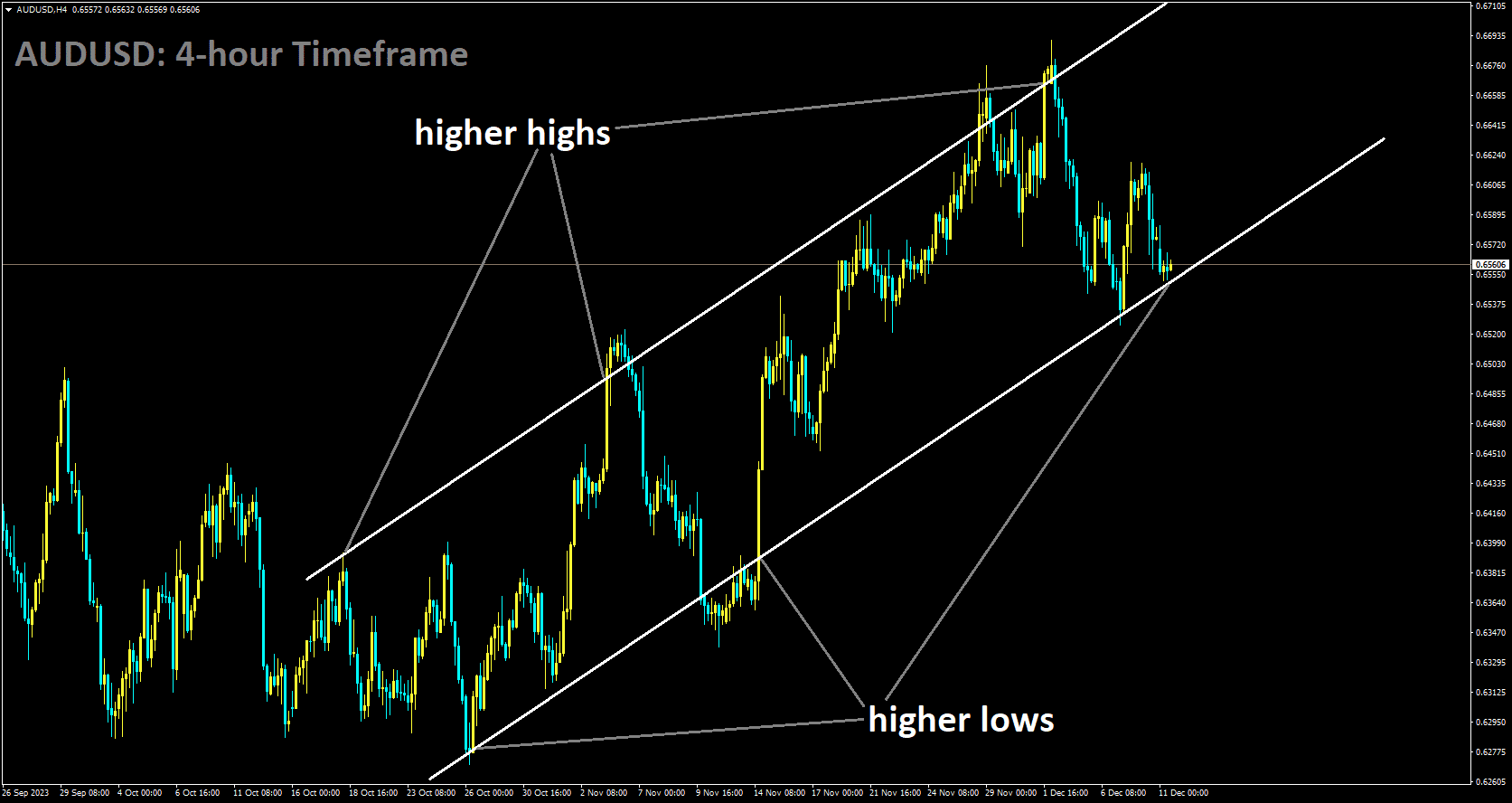

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher low area of the channel

On Monday, the Australian Dollar faced its second consecutive session of decline. This decline was primarily driven by the robust US employment figures released on Friday, which bolstered the US Dollar and exerted downward pressure on the AUDUSD pair. Furthermore, concerns about deflation in China, coupled with disappointing Consumer Price Index and Producer Price Index (PPI) numbers, contributed to a sell-off of the Australian Dollar. Last week, the US Bureau of Labor Statistics reported that November’s Nonfarm Payrolls exceeded market expectations, and the Unemployment Rate also declined during the same period. This led to a surge in US Treasury yields, supporting the strength of the USD. The strong employment data prompted discussions and speculations about the future course of the US Federal Reserve’s monetary policy and the duration of its rate restrictions. The focus will shift to the US Consumer Price Index (CPI) on Tuesday and the Fed Interest Rate Decision on Wednesday.

Michele Bullock, the Governor of the Reserve Bank of Australia (RBA), is set to deliver a speech on Tuesday. Despite the RBA’s tightening bias, recent economic indicators suggest that further interest rate hikes may not be imminent. In terms of economic data, Australia’s Trade Balance data for October showed a surplus slightly below expectations at 7,129M. In China, the Consumer Price Index saw a year-on-year decline of 0.5% in November, compared to a 0.2% decrease in October. On a monthly basis, Chinese inflation dropped by 0.5%, surpassing the 0.1% decline observed in October. China’s Producer Price Index recorded a more significant year-on-year drop in November at 3.0%, compared to the 2.6% decrease reported in October. In the United States, Nonfarm Payrolls for November increased by 199,000, surpassing both the previous month’s rise of 150,000 and the market’s expectation of 180,000. US Average Hourly Earnings Year-on-Year remained steady at 4.0%, in line with market projections for November. Meanwhile, the Unemployment Rate decreased to 3.7% from the previous 3.9%, and the preliminary Michigan Consumer Sentiment Index for December rose significantly to 69.4 from 61.3.

