In the dynamic world of Forex trading, understanding the impact of economic indicators is crucial for making informed decisions and navigating the complexities of the market. Currency values are influenced by a myriad of factors, with economic indicators playing a significant role in shaping market trends and determining the strength of a nation’s currency. This article delves into the intricate web of economic indicators that drive movements in the Forex markets, shedding light on how traders can decode the currency chaos and leverage this knowledge to enhance their trading strategies.

The Significance of Economic Indicators in Forex Trading

Economic indicators serve as vital signposts that reflect the overall health and performance of a country’s economy. These indicators provide valuable insights into key economic aspects such as employment levels, inflation rates, GDP growth, trade balances, and consumer sentiment. For Forex traders, staying abreast of these indicators is essential as they directly impact currency valuations and market sentiment. By analyzing economic data releases and understanding their implications, traders can anticipate market movements and make informed decisions to capitalize on trading opportunities.

Economic indicators can be classified into leading, lagging, and coincident indicators based on their predictive abilities and relationship with economic cycles. Leading indicators, such as consumer confidence surveys and building permits, provide early signals of future economic trends. Lagging indicators, such as unemployment rates and inflation figures, confirm trends that have already occurred. Coincident indicators, such as retail sales and industrial production, move in tandem with the overall economy. By analyzing a combination of these indicators, traders can gain a comprehensive view of the economic landscape and make well-informed trading decisions.

Key Economic Indicators Affecting Forex Markets

1. Gross Domestic Product (GDP)

GDP serves as a fundamental measure of a country’s economic performance, representing the total value of all goods and services produced within its borders. A robust GDP growth indicates a healthy economy and typically strengthens the domestic currency. Forex traders closely monitor GDP releases to gauge the economic health of a country and predict currency movements accordingly.

2. Employment Data

Employment data, including non-farm payrolls and unemployment rates, are crucial indicators of labor market conditions. High employment levels and declining unemployment rates signal a strong economy, leading to increased consumer spending and economic growth. Positive employment data often strengthens the domestic currency as it reflects a thriving economy.

3. Consumer Price Index (CPI)

The Consumer Price Index measures changes in the prices of goods and services, providing insights into inflation levels. Central banks closely monitor CPI data to assess price stability and make monetary policy decisions. Inflationary pressures can erode the value of a currency, making CPI releases significant for Forex traders in predicting potential currency devaluation.

4. Trade Balances

Trade balances reflect the difference between a country’s exports and imports. A positive trade balance, where exports exceed imports, contributes to a stronger currency as it signifies a competitive economy. Conversely, a negative trade balance can lead to currency depreciation. Forex traders analyze trade balance data to assess a country’s economic competitiveness and predict currency movements.

5. Interest Rates

Interest rates set by central banks play a critical role in determining currency values. Higher interest rates attract foreign investment, leading to currency appreciation. Conversely, lower interest rates can devalue a currency as investors seek higher returns elsewhere. Forex traders closely monitor central bank announcements on interest rate decisions to anticipate market reactions and adjust their trading strategies accordingly.

Strategies for Trading Economic Indicators in Forex Markets

Understanding the impact of economic indicators on currency movements is essential for developing effective trading strategies. Here are some key strategies that traders can employ to leverage economic data in their Forex trading:

1. Calendar Planning

Maintaining a calendar of economic releases and events helps traders stay informed about upcoming data releases that could impact the market. By planning ahead and being aware of key economic indicators, traders can prepare their trading strategies in advance and avoid being caught off guard by unexpected market movements.

2. News Analysis

Keeping abreast of financial news and market analysis is vital for interpreting economic indicators and their implications on currency markets. News outlets, economic websites, and financial publications provide valuable insights and expert opinions that can help traders make informed decisions based on economic data releases.

