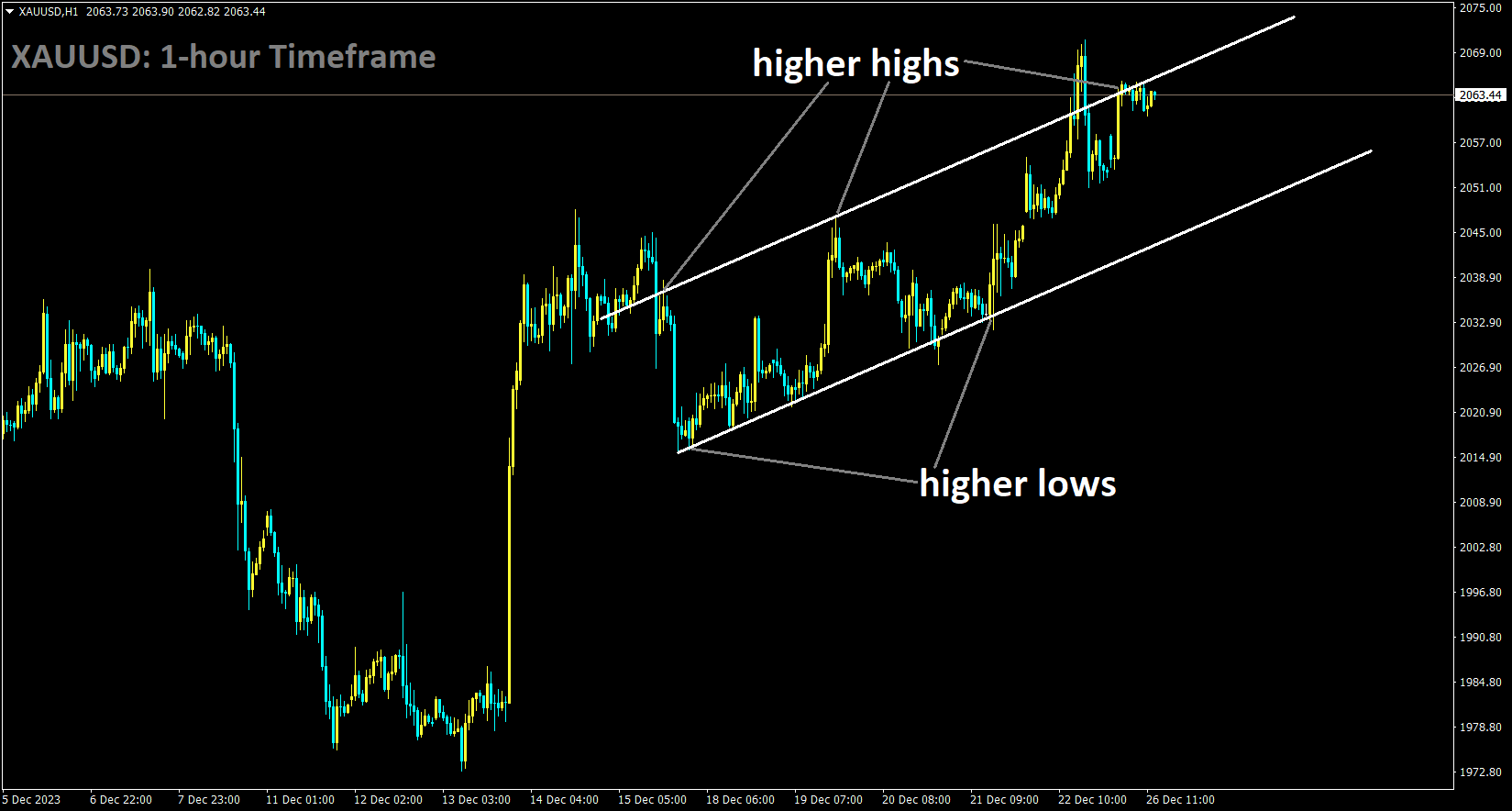

GOLD Analysis:

XAUUSD is moving in an Ascending channel and the market has reached the higher high area of the channel

Today gold prices experienced an upward surge, breaking free from the trading range that had characterized most of December. This move was driven by soft U.S. inflation data, which bolstered expectations of early interest rate cuts in 2024. The precious metal had been on a strong upward trajectory in recent sessions, following a disappointing reading on the PCE price index, which is the Federal Reserve’s preferred measure of inflation. The release of this data, coupled with dovish signals from the Fed during its final meeting for 2023, fueled hopes that the central bank might initiate interest rate reductions as early as March 2024. This sentiment created a favorable outlook for gold, as high interest rates increase the opportunity cost of investing in the precious metal.

Spot gold also broke out of its previous trading range of $2,000 to $2,050, which had prevailed throughout most of December. Currently, it is trading less than $100 away from its record high of over $2,130 per ounce, which it reached at the beginning of the month. The probability of rate cuts in March 2024 gained momentum following the softer-than-expected PCE inflation data released on Friday. CME Group’s FedWatch tool indicated that traders were pricing in a more than 70% chance of a 25 basis point interest rate cut in March 2024.

Goldman Sachs predicted that the central bank would follow a March rate cut with two additional cuts in the first half of 2024 and two more later in the year. However, it’s worth noting that several Fed officials expressed caution about overly optimistic expectations of early rate cuts by the central bank.

Simultaneously, the U.S. dollar slid to nearly a five-month low on Tuesday, and Treasury yields also witnessed a decline. These developments were favorable for gold. Furthermore, gold may continue to benefit from deteriorating global economic conditions in the coming year as major economies feel the effects of tighter monetary policies. In the realm of industrial metals, copper prices showed resilience in Asian trade on Tuesday, extending their recent gains amid growing optimism about the prospects for the red metal in 2024. Copper futures expiring in March rose by 0.4% to $3.9153 per pound. While the recent weakening of the dollar played a role in supporting copper prices, the expectations of increased demand in 2024, particularly in the context of rising global demand for electric vehicles, have also contributed to copper’s positive outlook. Copper is a crucial component in batteries and electronics. Moreover, concerns about tightening copper supplies have arisen due to significant mine closures in Panama and Peru.