Gold Analysis:

XAUUSD is moving in Ascending channel and market has reached higher low area of the channel

The price of gold experienced a notable turnaround, plummeting to a two-week low last Friday after reaching an all-time high just the week prior. This decline followed the release of unexpectedly strong employment data from the United States. The highly-watched US jobs report showcased the resilience of the US labor market, causing investors to scale back their expectations for a 25 basis points interest rate cut by the Federal Reserve (Fed) in March 2024. Consequently, both US Treasury bond yields and the US Dollar saw gains, exerting downward pressure on the price of gold. Additionally, the relative stability in equity markets contributed to gold’s second consecutive day of depreciation on Monday. However, concerns lingered about a potential global economic downturn, particularly in China, along with ongoing geopolitical risks, which provided some support to the precious metal and prevented more significant losses. Traders also appeared cautious, refraining from making bold moves ahead of key data releases and central bank events scheduled for the week. Tuesday will shift the focus to US consumer inflation figures, followed by the outcome of the crucial two-day FOMC meeting on Wednesday. The “dot plot” from the Fed, which offers insights into interest rate projections for the upcoming year, will be closely monitored and could impact the non-yielding gold price. Additionally, the Swiss National Bank, the Bank of England, and the European Central Bank are set to announce policy updates on Thursday. Subsequently, attention will shift to the release of flash PMI data from the Eurozone, the UK, and the US, providing further insights into the global economy’s health and influencing the precious metal.

Following the release of upbeat US jobs data, the benchmark 10-year US Treasury yield rebounded from a three-month low, bolstering the US Dollar and putting pressure on the price of gold on Friday. The US NFP report revealed the addition of 199,000 new jobs in November, surpassing estimates of 180,000 and exceeding the previous month’s 150,000 rise. Despite an increase in the Labor Force Participation Rate, the US Bureau of Labor Statistics (BLS) reported a decline in the Unemployment Rate from 3.9% in October to 3.7%, indicating underlying strength in the labor market. This led traders to speculate that the Federal Reserve might not implement an interest rate cut until May 2024. Furthermore, on Friday, Iran-backed militias in Iraq and Syria targeted US troops with rockets and drones multiple times due to US support for Israel amid the conflict in Gaza. An attack on the US embassy in Baghdad added to concerns of an expanding Middle East conflict. As traders await this week’s US consumer inflation figures and the Fed’s interest rate projections for the next year, they remain cautious about taking aggressive directional positions. The week ahead is marked by monetary policy meetings at the Swiss National Bank, the Bank of England, and the European Central Bank, all scheduled for Thursday.

Silver Analysis:

XAGUSD is moving in the Box pattern and the market is reaching the support area of the pattern

The U.S. Bureau of Labor Statistics released its report today, indicating that the United States added 199,000 jobs in November. This resulted in a slight drop in the unemployment rate to 3.7 percent. While the employment growth is below the average monthly increase of 240,000 jobs over the past year, it aligns with recent trends in job growth. This report presents a mixed picture for the Federal Reserve as they approach their upcoming meeting. The rise in hourly earnings and the decrease in unemployment may pose challenges for the Central Bank. Job gains were observed in the healthcare and government sectors, while manufacturing saw an increase in employment due to workers returning from a strike. On the flip side, the retail trade sector experienced a decline in employment. Manufacturing employment increased by 28,000, which was slightly below expectations, primarily due to the return of automobile workers following the resolution of the UAW strike.

In November, average hourly earnings for all private nonfarm payroll employees rose by 12 cents, or 0.4 percent, reaching $34.10. Over the past year, average hourly earnings have seen a 4.0 percent increase. Private-sector production and nonsupervisory employees also witnessed a 0.4 percent rise in average hourly earnings to $29.30. Lately, there have been some positive developments for the U.S. Federal Reserve, with the 10-year yield retreating to around 4 percent. Despite signs of an economic slowdown, concerns persist regarding the labor market and the service sector. This has led to an increase in market expectations for rate cuts. While the data released slightly outperforms estimates, it may not fundamentally alter the landscape. The positive results across the three major indicators in the report will undoubtedly give the Fed reason to contemplate their next steps, especially considering that average earnings could sustain demand in the future. As the dust settles from the jobs report and ahead of the FOMC Meeting, it will be intriguing to monitor the trajectory of rate cut expectations. The looming question is whether Fed Chair Powell will need to tailor his messaging at the upcoming meeting based on market expectations.

