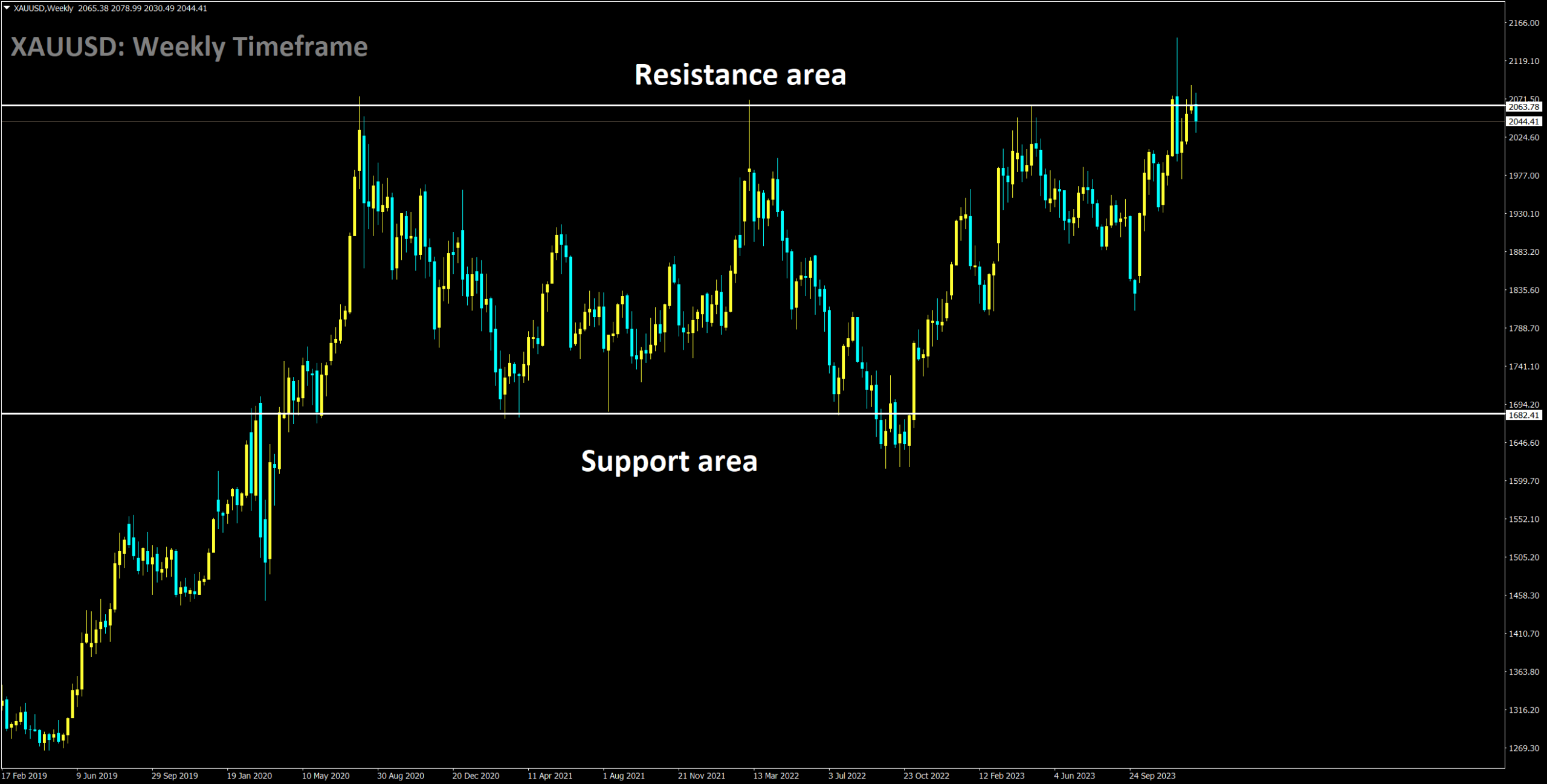

Analysis of GOLD:

XAUUSD is moving in box pattern and market has reached resistance area of the pattern

The price of gold has experienced a notable decline, primarily attributed to the concurrent rise in Treasury rates and the sustained strength of the U.S. dollar. In recent trading sessions, there has been a remarkable surge in bond yields, with the 10-year Treasury note inching perilously close to the psychologically significant 4.0% threshold. This surge in yields comes on the heels of the note trading below 3.80% just a month ago.

Consequently, the value of gold has retreated significantly, witnessing a decline exceeding 2.7% from its peak in late December. This decline has triggered a sense of caution among investors who are now pondering the implications of overbought conditions and the prevailing exuberant sentiment following the Federal Reserve’s notable policy shift. These considerations have fueled speculation that 2024 might usher in a reversal of the current trends.

Despite these recent developments, it’s worth noting that gold’s overall outlook remains optimistic. However, it is becoming increasingly apparent that its upward trajectory will likely encounter occasional corrections within the broader upward trend. The crucial turning point and a more precise sense of gold’s future direction are expected to emerge later in the week, contingent upon the Bureau of Labor Statistics’ release of the latest employment report.

Investors are keeping a keen eye on the nonfarm payrolls survey within this report, as it serves as a vital barometer of the labor market’s health. A strong showing in hiring could heighten expectations of impending higher interest rates, consequently reinforcing the upward surge in yields and the robustness of the U.S. dollar. Such a scenario would present a bearish outlook for gold. Conversely, should job growth fall notably short of market expectations, it would validate predictions of monetary easing in 2024. This outcome would exert downward pressure on yields and the U.S. currency, potentially creating favorable conditions for gold to resume its upward trajectory.

