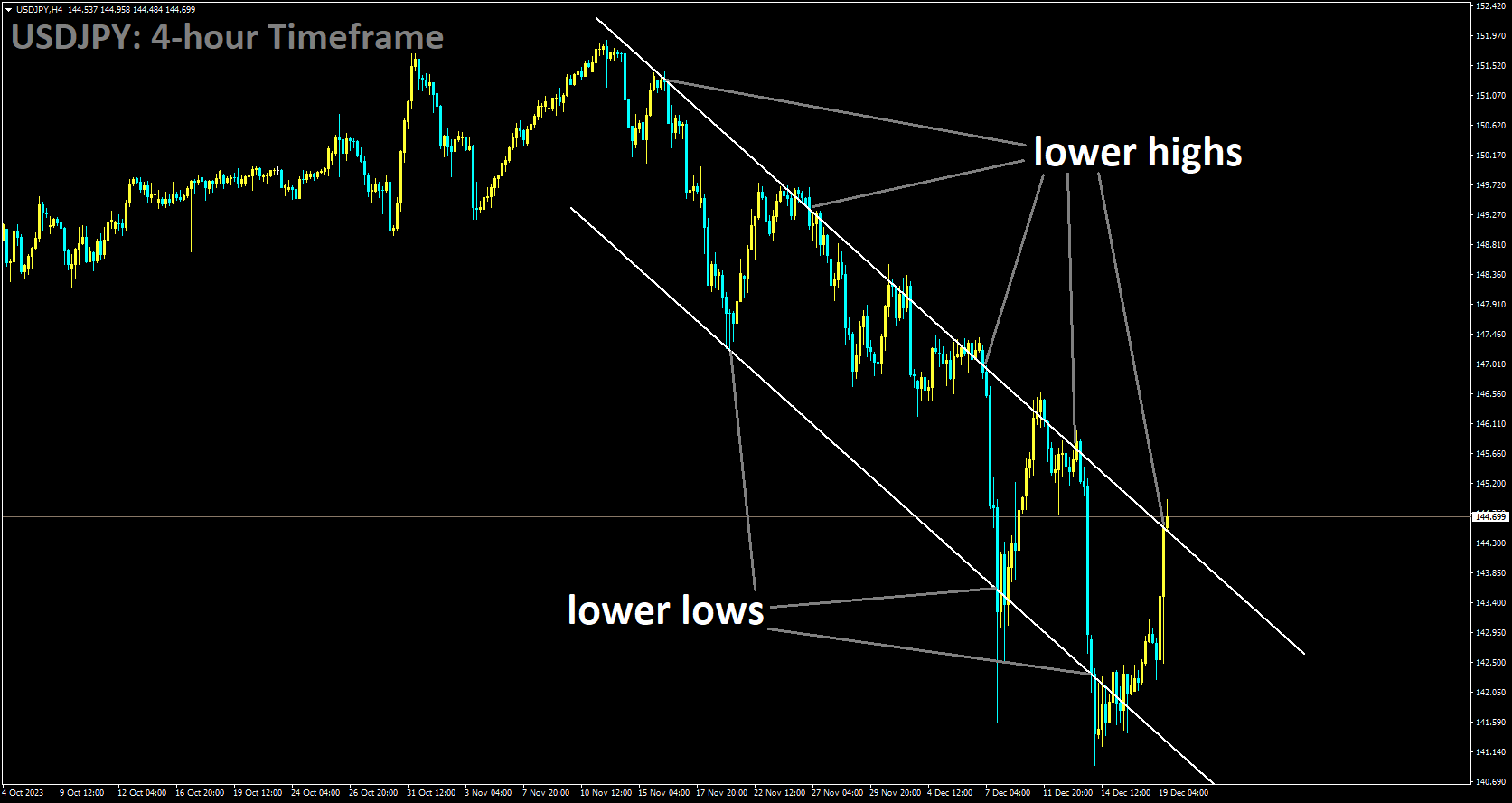

USDJPY Analysis:

USDJPY is moving in Descending channel and market has reached lower high area of the channel

During the December policy meeting on Tuesday, Bank of Japan Governor Kazuo Ueda addressed the potential impact of the US Federal Reserve’s rate-cut phase on Japan’s economy, particularly on foreign exchange rates. While Japan’s consumption has displayed some weaknesses, it is generally on a path of recovery. Governor Ueda expressed the desire to monitor the strength of wage growth next spring, as it plays a crucial role in supporting consumption. Governor Ueda also acknowledged the market’s ability to anticipate some aspects of their policy shifts. He did not deny that the negative interest rate policy could have adverse effects on the profitability of financial institutions, although banks are currently reporting strong profits. However, he admitted that presenting a clear roadmap for exiting this policy is challenging, and the specific order of policy measures remains uncertain.

Regarding the timeline for exiting the negative interest rate policy, Governor Ueda explained that they do not have a detailed plan at this time. The Bank of Japan intends to maintain accommodative conditions for an unspecified period following the removal of negative rates. He noted that the growing calls for normalization might indicate a rise in demand-driven inflation. Governor Ueda also pointed out the challenges in providing a short-term policy rate outlook, similar to the approach taken by the US Federal Reserve.

