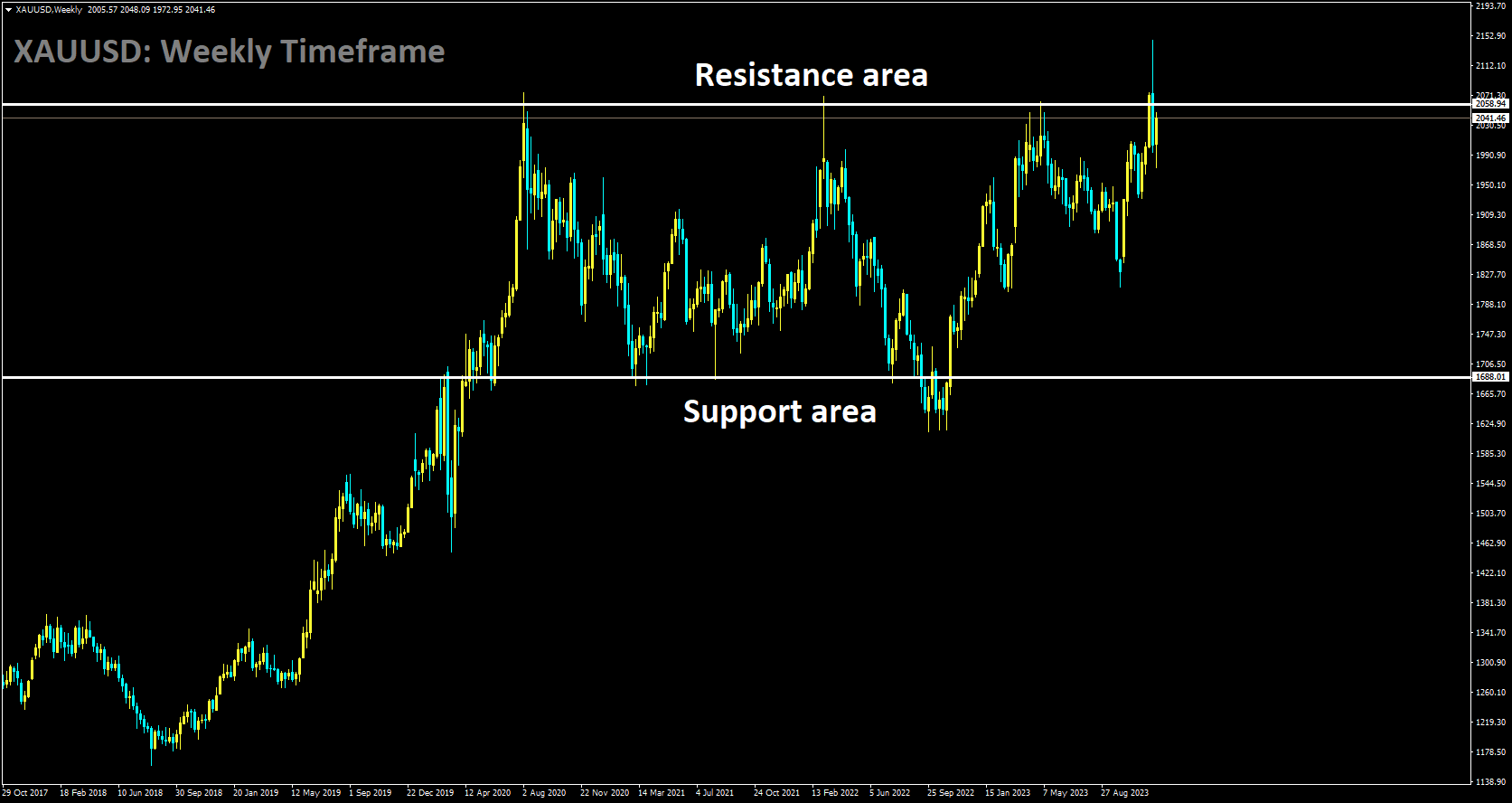

GOLD Analysis:

XAUUSD is moving in box pattern and market has reached resistance area of the pattern

As the European session neared on Friday, the price of gold continued its sideways consolidation trend, staying below the one-and-a-half-week high reached around the $2,047-2,048 level the previous day. This followed the release of stronger-than-expected monthly job reports on Friday, coupled with positive US macroeconomic data from Thursday. These factors indicated a robust economy and raised doubts about the Federal Reserve’s likelihood of implementing early policy easing in March 2024. Consequently, there was a modest uptick in US Treasury bond yields. Furthermore, the prevailing risk-on sentiment, fueled by hopes of stimulus measures from China, posed a challenge to the safe-haven status of gold. Presently, the markets are still pricing in a nearly 60% probability of the Fed initiating interest rate cuts in March 2024, with a 90% likelihood of a rate cut in May. This limits substantial upward movement in US bond yields and continues to weaken the US Dollar, which, in turn, lends some support to gold, a non-yielding asset. Nonetheless, for the time being, gold seems to have halted its post-FOMC rally. The release of flash PMI data on Friday is expected to provide fresh insights into the global economy’s health and may create short-term trading opportunities for XAUUSD.

Thursday’s upbeat US macroeconomic data has cast doubt on the possibility of an early Fed rate cut, providing relief to US Treasury bond yields and acting as a deterrent to gold prices amid the prevailing risk-on market sentiment. The US Commerce Department reported a 0.3% increase in Retail Sales for November, surpassing expectations of a 0.1% decline. Core Retail Sales, excluding automobiles, also exceeded forecasts with a 0.2% increase. Meanwhile, the US Labor Department reported a drop in first-time unemployment insurance claims to 202K last week, marking the lowest level since mid-October. Chinese data released on Friday indicated that Retail Sales had surged by 10.1% YoY in November, surpassing the previous figure of 7.6%, while Industrial Production grew by 6.6% YoY, up from a 4.6% rise in the previous month. Following this high-impact data release, the National Bureau of Statistics stated that the ongoing recovery in demand is contributing to improvements in consumer prices and that China is not likely to experience deflation.