Analysis of SILVER:

XAGUSD is moving in Ascending channel and market has reached higher low area of the channel

The U.S. dollar, as gauged by the DXY index, has continued its recovery in recent trading sessions. However, it’s essential to note that it experienced a significant retreat from its daily peak. This retreat was instigated by a pullback in yields following the release of the minutes from the Federal Reserve’s recent meetings.

This pullback in yields stems from the insights gleaned from the summary of the latest Federal Open Market Committee meeting. The summary conveyed the notion that interest rates might remain elevated for an extended duration. However, it also underscored the recognition among policymakers that inflation risks are becoming more balanced. This recognition often serves as the precursor to considering a reduction in interest rates, though no concrete commitment was made in this direction.

Given the uncertainty surrounding the trajectory of the Fed’s policy, it becomes crucial to closely monitor the upcoming macroeconomic data releases. These data points will be the primary drivers guiding the U.S. central bank’s future decisions and the timing of any potential interest rate cuts. The upcoming highlight on this front is the December nonfarm payrolls survey scheduled for release on Friday morning.

According to consensus estimates, this report is anticipated to reveal that U.S. employers added 150,000 jobs in the previous month, following the hiring of 199,000 individuals in November. It is also expected that the unemployment rate will edge up slightly from 3.7% to 3.8%, indicating a healthier equilibrium between labor supply and demand. Such a situation would be conducive to alleviating potential future wage pressures.

For the U.S. dollar to maintain its recovery in the upcoming weeks, labor market data must demonstrate sustained robustness in hiring. This scenario would likely drive yields upward, signaling that the economy remains resilient and can progress without immediate central bank intervention. In this context, any nonfarm payrolls figure exceeding 200,000 would be considered positive for the U.S. dollar. Conversely, if job growth falls significantly short of expectations, it could lead to the opposite outcome: a weaker U.S. dollar. Such a result would support the notion of substantial rate cuts, confirming a slowdown in economic growth and the need for timely intervention by the Fed to prevent a severe economic downturn.

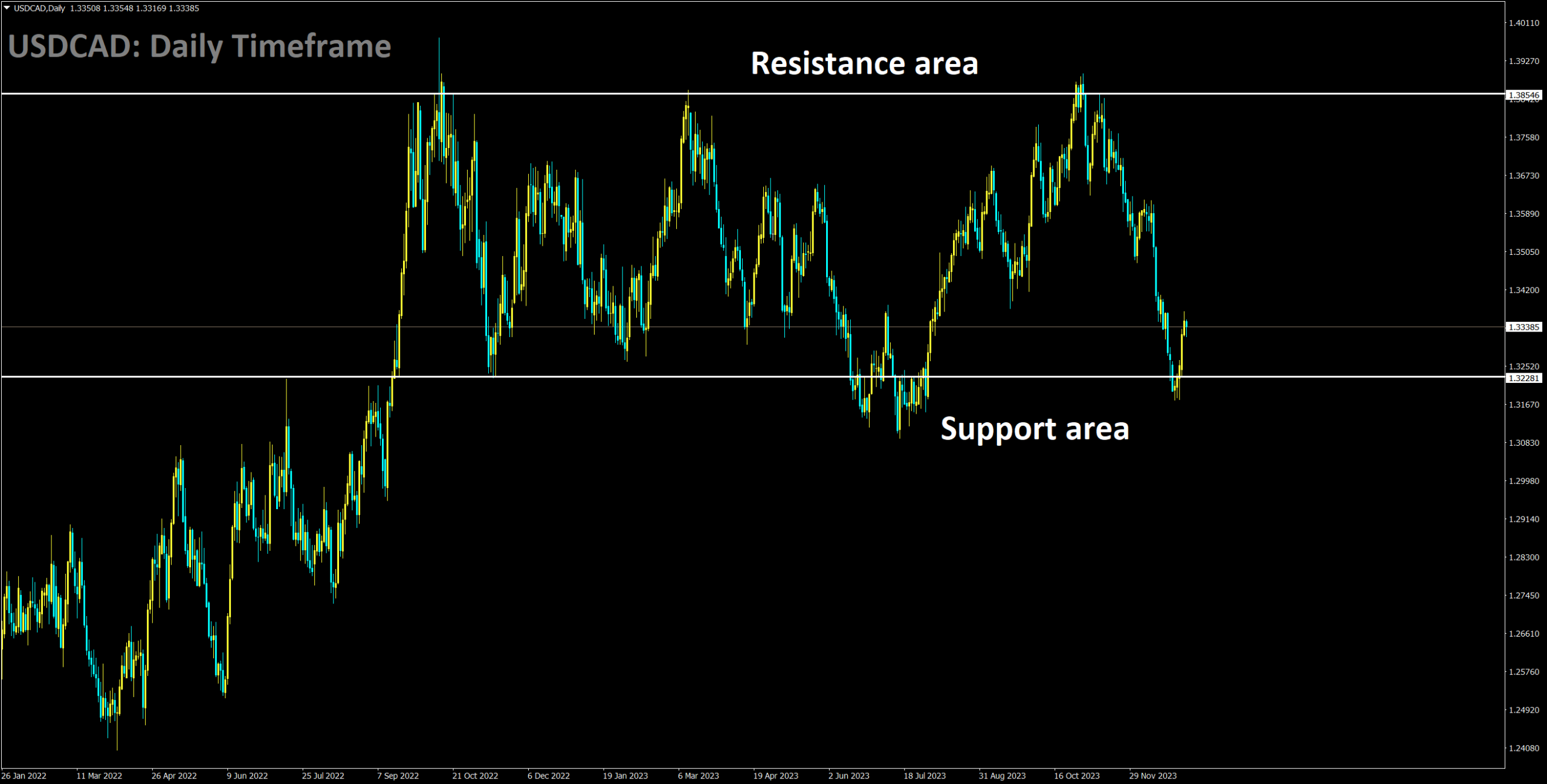

Analysis of USDCAD:

USDCAD is moving in box pattern and market has rebounded from the support area of the pattern

The price of West Texas Intermediate crude oil has demonstrated a notable uptick, currently hovering around the $73.10 per barrel mark. This surge in crude oil prices can be attributed to several influential factors, most notably heightened tensions in the Israel-Gaza conflict and disruptions at a pivotal oilfield in Libya.

