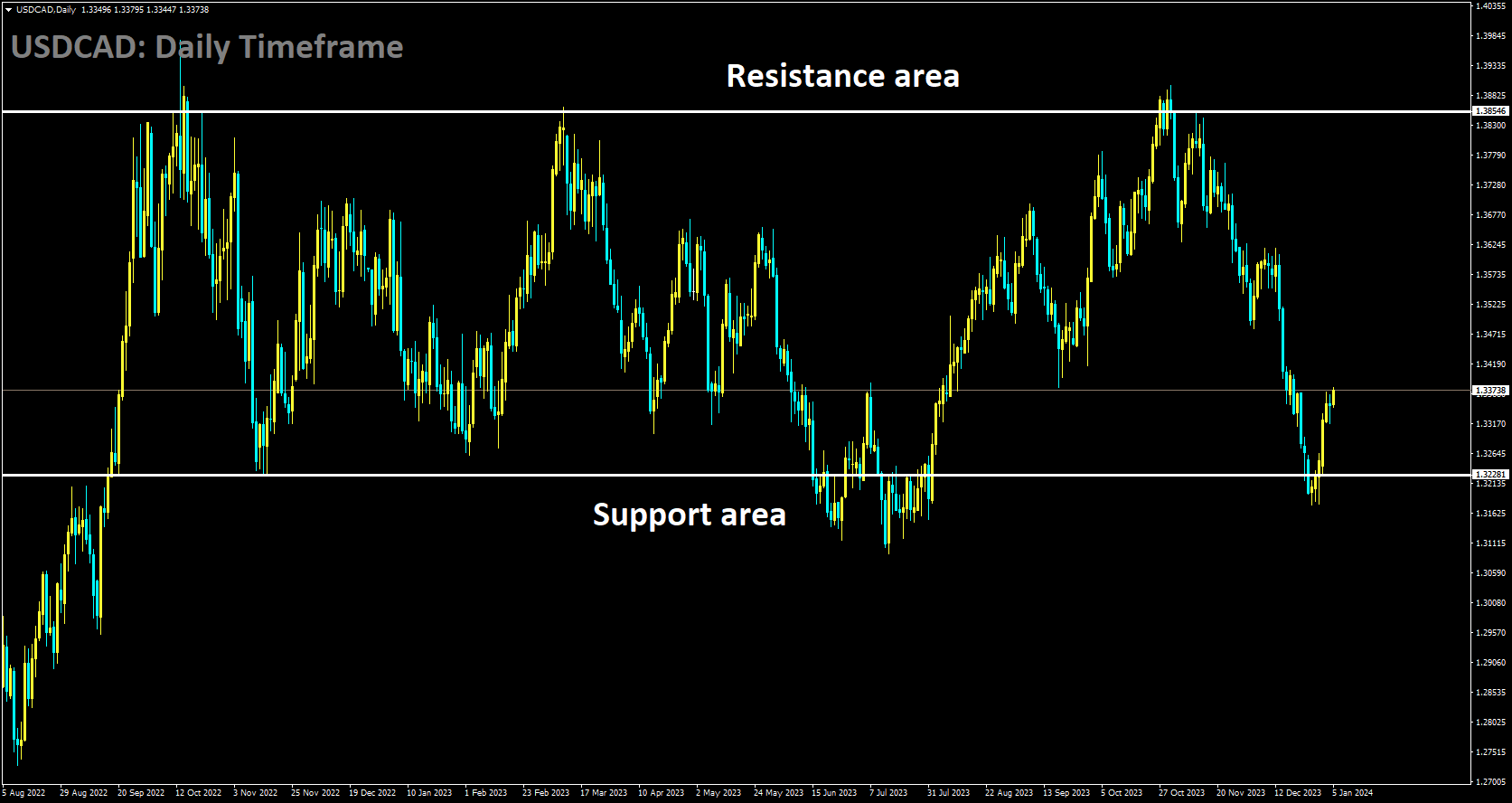

Analysis of USDCAD:

USDCAD is moving in box pattern and market has rebounded from the support area of the pattern

The US Dollar has rebounded from recent losses and is holding steady near 102.50, supported by improved US Treasury yields and positive labor data from the United States on Thursday. However, the Canadian Dollar could find support from rising crude oil prices. Currently, the 2-year and 10-year yields on US bonds are at 4.39% and 4.00%, respectively. Additionally, the favorable employment data released on Thursday helped limit the decline of the US Dollar, with the US ADP Employment Change showing a significant surge, adding 164K new positions, surpassing the market’s expectation of 115K. Initial Jobless Claims for the week ending on December 29 decreased to 202K from the previous 220K.

The Canadian Dollar, often referred to as the Loonie, may benefit from the improvement in crude oil prices. The West Texas Intermediate (WTI) price has rebounded from recent losses and is currently trading at around $72.70 per barrel. However, WTI has faced some downward pressure due to an increase in US gasoline and distillate inventories, which has raised concerns about demand stability.

Canada is preparing to release crucial economic data, including the Unemployment Rate and Net Change in Employment figures for December on Friday. Meanwhile, in the United States, all eyes are on the forthcoming releases of Average Hourly Earnings and Nonfarm Payrolls (NFP) data. These reports are expected to exert a significant impact on market sentiment and provide valuable insights into the labor market dynamics in both countries.

