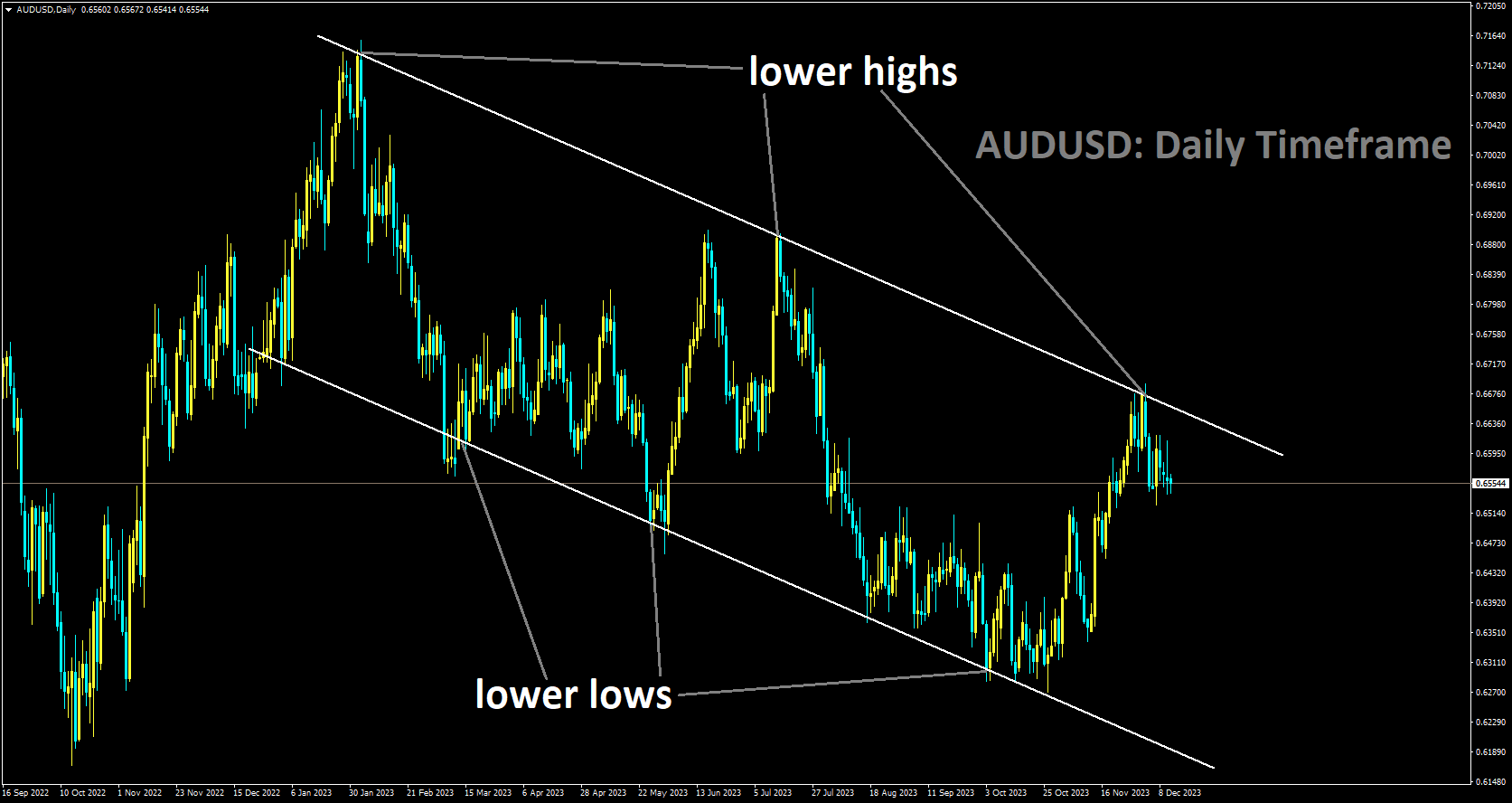

AUDUSD Analysis:

AUDUSD is moving in Descending channel and market has reached lower high area of the channel

On Wednesday, the Australian Dollar continued its downward slide, particularly following the release of moderate Consumer Price Index data from the United States. Investors are now eagerly awaiting the release of the US Producer Price Index and the Federal Reserve’s Interest Rate Decision. Australia’s government is projecting a significantly improved budget outlook for this year, as revenues are outpacing earlier forecasts. In the mid-year economic and fiscal outlook presented by Labor Treasurer Jim Chalmers, the projected budget deficit for the year ending in June 2024 has shrunk to just AUD 1.1 billion, down from the AUD 13.9 billion forecasted in May.

The government is resisting calls for additional cost-of-living assistance to avoid exacerbating inflationary pressures. The US Dollar Index is attempting to recover recent losses amid lower US Treasury yields. The DXY had experienced a decline, with the Federal Open Market Committee expected to make no changes in its upcoming policy decision. In November, US inflation cooled as anticipated, as indicated by the Consumer Price Index. Investors will closely monitor Fed Chair Jerome Powell’s comments for hints about potential interest rate adjustments in the coming year.

Additionally, economic sentiment in Australia appears to be on the rise, as reflected in the ANZ-Roy Morgan Australian Consumer Confidence survey, which increased to 80.8 from the previous week’s 76.4. Westpac Consumer Confidence for December also improved, rising by 2.7% after a previous decline of 2.6%. However, National Australia Bank Business Confidence, which assesses current business conditions in the country and provides insights into the short-term economic performance, declined to 9 from the previous decrease of 2.

RBA Governor Michele Bullock expressed confidence in the fight against inflation and emphasized a cautious approach, closely monitoring data while highlighting the RBA’s commitment to preserving employment gains. On Tuesday, the US Bureau of Labor Statistics reported that the US Consumer Price Index for November increased by 0.1% month-on-month and 3.1% year-on-year, aligning with market consensus and meeting inflation expectations. The US Core CPI, which excludes volatile food and energy prices, also rose by 0.3% MoM and 4.0% YoY, in line with expectations.

