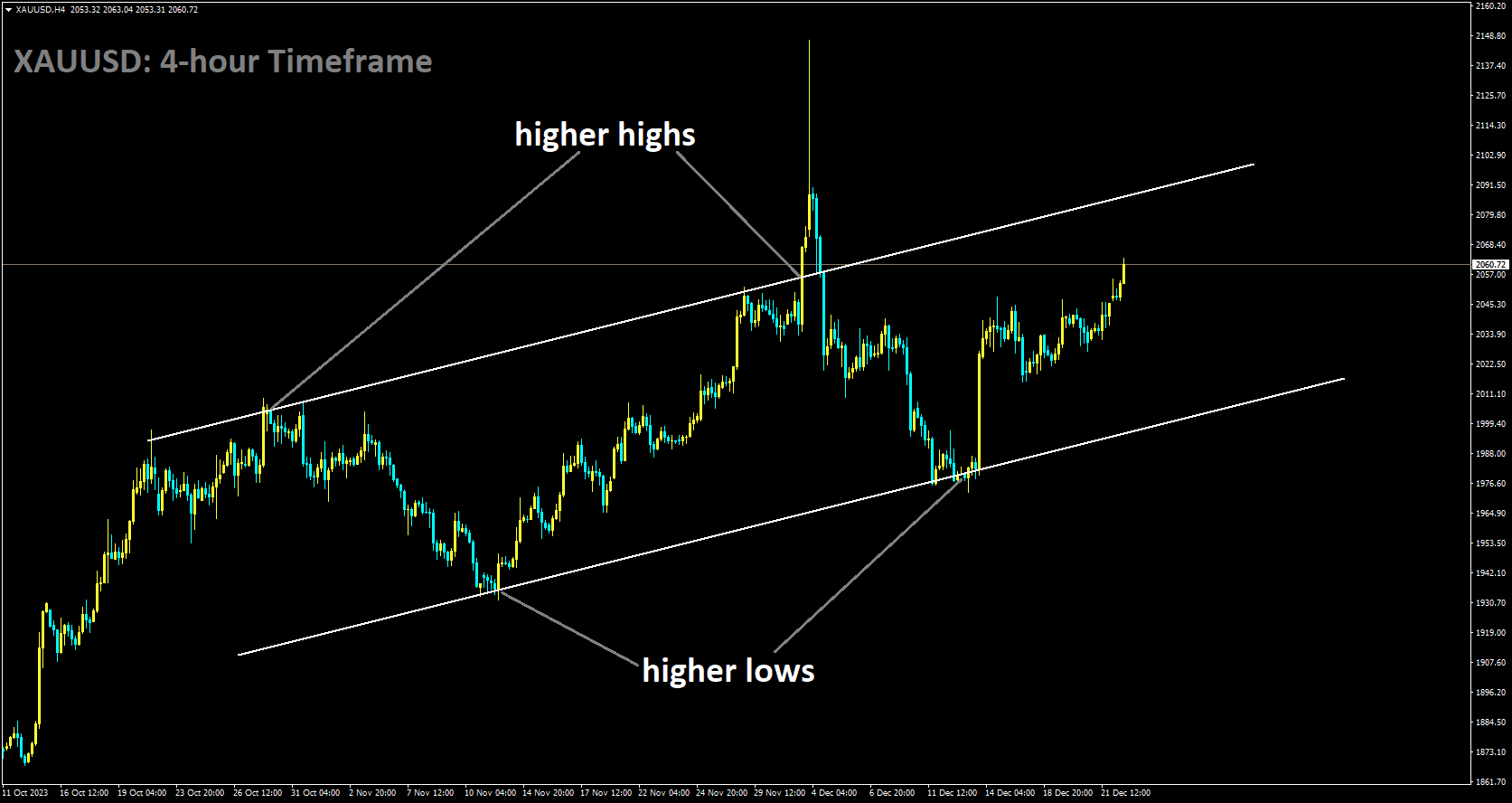

GOLD Analysis:

XAUUSD is moving in Ascending channel and market has rebounded higher low area of the channel

Gold prices have experienced a notable upswing in response to a combination of factors, including disappointing US domestic data and hints from the Federal Reserve about potential interest rate cuts in 2024. Despite some encouraging news with US Initial Jobless Claims coming in at 205,000, which was lower than the expected 215,000, it’s crucial to contextualize these numbers. While these claims are lower, they remain at historically low levels, indicating a robust job market. The XAUUSD, which represents the price of gold, initially showed a strong upward movement, reaching a near three-week high and hovering just below the $2,050 mark during the early European trading session on Friday. However, it eventually settled into a relatively stable trading pattern for the day. This cautious trading behavior can be attributed to traders lightening their bearish positions on the US Dollar. They are preparing for the release of crucial US inflation figures, which are seen as a potential headwind for gold. In other words, strong inflation data could strengthen the US Dollar and put downward pressure on gold prices.

However, despite this caution, significant downward movement for gold has been elusive due to widespread expectations that the Federal Reserve will initiate interest rate cuts as early as March 2024. The market’s confidence in these rate cuts is further reinforced by the downward revision of US Q3 GDP data. This revision, which caps a modest recovery in the US Dollar from its recent five-month low, underscores the belief in a global trend towards interest rate cuts. Gold, being a non-yielding asset, becomes more attractive in a low-interest-rate environment, which partly explains its resilience. The path of least resistance for gold seems to be on the upside. Investors are eagerly awaiting the release of the US Core Personal Consumption Expenditure Price Index, as it is expected to play a crucial role in shaping the Fed’s future policy decisions and providing fresh direction to XAUUSD.

The expectation of an imminent shift in the Federal Reserve’s policy stance has propelled gold prices to their highest level since December 4 by the end of the week. Despite efforts by several Fed officials to push back against the idea of rapid interest rate cuts in the coming year, investor sentiment has remained largely unchanged. The CME Group’s FED Watch Tool indicates a higher likelihood of a Fed rate cut by March 2024, along with expectations of a cumulative cut of 150 basis points by year-end.

The economic data further supports these expectations. The US economy expanded at an annualized pace of 4.9% in the third quarter, slightly below the previously reported 5.2% growth rate. Additionally, while Initial Jobless Claims increased to 205,000 for the week ending December 16, they still remain at historically low levels. Furthermore, the yield on the benchmark 10-year US Treasury bond is hovering near its lowest level since July, indicating a lower return on investment in US government bonds. This, coupled with the US Dollar showing signs of recovery from its recent five-month low, has not been sufficient to deter the expectation of a global trend towards interest rate cuts. This trend continues to support the non-yielding gold market and favor bullish traders.

Additionally, a significant drop in UK inflation in November, reaching its lowest rate in over two years, has raised expectations that the Bank of England may consider rate cuts in the first half of 2024. Moreover, a series of softer inflation data points from the Eurozone indicate the possibility of earlier rate cuts by the European Central Bank. As a result, the upcoming release of the US Core Personal Consumption Expenditure Price Index is highly anticipated as it is expected to offer insights into the Fed’s policy outlook and provide fresh momentum for XAUUSD.

