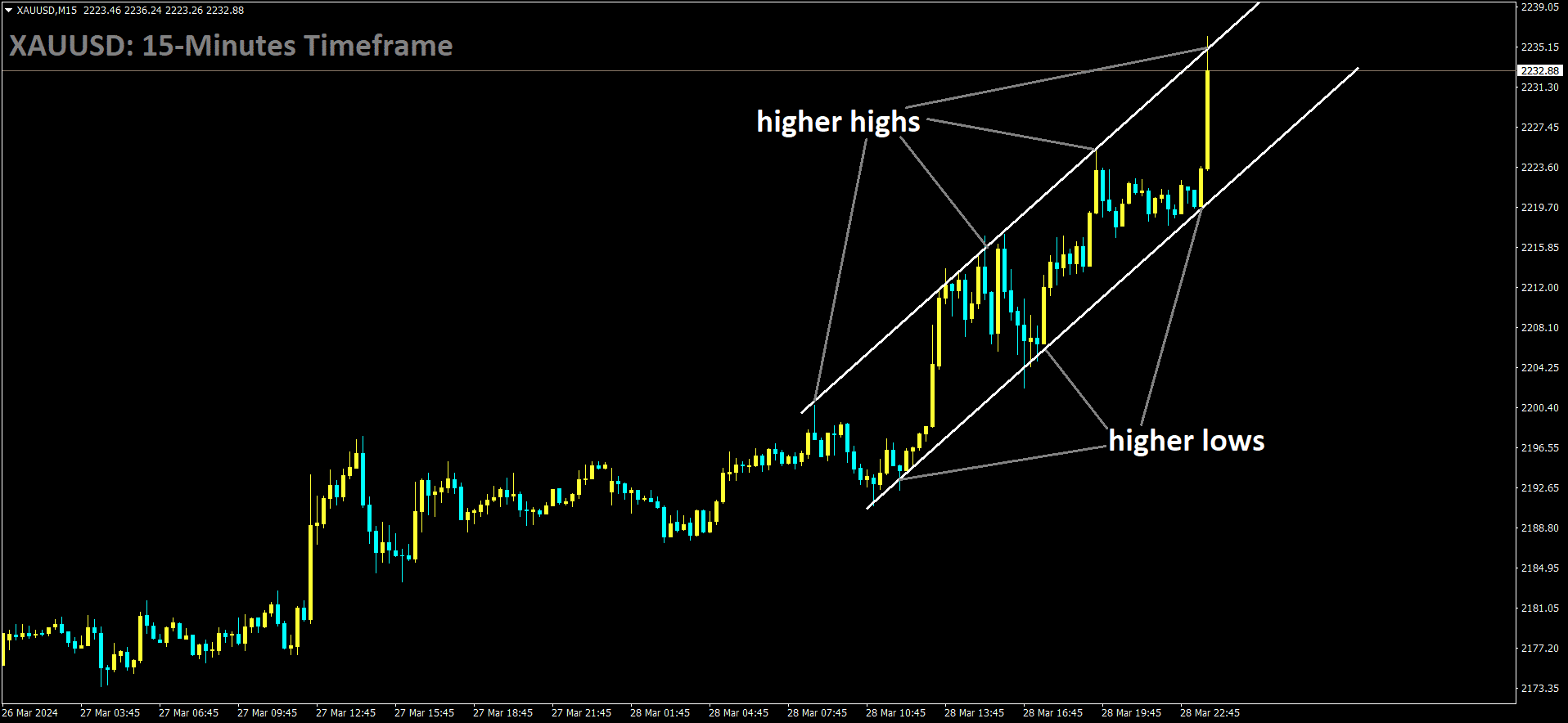

GOLD – Gold Prices Surge on Rate Cut Expectations

Gold prices are surging as market sentiments pivot towards the possibility of major central banks initiating interest rate cuts throughout 2024. The anticipation of three rate reductions by the US Federal Reserve (Fed) in the near future is bolstering investor confidence in the precious metal. Investors are eagerly awaiting the release of the US Personal Consumption Expenditures (PCE) report to gain deeper insights into the Fed’s stance on interest rates.

XAUUSD is moving in an Ascending channel and the market has reached the higher high area of the channel

Amidst subdued trading volumes observed on Good Friday, the allure of gold remains strong, attracting buyers amidst speculation that significant central banks may embark on a cycle of interest rate reductions this year.

Investor confidence in gold is further reinforced by the expectation of Fed rate cuts. Chicago Fed President Austan Goolsbee’s dovish outlook, forecasting three forthcoming rate cuts, underscores the need for tangible evidence of inflation easing before any policy actions are taken.

European Central Bank (ECB) policymaker Francois Villeroy cautiously expresses optimism regarding the ECB’s ability to achieve its 2% inflation target but warns against heightened downside risks if rate cuts are postponed. ECB executive board member Fabio Panetta echoes this sentiment, highlighting the emergence of conditions conducive to monetary easing.

In Europe, the unexpected rate cut by the Swiss National Bank in March sparks speculation of similar moves by other major central banks. Despite the Bank of Japan’s departure from negative interest rates, its continued accommodative stance is expected in the foreseeable future.

Geopolitical tensions persist as the conflict between Israel and Hamas continues unabated. Despite UN Security Council resolutions calling for ceasefire and hostage releases, reports of Israeli forces besieging Gaza hospitals escalate concerns, driving up demand for safe-haven assets like gold.