GOLD Analysis:

XAUUSD is moving in an Ascending channel and the market has reached the higher low area of the channel

During the early Asian session on Wednesday, gold prices experienced a slight dip to $1,980. This decline in the value of the precious metal was triggered by the release of US inflation data, which had a notable impact on market sentiment. The report reinforced the belief that the Federal Reserve would need to maintain higher interest rates for an extended period to achieve its 2% inflation target. Meanwhile, the US Dollar Index, measuring the USD’s value against a basket of currencies used by US trade partners, currently hovers around 103.80 after retreating from the 104.30 range. Treasury yields also saw a slight decrease, with the 10-year yield moving from 4.23% to 4.21%. In November, US inflation, as measured by the Consumer Price Index, increased by 0.1% month-on-month, in line with market expectations. The annual figure for November rose to 3.1% from 3.2% in October, as anticipated. Additionally, the Core CPI, excluding volatile food and energy prices, rose by 0.3% month-on-month and 4.0% year-on-year, matching market consensus.

US inflation remains elevated, and market participants anticipate that the Federal Reserve will need to maintain higher interest rates for a longer period to control rising prices. However, the focus now shifts to the upcoming Fed monetary policy meeting and the comments of Fed Chair Jerome Powell. The Fed is widely expected to keep interest rates unchanged on Wednesday, with an 80% chance of a rate hike in May, according to the CME FedWatch Tool. Late on Tuesday, the Chinese government emphasized the importance of industrial policy for the next year. Chinese authorities will guide financial institutions to provide increased support for technological innovation, green initiatives, inclusive small and micro businesses, and the digital economy. This announcement disappointed investors who were hoping for a significant stimulus to boost growth in the face of China’s worsening deflation, liquidity issues in the property sector, weak trade data, and a slowing recovery following Covid lockdowns. Market participants will closely watch the US Producer Price Index (PPI) ahead of the Fed monetary policy meeting on Wednesday. Traders will pay close attention to Fed Chair Jerome Powell’s comments after the meeting, as any hawkish remarks from Fed officials could exert selling pressure on the price of gold.

US inflation remains elevated, and market participants anticipate that the Federal Reserve will need to maintain higher interest rates for a longer period to control rising prices. However, the focus now shifts to the upcoming Fed monetary policy meeting and the comments of Fed Chair Jerome Powell. The Fed is widely expected to keep interest rates unchanged on Wednesday, with an 80% chance of a rate hike in May, according to the CME FedWatch Tool. Late on Tuesday, the Chinese government emphasized the importance of industrial policy for the next year. Chinese authorities will guide financial institutions to provide increased support for technological innovation, green initiatives, inclusive small and micro businesses, and the digital economy. This announcement disappointed investors who were hoping for a significant stimulus to boost growth in the face of China’s worsening deflation, liquidity issues in the property sector, weak trade data, and a slowing recovery following Covid lockdowns. Market participants will closely watch the US Producer Price Index (PPI) ahead of the Fed monetary policy meeting on Wednesday. Traders will pay close attention to Fed Chair Jerome Powell’s comments after the meeting, as any hawkish remarks from Fed officials could exert selling pressure on the price of gold.