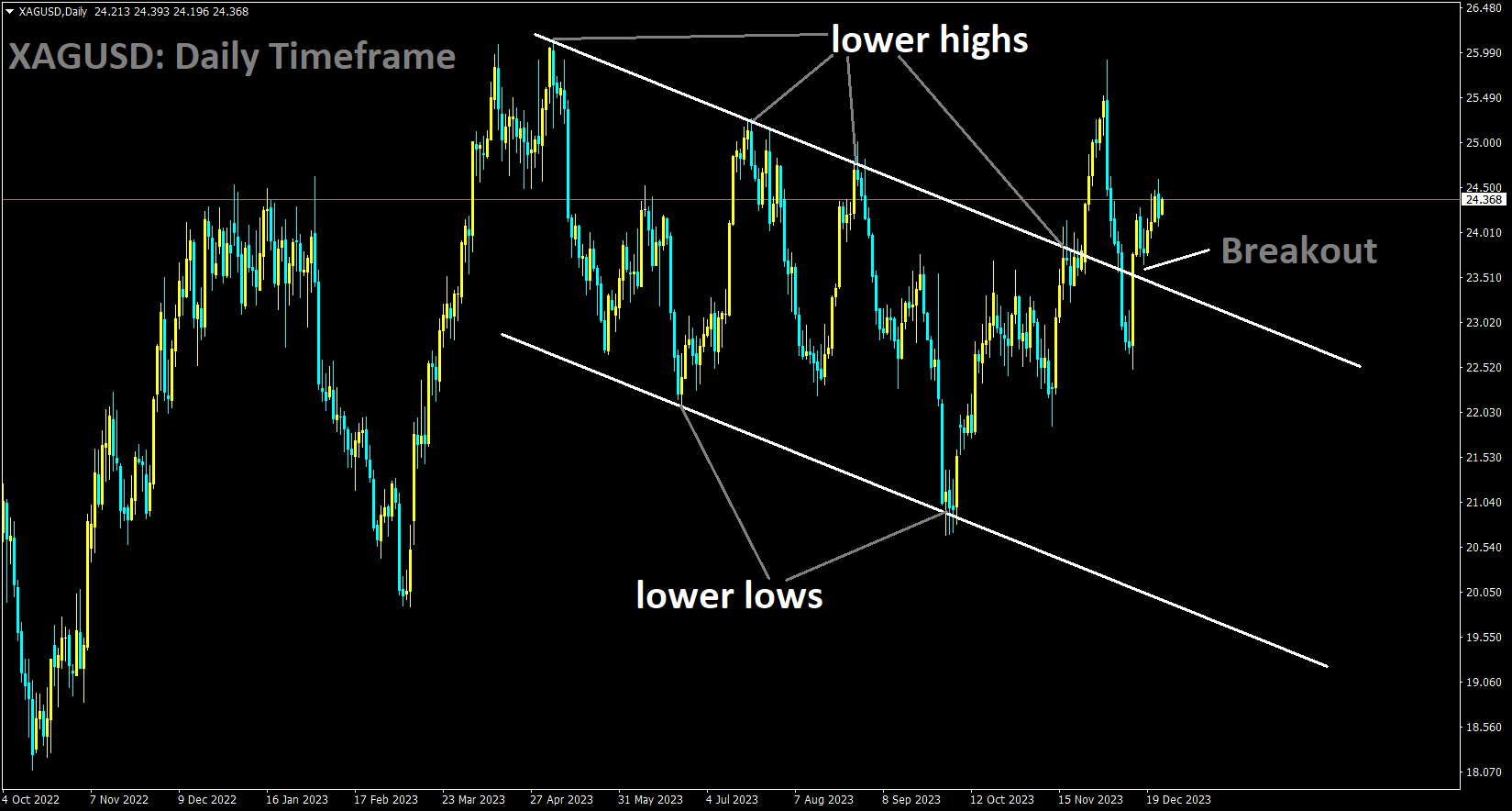

SILVER Analysis:

XAGUSD Daily TF Analysis Market has broken the Descending channel in upside

As 2023 comes to a close, it’s a good time to look ahead to 2024. Rabobank’s strategists have outlined their fundamental outlook for the upcoming year. They anticipate that 2024 will begin with contentious budget negotiations and the looming threat of a potential two-stage government shutdown. The trajectory of rising unemployment is expected to intensify and may lead to a recession in the first half of the year. This economic backdrop is likely to prompt the Federal Open Market Committee to shift from an aggressive tightening cycle to a more cautious easing cycle by mid-year.

Additionally, in November, Americans will cast their votes for the next President, members of the House of Representatives, and approximately one-third of the Senate. At the time of this analysis, it appears that the United States is on a course for a significant shift in its governing paradigm, which could have substantial implications for the global stage.

