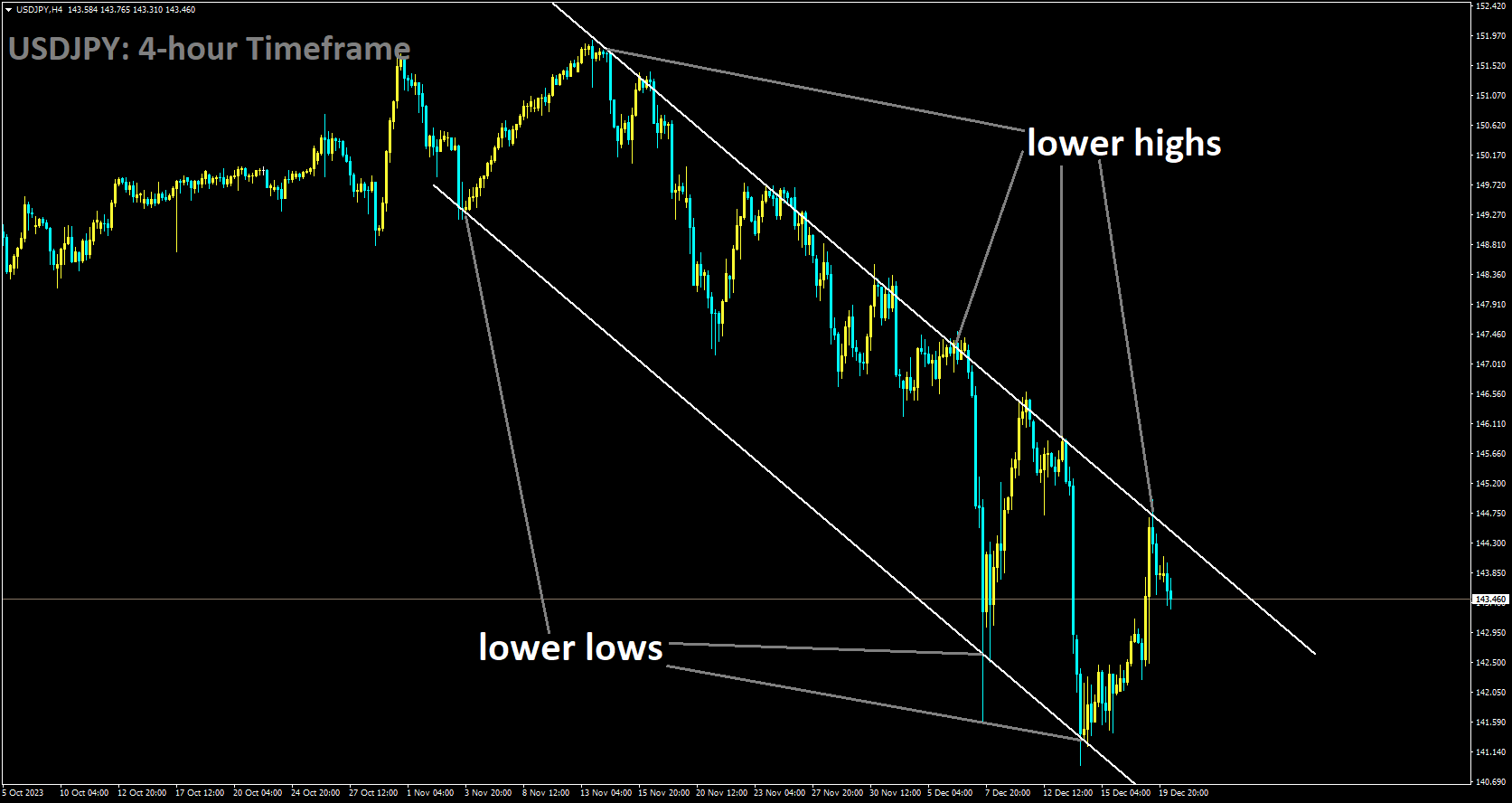

USDJPY Analysis:

USDJPY is moving in Descending channel and market has fallen from the lower high area of the channel

On Tuesday, the Bank of Japan decided to maintain its extremely loose monetary policy without any adjustments. This disappointed some investors who were hoping for a signal that the central bank might soon shift away from negative interest rates. Additionally, data released on Wednesday revealed that both imports and exports in Japan had declined more than expected in November. This, coupled with a generally positive sentiment in the equity markets, is expected to weaken the safe-haven status of the Japanese Yen, In contrast, the US Dollar is attracting buyers due to uncertainty surrounding when the Federal Reserve will begin reducing interest rates, providing some support for the USDJPY pair. Traders are also cautious about making aggressive directional bets ahead of a crucial US inflation report.

The US Core Personal Consumption Expenditure Price Index, which is the preferred inflation gauge of the Federal Reserve, is scheduled for release on Friday. This data is expected to influence the Fed’s future policy decisions, which will play a significant role in driving demand for the USD and providing a clear direction for the USDJPY pair. In the meantime, short-term trading opportunities will be influenced by the Conference Board’s Consumer Confidence Index, Existing Home Sales data, and an appearance by Chicago Fed President Austan Goolsbee during the North American session on Wednesday.

