GBP: GBP strengthens on robust UK Manufacturing PMI

UK Manufacturing PMI data came at 50.3 in March month than 49.9 in the previous month. The First quarter ending Manufacturing data came at higher than expected. Recent expansion in UK economy comes from new orders and increasing production. GBP Pairs slight upside due to slowdown in other economy features.

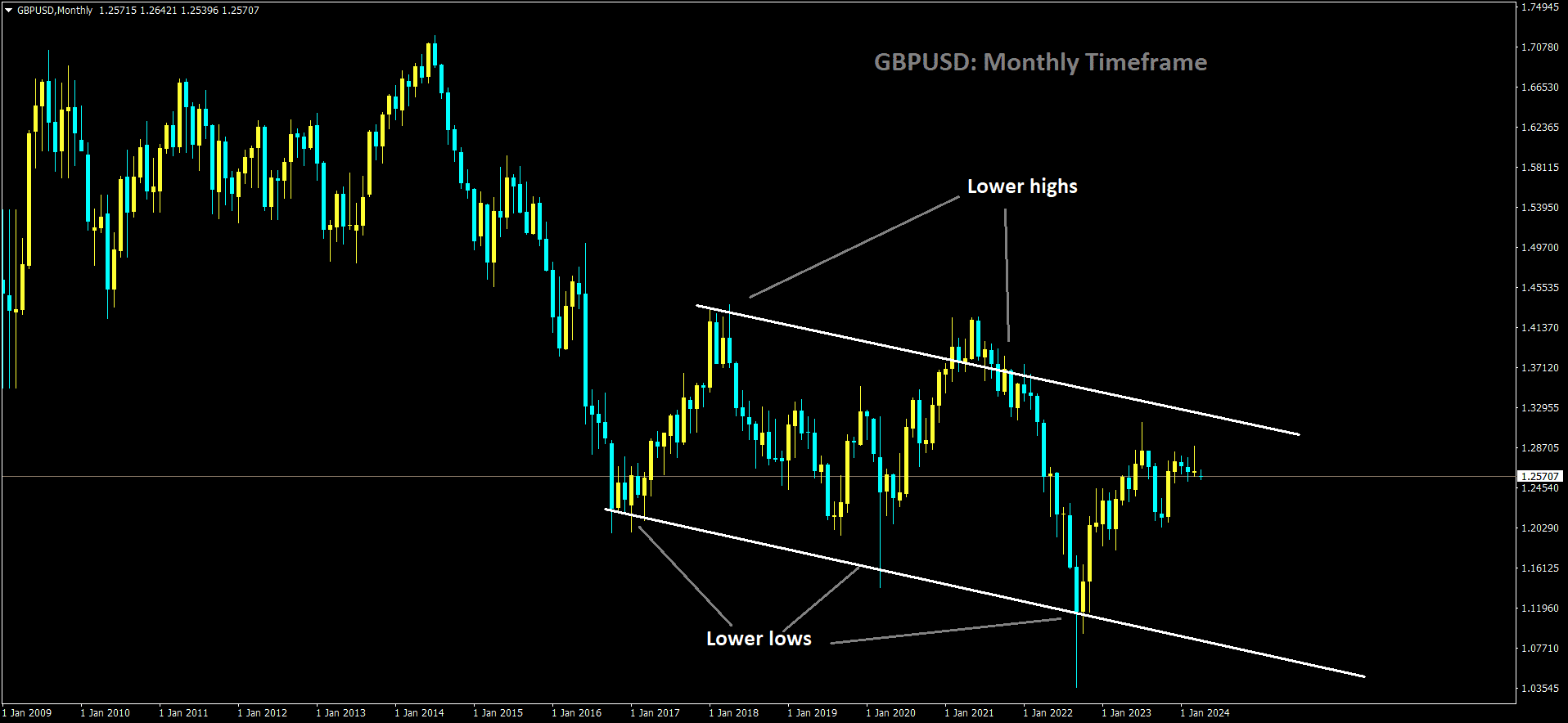

GBPUSD is moving in Descending channel and market has rebounded from the lower low area of the channel

GBP rallies as UK Manufacturing PMI beats expectations, reaching 50.3 in March, signaling expansion in the sector and providing a boost to the Pound Sterling (GBP). Rob Dobson from S&P Global Market Intelligence noted the recovery in UK manufacturing, with production and new orders showing growth, particularly driven by stronger domestic demand.