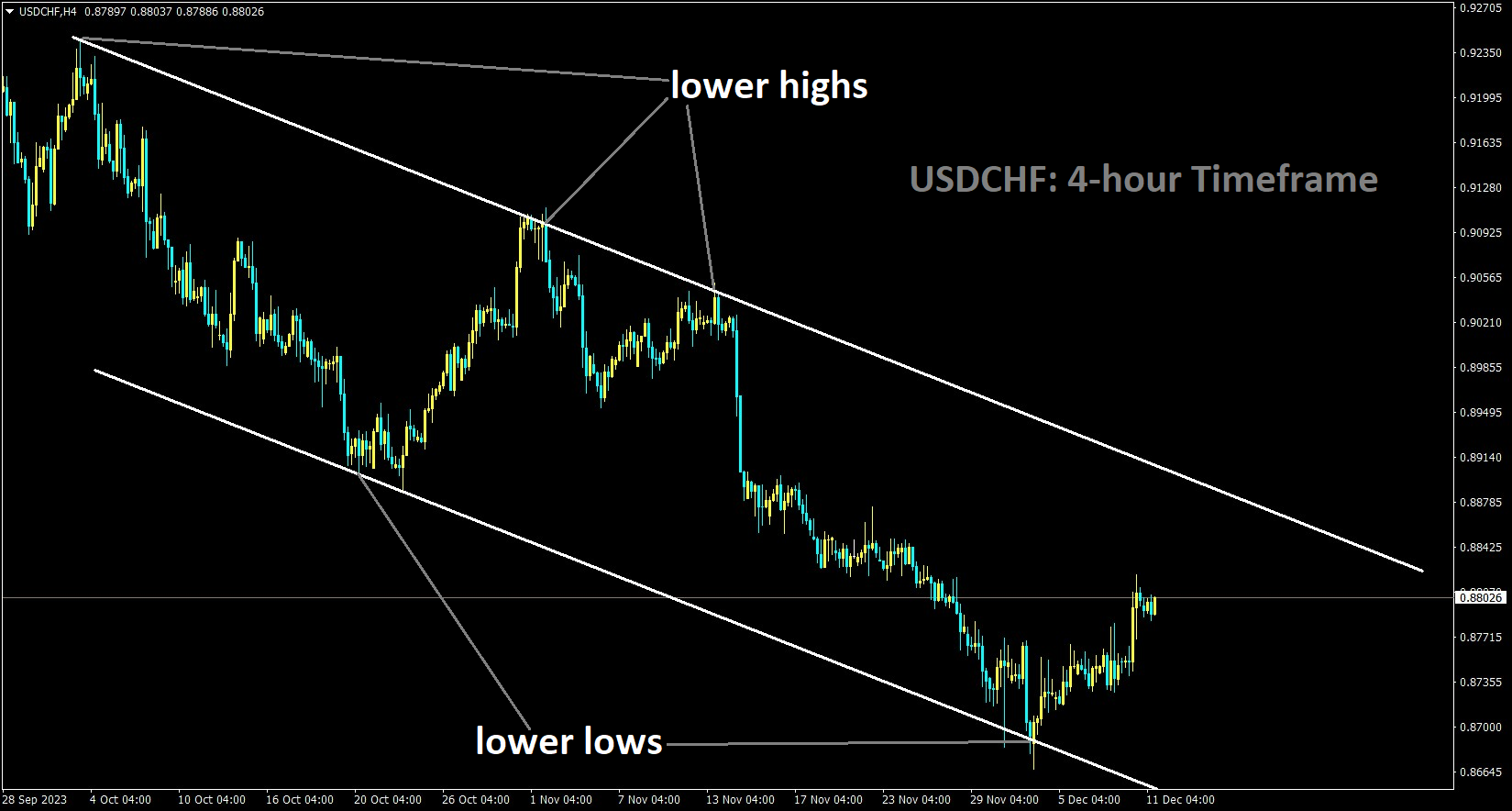

USDCHF Analysis:

USDCHF is moving in the Descending channel and the market has rebounded from the lower low area of the channel

The Swiss Franc experienced a decline against the US Dollar on Friday following the release of the US Nonfarm Payrolls report, which revealed a higher-than-expected number of job creations in November, indicating a robust labor market. According to the report from the US Bureau of Labor Statistics, 199,000 new positions were added, surpassing economists’ expectations of 180,000. Additionally, the report indicated that the US Unemployment Rate dropped to 3.7% in November, down from 3.9% in October, contrary to expectations of no change. Average Hourly Earnings also exceeded expectations at 0.4%, surpassing the anticipated 0.3%, suggesting the possibility of building wage inflation pressures. Furthermore, Hours Worked increased, indicating the filling of more full-time positions.

The higher wage data and stronger overall employment metrics suggest that the US economy is in better health than previously believed and that there may be emerging inflationary pressures. This data could lead the Federal Reserve to consider maintaining higher interest rates for a more extended period and reconsidering the possibility of interest rate cuts. Higher and more prolonged interest rates are likely to attract capital inflows, benefiting the US Dollar.