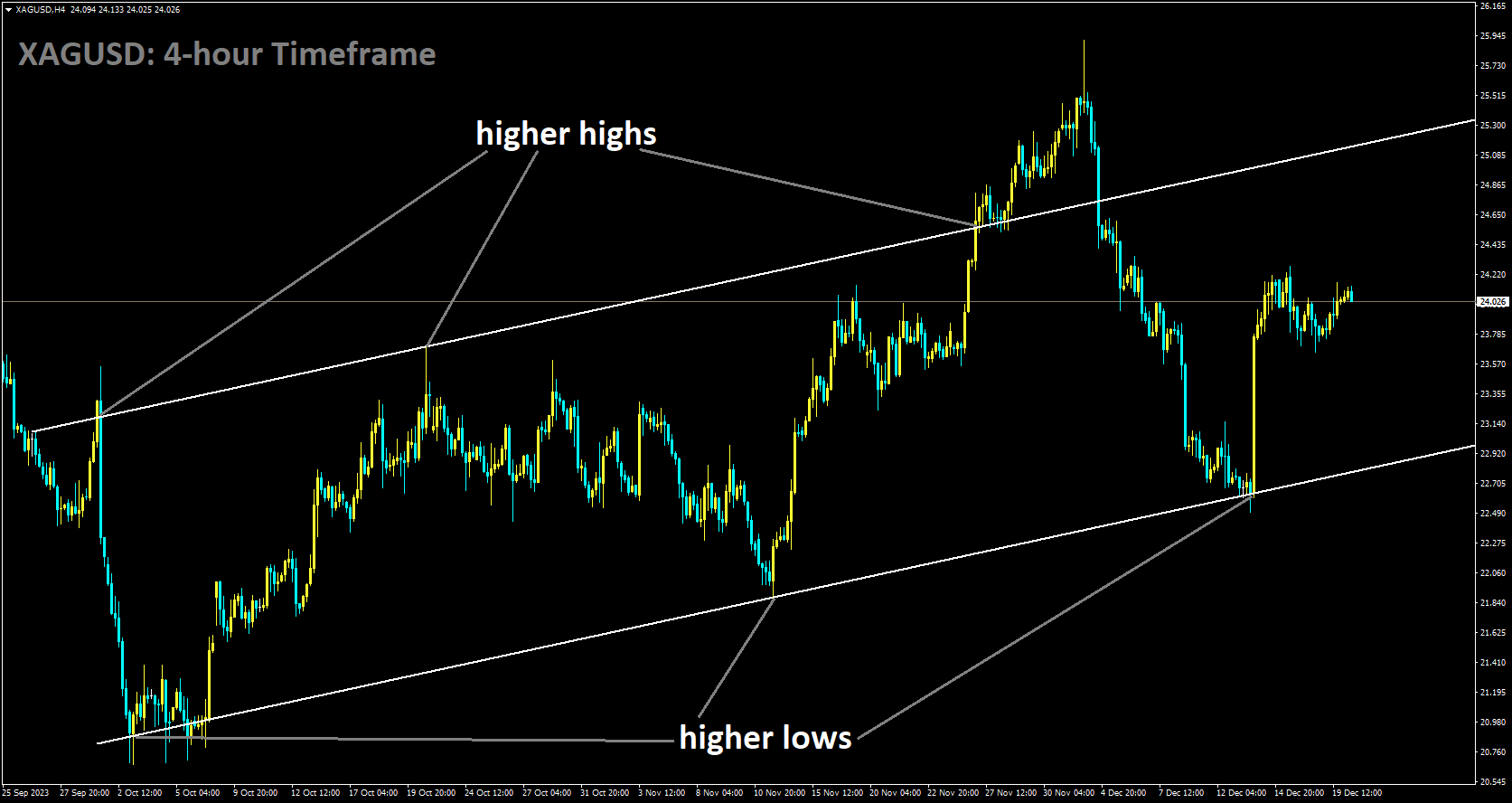

GOLD Analysis:

XAUUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel

In the past week, Federal Reserve Chair Jerome Powell hinted that the tightening cycle had concluded, leaving the possibility of policy easing in the upcoming year. Powell mentioned discussions about potential rate cuts had already begun. However, New York Fed President John Williams expressed a different perspective on Friday, raising questions about the sufficiency of current monetary policy. Despite these differing views, money market futures indicate more than 135 basis points of rate cuts for December 2024, according to fed funds futures contracts on the Chicago Board of Trade. Additionally, there is a 70% probability of a rate cut in March.

Meanwhile, according to Reuters sources, investors have been acquiring gold and are less inclined to divest from it. This sentiment arises from the belief that the Federal Reserve might opt for interest rate cuts before reaching its 2% inflation target. Regarding economic data, recent US housing statistics were robust but did not significantly impact the favorability of the US Dollar. Looking ahead to the coming week, the US economic calendar is set to become busier with the release of final Q3 GDP data, followed by Durable Goods Orders, the core PCE, and additional housing data.

SILVER Analysis:

XAGUSD is moving in Ascending channel and market has rebounded from the higher low area of the channel

In a Wednesday morning interview with Fox TV, Austan Goolsbee, President of the Federal Reserve Bank of Chicago, expressed concern that the market’s enthusiasm for anticipated interest rate cuts may be premature. He emphasized that if inflation continues to decrease, the Federal Reserve could potentially reassess its level of restraint. Goolsbee underlined that the Federal Reserve’s decisions are not influenced by political factors; instead, the key determinant for the possibility of reducing restraint is the trajectory of inflation. He also cautioned against allowing market sentiments to pressure or influence the Federal Reserve’s decisions.