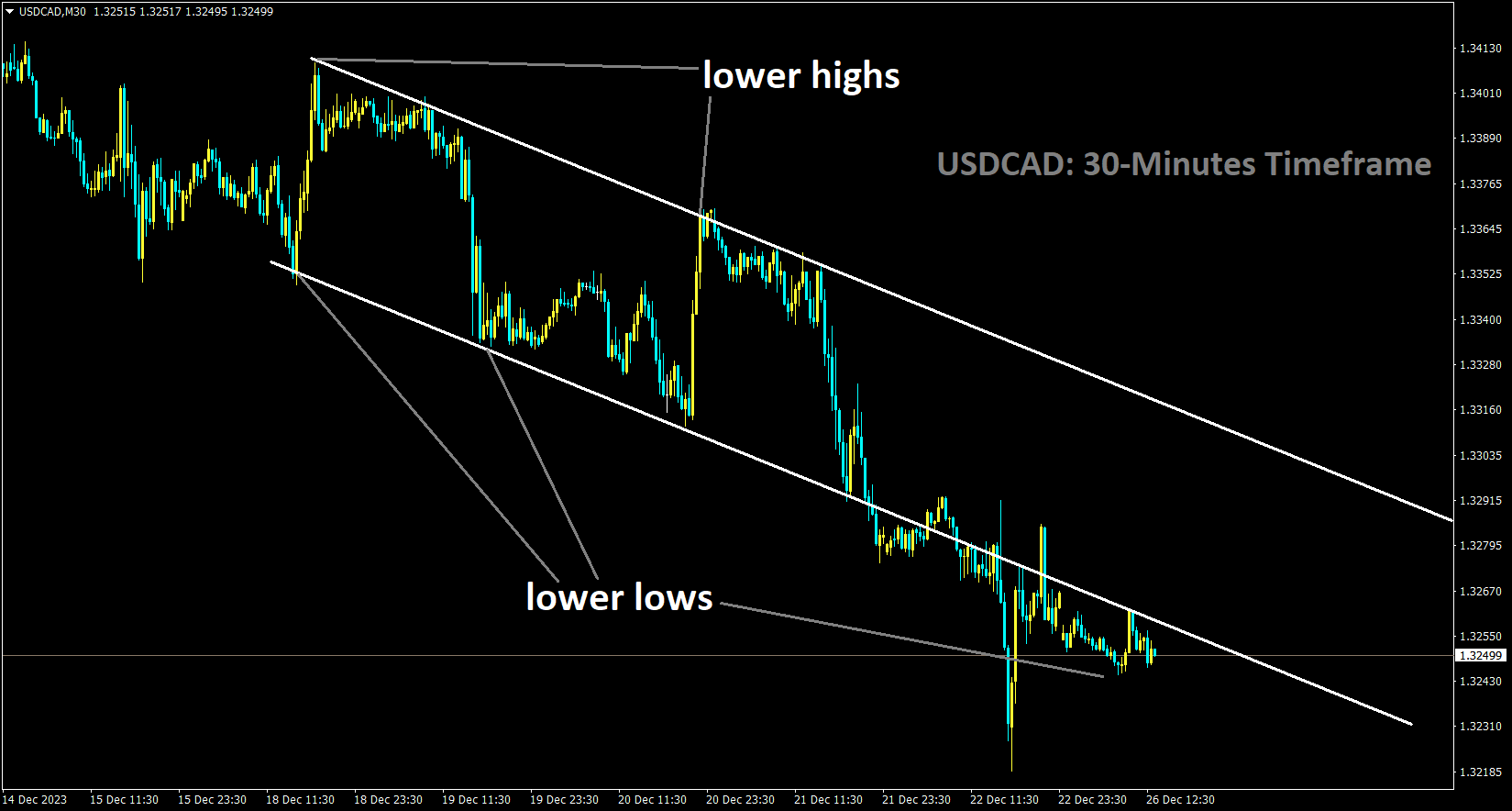

USDCAD Analysis

USDCAD is moving in the Descending channel and the market has reached the lower low area of the channel

CIBC economists analyzed the recently released growth data for Canada on Friday. Unfortunately, the latest data paints a less optimistic picture. Monthly GDP figures suggest only a modest recovery in the economy for the fourth quarter, following the contraction in Q3. This lackluster performance can be attributed to ongoing supply constraints, such as the recent US auto strike and St. Lawrence Seaway strike, which continue to disrupt economic activity.

Additionally, signs of weakness in domestic demand further contribute to the economic challenges. However, this weakness is expected to result in a more sustainable decrease in inflation next year, and CIBC anticipates that the Bank of Canada will implement its first interest rate cut in Q2 2024.

USDJPY Analysis:

USDJPY has broken Ascending channel in downside

Analysts and traders are anticipating that the Bank of Japan will cease its negative interest rate policy in the first half of the upcoming year. Kazuo Ueda, the Governor of the Bank of Japan, indicated that the bank would consider moving away from monetary easing measures once it gains confidence in achieving its inflation target.