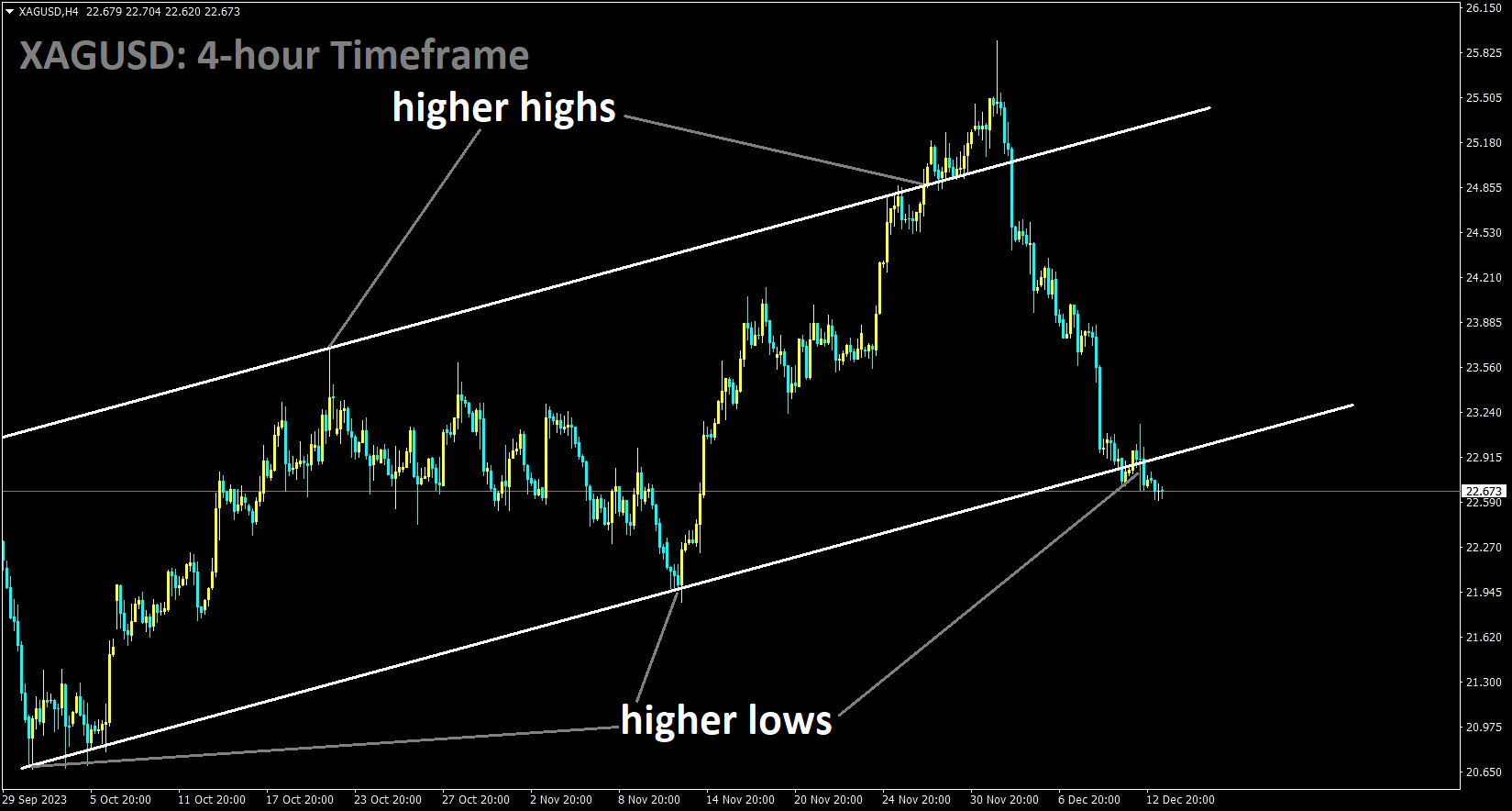

SILVER Analysis:

XAGUSD is moving in an Ascending channel and the market has reached the higher low area of the channel

In November, year-on-year headline inflation in the US dropped to 3.1%, aligning with predictions, while the year-on-year Core Consumer Price Index remained stable at 4%, as reported by the US Bureau of Labor Statistics today. This marks the lowest headline reading in five months, continuing the recent downward trend. Of particular concern and likely to sustain the current Federal Reserve discussion is the slight increase observed in the month-on-month print, with the Core MoM figure registering at 0.1% and 0.3%, respectively. Energy costs saw a decrease of 5.4%, compared to -4.5% in October, with gasoline dropping 8.9%, utility piped gas service falling by 10.4%, and fuel oil sinking by 24.8%. Meanwhile, the food index in November increased by 0.2%, following a 0.3% rise in October. The index for food at home showed a 0.1% increase during the month, while the index for food away from home rose by 0.4%. The index for all items, excluding food and energy, rose by 0.3% in November, compared to a 0.2% increase in October. Indexes that saw increases in November included rent, owners’ equivalent rent, medical care, and motor vehicle insurance. Conversely, indexes for apparel, household furnishings and operations, communication, and recreation experienced declines during the same period.

It’s worth noting that the data released today was not expected to significantly impact the Fed’s decision tomorrow. With the data closely aligning with expectations, the slight uptick in underlying inflation may lead the Fed to resist the growing narrative of rate cuts in 2024. Fed swaps following the data release indicate a slightly higher probability of rate cuts, while futures contracts tied to Fed policy suggest the possibility of rate cuts as early as March 2024. Given that the Fed is anticipated to maintain rates at their current levels, much like the European Central Bank, the focus will be on comments from Chair Powell and any revisions to the economic outlook. Markets will eagerly await any potential pushback from the Fed regarding the rate cut expectations priced in by market participants. The disparity between Fed and market expectations is likely to influence the US dollar and risk appetite following the Federal Open Market Committee meeting, potentially setting the tone for the early weeks of 2024.

USDJPY Analysis:

USDJPY is moving in Ascending channel and market has reached higher low area of the channel

This week holds significant importance as three major central banks are scheduled to provide updates on their monetary policies, with some also releasing economic forecasts. The Federal Reserve will offer insights into its perspectives on inflation, economic growth, the Fed funds rate, and unemployment. It is expected that the Fed will once again aim to avoid using dovish language, given that inflation has yet to reach the 2% target but has shown substantial progress throughout the year. The Bank of Japan’s meeting is scheduled for next week Tuesday, and market attention will certainly be drawn to any hints about potential shifts in policy. The data released this week could play a pivotal role in determining the direction of FX markets as we approach the end of the year, a period when trading typically slows down during the Christmas season.