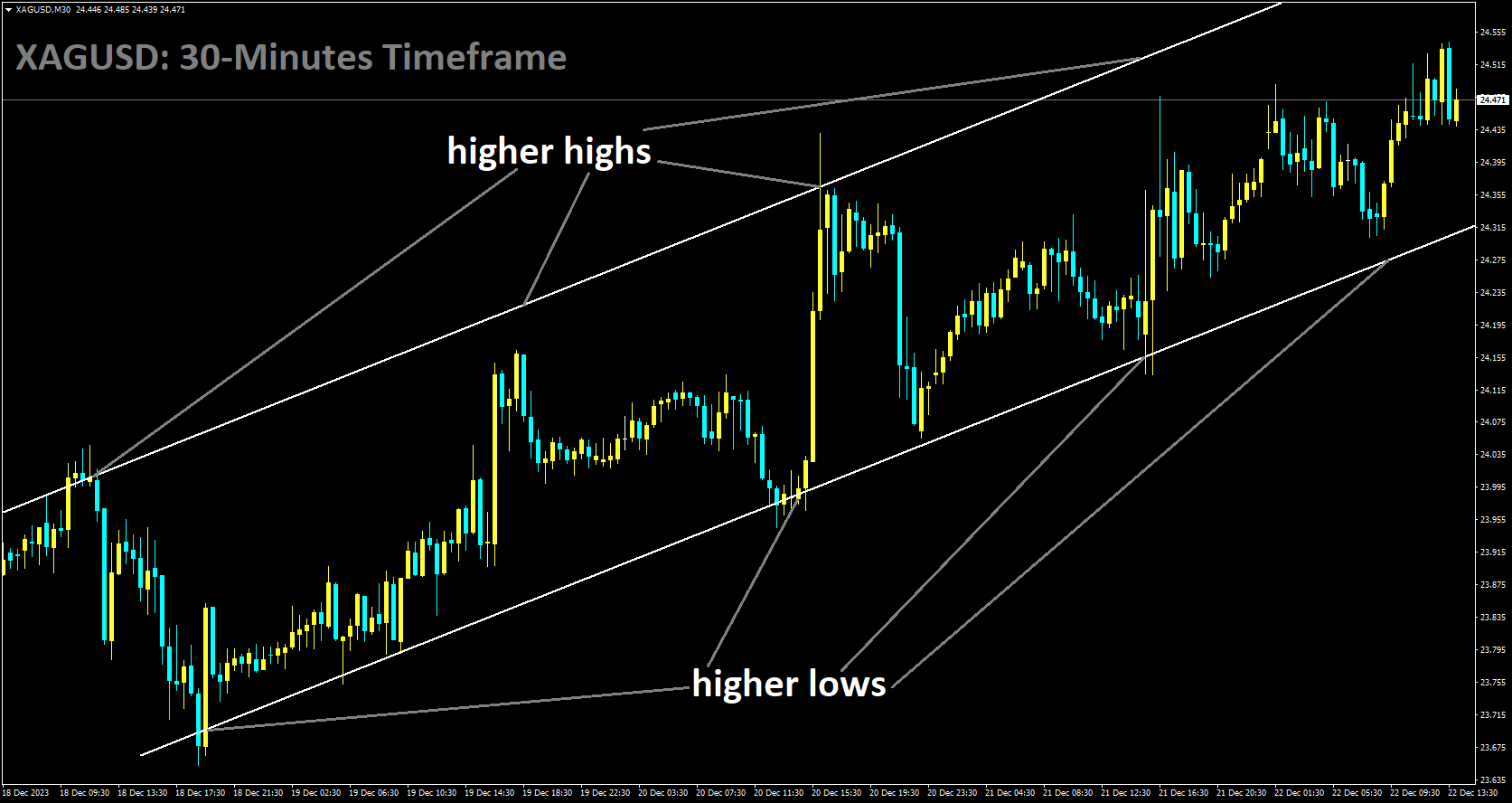

SILVER Analysis:

XAGUSD is moving in Ascending channel and market has rebounded higher low area of the channel

The United States’ third-quarter GDP data has fallen short of expectations, reporting a growth rate of 4.9% instead of the anticipated 5.2%. This data, compared to the previous quarter’s 2.1% growth, has implications for the market, particularly concerning the US Dollar. The downward revision of US Q3 GDP growth to 4.9% is mainly attributed to a reduction in consumer spending and downward revisions to imports. These revisions have negatively affected GDP calculations. It’s important to note that while there has been a slowdown in some areas, various sectors, including consumer spending, private inventory investment, exports, imports, state and local government spending, federal government spending, residential fixed investment, and nonresidential fixed investment, have contributed to the increase in real GDP.

When we analyze the acceleration in real GDP in the third quarter compared to the second quarter, it becomes clear that increased exports and faster growth in consumer spending and private inventory investment have been significant drivers. This growth was partially offset by a slowdown in nonresidential fixed investment. Additionally, imports saw an increase.

In terms of personal income, current-dollar personal income increased by $196.2 billion in the third quarter. However, this represents a downward revision of $22.1 billion from the previous estimate. This increase is primarily driven by higher compensation, particularly from private wages and salaries, indicating the resilience of the US labor market. It’s worth noting that there has been a decline in disposable income in the fourth quarter, which is a concerning trend. Nevertheless, the robust labor market and wage growth are currently supporting consumer spending and disposable income.

Recent data suggests a slowdown in the US economy, reinforcing expectations of Fed rate cuts. Investors are likely to adjust their expectations in a dovish direction. If the US Core PCE data disappoints in its release, it could put further pressure on the US Dollar as we approach 2024. While market repricing may occur with each new data release, the signs of a slowdown are becoming more pronounced. This may also revive concerns about a potential recession, although initial jobless claims continue to outperform estimates. The Fed appears to be making progress in addressing inflation, but external threats remain that could hinder their efforts to bring inflation below 2%.

