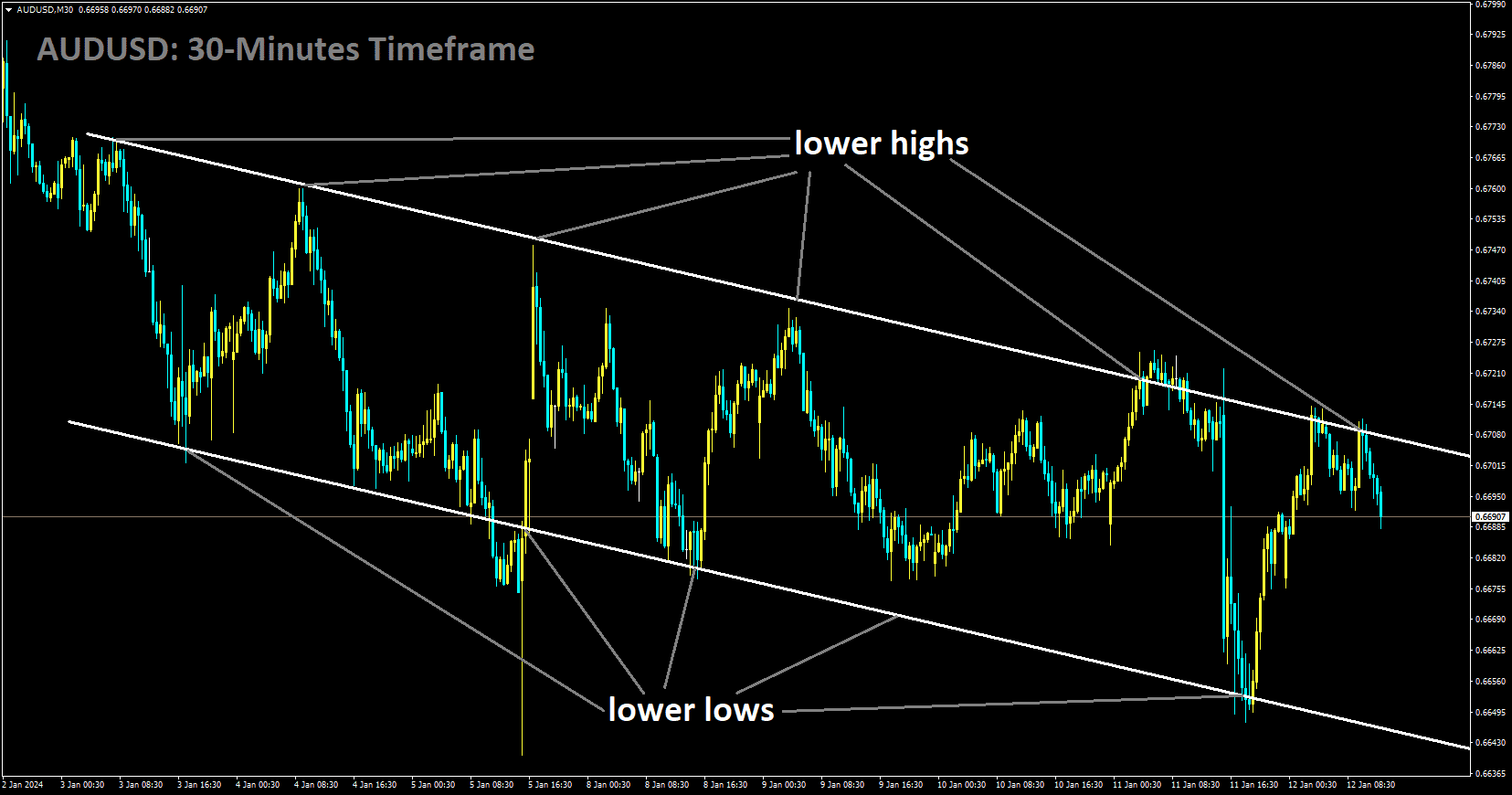

AUDUSD Analysis:

AUDUSD is moving in Descending channel and market has fallen from the lower high area of the channel

The economic outlook for China remains uncertain, with TD Securities’ economists providing their projections for fiscal and monetary policies in the upcoming year. Despite stimulus measures introduced in the fourth quarter of 2023, China’s economic momentum entering 2024 appears modest.

Policymakers will closely monitor economic data for the first quarter of 2024 before revising their assessment of the economic path ahead. Expectations are that authorities will maintain an active stance, utilizing both fiscal and monetary tools to aim for approximately 5% GDP growth for the year.

