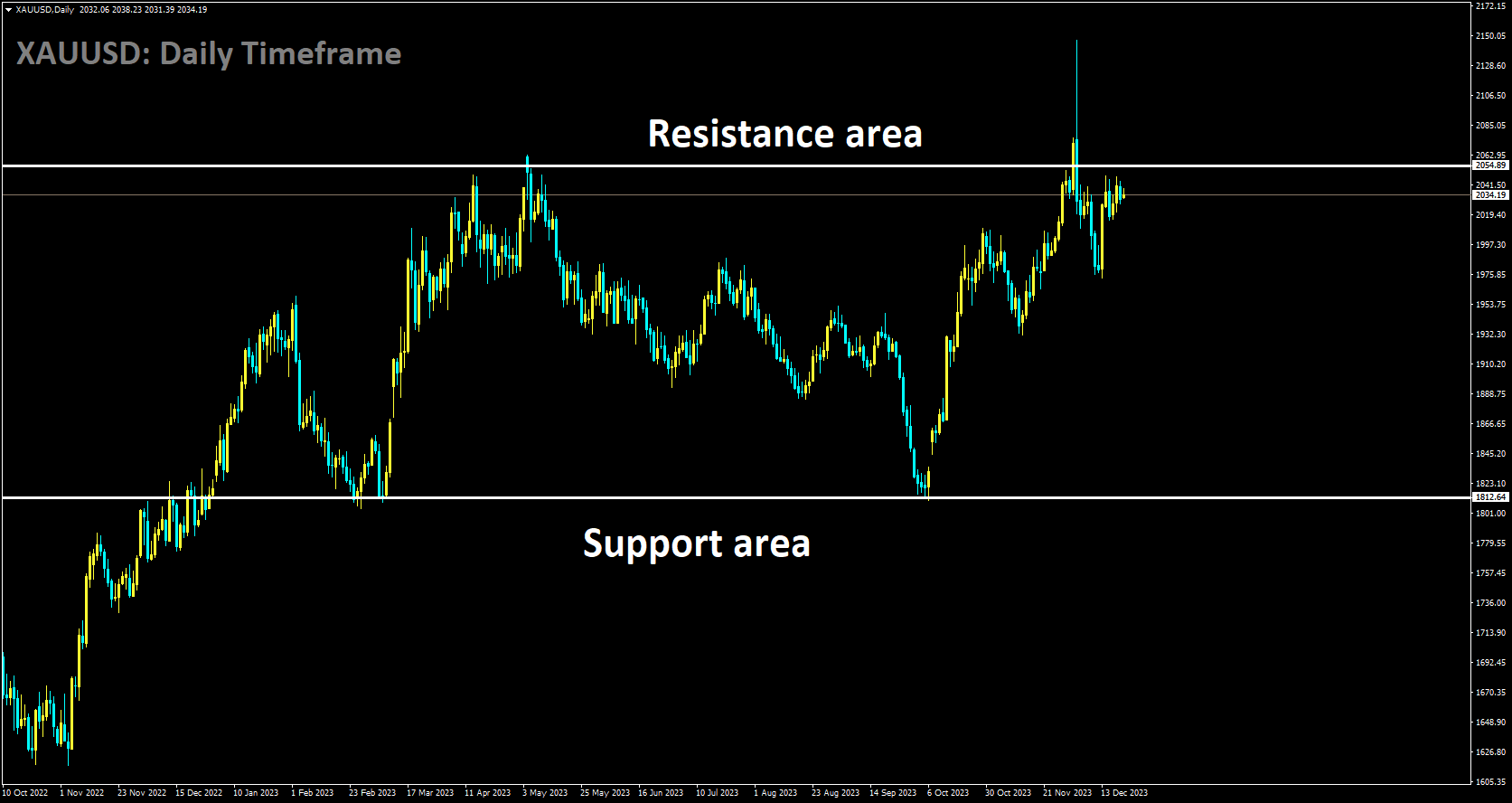

GOLD Analysis:

XAUUSD is moving in box pattern and market has reached resistance area of the pattern

During the US trading session, the price of gold experienced a notable rally, surging past the critical resistance level of $2040 per ounce. This surge was quite remarkable given that earlier in the European session, a relatively stronger US Dollar had momentarily subdued the bullish sentiment among gold traders. However, this initial setback was soon overshadowed by ongoing comments from Federal Reserve officials, who continued to discuss the possibility of implementing interest rate cuts. This talk of potential rate cuts served to exert downward pressure on the US Dollar, which, in turn, provided tailwinds for gold.

One of the focal points of the week has been the escalating geopolitical tensions in the Middle East, particularly in the Red Sea region. These tensions have contributed significantly to an atmosphere of uncertainty in the financial markets, and they appear poised to intensify further. In the backdrop of this geopolitical turmoil, gold has managed to maintain its dominant position. If the strife and tension in the Middle East persist without a resolution, there remains substantial potential for further gains in the price of gold.

The resurgence of weakness in the US Dollar has also been a significant factor supporting gold’s upward momentum. Federal Reserve policymakers have adopted a dovish stance this week, with many of them emphasizing the necessity for interest rate cuts in the year 2024. Apart from occasional comments expressing the need to monitor incoming economic data, there has been limited resistance to this dovish view. Of particular note is the dissenting opinion of policymaker Barkin, who believes that inflation is proving to be more persistent than what the typical Fed official anticipates.

In addition to these factors, US Treasury Yields have been facing challenges, particularly the 2-year and 10-year yields. These yield struggles have further benefited gold’s performance. Looking ahead, the financial markets are eagerly awaiting the release of important US economic data, with the US PCE data scheduled for release on Friday. The outcome of this data release could significantly influence US interest rate expectations as the year draws to a close. Furthermore, the final Q3 GDP figure will be released, adding another layer of economic data to consider. There are also other noteworthy US data releases, such as the CB consumer confidence and the final Michigan Consumer Sentiment numbers. While these data releases may prompt short-term market movements, they are unlikely to have a lasting impact and could potentially be reversed by the end of the trading session.