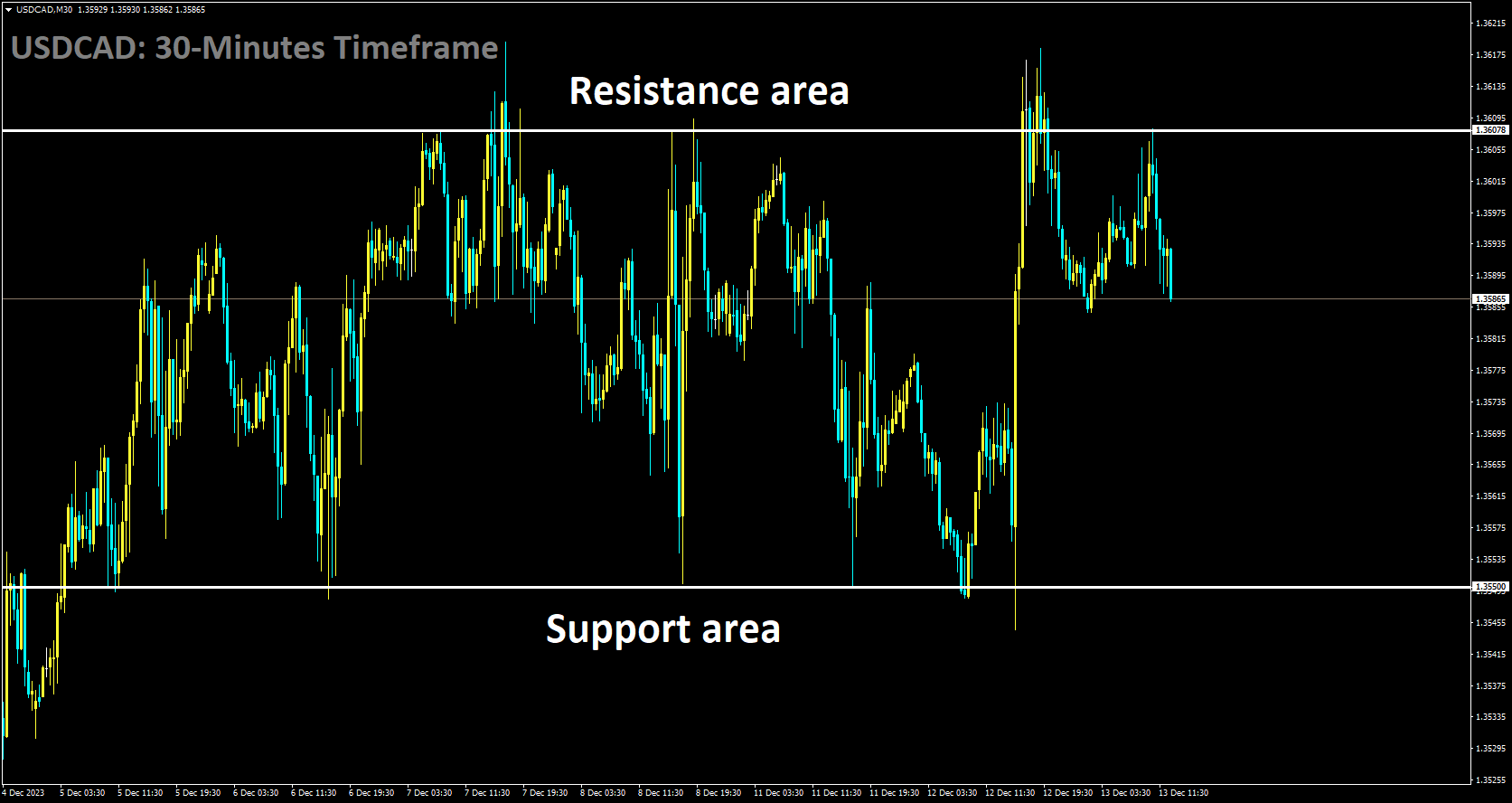

USDCAD Analysis:

USDCAD is moving in box pattern and market has fallen from the resistance area of the pattern

The Canadian Dollar retreated as market sentiment shifted in response to US Consumer Price Index inflation data meeting expectations, signaling concerns about slowing future growth. Canada lacks significant economic data on its calendar this week, leaving the CAD susceptible to broader market movements. Declining demand worries in crude oil markets are contributing to the pressure on the Canadian Dollar. On Tuesday, the Canadian Dollar recorded losses against most of its major currency counterparts, with the most significant declines observed against the Japanese Yen and the Swiss Franc, where it weakened by half a percent and four-tenths of a percent, respectively. The Canadian Dollar’s relatively strongest performance was against the Australian Dollar, where it remained mostly stable. It also saw a minor decline of a tenth of a percent against the US Dollar following the CPI release.

US Consumer Price Index inflation met expectations, with annualized CPI dropping from 3.2% to 3.1%, and the month-on-month figure increasing slightly from 0.0% to 0.1%. Core CPI inflation, which excludes volatile food and energy prices, remained at 4% for the year-on-year figure, while the month-on-month Core CPI for November was slightly higher at 0.3%, compared to October’s 0.2%. Crude oil markets are experiencing a decline in prices due to reduced growth in the US, adding to ongoing concerns in the energy market about declining demand overshadowing global production cuts, particularly those made by the Organization of the Petroleum Exporting Countries. US West Texas Intermediate Crude Oil has fallen to $69.00 per barrel, and this decline is weighing down the Canadian Dollar, which is closely tied to oil prices. The next major event for the markets will be the Federal Reserve’s Monetary Policy Statement and updates to its Interest Rate Projections, both scheduled for today.