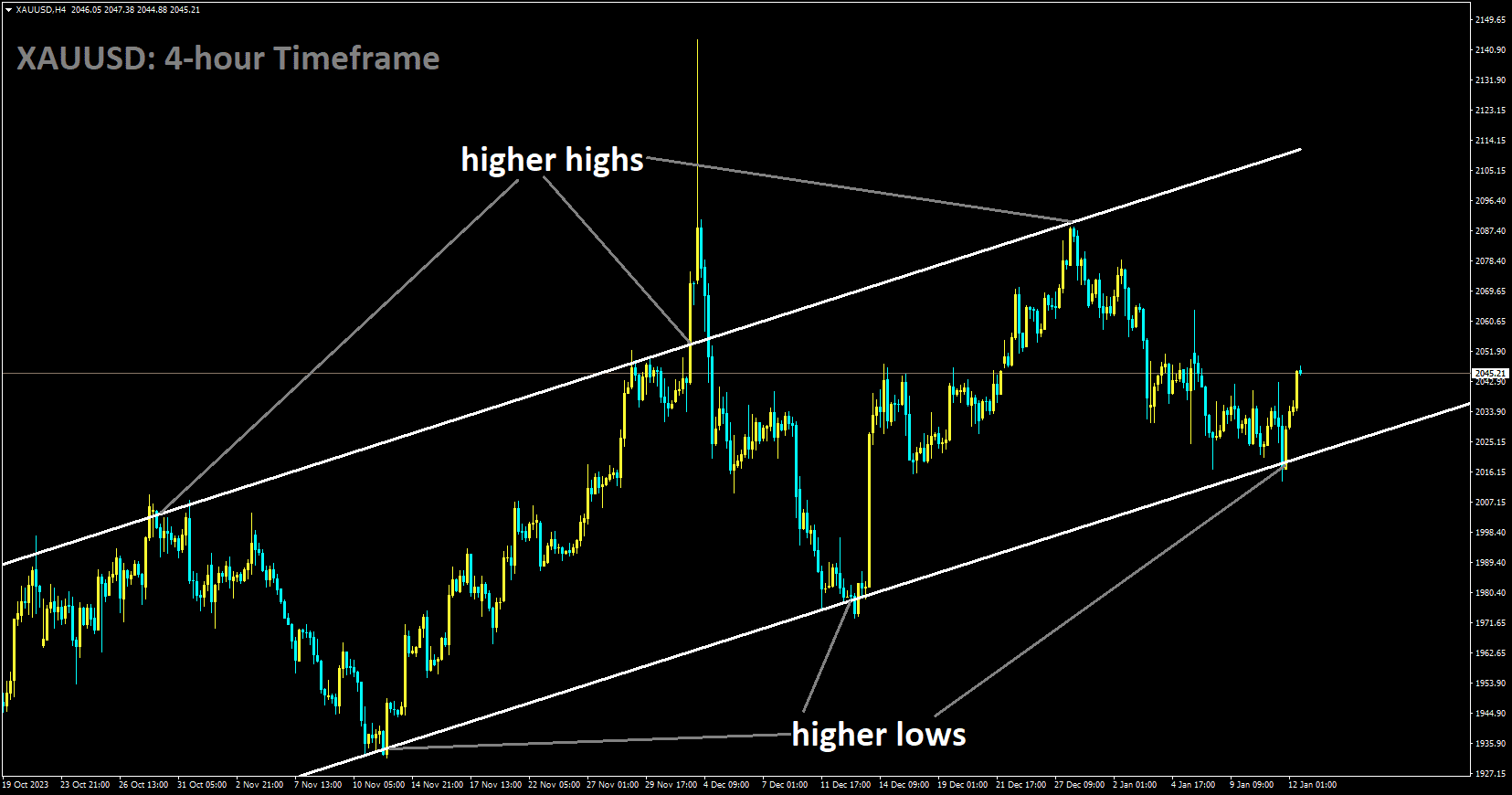

XAUUSD Analysis:

XAUUSD is moving in Ascending channel and market has rebounded from the higher low area of the channel

During the early European trading session, the precious metal continued its upward trend for the day, driven by increased demand for safe-haven assets amid concerns of potential geopolitical tensions in the Middle East. However, gold is still trading below the critical resistance zone of $2,040-2,042, indicating caution among bullish traders due to uncertainty surrounding the Federal Reserve’s stance on interest rates.

The recent release of slightly higher US consumer inflation figures on Thursday, along with hawkish comments from Fed officials, has led investors to adjust their expectations of aggressive policy easing. This adjustment has provided support to US Treasury bond yields and the US Dollar (USD), potentially limiting gains for gold, which does not yield interest. Nonetheless, the market still anticipates a higher likelihood of a Fed rate cut in March, which should provide a floor for the non-yielding yellow metal. In the short term, traders are closely monitoring the US Producer Price Index (PPI) and a speech by Minneapolis Fed President Neel Kashkari for market direction. The mixed US consumer inflation figures have raised the possibility that the Federal Reserve may postpone an anticipated rate cut in March, causing gold prices to drop to a one-month low on Thursday. In December, the headline US Consumer Price Index (CPI) increased from a year-on-year rate of 3.1% to 3.4%, while the core CPI recorded its smallest yearly increase since May 2021. Cleveland Fed President Loretta Mester commented on the CPI data, suggesting that it might be premature for the central bank to lower interest rates at the March policy meeting. Richmond Fed Chief Tom Barkin also stated that the central bank needs to be confident that inflation is moving toward the target before considering rate cuts, indicating a potential shift in policy once inflation reaches 2%. Chicago Fed President Austan Goolsbee added that the central bank remains comfortable with its approach to inflation and will assess policy restrictiveness as inflation continues to decline.

Market sentiment, as reflected in the CME Group’s FedWatch Tool, still indicates a more than 65% probability of a rate cut in March, providing support for gold. Additionally, the yield on the 10-year US government bond remains below the 4.0% threshold, keeping pressure on the US Dollar and benefiting gold. Furthermore, recent military actions by US and UK forces against Houthi targets in response to attacks on ships in the Red Sea have heightened geopolitical tensions, potentially adding further support to gold. US President Joe Biden has expressed willingness to take further measures following airstrikes on Houthi targets in Yemen, and UK Prime Minister Rishi Sunak has emphasized their commitment to safeguarding freedom of navigation and trade flow. Chinese inflation data released on Friday has raised deflationary concerns, and a 0.3% drop in imports for 2023 indicates sluggish domestic demand, contributing to worries about a slow economic recovery. In summary, gold seems poised to conclude the week with losses for the second consecutive week, with traders closely monitoring the US Producer Price Index and Minneapolis Fed President Neel Kashkari’s speech for potential market catalysts.