According to sources familiar with the matter, Reuters reported that Chinese leaders had agreed at an annual economic meeting this week to set the 2024 economic growth target at around 5.0%. Despite this, the markets still anticipate a nearly 60% chance of the Fed initiating rate cuts at its March meeting, with odds of a May rate cut standing at 90%. This, combined with the prevailing negative sentiment surrounding the US Dollar, which has been declining for four consecutive days and reaching a four-month low, is providing support to the precious metal. Looking ahead, the release of global flash PMI data on Friday could offer momentum to the precious metal and provide traders with short-term trading opportunities as the week concludes.

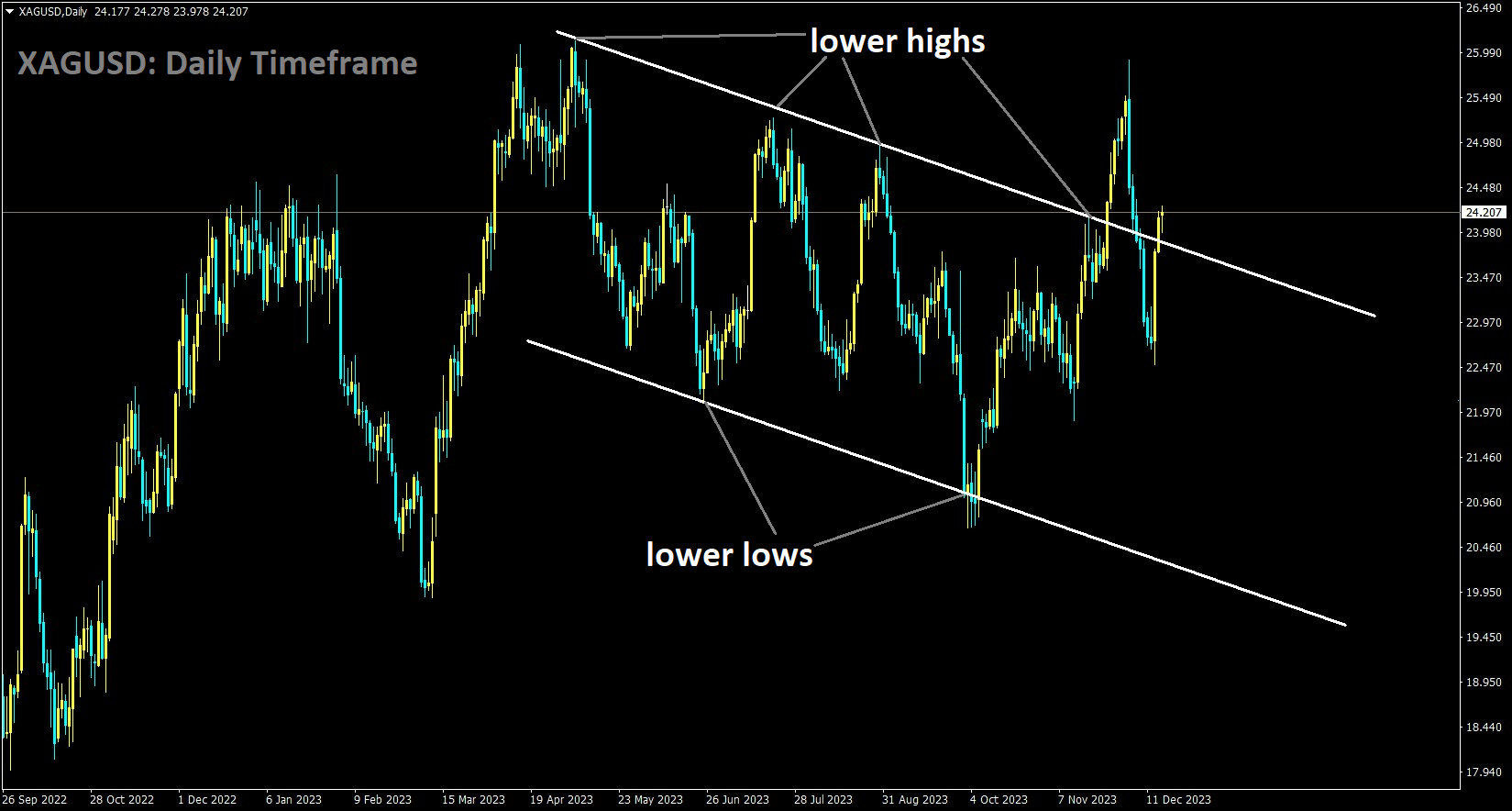

SILVER Analysis:

XAGUSD is moving in the Descending channel and the market has reached the lower high area of the channel

The US Dollar has weakened to 101.80, marking its lowest point since August. This decline is primarily attributed to the unexpected signal from the Federal Reserve suggesting the possibility of three rate cuts in 2024. This announcement has significantly impacted both US Treasury yields and the value of the Greenback. During the final Federal Reserve meeting of 2023, the central bank welcomed a moderation in inflation figures, and the revised Dot Plot revealed that Fed governors do not anticipate any interest rate hikes in 2024. Furthermore, they projected a total of 75 basis points in easing measures for the year. This alignment between market expectations and the Fed’s stance has been positively received by the markets, leading to increased risk-on sentiment. The Fed’s indication of the potential for three rate cuts in 2024 exerted downward pressure on the US Dollar.

In addition to the Fed’s actions, the November Retail Sales report released by the US Census Bureau showed a robust 4.1% increase, surpassing the previous month’s 2.2% growth. Moreover, the US Department of Labor reported Initial Jobless Claims for the week ending December 9 at 202K, lower than the consensus forecast of 220K and the previous week’s 221K, suggesting a stronger-than-expected job market. Currently, US bond yields are on the decline, with rates at 4.35% for the 2-year yield, 3.87% for the 5-year yield, and 3.91% for the 10-year yield. Projections from the CME FedWatch Tool indicate that the market anticipates rate cuts as early as March 2024. This collective information underscores the weakening position of the US Dollar in recent trading sessions.