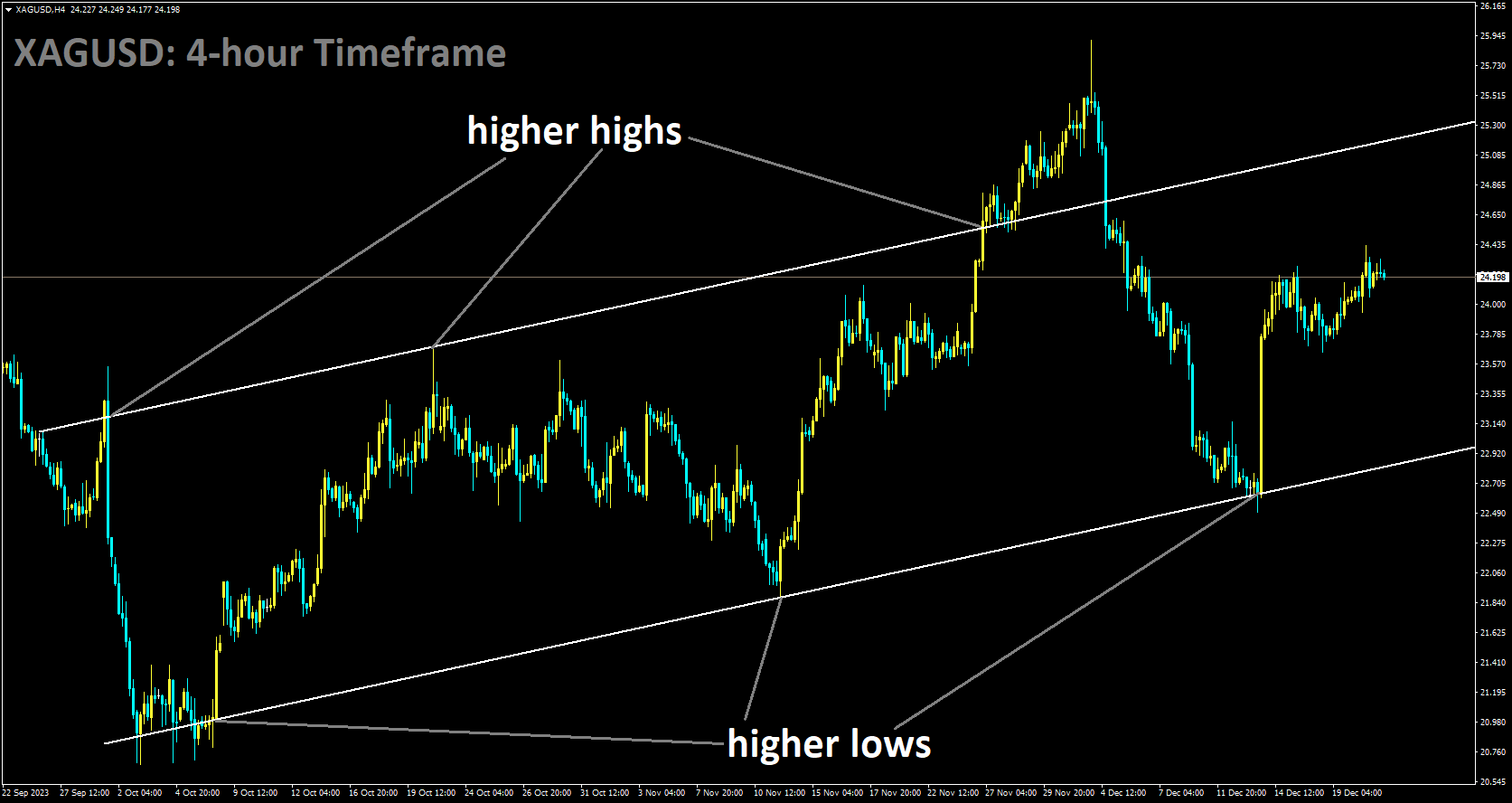

SILVER Analysis:

XAGUSD is moving in Ascending channel and market has rebounded from the higher low area of the channel

In the month of December, consumer sentiment in the United States exhibited signs of improvement, as indicated by the Conference Board’s Consumer Confidence Index. This index rose from 101.0 to 110.7, suggesting a more optimistic outlook among consumers. A closer examination of the report revealed that both the Present Situation Index and the Consumer Expectations Index posted gains. The former climbed from 136.5 to 148.5, while the latter saw an increase from 77.4 to 85.6. An interesting detail to note is that the one-year consumer inflation rate expectation slightly decreased to 5.6%, indicating that consumers anticipate somewhat lower inflation in the near term.