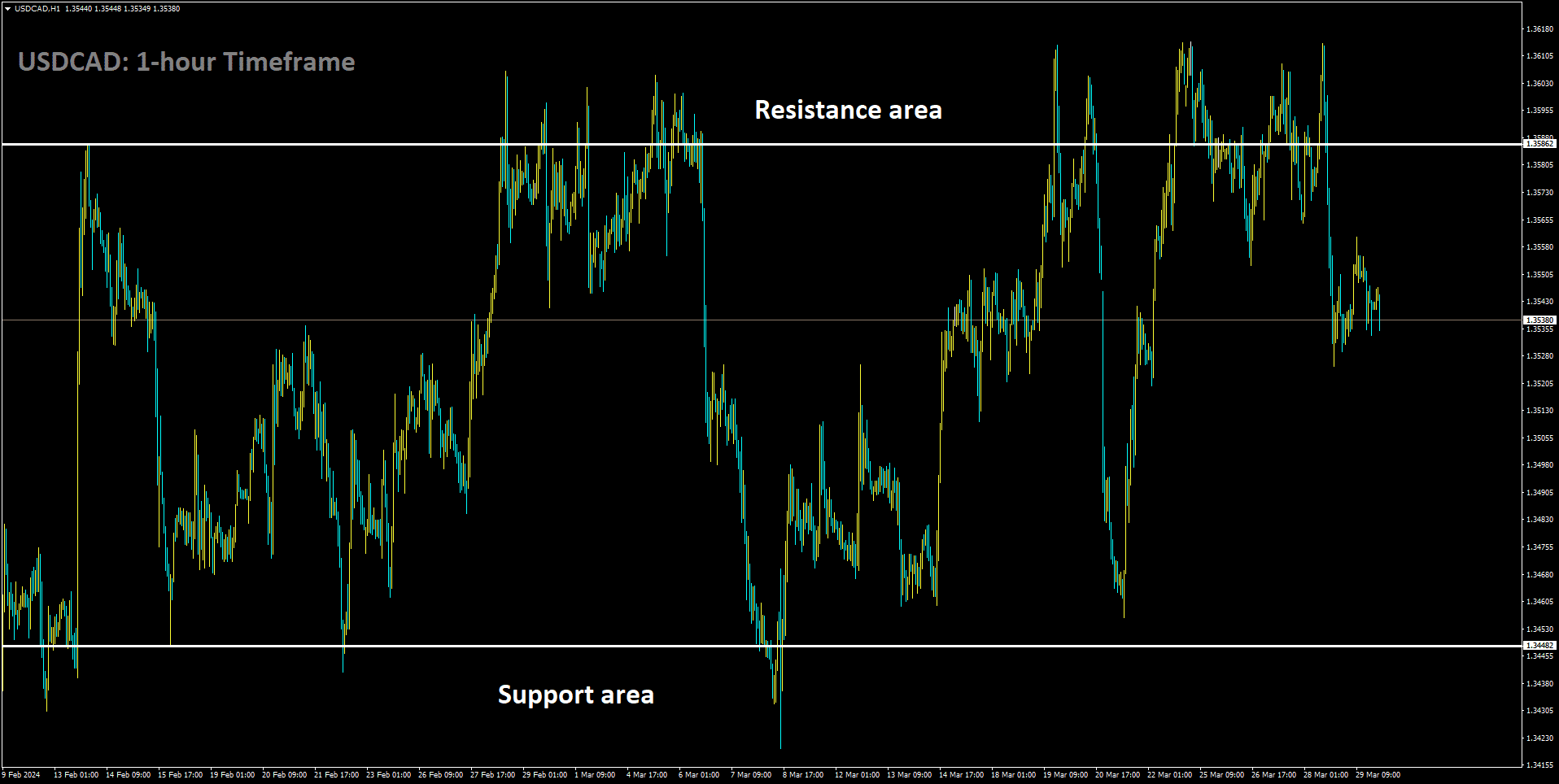

USDCAD – US February PCE Meets Expectations; Eyes on Nonfarm Payrolls

The recent release of US February’s Personal Consumption Expenditures (PCE) figures revealed a scenario largely in line with market expectations, setting the stage for investors to shift their focus to upcoming employment-related data to glean further insights into the Federal Reserve’s (Fed) stance on potential policy rate adjustments.

USDCAD is moving in box pattern and market has fallen from the resistance area of the pattern.

The PCE Price Index, a pivotal gauge utilized by the Fed to gauge inflationary trends, demonstrated a modest uptick to 2.5% annually in February, a slight increase from January’s 2.4%, aligning closely with analysts’ forecasts. Although the monthly increase of 0.3% fell marginally short of the anticipated 0.4%, the Core PCE, which excludes volatile food and energy components, maintained an annual ascent of 2.8%, in line with consensus predictions. Furthermore, the monthly rise of 0.3% corroborated expectations, suggesting a steady inflationary trajectory. The upward revision of January’s core PCE figures hinted at a sustained inflation trend, potentially influencing the Fed’s decision-making regarding maintaining current interest rates.

As the market digests the implications of the PCE data, attention now turns to next week’s eagerly anticipated Nonfarm Payrolls report. This key economic indicator is closely watched by investors and policymakers alike for its insights into the health of the labor market. Strong employment figures could potentially justify a delay in policy rate cuts beyond June, altering the projected trajectory of rate adjustments for 2024 from three cuts to two, thereby potentially bolstering the US Dollar. However, it’s essential to note that the baseline scenario still leans towards three rate cuts in 2024, commencing in June.

Against this backdrop, the incoming employment-related data is poised to play a crucial role in shaping the Fed’s monetary policy decisions. Investors will scrutinize the Nonfarm Payrolls report for indications of labor market strength or weakness, which could provide valuable insights into the Fed’s future course of action regarding interest rates and its implications for the broader economy.