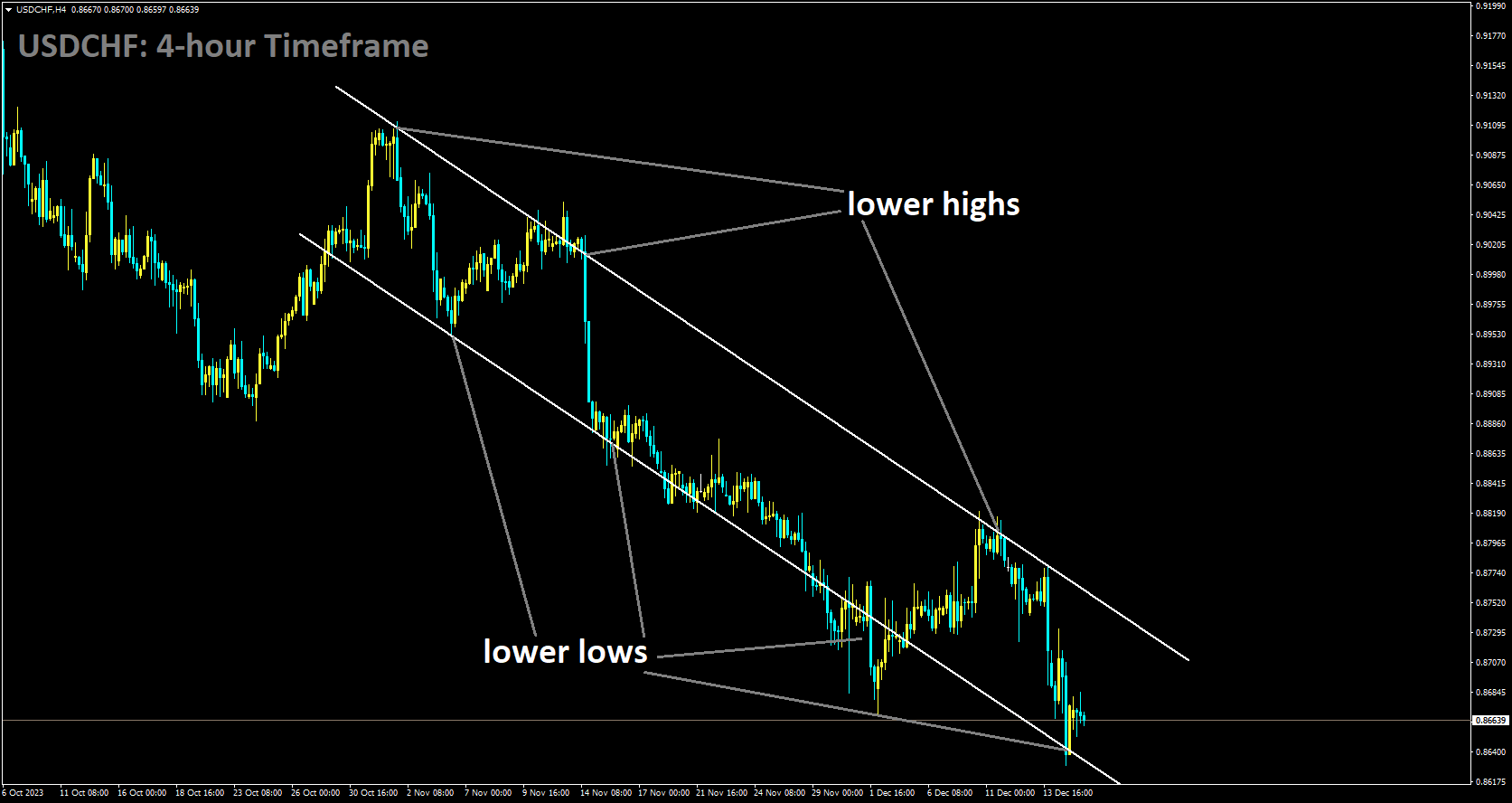

USDCHF Analysis:

USDCHF is moving in Descending channel and market has reached lower low area of the channel

The Swiss Franc exhibited mixed performance on Thursday following policy meetings held by major central banks, which shed light on the future direction of interest rates, a significant driver of currency valuations. At the time of writing, the Swiss Franc had gained 0.57% against the US Dollar, while it had edged higher by approximately 0.5% against both the Euro and the British Pound. The Swiss National Bank initiated this sequence of central bank meetings, opting to leave interest rates unchanged at 1.75% while revising down its inflation forecasts, implying a potential inclination toward future interest rate cuts. However, Thomas Jordan, Chairman of the Swiss National Bank, attempted to temper speculation about rate cuts by asserting that the bank would refrain from reducing rates due to persistently high global uncertainty. The prevailing sentiment from the SNB was generally dovish, as the anticipation of lower interest rates tends to weaken a currency by reducing capital inflows.

Nevertheless, the Swiss Franc appreciated against the US Dollar following the Federal Reserve (Fed) meeting on Wednesday, during which Fed Chair Jerome Powell adopted an even more dovish stance, hinting at the possibility of interest rate cuts. In contrast, the Swiss Franc faced depreciation against both the Euro and the Pound as neither of their respective central banks discussed the prospect of rate cuts, indicating a potential inclination to maintain higher rates for an extended period. On Thursday, the Swiss Franc strengthened against the US Dollar after Fed Chair Powell signaled that the tightening of monetary policy may be nearing its conclusion due to a faster-than-expected decline in inflation. He also mentioned that the discussion of interest rate cuts had emerged during the Fed meeting, marking the first time such discussions had arisen in this tightening cycle. Unlike Jordan of the SNB, Powell’s acknowledgment of the potential for rate cuts likely contributed to the Fed’s more dovish outlook compared to the SNB, which in turn explains the weakness of the USD against the Swiss Franc.