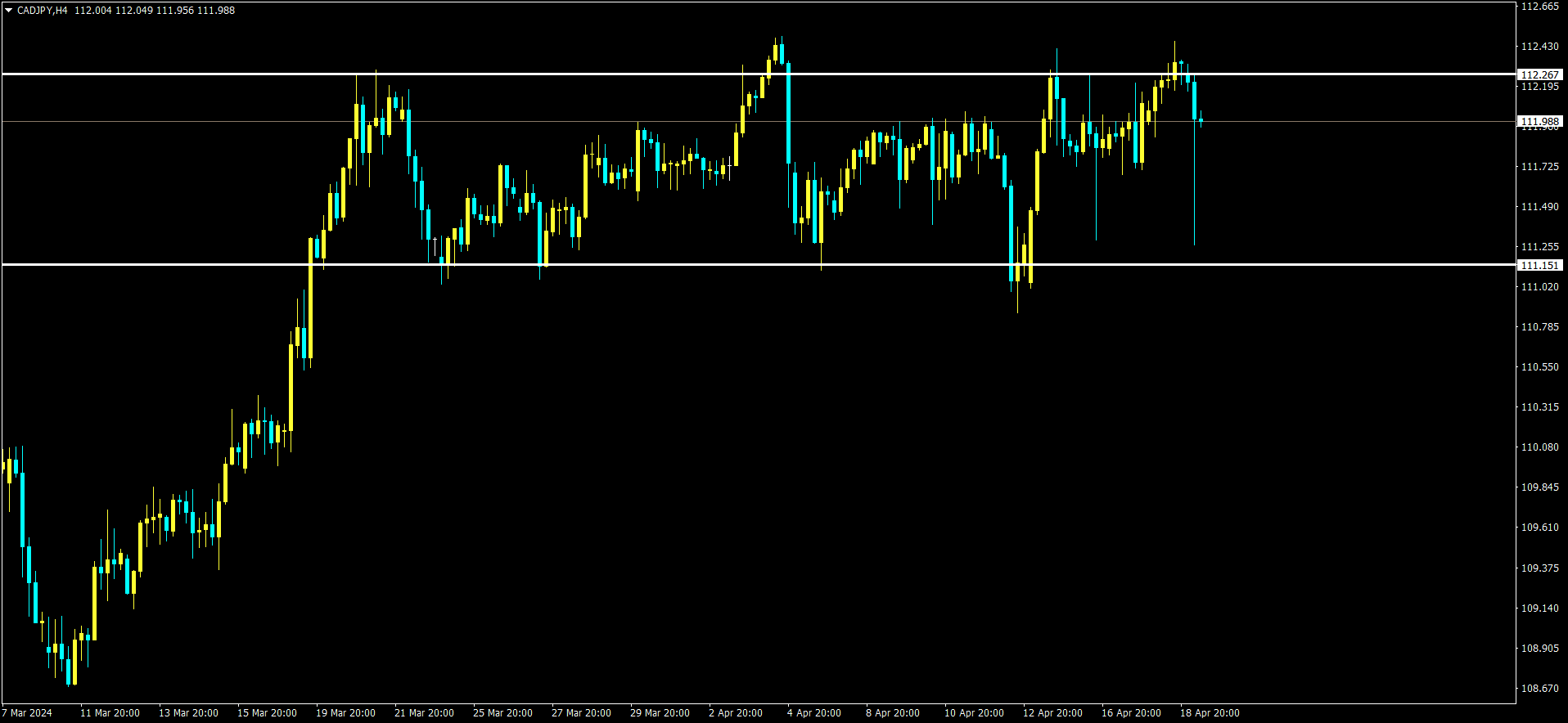

3. Technical Analysis

Combining technical analysis with an understanding of economic indicators can provide a comprehensive view of market trends and potential trading opportunities.

By analyzing price charts, trends, and key support and resistance levels alongside economic data, traders can make well-informed decisions and identify entry and exit points for their trades.

4. Risk Management

Implementing sound risk management practices is essential when trading economic indicators in Forex markets. Volatile market conditions following economic data releases can lead to sudden price fluctuations, making risk management crucial to protect capital and minimize potential losses. Setting stop-loss orders and position sizing based on risk tolerance can help traders navigate market uncertainties and preserve capital.

Conclusion

In the realm of Forex trading, economic indicators serve as powerful tools that enable traders to decipher market dynamics and make informed trading decisions. By understanding the significance of key economic indicators such as GDP, employment data, inflation figures, trade balances, and interest rates, traders can navigate the currency chaos with confidence and precision. Incorporating economic analysis into trading strategies empowers traders to capitalize on market opportunities, manage risks effectively, and achieve success in the dynamic world of Forex trading.

FAQs

Q1: How often are economic indicators released, and how do they impact Forex markets?

Economic indicators are typically released on a regular schedule, with some being published monthly, quarterly, or annually. These releases can have an immediate impact on Forex markets, causing price fluctuations and influencing market sentiment based on the data’s implications for the economy.

Q2: What role do central banks play in shaping currency values based on economic indicators?

Central banks use economic indicators as key inputs to make monetary policy decisions, including setting interest rates and implementing measures to control inflation and stimulate economic growth. These decisions can directly impact currency values by influencing investor confidence and capital flows.

Q3: How can traders interpret conflicting economic indicators to make trading decisions?

When faced with conflicting economic indicators, traders can assess the relative importance of each indicator based on its impact on the economy and market sentiment. Conducting thorough analysis, considering historical trends, and seeking expert opinions can help traders navigate conflicting data and make informed trading choices.

Q4: What are the risks associated with trading economic indicators in Forex markets?

Trading economic indicators carries inherent risks due to the potential for market volatility and unexpected price movements following data releases. Traders should be prepared for rapid market changes, set risk management strategies in place, and stay informed to mitigate risks and protect their trading capital.

Q5: How can traders stay updated on economic indicators and their impact on Forex markets?

Traders can stay informed about economic indicators and their implications by following financial news outlets, subscribing to economic calendars, attending webinars and seminars, and engaging with industry experts and analysts. Continuous learning and staying abreast of market developments are key to successful trading in Forex markets.