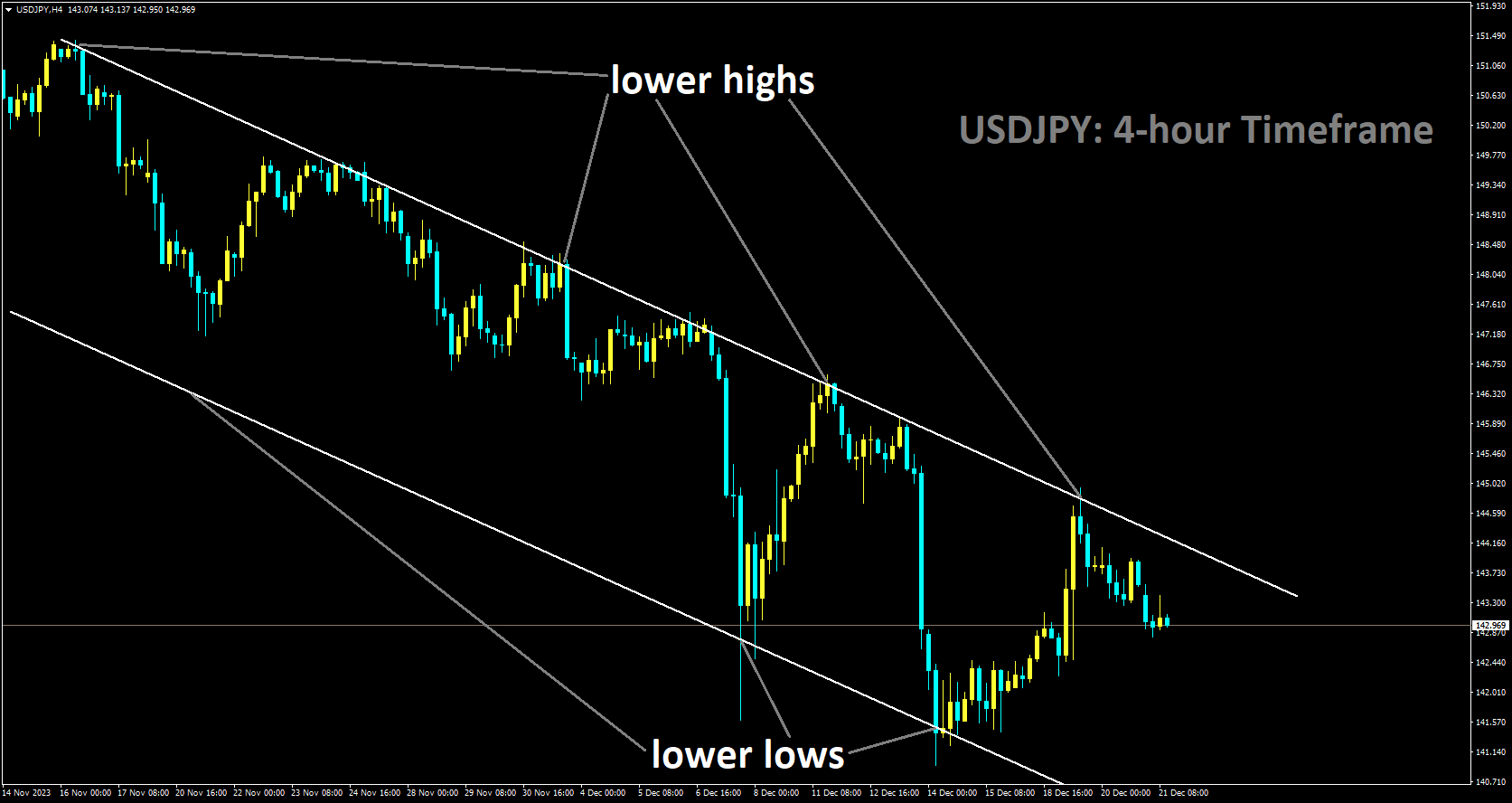

USDJPY Analysis:

USDJPY is moving in Descending channel and market has fallen from the lower high area of the channel

The recent decision by the Bank of Japan did not align with market expectations. Instead of implementing the changes that many had anticipated, the BOJ chose to maintain its existing monetary policy. This decision had immediate consequences, resulting in a weakening of the Japanese yen and a notable 1.4% increase in the Nikkei stock index. Meanwhile, in the United States, members of the Federal Reserve have been making efforts to counter market expectations of future interest rate cuts. However, despite these efforts, the market still anticipates a series of rate cuts starting as early as March 2022. Consequently, the US dollar remains weak, with the US dollar index consistently hovering at low levels. Additionally, US Treasury yields have also declined to their lowest levels in weeks.

These market conditions have created a favorable environment for gold. The anticipation of future rate cuts typically boosts the value of the precious metal. Nevertheless, despite these expectations, gold’s performance has been relatively modest. Currently, it is trading around $2028, with notable resistance levels at $2032 and $2043.

Despite the potential for short-term sell-offs, there is anticipated interest from buyers in gold, and the prevailing trend in the coming weeks is projected to be an increase in its value. In the realm of stock indices, the S&P 500, NASDAQ 100, and Dow Jones have all achieved new record highs. However, trading ranges have been relatively narrow due to reduced market activity during the holiday season. Toward the end of the week, there may be some profit-taking, particularly if the US inflation figure exceeds expectations.

In the currency market, the Japanese yen has emerged as a significant player, weakening against other currencies following the BOJ’s decision. Other currencies, such as the Canadian dollar, euro, and sterling, have also experienced some fluctuations. Overall, as the festive break approaches, the market is winding down and becoming less active. The US dollar is exhibiting limited movement, stock indices are relatively stable, and gold is consolidating. The upcoming release of the Core PCE data on Friday is expected to bring a final burst of volatility before the market enters a week and a half of reduced activity.

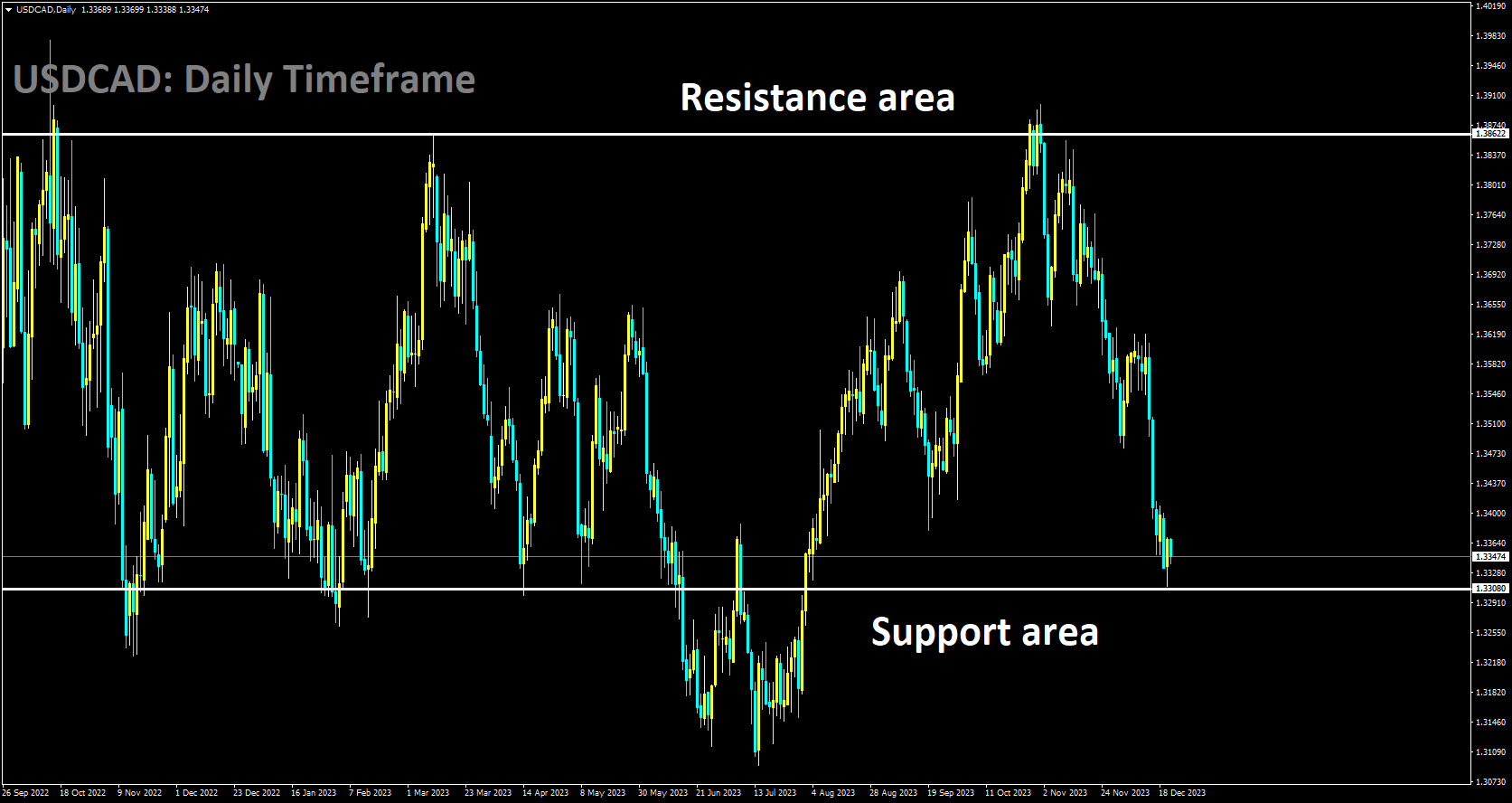

USDCAD Analysis:

USDCAD is moving in box pattern and market has reached support area of the pattern

The upside potential of the US Dollar appears to be constrained as market participants anticipate three impending rate cuts from the Federal Reserve. Investors are eagerly awaiting the release of Canadian Retail Sales and US GDP growth figures on Thursday. These events could potentially inject volatility into the currency pair ahead of the upcoming holiday season. The hawkish comments made by the Federal Reserve last week, coupled with the signal that the central bank intends to implement a total of 75 basis points in interest rate cuts, have placed some downward pressure on the US Dollar across the board. Although Fed Chair Jerome Powell did not provide specific guidance regarding the timing of these rate cuts, the market is bracing for a possible cut as early as March.

