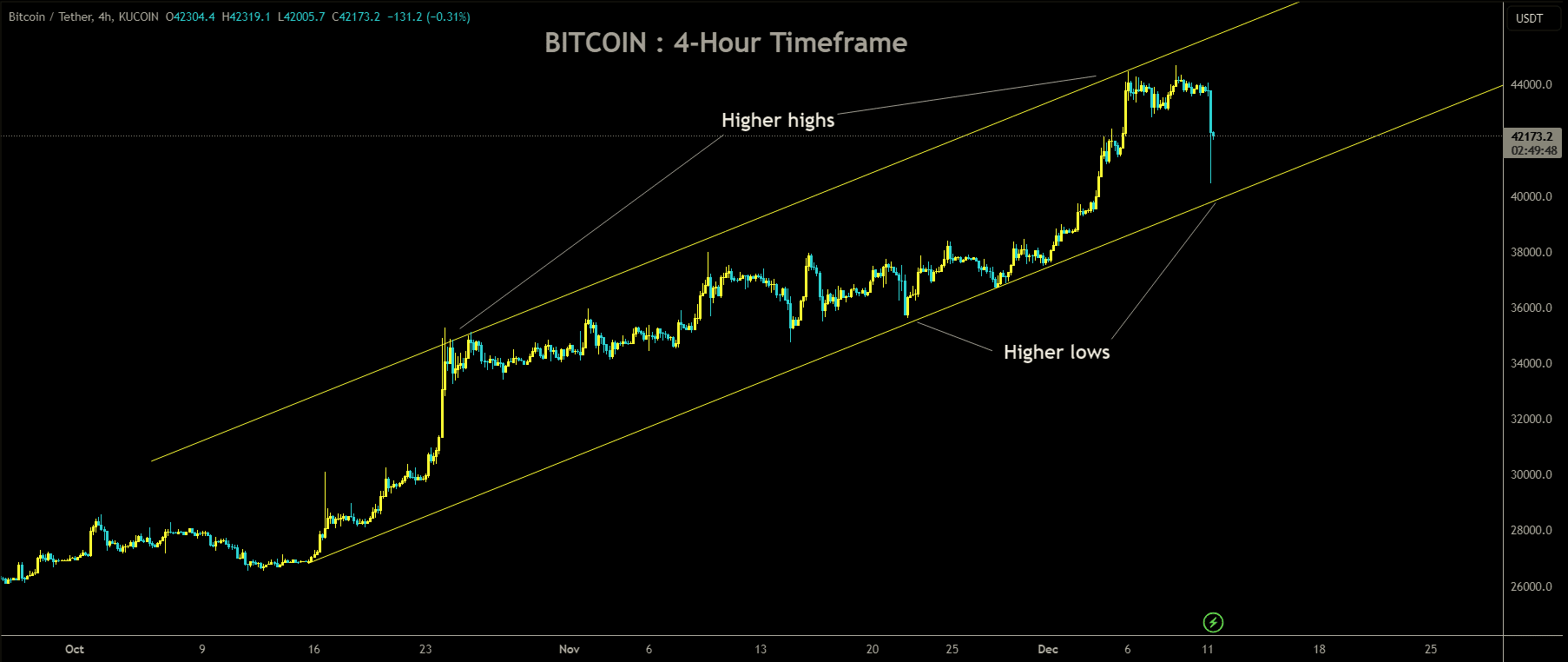

Bitcoin, the world’s leading cryptocurrency, experienced an unexpected drop of 7.74% today, briefly touching the $40,400 level. The sudden downturn led to the liquidation of nearly $200 million worth of positions, as reported by CoinGlass. This sharp decline can be attributed to the anticipation surrounding two major events this week: the Federal Reserve’s interest rate decision and the release of US Consumer Price Index (CPI) data.

Ether Follows Suit with a Decline

Ether (ETH), the second-largest cryptocurrency by market capitalization, also witnessed a steep decline of more than 8.9% during the same timeframe. While ETH’s price initially plummeted, it has since stabilized at around $2,233, marking a 5.3% decrease for the day. Notably, other prominent cryptocurrencies like Binance Coin (BNB), Ripple (XRP), and Solana also posted losses.

Long Positions Liquidated

CoinGlass data reveals that the abrupt drop led to the liquidation of more than $270 million worth of long positions. Furthermore, this decline erased approximately $1.2 billion in open interest on Bitcoin (BTC), which now stands at around $17.9 billion.

Largest Single-Day Bitcoin Decline in Over a Month

This drawdown comes as a surprise, especially considering that just moments before the drop, Scott Melker from “Wolf of All Street” had highlighted Bitcoin’s eighth consecutive green weekly candle and humorously asked, “When correction, sir?” This significant decline represents the most substantial single-day drop for Bitcoin in over a month, despite the asset’s impressive 12% growth over the past 30 days.