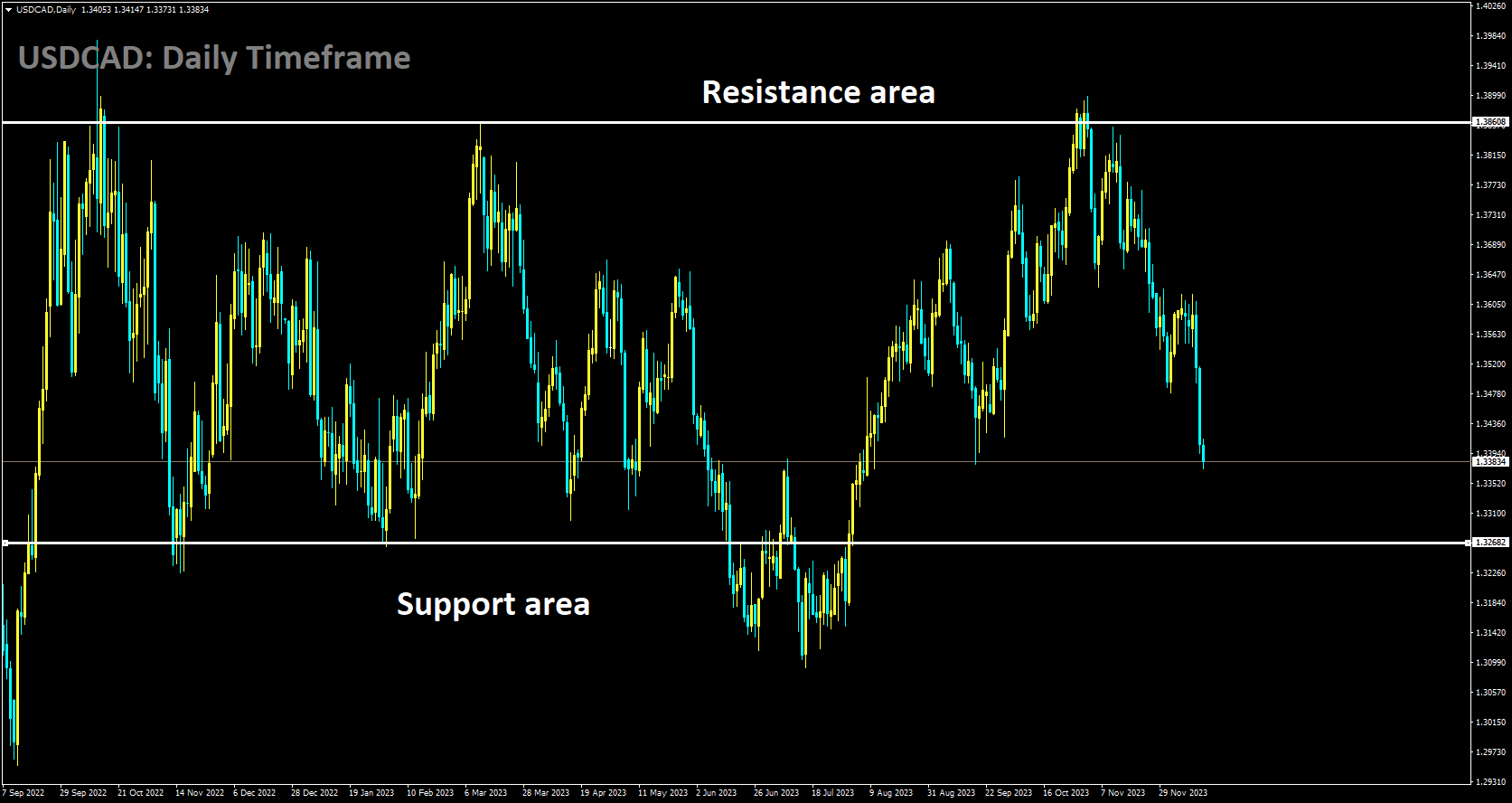

USDCAD Analysis:

USDCAD is moving in box pattern and market has fallen from the resistance area of the pattern

The USDCAD pair is currently facing challenges due to the weakened US Dollar, which can be attributed to lower US Treasury yields. Market observers are eagerly anticipating the scheduled appearance of Bank of Canada Governor Tiff Macklem on Friday. This event holds significant potential as participants will closely scrutinize any insights or comments he provides regarding the Canadian economic outlook and monetary policy. Meanwhile, during the Asian session on Friday, the West Texas Intermediate oil price is trading around $72.30 per barrel, driven by expectations of oil demand in 2024 and a weakened US Dollar. Given Canada’s position as the largest oil exporter to the United States, the improved WTI price could lend support to the Canadian Dollar (CAD) in its exchange with the US Dollar.

The US Dollar Index saw a decline, reaching a four-month low at 101.77 on Thursday, and is currently trading around 101.90. The US Dollar continues to experience downward pressure following the Federal Open Market Committee statement. The cautious stance of the US Federal Reserve on interest rates and the possibility of a more accommodative monetary policy in 2024 are contributing to the persistent weakness in the Greenback. Despite better-than-expected economic data from the US, including a 0.3% increase in Retail Sales for November compared to an expected decline of 0.1%, and Initial Jobless Claims coming in at 202K versus an anticipated 220K, support for the USD remains modest. Investors are likely to closely monitor the S&P Global Purchasing Managers Index data on Friday to gain further insights into the economic conditions in the United States.

