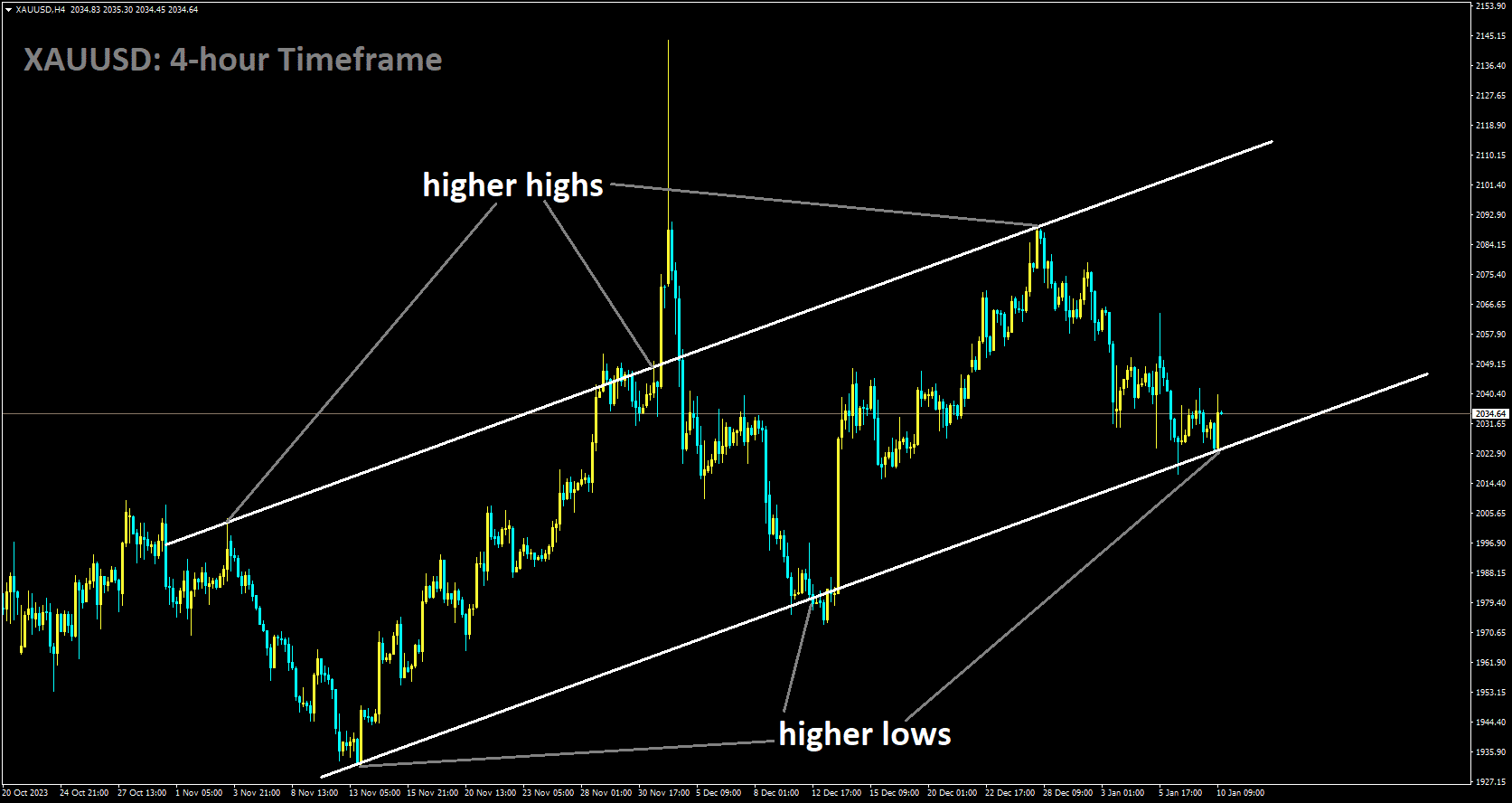

Analysis of Gold:

XAUUSD is moving in Ascending channel and market has reached higher low area of the channel

As we enter the European session on Wednesday, the price of gold continues to decline, moving even closer to the nearly three-week low observed on Monday. The decreasing likelihood of a more aggressive policy easing by the Federal Reserve (Fed) in 2024 is boosting US Treasury bond yields. This, in turn, provides support to the US Dollar and diverts investment away from gold, which doesn’t yield interest.

However, geopolitical tensions arising from the Israel conflict and persistent concerns regarding a sluggish economic recovery in China, the world’s second-largest economy, could provide some support to the safe-haven gold price. Traders may exercise caution and avoid making significant directional bets, choosing to wait for the release of the latest Consumer Price Index (CPI) data from the United States on Thursday. The upcoming US CPI report will shape expectations regarding the Fed’s future policy actions, which will, in turn, influence USD demand and determine the short-term trajectory of gold.

The uncertainty surrounding when the Federal Reserve will start cutting interest rates is holding back traders from taking new positions in gold. The New York Fed reported on Monday that consumer inflation expectations in the US dipped to their lowest point in nearly three years in December, heightening speculations of an imminent shift in the Fed’s policy stance. On the other hand, the resilient US economy, marked by above-target inflation, allows the US central bank more flexibility to maintain higher interest rates for a longer duration. This situation keeps the yield on the benchmark 10-year US government bond above the 4.0% threshold, strengthening the US Dollar and capping gold’s performance. Despite these factors, bearish traders seem hesitant and prefer to wait on the sidelines in anticipation of the forthcoming US consumer inflation figures, set to be unveiled on Thursday.

In recent developments, CNBC reported late on Tuesday that Iran-backed Houthi militants executed their largest attack to date on commercial merchant vessels, according to a senior US Defense Department official. Meanwhile, a senior official from the People’s Bank of China stated on Wednesday that the central bank might employ monetary policy tools to support reasonable credit growth. The official further mentioned that the PBoC intends to strengthen its counter-cyclical and cross-cycle policy adjustments to foster favorable conditions for the country’s economic growth. As for scheduled market-moving macroeconomic data from the US on Wednesday, there is none, leaving the XAUUSD pair susceptible to the dynamics of the USD price.