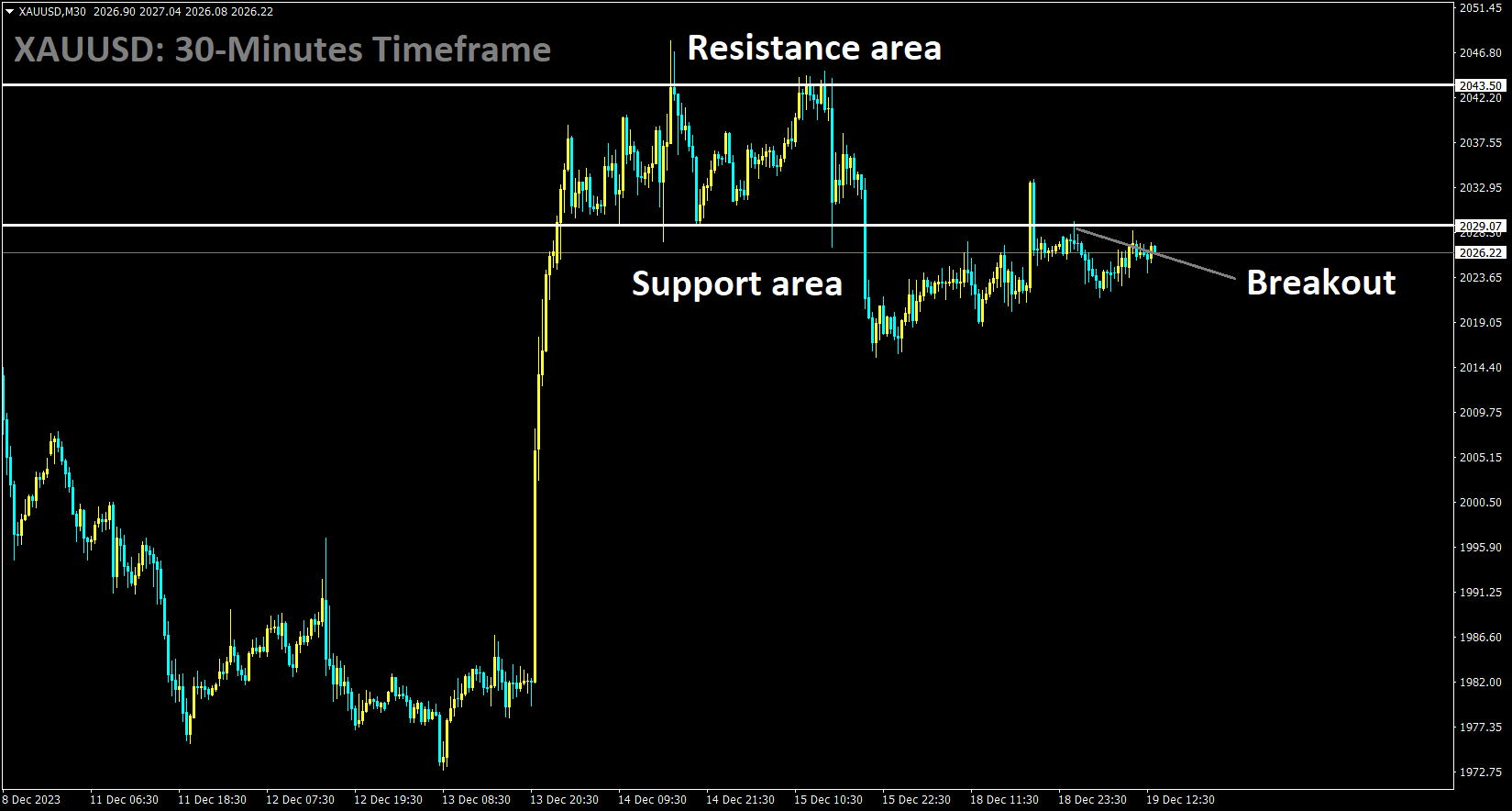

GOLD Analysis:

XAUUSD has broken the Box pattern in downside

The recent positive momentum in gold prices is struggling to gain traction as it faces downward pressure during the early European session on Tuesday. Federal Reserve officials have been actively downplaying the likelihood of a shift away from their hawkish stance, dampening expectations of early rate cuts in 2024. This, coupled with selling pressure on the Japanese Yen following actions by the Bank of Japan, is bolstering the US Dollar and exerting downward pressure on gold, which doesn’t offer interest.

Furthermore, the strong risk-on sentiment in global equity markets, exemplified by US stock indices closing near record highs on Monday, is undermining gold’s safe-haven appeal. Nevertheless, geopolitical concerns, especially amid growing worries about a deeper global economic downturn in China and the Eurozone, remain a significant risk for the markets. This could potentially boost XAUUSD and discourage aggressive bearish trading ahead of a crucial US inflation report scheduled for release on Friday.

Traders are closely monitoring the US Core Personal Consumption Expenditure Price Index for fresh insights into the Fed’s future policy decisions, which will, in turn, influence USD demand and provide a new directional impetus for gold prices. Additionally, market participants will keep a close eye on US housing market data, including Building Permits and Housing Starts, on Tuesday. A scheduled speech by Richmond Fed President Thomas Barkin could also impact XAUUSD.

On Monday, Chicago Federal Reserve President Austan Goolsbee and Cleveland Fed President Loretta Mester both pushed back against market expectations of interest rate cuts. Goolsbee expressed confusion over the market’s reaction to last week’s Federal Open Market Committee (FOMC) meeting, emphasizing that the central bank is not committing to rate cuts in the near future. Separately, Loretta Mester pointed out that financial markets had anticipated rate cuts sooner than the central bank was planning. These statements followed New York Fed President John Williams’ remarks on Friday, where he deemed it premature to speculate about rate cuts, which has limited the upside for gold. Despite this, the markets remain convinced that the Fed will shift towards easing monetary policy in the first half of 2024, which continues to weigh on the US Dollar and provide support for gold.

Furthermore, concerns related to geopolitical risks stemming from the Middle East conflict are expected to limit any substantial decline in the safe-haven precious metal. The Iran-aligned Houthi militants in Yemen conducted a series of drone and missile attacks on ships in the southern Red Sea, citing it as a response to Israel’s actions in the Gaza Strip. In response, US Defense Secretary Lloyd Austin announced the formation of a multinational coalition and the launch of Operation Prosperity Guardian to address the Houthi threat in the Red Sea. Investors are eagerly awaiting the US Core Personal Consumption Expenditure Price Index on Friday for insights into the Fed’s future policy decisions.