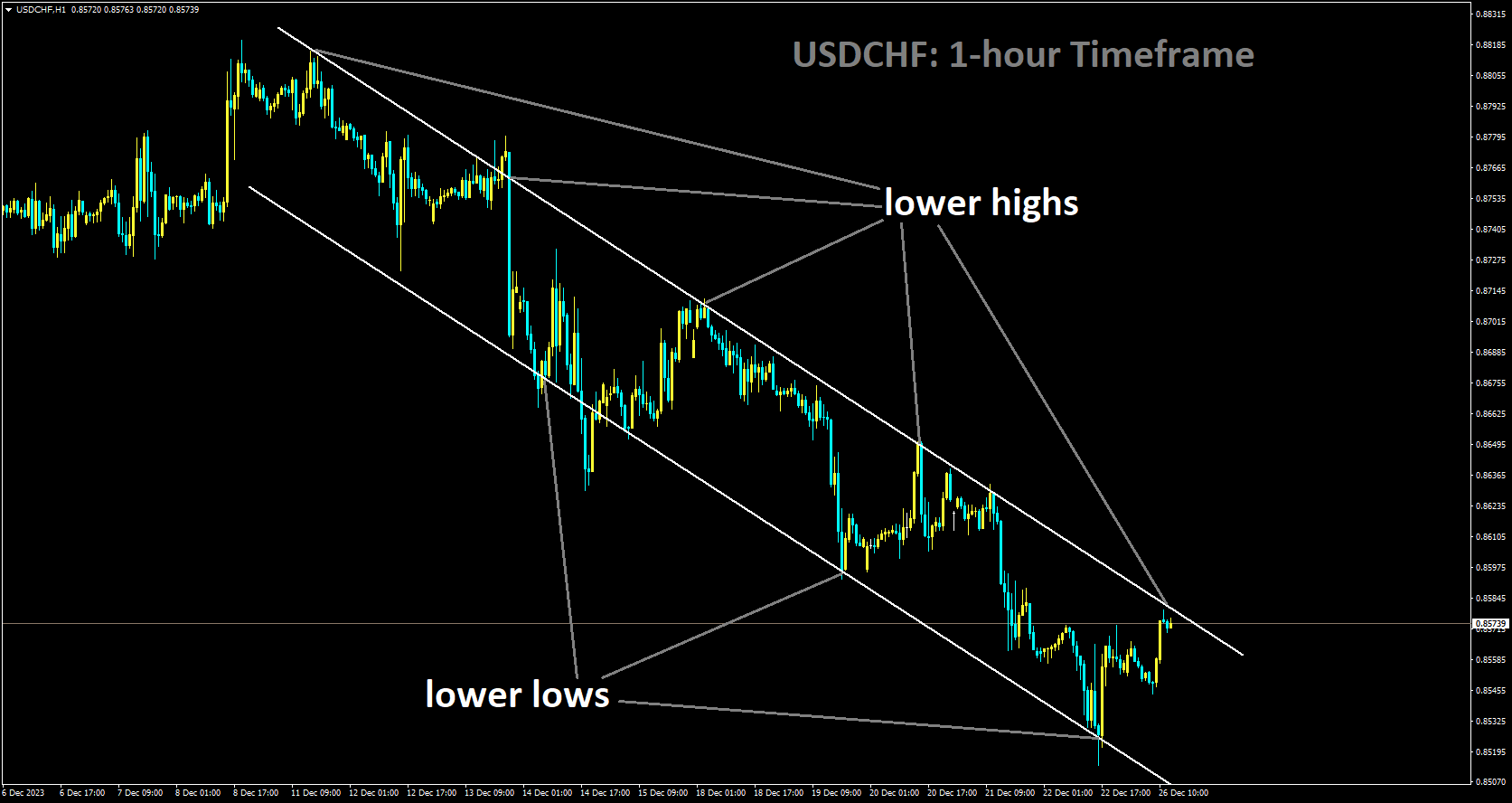

USDCHF Analysis:

USDCHF is moving in Descending channel and market has reached lower high area of the channel

UBS, the Swiss investment bank, has presented a rather cautious outlook for the economy in the upcoming year. They suggest that achieving profitable returns may be challenging as economic growth slows down. According to a communication shared with their clients, as reported by Business Insider, the bank has emphasized that there is limited potential for upward movement in current US stock levels. Nevertheless, UBS maintains an optimistic stance and has identified several attractive investment opportunities for savvy investors in the stock market.

EURUSD Analysis

EURUSD is moving in Ascending channel and market has fallen from the higher high area of the channel

On Friday, US inflation fell below expectations, leading investors to anticipate an accelerated pace of Federal Reserve rate cuts in 2024. The US Personal Consumption Expenditure Price Index showed greater softening than anticipated, with the Core Annualized PCE Price Index for the year through November registering at 3.2%, below the projected 3.3% and notably lower than October’s year-on-year figure of 3.4%. This trend in declining inflation metrics is exceeding most models’ predictions, prompting money markets to revise their expectations of more rapid Federal Reserve rate cuts throughout 2024.

Investor expectations have outpaced the Fed’s own projections for future interest rates, with money markets pricing in the possibility of up to 160 basis points in Federal Reserve rate reductions. Some even speculate that the rate cut cycle could begin as early as next March, while the Fed’s dot plot, outlining its interest rate expectations, indicates only a total of 75 basis points in cuts by the end of 2024. The market’s shift towards a weaker US dollar was somewhat tempered by a positive surprise in US Durable Goods Orders, which posted a growth of 5.4% for November, a significant improvement from October’s revised figure of -5.1% (revised slightly upward from -5.4%). This suggests that the US economy may still be resilient enough for the Fed to potentially implement fewer rate cuts than previously anticipated.