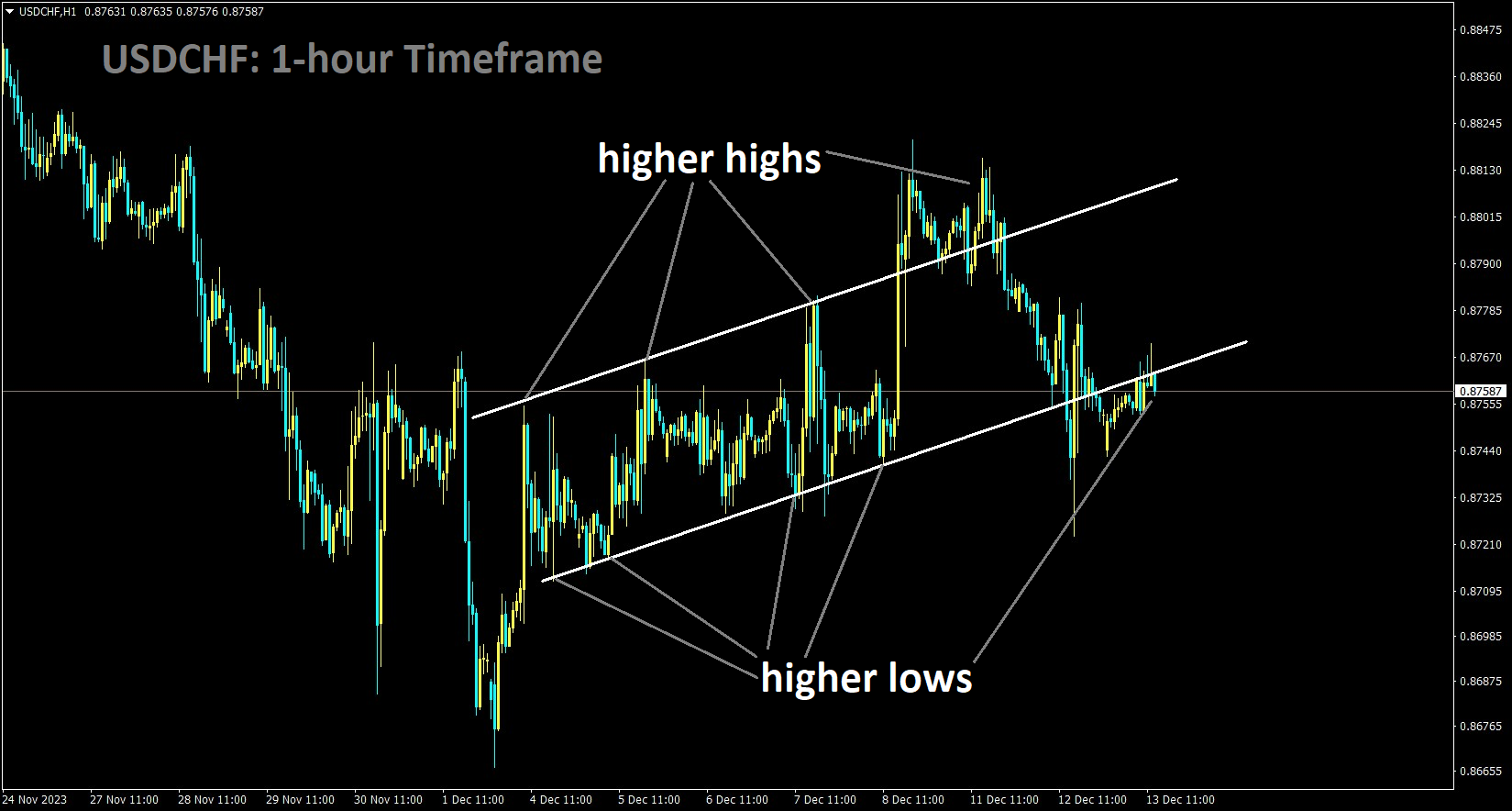

USDCHF Analysis:

USDCHF is moving in an Ascending channel and the market has reached the higher low area of the channel

The US Dollar is strengthening, buoyed by positive US bond yields. In Thursday’s meeting, the Swiss National Bank is expected to maintain its policy rate at 1.75%, especially given the recent decrease in Swiss inflation in November. The forthcoming Monetary Policy Assessment in the Quarterly Bulletin will provide valuable insights into the SNB’s outlook, including a medium-term conditional inflation forecast. The US Dollar Index is on an upward trajectory, nearing the 104.00 level, supported by higher yields on both the 2-year and 10-year US bond coupons, currently at 4.73% and 4.20%, respectively. However, market participants are adopting a cautious approach ahead of the Federal Reserve’s policy decision, introducing an element of uncertainty that could potentially exert downward pressure on the Greenback, consequently impacting the USDCHF pair. While the expectation is for the Federal Open Market Committee to maintain its current policy stance, the focus on cues regarding potential rate cuts in 2024 adds intrigue for investors.

The significance of Federal Reserve Chair Jerome Powell’s comments becomes even more pronounced, as they have the potential to shape market expectations and influence movements in the USDCHF pair. The recent volatility in the US Dollar, triggered by the release of the Consumer Price Index figures, reflects the market’s reaction to the expected 3.1% year-on-year increase in November, down from the previous 3.2%. The concurrent rise in the US Core CPI to 4.0% aligns with market expectations, indicating a degree of predictability in inflation trends. As market participants await the release of the US Producer Price Index for November, the focus shifts to expectations of a yearly growth reduction to 1.0%. Projections for a moderation in Core PPI to 2.2%, compared to the previous 2.4%, add another layer of anticipation to the market.

EURUSD Analysis:

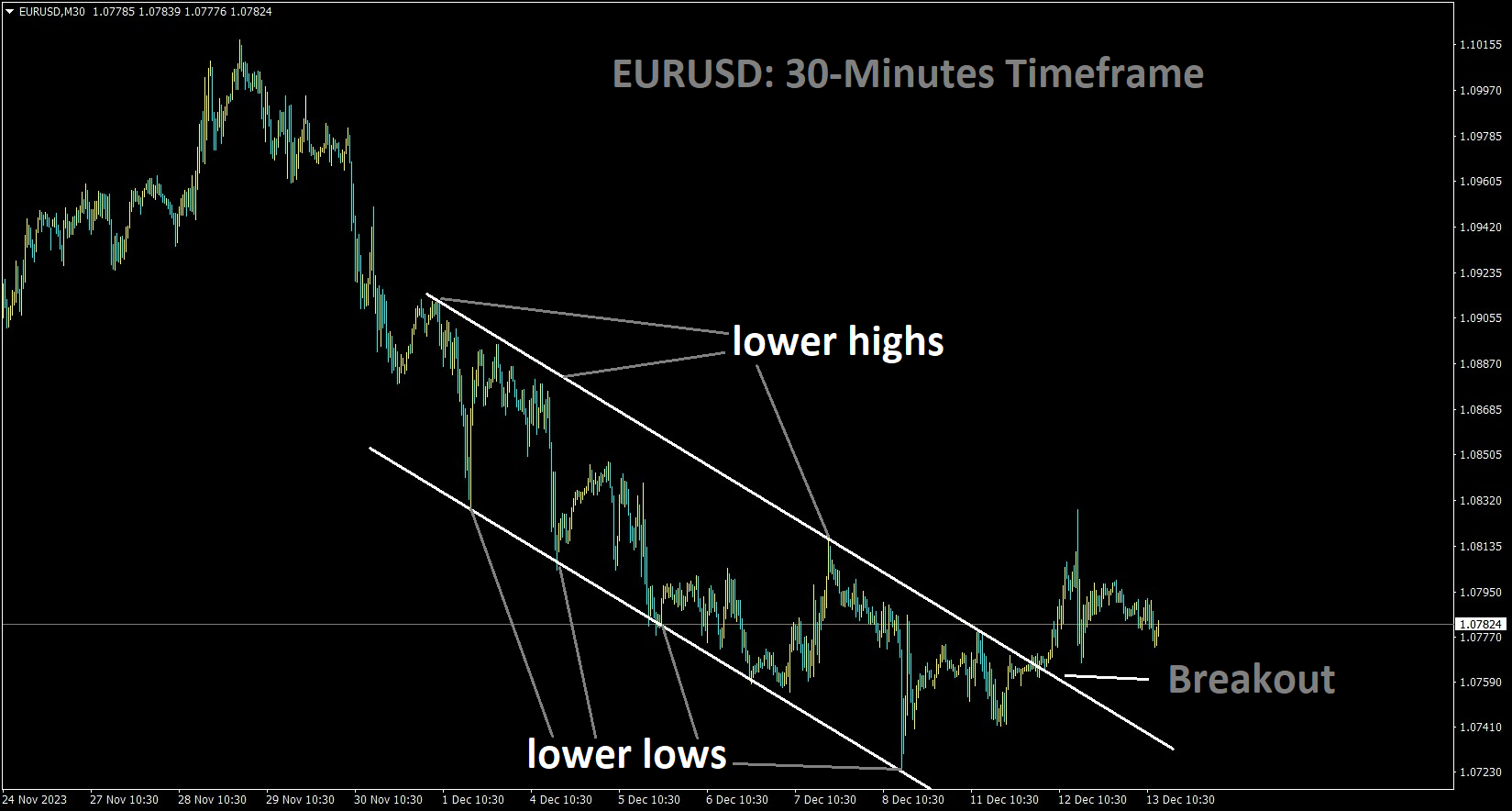

EURUSD has broken the Descending channel in upside

The most recent ZEW report paints a somewhat improved picture of the German and Euro Area economies, as economic sentiment has risen to its highest level in several months, surpassing market expectations. While German current conditions have shown slight improvement since November, they still hover near historically low levels when compared to the past five years.

Later today, the latest US inflation report will be published, with the year-on-year core reading expected to remain steady at 4%, while the annual headline reading is anticipated to decrease by 0.1% to 3.1%. Although this report has the potential to cause significant market movements, any such movements today are likely to be restrained, given the looming Federal Open Market Committee meeting on Wednesday and the European Central Bank policy decision on Thursday. Both central banks are widely expected to maintain their current policy settings, but the post-release press conferences may offer the market more insight into the conditions that would prompt these central banks to consider interest rate cuts.

GBPUSD Analysis:

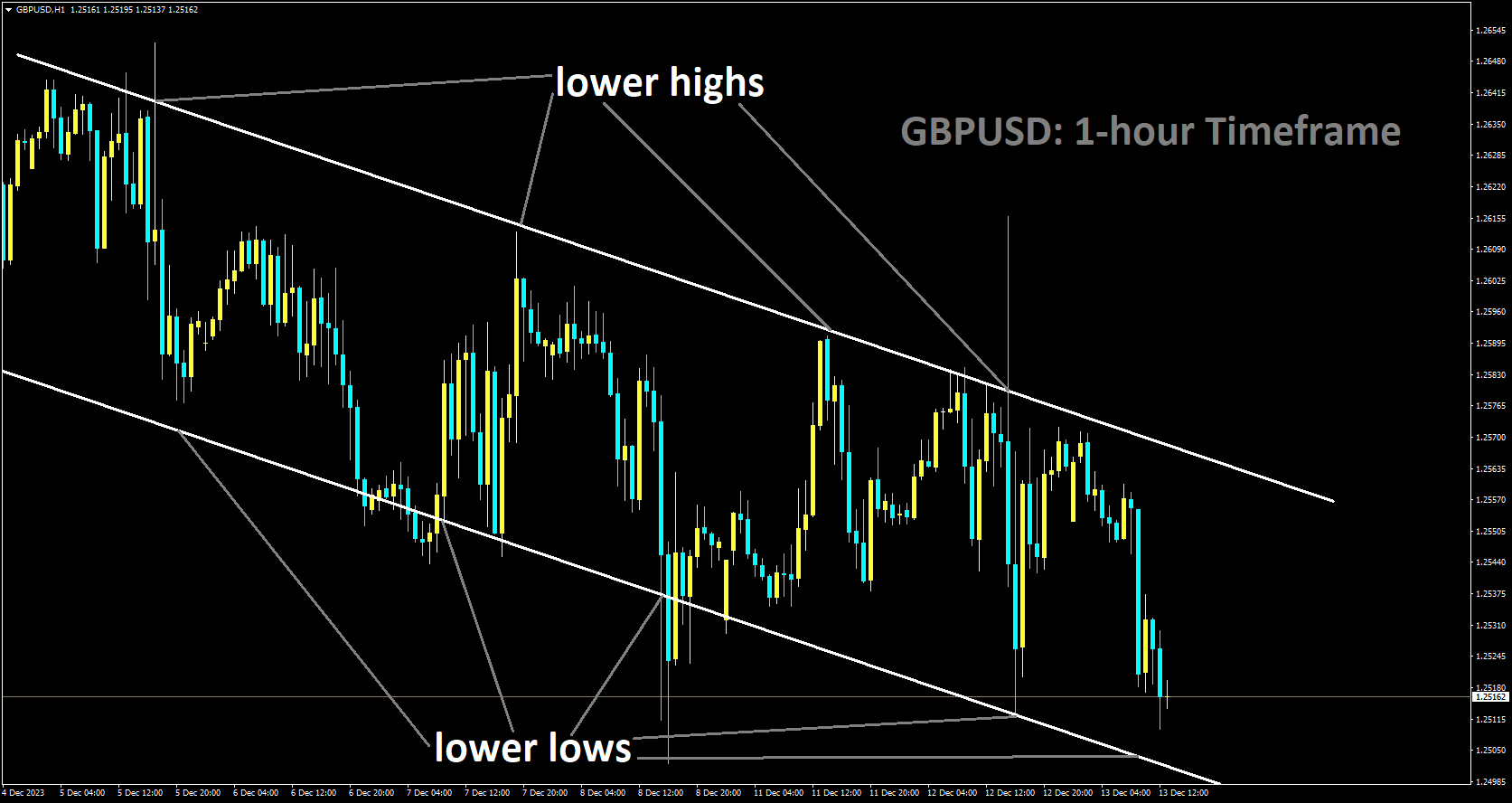

GBPUSD is moving in Descending channel and market has reached lower low area of the channel

Data released by the Office for National Statistics on Wednesday revealed a deepening downturn in the United Kingdom’s industrial sector in October. Manufacturing Output experienced a significant drop of 1.1% month-on-month (MoM) in October, contrasting with the expected 0% and the 0.1% observed in September. Meanwhile, total Industrial Production registered at -0.8% MoM, falling short of the -0.1% anticipated and the previous reading of 0%.

In terms of annual data, UK Manufacturing Production in October rose by only 0.8%, missing expectations of a 1.9% increase. Total Industrial Output for the same month accelerated by a mere 0.4%, well below the estimated growth of 1.1% and the previous figure of 1.5%. Additionally, the UK Goods Trade Balance figures were released, indicating a deficit of GBP -17.032 billion in October, compared to the expected GBP -14.10 billion and the previous GBP -14.288 billion. The total Trade Balance for non-EU countries in October stood at GBP -4.828 billion, slightly higher than the GBP -4.45 billion reported in September.

GBPJPY Analysis:

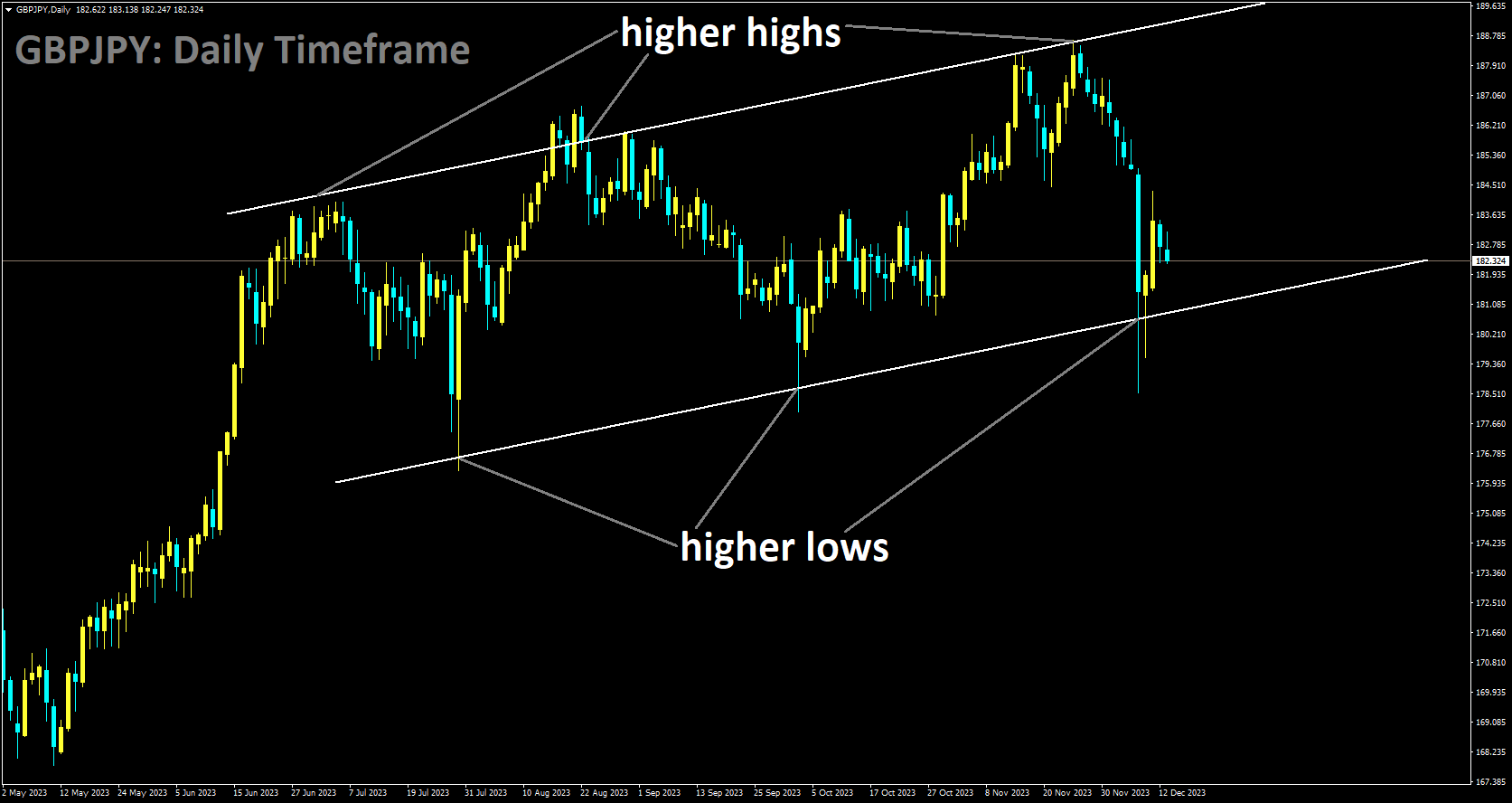

GBPJPY is moving in Ascending channel and market has reached higher low area of the channel

According to the Bank of Japan’s quarterly Tankan survey released on Wednesday, business confidence among large manufacturers in Japan continued to improve for the third consecutive quarter in the three months leading up to December.