On Wednesday, there was a notable uptick in US CB Consumer Confidence for December, marking the most significant increase since early 2021, with a reading of 110.7 compared to the previous figure of 101.0. Additionally, the annual rate of Existing Home Sales in November surpassed expectations, reaching 3.82 million, outperforming the market consensus of 3.77 million.

Turning to the Canadian Dollar, the Bank of Canada disclosed the Summary of Deliberations from its December 6 meeting. The Governing Council concluded that interest rates were sufficiently high to counteract inflation, leading them to maintain the status quo on borrowing costs at the December meeting. However, the central bank acknowledged that inflation-related risks remained elevated, leaving the door open for potential future rate hikes. Traders will be closely monitoring the Canadian Retail Sales data for October, which is expected to reveal a 0.8% month-on-month increase, up from the 0.6% recorded in the previous reading. Additionally, the release of US Gross Domestic Product Annualized data for the third quarter is scheduled for Thursday, with the growth rate anticipated to remain steady at 5.2%.

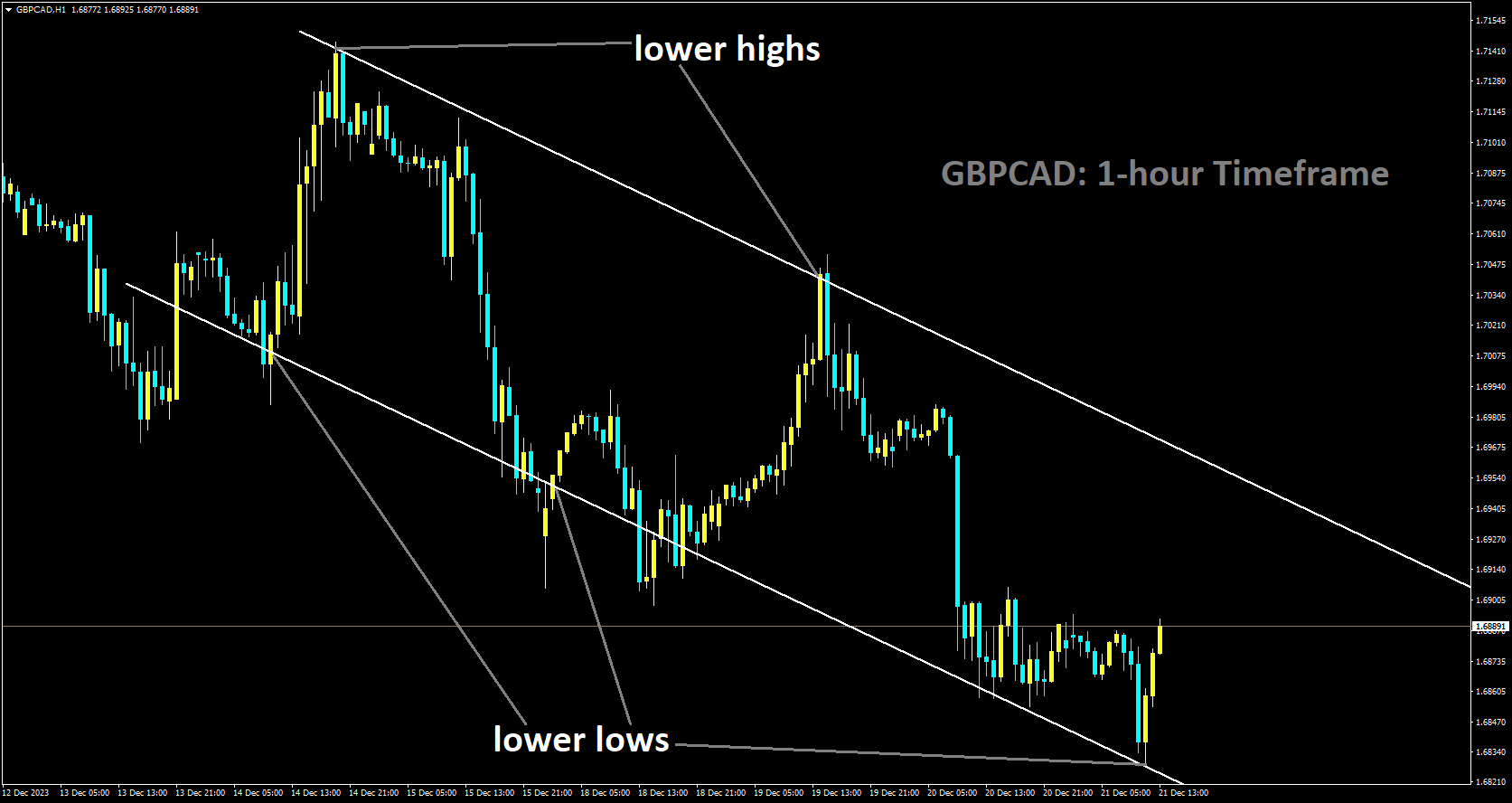

GBPCAD Analysis:

GBPCAD is moving in Descending channel and market has rebounded from the lower low area of the channel

Market participants are currently grappling with the prospect of interest rate reductions and are now confronted with the added uncertainty of increasing geopolitical tensions. The UK inflation figures released today have further fueled speculation of potential rate cuts, as the data fell significantly below expectations. This development is likely to bring relief to both UK consumers and the Bank of England, given that market expectations are already factoring in the possibility of rate cuts as early as May. In the backdrop of escalating geopolitical tensions in the Middle East, Gold and Oil have emerged as the primary beneficiaries this week. Both of these commodities are expected to maintain their positive trajectory in the short term, as concerns over supply disruptions are anticipated to worsen with the prolonged conflict in Israel. Looking ahead, market attention will shift to the release of US PCE data at the end of the week.