In the Middle East, concerns have arisen as the Iran-backed Houthis targeted a container ship in the southern Red Sea en route to Israel. These developments have raised serious concerns about maritime security in the Red Sea region. These geopolitical uncertainties are contributing significantly to the upward pressure on crude oil prices.

Furthermore, in Libya, disruptions at a crucial oilfield are further bolstering the upward momentum in crude oil prices. This combination of geopolitical tensions and supply-side disruptions has culminated in the current surge in oil prices. Looking ahead, market observers are closely monitoring the release of labor market data for December in Canada, set to be unveiled on Friday. This data includes critical metrics such as the Unemployment Rate and Net Change in Employment figures.

Meanwhile, in the United States, Thursday’s focus will be squarely on labor market data releases, including the ADP Employment Change and Initial Jobless Claims reports. It’s important to note that the US Dollar Index has strengthened recently, largely attributed to a risk-off sentiment prevailing in the market. This sentiment has been reinforced by improved U.S. Treasury yields. Additionally, the positive momentum in the U.S. dollar may have been further fueled by the favorable ISM Manufacturing PMI report, revealing an increase to 47.4 in December, surpassing the market consensus of 47.1. However, it’s worth highlighting that there is a contrasting trend as JOLTS Job Openings declined to 8.79 million, falling short of the expected figure of 8.85 million for November.

The minutes from the December FOMC meeting indicate that participants believe the policy rate has either reached its peak or is nearing it in the current tightening cycle. Nevertheless, they emphasize that the specific path of policy will depend on the evolving economic conditions.

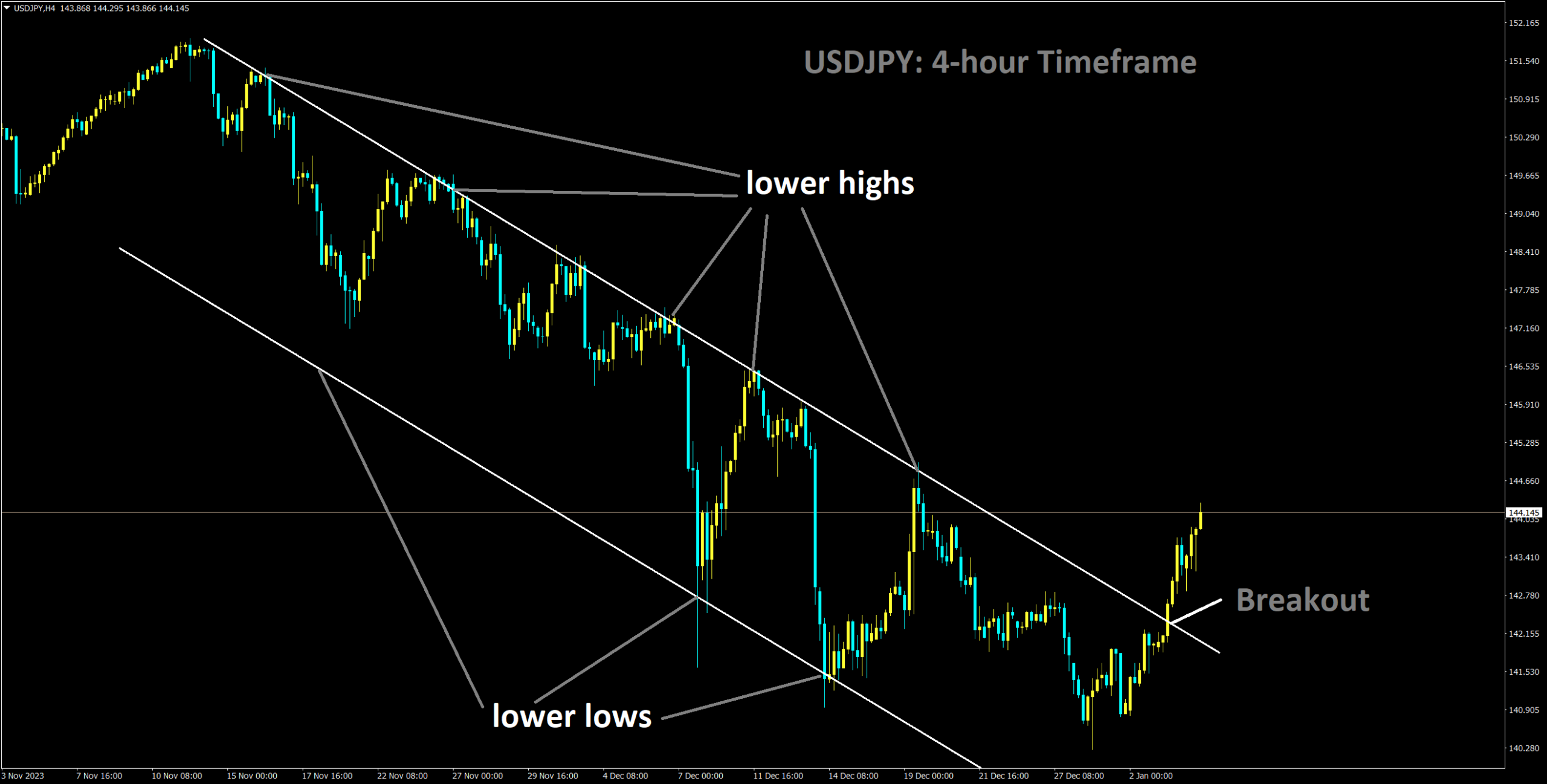

Analysis of USDJPY:

USDJPY has broken Descending channel in upside

Earlier today, data revealed that manufacturing activity in Japan contracted at its most severe rate in 10 months in December. This contraction follows a devastating 7.6 magnitude earthquake on New Year’s Day and is a significant factor weighing on the Japanese Yen. Simultaneously, doubts surrounding early interest rate cuts by the Federal Reserve are bolstering U.S. Treasury bond yields, which, in turn, are providing support for the U.S. Dollar and the USDJPY pair.

Despite these dynamics, it’s important to note that USD bulls appear to be hesitant to make aggressive bets. Concerns are mounting that the U.S. central bank may initiate interest rate cuts as early as March, particularly in anticipation of the crucial U.S. monthly employment data set to be released on Friday, known as the Nonfarm Payrolls report. This report will heavily influence the Fed’s future policy decisions and drive demand for the USD in the short term, potentially offering momentum to the USDJPY pair.

In the interim, traders on Thursday may seek guidance from the U.S. economic calendar, which includes the release of the ADP report on private-sector employment and the customary Initial Jobless Claims data. Furthermore, as expectations solidify regarding an impending shift in the Bank of Japan’s stance, coupled with a subdued risk appetite, the safe-haven JPY’s losses should be contained. This could, in turn, prevent any significant appreciation of the USDJPY pair and warrant caution for bullish traders.

The Japanese Yen has relinquished its modest gains from the Asian session due to weaker domestic data. However, various factors are poised to limit more substantial losses. The au Jibun Bank Japan Manufacturing PMI has remained in contraction territory for seven consecutive months, plummeting to 47.9 in December, its lowest reading since February. The expectation of policy divergence between the Bank of Japan and the Federal Reserve in 2024 is likely to continue supporting the JPY.

The minutes from the December 12-13 FOMC meeting indicated a consensus that inflation is under control and expressed concerns about the potential risks of overly restrictive policies on the economy. Nonetheless, these minutes did not offer direct hints about the timing of rate cuts, which is boosting U.S. bond yields and the U.S. Dollar.

In related news, the Institute for Supply Management reported that the pace of decline in the U.S. manufacturing sector has slowed, marked by a modest increase in production and an improvement in factory employment. The U.S. ISM Manufacturing PMI rose to 47.4 last month, breaking the trend of remaining unchanged at 46.7 for two consecutive months, although it still indicates contraction for the 14th straight month. Separately, the Labor Department’s Job Openings and Labor Turnover Survey indicated that employment listings dropped to 8.79 million in November, the lowest figure since March 2021.

Investors are now turning their attention to the U.S. ADP report, expected to show that private sector employers added 115K jobs in December compared to 103K in the previous month. Nevertheless, the primary focus will remain on Friday’s official monthly employment data release, the Nonfarm Payrolls report.

