BTCUSDT: Bitcoin falls 5% on strong US factory data, boosts dollar to 5-month high

The Bitcoin prices are dropped to 5% after the US Manufacturing data printed at stronger reading in this week. US ISM Manufacturing PMI printed at 50.3 in March month from 47.8 in February month.

Bitcoin (BTC) faced selling pressure in Asian trading hours on Tuesday as upbeat U.S. factory data buoyed the dollar index (DXY) to its highest level since mid-November.

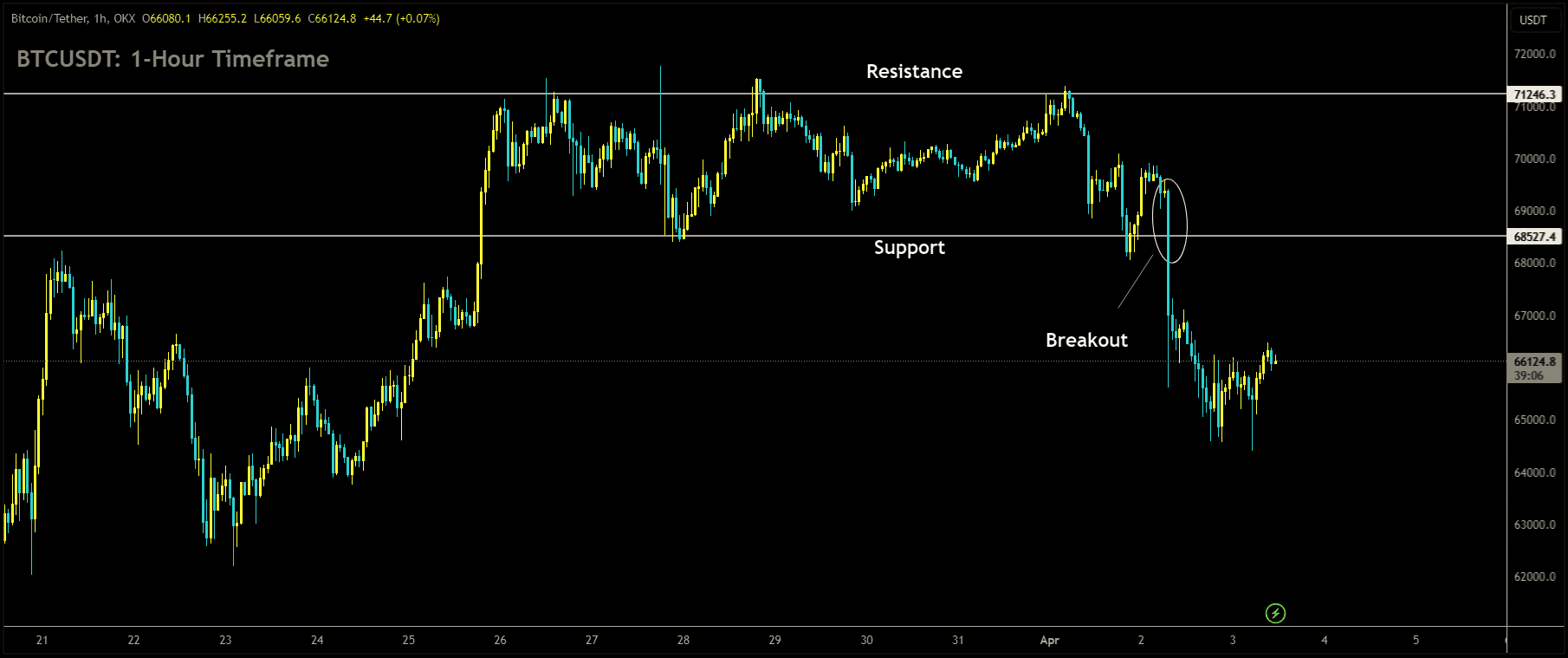

BTCUSDT Market Price has broken box pattern in downside.

The dollar index, which measures the greenback’s strength against major fiat currencies, surpassed the 105 mark for the first time in over four months, with a four-week gain of 2.58%. A stronger dollar tends to make dollar-denominated assets like bitcoin and gold more expensive, potentially dampening demand. Additionally, continued dollar strength can lead to global financial tightening, reducing investors’ appetite for risk.

The Institute for Supply Management’s (ISM) manufacturing purchasing manager’s index (PMI) for March, released on Monday, unexpectedly showed expansion in factory activity for the first time since September 2022. The PMI increased by 2.5 points to 50.3 last month, signaling growth above the 50 threshold after 16 consecutive months of contraction. This improvement weakened the case for Federal Reserve rate cuts. The new orders index also returned to expansion territory, and the prices index surged to 55.8%.