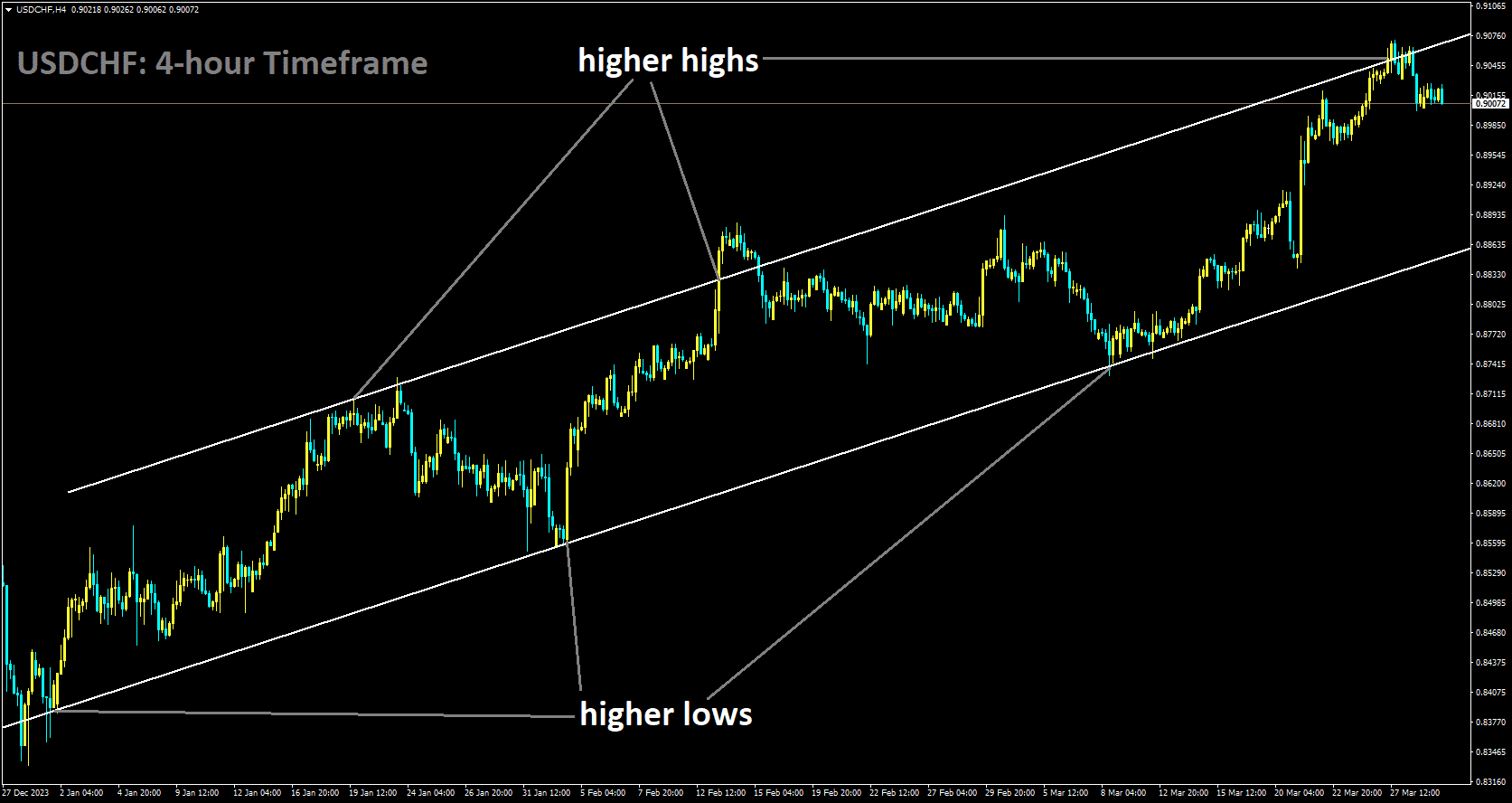

USDCHF – USD Gains Against CHF; SNB Watches Closely

Amidst a narrative of prolonged high rates in the US, the Dollar strengthens against the Swiss Franc (CHF). Swiss National Bank (SNB) Vice President Martin Schlegel asserts the bank’s readiness to monitor FX rates closely, intervening if necessary. The USD/CHF pair rebounds from a two-day decline near 0.9025 during the Asian session. Hawkish remarks from the US Federal Reserve (Fed) and robust US economic data propel the USD upward, albeit with potential constraints due to potential SNB intervention.

USDCHF is moving in Ascending channel and market has fallen from the higher high area of the channel.

Fed Governor Christopher Waller’s recent comments highlight a patient approach towards interest rate adjustments, citing elevated inflation as grounds for maintaining current rates. Fed Governor Lisa Cook echoes this sentiment, emphasizing the importance of cautious policy shifts to ensure sustainable inflation return. The prospect of prolonged high US rates could further bolster the Greenback, providing support for the USD/CHF pair in the short term.

Conversely, SNB’s Schlegel underscores the bank’s commitment to FX rate surveillance and intervention, despite lacking a specific CHF exchange rate target. Last week’s surprise cut in the SNB’s benchmark interest rate triggered CHF sell-offs, but speculation regarding SNB intervention may limit CHF depreciation against the USD.

Geopolitical tensions in the Middle East add another layer of complexity, potentially benefiting safe-haven currencies like the Swiss Franc. Reports of Israeli forces besieging Gaza hospitals escalate concerns, underscoring the appeal of the CHF in times of uncertainty.

Looking ahead, market focus shifts to the US Core Personal Consumption Expenditures (PCE) Price Index due later on Friday. Expected to remain stable at 2.8% year-on-year (YoY), this figure serves as the Fed’s preferred inflation gauge, likely influencing further market sentiment and currency movements.

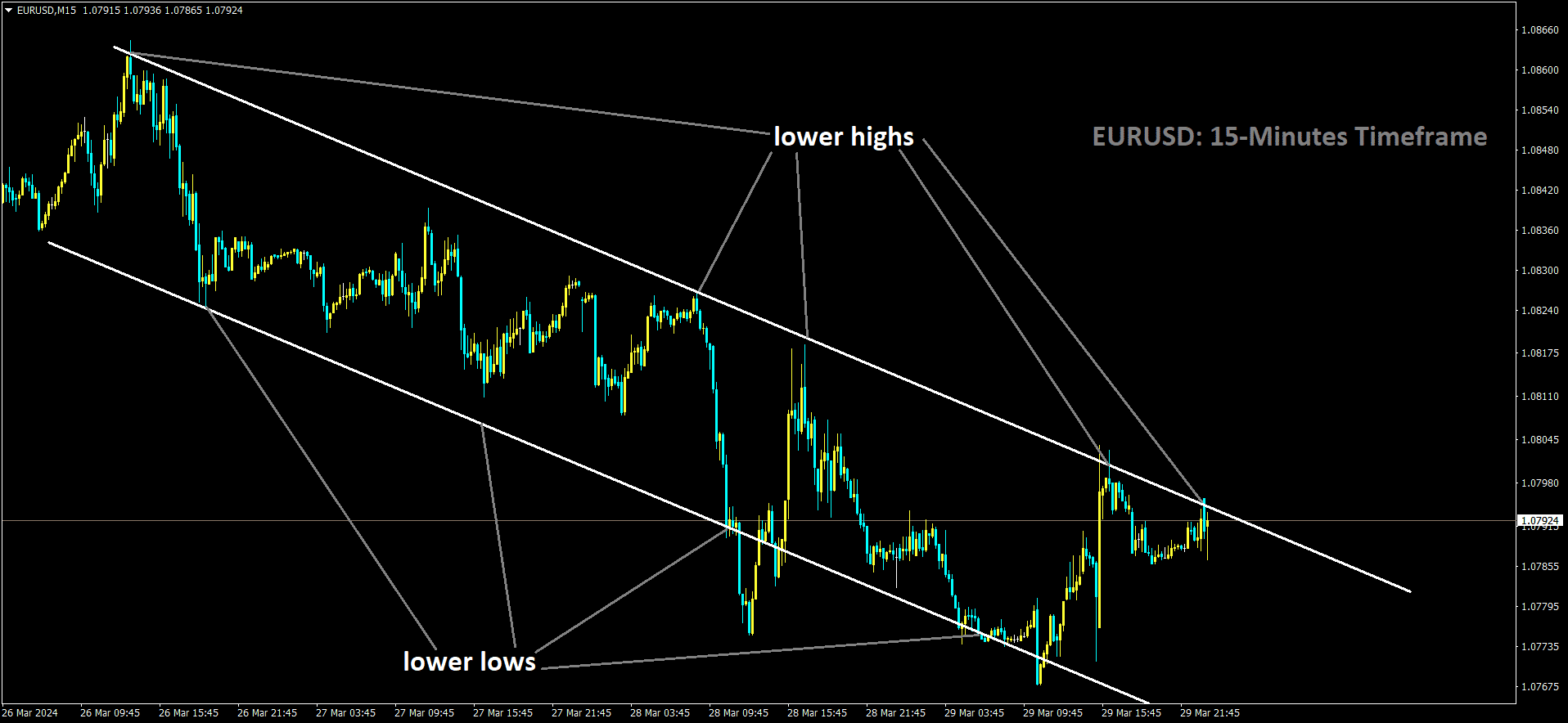

EURUSD – Euro Weakens Amid ECB Rate Cut Speculation and Weak German Retail Sales

EUR/USD pair remains entrenched in a downward trajectory, largely influenced by the dovish sentiments expressed by members of the European Central Bank (ECB). This trend is emblematic of the market’s response to suggestions of potential monetary policy adjustments from the ECB.