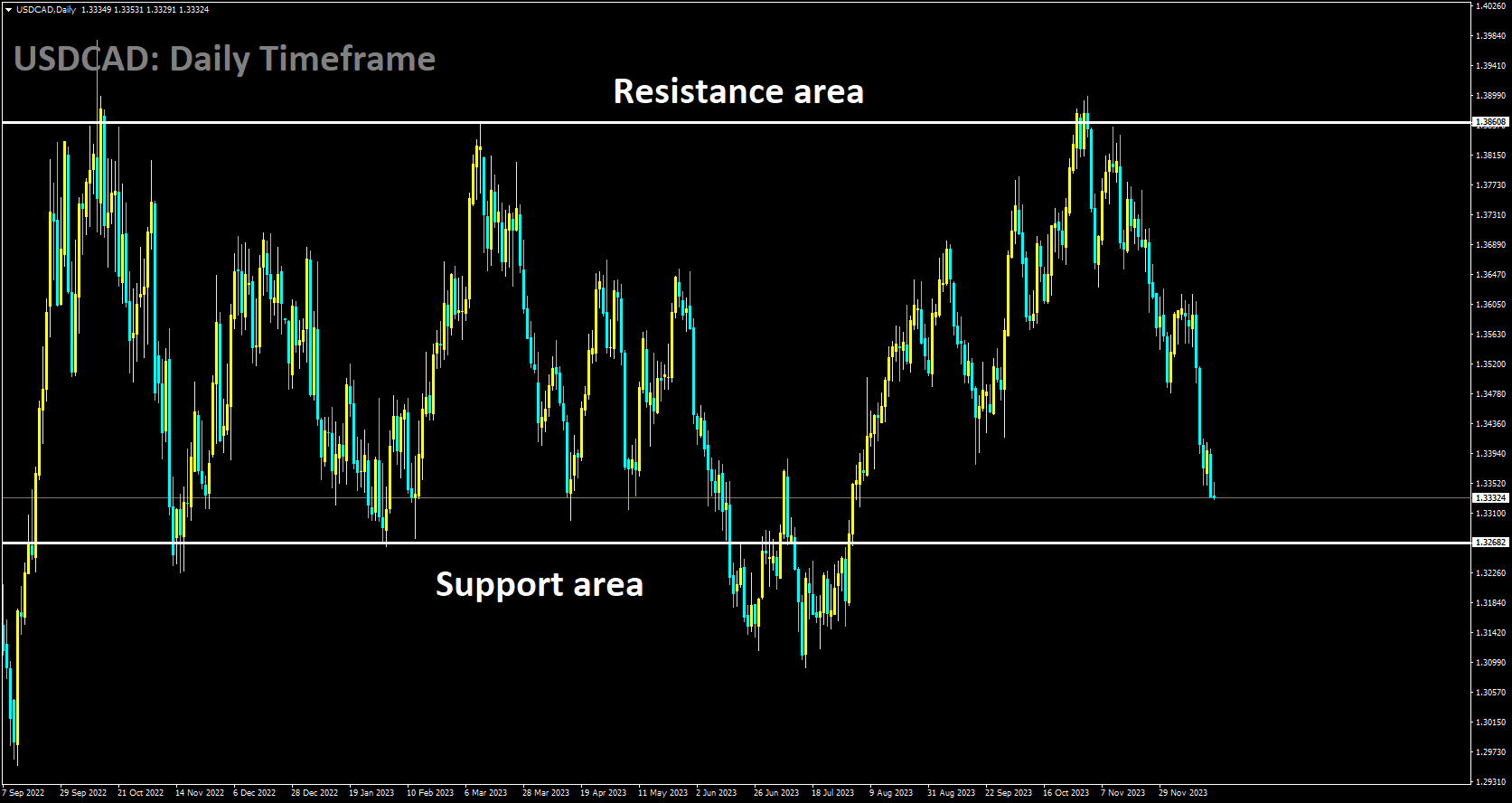

USDCAD Analysis:

USDCAD is moving in box pattern and market has fallen from the resistance area of the pattern

The annual consumer inflation rate in Canada unexpectedly remained stable at 3.1% in November, leading traders to reconsider their expectations for when the Bank of Canada might initiate interest rate cuts. This development, coupled with the recent moderate recovery in Crude Oil prices from their lowest point since late June earlier this month, could continue to support the commodity-linked Canadian Dollar (Loonie). Additionally, the prevailing bearish sentiment surrounding the US Dollar may further constrain the USDCAD currency pair. The Federal Reserve adopted a more dovish stance last week and forecasted an average of three 25 basis points rate reductions in 2024. This, combined with the ongoing risk-on market sentiment, has kept the safe-haven US Dollar near its lowest level in over four months, reached last Friday.