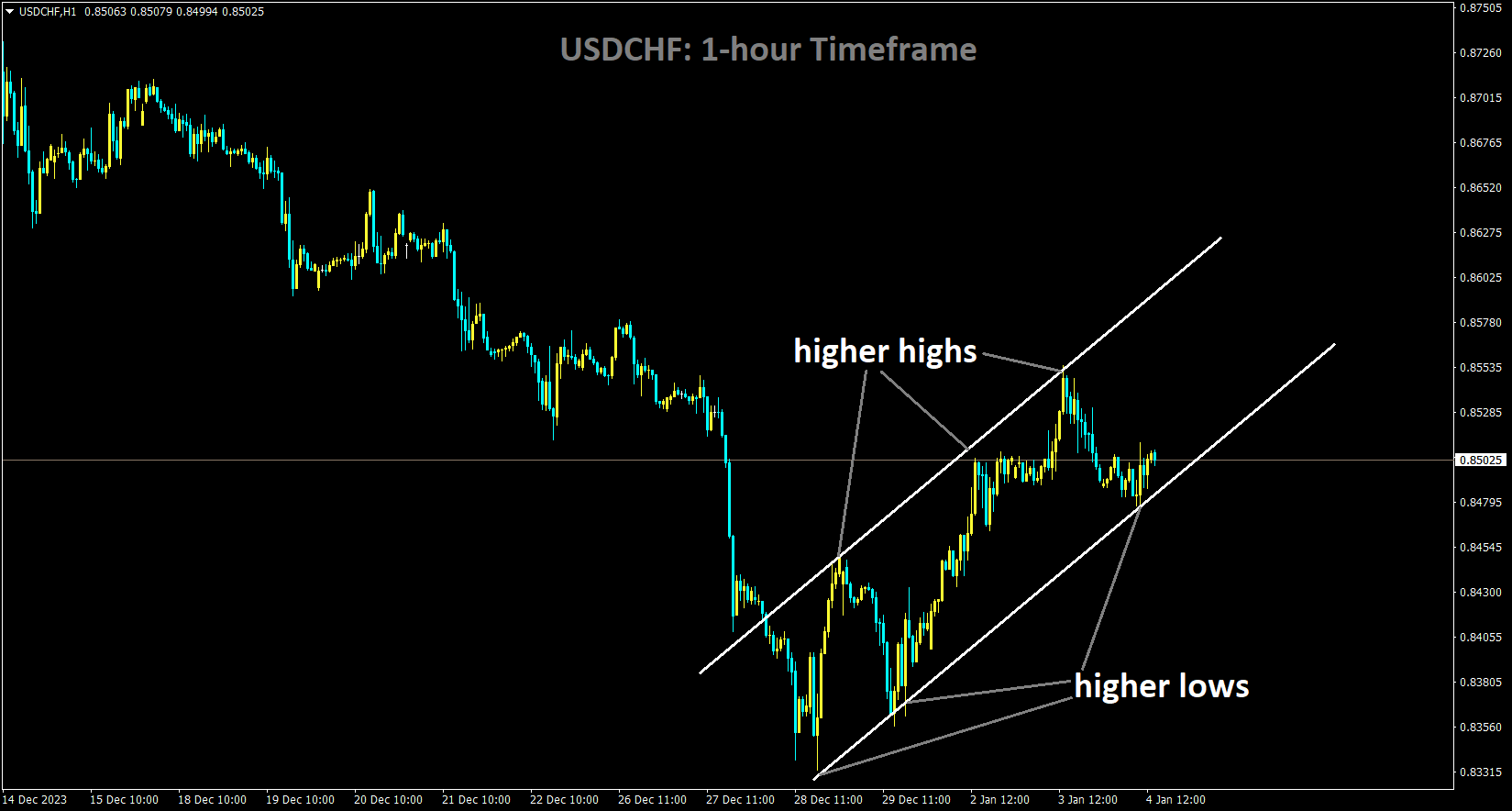

Analysis of USDCHF:

USDCHF is moving in an Ascending channel and the market has rebounded from the higher low area of the channel

The USDCHF pair is currently facing downward pressure, possibly due to interventions by the Swiss National Bank in the foreign exchange market. Furthermore, the release of the SVME Manufacturing Purchasing Managers Index for December on Wednesday showed an improved figure of 43, up from 42.1 previously. This improvement in business conditions within the manufacturing sector may have influenced buyers of the Swiss Franc .

On the other hand, concerns about sluggish global economic growth at the end of 2024 have prompted a risk-off sentiment among investors, leading them to seek safety in the U.S. Dollar (USD). Additionally, the strengthening of U.S. bond yields has contributed to the USD’s strength, with the U.S. Dollar Index (DXY) hovering around 102.40 after recent gains. By the current press time, 2-year and 10-year yields on U.S. Treasury bonds stand at 4.33% and 3.93%, respectively.

The positive momentum of the USD is further supported by the favorable ISM Manufacturing PMI report released on Wednesday, which showed an increase to 47.4 in December, surpassing the market consensus of 47.1 and up from the previous reading of 46.7. However, there is a contrasting trend as JOLTS Job Openings declined to 8.79 million, falling short of the expected figure of 8.85 million for November. Looking ahead, market attention will focus on Thursday’s labor market data releases, including ADP Employment Change and Initial Jobless Claims, which will provide additional insights into the current economic landscape.