EURUSD is moving in the Descending channel and the market has reached the lower high area of the channel.

In Germany, the latest data on retail sales paints a concerning picture, with both month-on-month (MoM) and year-on-year (YoY) figures experiencing notable declines. Specifically, in February, retail sales dropped by 1.9% compared to the previous month, and by 2.7% in comparison to the same period last year. These figures underscore a challenging environment for the retail sector, casting shadows on the overall economic outlook for the Eurozone’s largest economy.

Investors are keenly awaiting the release of US Personal Consumption Expenditures (PCE) data, viewing it as a crucial indicator that could provide further clarity on the Federal Reserve’s (Fed) stance regarding interest rates. The outcome of this data is expected to have significant implications for the trajectory of US monetary policy.

Despite the importance of economic indicators, trading activity remains subdued, largely due to the observance of Good Friday. This subdued trading environment adds another layer of complexity to market dynamics, potentially dampening the impact of recent developments on currency movements.

Within the ECB, there is a discernible shift towards a consensus for implementing a rate reduction in June. This sentiment has been echoed by prominent figures such as Yannis Stoumaras, suggesting a growing inclination towards a more accommodative monetary policy stance to address prevailing economic challenges.

The Euro’s decline is further exacerbated by weaker-than-expected retail sales data from Germany, which revealed a sharper contraction than anticipated. The unexpected downturn in retail sales adds to concerns about the resilience of the Eurozone economy, particularly in the face of ongoing headwinds.

Key ECB policymakers, including Francois Villeroy and Fabio Panetta, have highlighted the urgency of addressing core inflation dynamics and the need for proactive measures to support economic recovery. Their remarks underscore the delicate balance policymakers must strike between stimulating economic activity and managing inflationary pressures.

On the other hand, the US Dollar has witnessed renewed strength, buoyed by robust economic indicators, notably the expansion of Gross Domestic Product (GDP) in the fourth quarter of 2023. Additionally, hawkish comments from Fed Governor Christopher Waller have reinforced the Greenback’s position, suggesting a potential delay in interest rate adjustments given the current inflationary backdrop.

As investors await the release of the US PCE report, all eyes are on the Fed for further guidance on the future trajectory of monetary policy. The outcome of this report is likely to influence market sentiment and shape currency movements in the near term.

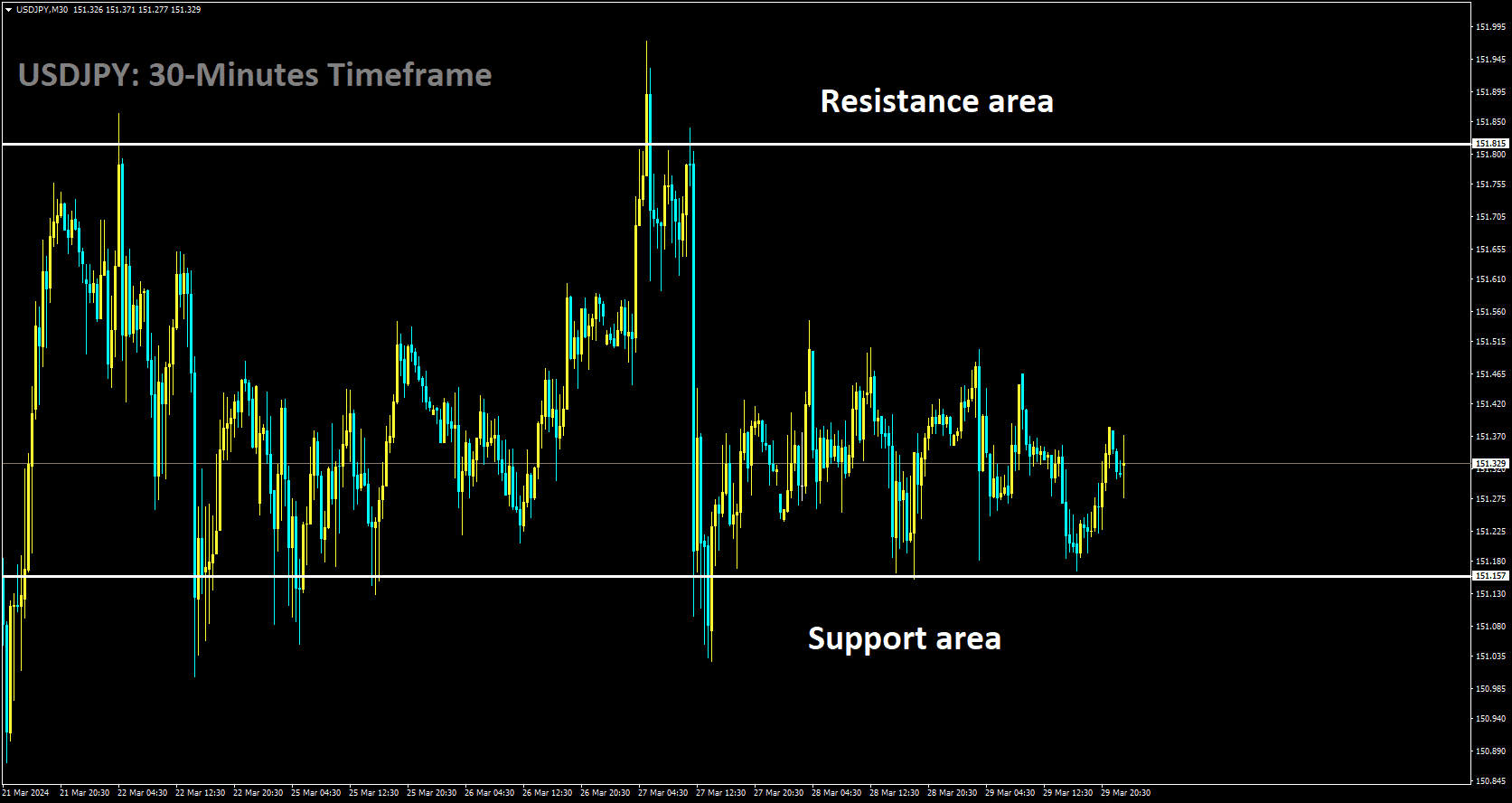

USDJPY- Dips on Core PCE Data, Fed Cautious on Rate Cuts

The USD/JPY pair experienced slight declines following the release of February’s Core Personal Consumption Expenditure (PCE) data, signaling a gradual easing of inflationary pressures, yet concerns persist. While the figures met expectations, indicating a slowdown in price declines, the Federal Reserve remains vigilant for sustained disinflationary trends before considering rate adjustments.

USDJPY is moving in box pattern and market has rebounded from the support area of the pattern.