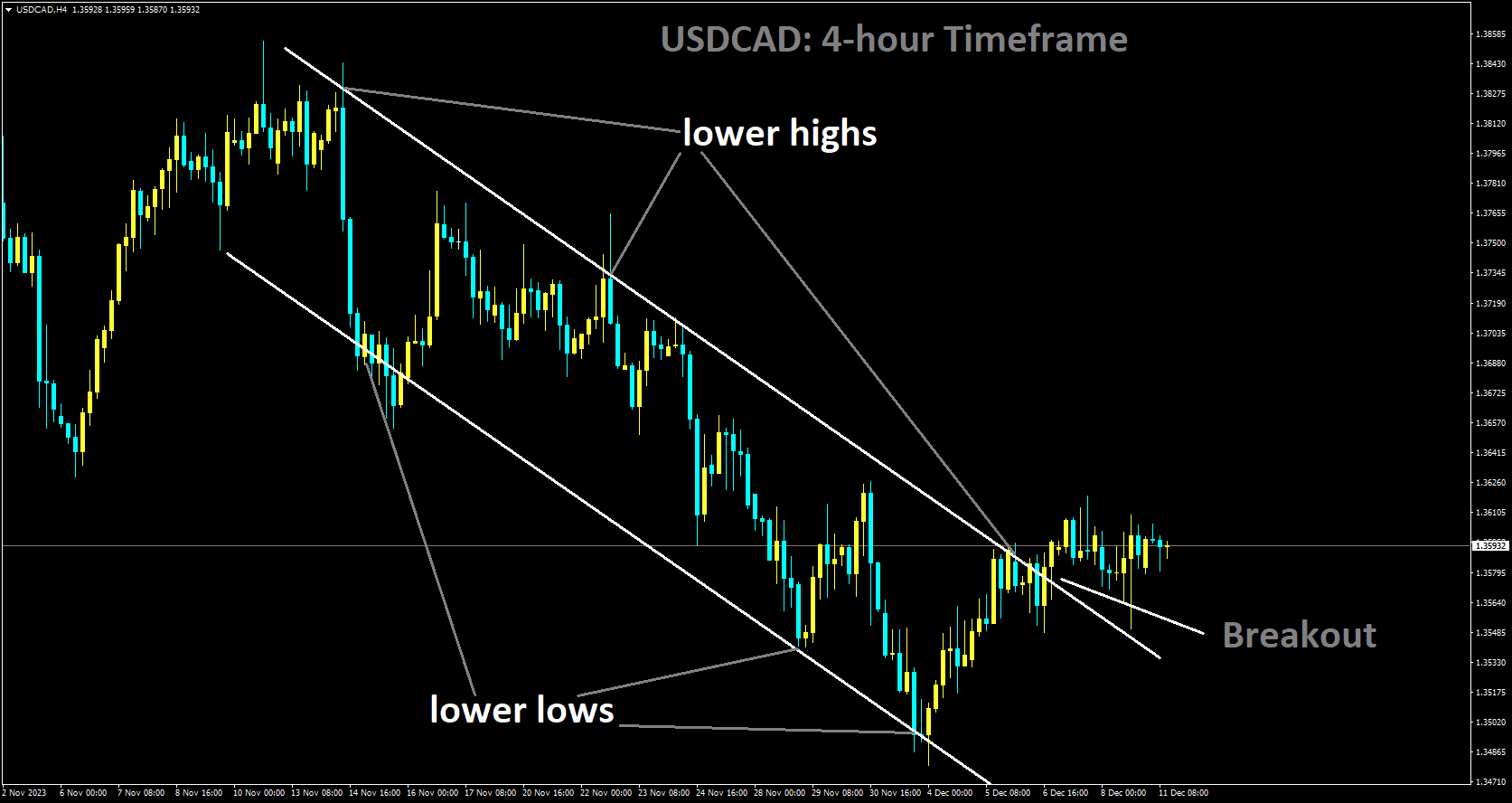

USDCAD Analysis:

USDCAD has broken descending channel in upside

The Canadian Dollar made modest gains in the foreign exchange market on Friday, recovering from recent declines. However, the gains were marginal, and the charts still exhibit volatility as investors adjust their positions and expectations following the surprisingly positive US Nonfarm Payrolls report for November. The CAD ended Friday with a slight increase of one-tenth of a percent against the US Dollar. Its strongest performance was against the New Zealand Dollar, where it rose by approximately seven-tenths of a percent on the last trading day of the week.

On the economic data front, Bank of Canada Governor Tiff Macklem is scheduled to speak at the Canadian Club of Toronto. During this event, Governor Macklem is expected to address audience questions. In the broader FX market, the Canadian Dollar showed strength on Friday, gaining ground against all other major currencies, with the US Dollar coming in a close second. The US Dollar initially advanced ahead of Friday’s US Nonfarm Payrolls report but retraced its steps after the release.

The NFP report for November exceeded expectations, with nearly 200,000 new jobs added, well above the forecasted 180,000 and a significant improvement from October’s 150,000 figure. Despite the shift in risk sentiment following the positive NFP report, investors remain cautious and will closely monitor recent data as they look ahead to 2024, paying particular attention to potential revisions. Notably, in the last twelve consecutive NFP releases, all but four were later revised downward, with only two being revised upward. The most recent two releases have not yet undergone revisions.

Additionally, the University of Michigan’s Consumer Sentiment Index significantly exceeded expectations, registering at 69.4, well above the forecasted 62.0 and extending its lead over November’s reading of 61.3. In the upcoming week, investors will keep a close eye on US Consumer Price Index inflation figures and the Federal Reserve’s final Interest Rate Decision. Markets will be eager to see any updates to the Fed’s ‘dot plot,’ which outlines interest rate projections. Crude Oil experienced a moderate rebound after a week of declines. West Texas Intermediate Crude Oil climbed to $71.50 per barrel on Friday, recovering from a nearly 8% drop from Monday’s opening price, which had fallen to $69.01 per barrel on Thursday. This rebound in Crude Oil prices, even if slight, is welcome news for the Canadian Dollar, which remains down by eight-tenths of a percent against the US Dollar since the start of the week.