The headline Large Manufacturers’ Sentiment Index stood at 12.0, an improvement from the previous reading of 9.0 and exceeding the market’s anticipated figure of 10.0. However, when delving into the specifics, it was revealed that the Large Non-Manufacturing Outlook for the fourth quarter reached 24.0, a decline from the previous figure of 21.0, and slightly below the market consensus of 25.0.

NZDUSD Analysis:

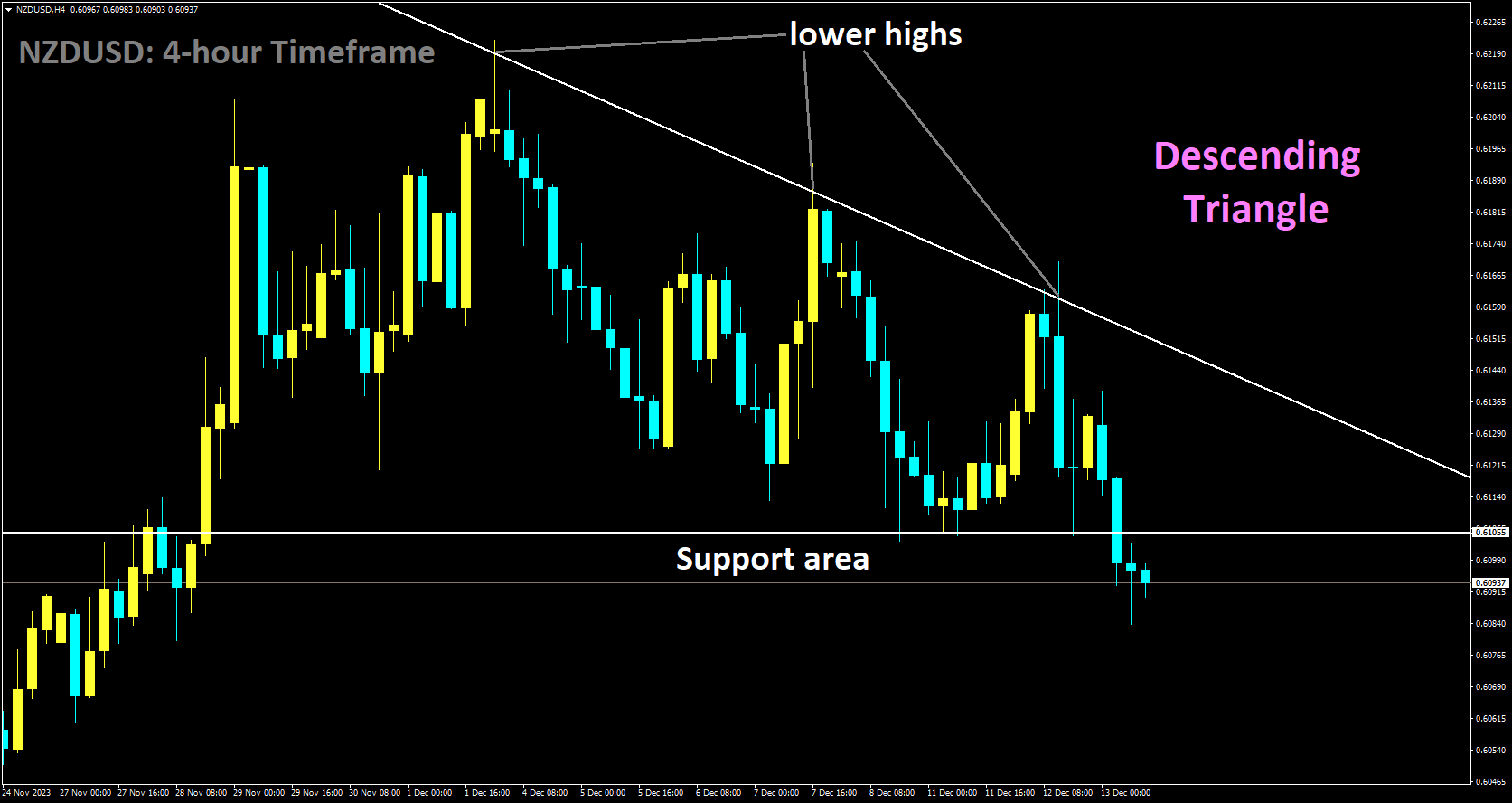

NZDUSD is moving in Descending Triangle and market has reached support area of the pattern

On Wednesday, the new coalition government in New Zealand passed legislation that has brought about a significant change in the mandate of the Reserve Bank of New Zealand (RBNZ). The updated mandate now places exclusive emphasis on maintaining price stability, thereby removing the previous dual mandate that also included a focus on achieving maximum sustainable employment. Nicola Willis, who serves as the Finance Minister of New Zealand, was responsible for amending the Remit for the RBNZ’s Monetary Policy Committee. It’s important to note that this change does not alter the bank’s inflation target, which remains in the range of 1-3%.

In addition to the revised Remit, the Monetary Policy Committee has collaborated with the Minister of Finance to make further adjustments to its Charter, as confirmed by the RBNZ. This Charter outlines the decision-making processes and transparency requirements that govern the MPC’s operations, as established by the central bank.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/