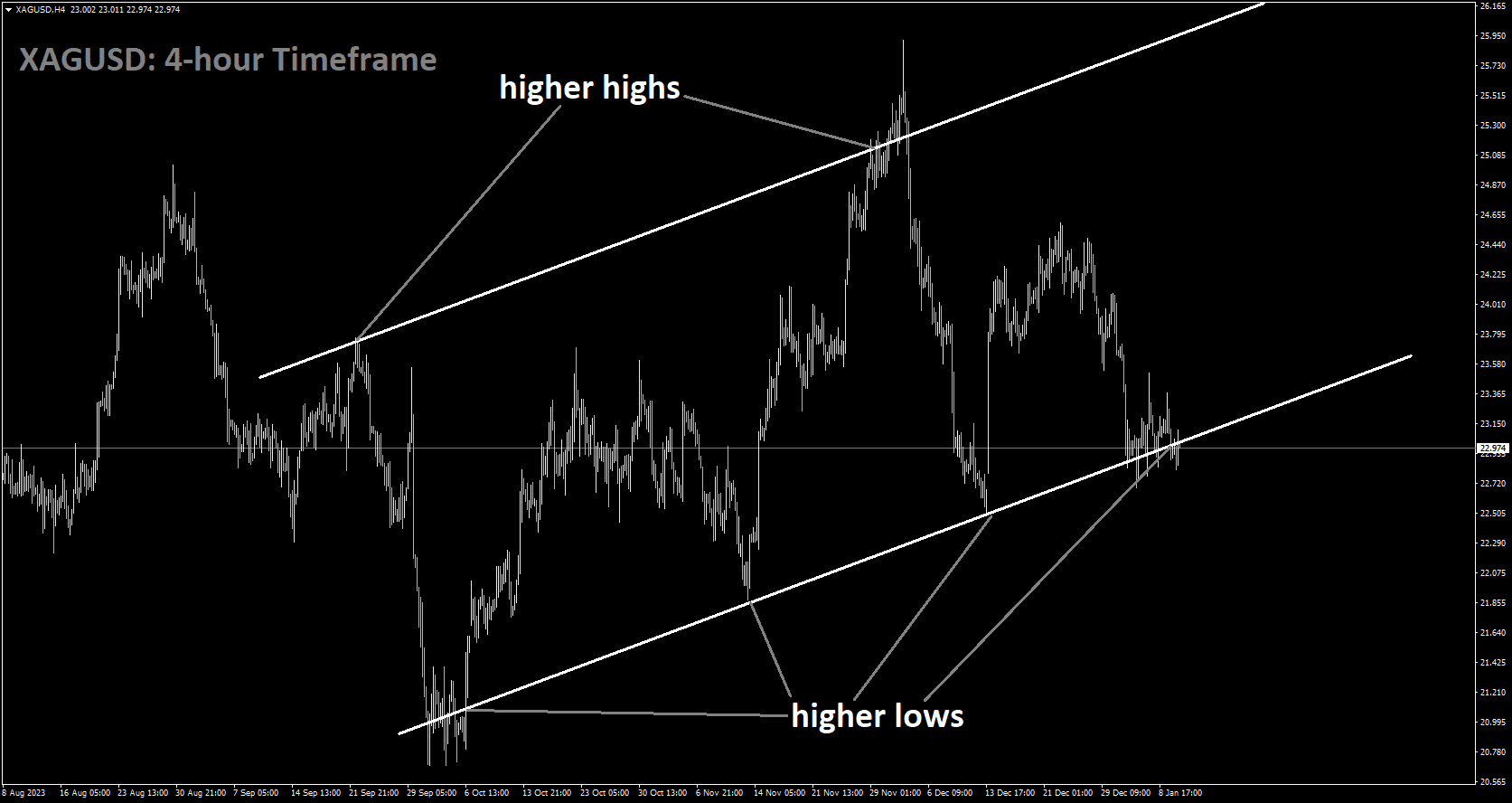

Analysis of Silver:

XAGUSD is moving in Ascending channel and market has reached higher low area of the channel

On Tuesday, the US Dollar gained strength against other currencies as market participants adopted a cautious stance in anticipation of eagerly awaited inflation data set to be released on Thursday. As we move into Wednesday, the major currency pairs appear relatively stable. The potential influence on currency valuations looms with forthcoming comments from central bankers and the scheduled 10-year US Treasury note auction later in the day. The benchmark 10-year US Treasury bond yield remains firmly above the 4% mark, while the USD Index maintains its position above 102.50. Notably, New York Federal Reserve (Fed) President John Williams, who had previously stated in December that rate cuts were not under discussion, is scheduled to deliver a speech.