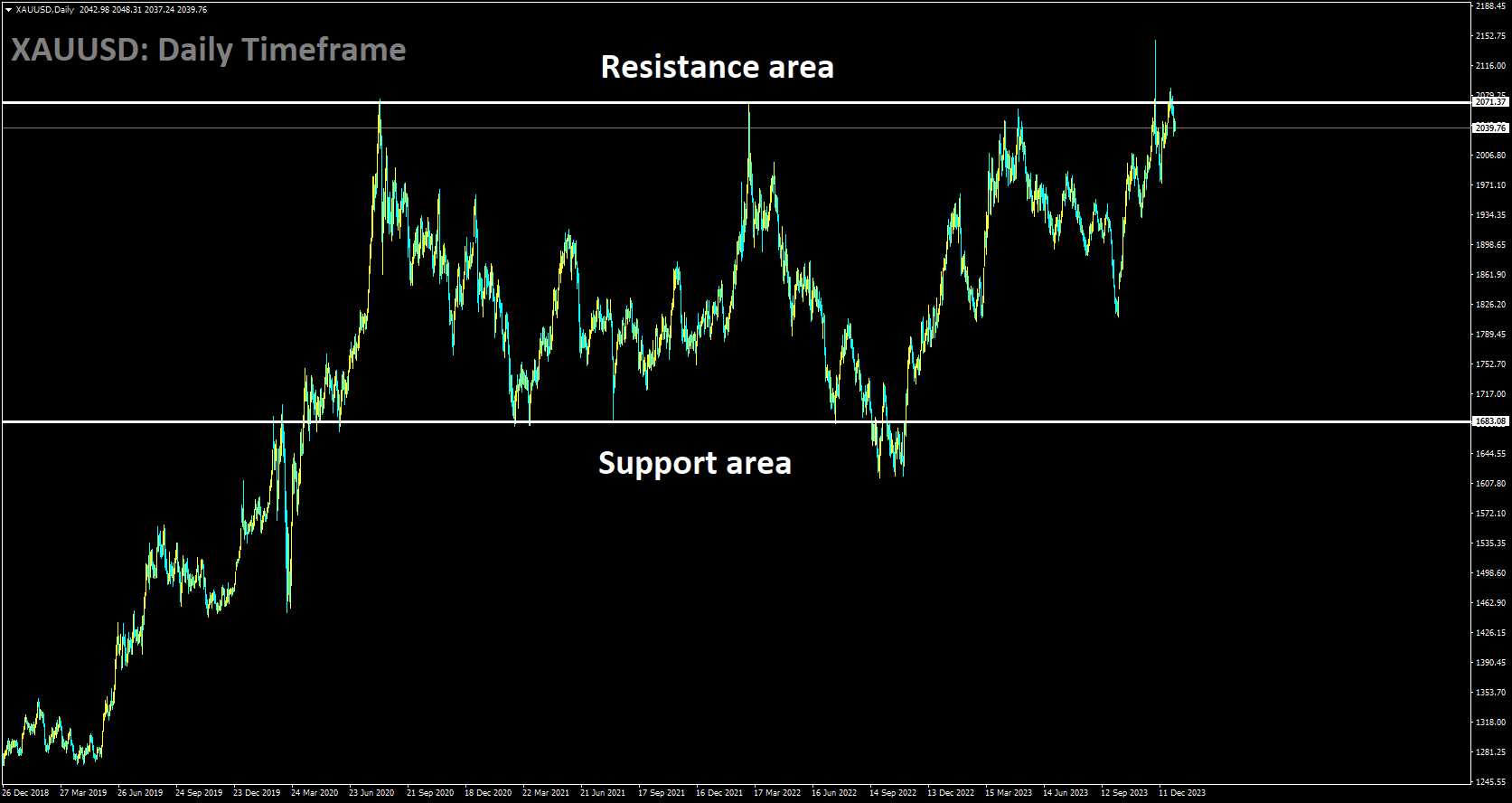

Analysis of GOLD:

XAUUSD is moving in box pattern and market has reached resistance area of the pattern

The price of gold is currently trading sideways as traders adopt a cautious approach, awaiting further clarity from the upcoming US Nonfarm Payrolls report. This report is anticipated to shed light on the Federal Reserve’s future policy decisions, which in turn will provide a new direction for the non-yielding gold market. Meanwhile, investors are revising their expectations for aggressive policy easing by the Fed following the release of positive US labor market reports on Thursday. This has led to elevated US Treasury bond yields and a strengthened US Dollar, which is limiting the potential gains for gold.

Despite this, the overall cautious sentiment in the market is supporting gold’s status as a safe-haven asset as the key data release approaches. Nevertheless, the XAUUSD remains close to a one-and-a-half-week low reached on Wednesday, suggesting the possibility of registering losses for the first time in the past four weeks. Geopolitical risks and concerns about China’s economic situation are still weighing on investor sentiment, offering some support to the safe-haven appeal of gold on Friday. The 10-year US Treasury yield remains stable near 4.0%, as expectations for multiple rate cuts by the Federal Reserve have diminished, which is capping the gains in XAUUSD. Traders have reduced their expectations for the number of rate cuts by the Fed in 2024, lowering it from six to four after the release of positive US economic data on Wednesday.

On Thursday, the Automatic Data Processing (ADP) report revealed that US private-sector employers added 164K jobs in December, surpassing the expected 115K. Additionally, the US Department of Labor reported that Weekly Jobless Claims fell more than anticipated, reaching 202K last week. Meanwhile, US Dollar bulls appear cautious and are waiting for the release of the highly anticipated official US monthly jobs data, known as the Nonfarm Payrolls (NFP) report. The NFP report is expected to show that the economy added 170K new jobs in December, compared to 199K in the previous month. The unemployment rate is predicted to edge higher to 3.8% from 3.7%, while Average Hourly Earnings growth is expected to ease to a 3.9% YoY rate from 4.0% in November. These crucial employment figures will guide the Fed’s near-term policy outlook, influencing the US Dollar and providing new momentum for the gold market.