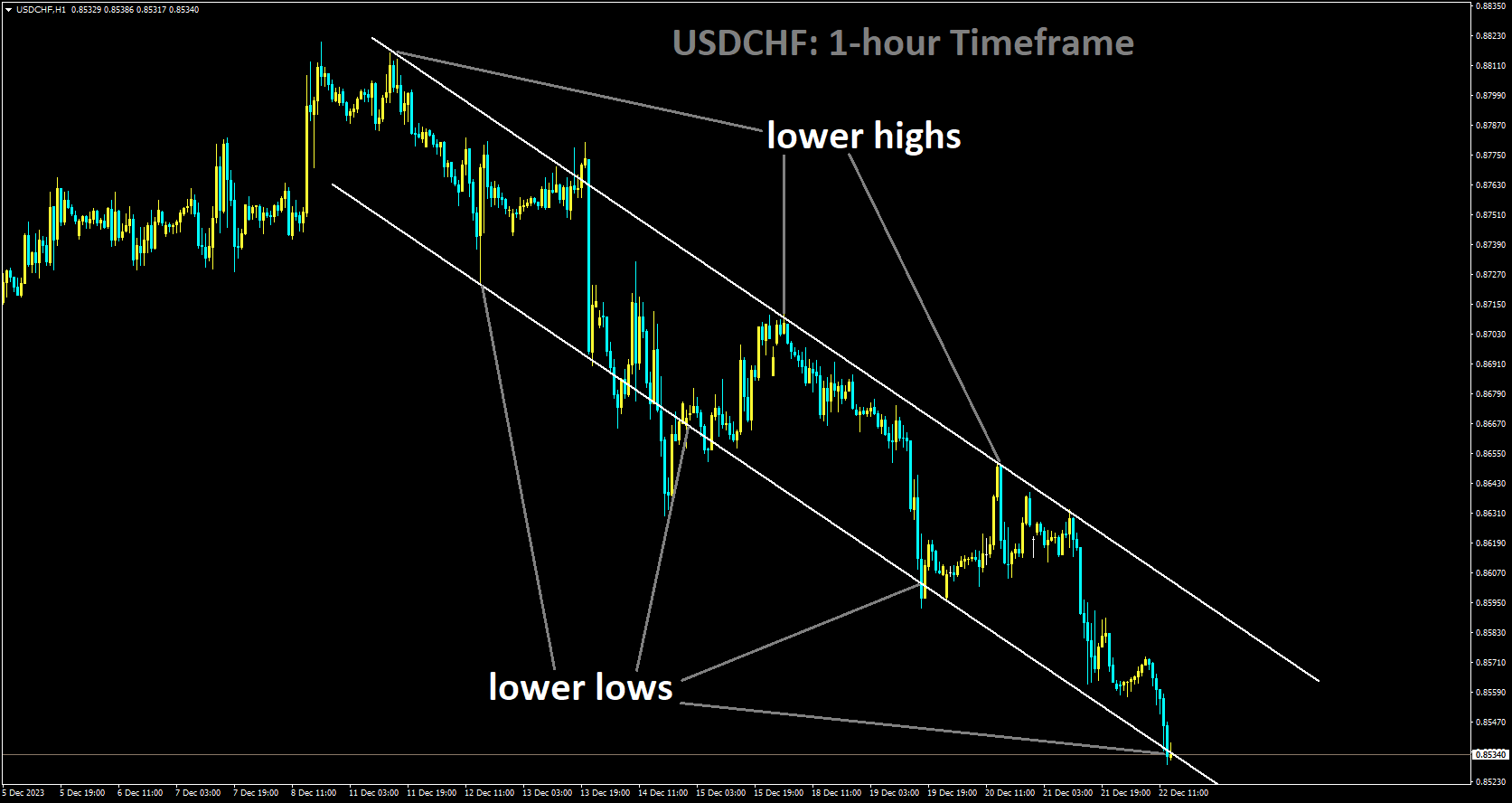

USDCHF Analysis:

USDCHF is moving in Descending channel and market has reached lower low area of the channel

Official approval of the Berne Financial Services agreement between the UK and Switzerland has been a significant development. This agreement aims to facilitate and streamline financial services between the two nations. Specifically, it addresses potential obstacles that could arise from the UK’s third-country status in the aftermath of Brexit. Chancellor Jeremy Hunt’s signing of the Berne Financial Services Agreement on December 21st establishes a form of regulatory equivalence between the UK and Switzerland. This equivalence allows asset managers, bankers, and financial advisors to conduct business between the two countries without the need to obtain specific permissions in each jurisdiction. This agreement is crucial for the UK, as it helps maintain its position as a global financial hub despite the challenges posed by Brexit.

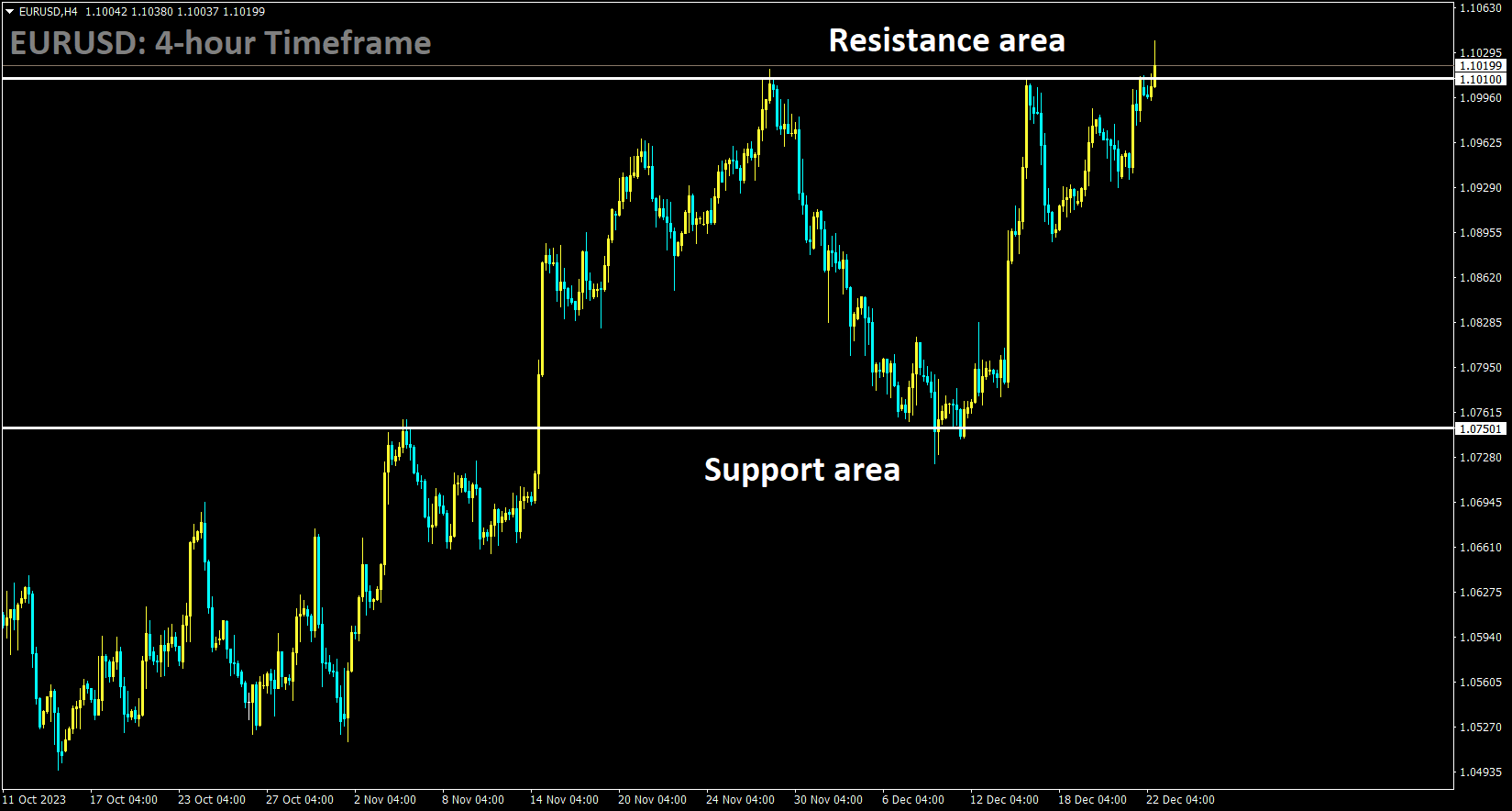

EURUSD Analysis:

EURUSD is moving in the Consolidation pattern and the market has reached the resistance area of the pattern

Luis de Guindos, the Vice President of the European Central Bank (ECB), has stated that the Eurozone is not currently in a technical recession. Moreover, the EU is actively implementing reforms to address market uncertainty. This statement comes as a reassurance to the market. ECB Governing Council member Martins Kazaks has also weighed in on monetary policy, mentioning the possibility of rate cuts by the ECB starting from mid-2024. These statements and developments have influenced the EURUSD currency pair. Investors are now closely monitoring the release of November’s US Core Personal Consumption Expenditure Price Index, with expectations of a 0.2% month-on-month increase and a 3.3% year-on-year rise. This key data release can significantly impact the major currency pair, which is currently trading around 1.1008, marking a 0.05% gain for the day.

ECB Vice President Luis de Guindos emphasized that it is premature to consider easing monetary policy. He also reassured that the ECB does not anticipate a technical recession in the Eurozone and expressed support for an agreement on EU fiscal reform to alleviate market uncertainty. Furthermore, ECB Governing Council member Martins Kazaks mentioned that interest rates should remain unchanged for some time, potentially delaying the first rate cut, which investors had been pricing in around mid-2024.

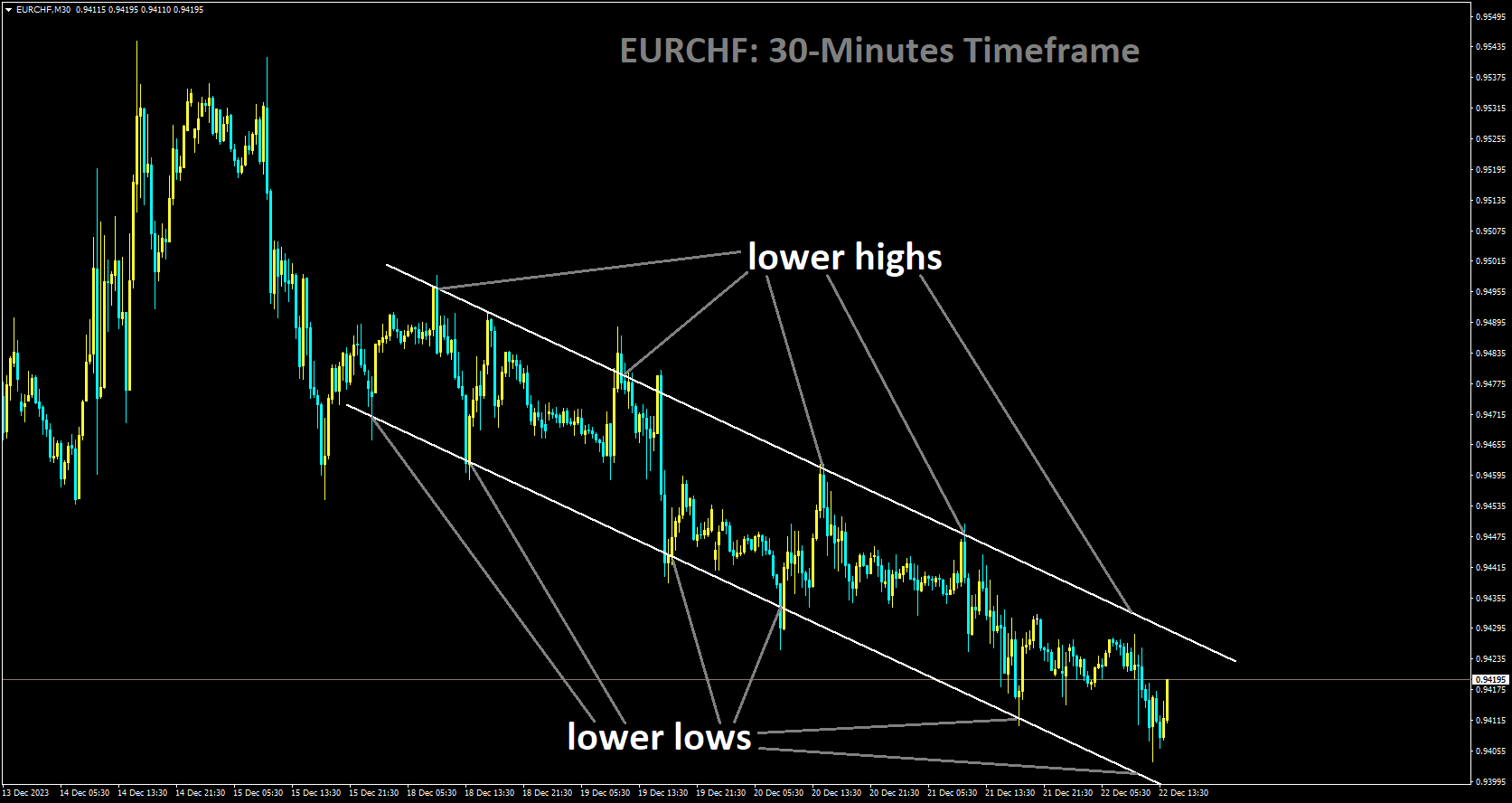

EURCHF Analysis:

EURCHF is moving in Descending channel and market has rebounded from the lower low area of the channel

Conversely, the Federal Reserve in the United States has adopted a more dovish stance, with expectations of possible rate cuts totaling 75 basis points in the latter half of 2024. This contrast in monetary policy between the US and the Eurozone has influenced market dynamics. Economic data, such as the US Gross Domestic Product for the third quarter expanding by 4.9% instead of the expected 5.2%, and the recent dovish stance by the Fed, has placed downward pressure on the US Dollar. This has, in turn, provided tailwinds for the EURUSD currency pair.

Looking ahead, market participants are closely monitoring economic indicators, including the German Import Price Index and Consumer Confidence data from France and Italy. Additionally, the release of the US Core PCE data is expected to generate market volatility ahead of the holiday season. Traders are analyzing this data for potential trading opportunities within the EURUSD pair.