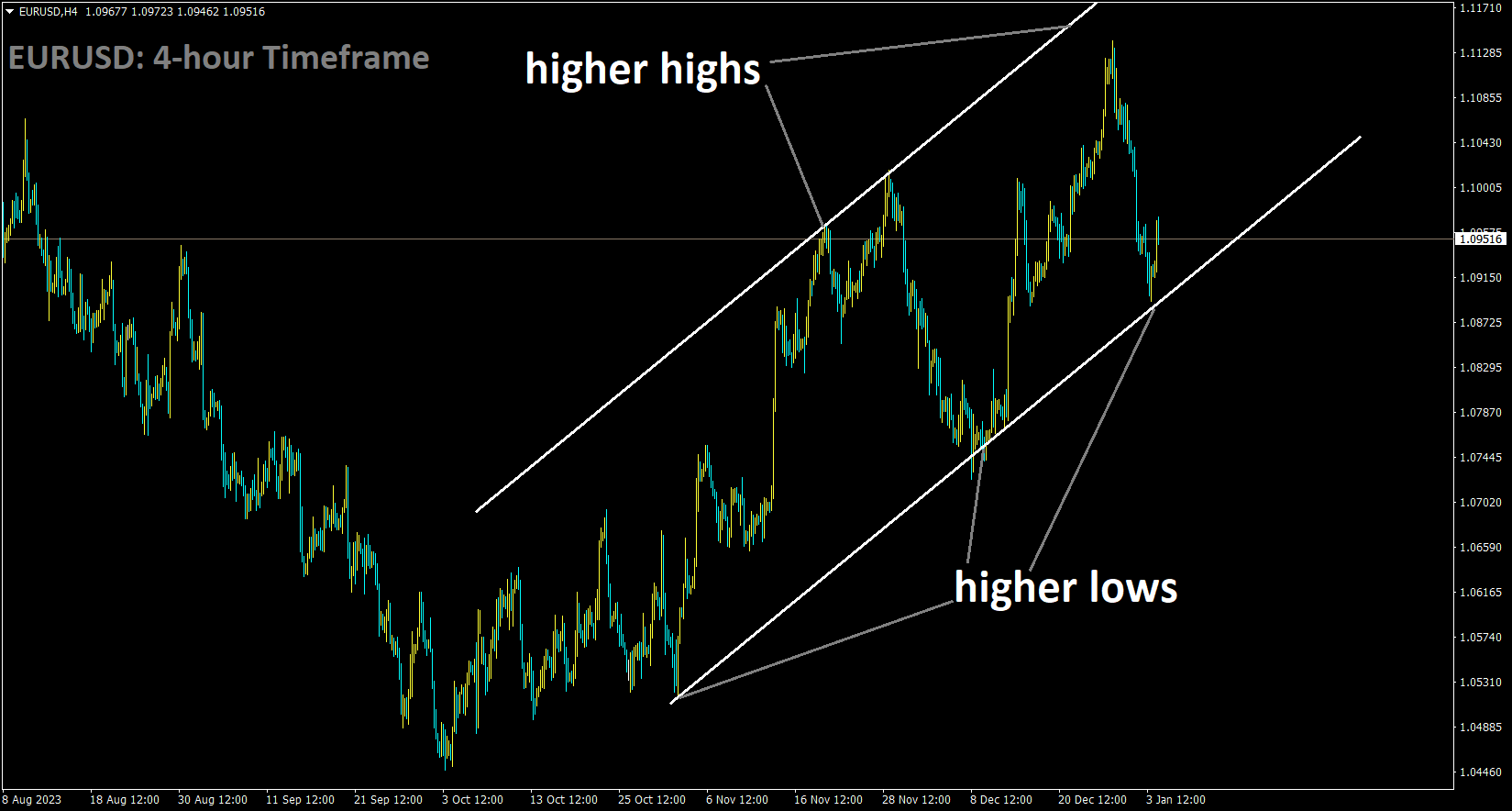

Analysis of EURUSD:

EURUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel

The German Unemployment Rate remained steady at 5.9%, in line with expectations. The Unemployment Change data revealed an increase of 5,000 unemployed individuals, which was below the market consensus of 20,000 and the previous figure of 21,000. Investors are now looking ahead to the Eurozone inflation report scheduled for Friday, hoping for fresh market momentum. The Annualized Harmonized Index of Consumer Prices for December is expected to bounce back to 3.0% from the previous reading of 2.4%.

On the other side of the Atlantic, the Federal Open Market Committee decided to maintain its benchmark rate within a range of 5.25% to 5.5% at its December 2023 meeting. FOMC members anticipate three quarter-point rate cuts by the end of 2024. However, the minutes from the meeting highlighted that the actual path of policy will depend on how the economy evolves, despite participants’ belief that the policy rate is likely at or near its peak in this tightening cycle.

In a somewhat hawkish tone, Richmond Fed President Thomas Barkin commented on Wednesday that interest rate hikes should not be ruled out despite progress in controlling inflation. These remarks bolstered the US Dollar across the board while putting pressure on the Euro.

Market participants will closely monitor the release of December’s HCOB Composite PMI and Services PMI data from France, Germany, and the Eurozone. Additionally, the German Consumer Price Index is due on Thursday. In the United States, attention will focus on the US ADP Employment Change report and the weekly Initial Jobless Claims.