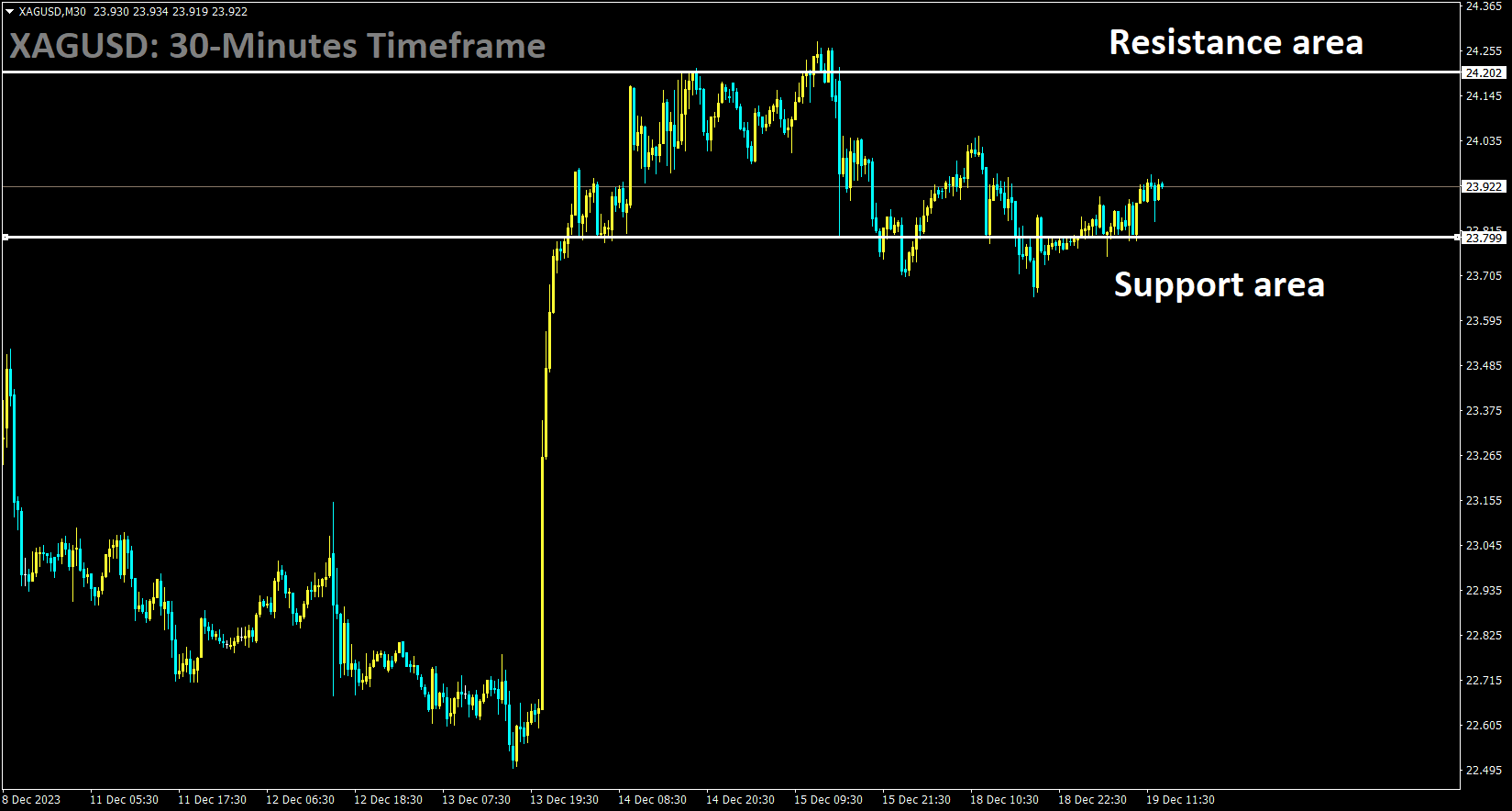

SILVER Analysis:

XAGUSD is moving in the Box pattern and the market has rebounded from the Support area of the pattern

On Monday, San Francisco Federal Reserve President Mary Daly stated that there might be a necessity for interest rate reductions in 2024 to prevent excessive tightening of monetary policy. In an interview with the Wall Street Journal, Daly also suggested that additional rate cuts could be suitable if inflation declines more rapidly, while fewer cuts might be warranted if progress in inflation stalls. As a voting member in 2024, Daly noted that her economic projections closely aligned with the median outlook of the Federal Open Market Committee.