However, the overall outlook for GBP/USD remains subdued due to weak market sentiment. Traders have adjusted their expectations for the Federal Reserve’s interest rate cuts, now anticipating a delay in the first cut, previously expected in the June meeting. This adjustment favors the US Dollar (USD) and weighs on the currency pair.

The robust recovery in the US manufacturing sector, evidenced by strong economic indicators, has led traders to reconsider their bets on rate cuts. Increased demand in the US manufacturing industry indicates healthy household spending, giving the Federal Reserve more time to assess inflation data before considering rate adjustments.

The US Dollar Index (DXY) has reached a fresh four-month high above 105.00, supported by safe-haven demand and positive US economic prospects. Market participants await the Nonfarm Payrolls (NFP) data for March from the US Bureau of Labor Statistics (BLS) on Friday, with the US JOLTS Job Openings data for February scheduled for release earlier in the week.

The Pound Sterling faces additional pressure from slowing UK inflation, as reported by the British Retail Consortium (BRC), with shop price inflation growing at its slowest pace in over two years. Lower inflation could provide grounds for the Bank of England (BoE) to consider interest rate cuts, with expectations for a reduction starting from the June meeting.

Despite these challenges, the US Dollar’s strength persists, fueled by positive US economic data, creating a challenging environment for the Pound Sterling.

GBP: UK PMI Survey: Manufacturing Sector Grows After 2-Year Slump

UK Manufacturing PMI data came at 50.3 in March month than 49.9 in the previous month. The First quarter ending Manufacturing data came at higher than expected. Recent expansion in UK economy comes from new orders and increasing production. GBP Pairs slight upside due to slowdown in other economy features.