The US Bureau of Economic Analysis (BEA) reported that the Core PCE for February fell short of projections, registering a 0.3% month-on-month (MoM) decrease, below the previous month’s figures. Yearly data also showed a cooling trend, dropping from 2.9% to 2.8%, as anticipated. Although headline inflation for February matched forecasts with a 0.3% increase, the annual rate rose to 2.5%, up from January’s 2.4%.

Despite the somewhat alleviated pressure on the Federal Reserve, policymakers remain cautious, particularly with other inflation indicators like the Consumer Price Index (CPI) and the Producer Price Index (PPI) signaling persistent inflation above the 3% mark.

Fed Governor Christopher Waller’s hawkish stance earlier in the week emphasized the central bank’s reluctance to rush into rate cuts. Traders eagerly await insights from San Francisco Fed President Mary Daly and Fed Chair Jerome Powell for further guidance on monetary policy.

Bank of Japan is currently deliberating measures to address the depreciation of the JPY

While the disinflationary process progresses, the labor market shows signs of re-tightening, as evidenced by a decline in weekly unemployment benefit claims for four consecutive weeks. This tightening could potentially boost consumer spending, thereby exerting upward pressure on prices.

Analysts from Wells Fargo, as cited by Bloomberg, highlight the resilience of consumer spending, making it challenging for businesses to resist price increases. This dynamic underscores the complexity facing policymakers as they navigate evolving economic conditions.

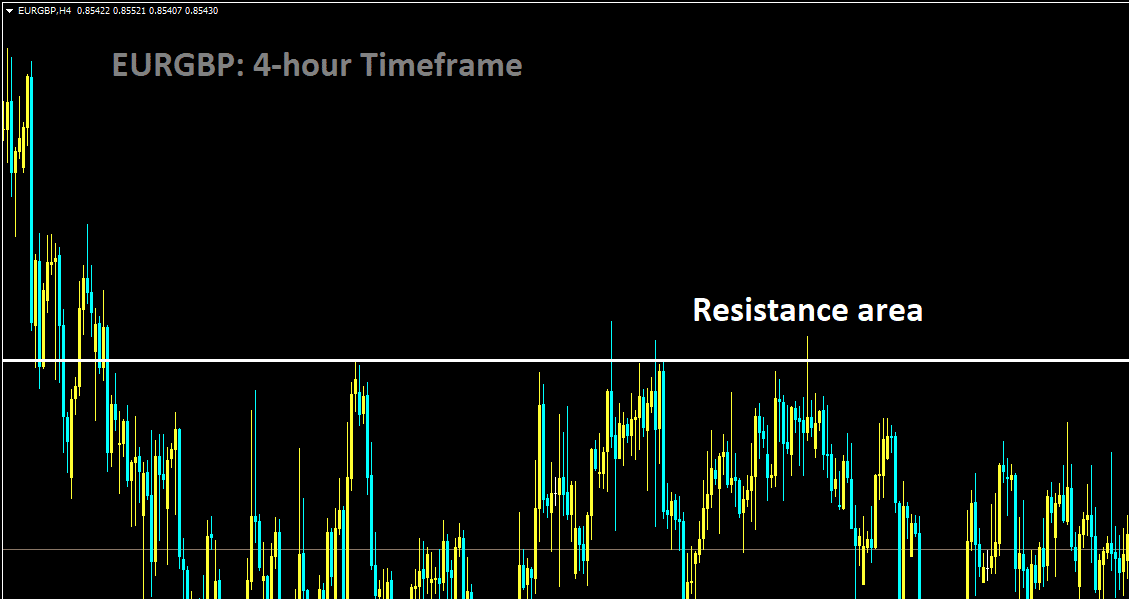

EURGBP – Dips on ECB Caution; BoE Remains Wary of Rate Cuts

EUR/GBP pair experiences a decline as dovish sentiments from European Central Bank (ECB) policymakers, notably Francois Villeroy, weigh on the Euro. Villeroy’s remarks emphasize the challenges confronting the ECB’s efforts to achieve its 2% inflation target, highlighting the escalating downside risks associated with delaying rate cuts.

EURGBP is moving in box pattern and market has fallen from the resistance area of the pattern.

Furthermore, Fabio Panetta, a member of the ECB’s executive board, adds to the cautious tone by indicating that conditions conducive to monetary policy easing are emerging. Panetta points out that restrictive policies are stifling demand, contributing to a rapid deceleration in inflation. Despite these concerns, the Bank of England (BoE) adopts a guarded approach towards potential rate cuts, with Jonathan Haskel, a BoE official, advocating for them to remain “a long way off.” Similarly, Catherine Mann, another BoE official, warns against harboring overly optimistic expectations regarding rate cuts in the near term.

Meanwhile, the Pound Sterling (GBP) holds its ground, potentially buoyed by Haskel’s less dovish stance. However, the UK’s economic landscape presents challenges, with data revealing a recession in the latter part of 2023. The 0.3% contraction in GDP in Q4 underscores the economic headwinds facing the nation. Despite this, speculation persists regarding potential rate cuts by the BoE, with Governor Andrew Bailey hinting at the possibility of discussions on this matter during future policy meetings.

Overall, market sentiment remains cautious as investors weigh the implications of central bank rhetoric and economic data releases on currency movements in the EUR/GBP pair.