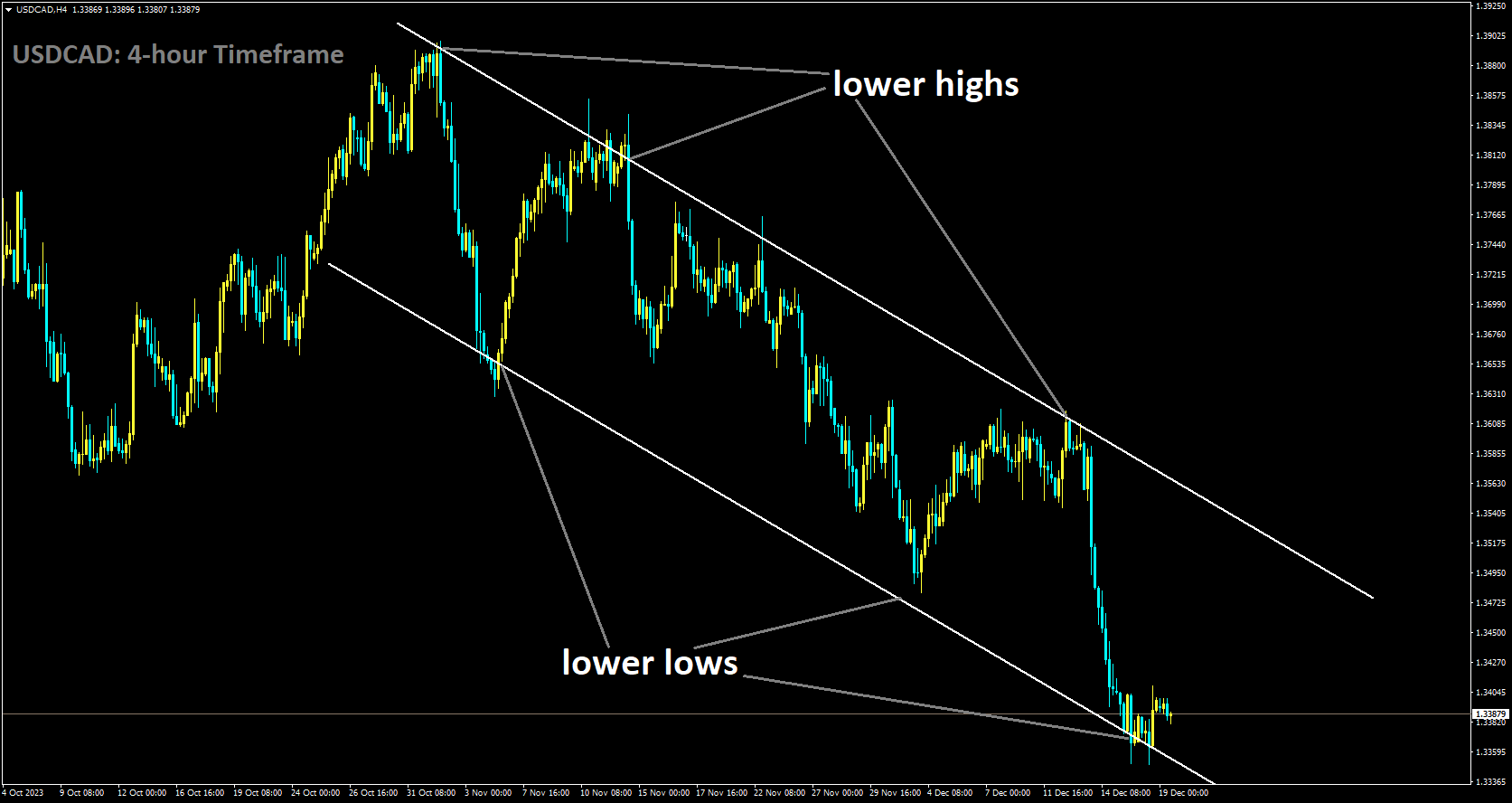

USDCAD Analysis:

USDCAD is moving in Descending channel and market has reached lower low area of the channel

Canada is set to release inflation-related data on December 19th. Statistics Canada will unveil the November Consumer Price Index, with expectations of a 2.9% year-on-year increase, slightly below the 3.1% recorded in October. On a monthly basis, the index is anticipated to show a 0.2% decline following a 0.1% increase in the previous month. The Canadian Dollar is currently strong against the US Dollar, trading at four-month highs.

Additionally, the Bank of Canada will publish the Core Consumer Price Index, which excludes volatile components like food and energy prices. In October, the annual BoC Core CPI increased by 0.3% month-on-month and 2.7% year-on-year. These figures will be closely monitored for potential implications on the Canadian Dollar and expectations regarding the Bank of Canada’s monetary policy.

It is expected that price pressures in Canada will have eased further in November. The anticipated slowdown in November’s inflation, moving closer to 2.8%, the lowest level seen in 2023 since June, is noteworthy. After the rebound in August, reaching 4%, inflation has been trending downward. All measures of inflation, including the Core CPI, are expected to have decelerated, signaling reduced price pressures, albeit remaining above the Bank of Canada’s 2% target.

A softening of inflation may not necessarily be negative news for the Canadian Dollar. Investors could welcome this development as it may alleviate pressure on the Bank of Canada to implement further monetary tightening measures. With the global focus on when central banks might begin reducing interest rates next year, a surprise increase in inflation is not likely to reintroduce discussions about rate hikes. However, it might lead markets to consider the possibility of higher rates being sustained for a longer period, a scenario that could briefly benefit the Canadian Dollar.

In his year-end speech, BoC Governor Tiff Macklem acknowledged that inflation has moderated but remains relatively elevated. He cautioned that the effects of previous interest rate increases will continue to influence the economy, restraining spending and limiting growth and employment. Despite these challenges, Macklem emphasized that this period of economic weakness will pave the way for a more balanced economy, with expectations of increased growth and job opportunities in the coming year, bringing inflation closer to the 2% target.