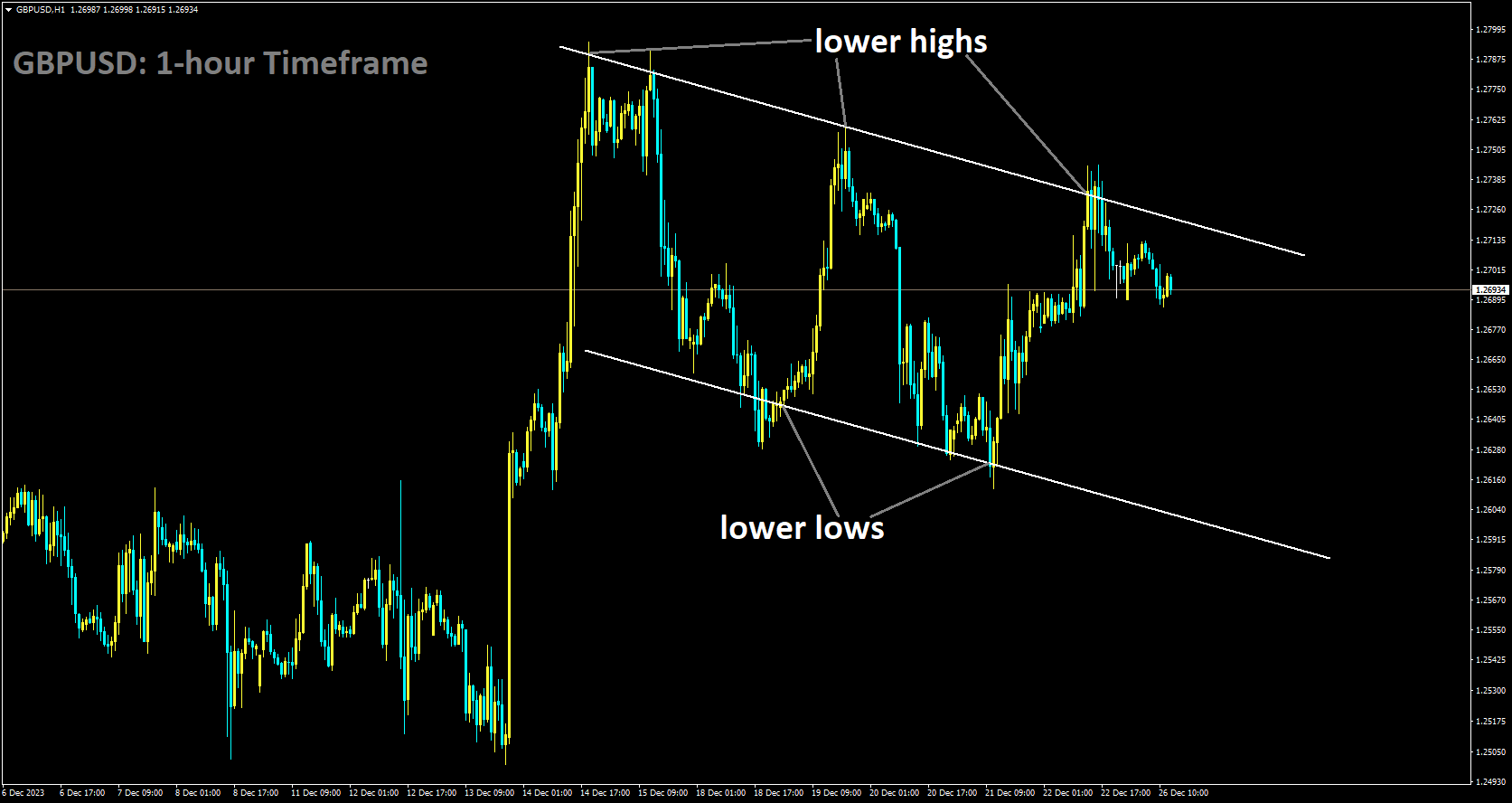

GBPUSD Analysis:

GBPUSD is moving in Descending channel and market has fallen from the lower high area of the channel

On Friday, the Pound Sterling continued its rebound, buoyed by encouraging UK Retail Sales data for November. The Office for National Statistics delivered a positive surprise as household retail spending remained resilient compared to the previous year, defying market expectations of a sharp decline. The robust Retail Sales figures were bolstered by a 2.8% surge in non-food retail stores, taking advantage of significant discounts during the Black Friday Sale. This upbeat Retail Sales report for November is likely to embolden the Bank of England (BoE) to maintain its restrictive monetary policy stance. Wages continue to grow at a rate significantly higher than necessary to combat inflation and are enabling households to spend robustly, potentially impeding a clear downward trend in price pressures. The Pound Sterling’s strong recovery appears to have overshadowed concerns over the downbeat Q3 Gross Domestic Product revision, which indicated a 0.1% contraction. This has amplified worries about a potential technical recession in the UK economy, aligning with the BoE’s projection of stagnant performance in the final quarter of 2023. Following the release of this economic data, Finance Minister Jeremy Hunt expressed optimism about the medium-term outlook for the UK economy, suggesting that the numbers might not fully reflect this positive outlook.

Monthly Retail Sales displayed robust growth, expanding by 1.3% compared to the consensus estimate of 0.4% and the previous month’s stagnant performance in October. Annual consumer spending defied expectations by rising 0.1% when investors had anticipated a 1.3% contraction. Retail Sales, excluding fuel, also exceeded expectations, rising by 1.3% against a forecast of 0.4%.

This surge in Retail Sales was primarily driven by strong demand in non-food retail establishments. Meanwhile, official figures indicated a mild contraction of 0.1% in the UK economy during the July-September quarter, deviating from preliminary estimates of stagnation. This slight contraction in Q3 heightens concerns about a potential recession in the UK economy. In December’s monetary policy statement, BoE policymakers had foreseen a stagnant fourth quarter for the UK economy. If the UK experiences another contraction in the final quarter of the year, it would officially meet the criteria for a technical recession.

Furthermore, higher interest rates and cost pressures have eroded confidence among British businesses regarding the economic outlook. The Lloyds Bank Business Barometer declined by seven percentage points to 35%, reflecting the persistent negative impact of a deteriorating demand environment and elevated wage growth on business confidence. Looking ahead, the momentum in consumer spending is poised to support the Bank of England’s resolve to maintain its restrictive monetary policy stance. The Pound Sterling’s overall outlook remains positive, as BoE policymakers have yet to discuss a shift away from their current stance. With UK inflation data showing a significant drop and expectations of potential interest rate cuts in 2024, market participants are eagerly awaiting the central bank’s guidance, with some anticipating rate cuts starting as early as March, particularly following a sharp decline in price pressures in November. The broader market sentiment remains optimistic, as the US Dollar Index extended its decline following the release of the United States core Personal Consumption Expenditure Price Index data for November. The annual core PCE price index decelerated to 3.2%, falling below the consensus estimate of 3.3% and October’s reading of 3.5%. On a monthly basis, the Federal Reserve’s preferred inflation gauge registered a modest 0.1% growth, slightly below the 0.2% anticipated by investors.