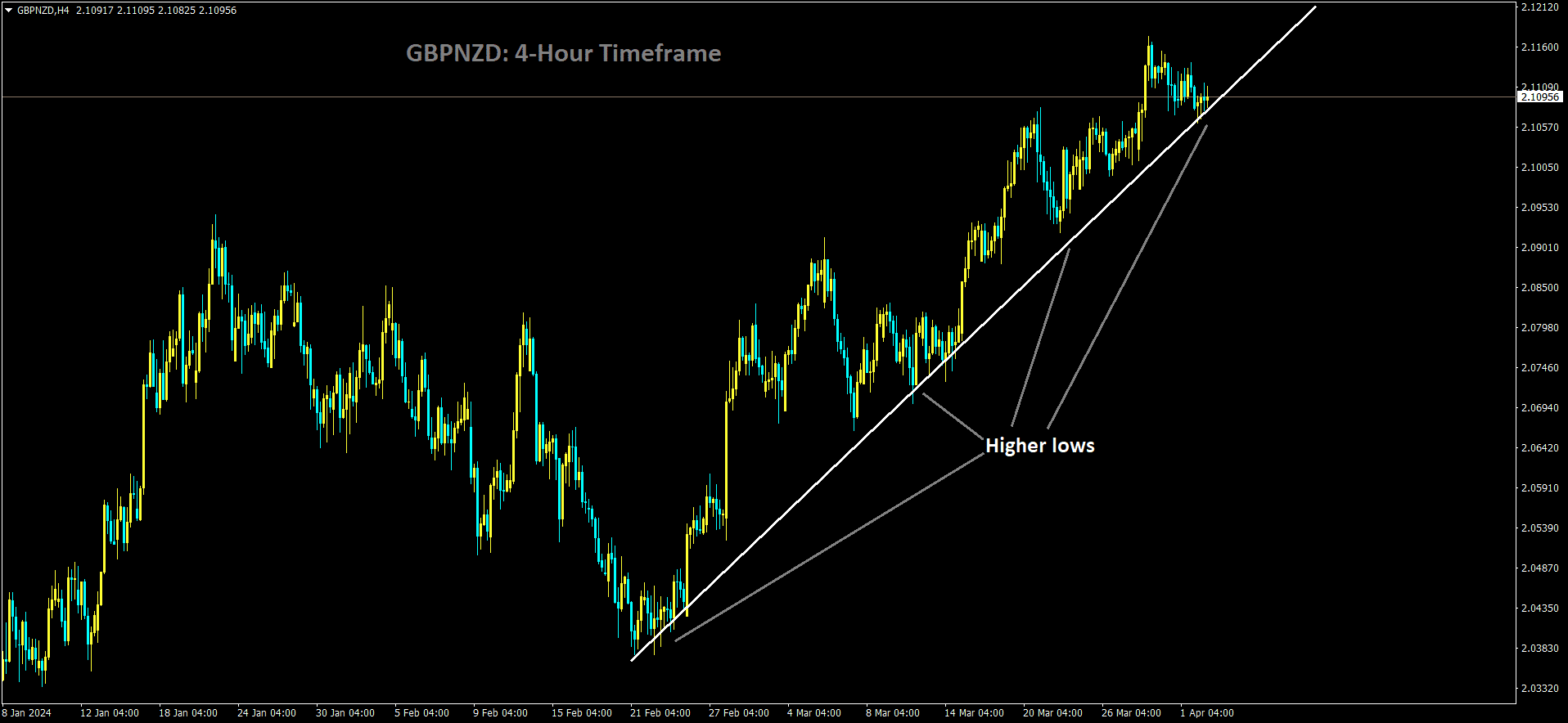

GBPNZD is moving in uptrend line and market has reached higher low area of the pattern

British manufacturers saw their first overall growth in activity in 20 months in March, indicating a rebound in demand within the domestic market and suggesting an end to last year’s shallow recession. The S&P Global/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) climbed to 50.3, surpassing the preliminary March reading of 49.9 and marking an improvement from February’s 47.5. This is the first time since July 2022 that the PMI has crossed the 50 threshold, indicating growth.

The latest PMI data, along with other business surveys and official statistics, indicates a stronger start to 2024 for the UK economy after experiencing a recession in the latter half of 2023. The Bank of England will scrutinize the PMI figures for signs that underlying inflation pressures are easing, potentially paving the way for interest rate cuts.

While the survey’s employment index showed a continued reduction in staffing levels for the 18th consecutive month, the pace of decline slowed, marking the slowest rate since May of the previous year. Input costs accelerated slightly, rising at the fastest pace in a year, leading companies to raise prices by the most since May of the previous year. Delays in shipping in the Red Sea further prolonged delivery times for supplies.

GBP: GBP sees mild recovery from near 2-month low on improving PMI data.

UK Manufacturing PMI data came at 50.3 in March month than 49.9 in the previous month. The First quarter ending Manufacturing data came at higher than expected. Recent expansion in UK economy comes from new orders and increasing production. GBP Pairs slight upside due to slowdown in other economy features.