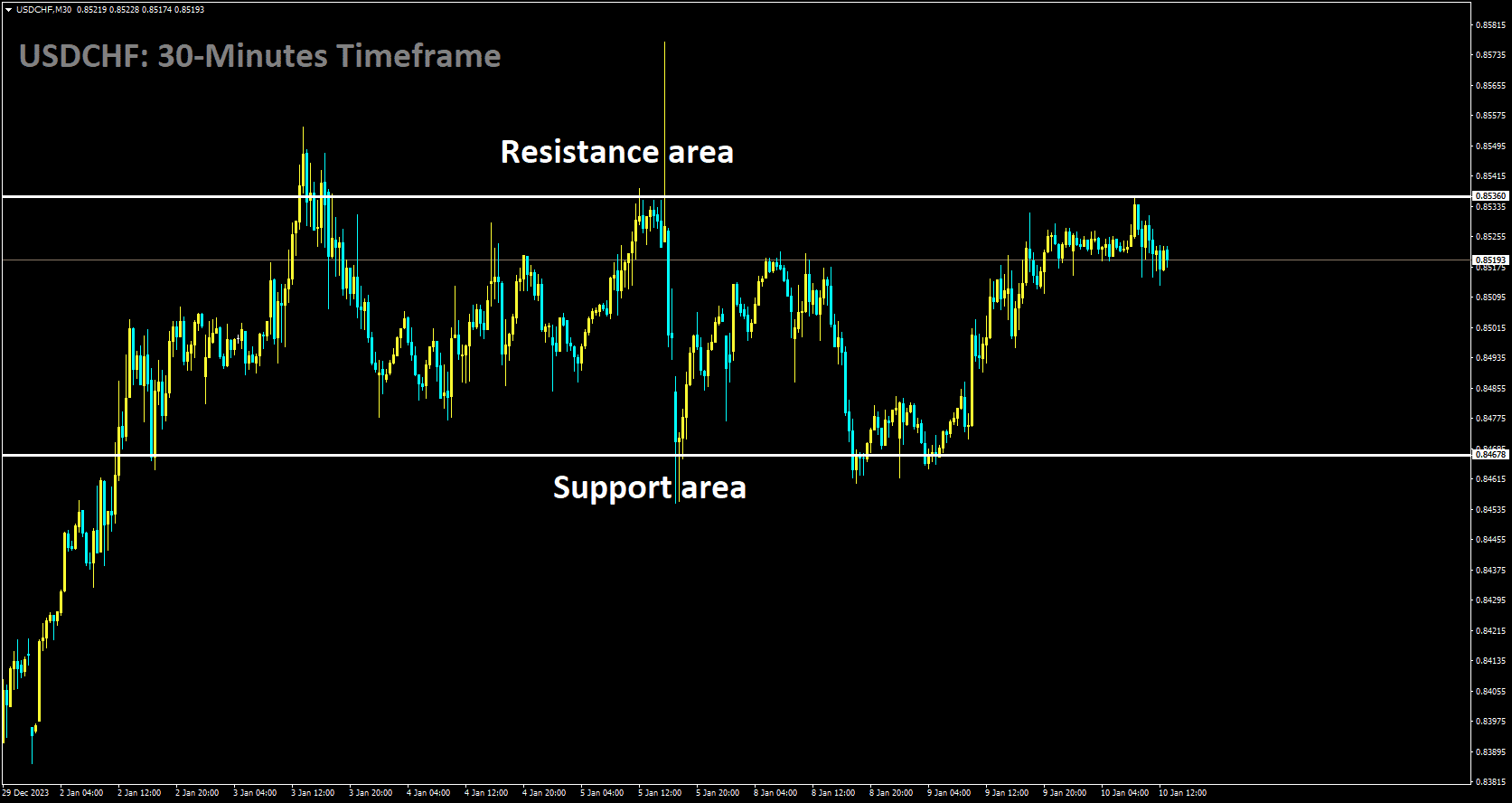

Analysis of USDCHF:

USDCHF is moving in box pattern and market has fallen from the resistance area of the pattern

The US Dollar Index is holding steady above the 102.50 level, supported by stable US bond yields, with the 2-year and 10-year yields at 4.35% and 4.02%, respectively. The recent risk-on sentiment was ignited by remarks made earlier in the week by Atlanta Federal Reserve President Raphael W. Bostic, speculating on potential interest rate cuts by the end of 2024. This has placed downward pressure on the US Dollar, as Bostic cited a greater-than-expected decline in inflation and expressed the expectation of two quarter-point rate cuts by the close of 2024. Additionally, market attention will be focused on Thursday’s release of December’s Consumer Price Index (CPI) data for the United States.

On a contrasting note, Switzerland saw positive economic data on Monday, bolstering the Swiss Franc’s gains. The December Consumer Price Index (YoY) exhibited an increase from 1.4% to 1.7%, while Real Retail Sales improved to 0.7%, surpassing the anticipated flat reading of 0.0%. Tuesday brought further good news as the seasonally adjusted Unemployment Rate improved to 2.2%, up from the previous rate of 2.1%. It’s worth noting that the Swiss National Bank is anticipating an annual loss of approximately 3 billion CHF for the previous year, primarily due to the robust strength of the Swiss Franc, which has offset capital gains derived from the bank’s equity and bond portfolios denominated in foreign currencies.