Following the manufacturing report, the amount of expected Fed rate cuts priced into swap contracts for this year dropped to less than 65 basis points, according to Bloomberg. This indicates reduced market expectations for the Fed’s forecast of three 25-basis point rate cuts in 2024. The probability of the Fed delivering the first rate cut in June has fallen below 50%.

Despite these developments, some analysts foresee rapid rate cuts by the Fed due to escalating fiscal debt, which could provide significant bullish momentum for crypto prices. In the past, the Fed’s tightening measures, including rate hikes, have contributed to significant price declines in bitcoin, such as the 80% crash observed in 2022.

BTCUSDT: Crypto Prices on April 2: Bitcoin drops 6% to $66,400 post US March manufacturing data

The Bitcoin prices are dropped to 5% after the US Manufacturing data printed at stronger reading in this week. US ISM Manufacturing PMI printed at 50.3 in March month from 47.8 in February month.

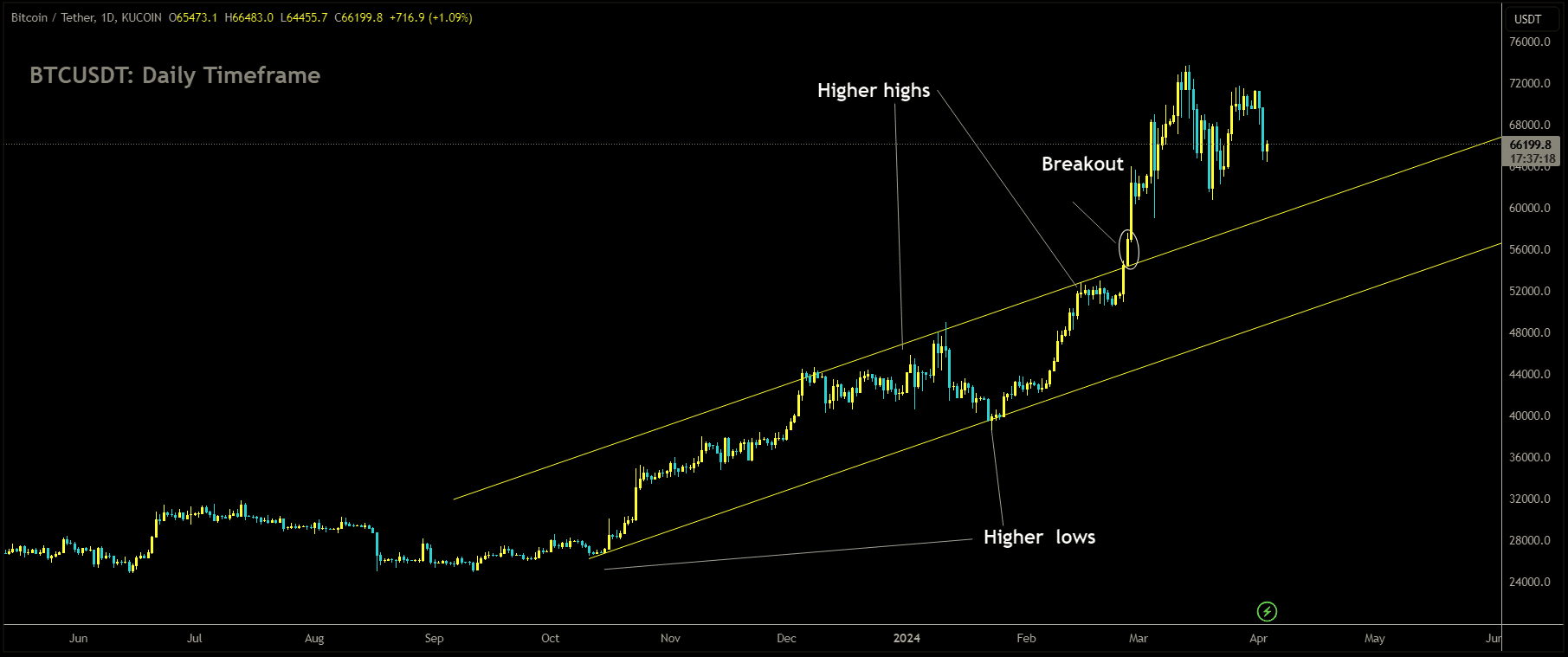

BTCUSDT has broken Ascending channel in upside

During the trading session on Tuesday, Bitcoin experienced a decline of 5.8%, dropping to $66,398, following the release of US manufacturing sector data for March, which surpassed expectations. Simultaneously, Ethereum, the second-largest cryptocurrency, also saw a significant plunge of over 6.6%, reaching $3,365.