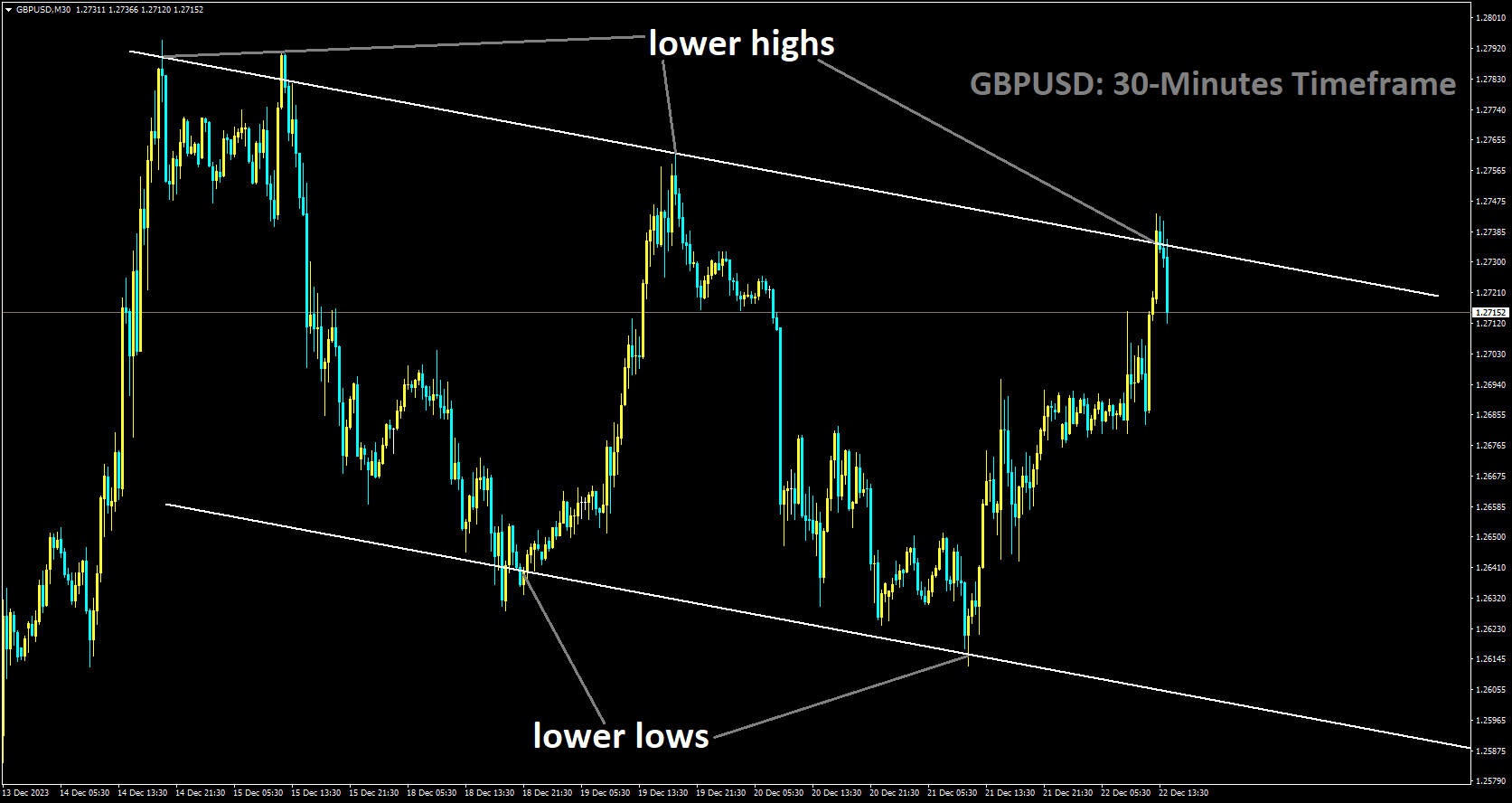

GBPUSD Analysis:

GBPUSD is moving in Descending channel and market has fallen from the lower high area of the channel

The UK’s third-quarter GDP data fell short of expectations, reporting a growth rate of 0.30% compared to the forecasted 0.60% and the previous quarter’s performance. However, UK retail sales showed a positive trend, increasing by 1.3% in November, a significant improvement from the -0.30% decline observed in October.

The UK’s Office for National Statistics released data indicating that retail sales in the UK experienced a 1.3% monthly increase in November, surpassing market expectations of a 0.4% increase. On an annual basis, retail sales saw a modest 0.1% uptick. Additionally, the Office for National Statistics revised down the annualized Gross Domestic Product growth for the third quarter from 0.6% in the initial estimate to 0.3%. Lastly, Total Business Investment showed a quarterly decline of 3.2% in the third quarter, marking an improvement compared to the 4.2% contraction reported in the initial estimate.

The UK’s Office for National Statistics released data indicating that retail sales in the UK experienced a 1.3% monthly increase in November, surpassing market expectations of a 0.4% increase. On an annual basis, retail sales saw a modest 0.1% uptick. Additionally, the Office for National Statistics revised down the annualized Gross Domestic Product growth for the third quarter from 0.6% in the initial estimate to 0.3%. Lastly, Total Business Investment showed a quarterly decline of 3.2% in the third quarter, marking an improvement compared to the 4.2% contraction reported in the initial estimate.