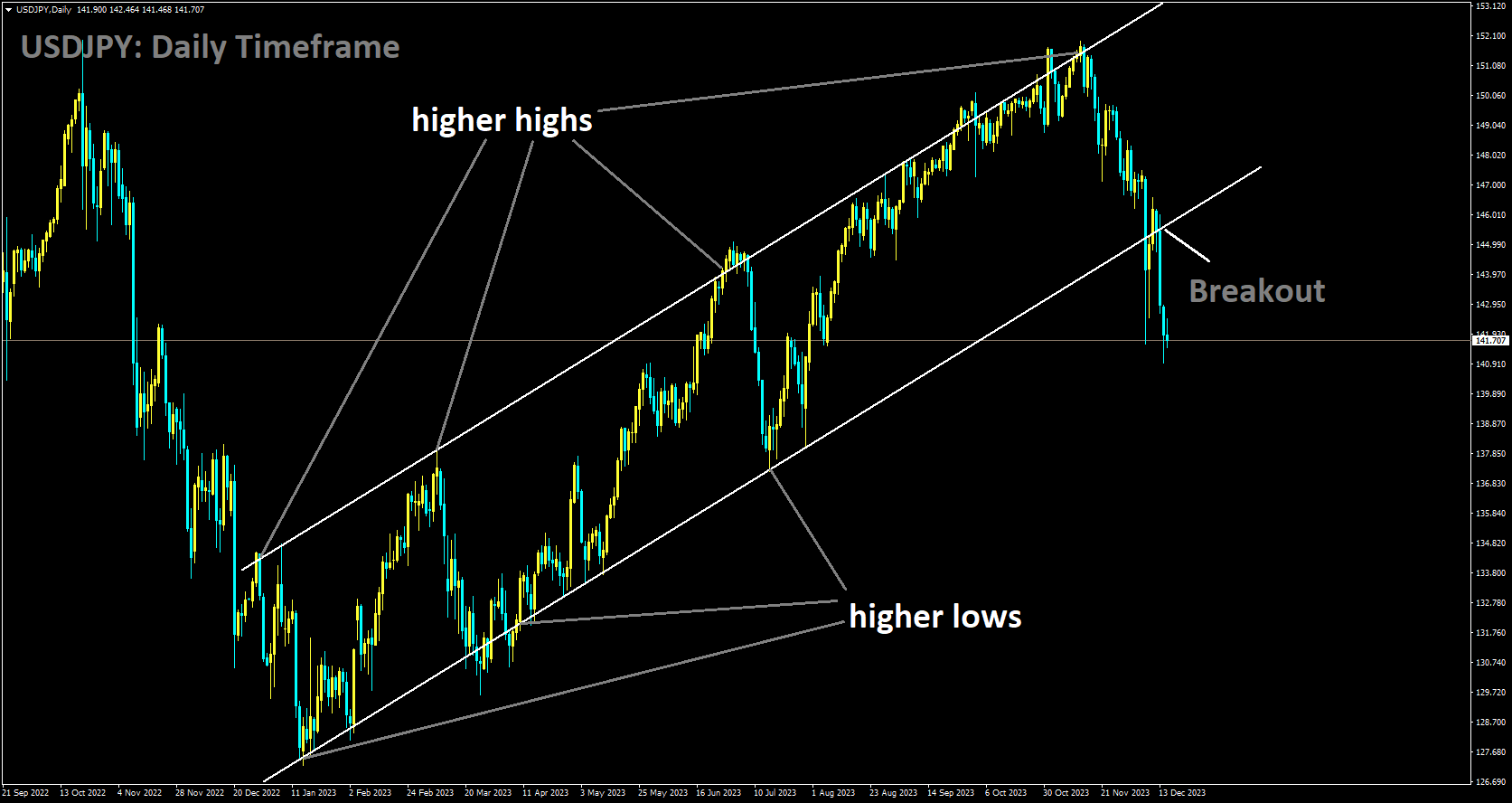

USDJPY Analysis:

USDJPY has broken Ascending channel in downside

Japanese Finance Minister Shunich Suzuki has made a statement via Reuters, addressing concerns about the recent rapid strengthening of the Japanese Yen. He refrained from commenting on daily fluctuations in the foreign exchange market and emphasized his vigilant monitoring of market developments. Minister Suzuki expressed the preference for currencies to exhibit stable movements that align with underlying economic fundamentals. He acknowledged the presence of various market discussions but chose not to comment on any specific topics.

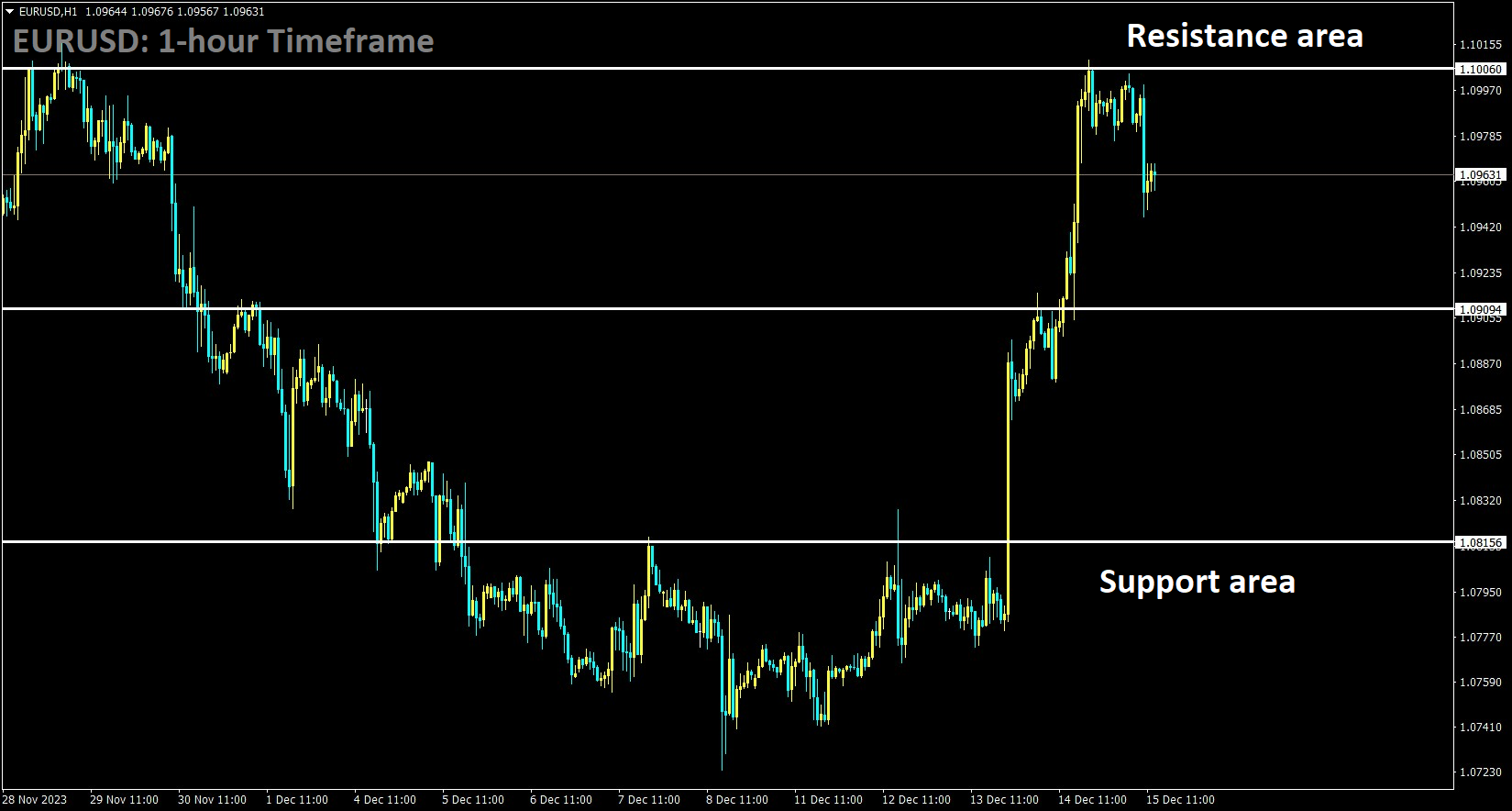

EURUSD Analysis:

EURUSD is moving in the Uptrend and the market has fallen from the resistance area in the Uptrend

On Friday, Madis Muller, a policymaker at the European Central Bank, emphasized that discussing rate cuts in the near future and prematurely celebrating victory over inflation is premature. He pointed out that there is still some distance to cover in order to attain the ECB’s 2% inflation target.

EURGBP Analysis:

EURGBP is moving in the Descending triangle pattern and the market has rebounded from the support area of the pattern

On Thursday, the European Central Bank and the Bank of England made the widely expected decision to keep their interest rates unchanged. Now, all eyes are turning to the high-impact economic data scheduled for release from both the Eurozone and the UK on Friday, which could provide a clear sense of direction for the EURGBP. During its December meeting, the ECB maintained its interest rates at the current level of 4.0%. ECB President Christine Lagarde emphasized the need for continued efforts to bring inflation back to the target of 2.0%. She cautioned against complacency in the face of consumer price pressures. Analysts are projecting a potential rate cut by the ECB next year, although the exact timing remains uncertain, with estimates ranging from March to September.

On the other hand, the BoE opted to leave its benchmark rates unchanged at 5.25%, maintaining a 15-year high. BoE Governor Andrew Bailey acknowledged that there is still progress to be made in the UK to achieve their inflation target. Bailey also emphasized the central bank’s commitment to closely monitor economic data and take appropriate actions to steer inflation back to the 2.0% target. Market participants are eagerly anticipating the release of preliminary German and Eurozone HCOB Purchasing Managers’ Index data for December on Friday. Additionally, the initial reading of the UK S&P Global/CIPS PMI for December is expected later in the day. Traders will closely analyze these data points to identify potential trading opportunities within the EURGBP currency pair.

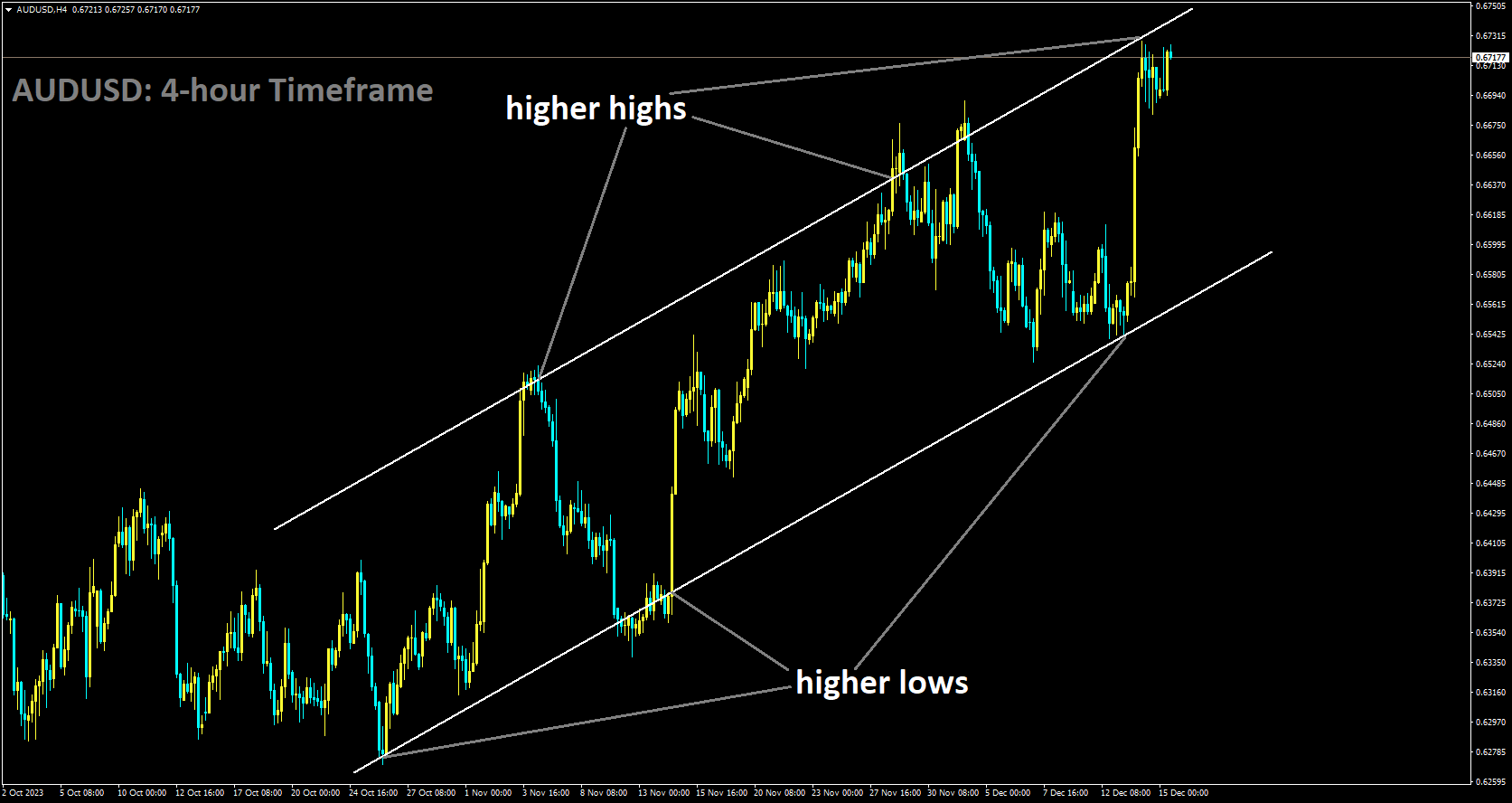

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher high area of the channel