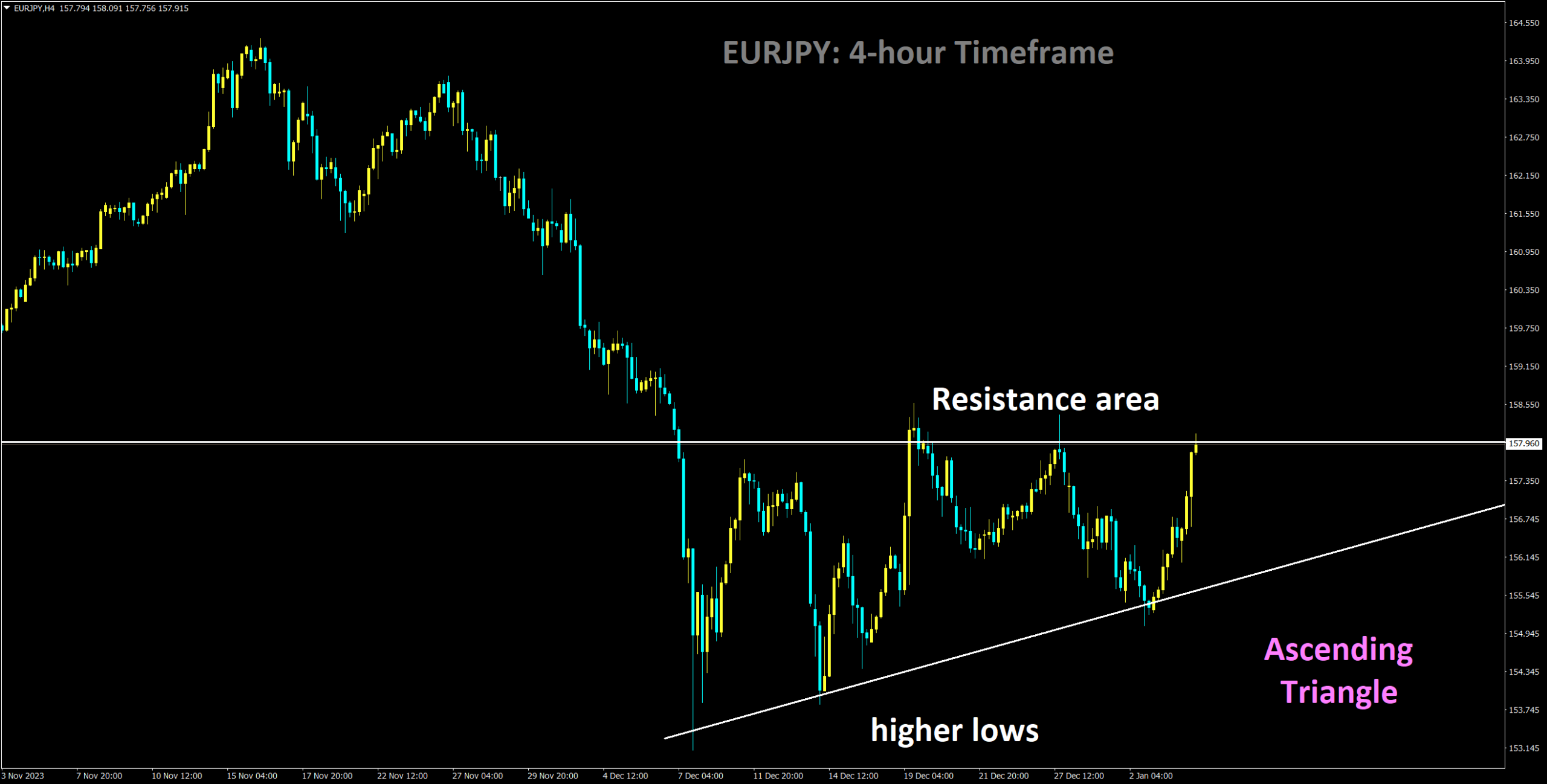

Analysis of EURJPY:

EURJPY is moving in Ascending Triangle and market has reached resistance area of the pattern

Bank of Japan Governor Kazuo Ueda expressed his hope for Japan’s economy to achieve a harmonious equilibrium between wage increases and inflation. The aspiration is that a well-balanced rise in both wages and inflation will encourage companies to invest in equipment and research and development.

Analysis of GBPUSD:

GBPUSD is moving in Ascending channel and market has reached higher low area of the channel

The British Pound is currently under pressure due to increasing pessimism among UK business leaders regarding the economic outlook. These leaders are urging the Bank of England (BoE) to initiate rate cuts early in the year. Money market indicators suggest that traders are anticipating approximately 140 basis points of rate cuts in 2024.

Furthermore, the GBPUSD pair is encountering headwinds from a modest show of strength in the U.S. Dollar. The minutes from the December 12-13 FOMC meeting, released on Wednesday, did not provide any clear indications of when the Federal Reserve might commence a series of rate cuts. This uncertainty has led to an increase in U.S. Treasury bond yields, offering some support to the U.S. Dollar.

Additionally, a generally subdued sentiment in equity markets has boosted demand for the safe-haven Greenback, thereby restraining the GBPUSD pair. Market expectations currently include a higher likelihood of a 25-basis point Fed rate cut in March. Such a cut could limit the recent rally in U.S. Treasury bond yields that has lasted for a week. This scenario might discourage aggressive bullish positions on the U.S. Dollar and help minimize downward pressure on the GBPUSD pair.

Additionally, a generally subdued sentiment in equity markets has boosted demand for the safe-haven Greenback, thereby restraining the GBPUSD pair. Market expectations currently include a higher likelihood of a 25-basis point Fed rate cut in March. Such a cut could limit the recent rally in U.S. Treasury bond yields that has lasted for a week. This scenario might discourage aggressive bullish positions on the U.S. Dollar and help minimize downward pressure on the GBPUSD pair.

Investors appear hesitant and are opting to stay on the sidelines ahead of the release of the U.S. monthly jobs report on Friday. In the meantime, Thursday’s economic calendar will include the final Services PMIs from both the UK and the U.S., along with the US ADP report on private-sector employment. These releases will be closely watched for potential short-term trading opportunities.