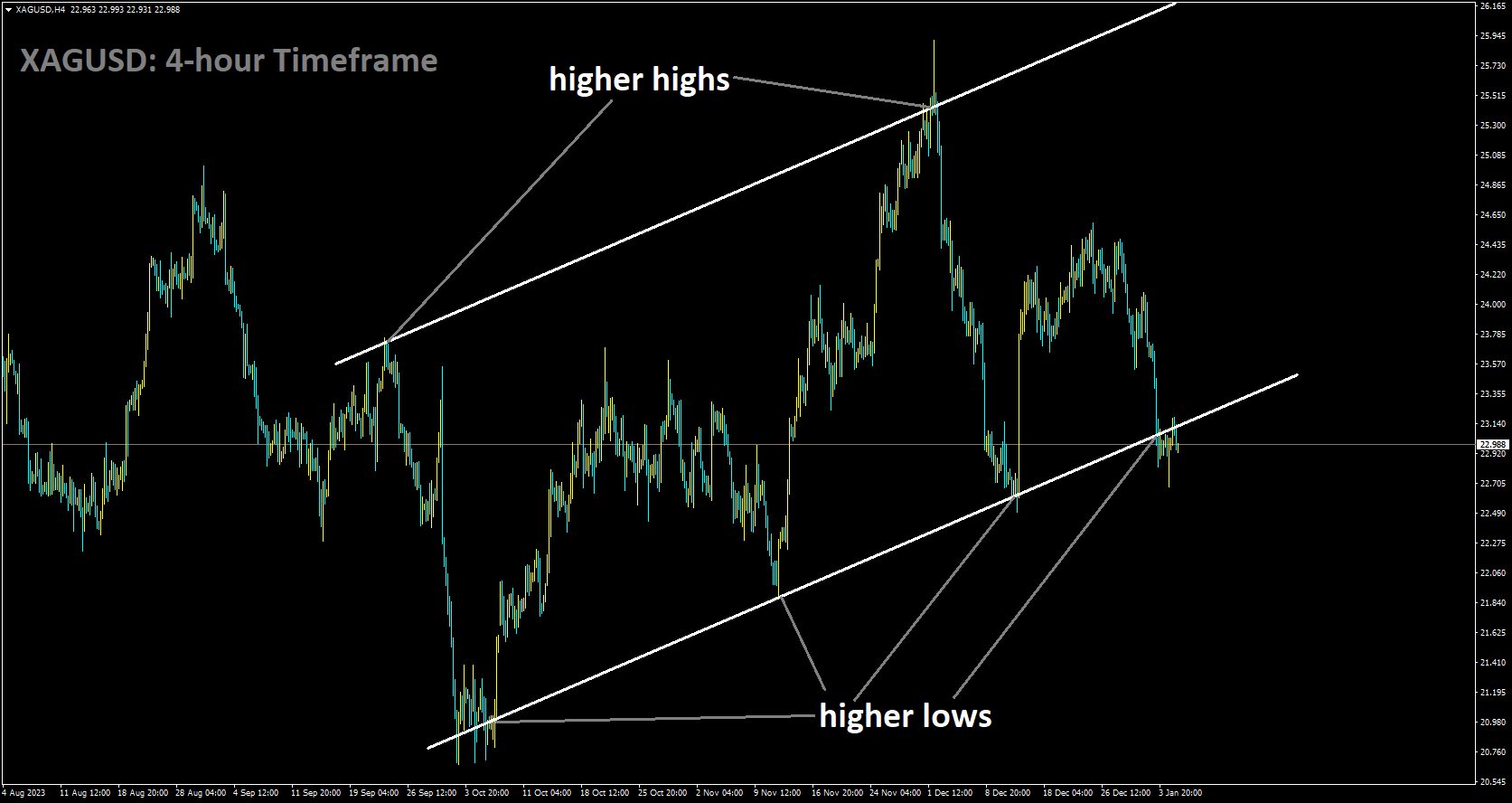

Analysis of SILVER:

XAGUSD is moving in Ascending channel and market has reached higher low area of the channel

The US Dollar has strengthened, primarily driven by encouraging figures in the ADP Employment Change for December and Initial Jobless Claims, which have boosted the Greenback’s daily performance. The Federal Reserve’s recent assessment regarding inflation easing has created a perception of a dovish stance, with officials anticipating no rate hikes in 2024 and the possibility of a 75 basis point easing. Current market expectations indicate that investors are increasingly considering the likelihood of rate cuts in March and May, although these expectations have slightly moderated in recent sessions, providing support for the US Dollar.

The upcoming labor market reports for December could potentially influence these expectations. Notably, US Initial Jobless Claims for the week ending on December 30 came in lower than anticipated at 202K, compared to the consensus estimate of 216K. The ADP Employment Change, a measure of private sector employment, exceeded expectations by reporting 164K new jobs added in December, surpassing the anticipated 115K. However, the S&P Global Composite PMI for December fell slightly below expectations, recording a reading of 50.9, compared to the expected 51.00. All eyes will be on Friday’s release of Nonfarm Payrolls, Average Hourly Earnings, and the Unemployment Rate for the final month of 2023.

US bond yields are on the rise, with the 2-year yield at 4.38%, the 5-year yield at 3.97%, and the 10-year yield at 4.00%. The CME Fed Watch Tool indicates that the markets have priced in the likelihood of the upcoming January meeting maintaining the current interest rates, with only a 15% chance of a rate cut. However, market expectations are increasingly leaning towards rate cuts in March and May of 2024.

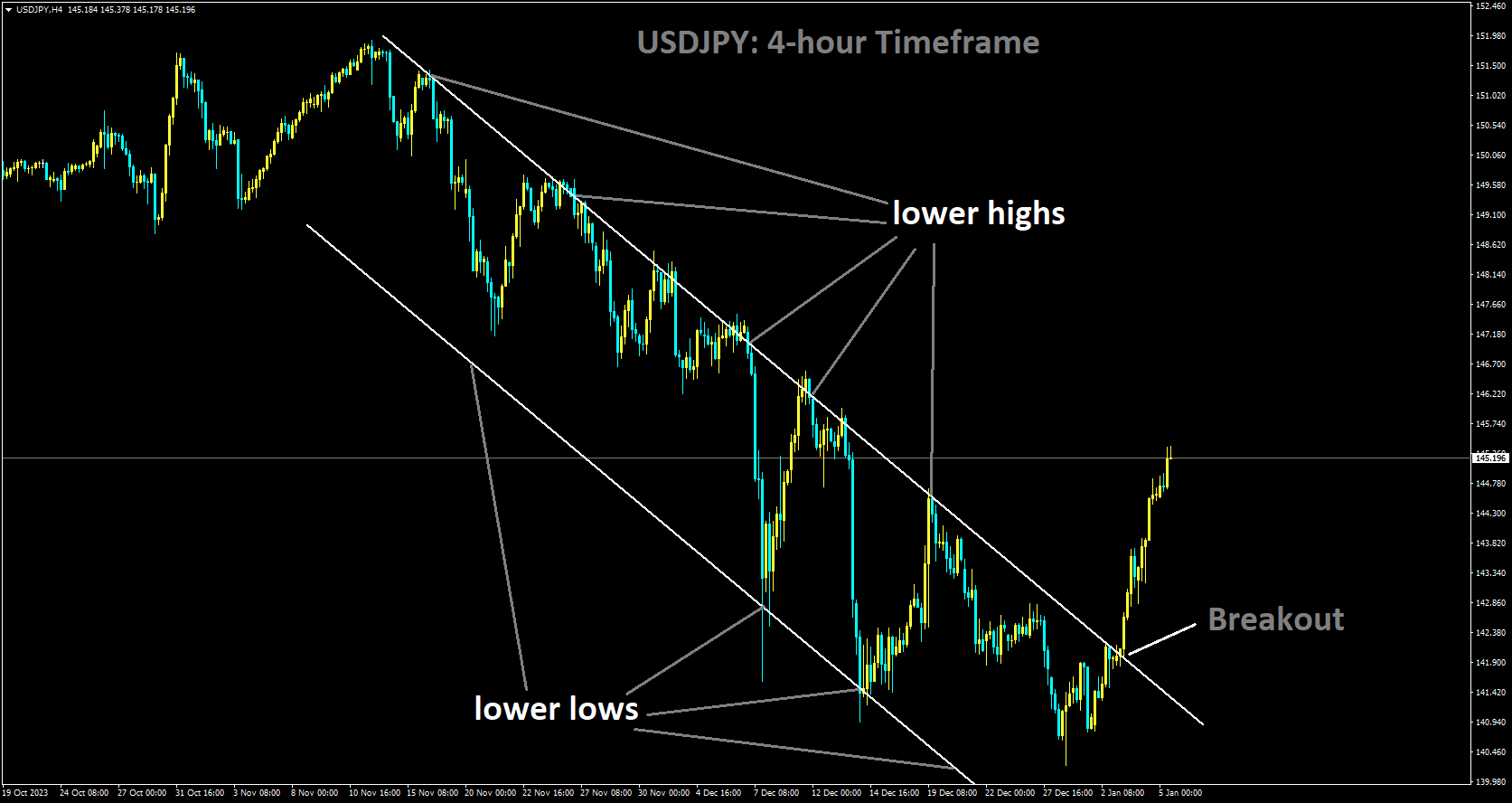

Analysis of USDJPY:

USDJPY has broken Descending channel in upside

On the Japan front, the year-on-year growth of Japan’s Monetary Base for December registered a decrease, reaching 7.8%, which fell short of the median market predictions of 9%. This figure also represents a further decline from November’s annualized reading of 8.9%. When accounting for seasonal adjustments, the Monetary Base exhibited a significant decline, with a 14.5% decrease after adjusting for cyclical factors.

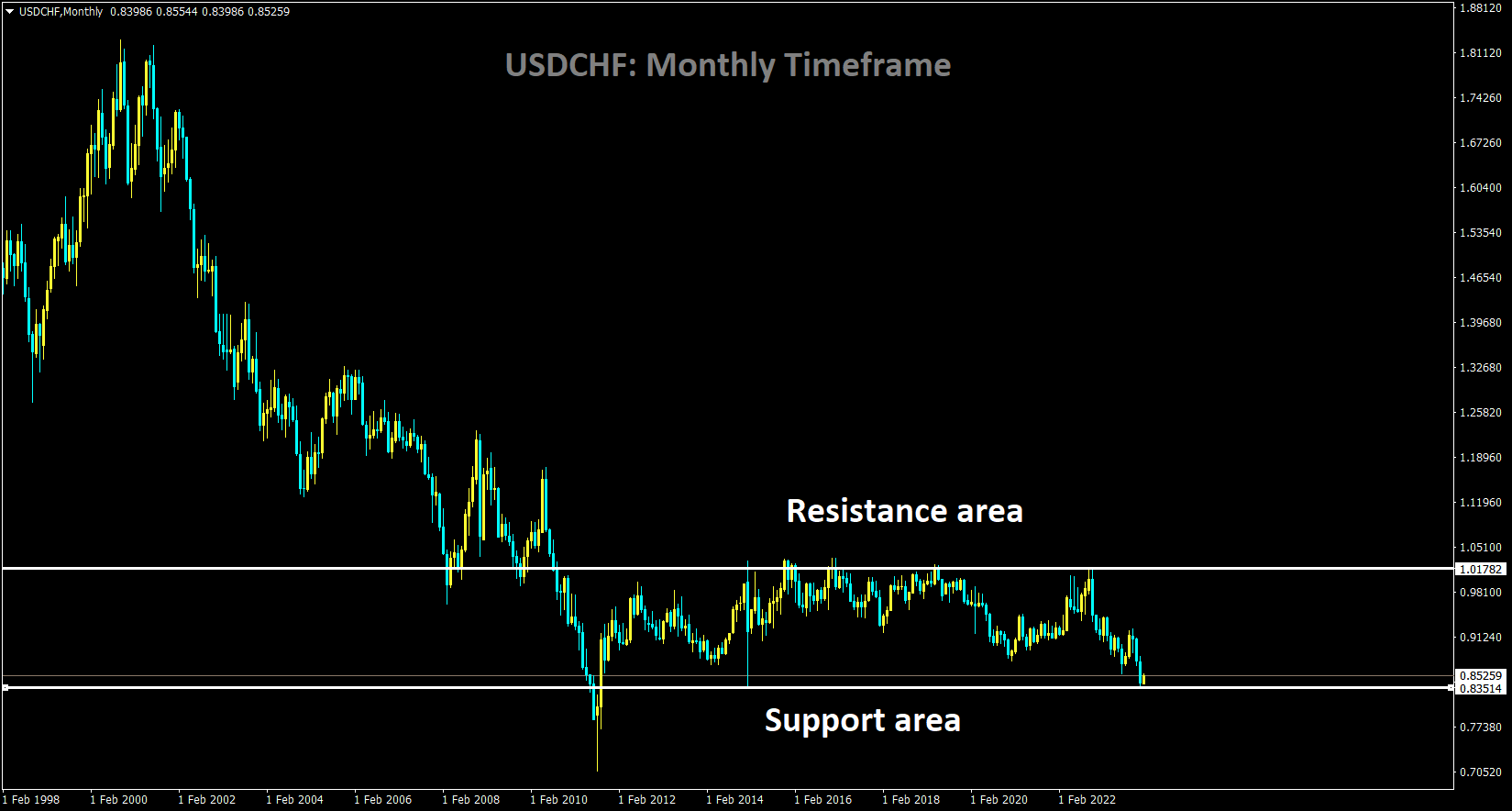

Analysis of USDCHF:

USDCHF is moving in the Box pattern and the market has reached the support area of the pattern

USDCHF continues to advance for the second consecutive session, driven by a stronger US Dollar. This USD strength is attributed to prevailing risk-off sentiment due to concerns about sluggish global growth at the close of 2024. The US Dollar Index is benefiting from improved US Treasury yields, and the recent positive labor market data from the United States has further supported the US Dollar, helping it to limit its losses.

The employment landscape in the US for December has shown significant improvement, with the ADP Employment Change report revealing the addition of a substantial 164K new positions. This figure surpasses both the previous reading of 101K and the market’s expectation of 115K. Additionally, Initial Jobless Claims for the week ending on December 29 displayed a decrease in claims for unemployment benefits, dropping to 202K from the previous 220K and surpassing the anticipated 216K. Traders are anxiously awaiting further data releases from the US employment market, with a particular focus on key indicators such as Average Hourly Earnings and Nonfarm Payrolls data for December.