Despite this, several influential Fed officials have recently attempted to downplay speculations about an imminent dovish shift in the US central bank’s policy stance, although their efforts have had limited impact on bolstering the USD bulls. Market participants are now turning their attention to the US economic calendar, which includes the release of the Conference Board’s Consumer Confidence Index and Existing Home Sales data. These releases, along with the scheduled appearance of Chicago Fed President Austan Goolsbee, will shape the demand for the US Dollar during the North American session and provide fresh momentum to the USDCAD pair. In addition, traders will be closely monitoring Oil price movements for short-term trading opportunities. Nevertheless, the primary focus will remain on the US Core PCE Price Index, the Federal Reserve’s preferred inflation gauge, which is scheduled for release on Friday.

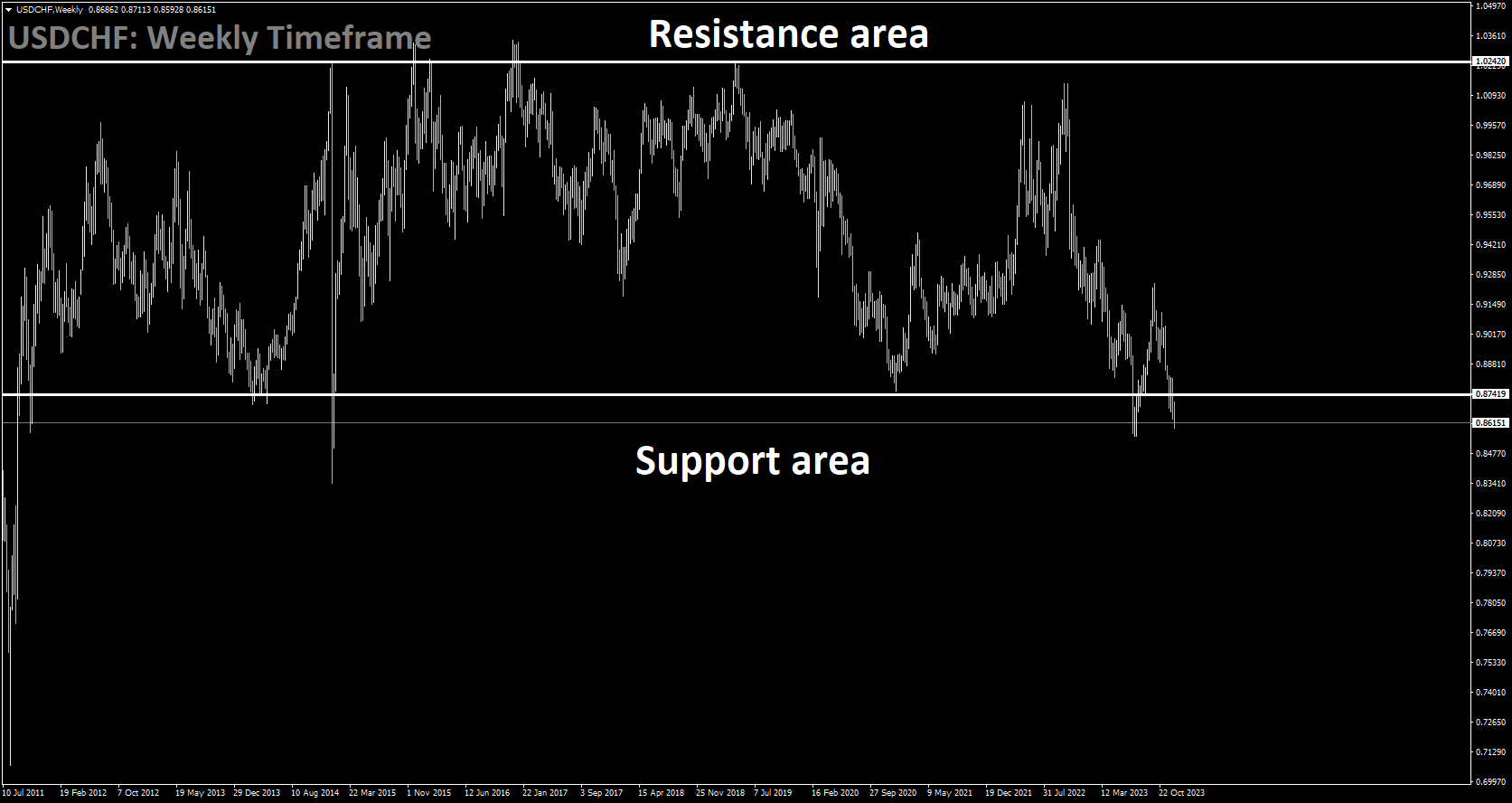

USDCHF Analysis:

USDCHF is moving in box pattern and market has reached support area of the pattern

During last Wednesday’s meeting, it was indicated that there likely won’t be any further tightening, and the revised dot plots showed that bank officials were forecasting a 75 basis points easing in 2024. Since then, the US Dollar has been under selling pressure, with any dovish guidance adding to the downward pressure on the Greenback. In alignment with this sentiment, Thomas Barkin commented on Tuesday that if inflation continues to decline, the Federal Reserve will respond, fueling expectations of further easing. On the contrary, Raphael Bostic from the Atlanta Fed sounded more cautious and emphasized the need for a resolute and patient policy, forecasting only two rate cuts in 2024. Currently, US bond yields are trading lower, with the 2-year rate at 4.40%, and the 5 and 10-year rates standing at 3.94% and 3.92%, respectively. This downward trend in US yields is contributing to the pair’s decline as the US Dollar loses its appeal.