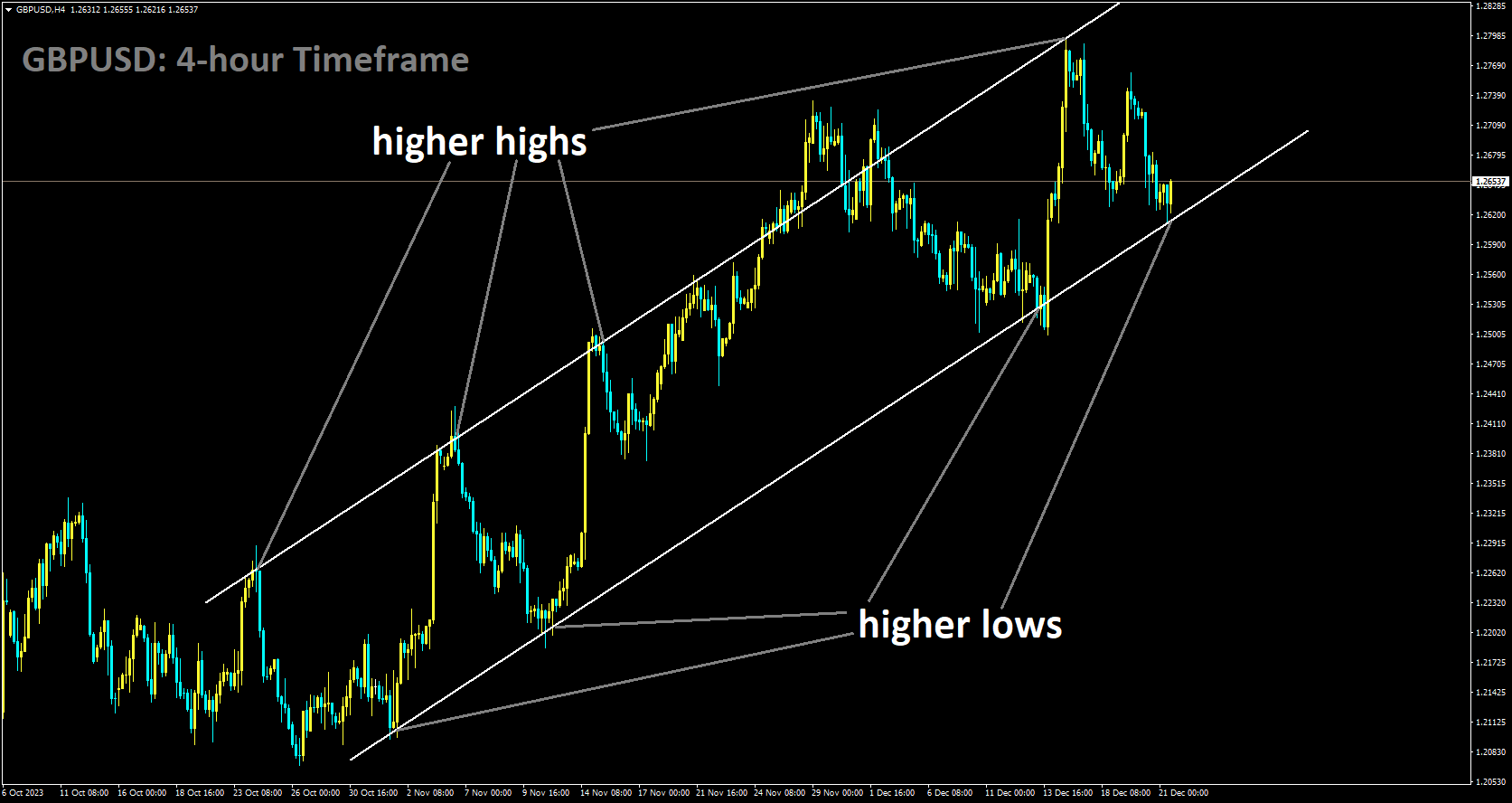

GBPUSD Analysis:

GBPUSD is moving in Ascending channel and market has reached higher low area of the channel

On Thursday, the UK and Switzerland are set to formalize a closer relationship through a post-Brexit agreement, aimed at strengthening the connection between London’s financial hub and the Swiss banking system. This mutual recognition agreement will be signed during Chancellor Jeremy Hunt’s visit to Berne, marking a significant step in aligning Europe’s largest financial centers. The UK Treasury asserts that this partnership will provide a post-Brexit boost for the UK, facilitating cross-border market access for a wide range of financial services offered by insurers, banks, and asset managers. Chancellor Hunt will emphasize that this agreement became possible once the UK exited the EU, enabling it to negotiate its own agreements with major financial hubs. The Berne Financial Services Agreement builds upon the already thriving financial services relationship between the UK and Switzerland. The Treasury anticipates that this deal will simplify business transactions for large corporations and affluent individuals in both countries. London, renowned for its extensive financial activities, has previously established an agreement with New York, the world’s largest financial center.

Nonetheless, a recent study by the City of London Corporation revealed that other financial centers are outpacing London’s growth, ranking it second to its US counterpart. Cities such as Singapore, Paris, and Frankfurt were identified as gaining ground at London’s expense. Switzerland has also seen its financial reputation tarnished following the collapse of its second-largest bank, Credit Suisse, necessitating a rescue through a merger with its rival UBS earlier this year.

Trade expert David Henig, UK director at the European Centre for International Political Economy, noted that assessing the impact of the agreement is challenging without specific details. He suggested that it might go beyond the equivalence agreement the EU has with Switzerland but emphasized the need for more information to make a comprehensive judgment.

This agreement is expected to benefit companies like Lloyd’s of London and other insurers that have faced regulatory obstacles when structuring complex deals. The UK government has portrayed the signing of new trade deals as one of the advantages of Brexit. Earlier this year, the UK entered into an agreement to join an 11-nation Asia-Pacific free-trade bloc, which includes countries such as Australia, Singapore, Japan, and Canada. Labour MP Paul Blomfield, co-convener of the cross-party UK Trade and Business Commission, welcomed the agreement as a positive step toward providing regulatory certainty for UK industries and their vital markets. However, he urged the government to go further and engage in talks with Brussels, emphasizing the importance of maintaining beneficial regulatory alignment with the EU, which remains the largest overseas market for most British businesses.