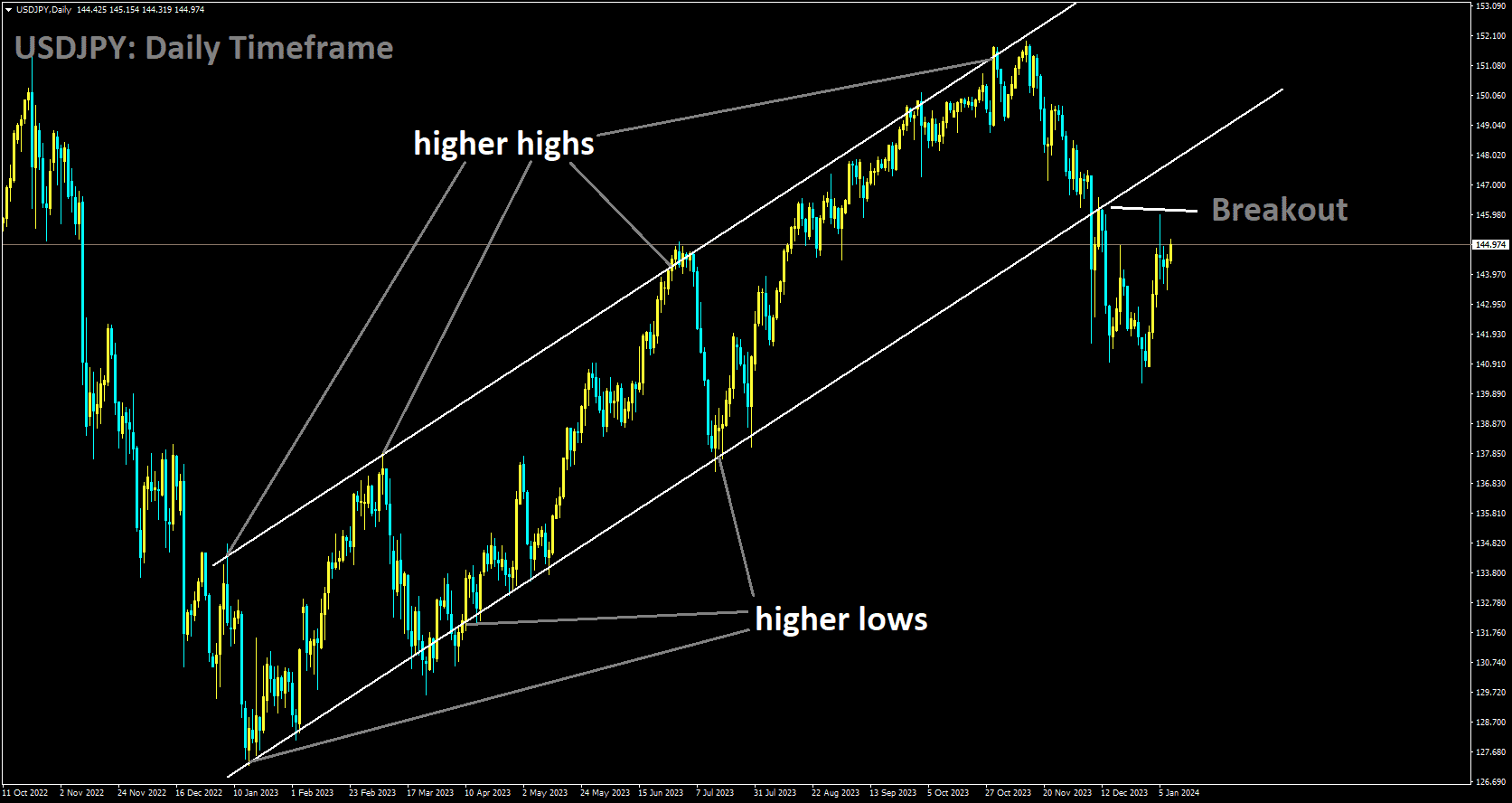

Analysis of USDJPY:

USDJPY has broken Ascending channel in downside

Data released on Tuesday indicated a decline in inflation rates in Tokyo. Furthermore, the Labor Ministry’s report today revealed that real wages in Japan contracted for the 20th consecutive month in November, reinforcing expectations that the Bank of Japan (BoJ) will maintain its highly accommodative policy stance at the January 22-23 meeting. This, combined with government stimulus measures following a destructive earthquake, is likely to postpone the BoJ’s plan to move away from negative interest rates. Additionally, the stable performance of equity markets undermines the safe-haven status of the Japanese Yen (JPY), providing support to the USD/JPY pair. However, the restrained movement of the US Dollar, driven by uncertainty regarding the Federal Reserve’s rate-cut trajectory, is preventing bullish sentiment and limiting potential gains. Market participants also appear cautious and are opting to await the release of the latest consumer inflation data from the United States on Thursday.

The Japanese Yen continues to weaken following the Labor Ministry’s report on Wednesday, which disclosed that inflation-adjusted real wages had decreased by 3.0% in November compared to the previous year. Furthermore, nominal pay for Japanese workers only grew by a modest 0.2% in November, marking the slowest increase in nearly two years, in contrast to a 1.5% rise in the preceding month. This follows Tuesday’s data, which revealed that Tokyo’s core Consumer Price Index had decelerated to a 2.1% year-on-year rate in December, matching a low recorded in June 2022.

These developments further diminish hopes of a hawkish shift by the Bank of Japan, which considers wage trends and inflation projections as pivotal factors in its deliberations on reversing its negative interest rate policy. The Asahi newspaper reported that the Japanese government is contemplating doubling budget reserves to 1 trillion Yen for the upcoming fiscal year starting in April to cover the expenses associated with earthquake reconstruction. Japanese Prime Minister Fumio Kishida’s cabinet also approved 4.74 billion Yen in spending from fiscal 2023/24 reserves for items such as water, food, diapers, and heaters.

The yield on the 10-year US government bond remains steady above the 4.0% threshold, as expectations for an early interest rate cut have diminished, lending support to the US Dollar. The fundamental backdrop suggests the potential for further appreciation in the USD/JPY pair, although bullish traders may choose to await the release of US consumer inflation figures on Thursday before making significant moves.