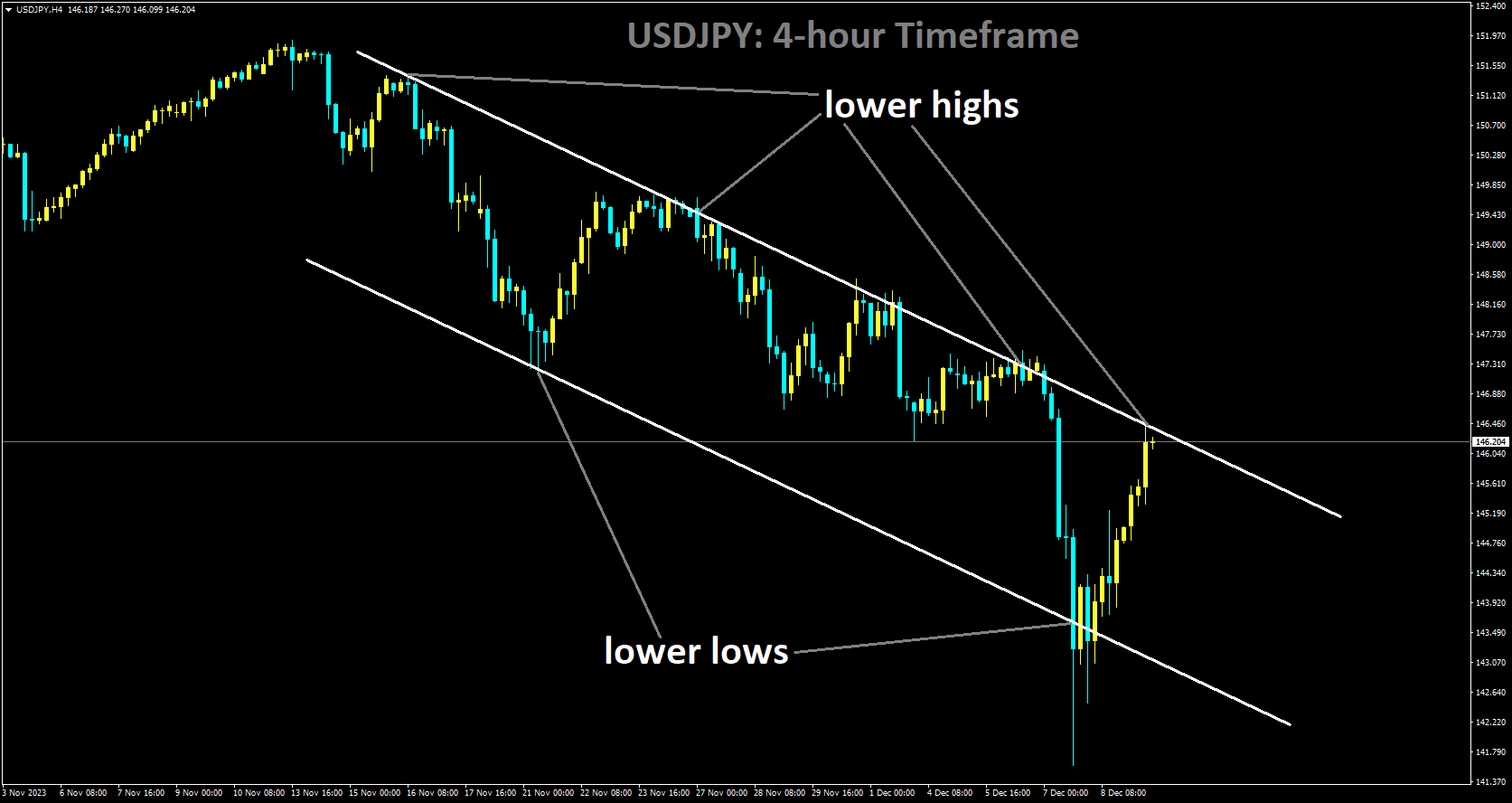

USDJPY Analysis:

USDJPY is moving in Descending channel and market has reached lower high area of the channel

The Japanese Yen experienced a turbulent end to the previous week, facing fluctuations from the Asian session all the way to the highly anticipated Non-Farm Payroll report. Notably, Japan’s GDP fell significantly short of expectations, with the quarter-on-quarter figure slipping into negative territory, raising concerns about a potential recession in the near future. These economic conditions may prompt the Bank of Japan to exercise caution in tightening its monetary policy, despite the presence of high inflation levels. Although there have been hints from BoJ Governor Ueda regarding a possible policy shift, I do not anticipate any major moves during the December meeting, as they are likely to take a gradual approach.

The Japanese central bank’s decisions will heavily rely on economic data, particularly with regard to inflation and labor statistics, as robust additional evidence will be necessary to persuade the BoJ to alter its current stance. Money markets are currently pricing in an interest rate hike around September or October 2024, aligning with my expectation of no significant changes in the immediate future.

This week, as Japan lacks specific economic data, attention will shift to the United States. Following a positive surprise from the Non-Farm Payroll report across all metrics, the US dollar may continue to strengthen, especially if inflation surpasses forecasts. However, it is worth noting that the Federal Reserve is expected to maintain its current interest rates, potentially accompanied by a hawkish stance from Fed Chair Jerome Powell to uphold a restrictive monetary policy environment. Key data releases such as US PPI and retail sales will conclude the high-impact events for the week, leading up to the Bank of Japan’s rate announcement in the following week.