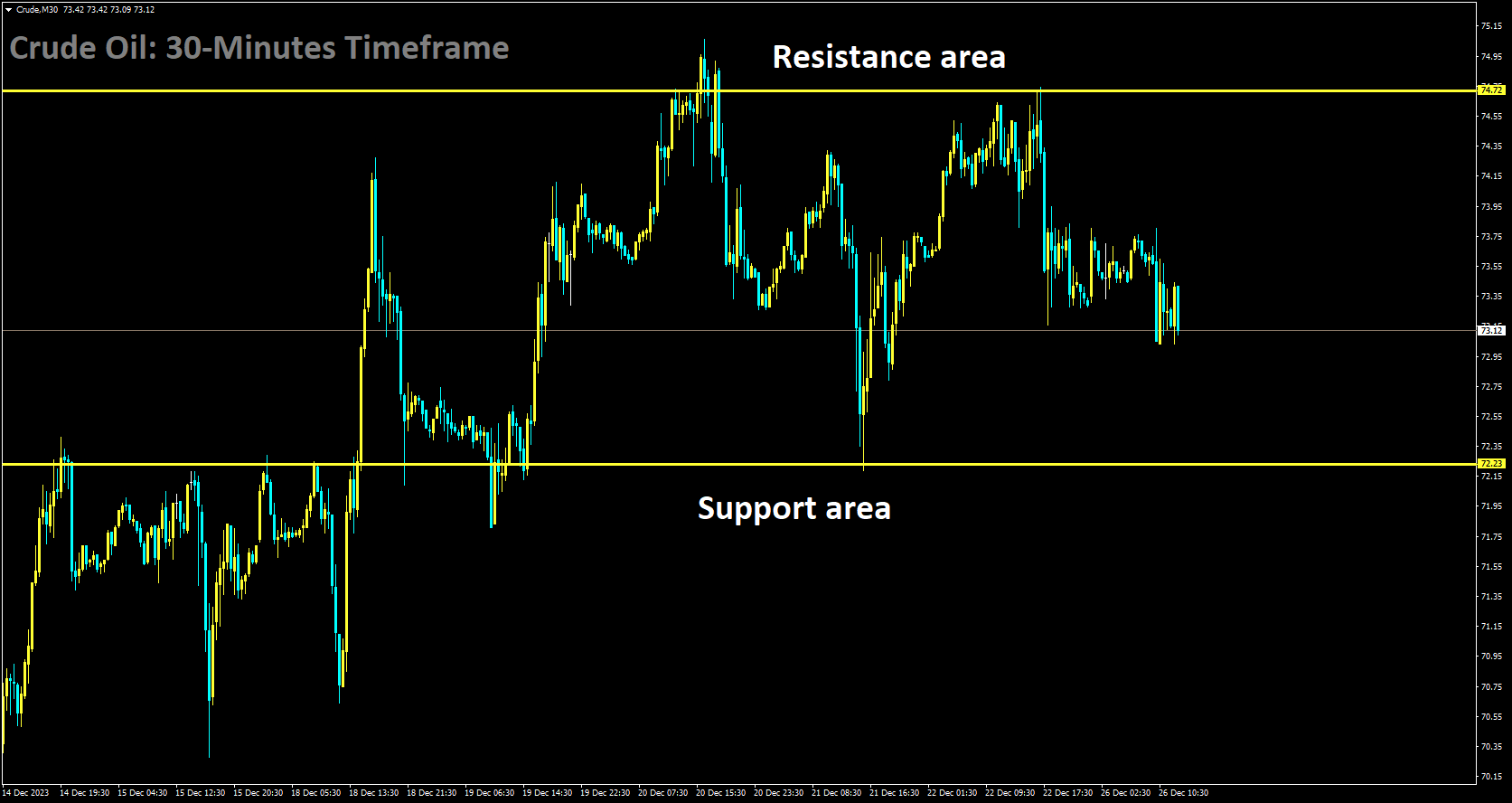

Crude Oil Analysis:

Crude is moving in box pattern and market has fallen from the resistance area of the pattern

Oil prices resumed their upward trajectory on Friday, approaching the $84 mark, driven by escalating geopolitical tensions in the Red Sea region. As the trading day before Christmas unfolds, one headline continues to dominate: Houthi rebels have effectively declared the Red Sea off-limits to major freight operators. This development has forced a significant portion of global fleets to reroute their journeys around the African continent. As a result, both demand and price pressure for Crude oil are anticipated to surge in the coming weeks. Meanwhile, on Thursday, Angola announced its decision to exit OPEC due to disagreements over the allocation of lower oil production quotas for the country. This decision underscores the ongoing challenges within OPEC and its member nations.

In the currency markets, the US Dollar is experiencing a decline as investors increasingly bet on early 2024 interest rate cuts. This shift in market sentiment contradicts several warnings from Federal Reserve members who have cautioned that markets may be overly optimistic about the possibility of rate cuts in 2024. The previously strong US Dollar, driven by the elevated rate differential between US yields and those of other countries in 2023, is showing signs of weakening. This development could potentially lead to discord and disruption between the Fed and global markets as 2024 gets underway.

Additionally, the Sonangol Cabinda, previously redirected due to the Houthi rebel attack, is now reversing its course and heading back to the Suez Canal. Angola’s decision to leave OPEC in January aligns with its previous stance against Saudi Arabia’s push for the entire OPEC group to share the burden of production cuts. Reports indicate a significant drop in the number of tankers in the Red Sea on Friday morning, further highlighting the disruption caused by the ongoing situation in the region. The Baltic Dry Index, a key indicator of shipping costs, is rallying higher due to the longer routes around Africa that vessels are forced to take. As the day progresses, if Friday’s US data confirms a further decline in inflation, it is expected that Crude oil prices will surge higher. This is because the anticipated rate cuts from the Federal Reserve in early 2024 are likely to stimulate economic activity, leading to increased demand for oil.