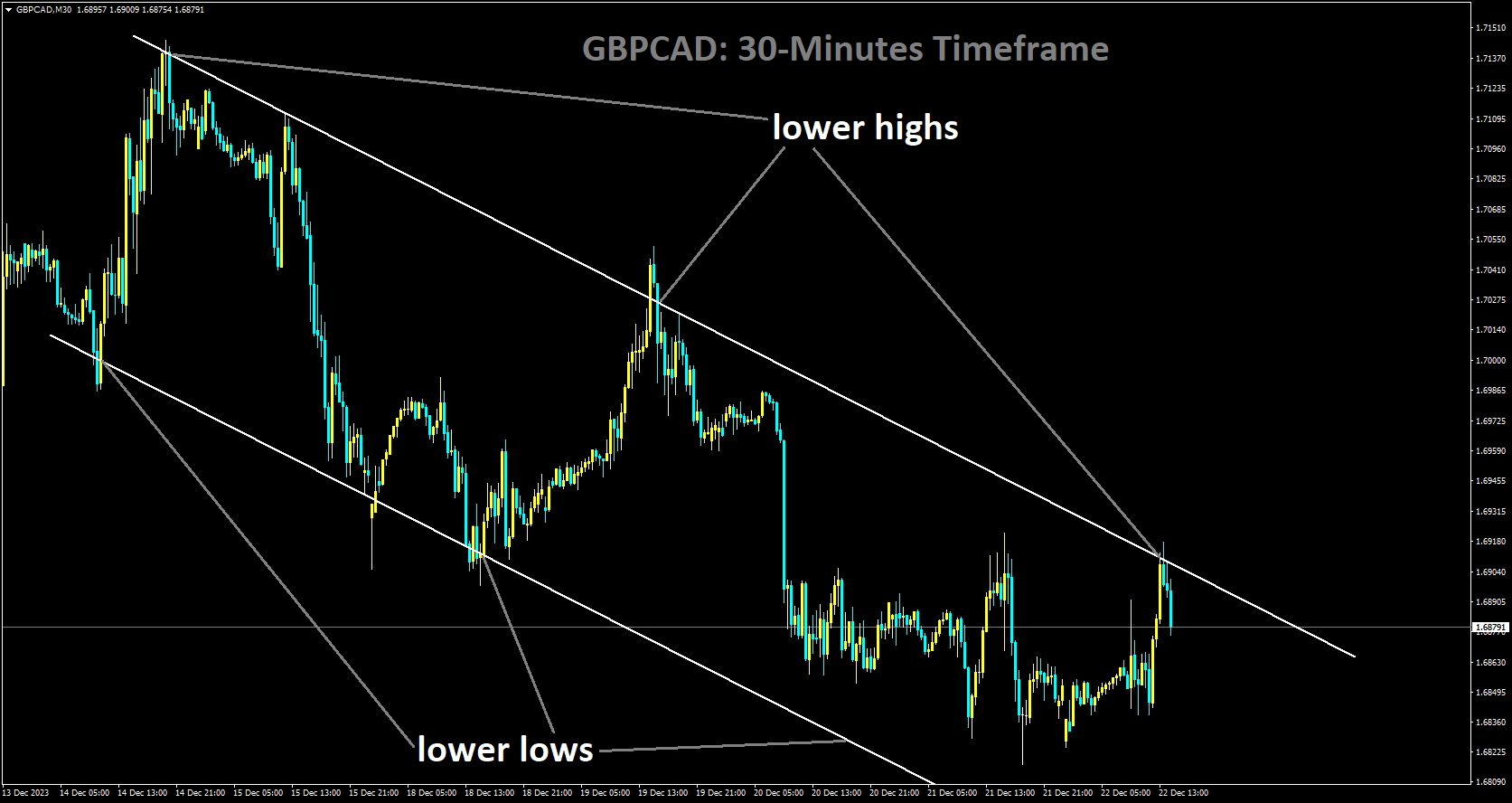

GBPCAD Analysis:

GBPCAD is moving in Descending channel and market has fallen from the lower high area of the channel

In October, Canadian retail sales increased to 0.70%, surpassing the previous reading of 0.50%. The Canadian Dollar continues to exhibit strength against other currency pairs, maintaining a positive trend. On Thursday, Canada’s Retail Sales may have offered limited support to the Canadian Dollar. The Retail Sales for October slipped to 0.7%, compared to September’s 0.5%. However, Retail Sales excluding motor vehicles and vehicle parts increased to 0.6%, up from the previous 0.1%.

The price of West Texas Intermediate is trading higher at around $74.40 per barrel, marking its second consecutive day of gains. The recent rise in crude oil prices can be attributed to ongoing tensions in the Middle East, particularly due to Houthi attacks on ships in the Red Sea. More shipping companies, such as Germany’s Hapag-Lloyd and Hong Kong’s OOCL, are opting to avoid the Suez Canal waterways. Additionally, the geopolitical landscape sees Angola deciding to withdraw from the Organization of the Petroleum Exporting Countries and its allies. Angola’s oil minister stated that the country’s interests were not being served within the group. Market participants will be closely watching Canada’s Gross Domestic Product data for October, which is expected to show improvement. On the US economic calendar, attention will be on the Core Personal Consumption Expenditures – Price Index data and the Michigan Consumer Sentiment Index on Friday.

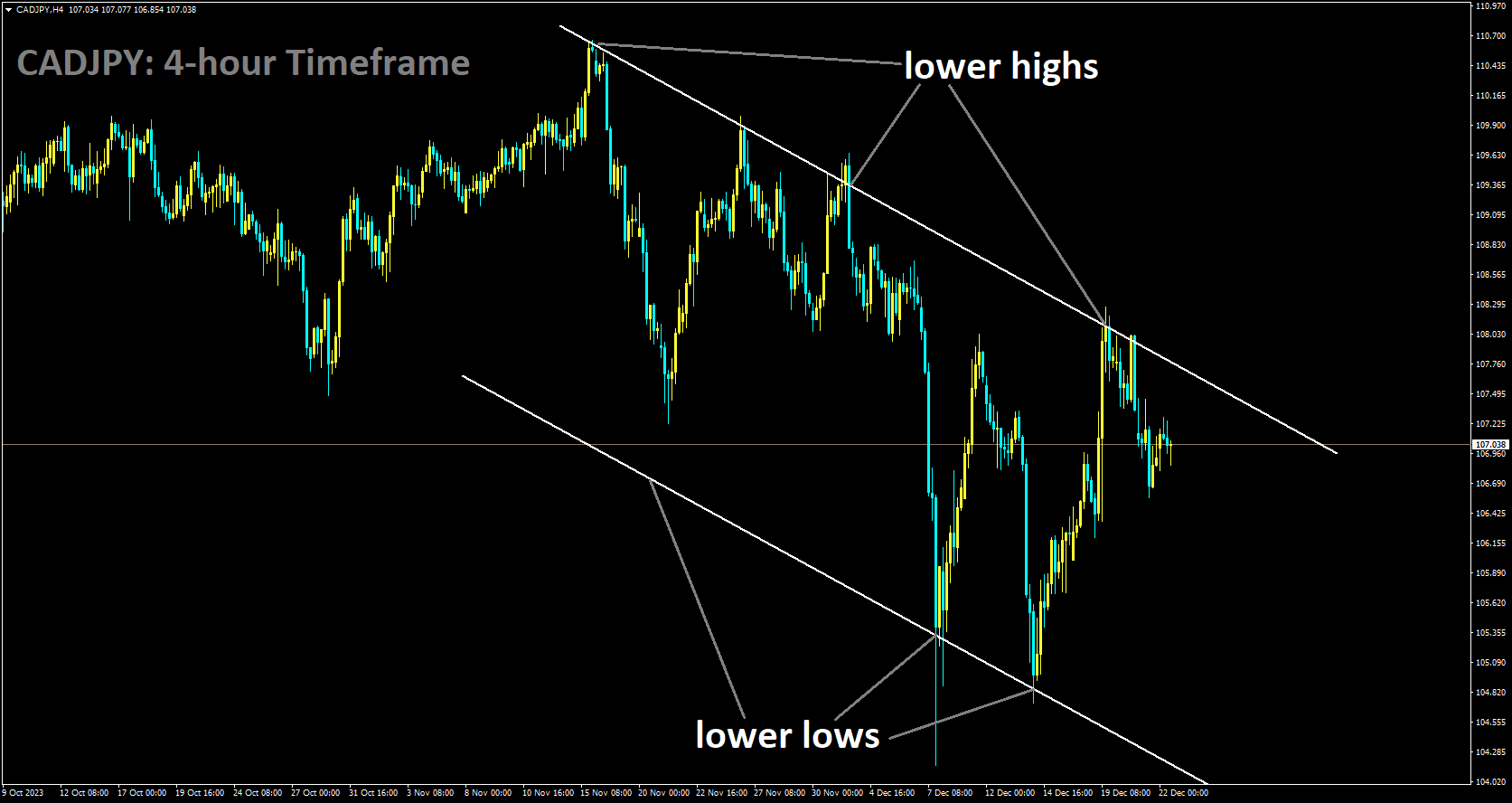

CADJPY Analysis:

CADJPY is moving in Descending channel and market has fallen lower high area of the channel

In November, Japan’s Consumer Price Index data showed a decrease to 2.8% from the previous month’s 3.3% in October. The Bank of Japan’s preferred inflation reading is approaching the 2% target level. The outcome of the Bank of Japan meeting minutes reveals that the YCC policy settings will be maintained for the foreseeable future. The bank emphasizes that adjustments to monetary policy settings will only occur once wage and inflation levels align with their target. According to the most recent data published by the Japan Statistics Bureau, Japan’s National Consumer Price Index for November registered a year-on-year figure of 2.8%, down from the 3.3% reported in October. Additionally, when excluding fresh food from the calculation, the National CPI for November, known as the National CPI ex Fresh Food, stood at 2.5% YoY, compared to the previous figure of 2.9%.

In the BoJ Minutes of the October meeting, the Bank of Japan’s Board members expressed their perspectives on monetary policy outlook and the concept of Yield Curve Control (YCC). The consensus among members was the need to maintain the current accommodative policy stance with patience. Several members emphasized the importance of sustaining YCC as a means to continue supporting wage growth. Additionally, one member highlighted the necessity of confirming the relationship between wages and inflation in determining whether the sustained achievement of the price goal can be realistically pursued. Furthermore, one member pointed out that the probability of Japan achieving sustained 2% inflation is increasing, which implies that the Bank of Japan should gradually adjust the extent of monetary easing. Several members also noted that Japan’s price developments might act as a factor pushing up long-term interest rates.

Regarding the 10-year Japanese Government Bond (JGB) yield, one member suggested that it could potentially reach 1%, depending on developments in the US Treasury market and domestic price trends. However, many members expressed concerns about the potential adverse effects on markets and corporate funding if the BOJ maintains tight control over the JGB yield. Several members advocated for greater flexibility in YCC, believing that this would help reduce speculative activities in the market and enhance the sustainability of the YCC framework.

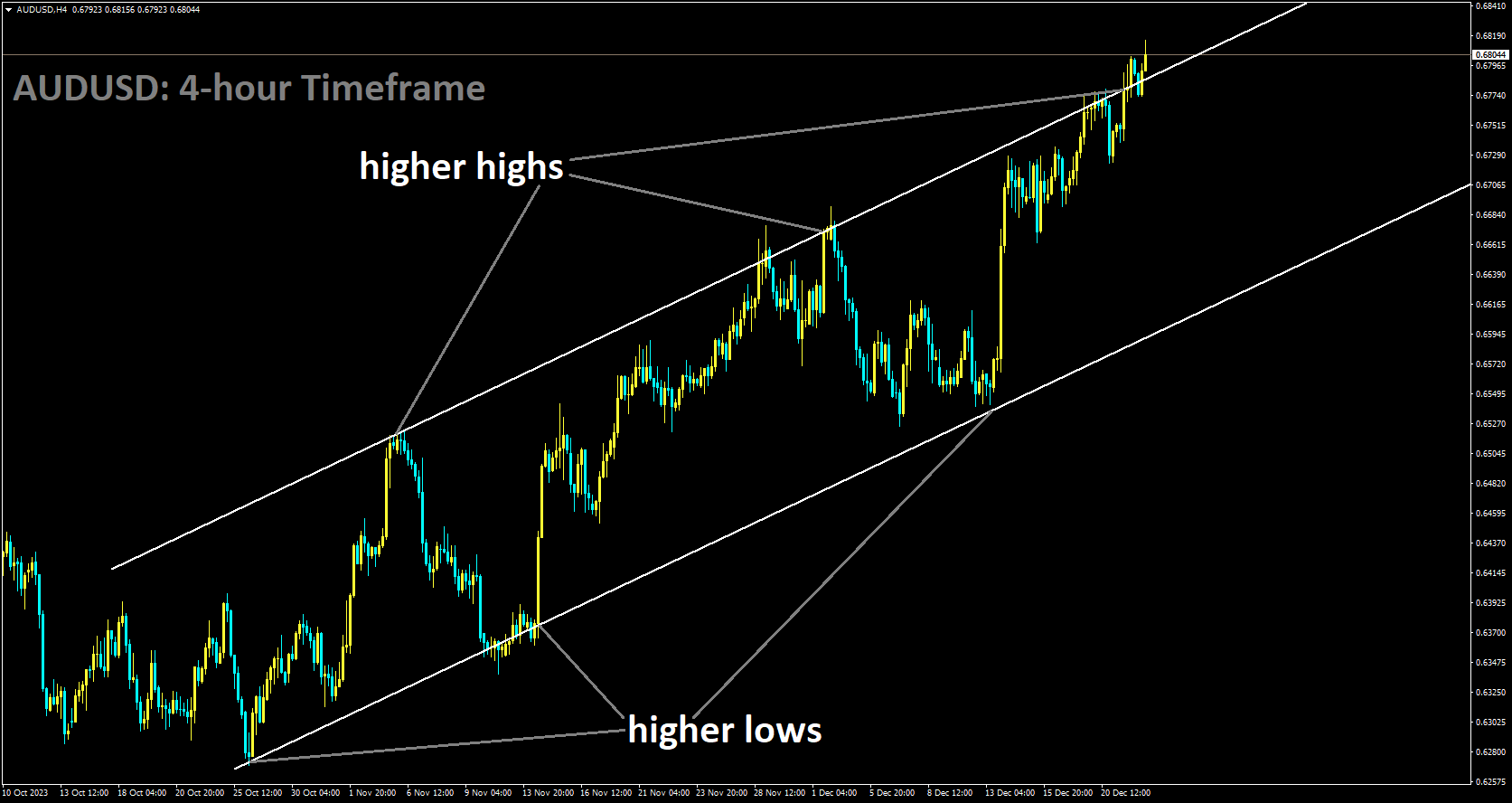

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher high area of the channel

The Australian Dollar is strengthening against the US Dollar due to negative US domestic data and anticipation surrounding the upcoming release of the Core PCE index data today. The Reserve Bank of Australia is considering a rate hike, supported by incoming inflation data, contributing to positive sentiment for the Australian Dollar. During Thursday’s trading session, the Australian Dollar surged against the US Dollar. This rally was driven by the revision of Q3 Gross Domestic Product (GDP) figures, which had a dampening effect on the US Dollar. Additionally, medium-tier economic reports, including Jobless Claims and Philly’s Federal Reserve Manufacturing Survey, further boosted the Australian Dollar. The final estimate from the US Bureau of Economic Analysis showed a 4.9% annual increase in US real GDP for Q3, falling short of the market’s 5.2% projection. Furthermore, the Philly Fed Manufacturing sector survey in December dropped to -10.5, and the US Department of Labor’s initial Jobless Claims for the week ending December 16 increased to 215,000, although still below the expected 215,000.