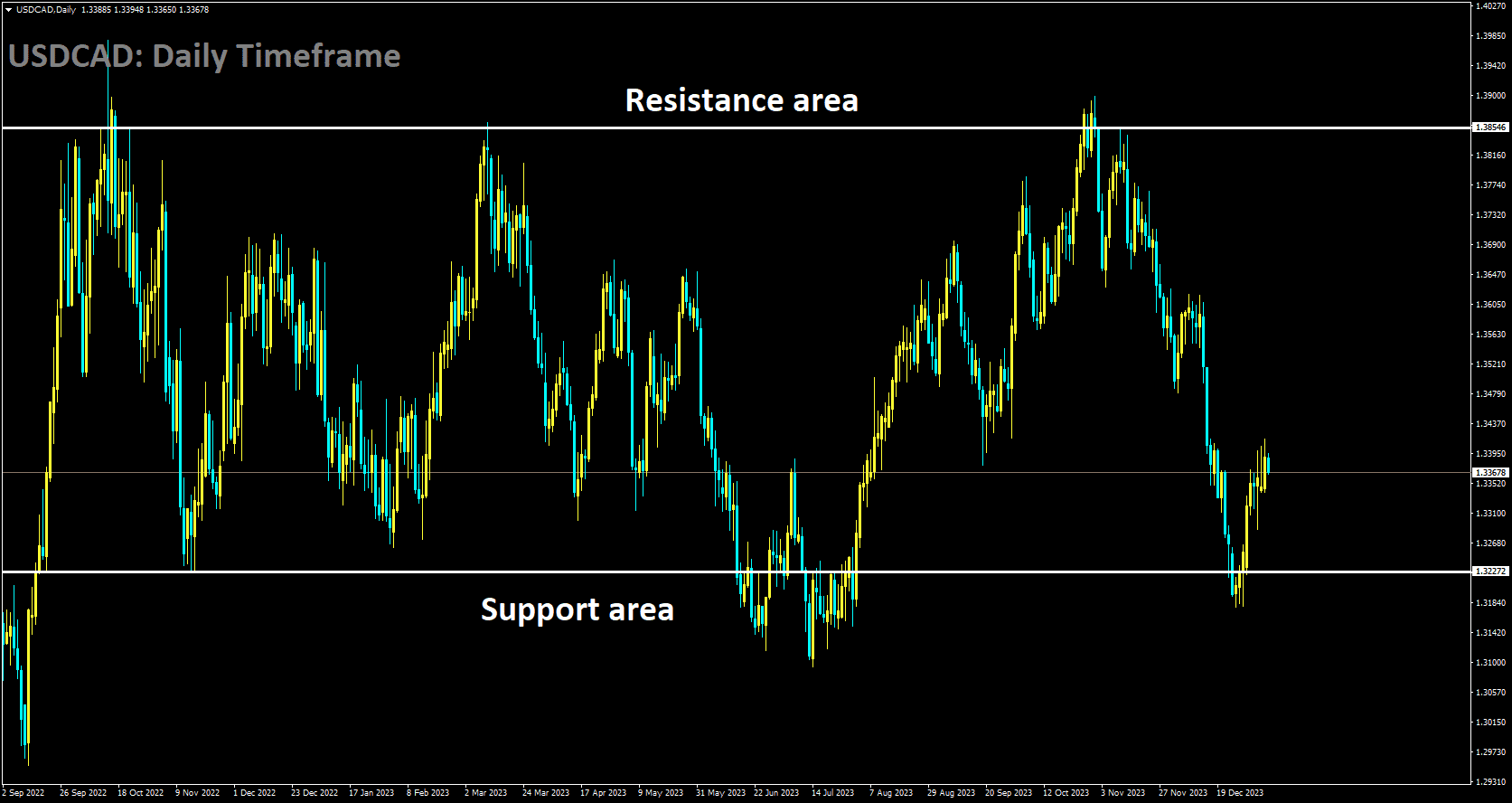

Analysis of USDCAD:

USDCAD is moving in box pattern and market has rebounded from the support area of the pattern

The Canadian Dollar continued to weaken as Canada’s International Merchandise Trade in November retreated from the 14-month high reached in October. Additionally, Canadian Building Permits for November registered a nearly 4% decline. While Crude Oil attempted to recover from Monday’s downturn, it struggled to gain significant upward momentum, resulting in Crude Oil remaining relatively flat for the week as buyers found it challenging to push prices higher. Canada’s trade balance is moving back towards the average as November’s International Merchandise Trade Balance decreased from October’s 14-month peak of CAD 3.2 billion to CAD 1.57 billion, with October receiving an upward revision from CAD 2.97 billion.

Moreover, Canada’s Building Permits for November fell more than anticipated, dropping by 3.9% compared to the forecast of -1.7%. October’s Building Permits, on the other hand, increased by 3% following a positive revision from 2.3%.

In the United States, the trade deficit decreased by a smaller margin than expected, with the Goods Trade Balance for November improving slightly from a slightly-revised -90.3 billion to -89.4 billion. November’s US Goods and Services Trade Balance also saw a smaller decline than anticipated, reaching $-63.2 billion compared to the forecast of $-65.0 billion. October’s figure was mildly revised from $-64.3 billion to $-64.5 billion. The market’s primary focus will be on Thursday’s US Consumer Price Index inflation report, where headline CPI inflation is expected to rise to 3.2% YoY in December.

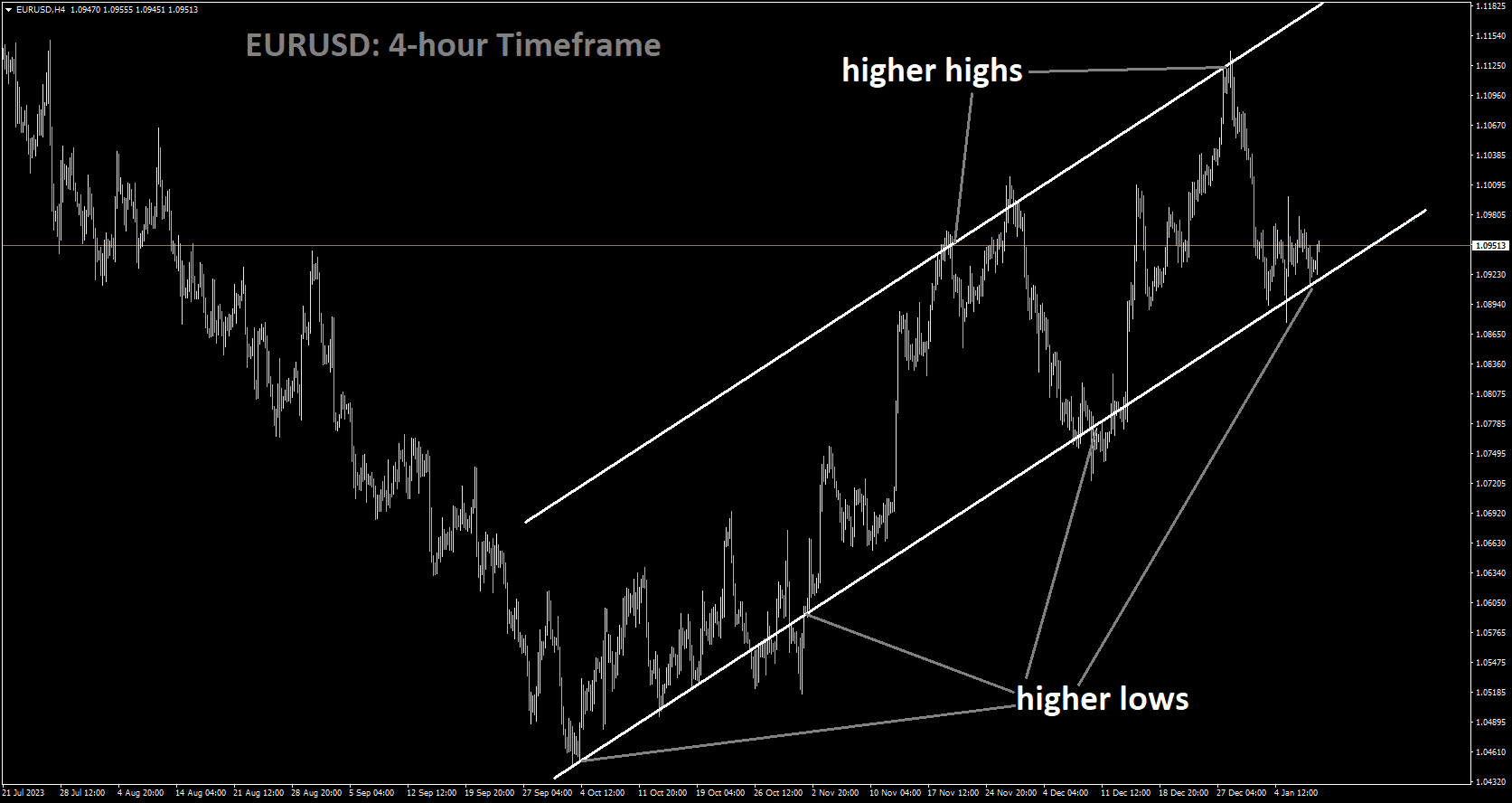

Analysis of EURUSD:

EURUSD is moving in Ascending channel and market has reached higher low area of the channel

Banque de France Governor and European Central Bank (ECB) policymaker François Villeroy de Galhau reiterated his expectation of rate cuts in 2024 during his New Year’s address to the European financial sector on Tuesday. Villeroy, who plays a significant role in shaping European central bank and monetary policy as a member of the ECB’s Governing Council, emphasized that the ECB is poised to lower rates in 2024 as long as unforeseen surprises do not alter the underlying economic fundamentals. He stressed that the ECB will not make any rate adjustments until inflation expectations are firmly anchored at the 2% target. Villeroy also highlighted the ECB’s commitment to data-driven decisions, indicating that central policy planners will not rush but will remain flexible in their approach. He underscored the importance of continued vigilance regarding inflation data.

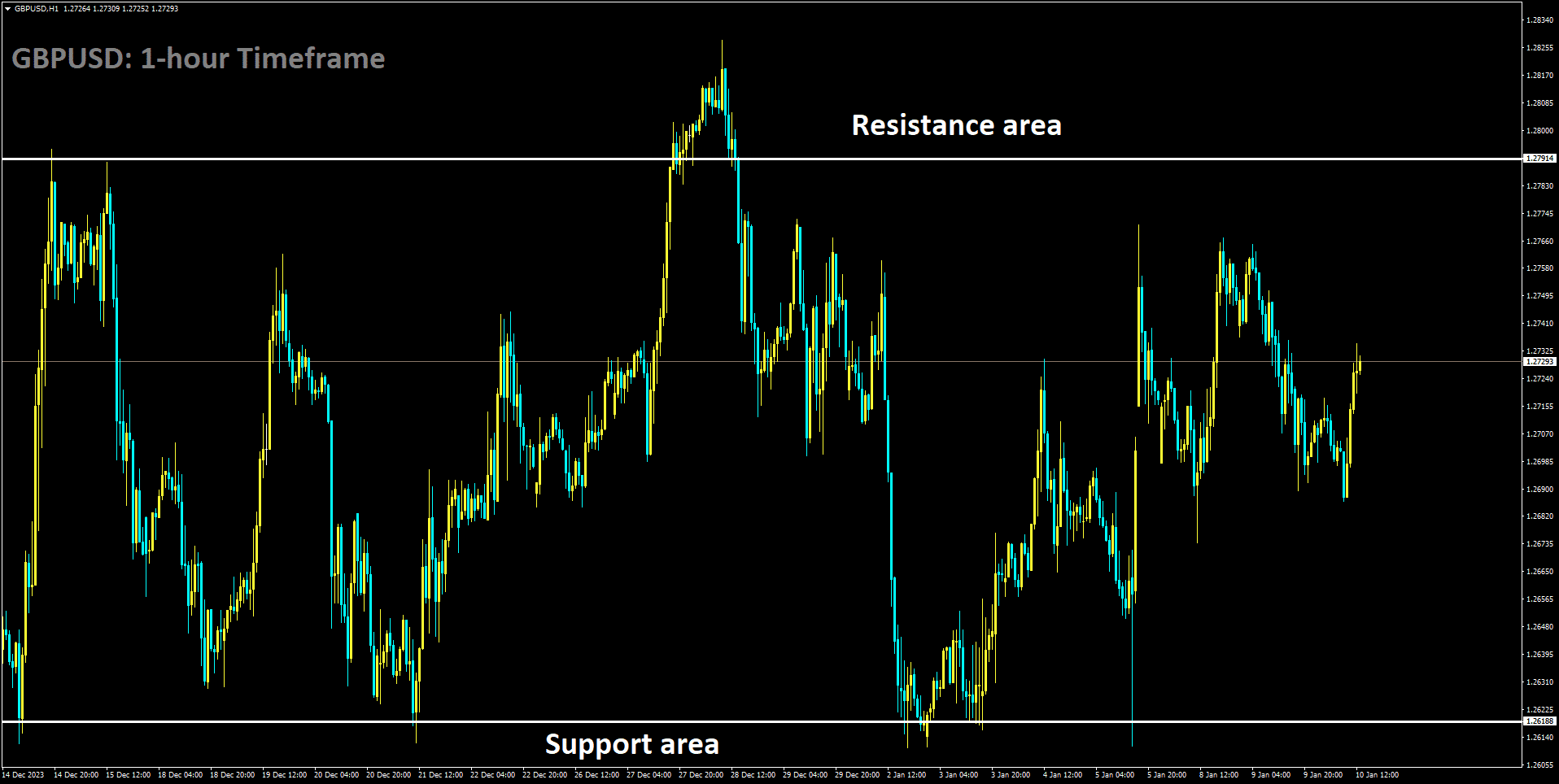

Analysis of GBPUSD:

GBPUSD is moving in box pattern and market has rebounded from the support area of the pattern

An improved market risk appetite, fueled by comments from Federal Reserve (Fed) members speculating about potential rate cuts by the end of 2024, has contributed to a weaker US Dollar. However, a sudden shift towards risk aversion has added pressure, impacting the GBP/USD pair. The US Dollar Index is currently consolidating near 102.50 after recent gains, attempting to extend its profits due to improved US Treasury yields. As of the latest data, the 2-year and 10-year yields on US bond coupons stand at 4.36% and 4.02%, respectively. Nevertheless, the risk-on sentiment triggered by the Federal Reserve’s members’ remarks speculating on interest rate cuts by the end of 2024 has exerted downward pressure on the US Dollar. Atlanta Fed President Raphael W. Bostic mentioned that inflation has declined more than initially anticipated and expressed an expectation of two quarter-point cuts by the end of 2024. Additionally, US Fed Governor Michelle W. Bowman expressed that the current policy stance appears sufficiently restrictive, but it might eventually become appropriate to lower the Fed’s policy rate if inflation falls closer to the 2% target.