However, the Swiss economy, like much of Europe, is experiencing contraction, marked by declining business confidence and investment, especially in energy-intensive industries. These factors could potentially strengthen the USD against the Swiss Franc, given the relative strength of the American economy. On Wednesday, investors will be closely monitoring the Swiss National Bank Quarterly Bulletin for Q4 to gain further insights into the Swiss economy.

EURUSD Analysis:

EURUSD is moving in the Consolidation pattern and the market has fallen from the resistance area of the pattern

Data released by Eurostat on Tuesday revealed that Eurozone inflation for November fell short of market expectations due to a decline in energy prices. The Eurozone Harmonized Index of Consumer Prices for November showed a month-on-month decrease of -0.6%, compared to the -0.5% figure from the previous month, indicating weaker performance than anticipated. However, the annual inflation rate for the Eurozone stood at 2.4%, aligning with analysts’ predictions. Notably, the Core HICP, which excludes the volatile components of food and energy, reported a year-on-year increase of 3.6%, marking its lowest reading since April 2022. Following its recent monetary policy meeting, the European Central Bank stated that it had not discussed rate cuts. The ECB also issued a warning that inflation might spike again in December due to colder weather, which typically raises energy demand and prices. This development could potentially limit the Euro’s upward momentum and create headwinds for the EURUSD currency pair.

On the other side of the Atlantic, Building Permits in the United States dropped to 1.46 million in November, down from October’s 1.498 million, falling short of the market’s expected figure of 1.47 million. However, Housing Starts increased to 1.56 million in November, up from the previous reading of 1.359 million, surpassing the consensus estimate of 1.36 million, as reported by the US

Census Bureau on Tuesday. Looking ahead to Wednesday, traders will closely monitor the release of the German Producer Price Index (PPI) for November, Eurozone data including October’s Current Account and Construction Output, as well as December’s Consumer Confidence. On the US economic calendar, Existing Home Sales will be a key release of the day.

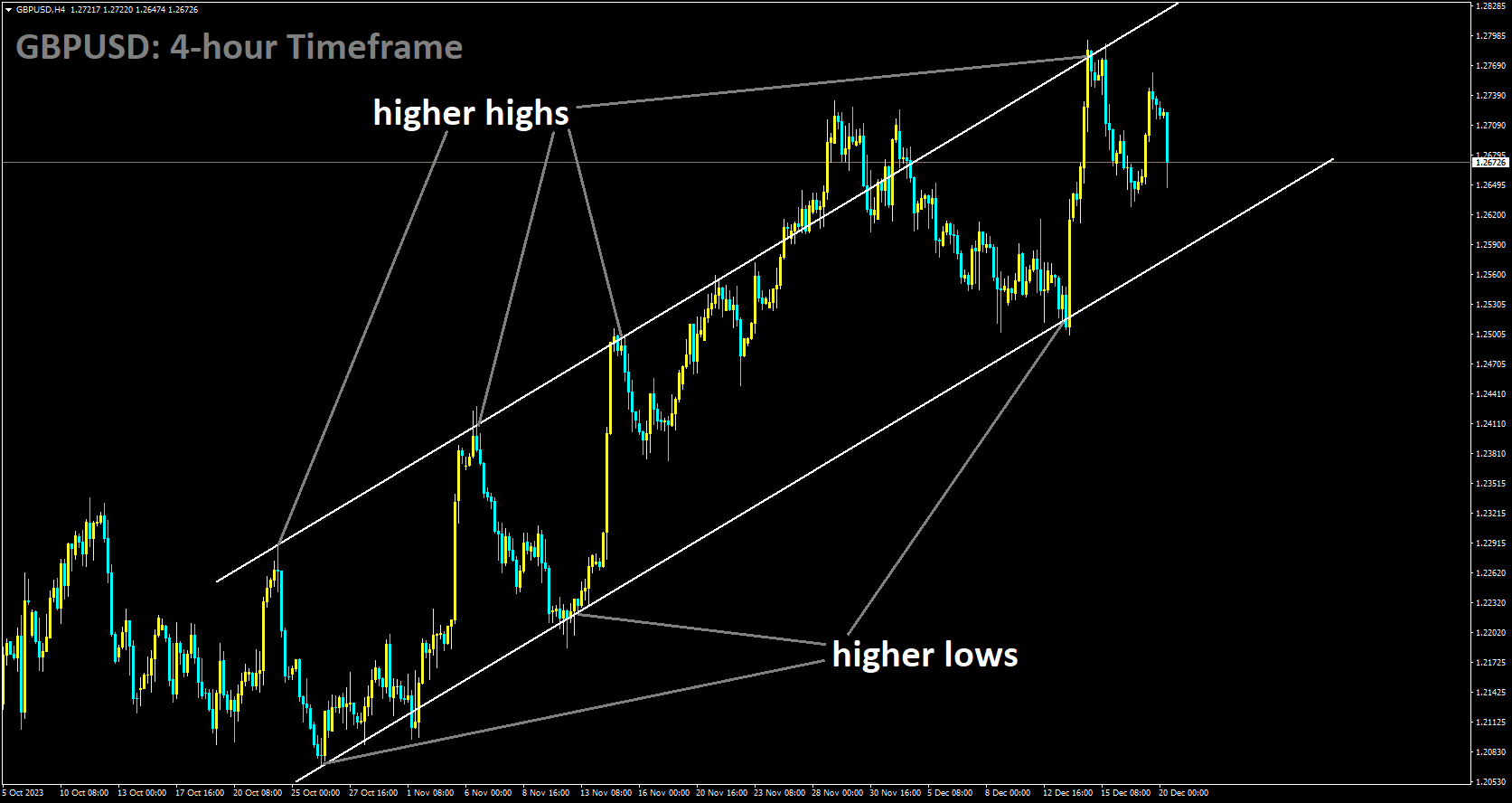

GBPUSD Analysis:

GBPUSD is moving in Ascending channel and market has fallen higher high area of the channel

According to the Office for National Statistics’ latest data released on Wednesday, the United Kingdom’s Consumer Price Index showed a year-on-year increase of 3.9% in November. This marks a decrease from the 4.6% rise observed in October, which was lower than the market’s anticipated acceleration of 4.4%. Furthermore, the Core CPI, which excludes volatile food and energy items, experienced a year-on-year increase of 5.1% in November, in contrast to the 5.7% growth seen in October and falling short of the expected 5.6%.

In addition, the UK Consumer Price Index registered a 0.2% month-on-month decrease in November, contrary to the expected 0.1% increase and the zero percent change recorded in October.

In addition, the UK Consumer Price Index registered a 0.2% month-on-month decrease in November, contrary to the expected 0.1% increase and the zero percent change recorded in October.

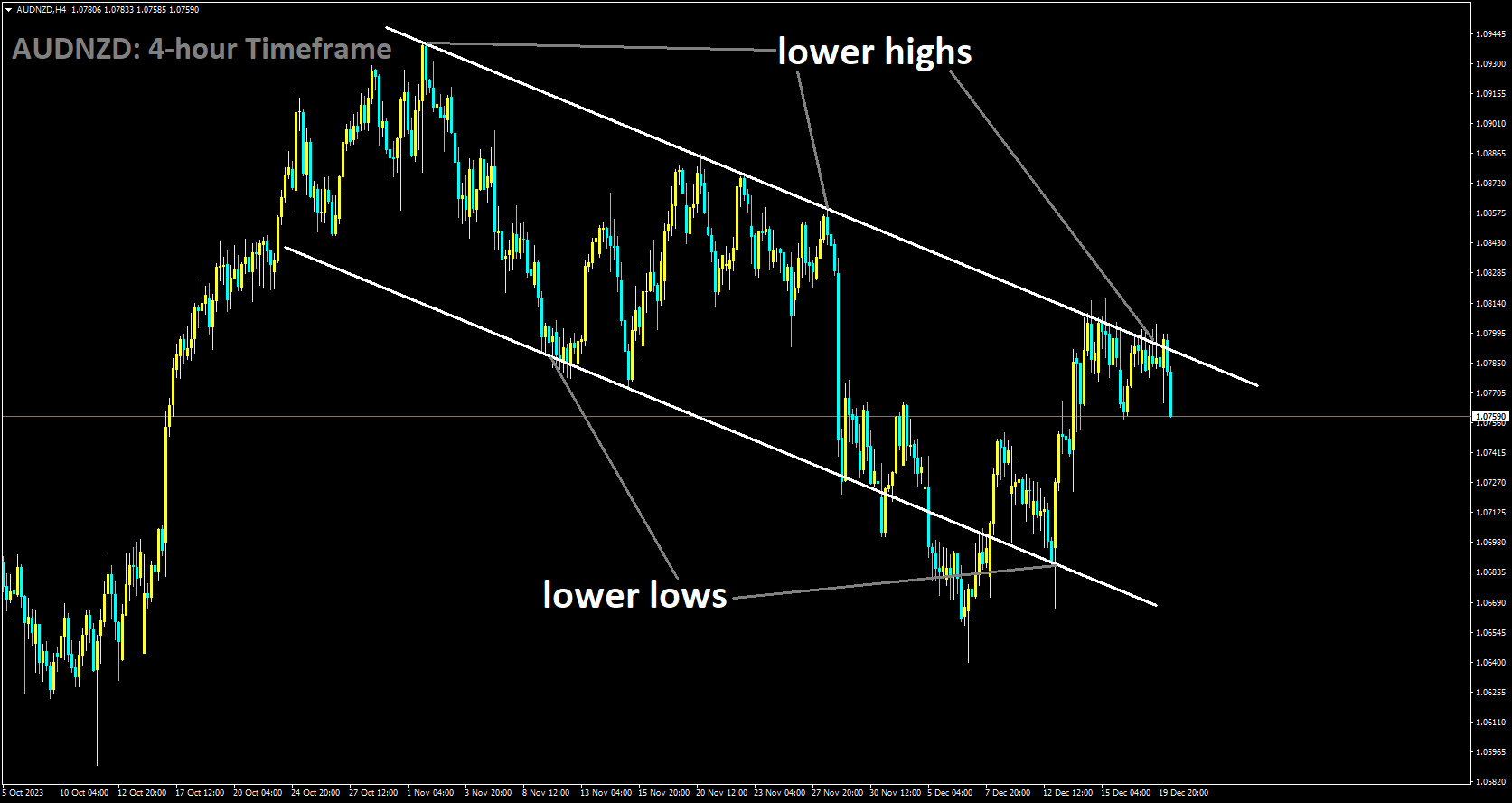

AUDNZD Analysis:

AUDNZD is moving in Descending channel and market has fallen from the lower high area of the channel

On Wednesday, the People’s Bank of China made an announcement confirming that it has decided to keep the Loan Prime Rate unchanged across all maturity periods. Specifically, the Chinese central bank has maintained the one-year LPR at 3.45% and the five-year LPR at 4.20%.