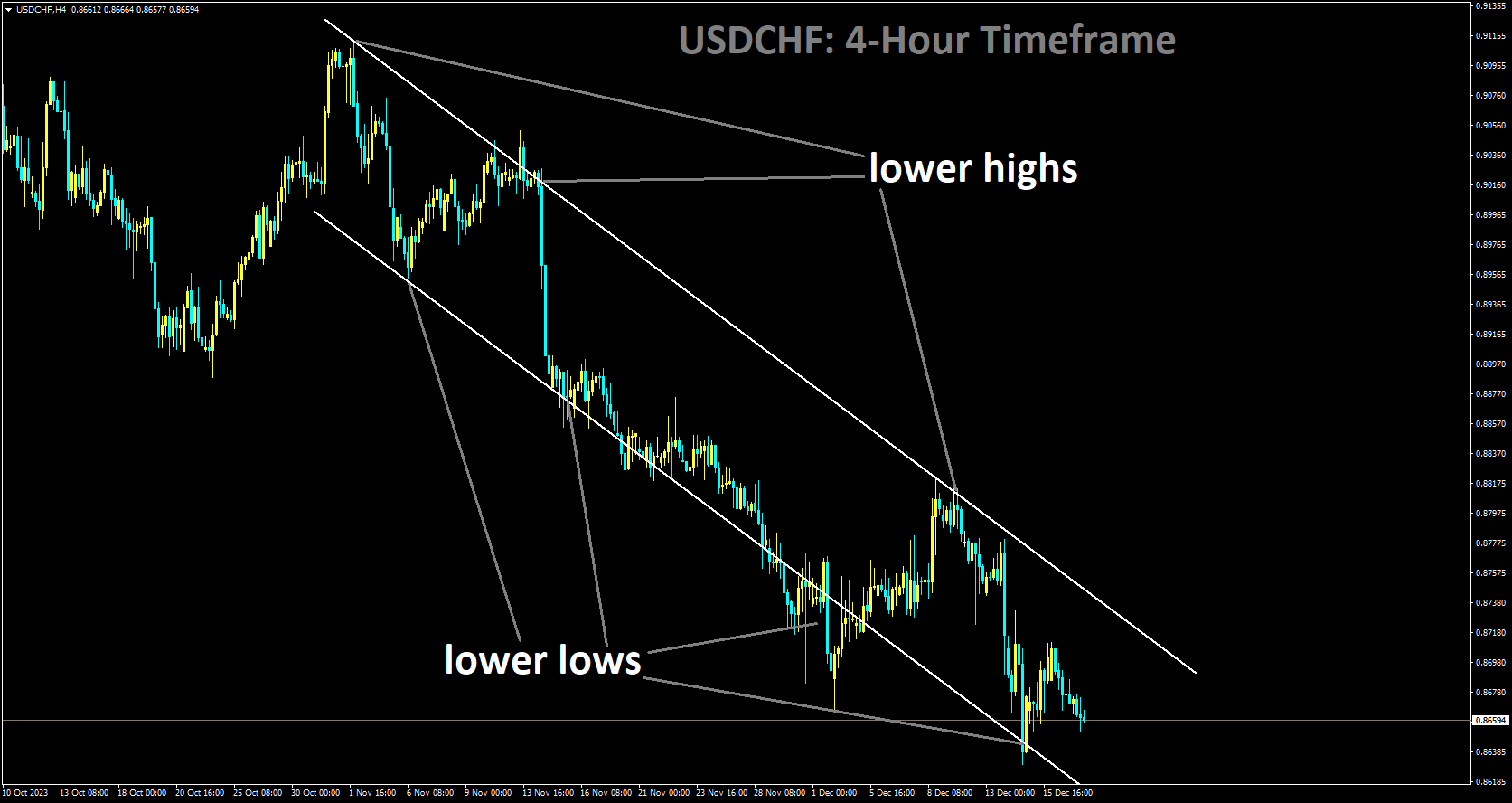

USDCHF Analysis:

USDCHF is moving in Descending channel and market has reached lower low area of the channel

The situation in Israel appears to be escalating, as the Iran-led Houthi militant group has carried out attacks on commercial ships near Libya. In response, major shipping companies are contemplating avoiding the Suez Canal waterway. This has sparked a sense of risk aversion in trade and supply dynamics, potentially driving investors toward the safe-haven Swiss Franc. However, the Swiss Franc faced an obstacle when the Swiss National Bank decided to keep interest rates unchanged for the second consecutive rate announcement. SNB Chairman Thomas Jordan acknowledged a slight decrease in inflationary pressures, underscoring the ongoing high level of uncertainty.

The US Dollar is facing challenges due to a weakened sentiment, largely influenced by the dovish statement from the Federal Open Market Committee (FOMC). Furthermore, dovish remarks from various Fed members have added pressure to the Greenback. However, US Federal Reserve (Fed) Bank of New York President John Williams dismissed speculation about a potential rate cut in March by the FOMC. Additionally, San Francisco Fed President Mary Daly indicated that even if there are three rate cuts next year, the Fed would maintain a relatively restrictive stance. It is premature to speculate on which meetings might witness a shift in the policy stance for the upcoming year. Daly emphasized that ongoing work is underway, with a focus extending beyond solely achieving a 2% inflation target. The US Dollar Index is attempting to recover its recent losses, driven by improved US Treasury yields. Both the 2-year and 10-year yields on US bonds are factors contributing to this retracement.

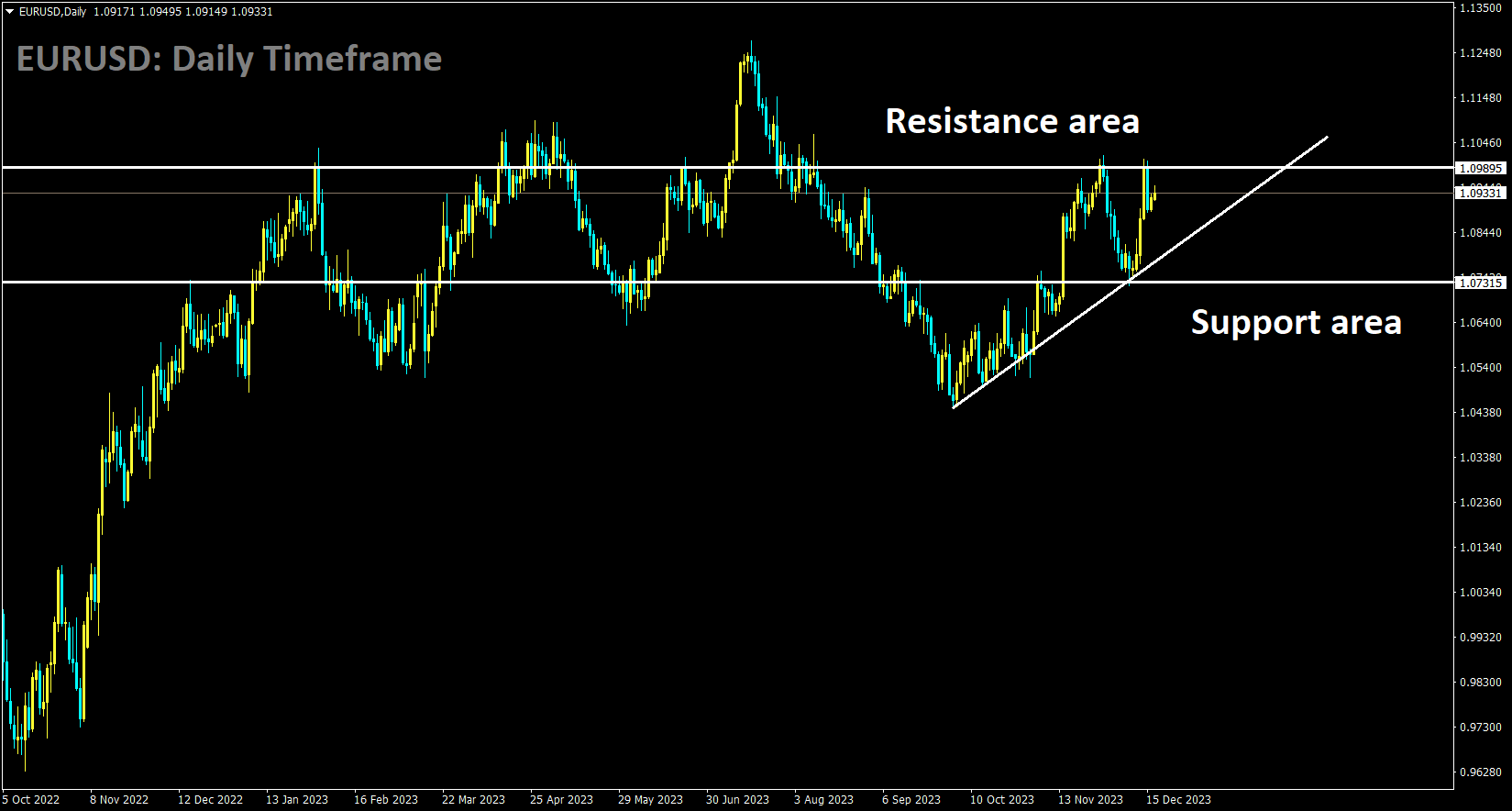

EURUSD Analysis:

EURUSD is moving in the Consolidation pattern and the market has fallen from the resistance area

According to the latest Ifo report, sentiment among German businesses has become less optimistic. Companies are expressing reduced satisfaction with their current business situations and increased skepticism about the first half of 2024. In the manufacturing sector, there was a noticeable decline in the Business Climate Index, with companies reporting significantly worse current business conditions and more pessimistic expectations. Energy-intensive industries are facing particular challenges, as order books continue to shrink overall.