Based on the Preliminary Judo Bank Australia Purchasing Managers’ Index by S&P Global, the flash Composite PMI for December has risen to 47.4, reaching a two-month high compared to November’s 46.2, which marked a thirteen-month low. The key figures for the flash Australia Composite PMI Output Index are as follows: December – 47.4, November – 46.2. Additionally, the Flash Australia Services PMI Business Activity Index for December stands at 47.6, marking a two-month high compared to November’s 46.0. Likewise, the Flash Australia Manufacturing PMI for December is at 47.8, also reaching a two-month high compared to November’s 47.7. It’s worth noting that all three sectors of the preliminary December PMI have shown improvement, hitting two-month highs. However, they all remain in contraction territory, below the threshold of 50.0.

According to Warren Hogan, Chief Economic Advisor at Judo Bank, the December Flash PMI report indicates slight improvements in business activity as the year comes to a close. However, it also confirms that the economy is still following a soft-landing trajectory. Both key activity indicators remain below 50, consistent with a temporary growth slowdown, and are significantly above levels indicative of an economic recession.

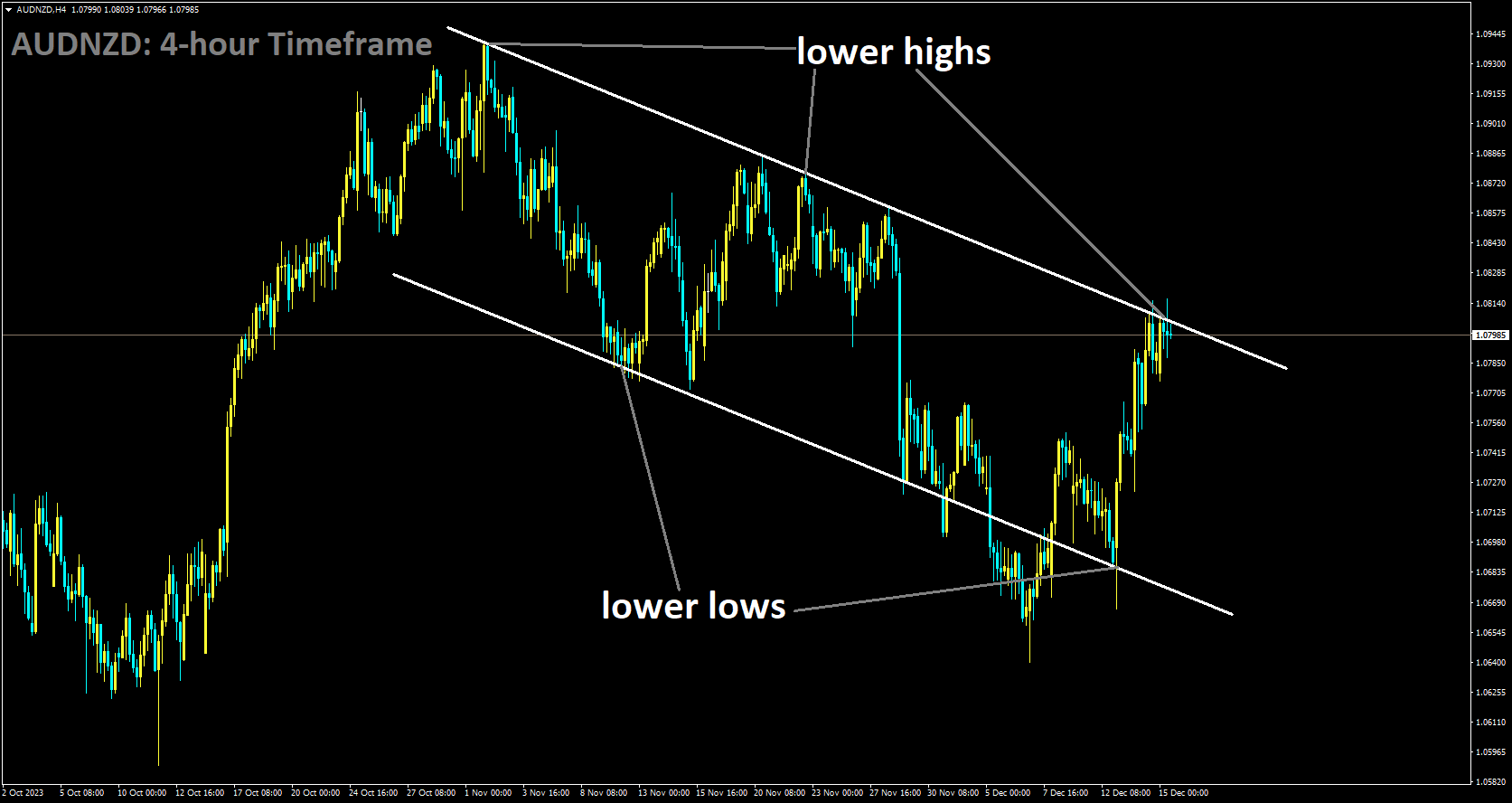

AUDNZD Analysis:

AUDNZD is moving in Descending channel and market has reached lower high area of the channel

After the publication of significant economic data for November in China, the National Bureau of Statistics shared its perspective on the state of the economy. The Chinese economy is rebounding as the effects of macroeconomic policies take hold. However, it is noted that domestic demand has not yet reached an adequate level, and further efforts are needed to consolidate the ongoing economic recovery. It is expected that China will meet its annual development targets, and the sustained growth in demand is contributing positively to improvements in consumer prices. As a result, China is not anticipated to experience deflation. Moreover, the short-term adjustments observed in the property sector are deemed beneficial for the sector’s stable and sustainable long-term development.