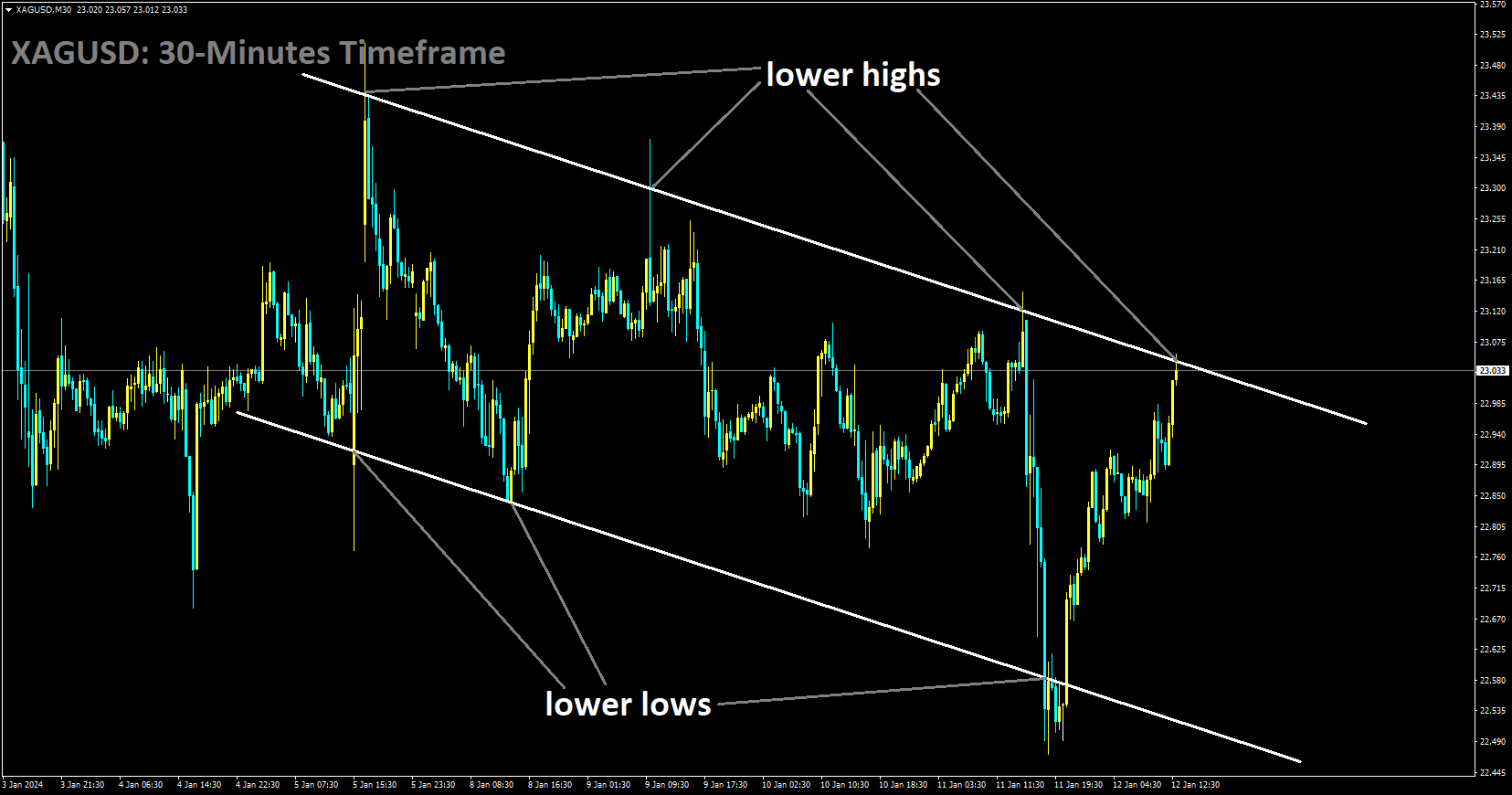

XAGUSD Analysis:

XAGUSD is moving in Descending channel and market has reached lower high area of the channel

Following the release of December inflation figures on Thursday, the US Dollar initially showed strength against other currencies but failed to sustain its momentum as US Treasury bond yields declined during the later part of the American session. While markets remained relatively calm early on Friday, the upcoming Producer Price Index (PPI) data for December from the US has the potential to increase volatility as the weekend approaches. According to the US Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) rose by 3.4% on a yearly basis in December, exceeding market expectations of a 3.2% increase. The Core CPI, which excludes volatile components like food and energy prices, increased by 0.3% on a monthly basis, in line with forecasts. After the release of the inflation report, the USD Index surged to a five-day high of 102.76. However, it ended the day with little change below 102.50, as the yield on the benchmark 10-year US Treasury bond failed to hold above 4%. In China, data showed that the Consumer Price Index (CPI) in December increased by 0.1% on a monthly basis, rebounding from a 0.5% decrease observed in November.

Additionally, China’s trade surplus widened to $75.34 billion in December from $68.39 billion, surpassing market expectations of a surplus of $74.75 billion. Despite these positive economic indicators, both the Shanghai Composite and the Hang Seng indexes were trading flat at the time of reporting.

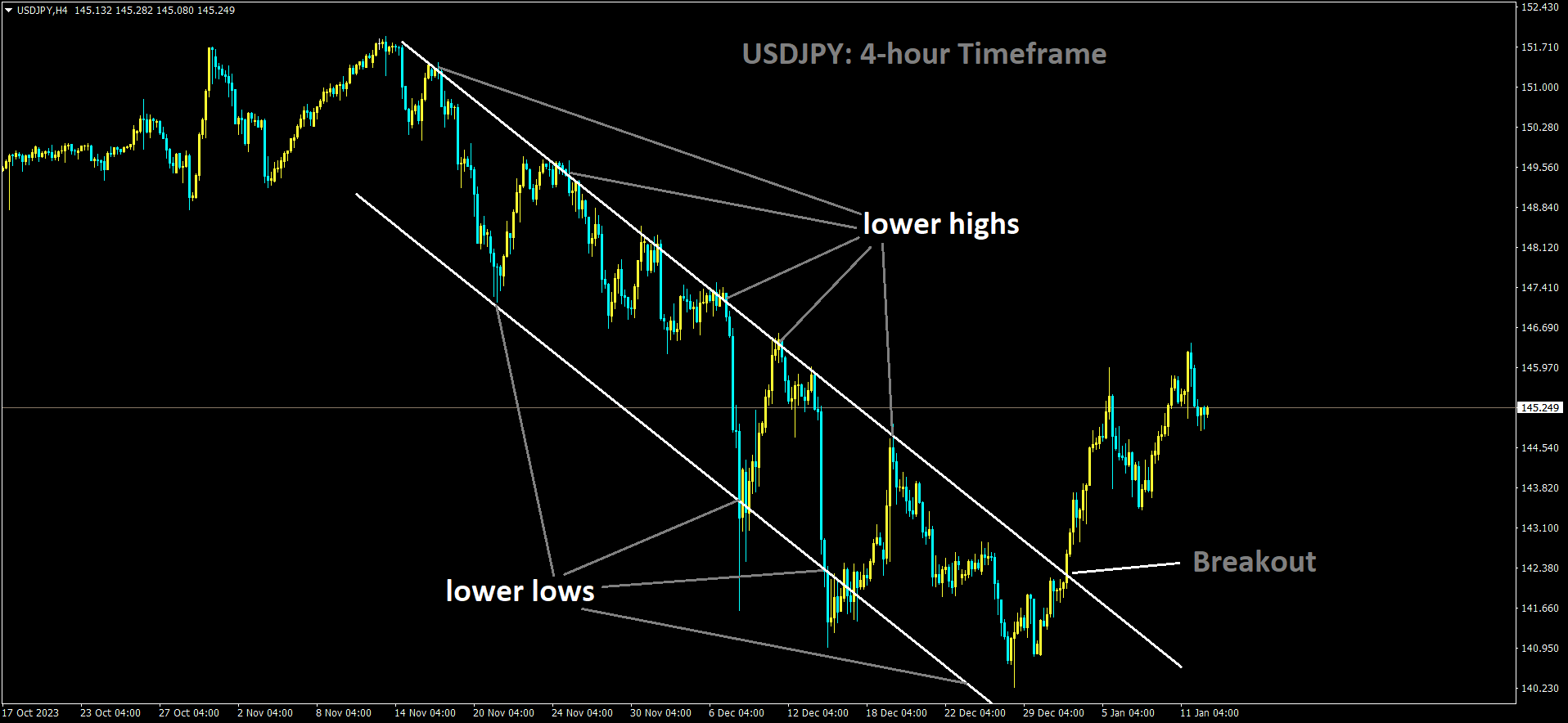

USDJPY Analysis:

USDJPY has broken the Descending channel in upside

On Friday, the Japanese Yen continued its upward momentum for the second consecutive day against the US Dollar, recovering further from a one-month low it had reached following the release of US consumer inflation figures. This rise in the Yen’s value can be attributed to several factors. Firstly, amid China’s economic challenges, the Japanese Yen is benefiting from its relative safe-haven status, especially with the potential for increased geopolitical tensions in the Middle East looming in the background. Secondly, the US Dollar remained subdued in terms of price action, which put downward pressure on the USDJPY currency pair. The recent headlines regarding a slightly higher US Consumer Price Index and comments from Federal Reserve officials have led to speculation that US interest rates may remain elevated for a longer period. However, the market still anticipates a possible shift in the Fed’s policy stance in March. This, in turn, has had an impact on US Treasury bond yields and has weighed on the US Dollar. Despite these factors, the downside for the USDJPY pair is somewhat cushioned by the growing consensus that the Bank of Japan (BoJ) is unlikely to deviate from its ultra-dovish monetary policy stance. Given this mixed fundamental backdrop, it is advisable to wait for more pronounced selling pressure before considering fresh bearish positions, confirming that the recent recovery of the USDJPY pair from multi-month lows has reached its limits. Traders are now closely watching the US Producer Price Index and a speech by Minneapolis Fed President Neel Kashkari, as these events could influence the US Dollar and provide further market direction. Nevertheless, it appears that the currency pair is set to end the week with gains for the second consecutive week. It is expected that the Bank of Japan will maintain its ultra-loose monetary policy settings at its upcoming meeting on January 22-23, which continues to weigh on the Japanese Yen. Additionally, the US consumer inflation figures released on Thursday have cast doubt on the likelihood of a rate cut by the Federal Reserve in March, offering some support to the USDJPY pair. The US Labor Department reported that the headline US CPI increased by 0.3%, with a year-on-year rise from 3.1% to 3.4% in December. Excluding the volatile food and energy prices, the core CPI increased by 0.3% last month and rose 3.9% year-on-year in December, marking its smallest gain since May 2021. Comments from Cleveland Fed President Loretta Mester and Richmond Fed Chief Tom Barkin suggested that the central bank is not in a rush to lower interest rates in March. However, they indicated that the Fed would consider rate cuts once inflation is on track to reach its 2% target. In a separate development, reports emerged of attacks by US and UK forces against multiple Houthi targets in response to repeated drone and missile attacks on ships in the Red Sea. This geopolitical situation adds another layer of complexity to the market. Traders will be closely monitoring the US Producer Price Index for fresh insights, with expectations of a 1.3% year-on-year increase in December, up from the previous 0.9%. The core PPI is expected to tick down to 1.9% from November’s 2.0%.

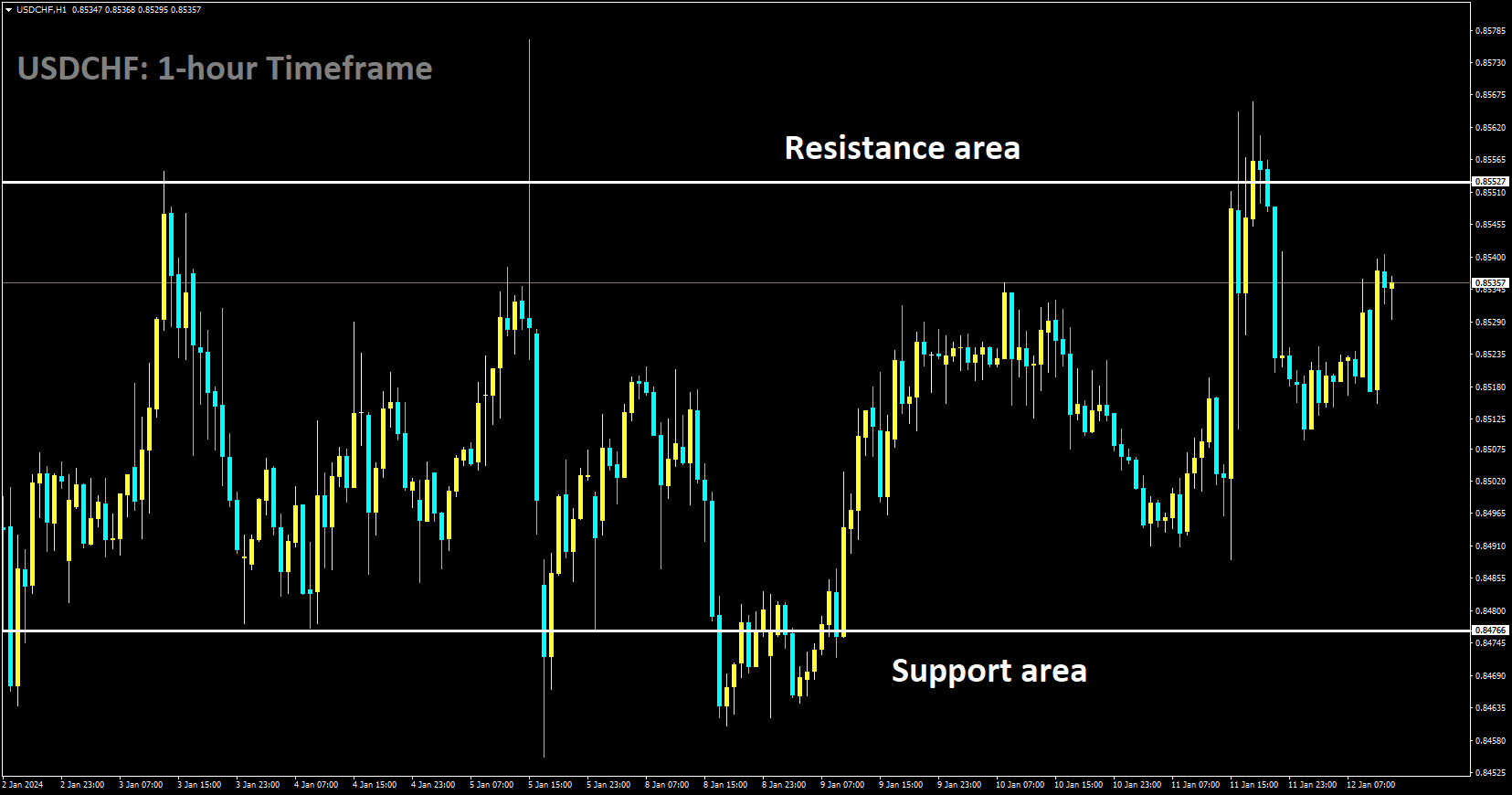

USDCHF Analysis:

USDCHF is moving in box pattern market has fallen from the resistance area of the pattern

While the stronger US Dollar, driven by positive US inflation data, may provide some support to the USD, its potential upside against the Swiss Franc (USDCHF) could be limited by increasing tensions in the Middle East. Inflation in the United States showed an upward trend in December, with the Bureau of Labor Statistics reporting an annual Consumer Price Index (CPI) increase of 3.4%, up from 3.1% in the previous month, surpassing expectations of 3.2%. On a monthly basis, the CPI rose by 0.3%, compared to a 0.1% increase in November. It’s worth noting that this robust US inflation data, along with positive labor market indicators, might delay the anticipated Federal Reserve rate cut in March. On the flip side, escalating tensions in the Middle East could lead to safe-haven flows into currencies like the Swiss Franc. Recent events have seen US and UK forces conducting strikes against multiple Houthi targets in areas of Yemen controlled by the Houthi rebels.

US President Joe Biden has stated that these actions are a direct response to Houthi attacks on international maritime vessels in the Red Sea. Earlier this week, Switzerland’s Consumer Price Index for December outperformed expectations, rising to 1.7% year-on-year from the previous reading of 1.4%. Additionally, Real Retail Sales for November came in at 0.7%, surpassing the previous figure of -0.3%. Looking ahead, the release of the December US Producer Price Index (PPI) is expected later on Friday, with forecasts indicating a 0.1% month-on-month increase and a 1.3% year-on-year rise. Traders will closely monitor these data releases for potential trading opportunities within the USDCHF pair.

USDCAD Analysis:

USDCAD is moving in box pattern and market has rebounded from the support area of the pattern

The Canadian Dollar has gained strength in response to the rise in crude oil prices, a surge that can be attributed to heightened tensions in the Middle East. The military forces of the United States (US) and United Kingdom, supported by Australia, Bahrain, Canada, and the Netherlands, conducted airstrikes on Houthi targets in Yemen, which is backed by Iran. This action was taken to protect maritime vessels in the Red Sea. The West Texas Intermediate oil price is currently trading near $73.40 per barrel. With no economic data from Canada available for the entire week, traders are eagerly anticipating next week’s release of Canada’s Consumer Price Index data for December and Retail Sales figures for November, scheduled for Tuesday and Friday, respectively. Meanwhile, the US Dollar is facing challenges due to improved risk appetite, leading traders to move away from the Greenback. This shift in sentiment may be linked to speculations about potential rate cuts by the Federal Reserve in March and May. Despite positive US inflation data that provided some support for the US Dollar on Thursday, pushing it higher, the US Consumer Price Index reported a year-on-year increase of 3.4% in December, surpassing both November’s 3.1% and the expected market estimate of 3.2%. Additionally, the monthly CPI growth for December exceeded market projections, with a 0.3% increase compared to the anticipated 0.2%.

However, the annual Core CPI showed a slight easing to 3.9% from the previous reading of 4.0%, while the monthly figure remained steady at 0.3%, in line with expectations. Looking ahead, traders are eagerly awaiting the release of the US Producer Price Index data for December, along with a speech by Federal Reserve member Neel Kashkari later in the North American session. These events are expected to provide further insights into the economic landscape of the United States. Despite this, the US Dollar Index is trading slightly lower, hovering around 102.20, despite improved US Treasury yields.