On the other hand, in the service sector, there was a slight improvement in the business climate. Service providers expressed greater satisfaction with their current business situations and reported less skepticism about the outlook for the next six months. However, in the restaurant and catering industry, while the business situation improved, expectations took a sharp downturn. In the trade sector, the business climate suffered a setback, with companies assessing their current situation as notably worse, and their expectations darkening. Holiday trade for retailers has been disappointing this year.

In the construction sector, the Business Climate Index has reached its lowest level since September 2005. Companies evaluated their current situations as worse, and approximately half of them anticipate further deterioration in the coming months.

ECB policymaker Bostjan Vasle continued to push back against current interest rate expectations, stating that market expectations for rate cuts are premature and inconsistent with the stance needed to return inflation to the target. Currently, market pricing indicates a fully priced-in 25 basis point rate cut at the April meeting, with a total of 150 basis points of cuts expected throughout 2024.

GBPUSD Analysis:

GBPUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

As we approach the holiday season, the British pound is holding onto most of its gains from last week. However, the US dollar gained strength on Friday following comments from Federal Reserve voting members, John Williams and Raphael Bostic, which pushed back against market expectations of multiple rate cuts in the coming year. Mr. Williams mentioned in an interview that the Fed is not currently discussing rate cuts, while Mr. Bostic indicated that the US central bank might consider cutting rates twice next year, with the first cut potentially occurring in the third quarter. Market forecasts currently suggest the Fed might reduce rates six times, starting in March, amounting to a total of 150 basis points. Although Friday’s remarks from Williams and Bostic temporarily reversed the recent decline in the US dollar, it is unlikely that the dollar’s recent strength will be sustained for an extended period.

Looking ahead to this week, there will be a focus on the latest UK inflation figures and the final Q3 GDP report. In recent months, UK inflation has been trending downwards, and any further decline will increase pressure on BoE Governor Andrew Bailey to acknowledge that interest rates may need to move lower next year. This would mark a shift from his previously hawkish stance during the last Monetary Policy Committee meeting.

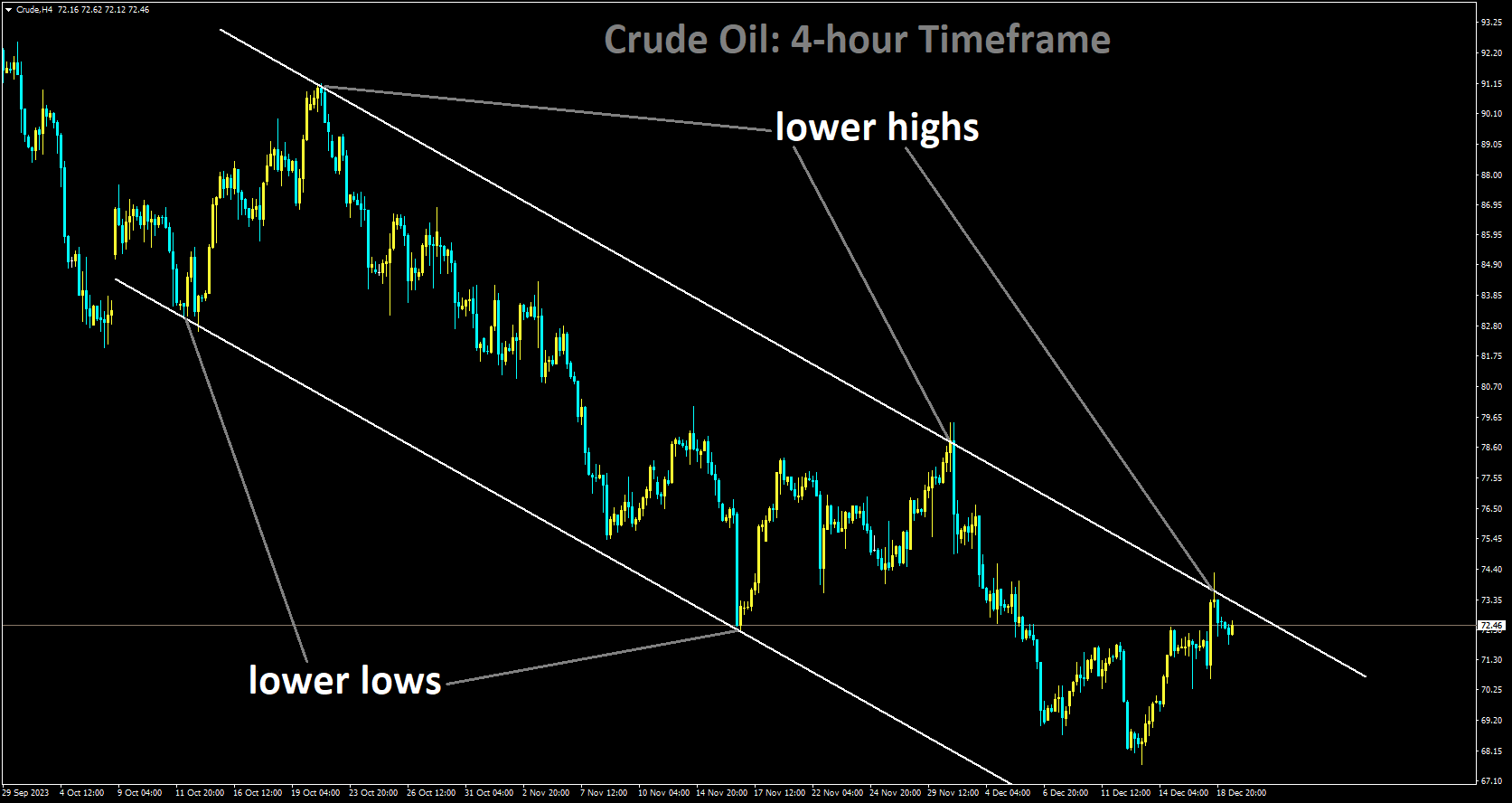

Crude Oil Analysis:

Crude Oil is moving in Descending channel and market has reached lower high area of the channel

Today, oil prices surged by up to 3%, surpassing the $73 per barrel mark, due to heightened tensions in the Red Sea region. The surge was triggered by attacks carried out by the Houthi rebels in Yemen, who are seeking to end the ongoing offensive in Gaza, which has now extended into its third month. These events mark the first indications of a potential spill-over in tensions that could impact global supply chains in 2024.

The escalating tensions in the Red Sea are concerning for those who had hoped the conflict would remain localized. It serves as an early warning sign that the conflict may spread and have repercussions on the global economy, a concern previously voiced by leaders of central banks in the European Union, Bank of England, and the US Federal Reserve. All central bank heads expressed apprehension that the longer the war persists, the greater the likelihood of its global impact on growth and the economy. Just when it appeared that central banks were gaining control over inflation, the disruptions in the supply chain and the potential for conflict escalation in the Middle East pose uncertainties for global markets heading into 2024. These developments are likely to reinforce the belief that the early part of 2024 may bring further challenges.

In response to the escalating tensions, BP announced today that it has temporarily halted all transits through the Red Sea. This decision comes in the wake of an attack on a Norwegian vessel earlier in the day. Consumers now face the prospect of increased transportation costs and delays in refinery operations. As the war continues, there is a growing risk of disruptions in the Strait of Hormuz, as Iran and its regional allies become more assertive. This issue could become a prominent focal point in the early part of 2024.

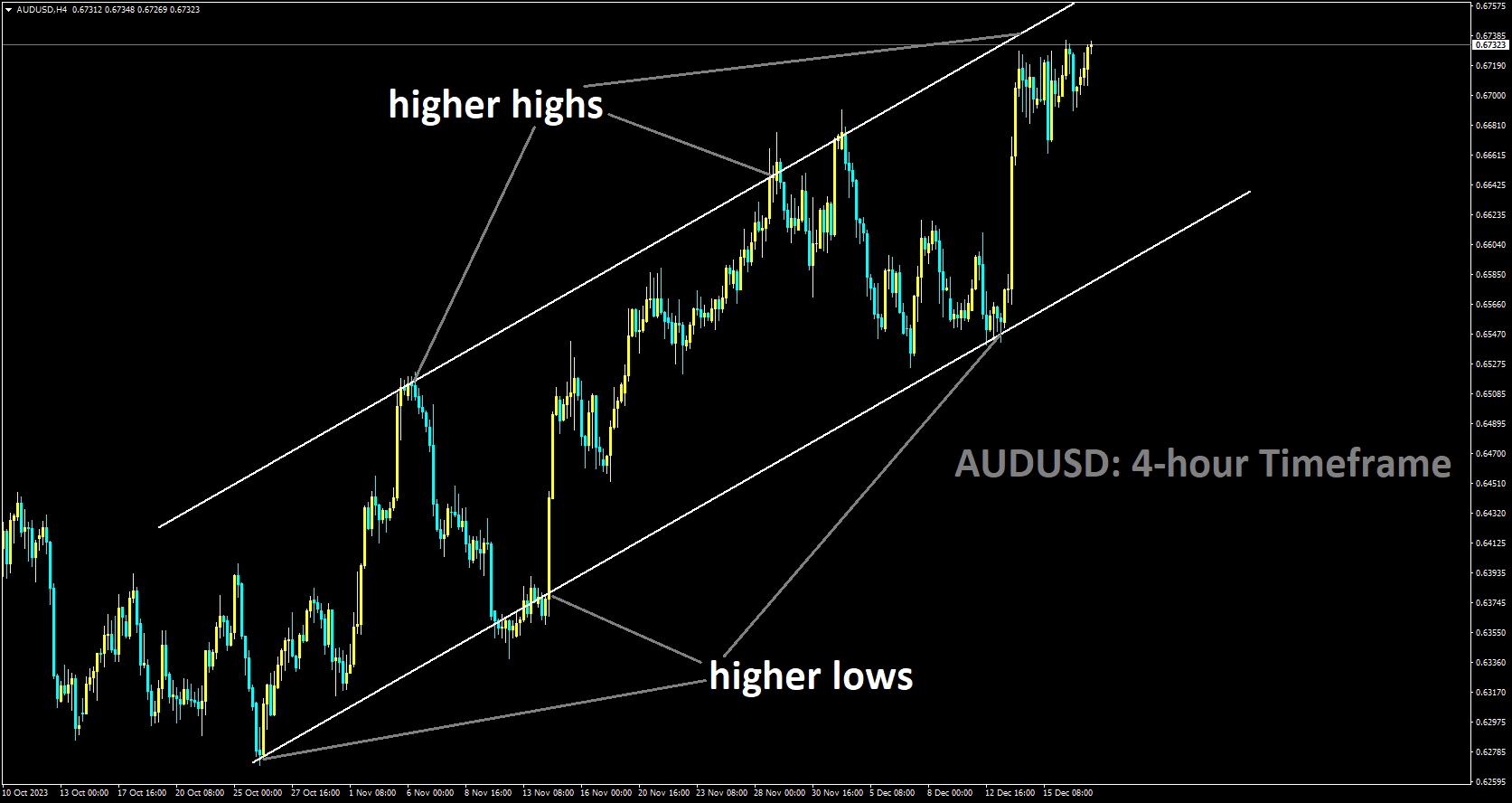

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher high area of the channel

The Reserve Bank of Australia released the minutes of its December monetary policy meeting on Tuesday, revealing that the Board members concluded that maintaining steady interest rates was the preferred course of action at this gathering. Further insights from the RBA Minutes indicate that the central bank observed positive indications of progress concerning inflation, emphasizing the importance of this trend continuing. During the meeting, the Board deliberated whether to raise rates by 25 basis points or keep them unchanged. Ultimately, the consensus favored maintaining the status quo in this instance.