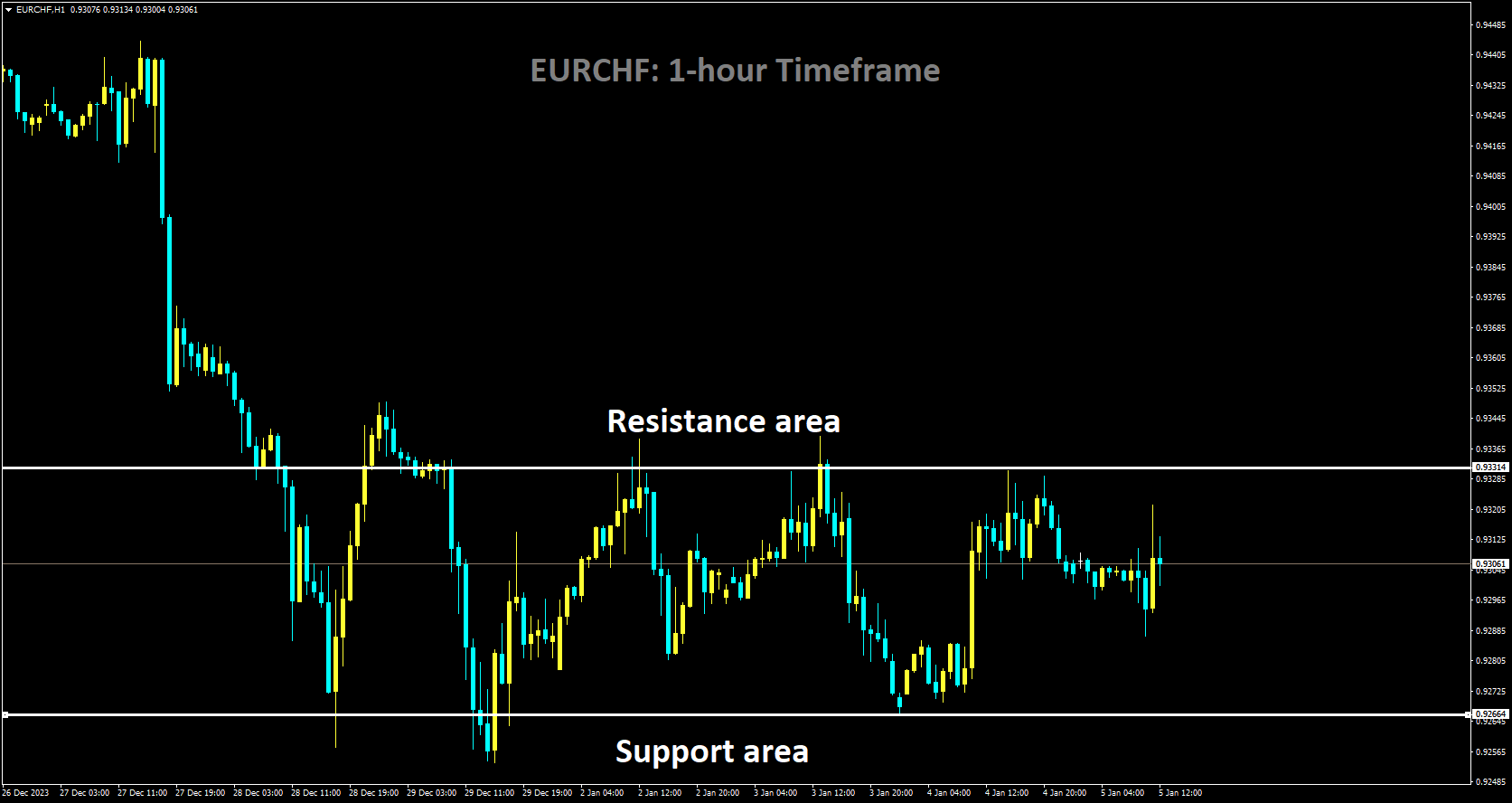

Analysis of EURCHF:

EURCHF is moving in box pattern and market has fallen from the resistance area of the pattern

Conversely, the Swiss Franc (CHF) has shown resilience against losses, possibly due to interventions in the foreign exchange market by the Swiss National Bank (SNB). Furthermore, the release of the SVME Manufacturing Purchasing Managers Index (PMI) for December on Wednesday indicated improvement, with the figure rising to 43 from the previous 42.1. This positive shift in business conditions within the manufacturing sector may be influencing a more favorable sentiment towards the Swiss Franc.

Traders are now awaiting significant data releases from Switzerland, including the Consumer Price Index and Real Retail Sales, scheduled to be unveiled on Monday. These releases hold the potential to provide vital insights into the economic health of Switzerland and may impact market sentiment, thereby guiding trading decisions in the USDCHF pair.