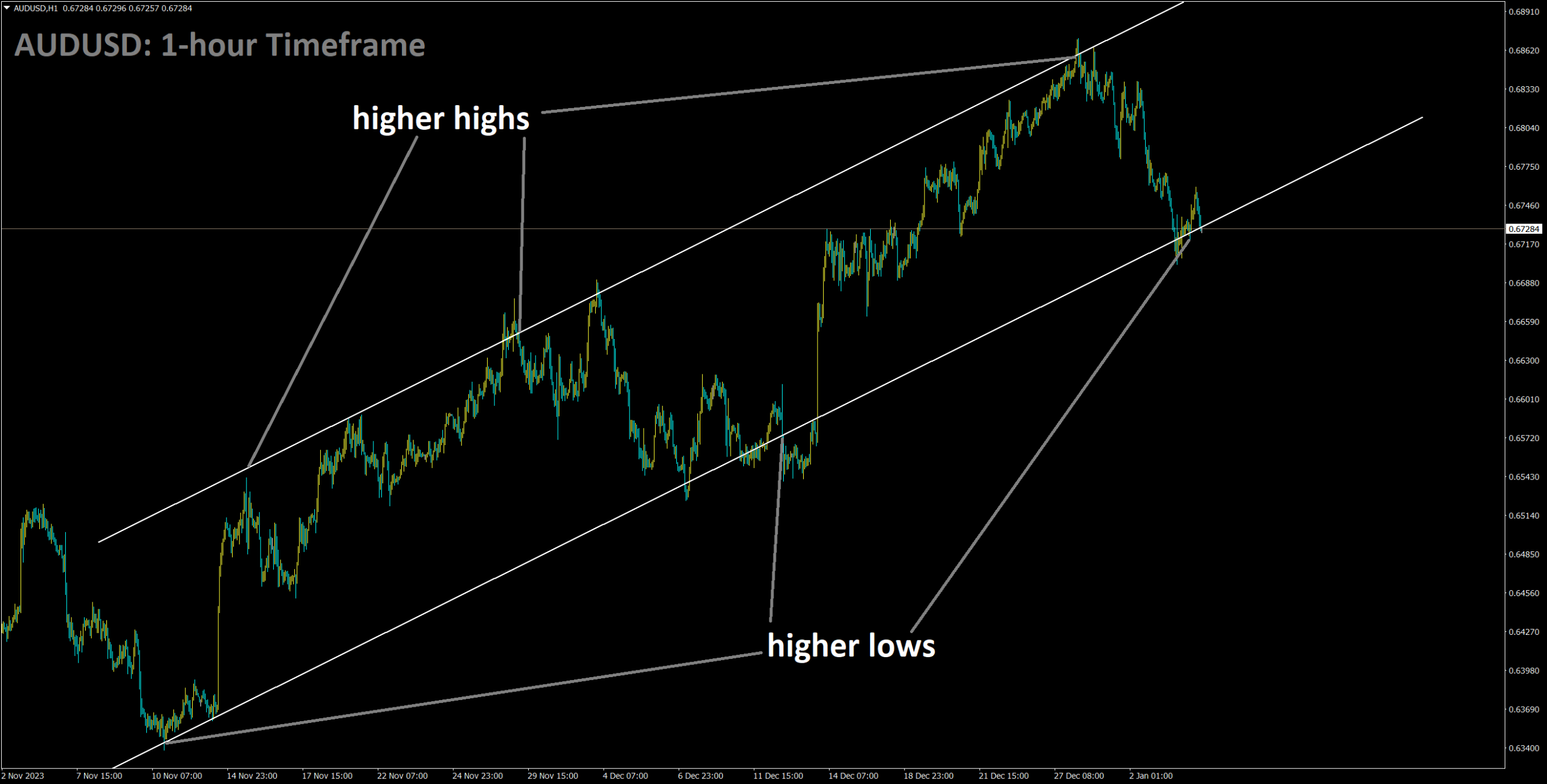

Analysis of AUDUSD:

AUDUSD is moving in Ascending channel and market has reached higher low area of the channel

The Australian Dollar (AUD) faced additional pressure as the Judo Bank Purchasing Managers Index data indicated weakness. However, on a positive note, improved Chinese services data could help limit the losses of the AUD. The Caixin Services PMI for December rose to 52.9, surpassing expectations of 51.6 and the previous 51.5.

Contrastingly, Australia’s services sector experienced a contraction in December, according to the latest Judo Bank Services PMI, which reported a reading of 47.1. This fell short of market expectations that it would remain at 47.6. Additionally, the Composite PMI decreased to 46.9 from the previous figure of 47.4, marking the sharpest pace of services contraction since Q3 2021.

Economist Matthew De Pasquale of Judo Bank suggests that recent readings over the past two months indicate a slowdown in the Australian economy, but one that is not accelerating. Despite households grappling with challenges posed by elevated interest rates, both the output and new order indexes remain at levels consistent with the Reserve Bank of Australia’s anticipated soft landing scenario.

Meanwhile, the U.S. Dollar Index maintains a positive trajectory, bolstered by improved United States Treasury yields. This momentum may receive additional support from the enhanced ISM Manufacturing PMI report, which reported an increase to 47.4 in December, surpassing the market consensus of 47.1. However, JOLTS Job Openings contracted to 8.79 million in November, falling short of the expected 8.85 million figure.

Traders are eagerly awaiting U.S. labor market data releases, including ADP Employment Change and Initial Jobless Claims. The December minutes from the Federal Open Market Committee indicate that the policy rate has likely reached or is close to its peak in the current tightening cycle. However, the trajectory of policy will continue to depend on evolving economic conditions.

In Australia, the Judo Bank Manufacturing PMI revealed a modest contraction in manufacturing activity, declining to 47.6 in December from the previous reading of 47.8. RBA’s internal documents show a decline in domestic tourism demand, with consumers opting for more affordable products or reducing overall purchases due to cost-of-living pressures. Nevertheless, the documents suggest that private sector wage growth has stabilized at around 4.0%.

Australian Prime Minister Anthony Albanese has directed Treasury and Finance to explore measures to ease the financial burden on families in terms of the cost of living without exacerbating inflation pressures.

Analysis of NZDUSD:

NZDUSD is moving in Ascending channel and market has reached higher low area of the channel

The New Zealand Dollar is facing a decline, reinforced by the robust performance of the U.S. Dollar. With no economic data being released from the New Zealand side, the NZDUSD pair remains subject to the fluctuations in the USD’s value. New Zealand’s economic calendar is relatively quiet for the week.

On Thursday, there was a noteworthy development as China’s Caixin Services Purchasing Managers’ Index surged to 52.9 in December, up from November’s 51.5, surpassing market expectations of 51.6. Despite expectations among market participants that the policy rate may have reached or is close to its peak in the current tightening cycle, the FOMC minutes emphasized that monetary policy direction hinges on the performance of the economy.

In light of these less dovish remarks, the U.S. Dollar gained strength, creating a headwind for the NZDUSD pair. Later on Thursday, attention will shift to the release of the U.S. ADP Employment Change and the weekly Initial Jobless Claims data. Traders will closely monitor these figures for insights and potential trading opportunities involving the NZDUSD pair. Additionally, the highly anticipated U.S. Nonfarm Payrolls report, along with the Unemployment Rate and Average Hourly Earnings, is scheduled for release on Friday, further shaping market sentiment and trading dynamics for the pair.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/