The GBPUSD pair has recently exhibited strength, largely influenced by monetary policy differences between the Bank of England and the US Federal Reserve (Fed). The BoE has maintained its stance on further rate hikes, even as indicators like inflation and wage growth show signs of easing. In contrast, expectations are growing that the Fed may initiate an easing cycle as early as March. DeAnne Julius, a former member of the Bank of England’s monetary policy committee, holds a different view regarding interest rates. She believes that the Bank of England won’t be in a position to start cutting interest rates in 2024. Additionally, she mentioned that escalating tensions in the Middle East could potentially lead to a new round of energy price increases, triggering a fresh inflation shock. BoE’s Governor Andrew Bailey is scheduled to deliver a speech on Wednesday. Furthermore, UK Manufacturing Production data will be released on Friday, with expectations of growth in November. On the US calendar, December’s Consumer Price Index (CPI) data from the United States will be released on Thursday.

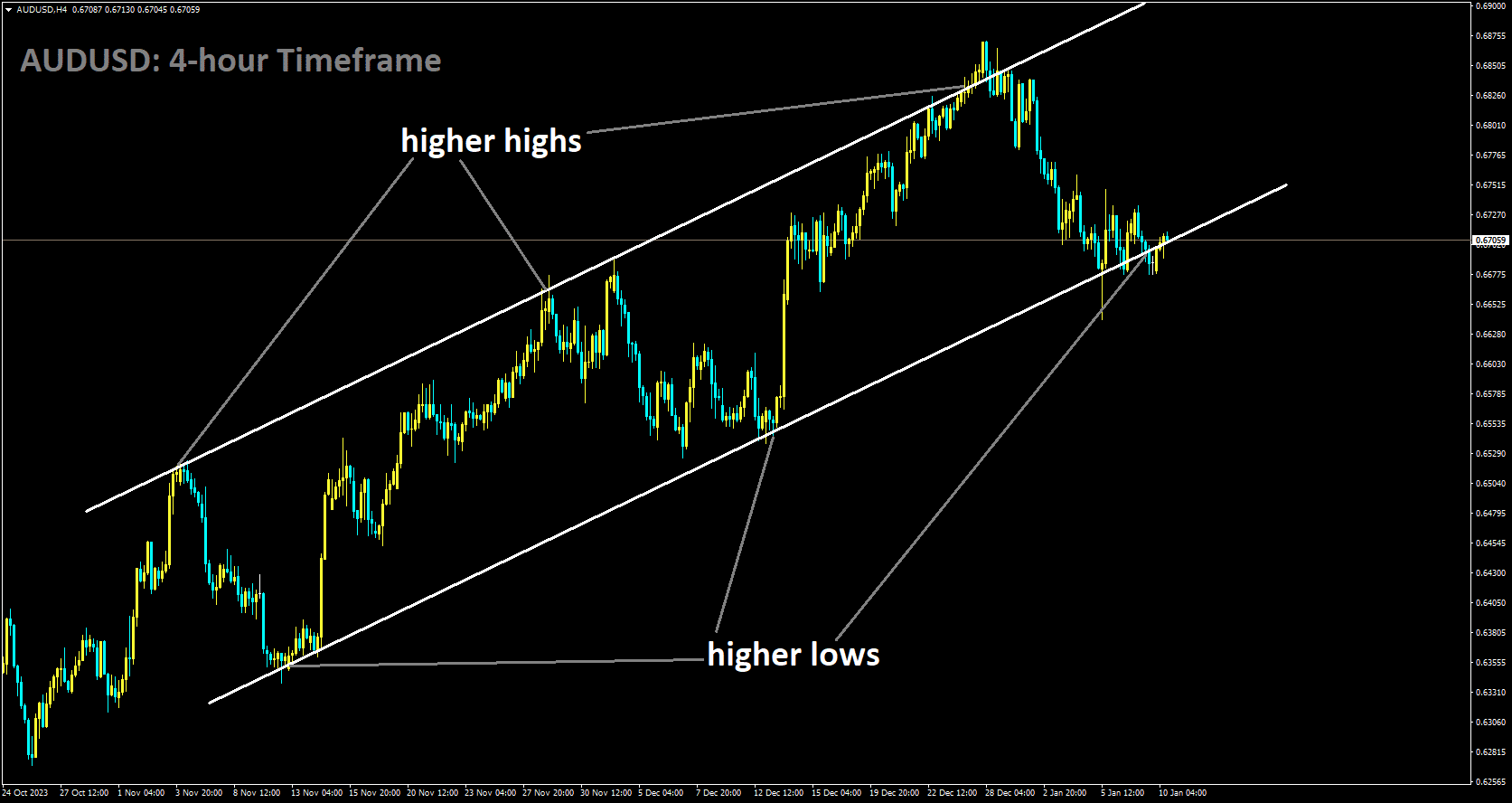

Analysis of AUDUSD:

AUDUSD is moving in Ascending channel and market has reached higher low area of the channel

Australia’s economic data is sending mixed signals. The November Monthly Consumer Price Index showed a slight decrease to 4.3%, slightly below the market’s expectation of 4.4% and down from the previous 4.9%, suggesting a modest easing of year-on-year inflationary pressures. On a more positive note, Australian Retail Sales increased, indicating higher consumer spending. Additionally, the monthly Building Permits data showed growth, defying expectations of a decline. These favorable trends in retail sales and building permits suggest resilience in the domestic economy. The release of Australian Trade Balance data for December is expected to show an increase, potentially indicating improved export performance and contributing positively to the overall economic outlook.

The US Dollar Index is currently moving sideways after experiencing gains, despite weaker US Treasury yields on Tuesday. However, the risk-on sentiment sparked by remarks from Federal Reserve members speculating about interest rate cuts by the end of 2024 may have limited the US Dollar’s profits. Traders are eagerly awaiting the release of December’s Consumer Price Index data from the United States on Thursday, a crucial economic indicator for assessing inflationary pressures and influencing market expectations regarding the Fed’s monetary policy stance.