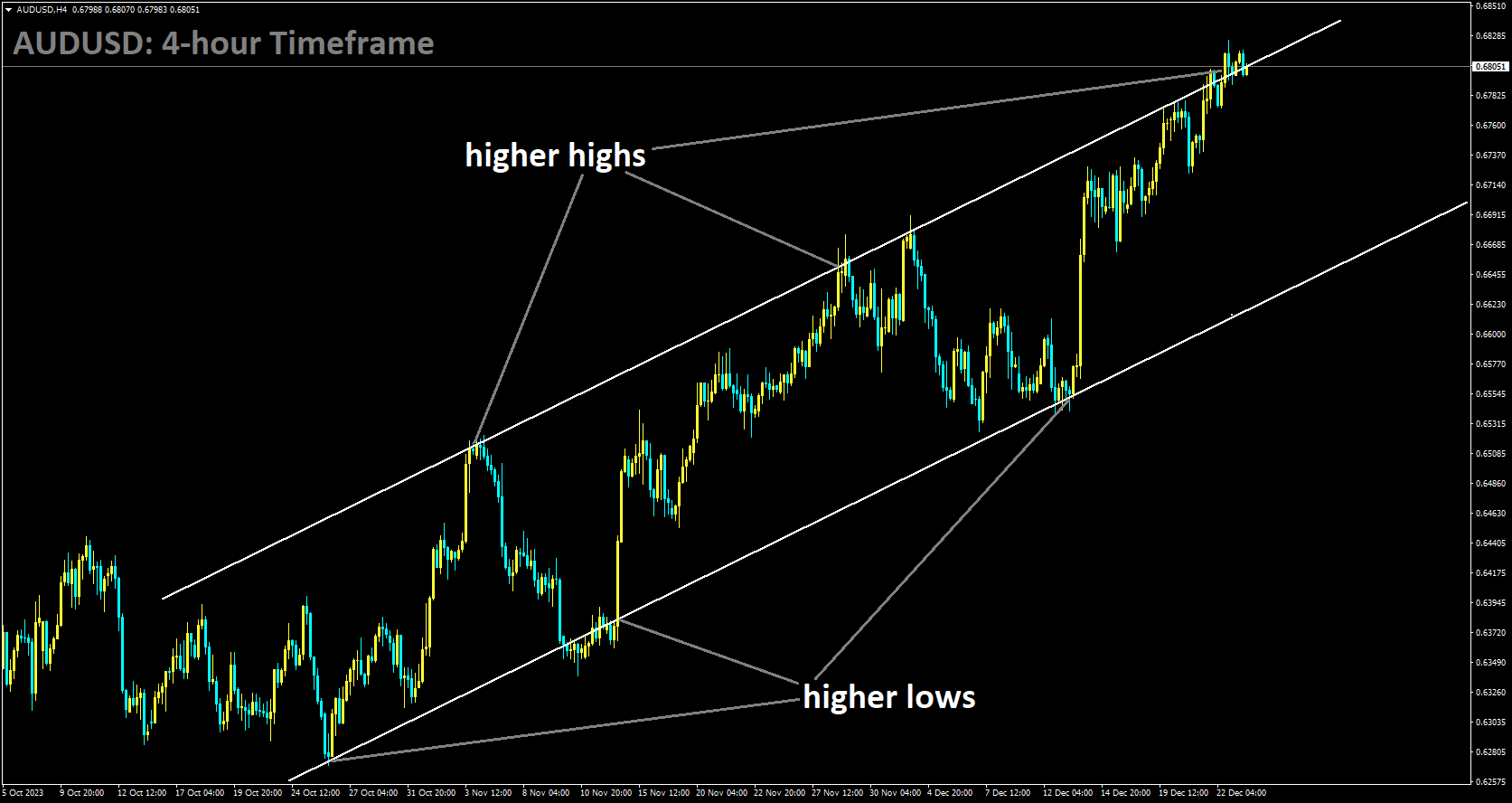

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher high area of the channel

Australians are expected to provide a much-needed boost to the sluggish retail sector during the crucial Boxing Day clearance frenzy. Households, grappling with the ongoing cost-of-living crisis, are seizing the opportunity presented by the year’s largest sales event. Retailers are projecting a total expenditure of $1.25 billion on Boxing Day sales nationwide, marking a 1.6% increase from the previous year. The post-Christmas sales period, extending until January 15, is poised to generate a record-breaking $24 billion in revenue, with South Australia and Victoria experiencing the most substantial growth, according to the Australian Retail Association. New South Wales is expected to spend $7.5 billion over the next three weeks, followed by $6 billion in Victoria and $4.8 billion in Queensland.

Fleur Brown, the Chief Industry Affairs Officer of the ARA, noted that many consumers, facing the cost-of-living crisis, had curtailed their spending throughout the year to take advantage of significant discounts during this clearance event. Brown observed that overall spending had remained subdued in recent months but expressed satisfaction that Christmas and post-Christmas spending had shown a slight improvement from the previous year.The combination of high inflation and rising interest rates has put considerable strain on household budgets, reminiscent of the challenges faced during the global financial crisis. Data from the Australian Bureau of Statistics reveals that households are now spending more than their earnings. Brown emphasized that, in response to the cost-of-living crisis, Australians were seeking ways to indulge and reward themselves. According to the ARA, spending on department stores and clothing is expected to increase by 4.8% and 3.4%, respectively, over the next three weeks compared to the previous year.

Allyce McVicar, store manager at Myer, highlighted that pillows, sheets, quilts, children’s clothing, and activewear were among the top-selling items for shoppers on Tuesday. McVicar anticipated that the brisk shopping activity, both in-store and online, would continue. Brown acknowledged that it was challenging to determine to what extent the modest increase in spending was influenced by supply chain pressures, as the cost of doing business had risen for many retailers. She mentioned that, in certain categories, this increase might actually represent a negative outcome. Nonetheless, it is viewed as a positive result for retailers amidst the cost-of-living crisis, offering a promising outlook as they move into the new year.