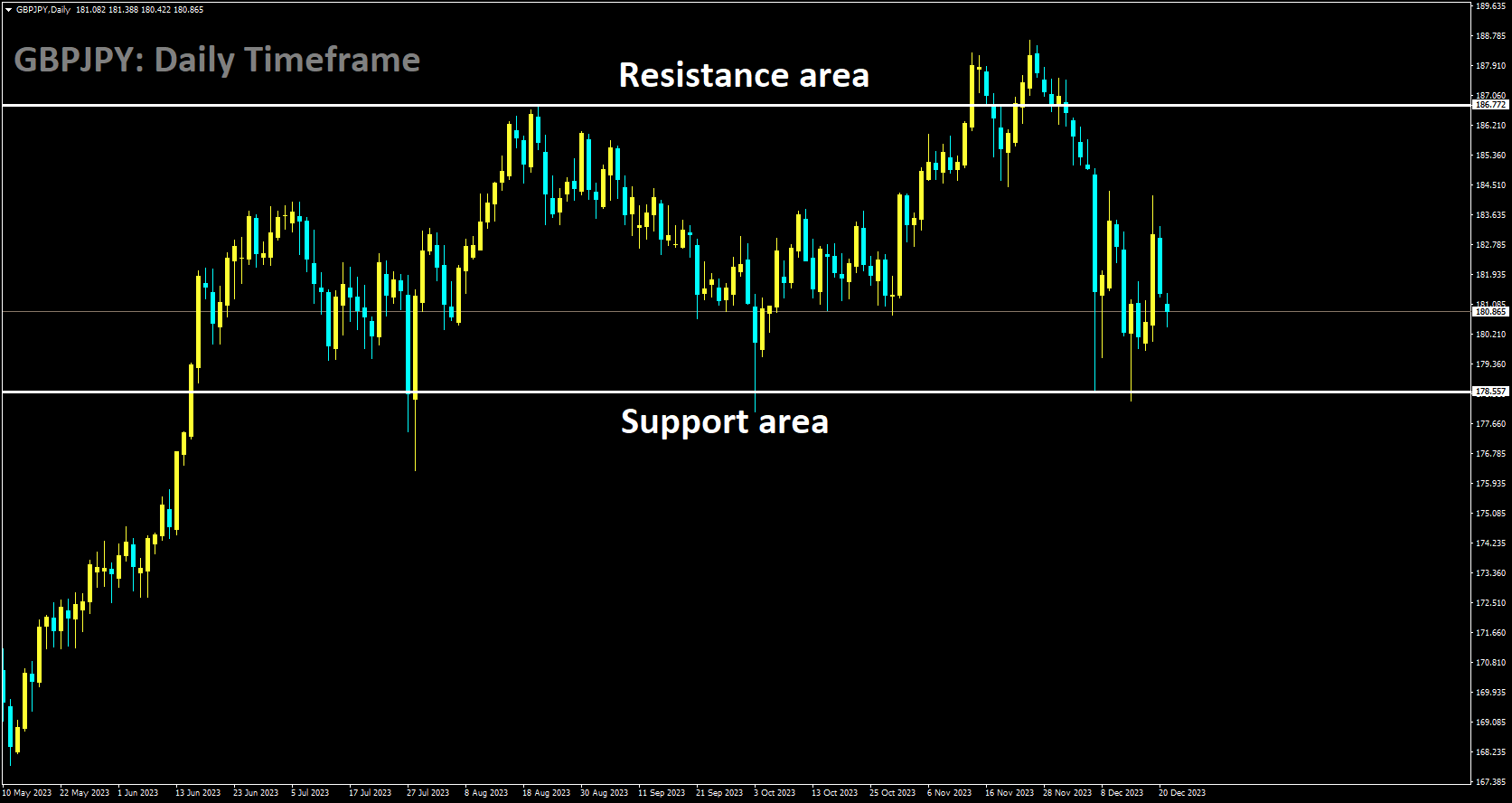

GBPJPY Analysis:

GBPJPY is moving in box pattern and market has rebounded from the support area of the pattern

On Thursday, the Japanese Cabinet Office revised its economic growth forecasts for the current fiscal year, indicating that robust external demand is expected to compensate for sluggish domestic consumption. The revised estimate for real economic growth in fiscal year 2023/24 now stands at 1.6%, up from the 1.3% projection made six months ago. Additionally, the economic growth projection for fiscal year 2024/25 has been raised to 1.3%, slightly exceeding the previous estimate of 1.2%. This shift is primarily attributed to the anticipation that external demand will more than offset the weakness in domestic consumption. The outlook for domestic demand is anticipated to improve in the upcoming fiscal year, buoyed by planned income tax reductions in addition to the ongoing trend of wage increases. Furthermore, inflation is projected to decelerate to 2.5% for the next fiscal year.