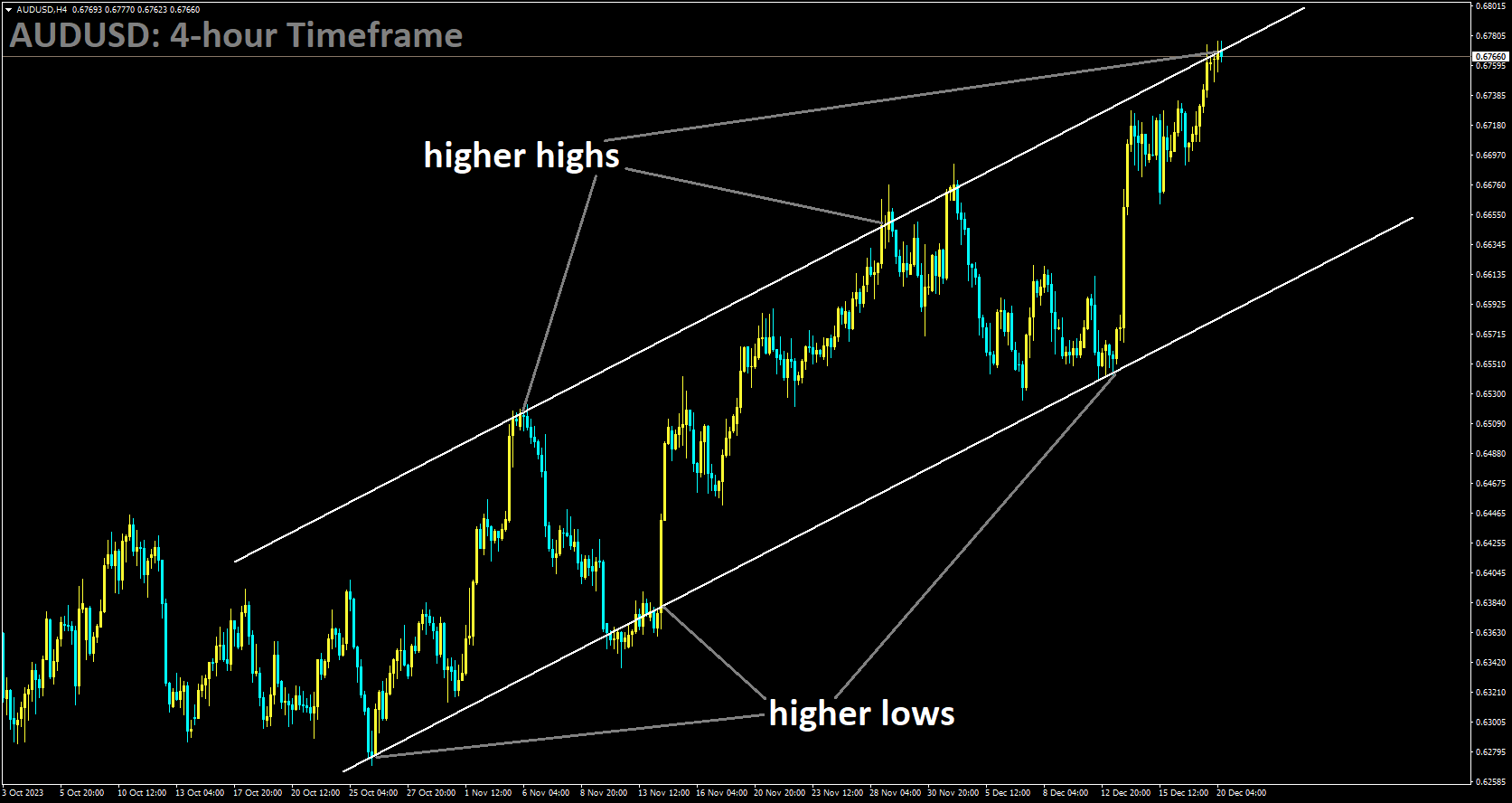

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher high area of the channel

The latest US housing data, released on Tuesday, presented a mixed picture. Housing Starts exceeded expectations by reaching 1.56 million, surpassing the market consensus of 1.36 million. Conversely, Building Permits fell to 1.46 million, which was worse than the anticipated 1.47 million. Following the Federal Open Market Committee meeting last week, market sentiment suggests that the US central bank has completed its tightening cycle and may consider rate cuts in the coming year. This development has put downward pressure on the US Dollar and provided support for the AUDUSD pair. According to CME’s Fed Watch tool, financial markets are pricing in a 67.5% probability that the Federal Reserve will implement a 25 basis point rate cut as early as March.