While the upturn in retail turnover has exceeded expectations, the underlying spending momentum has been lackluster. Inflation-adjusted sales have declined for three consecutive quarters and have lagged behind population growth. Recent inflation figures from October indicated a 4.9% increase in prices compared to the previous year. Economists, the ARA, and the Reserve Bank of Australia will closely monitor retail sales and January’s inflation figures to determine whether the cash rate will be further adjusted in the new year. Financial markets currently anticipate that the RBA will maintain interest rates at 4.35% during its February meeting, with some analysts even speculating a rate cut in March. Traders are nearly fully pricing in a rate cut by June 2024 and are betting on two rate cuts by the end of the year.

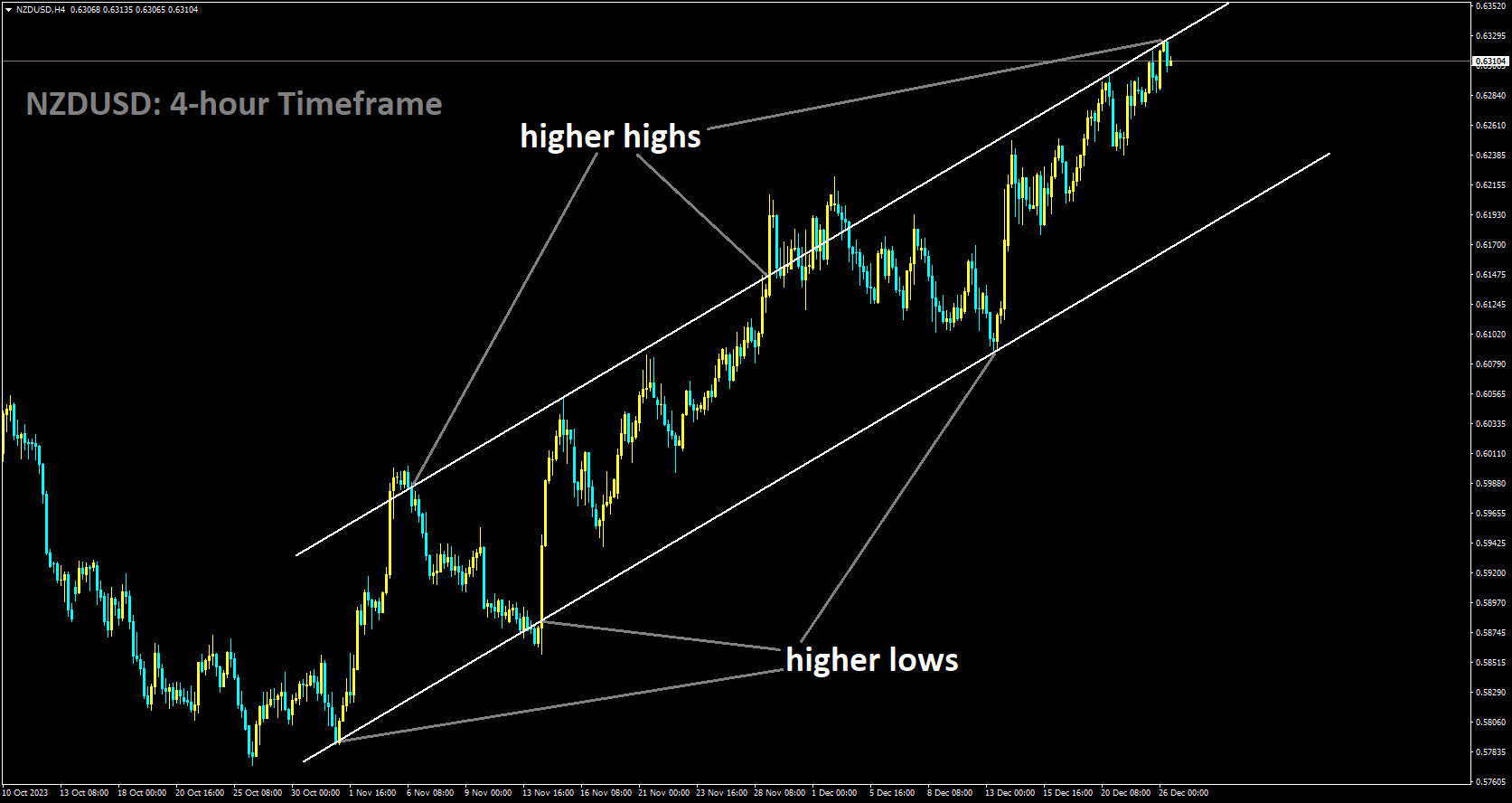

NZDUSD Analysis:

NZDUSD is moving in Ascending channel and market has reached higher high area of the channel

ASB has recently made adjustments to its mortgage rates. On Friday, the bank reduced its two-year rate from 7.05 percent to 6.89 percent and its three-year rate to 6.75 percent. ASB has also modified some of its long-term deposit rates. According to spokesperson Adam Boyd, these rate adjustments are a response to recent decreases in wholesale rates. These changes in ASB’s home lending and term deposit rates went into effect on Friday.

Similarly, BNZ lowered its standard two-year fixed rate by 16 basis points to 7.49 percent and its three-year fixed rate by six basis points to 7.39 percent on the preceding Thursday. BNZ also introduced reductions in special mortgage offers. Earlier in the week, ANZ decreased certain lending and deposit rates due to a decline in wholesale rates, which partly fund the banks’ lending activities. In November, the Reserve Bank decided to maintain the official cash rate at 5.5 percent, a level it had held since May, reiterating concerns about slowing inflation despite remaining elevated.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/