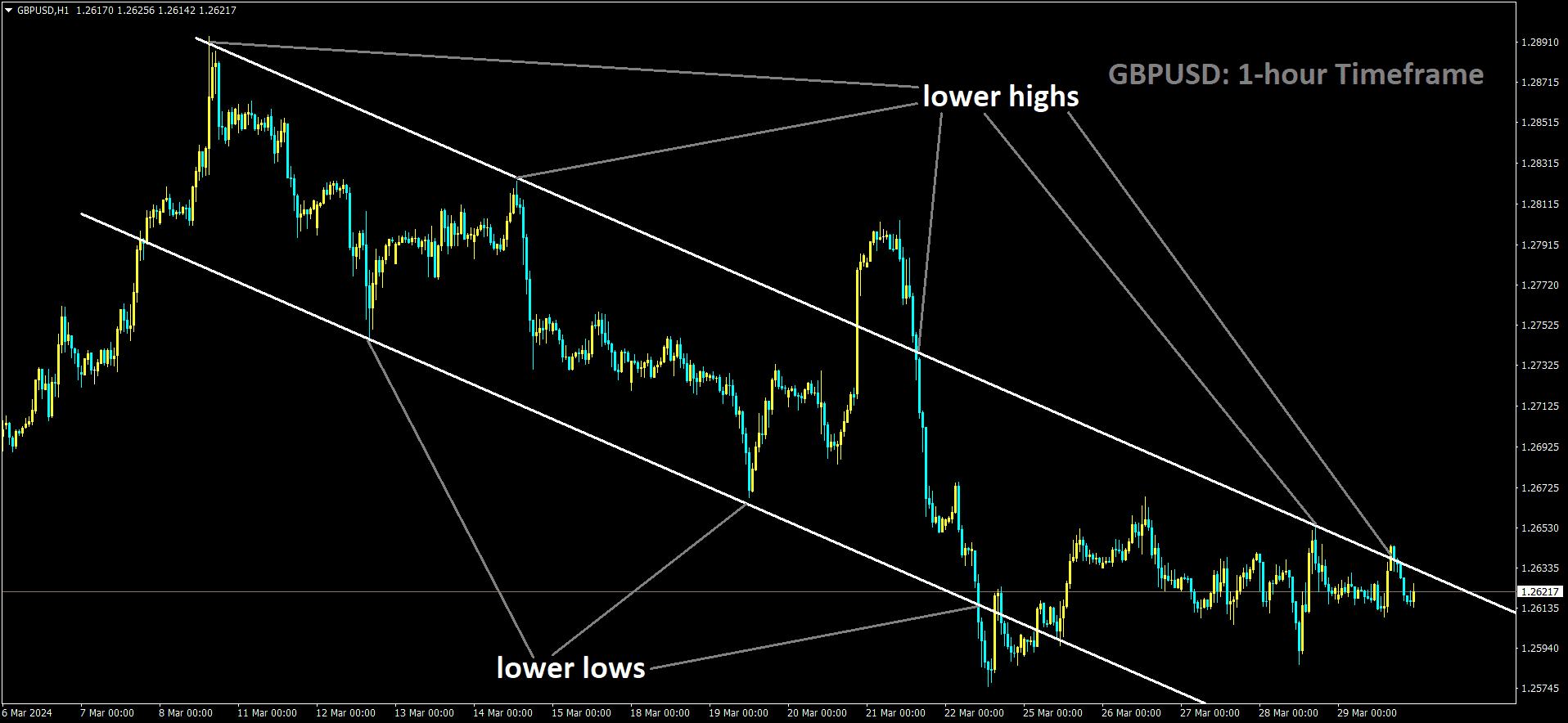

GBPUSD- US PCE Price Index Holds Steady; Focus on Employment Data

US PCE Price Index Remains Stable; Attention Turns to Employment Data

In February, the US Personal Consumption Expenditures (PCE) Price Index showed resilience, maintaining a steady course with a modest increase to 2.5% year-over-year (YoY) and 0.3% month-over-month (MoM). These figures aligned closely with market expectations, indicating a stable inflationary environment. Similarly, the core PCE, which excludes volatile food and energy prices, mirrored this trend, meeting anticipated levels.

GBPUSD is moving in the Descending channel and the market has reached the lower high area of the channel

This data is particularly significant as the PCE Price Index is the preferred metric for tracking inflation by the Federal Reserve (Fed). The slight uptick from January’s 2.4% YoY figure suggests a marginal increase in inflationary pressures, albeit within expected ranges. However, the MoM increase of 0.3% fell slightly below the consensus forecast of 0.4%, indicating a nuanced picture of price movements.

Looking deeper into the core PCE, which provides a more accurate reflection of underlying inflationary trends, the annual increase of 2.8% and the monthly rise of 0.3% were consistent with market projections. This stability in core inflation suggests that underlying price pressures remain relatively steady, providing further insights into the overall inflationary landscape.

Given the importance of inflation data in shaping monetary policy decisions, market participants are now turning their attention to upcoming employment data. This data release carries significant weight as it could potentially influence the timing and magnitude of any future adjustments to interest rates by the Fed.

Should the employment data indicate robust job growth and a tightening labor market, it may signal upward pressure on wages, which could in turn fuel inflationary pressures. In such a scenario, the Fed might be compelled to reconsider its stance on interest rates, potentially delaying any planned rate cuts.

Conversely, if the employment data falls short of expectations, indicating sluggish job growth or persistent weaknesses in the labor market, it could dampen inflationary pressures. In this case, the Fed may maintain its current accommodative stance on monetary policy or even consider further easing measures to stimulate economic activity.

Overall, the interplay between inflation data, particularly the PCE Price Index, and upcoming employment figures will be crucial in shaping the Fed’s policy trajectory. Market participants will closely monitor these developments for insights into the future direction of interest rates and their potential impact on financial markets.