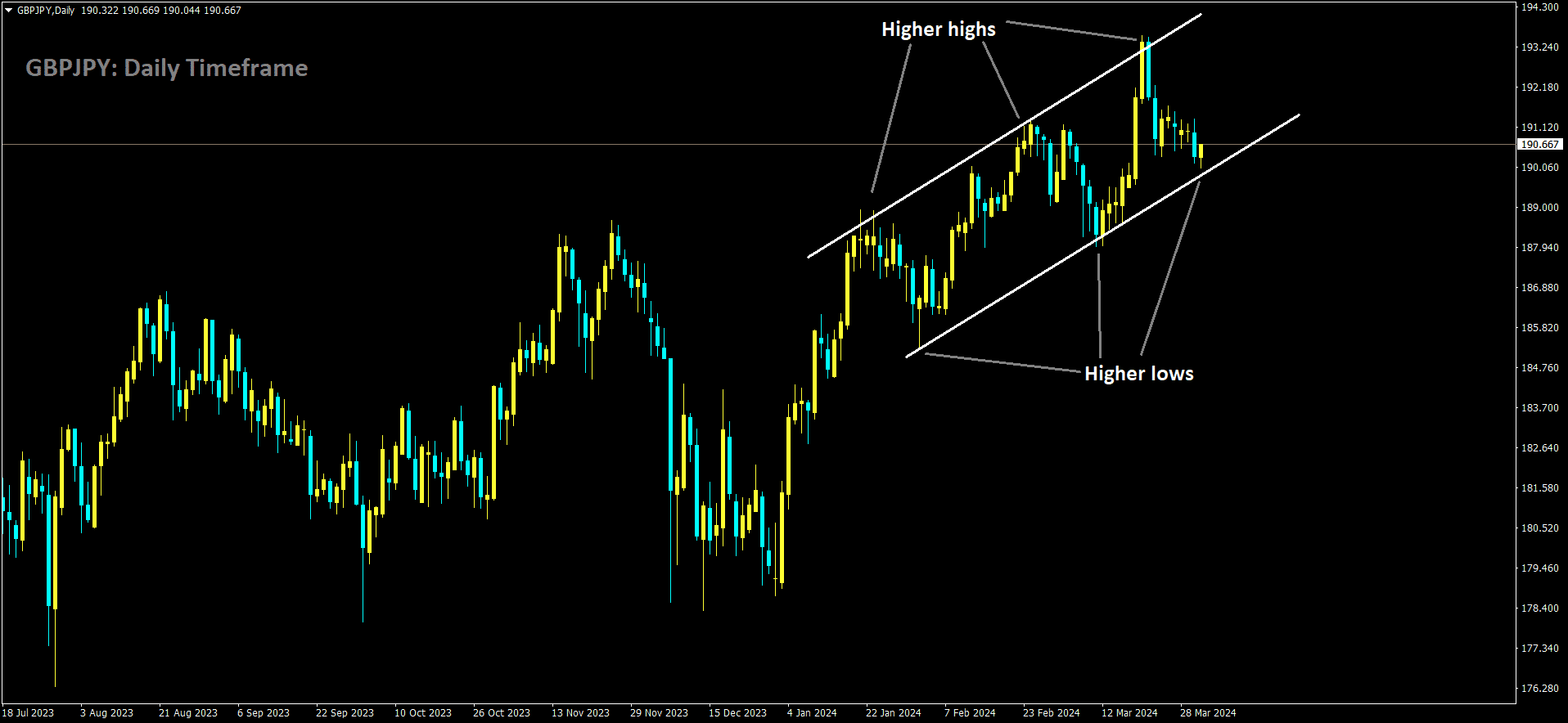

GBPJPY is moving in Ascending channel and market has reached higher low area of the channel

During the European session on Tuesday, the UK pound showed signs of recovery, bouncing back from a near two-month low against the dollar. This upward movement was driven by positive economic data indicating a tentative improvement in the UK manufacturing sector for March. Both output and new orders saw increases, marking a turnaround from year-long declines. The seasonally adjusted S&P Global UK Manufacturing Purchasing Managers Index (PMI) climbed to a 20-month high of 50.3 in March, up from 47.5 in February and surpassing the earlier flash estimate of 49.9. Notably, this marked the first time since July 2022 that the PMI exceeded the neutral 50.0 mark.

In response to this positive news, However, despite this recovery, the pair faced pressure from the broad strength in US dollar index futures in the overseas market, which had been weighing on it for several days. Following the release of the US ISM business activity report from March. This report showed the highest growth in business activity since September 2022, indicating resilience in the US economy and potentially deterring the Federal Reserve from immediate rate cuts.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/