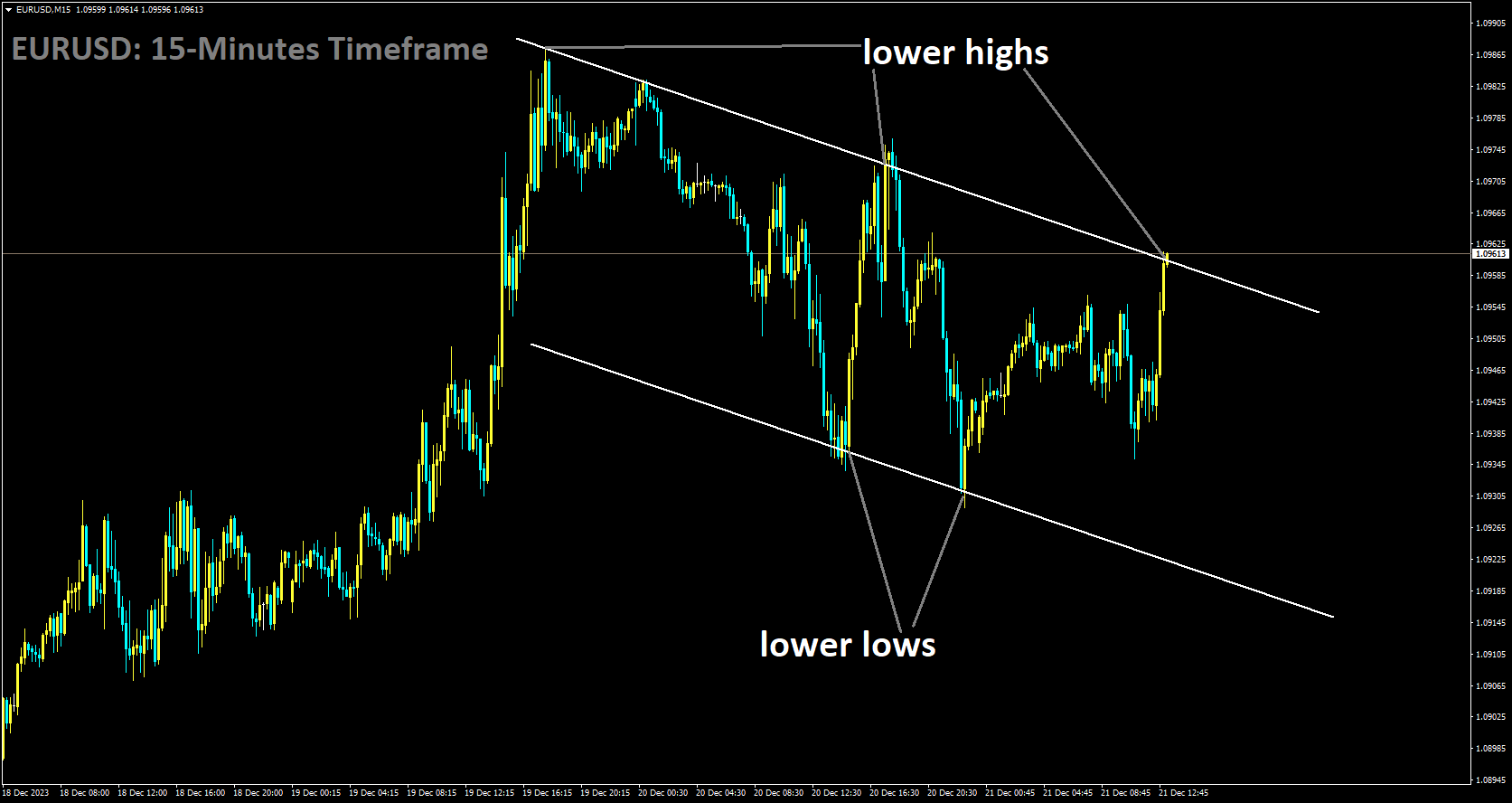

EURUSD Analysis:

EURUSD is moving in Descending channel and market has reached lower high area of the channel

Late on Wednesday, Martins Kazaks, a member of the European Central Bank’s Governing Council, emphasized the need to maintain the current interest rates for an extended period. However, it appears that the initial rate reduction may occur later than what investors are currently anticipating, which is around the middle of 2024. It is more likely to take place in June or July of the following year. However, as of the present moment, implementing rate cuts in the spring is deemed premature. The timing and pace of these rate cuts will be contingent on the actual performance of the economy and the unfolding economic developments.

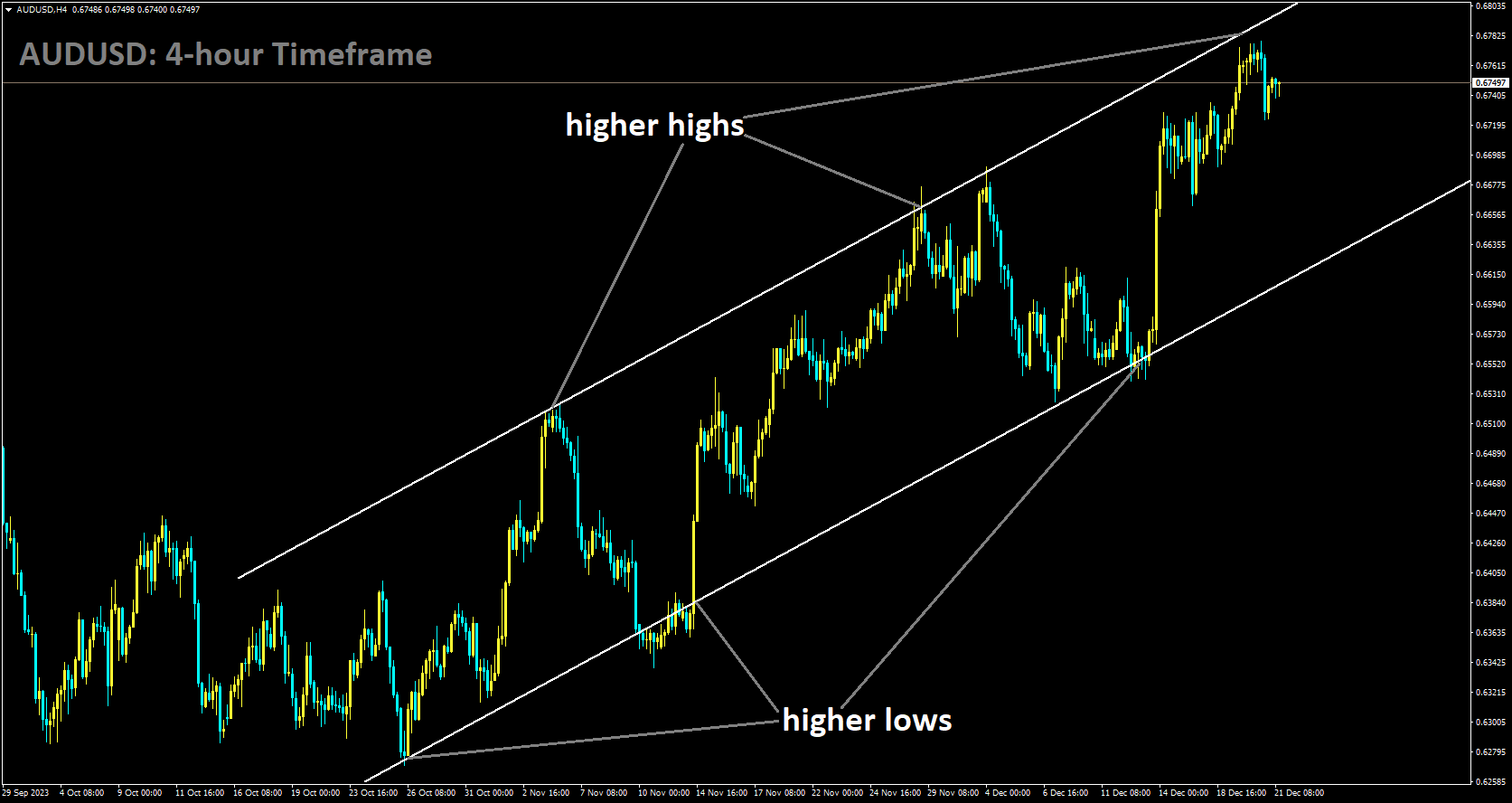

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher high area of the channel

In the previous trading session, the US Dollar strengthened against the Australian Dollar, driven by improved economic data from the United States. As a result, the AUDUSD pair ended a five-day winning streak. The Reserve Bank of Australia took a hawkish stance, as evidenced in the Meeting Minutes released on Tuesday, providing support for the Australian Dollar. The central bank is expected to closely analyze additional data to assess the risk balance before making future interest rate decisions. According to the World Interest Rate Probability Tool, there is a widespread expectation that the RBA will refrain from cutting rates in its February policy meeting.

Despite improved US Treasury yields, the US Dollar Index faced downward pressure on Thursday. This was partly due to the dovish sentiment surrounding the US Federal Reserve’s interest rate outlook for early 2024. However, Fed officials cautioned against premature speculations and advocated for a cautious approach. In economic news, US Existing Home Sales Change rebounded with a 0.8% monthly increase in November, reversing the previous month’s 4.1% decline. CB Consumer Confidence also saw substantial growth in December, marking the most significant increase since early 2021, rising from 101.0 to 110.07.