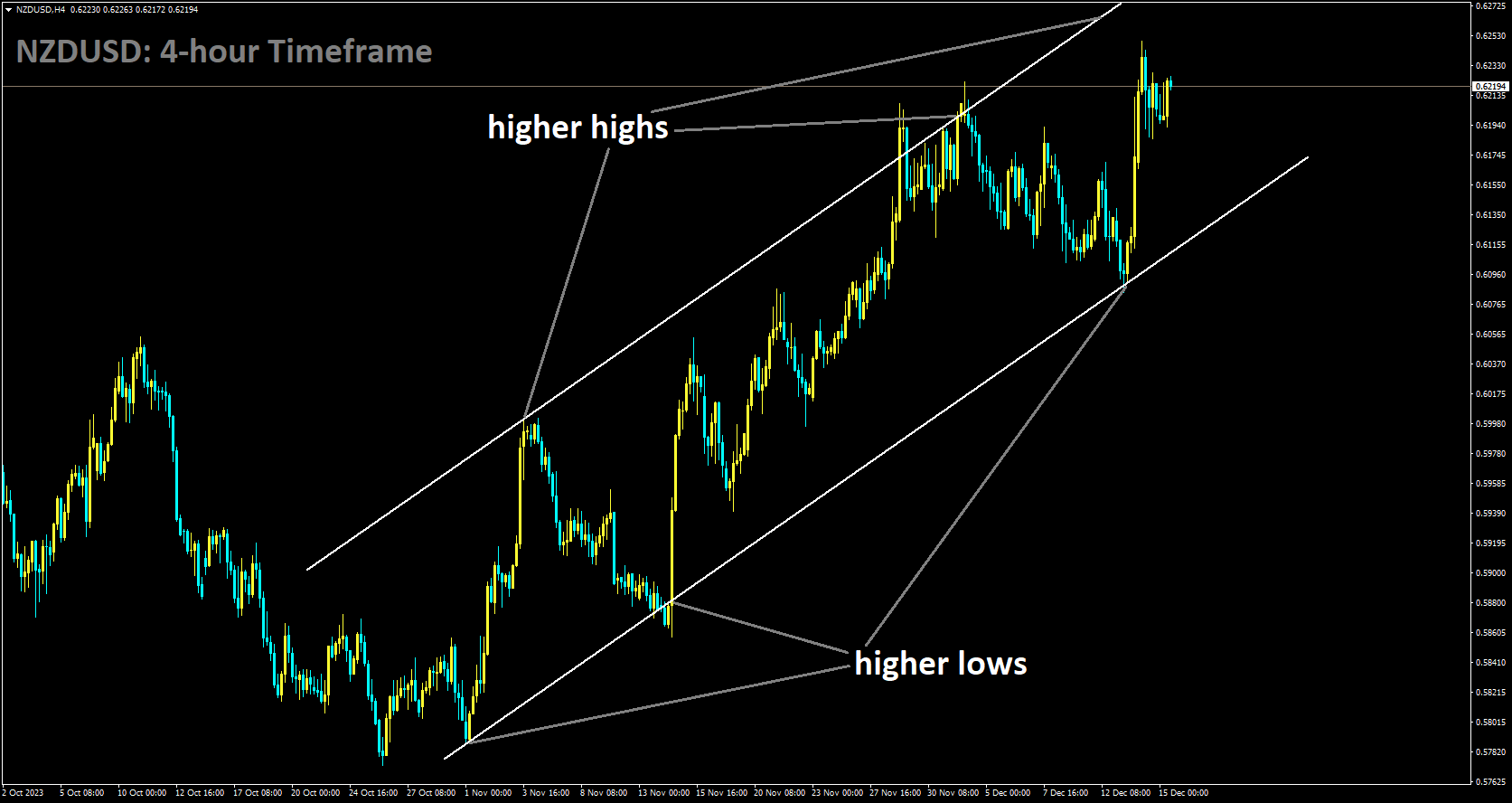

NZDUSD Analysis:

NZDUSD is moving in Ascending channel and market has reached higher high area of the channel

In the early Asian session on Friday, the NZDUSD pair’s four-day winning streak came to a halt. The shift in momentum was triggered by disappointing New Zealand GDP growth figures, which had a negative impact on the New Zealand Dollar (Kiwi) and presented a challenge for the NZDUSD pair. Currently, the pair is trading around 0.6198, reflecting a 0.21% decline for the day. On Wednesday, the Federal Reserve decided to keep interest rates within the range of 5.25%–5.50%. During the subsequent press conference, Fed Chair Jerome Powell highlighted significant uncertainty and the central bank’s need to closely observe further progress. Powell also noted that the possibility of future rate hikes was not being ruled out, despite Fed policymakers projecting at least three rate cuts in the coming year.

Turning to economic data, US Retail Sales for November demonstrated growth of 0.3%, rebounding from a 0.2% decline in the previous reading and surpassing market expectations. Furthermore, Initial Jobless Claims for the week ending December 9 improved to 202K, down from the previous week’s 221K and better than the estimated 220K. However, Continuing Claims increased by 20,000 to 1.876M for the week ending December 2.

On the Kiwi front, New Zealand’s economy contracted in the third quarter of 2023. Statistics New Zealand revealed that the country’s Gross Domestic Product for the third quarter declined by 0.3% compared to the 0.5% expansion in the previous reading, falling short of the market’s expected 0.2% increase. Additionally, annual GDP growth stood at -0.6%, a significant drop from the 1.5% growth seen in Q2 and below the market consensus of a 0.5% increase. This disappointing GDP data exerted downward pressure on the New Zealand Dollar.

Recent data from China’s National Bureau of Statistics, released on Friday, showed that Chinese Industrial Production for November exceeded expectations with a year-on-year growth of 6.6%, compared to the previous reading of 4.6%. However, Retail Sales grew by 10.1% year-on-year, falling short of the market consensus of a 12.5% increase. Looking ahead, investors will closely monitor the preliminary US S&P Global PMI report for December, which could provide clear guidance for the NZDUSD pair. The Manufacturing PMI is expected to ease from 49.4 to 49.3, while the Services PMI is projected to decline from 50.8 to 50.6. These figures will be closely watched for their potential impact on the currency pair.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/