The Board acknowledged the promising signs of improvement in inflation but emphasized the need for this trend to persist. The decision on whether further tightening was necessary would be contingent on forthcoming data and the assessment of associated risks. The recent data did not warrant a substantial alteration to the economic outlook.

The Board recognized the value in waiting for additional data to better evaluate the balance of risks. There was a concern that inflation might remain elevated for an extended period, which needed to be weighed against the risk of a more pronounced deceleration in demand. The minutes also highlighted that consumption growth was relatively weak, with many households experiencing financial constraints. Nevertheless, domestic demand continued to outpace supply, resulting in inflation levels above those seen in several other countries. The Board took note that the RBA staff’s forecasts indicated inflation returning to the upper end of the target range by the end of 2025, rather than settling at the midpoint.

The Board recognized the value in waiting for additional data to better evaluate the balance of risks. There was a concern that inflation might remain elevated for an extended period, which needed to be weighed against the risk of a more pronounced deceleration in demand. The minutes also highlighted that consumption growth was relatively weak, with many households experiencing financial constraints. Nevertheless, domestic demand continued to outpace supply, resulting in inflation levels above those seen in several other countries. The Board took note that the RBA staff’s forecasts indicated inflation returning to the upper end of the target range by the end of 2025, rather than settling at the midpoint.

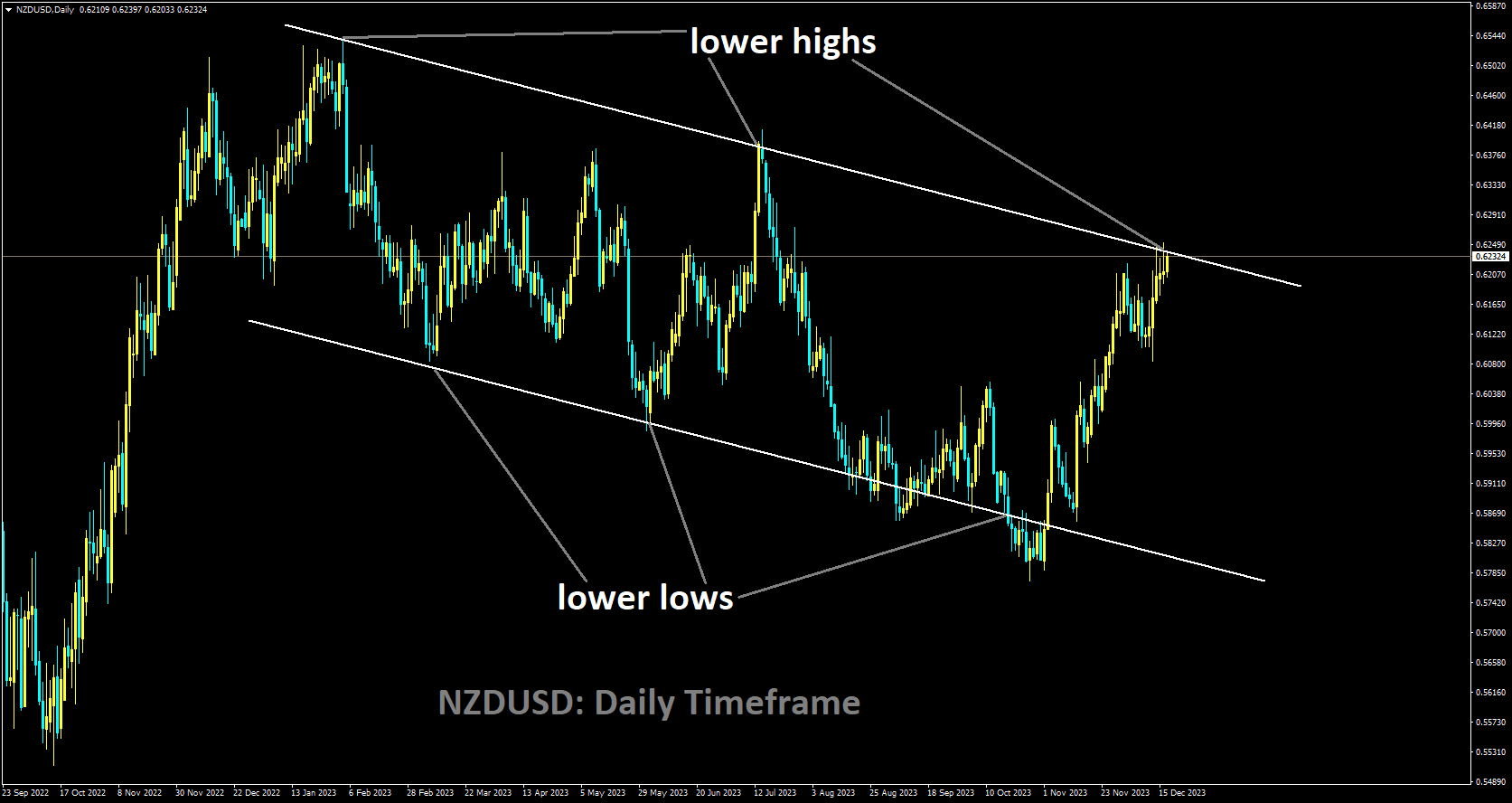

NZDUSD Analysis:

NZDUSD is moving in Descending channel and market has reached lower high area of the channel

In November, New Zealand’s Trade Balance took a larger hit than expected. This was primarily due to a sharp decline in the export of goods, which contracted by $337 million, marking a 5.3% decrease. The total value of goods exports for the year through November amounted to $6 billion. Simultaneously, there was a significant drop in goods imports, with an additional $1.3 billion reduction for the year, translating to a 15% decrease and a total of $7.2 billion.

While New Zealand’s exports to the United States showed a notable 18% increase, equivalent to $110 million, exports to all other major trading partners experienced declines. Particularly noteworthy was the decline in exports to China, which saw a substantial drop of $183 million, nearly ten percent. Across the board, imports also witnessed a general decrease, with motor vehicles and vehicle parts being the hardest-hit category, plummeting by over 50% for the year, resulting in a $352 million decline.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/