In contrast, the Reserve Bank of Australia, in its December minutes, indicated the possibility of raising interest rates in response to encouraging signs of decreasing inflationary pressures across the economy. However, the central bank emphasized that its policy decisions will hinge on incoming data and the evolving assessment of risks. Looking ahead, traders will closely monitor the release of US Existing Home Sales on Wednesday. Later in the week, attention will shift to the release of the third-quarter US Gross Domestic Product Annualized, which is expected to remain steady at 5.2%. On Friday, the focus will be on the Core Personal Consumption Expenditures Price Index.

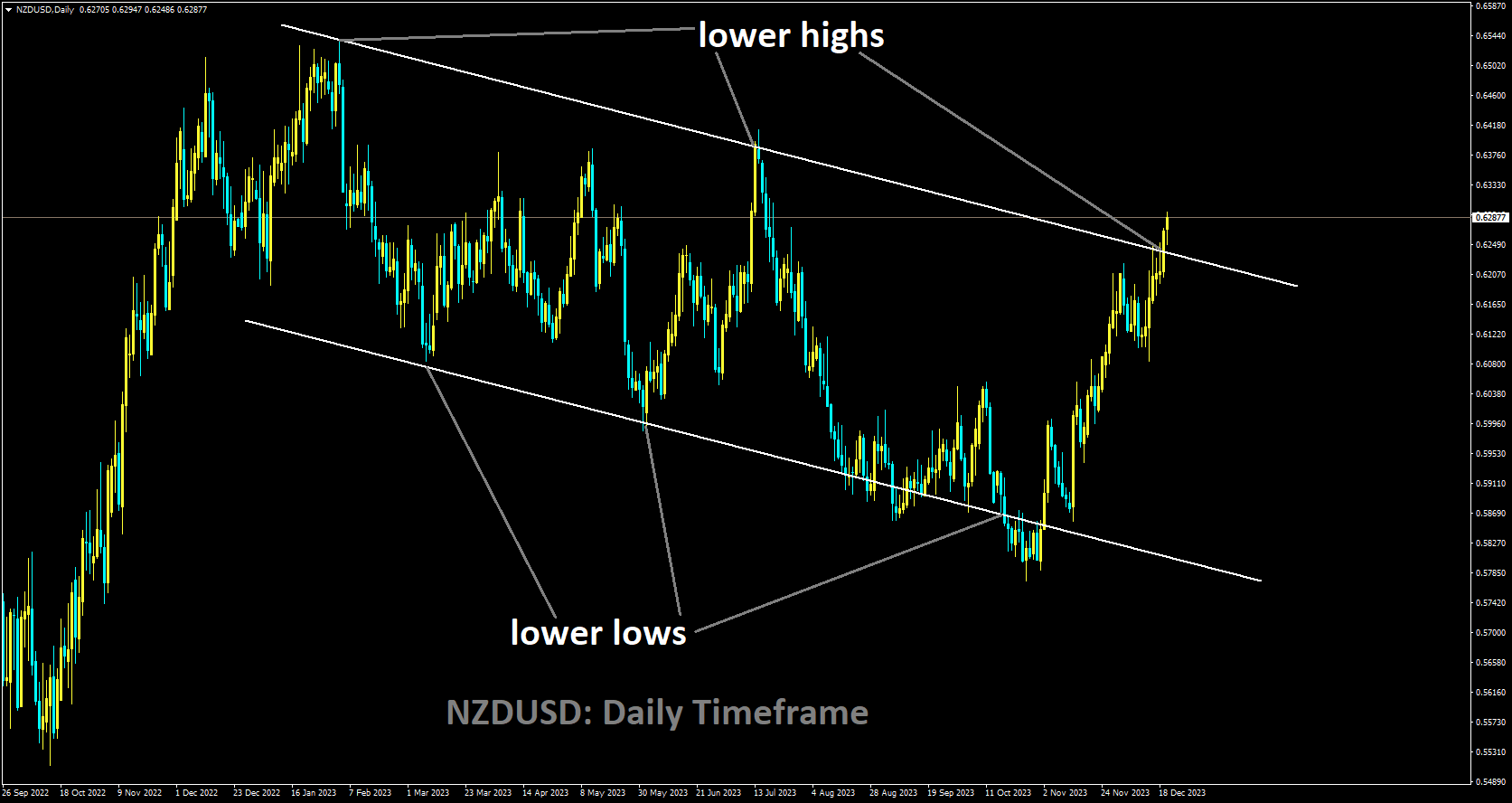

NZDUSD Analysis:

NZDUSD is moving in Descending channel and market has reached lower high area of the channel

Reserve Bank of New Zealand Governor Adrian Orr stated on Wednesday that they were taken aback by last week’s GDP data, which showed a contraction in the economy. However, he emphasized that they have not yet formed an opinion regarding its impact on the future interest rate outlook, as reported by Bloomberg.Orr acknowledged that the GDP data was unexpectedly lackluster, and they are currently carefully considering the intricate nature of the situation. He mentioned their plans to provide further insights in February through their monetary policy statement. Additionally, he expressed surprise at the sustained high levels of net inward migration.

Furthermore, Orr underscored the significance of addressing core inflation as a challenge they will encounter in the future. He pointed out that core inflation presents a notable challenge, with many aspects related to it falling under the purview of central and local government, such as rates and taxes. He recognized that the final stages of the battle against inflation are likely to be demanding, particularly in light of the persistent high levels of core inflation, or domestically generated inflation.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/