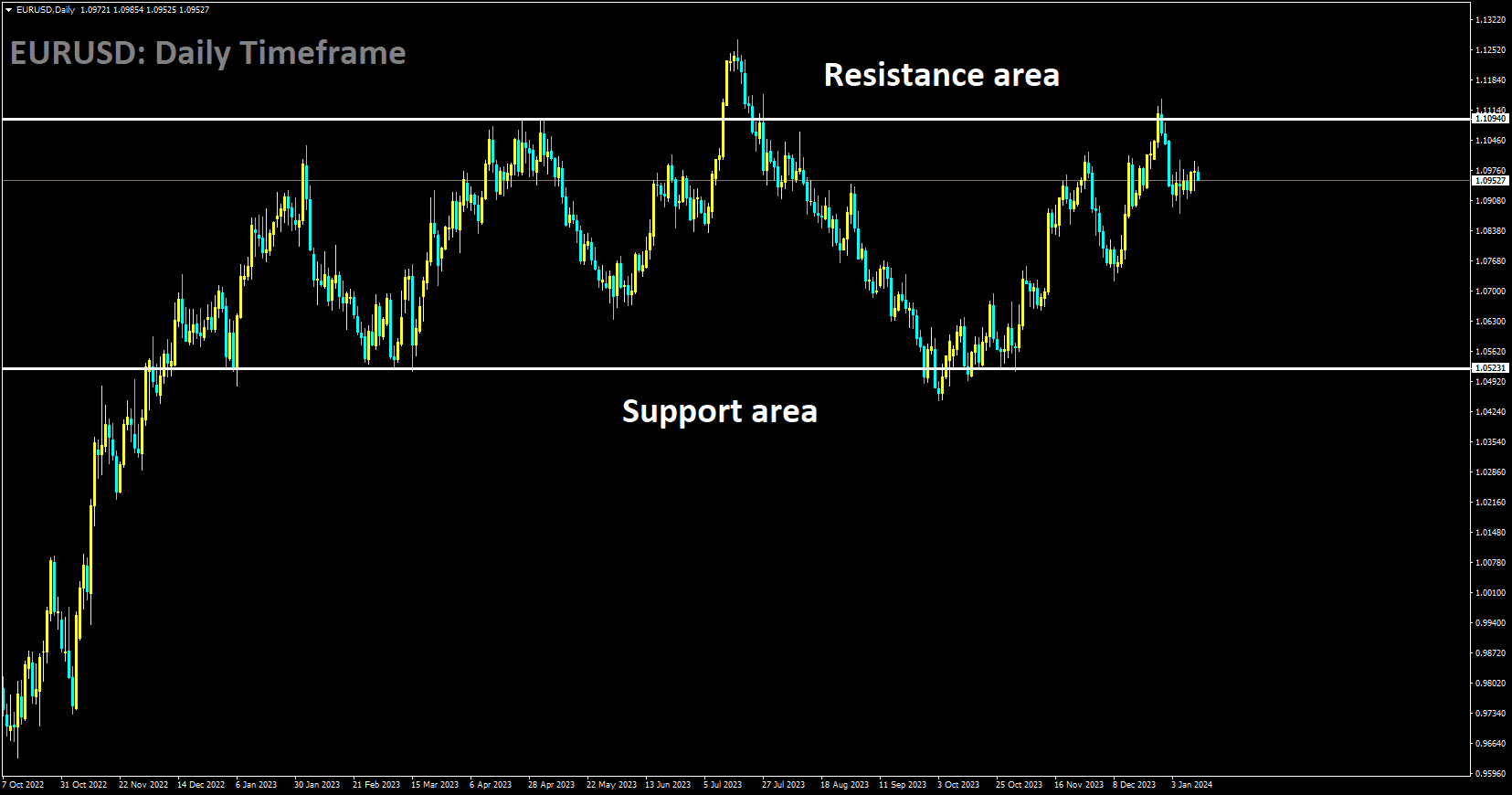

EURUSD Analysis:

EURUSD is moving in box pattern and market has fallen from the resistance area of the pattern

During the US trading session, the Euro faced a decline against the US Dollar, primarily driven by the release of US Consumer Price Index inflation figures that exceeded market expectations. This setback offset the Euro’s earlier positive performance for the day. While the Euro exhibited strength against most major currencies on Thursday, it remained relatively flat against the safe-haven currencies, the US Dollar and the Japanese Yen, during the first half of the US session. However, it managed to rebound before the close of the Thursday trading session. Earlier in the day, the European Central Bank (ECB) released its latest Economic Bulletin, maintaining its existing stance. The ECB reiterated its commitment to a data-driven approach, with a continued focus on inflation expectations for the European economy. The Euro initially made notable gains on Thursday but experienced a slight setback following the release of the US CPI data.

The US CPI inflation data for December surprised to the upside, with headline inflation rising by 0.3% month-on-month (MoM), surpassing the expected 0.2% and November’s 0.1%. The annualized core US CPI saw a modest decline from 4.0% to 3.9%, which was less than the market’s anticipated drop to 3.8%. Year-on-year December headline CPI increased to 3.4% from 3.1%, surpassing the forecast of 3.2%. These higher inflation figures may complicate the Federal Reserve’s ability to justify rate cuts as quickly as some market participants had hoped. The European Economic Bulletin highlighted that the ECB continues to prioritize data releases, and potential rate cuts hinge on forward-looking inflation expectations. The bulletin also mentioned a slight contraction in the euro area economy in the third quarter of 2023, attributed to a decline in inventories. Despite expectations of weakening growth, the ECB acknowledged the resilience of employment in the euro area. Overall, the Euro experienced fluctuations during the trading session, with its performance influenced by the US CPI data and the ECB’s commitment to data-driven decision-making.

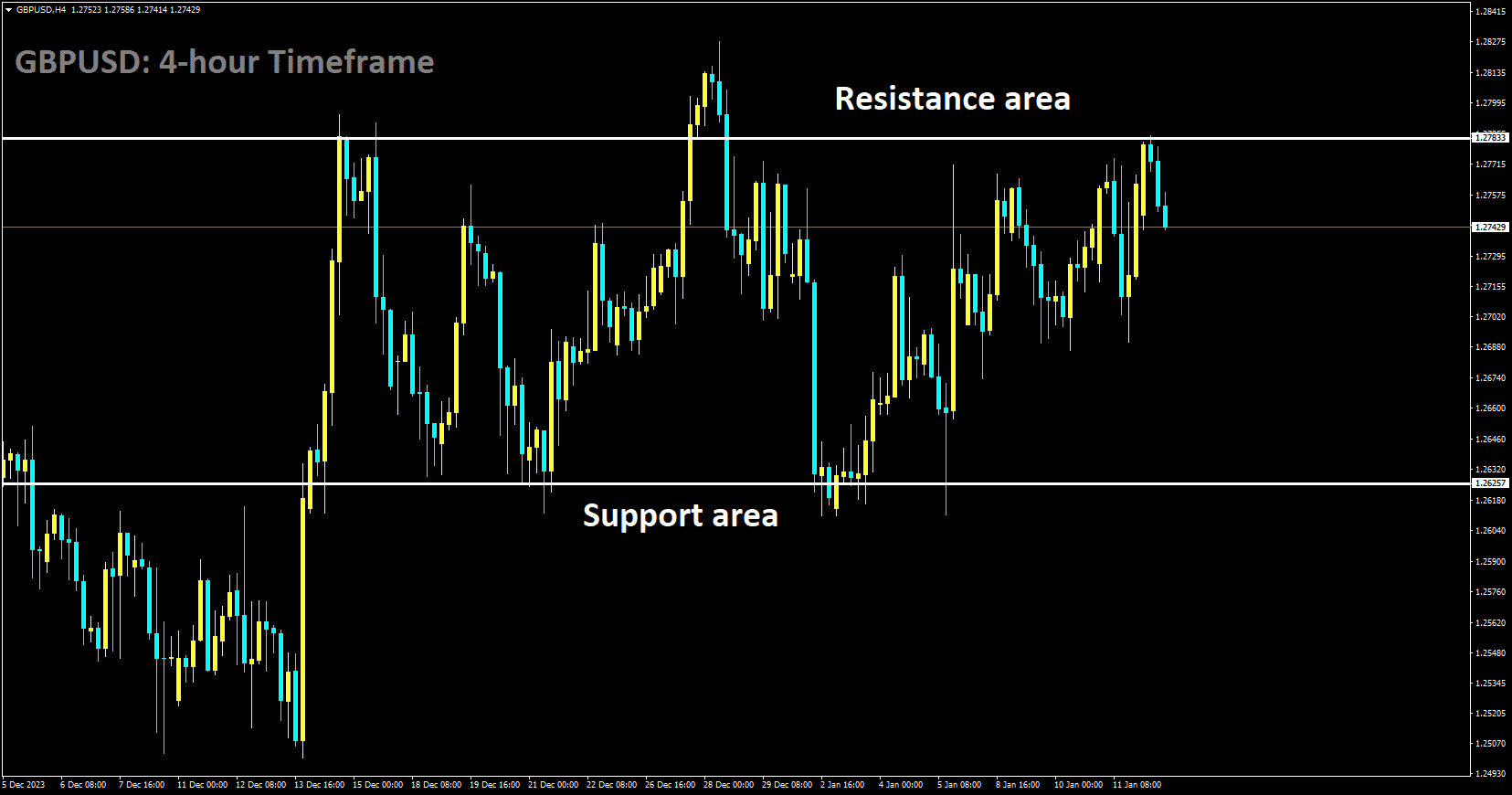

GBPUSD Analysis:

GBPUSD is moving in box pattern and market has fallen from the resistance area of the pattern

According to the latest data released by the Office for National Statistics (ONS) on Friday, the UK economy rebounded in November, showing a growth of 0.3% following a 0.3% contraction in October.

This exceeded market analysts’ expectations of a 0.2% expansion during the same period. Additionally, the Index of Services for November recorded a 3-month growth rate of 0%, surpassing the -0.1% reading in October and exceeding expectations of a 0.2% increase.

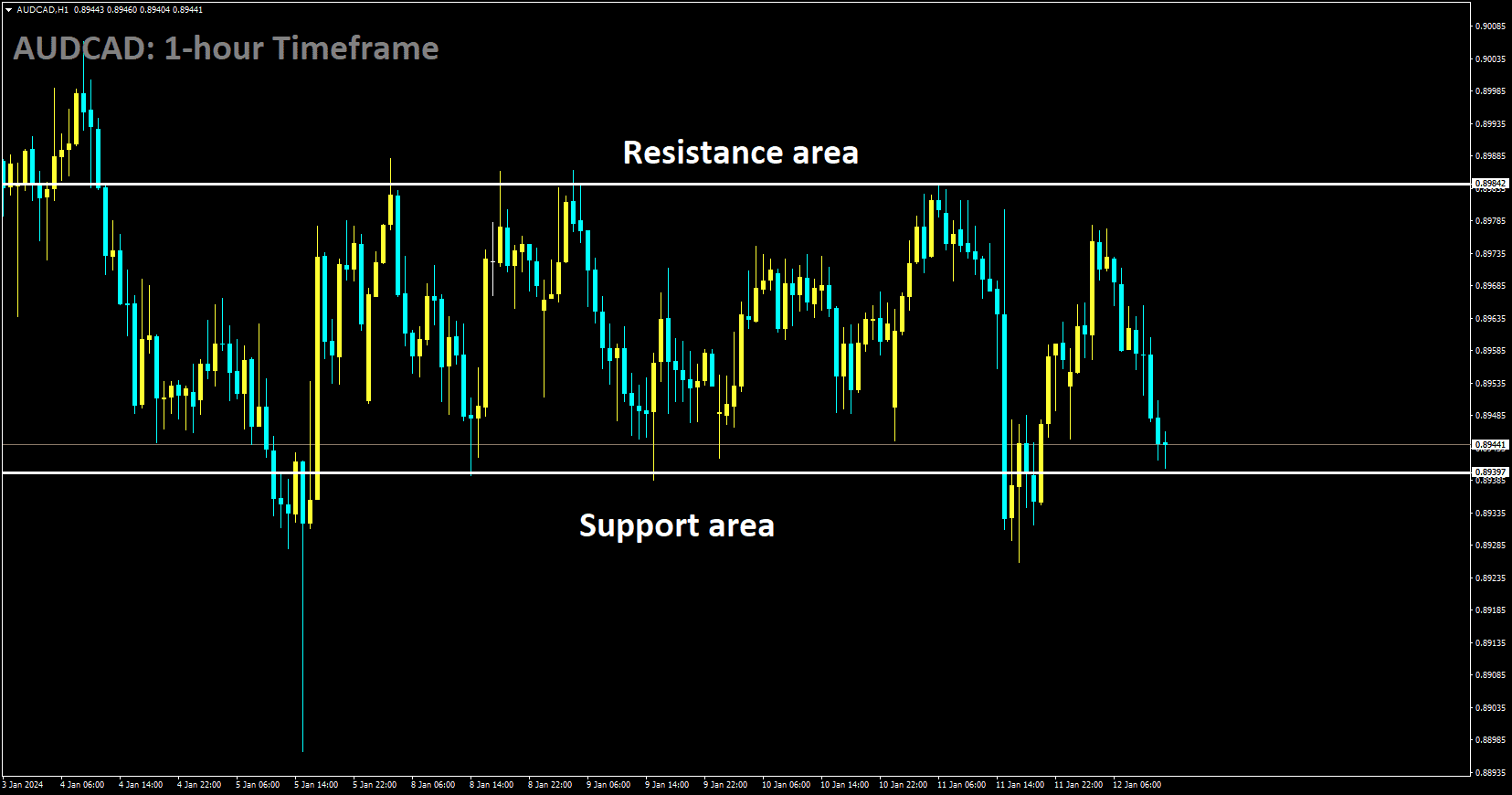

AUDCAD Analysis:

AUDCAD is moving in box pattern and market has reached support area of the pattern

The National Bureau of Statistics in China reported a third consecutive month of decline in the Consumer Price Index (CPI), showing a 0.3% year-on-year decrease in December. Additionally, the Producer Price Index (PPI) fell by 2.7% year-on-year in December, marking the 15th consecutive month of decline. These data releases have raised speculation that the Chinese government may introduce further stimulus measures to address deflationary risks. Furthermore, China’s Customs department reported that the country’s exports and imports of goods for 2023 exceeded expectations. This development has boosted the Australian Dollar, which is often seen as a proxy for China’s economic performance, and has contributed to the AUD/JPY currency pair gaining positive momentum. China’s Yuan-denominated exports for 2023 increased by 0.6% year-on-year, indicating signs of recovery in global trade. However, imports for the same period declined by 0.3% year-on-year, suggesting weak domestic demand and raising concerns about a sluggish economic recovery. Despite these factors, geopolitical risks arising from the conflict in Israel have supported the Japanese Yen’s status as a relative safe haven, which has limited the gains of the AUD/JPY cross. Nonetheless, the downside potential remains somewhat limited due to expectations that the Bank of Japan is unlikely to deviate from its ultra-dovish policy stance in the near future, particularly after implementing government stimulus measures in response to a significant earthquake in Japan. Given this mixed fundamental backdrop, it is advisable to exercise caution before making aggressive directional bets on the AUDJPY cross. Additionally, from a technical perspective, spot prices have been trading within a well-defined range for the past three weeks or so. This reinforces the importance of waiting for a sustained breakout from this trading range before establishing a more definitive near-term trajectory for spot prices.