Australia’s Bureau of Statistics reported seasonally adjusted Retail Sales for November, which increased by 2.0%, surpassing expectations and reversing a previous decline. Building Permits in Australia also grew, contrasting with expectations of a decline. In other news, Chinese wealth manager Zhongzhi Enterprise Group has filed for bankruptcy liquidation, facing substantial liabilities. Atlanta Fed President Raphael W. Bostic mentioned on Monday that inflation has declined more than initially anticipated and expressed the expectation of two quarter-point cuts by the end of 2024. Bostic expressed comfort with the current rate level and emphasized the importance of allowing the Fed’s tight policy time to address inflation.

US Fed Governor Michelle W. Bowman suggested that inflation could decrease further with the policy rate held steady for some time. Bowman stated that the current policy stance appears sufficiently restrictive, but it may become appropriate to lower the Fed’s policy rate if inflation approaches the 2% target. In terms of US economic data, Nonfarm Payrolls rose in December, exceeding expectations. US Average Hourly Earnings (YoY) also improved, and the monthly index remained unchanged. However, the US ISM Services Purchasing Managers Index (PMI) came in below expectations, with the Services Employment Index dropping.

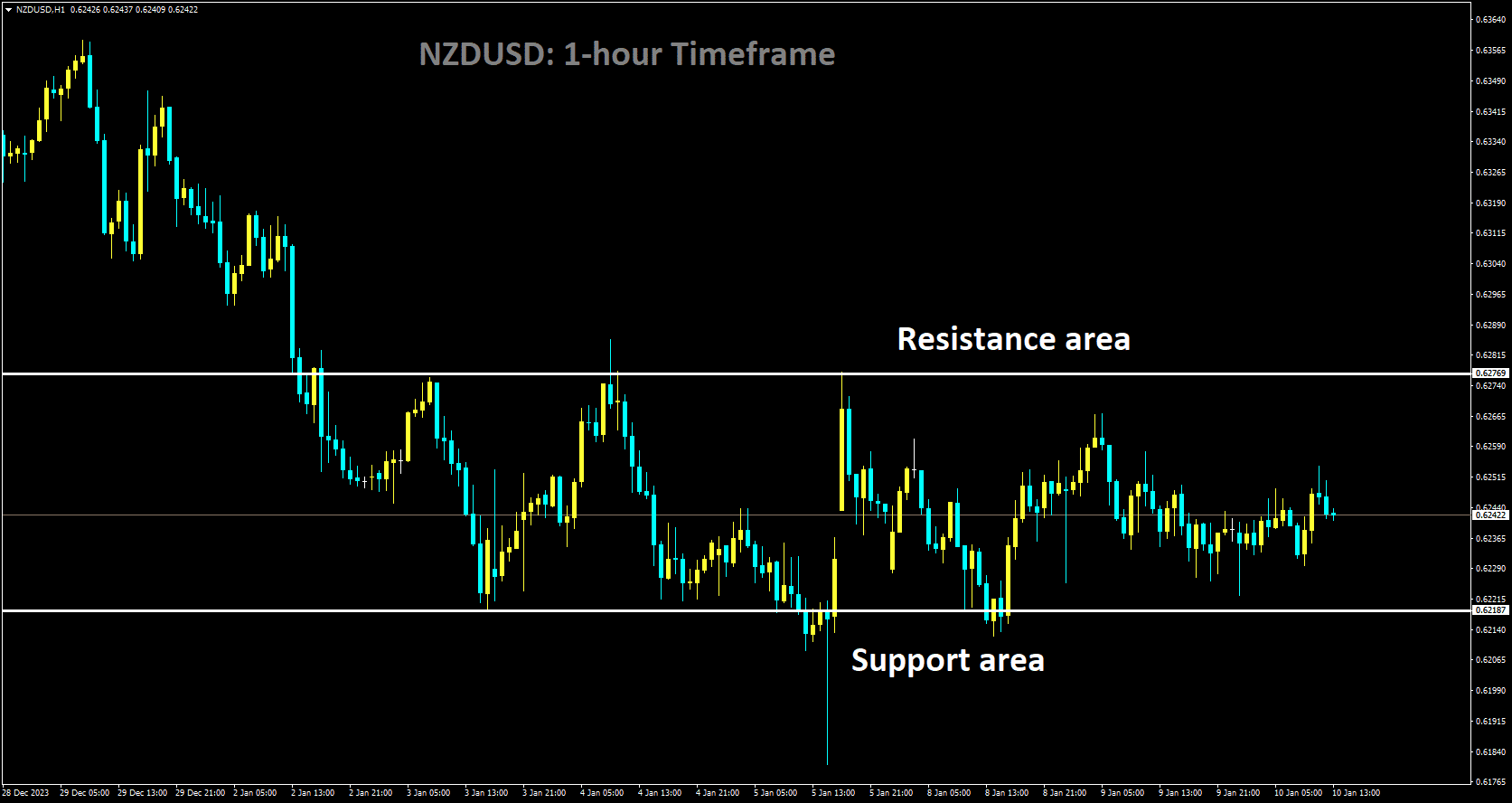

Analysis of NZDUSD:

NZDUSD is moving in box pattern

The New Zealand Dollar faced losses against the US Dollar, and traders are now anticipating the release of November’s Building Permits data from New Zealand, following a substantial increase reported in October. Positive Kiwi Consumer Confidence and Business Confidence figures for November have strengthened the belief that the Reserve Bank of New Zealand will maintain a hawkish stance by refraining from policy easing in the upcoming meeting, contributing to a favorable outlook for the New Zealand Dollar. Furthermore, attention is likely to turn to Friday’s Chinese Consumer Price Index and Producer Price Index figures, given the close economic ties between China and New Zealand.

The US Dollar Index is holding steady following recent gains, despite uncertain US Treasury yields. Currently, the 2-year and 10-year yields on US bonds stand at certain levels. The Greenback may find support if risk aversion sentiment strengthens ahead of the release of December’s Consumer Price Index (CPI) data from the United States, scheduled for Thursday. Investors are keenly observing signals from the Federal Reserve regarding the trajectory of interest rates. While higher interest rates could potentially weigh on overall demand, leading to subdued economic growth and a softer job market, the consensus suggests that the Fed is unlikely to implement any rate cuts in its upcoming January policy meeting.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/