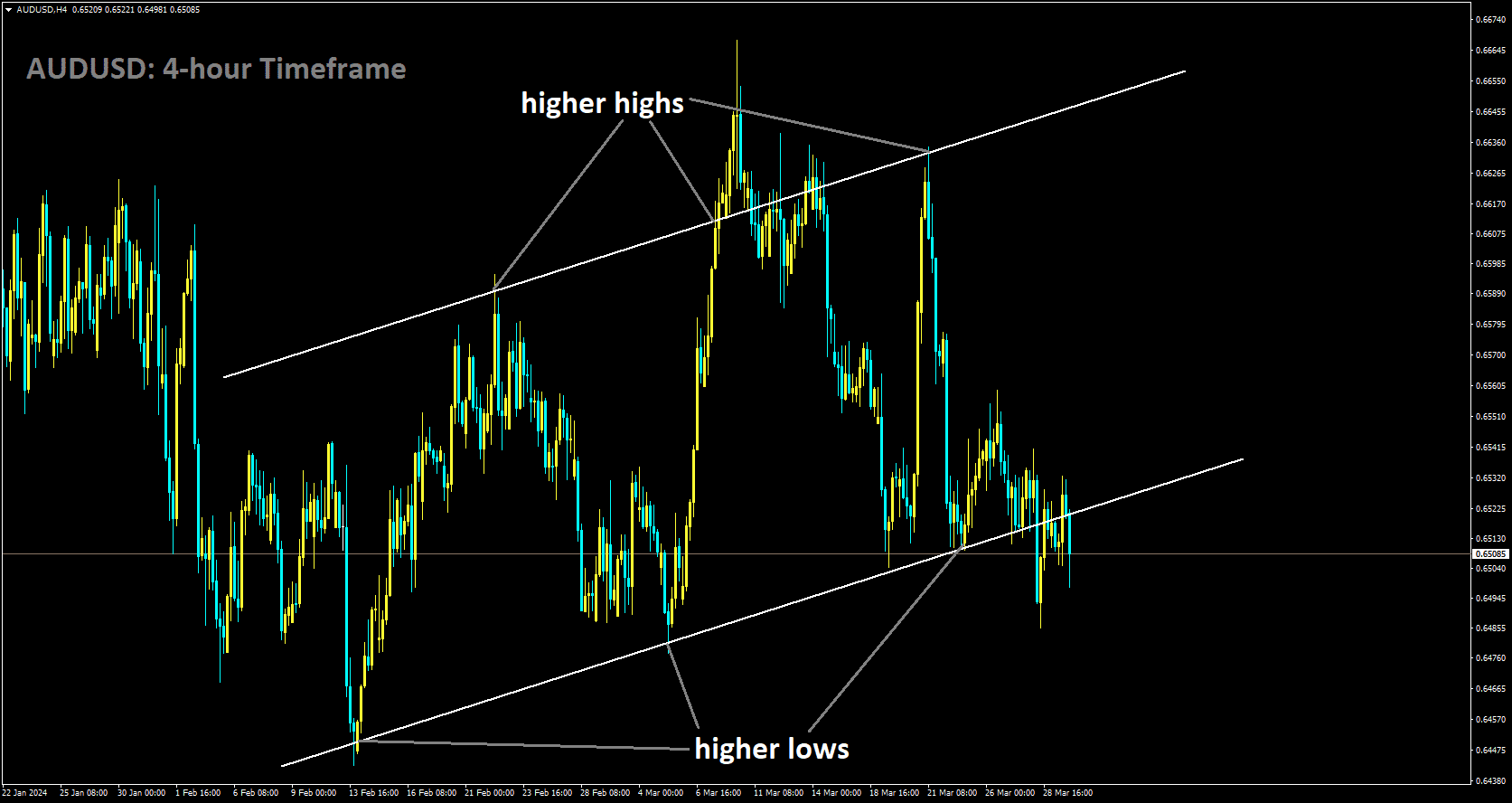

AUDUSD- Awaits US Core PCE Data Amid Economic Speculations

The AUD/USD pair maintains stability as market focus shifts to upcoming US Core Personal Consumption Expenditure (PCE) inflation figures and insights into personal spending. Projections anticipate a marginal slowdown in Core PCE inflation for February, accompanied by scrutiny of personal income and spending data.

AUDUSD is moving in Ascending channel and market has reached higher low area of the channel.

Amid thin liquidity conditions on Good Friday, the Aussie Dollar remains subdued against the US Dollar. However, attention is poised to shift as the Forex market anticipates the release of the Core PCE index and speeches from Federal Reserve officials in the US.

Traders are particularly keen on the Core PCE data for February, with expectations of a slight MoM slowdown to 0.3%, while annual figures are projected to remain steady at 2.8%. Concurrently, headline PCE is forecasted to see a slight increase in both MoM and YoY figures.

Additionally, the US Bureau of Economic Analysis (BEA) will unveil insights into personal income and spending, providing further context on American consumer behavior. Analysts suggest that the surge in February Retail Sales may bolster personal spending data.

Meanwhile, Australian economic indicators point to a cooling economy, as evidenced by lower-than-expected monthly inflation and Retail Sales figures. These developments raise speculation regarding potential interest rate cuts by the Reserve Bank of Australia (RBA) in the latter half of 2024.

Meanwhile, Australian economic indicators point to a cooling economy, as evidenced by lower-than-expected monthly inflation and Retail Sales figures. These developments raise speculation regarding potential interest rate cuts by the Reserve Bank of Australia (RBA) in the latter half of 2024.

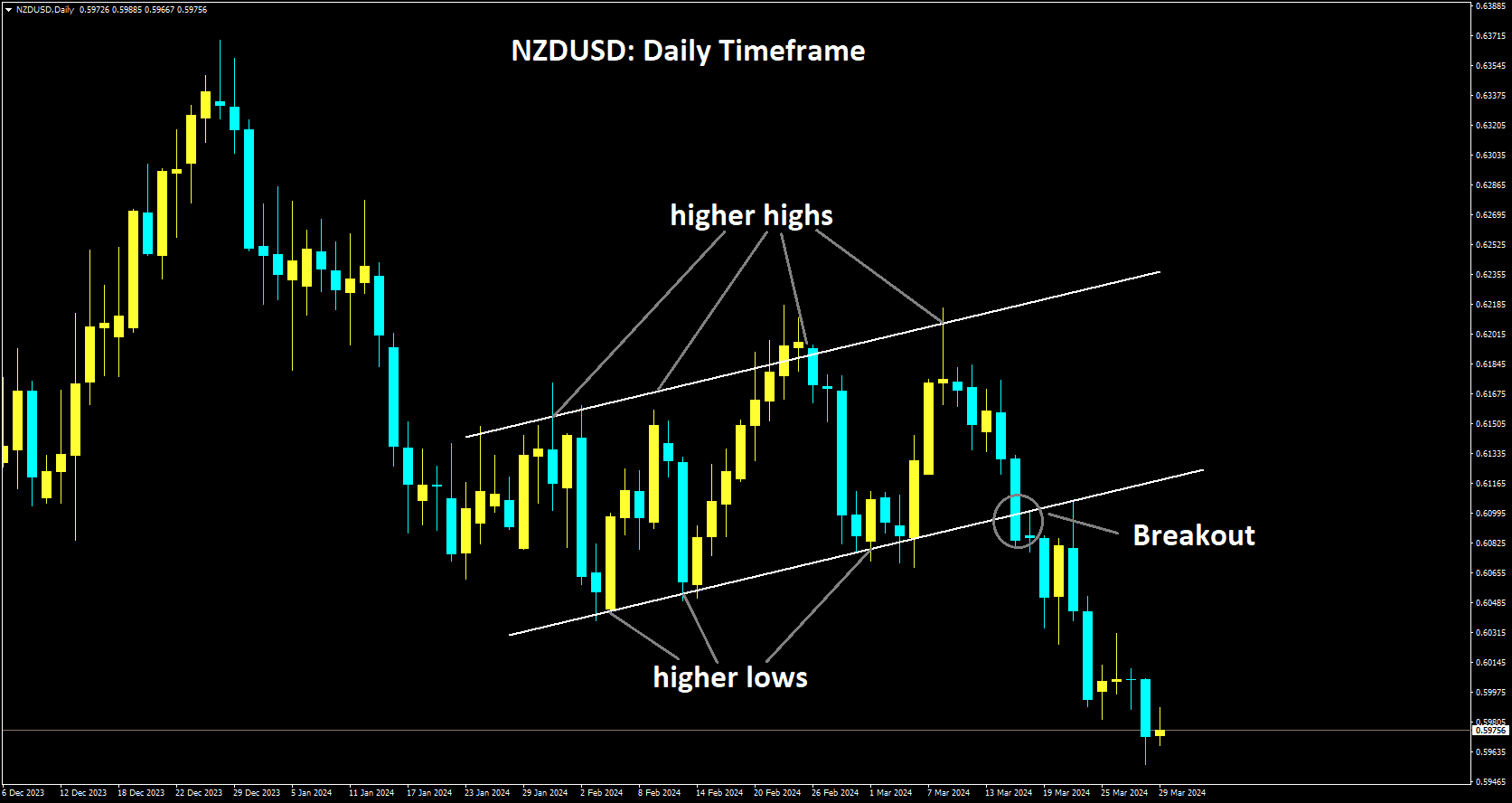

NZDUSD – US Economy Surpasses Expectations in Q4; RBNZ Dovishness Weighs on NZD

The latest data from the Bureau of Economic Analysis revealed that the US economy experienced stronger-than-anticipated growth in the fourth quarter (Q4), driven by robust consumer spending and corporate investment. According to the third estimate, Q4 Gross Domestic Product (GDP) expanded at an annualized rate of 3.4%, surpassing the previous estimate of 3.2%. This positive development prompted a rise in the value of the US Dollar (USD), reflecting the market’s optimism about the economic outlook.