In a broader context, the US Dollar is under pressure due to speculation about Federal Reserve easing. This follows the dovish stance taken by the Fed during its last 2023 meeting, which weakened the US Dollar, despite subsequent damage control efforts by Fed officials. Incoming data supporting the dovish stance may lead to further gains for the AUDUSD currency pair. On Friday, investors will closely monitor November’s Personal Consumption Expenditures data from the US, a key indicator for assessing inflation trends. US bond yields, which hit multi-month lows earlier, are recovering, with the 2-year rate at 4.34% and the 5 and 10-year yields both at 3.86%, making the US Dollar less appealing to investors.

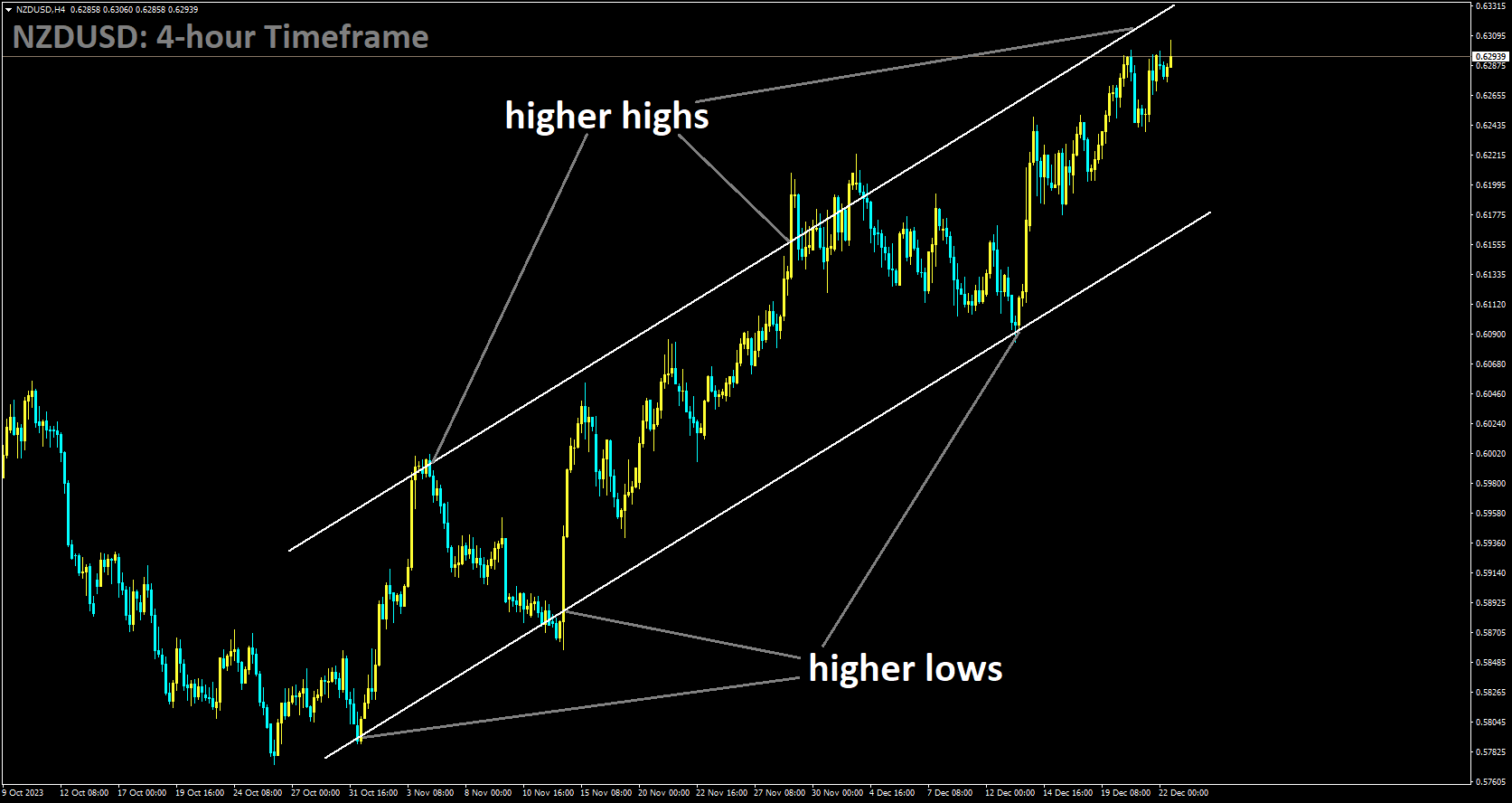

NZDUSD Analysis:

NZDUSD is moving in Ascending channel and market has reached higher high area of the channel

In November, New Zealand’s credit card spending increased by 3.3%, up from October’s 2.8%, demonstrating the resilience of the New Zealand Dollar against other currency pairs, particularly amid weak US domestic data. The impact of New Zealand data on the markets was limited, as most investors were focused on US inflation figures. In the United States, Initial Jobless Claims rose by 205,000 for the week ending December 15, slightly higher than the previous week’s 203,000 but still below the expected 215,000. US Annualized Gross Domestic Product for the third quarter also fell short of expectations, indicating growth slowed to 4.9% from the previous year’s third-quarter figure of 5.2%, contrary to market expectations for steady GDP growth.

Similarly, US Core Personal Consumption Expenditures for the third quarter also missed forecasts, reporting a 2.0% rate compared to the expected 2.3%. As growth decelerates and inflation falls short of predictions, investors are increasingly anticipating additional rate cuts from the Federal Reserve in 2024. Market expectations are currently pricing in a substantial 160 basis points in rate cuts throughout 2024, with some investors even betting on rate cuts starting as early as March. As the trading week concludes, all eyes will be on the US PCE Price Index for the year through November, expected to dip from 3.5% to 3.3%. If this data also falls below expectations, it could intensify speculation about additional Fed rate cuts in the coming year.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/