Looking ahead, market participants will be closely watching the release of US Gross Domestic Product Annualized, Initial Jobless Claims, and the Philadelphia Fed Manufacturing Survey on Thursday. Australia’s preliminary Judo Bank Composite PMI improved to 47.4 from the previous reading of 46.2, with the Manufacturing PMI registering 47.8, a slight increase from the prior figure of 47.7, and the Services PMI growing to 47.6 compared to the previous reading of 46.0. Australia’s Consumer Inflation Expectations for December eased to 4.5% from the previous figure of 4.9%. The People’s Bank of China maintained its benchmark rate at 3.45% in its Interest Rate Decision released on Wednesday.

Several Fed officials, including New York Fed President John Williams, San Francisco Fed President Mary Daly, and Chicago Fed President Austan Goolsbee, expressed skepticism about the market’s anticipation of a rate cut in March, cautioning that such predictions may be premature. In terms of housing data, US Housing Starts exceeded expectations at 1.56 million, while Building Permits slightly missed forecasts at 1.46 million, just below the expected 1.47 million.

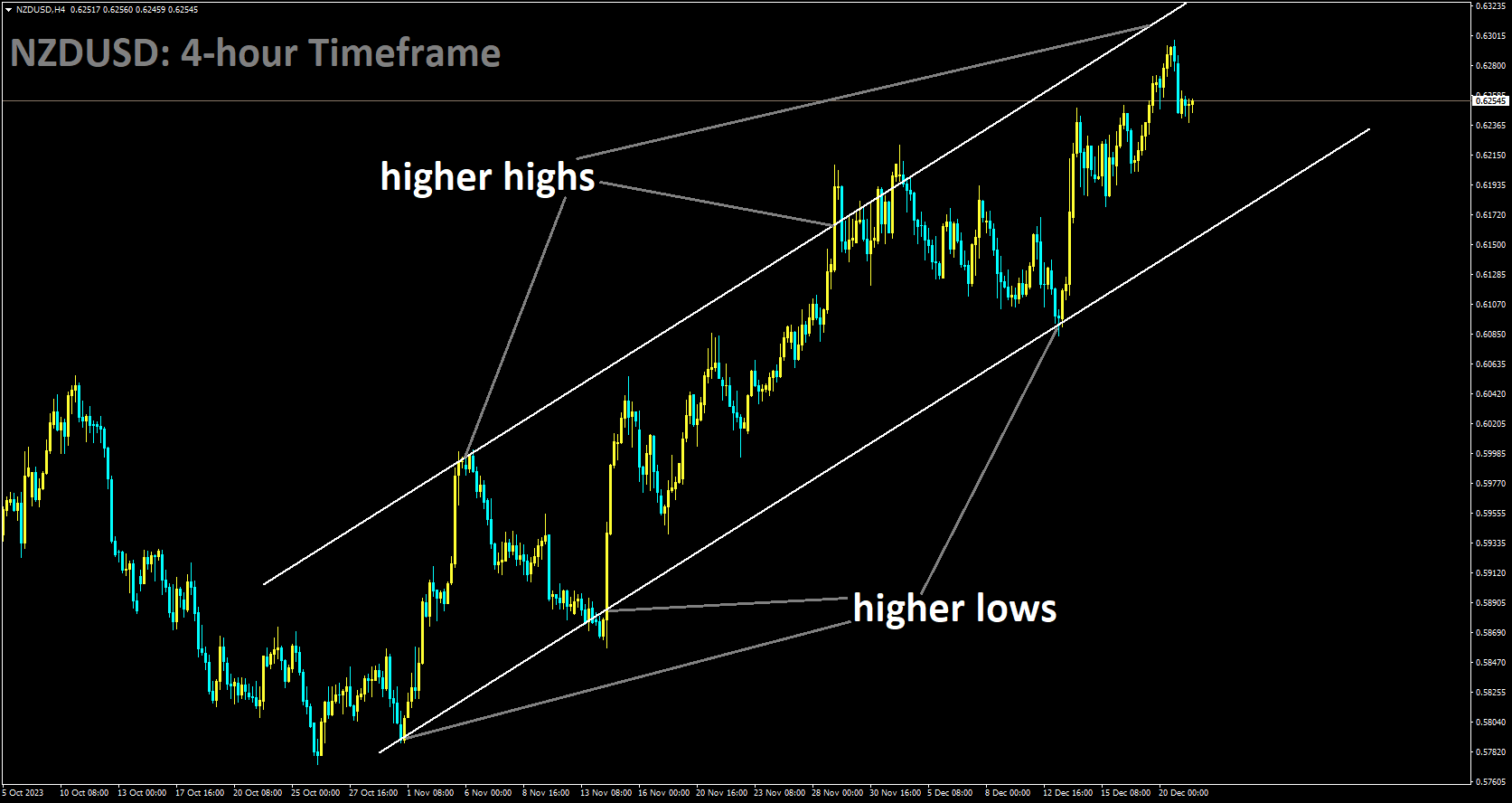

NZDUSD Analysis:

NZDUSD is moving in Ascending channel and market has fallen higher high area of the channel

The US economy is showing promising signs with a resurgence in existing home sales and a substantial increase in consumer confidence. In November, there was a noteworthy rebound in the US Existing Home Sales Change, with a monthly increase of 0.8%, reversing the previous month’s decline of 4.1%. Simultaneously, the CB Consumer Confidence index experienced significant growth in December, soaring from 101.0 to 110.07. It’s worth noting that despite higher Treasury yields, the US Dollar Index has declined, indicating that investors are closely monitoring the Federal Reserve’s stance on interest rates. The prevailing dovish sentiment regarding the trajectory of interest rates appears to be impacting market sentiment. Currently, the DXY is trading lower at around 102.40, while the yields on US 2-year and 10-year bonds are at 4.38% and 3.88%, respectively.

Turning to the New Zealand Dollar, it received a boost from improved Consumer Confidence data on Wednesday, strengthening against the US Dollar. Reserve Bank of New Zealand Governor Adrian Orr’s cautious approach and recognition of the challenges ahead, particularly in the context of elevated inflation levels, underscore the complexities of navigating the economic landscape. Additionally, on Thursday, Kiwi Credit Card Spending data revealed a 3.3% increase in November, contrasting with the 2.8% decline observed in October. In the United States, investors are eagerly awaiting the release of key data, including US Gross Domestic Product Annualized, Initial Jobless Claims, and the Philadelphia Fed Manufacturing Survey.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/