NZDUSD has broken Ascending channel in downside.

In contrast, the New Zealand Dollar (NZD) encountered downward pressure following dovish remarks made by Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr. Orr conveyed the central bank’s commitment to restoring inflation to within the target range, while also hinting at the likelihood of impending rate cuts. Despite the RBNZ’s indication of potential rate reductions starting from early next year, market expectations lean towards cuts occurring as soon as August. This dovish stance exerted significant downward pressure on the NZD, acting as a drag on the NZD/USD currency pair.

With the focus now turning to the release of US February Personal Consumption Expenditures (PCE) data, scheduled for Friday, investors are anticipating further insights into the state of the US economy. Projections suggest a 0.3% month-on-month (MoM) increase and a 0.8% year-on-year (YoY) rise in the Core PCE. A report that exceeds these expectations could provide additional support for the USD. Meanwhile, the NZD remains vulnerable to the headwinds generated by the cautious tone adopted by the RBNZ, as investors await fresh catalysts from the upcoming data release.

With the focus now turning to the release of US February Personal Consumption Expenditures (PCE) data, scheduled for Friday, investors are anticipating further insights into the state of the US economy. Projections suggest a 0.3% month-on-month (MoM) increase and a 0.8% year-on-year (YoY) rise in the Core PCE. A report that exceeds these expectations could provide additional support for the USD. Meanwhile, the NZD remains vulnerable to the headwinds generated by the cautious tone adopted by the RBNZ, as investors await fresh catalysts from the upcoming data release.

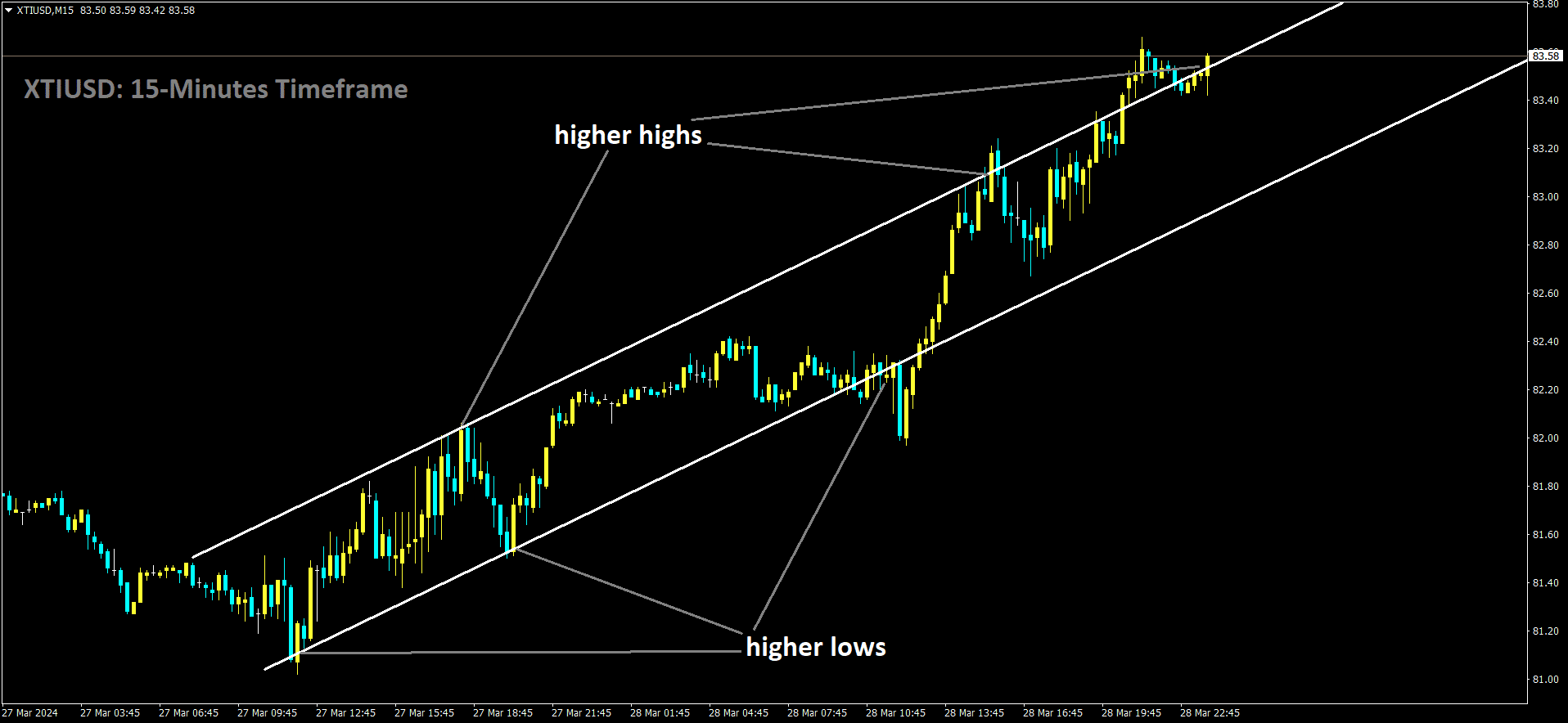

CRUDE OIL – US Oil Prices Surge as Dollar Strengthens

WTI Oil closes near a five-month high at $82.82 on Thursday, with traders maintaining bullish sentiments despite recent US stockpile build-ups. The US Dollar Index also trends upward, potentially reaching a fresh monthly high.

Crudeoil is moving in an Ascending channel and the market has reached the higher high area of the channel.

Recent weeks have witnessed a notable uptick in oil prices, fueled by various factors affecting the US’s position in the global oil market. While some bearish movements were attributed to US efforts to flood the market and temper prices, Bloomberg reports a contradictory scenario. The US Energy Department actively purchases oil at current prices to replenish strategic reserves, despite selling oil to lower prices. This dynamic adds complexity to the oil market outlook.

Simultaneously, the US Dollar exhibits strength, with bulls experiencing a four-day winning streak ahead of the US Personal Consumption Expenditures (PCE) Price Index release. Elevated inflation measures prompt market apprehension, potentially leading to reassessment of anticipated interest rate cuts by the US Federal Reserve.

Anticipation builds for the upcoming OPEC meeting, where discussions on extending production cuts are expected. Saudi Arabia is anticipated to continue its contribution until year-end.

Despite Easter Monday, the US Energy Information Administration will release weekly US stockpile changes as scheduled, with the American Petroleum Institute issuing overnight figures on Tuesday.

Meanwhile, reports indicate numerous oil tankers stranded off the coast of Venezuela, posing challenges for traders who capitalized on eased sanctions against the country but now face loading difficulties.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/