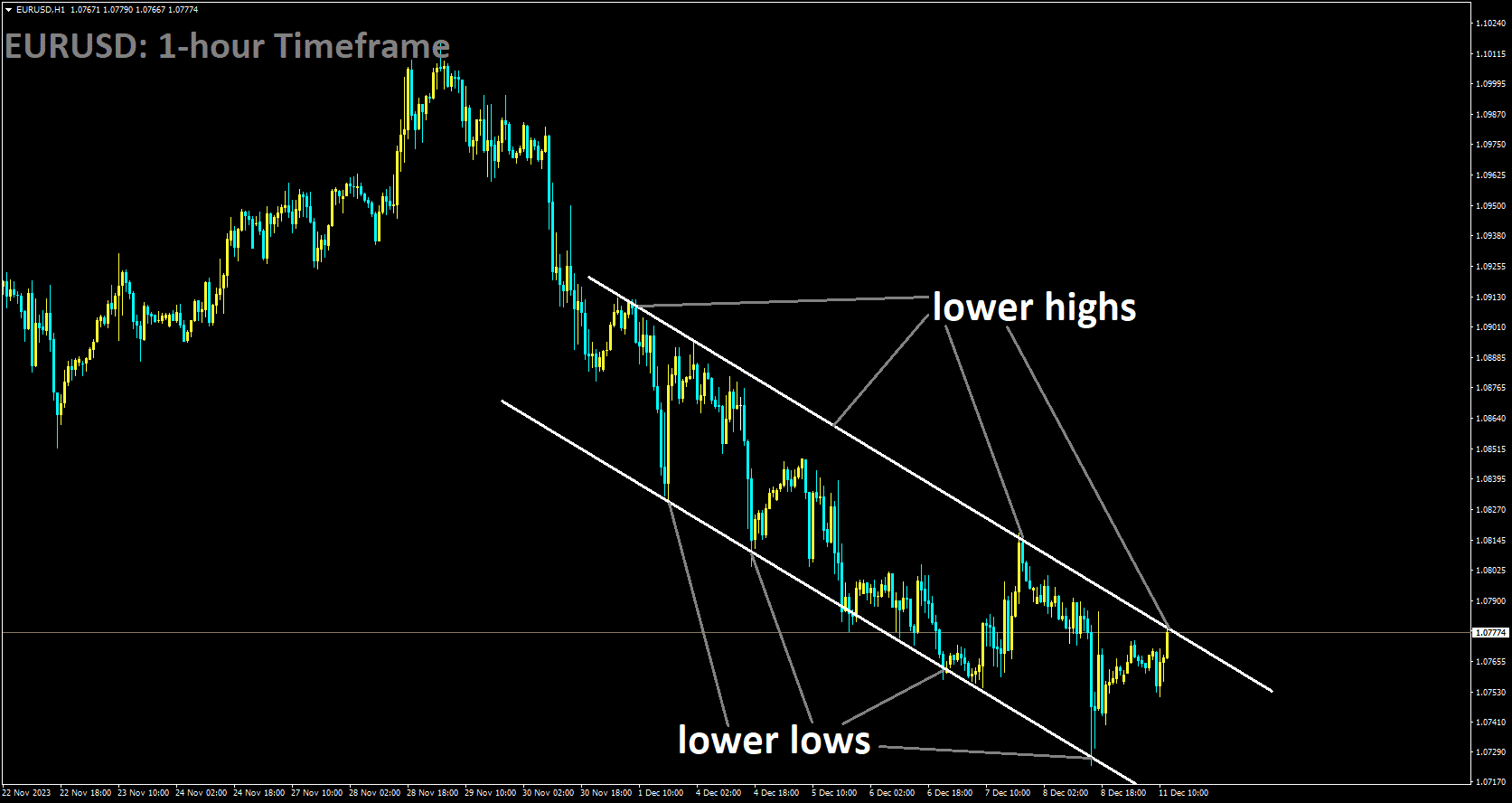

EURUSD Analysis:

EURUSD is moving in Descending channel and market has reached lower high area of the channel

The Euro encountered challenges in the previous week due to a downward revision of the Euro Area Q3 GDP figure. This revision affirmed the economic stagnation within the Euro Area and has cast a pessimistic shadow over the upcoming ECB meeting. During the past week, Euro pairs were largely influenced by external factors and the revised GDP data. This ECB meeting, along with the release of updated economic forecasts, is anticipated to be of great significance for the Euro Area.

It is widely expected that the ECB will maintain its current interest rates. As a result, the key focus of the meeting will be on the newly updated economic forecasts and the statements made by the ECB officials. Market sentiment continues to reflect an anticipation of a 125 basis points easing by the ECB in 2024. Consequently, there will be a keen interest in comparing these market expectations with the Central Bank’s projections. A notable discrepancy between the ECB’s outlook and market predictions could potentially bolster the Euro’s strength. However, the Euro’s response will also hinge on how the financial markets interpret the ECB’s forecasts, as we have witnessed instances where market participants have diverged from the Central Bank’s stance.

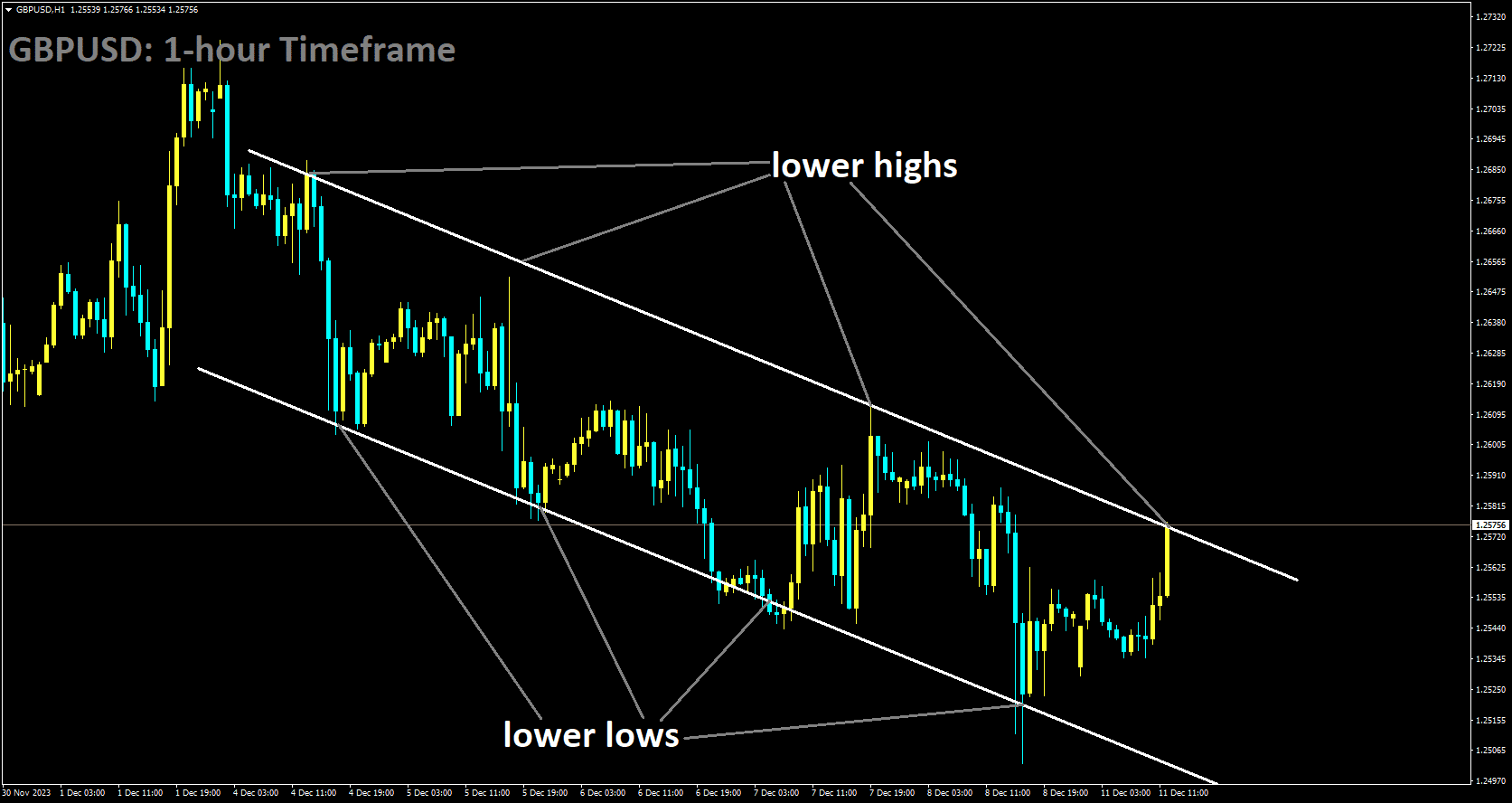

GBPUSD Analysis:

GBPUSD is moving in Descending channel and market has reached lower high area of the channel

The US Nonfarm Payrolls outperformed market expectations, with 199,000 new jobs added to the US economy in November, surpassing the previous month’s figure of 150,000 payroll additions. Additionally, the Unemployment Rate decreased from 3.9% to 3.7%, while Average hourly earnings remained steady at 4.0% year-on-year. Looking ahead, traders are eagerly anticipating key events from the upcoming FOMC and BoE meetings this week, which have the potential to inject volatility into the market. Bank of England Governor Andrew Bailey had previously emphasized that it was premature to consider rate cuts, despite a decline in the Consumer Price Index from 6.7% in September to 4.6% in October. As a result, it is widely expected that the BoE will maintain borrowing costs at a 15-year high during its December meeting on Thursday.

Notably, Federal Reserve Chair Jerome Powell had recently stated that it would be too early to confidently conclude that the Fed had adopted a sufficiently restrictive stance to control inflation. Powell emphasized the Fed’s readiness to tighten policy further if necessary. However, the upbeat US Nonfarm Payrolls report has led some investors to speculate that the Fed might postpone rate cuts in 2024. Market participants will also keep a close watch on UK employment data, including Employment Change, Claimant Count Change, and ILO Unemployment Rate, scheduled for release on Tuesday. Furthermore, the US Consumer Price Index data will be published later that day, adding to market interest. Ultimately, attention will turn to the US FOMC meeting on Wednesday and the Bank of England policy meeting on Thursday, where pivotal decisions and statements are expected to shape market dynamics.

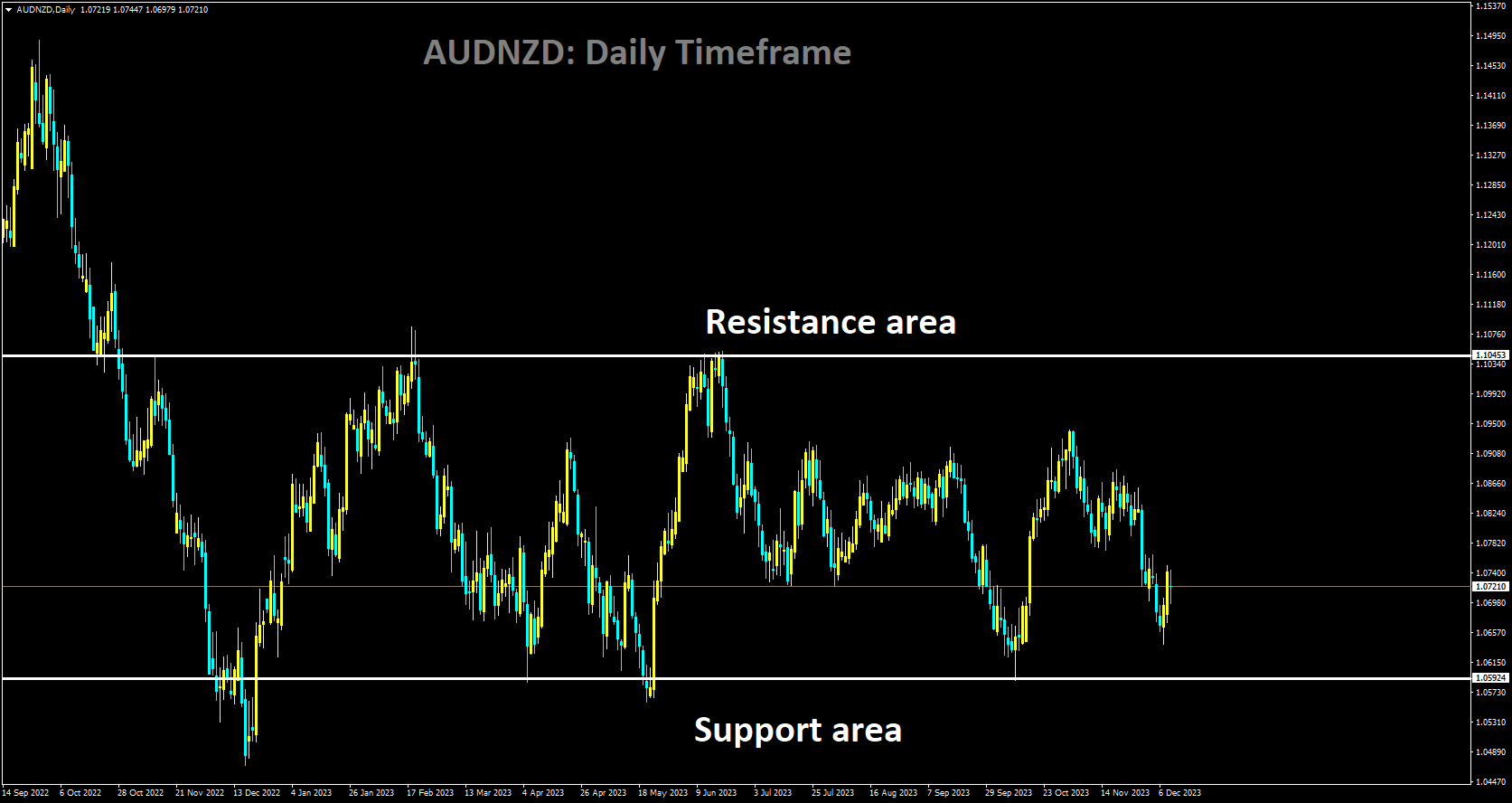

AUDNZD Analysis:

AUDNZD is moving in box pattern and market has rebounded from the support area of the pattern

Following its meeting on Friday, China’s Communist Party’s Politburo announced its plans for 2024, emphasizing proactive fiscal policies and prudent monetary policies with a focus on flexibility and precision. The government aims to strengthen counter-cyclical and cross-cyclical macroeconomic policies while enhancing industrial supply chain resilience and security. The government also intends to boost domestic demand, deepen key area reforms, and expand openness levels.