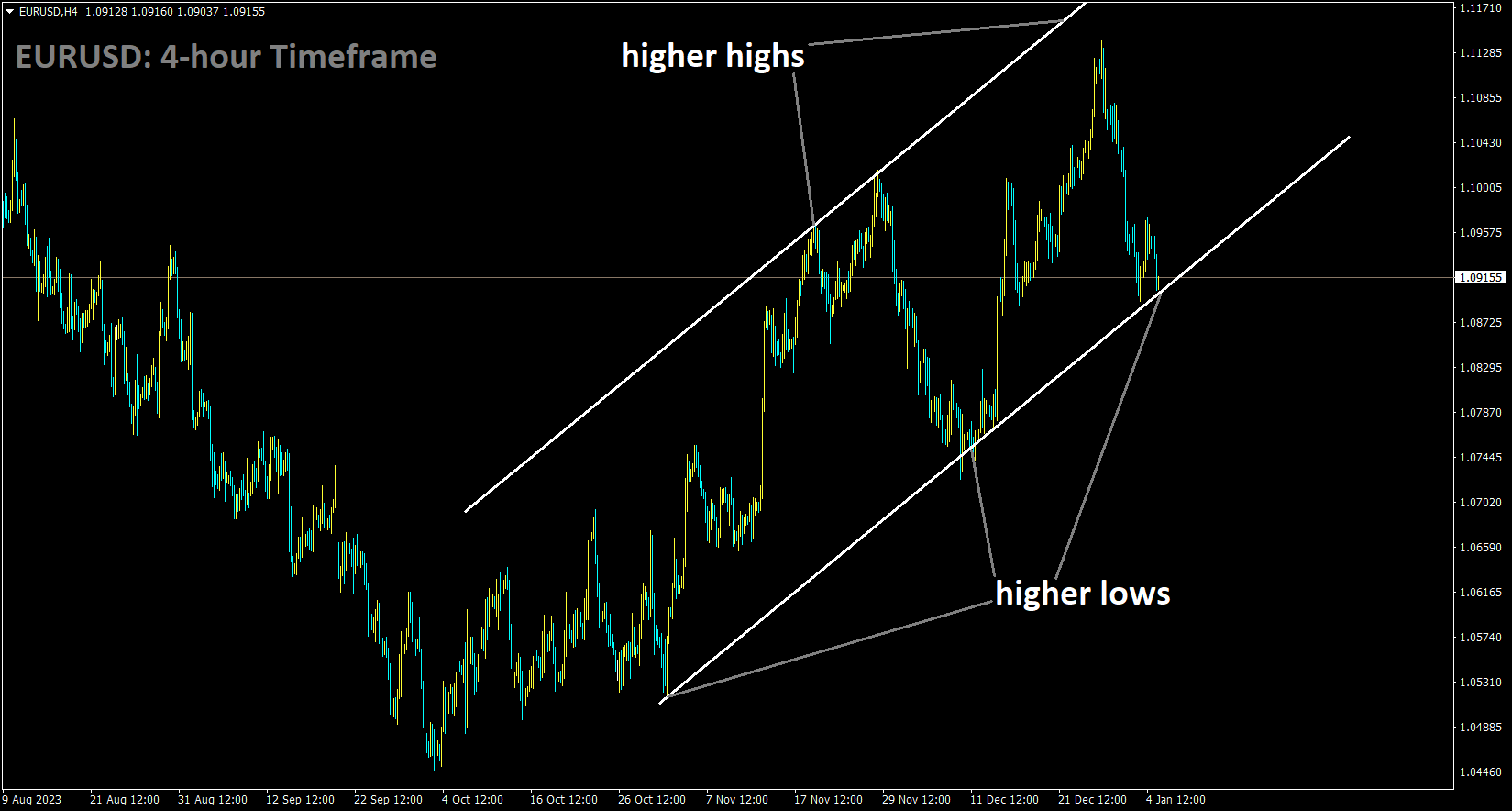

Analysis of EURUSD:

EURUSD is moving in an Ascending channel and the market has reached the higher low area of the channel

The major currency pair, EURUSD, remains relatively stable as the preliminary German Harmonized Index for Consumer Prices for December met expectations. The monthly HICP showed a slightly slower growth rate of 0.2%, compared to the consensus forecast of a 0.3% increase. In November, there was a contraction in price pressures by 0.7%. The annual HICP reached 3.8%, in line with expectations and higher than the earlier growth rate of 3.2%. This may lead European Central Bank policymakers to maintain their current stance of keeping interest rates unchanged.

In the European session, S&P500 futures have seen significant gains. US equities experienced notable sell-offs in the last two trading sessions, and the substantial gains in overnight futures suggest a potential recovery in market participants’ risk appetite. The US Dollar Index has corrected to 102.20 following a sharp rebound, as investors exercise caution ahead of the release of the United States ADP Employment Change data for December.

According to consensus estimates, the labor market is expected to have added 115K new workers, compared to 103K additions in November. Meanwhile, the likelihood of rate cuts by the Federal Reserve this year has increased, as the minutes from the Federal Open Market Committee’s December monetary policy meeting revealed concerns among policymakers about the potential over-tightening of interest rates.

Analysis of GBPUSD:

GBPUSD is moving in Ascending channel and market has reached higher low area of the channel

The Pound Sterling is facing selling pressure as market sentiment sours following the release of robust private employment data for December from the United States. The US Automatic Data Processing report showed that private payrolls increased by 164K, surpassing the consensus estimate of 115K and the previous reading of 103K. A resilient labor market in the US could lead Federal Reserve policymakers to support higher interest rates for an extended period. Despite concerns about potential rate cuts by the Fed, the overall outlook for the GBPUSD pair remains positive, as the Bank of England continues to emphasize the need for a prolonged period of higher interest rates. Additionally, the Pound Sterling’s recovery has been bolstered by encouraging S&P Global UK Composite and Services PMI figures. Both the Composite and Services PMI, at 52.1 and 53.4 respectively, exceeded expectations of 51.7 and 52.7.

However, pressure on the Pound Sterling could intensify if fears of the United Kingdom slipping into a mild recession heighten. The economic outlook appears gloomy due to challenging conditions related to credit and household demand, potentially leading BoE policymakers to reconsider their restrictive monetary policy stance earlier than anticipated. The Pound Sterling’s recovery has faltered in the wake of the upbeat US labor market data, which has dampened overall market sentiment. The improved labor market conditions could sustain the expectation of higher interest rates for longer. Earlier, the market sentiment of investors had improved following the release of the Federal Reserve’s FOMC minutes, which indicated that policymakers were cautious about implementing an overly restrictive monetary policy.

While the Fed minutes suggested the possibility of interest rate cuts, the timing remains uncertain. Fed policymakers expressed confidence in controlling inflation without triggering a recession. Meanwhile, the Pound Sterling is facing downward pressure from the combination of domestic uncertainties in the UK and a pessimistic market mood. S&P Global reported this week that the UK’s Manufacturing PMI dropped to 46.2, slightly below the preliminary reading of 46.4, signaling the impact of high inflation and interest rates both domestically and internationally. Business optimism in the UK has declined due to soft orders amid an escalating cost-of-living crisis. Business investment remains lackluster due to elevated borrowing costs.

The UK economy is vulnerable to a technical recession after a 0.1% contraction in Gross Domestic Product in the third quarter of 2023, with a significant likelihood of another decline in the fourth quarter. In its latest projections, the Bank of England indicated it does not anticipate any growth ahead. The BoE faces the challenge of balancing efforts to prevent the economy from slipping into a recession while addressing persistently high inflationary pressures. Underlying inflation in the UK exceeds the targeted rate of 2%, compelling policymakers to maintain a restrictive monetary policy stance. Meanwhile, the US Dollar Index is staging a recovery, approaching 102.50, as investors seek safe-haven assets amid a shift towards risk aversion in the market.