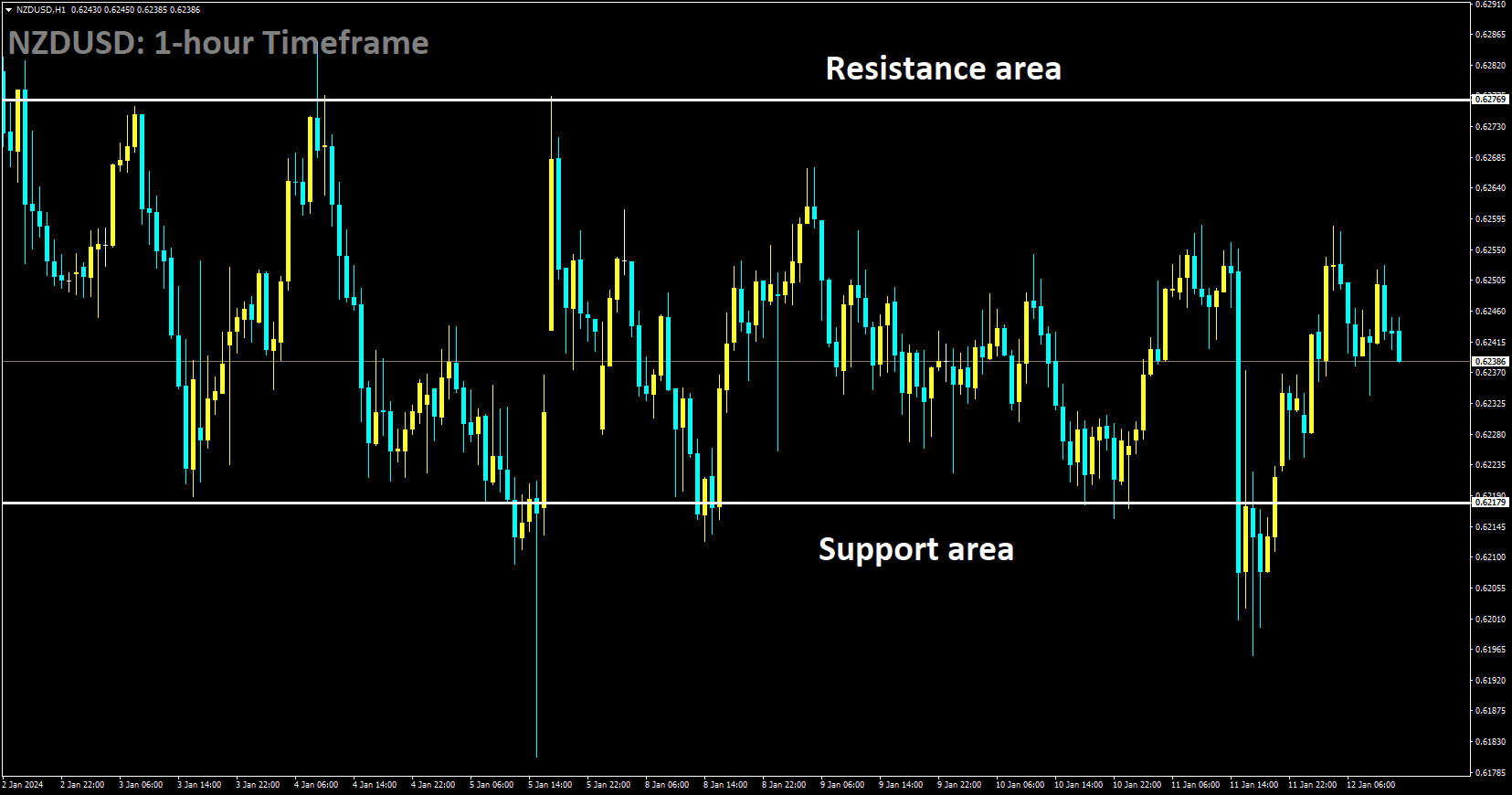

NZDUSD Analysis:

NZDUSD is moving in box pattern and market has rebounded from the support area of the pattern

The NZDUSD pair is experiencing upward momentum as improved risk appetite prevails in the market, driven by trader speculation regarding potential rate cuts by the Federal Reserve in March and May. This optimism persists despite the release of upbeat inflation data from the United States. Moreover, the New Zealand Dollar is finding support from moderate Chinese inflation figures, considering the close trade relationship between the two countries. In December, the Chinese Consumer Price Index unexpectedly decreased by 0.3%, diverging from the anticipated 0.4% decline. The monthly Consumer Price Index exhibited a more modest easing of 0.1%, compared to the market’s expected 0.2%. Meanwhile, the annual Producer Price Index recorded a 2.7% decline, slightly surpassing the anticipated decrease of 2.6%. Additionally, the Chinese Trade Balance for December surged to $75.34 billion from the previous $68.39 billion, exceeding the expected figure of $74.75 billion. Export figures showed a growth of 2.3%, surpassing the expected 1.7%, while the annual Imports in CNY increased by 1.6% compared to the previous 0.6%.

Traders are now awaiting the release of the US Producer Price Index data for December, seeking further insights into the economic landscape of the United States. In contrast, the US Dollar Index has been relatively stable, consolidating recent gains during the early Asian trading hours on Friday, following the release of positive US inflation data. However, the DXY is trading slightly lower, hovering near 102.20, despite improved US Treasury yields. As of the latest available data, the 2-year and 10-year yields on US bonds are at 4.26% and 3.97%, respectively. Furthermore, the robust US inflation data has provided some support to the US Dollar, enabling it to gain slight upward traction. The US Consumer Price Index (CPI) for December reported a year-on-year increase of 3.4%, surpassing both November’s 3.1% and the market’s expected figure of 3.2%. The monthly CPI growth for December showed a 0.3% increase, exceeding the market’s projection of 0.2%. The annual Core CPI, which excludes volatile items, eased slightly to 3.9% from the previous reading of 4.0%, while the monthly figure remained steady at 0.3%, in line with expectations.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/