Measures will be taken to ensure stability in foreign trade and capital flows and to mitigate risks in critical areas. Macroeconomic policies will maintain consistency, and anti-corruption efforts, particularly related to industrial, systemic, and regional corruption, will continue. The country’s current economic recovery remains in a critical phase.

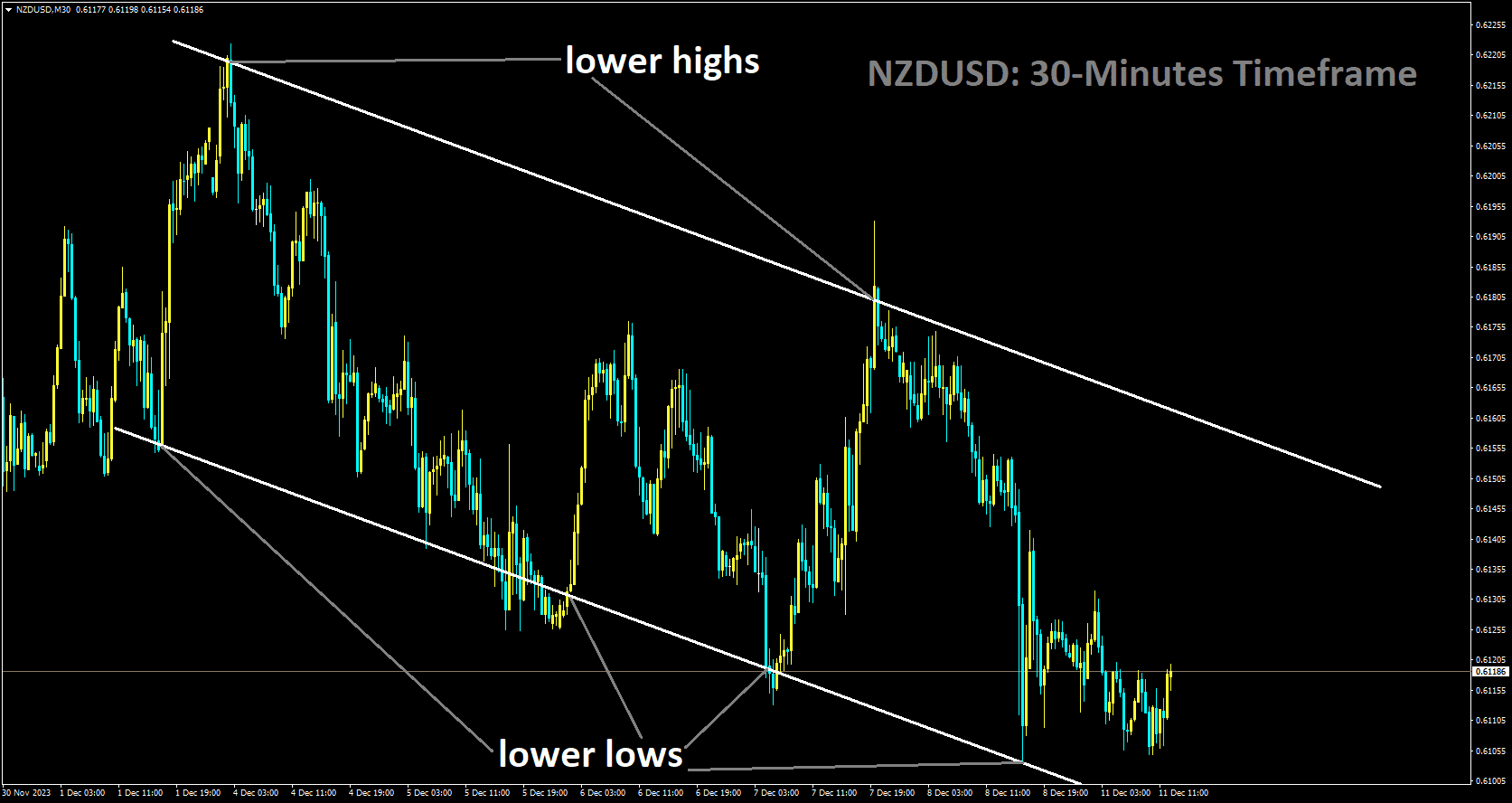

NZDUSD Analysis:

NZDUSD is moving in Descending channel and market has rebounded from the lower low area of the channel

The US Department of Labor recently released its November Nonfarm Payrolls report, which painted a more optimistic picture of the labor market than earlier indications. The report revealed the addition of 199,000 jobs to the economy, exceeding both October’s figure of 150,000 and the market forecast of 180,000. Consequently, the unemployment rate declined from 3.9% to 3.7%, and Average Hourly Earnings remained stable at 4% over the past 12 months, alleviating concerns of a wage-price spiral. In response, the NZDUSD exhibited significant volatility, ultimately declining to its lowest point. Additionally, the University of Michigan’s latest consumer survey showed increased optimism among American households about the economic outlook, with the Consumer Sentiment Index reaching 69.0, its highest level since August. Inflation expectations were also revised downward. The US Dollar Index (DXY) rose by 0.30%, reaching 104.01, supported by a rise in US yields, with the US 10-year bond yield concluding the week at 4.236%.

In New Zealand, the upcoming economic calendar includes the release of Current Account and Gross Domestic Product figures for the third quarter. Projections suggest a growth rate of 0.2%, lower than the previous quarter’s expansion of 0.9%. Traders in the United States are preparing for the release of the US inflation report and the Federal Open Market Committee meeting in the following week, both of which are expected to be significant market events.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/