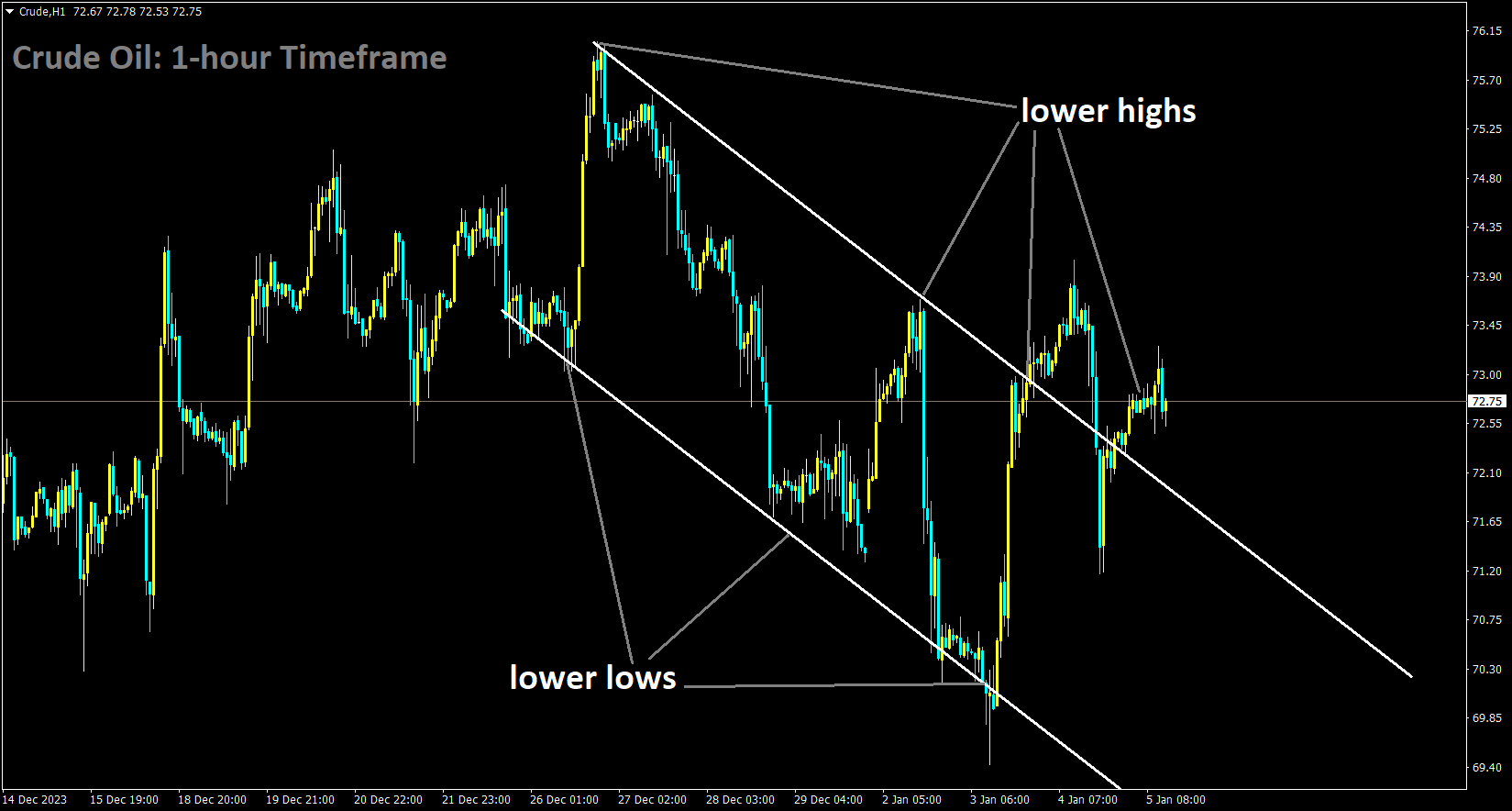

Analysis of Crude Oil:

Crude is moving in the Descending channel and the market has reached the lower high area of the channel

West Texas Intermediate US Crude Oil experienced a decline on Thursday, despite a reduction in Crude Oil supplies. Data from the Energy Information Administration revealed that gasoline reserves saw a significant increase. Crude Oil had risen on Wednesday due to ongoing attacks by Iranian-backed Houthi rebels on ships in critical maritime routes near Yemen. Additionally, energy investors remained concerned about potential supply disruptions between Europe and Asia, as ships initially destined for the Suez Canal were diverted around the African continent, resulting in extended shipping times for already-loaded goods.

Despite these factors, the actual state of global Crude Oil supply contradicts market fears of hypothetical supply constraints, particularly as US refined gasoline supplies continue to grow. The EIA reported a 5.5 million barrel decrease in US Crude Oil reserves for the week ending December 29, surpassing the forecasted decline of 3.7215 million barrels. This reduction follows the previous week’s drawdown of 7.114 million barrels. However, the surge in EIA refined gasoline reserves by nearly 11 million barrels, compared to the market’s expected decline of 1.67 million barrels and the previous week’s drawdown of 6769K barrels, has had a dampening effect on Crude Oil prices.

The substantial increase in gasoline product stockpiles has placed downward pressure on Crude Oil, as the global production of fossil fuel products continues to contribute to supply surpluses. This has led to a tempering of expectations for future purchases. In an effort to boost immediate demand for barrels, the Organization of the Petroleum Exporting Countries released a statement in conjunction with non-OPEC Declaration of Cooperation countries. This statement reaffirmed OPEC’s commitment to market stability, a signal often used by OPEC to convey their intention to significantly undersupply global oil markets. However, with global oil demand showing signs of decline and reserves accumulating at a faster rate than expected, investors are increasingly sceptical about OPEC’s ability to persuade more of its member states to reduce oil production further. Many of these countries rely heavily on Crude Oil sales to support their government budgets, adding complexity to the situation within the OPEC cartel itself.

Analysis of AUDUSD:

AUDUSD is moving in Ascending channel and market has reached higher low area of the channel

The AUDUSD pair is facing downward pressure despite the absence of a clear direction for the US Dollar and an improvement in China’s Caixin Services PMI in December. The Australian Dollar’s weakness is primarily driven by subdued market sentiment and a widespread decline in commodity prices. Recent data from Australia’s Judo Bank Purchasing Managers Index reveals a contraction in business activities in both the services and manufacturing sectors, highlighting the vulnerability of the Australian Dollar. Notably, the Services PMI recorded its sharpest decline in services since Q3 2021. Nevertheless, Matthew De Pasquale, an Economist at Judo Bank, suggests that the slowdown in the Australian economy is not gaining momentum. The US Dollar Index remains relatively stable, showing a slight inclination towards positive sentiment and potential gains. However, the retracement of recent advances in United States Treasury yields could exert pressure on the Greenback. Additionally, optimistic employment data released on Thursday may be providing support for the US Dollar.

In December, US ADP Employment Change surged, adding 164K new positions, surpassing both the previous figure of 101K and the market expectation of 115K. Initial Jobless Claims for the week ending on December 29 provided positive signs for the labor market, decreasing to 202K from the previous 220K, beating the anticipated 216K. However, the S&P Global Composite PMI for December reported a minor dip in business activities, registering a reading of 50.9 compared to the market consensus of a steady 51.0. Traders are eagerly awaiting more crucial data from the US employment market, including Average Hourly Earnings and Nonfarm Payrolls (NFP) data for December.