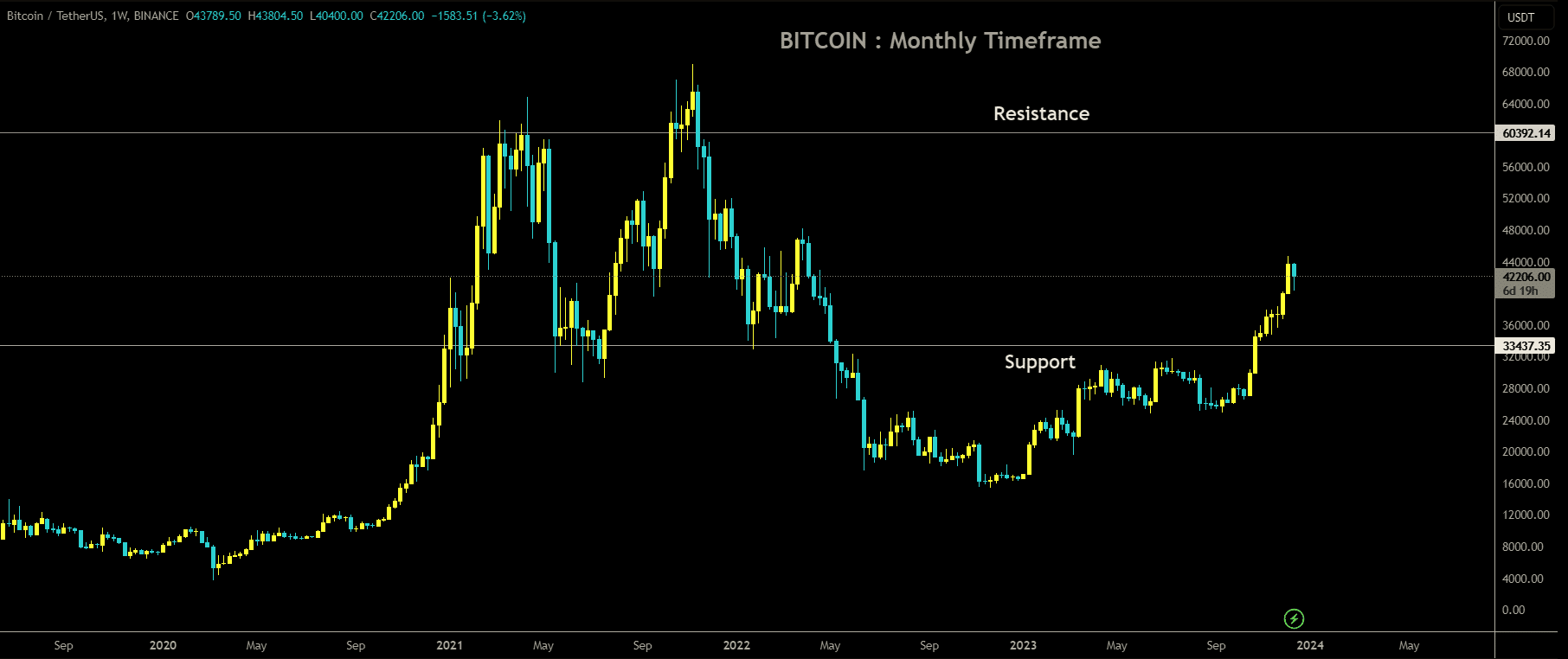

Factors Driving Bitcoin’s Rally

Bitcoin’s recent surge, which has seen it rise more than 150% since the beginning of the year, is largely attributed to expectations of the United States Securities and Exchange Commission (SEC) approving multiple spot Bitcoin exchange-traded funds (ETFs). This move would provide substantial exposure to the cryptocurrency for institutional investors. Additionally, the market anticipates that the Federal Reserve will initiate interest rate cuts next year.

Investors are also keeping a close eye on upcoming inflation data and the final Federal Open Market Committee (FOMC) meeting of the year.

Bitcoin’s Current State

Bitcoin reached a high of $42,100 before its sudden drop, and it is currently trading at $41,600. This retracement brings Bitcoin back to its May 2022 level above the $41,000 mark, marking a year-to-date increase of over 150%. The overall cryptocurrency market cap has reached $1.62 trillion, experiencing a 4.0% increase in the past 24 hours, a level not seen since late April 2022. November’s cryptocurrency exchange trading volume reached over $826 billion, the highest monthly volume since March of the same year.

Liquidity Crunch and Trading Volumes

Over the past 24 hours, CoinGlass data reports that 75,887 traders were liquidated, resulting in total liquidations exceeding $216 million. The majority of these liquidations involved short positions, with $166 million in shorts wiped out compared to just over $50 million in long positions. Additionally, more than $86 million in leveraged bitcoin positions were liquidated, with shorts accounting for over $76 million and long positions around $10 million.

Other Cryptocurrencies’ Performance

While Bitcoin experienced a significant drop, other leading cryptocurrencies displayed different movements. Ether increased by over 4%, maintaining its position above $2,250. Binance Coin posted a modest gain of over 2%, reaching a price of $234, while Solana traded relatively flat over the past 24 hours, hovering around the $63.50 mark.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/