Additionally, the ISM Services PMI is set to reveal the current conditions within the US service sector. Australia’s Judo Bank Services PMI reported a reading of 47.1, falling short of market expectations that it would remain consistent at 47.6. The Composite PMI decreased to 46.9 from the previous figure of 47.4. Australia’s Judo Bank Manufacturing PMI indicated a modest contraction in manufacturing activity, declining to 47.6 in December from the previous reading of 47.8. RBA’s internal documents revealed a decline in domestic tourism demand. Furthermore, consumers are reported to be shifting to more affordable products or reducing their overall purchases due to cost-of-living pressures. However, the documents suggest that private sector wage growth has stabilized at around 4.0%.

Australian Prime Minister Anthony Albanese has announced that he has instructed Treasury and Finance to explore measures to alleviate the financial burden on families in terms of the cost of living without adding to inflation pressures. China’s Caixin Services PMI rose to 52.9 in December, surpassing the expected 51.6 and the previous 51.5. The December minutes from the Federal Open Market Committee indicate that participants believe the policy rate has either reached its highest point in the current tightening cycle or is very close to it. However, they emphasize that the specific trajectory of the policy will depend on evolving economic conditions. US ISM Manufacturing PMI increased to 47.4 in December from the previous reading of 46.7, exceeding the market consensus of 47.1. US JOLTS Job Openings contracted to 8.79 million, falling short of the expected figure of 8.85 million in November. US ISM Manufacturing Employment Index improved to 48.1 in December from 45.8 in November. US S&P Global Manufacturing PMI posted a lower-than-expected figure of 47.9, deviating from the anticipated consistency at 48.2.

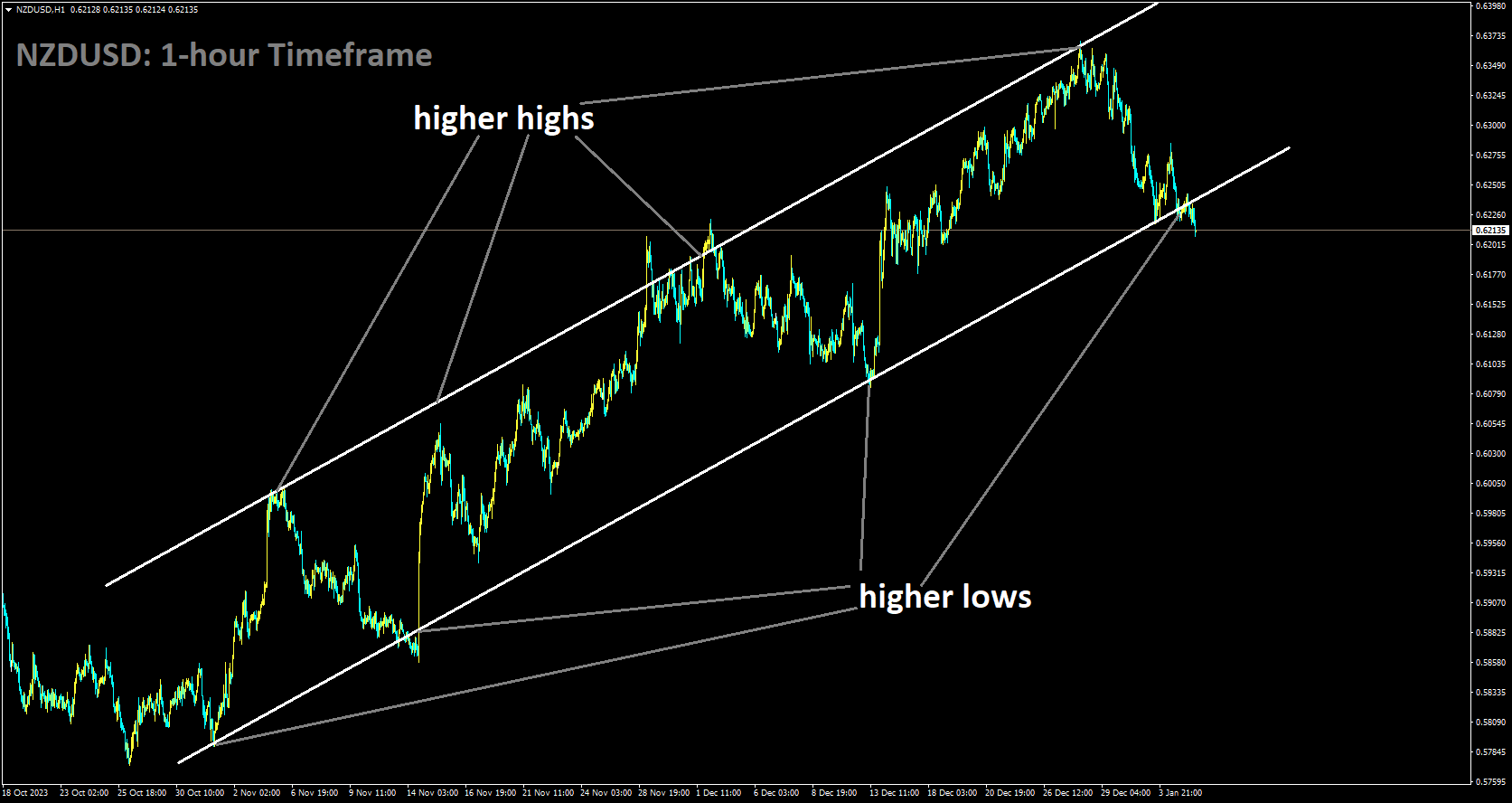

Analysis of NZDUSD:

NZDUSD is moving in Ascending channel and market has reached higher low area of the channel

Chinese Services Purchasing Managers’ Index figures have exceeded expectations, but a surge in US labor and jobless claims has prompted investors to retreat to familiar midranges in anticipation of Friday’s US Nonfarm Payrolls labor report. China’s Caixin Services PMI rebounded to 52.9 in December, surpassing the forecasted increase from November’s 51.5 to 51.6. Alongside China’s better-than-expected performance in the Manufacturing component of the Caixin PMIs, the risk appetite in the Asian market session firmly shifted to a risk-on mode.

Surprisingly, the US ADP Employment Change for December saw a significant increase, reaching 164K, comfortably surpassing the expected 115K and outperforming November’s 101K ADP job additions. US Initial Jobless Claims also outperformed expectations, with 202K new jobless benefit applicants for the week ending December 29, compared to the projected 216K and a further drop from the previous week’s 220K. The current forecast for Friday’s US Nonfarm Payrolls (NFP) suggests a decrease from November’s 199K to 170K in December, and the annualized Average Hourly Earnings growth for December is expected to dip slightly from 4.0% to 3.9% on a month-over-month basis.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/