In March, the manufacturing sector in the United States witnessed growth for the first time in 1-1/2 years. This growth was characterized by a sharp rebound in production and an increase in new orders. However, despite these positive indicators, employment levels at factories remained subdued. Additionally, prices for inputs were pushed higher during this period.

BTCUSDT: Bitcoin Falls Over 5% as US Factory Data Boosts Dollar Index

The Bitcoin prices are dropped to 5% after the US Manufacturing data printed at stronger reading in this week. US ISM Manufacturing PMI printed at 50.3 in March month from 47.8 in February month.

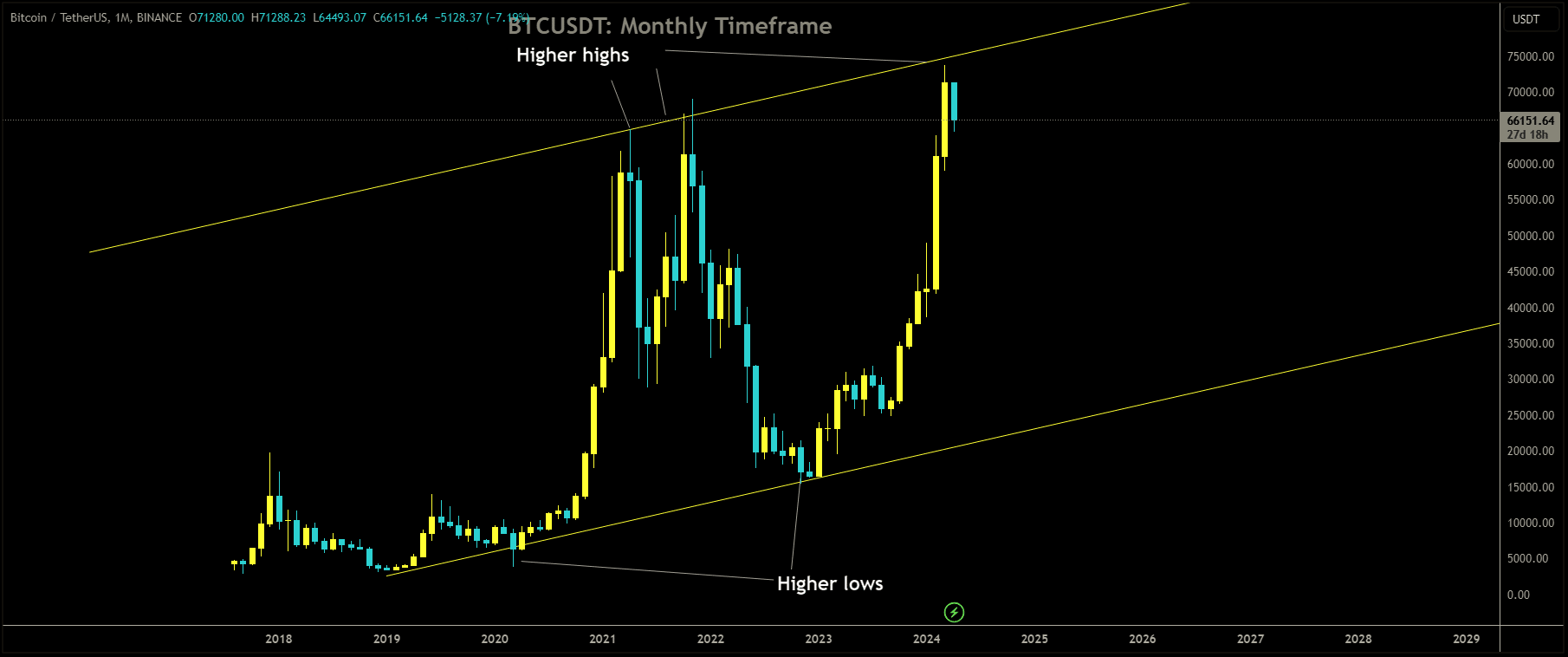

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

On Monday, data revealed that U.S. manufacturing activity unexpectedly accelerated in March. The Institute for Supply Management’s (ISM) manufacturing purchasing manager’s index (PMI) for March showed that factory activity expanded, marking the first growth since September 2022. The PMI rose by 2.5 points to 50.3 last month, surpassing February’s reading of 47.8. This expansion halted 16 consecutive months of contraction and weakened the case for Federal Reserve rate cuts. Additionally, the new orders index returned to expansion territory, while the prices index surged to 55.8%.

Following the release of the manufacturing report, the probability of a June rate cut by the Federal Reserve dropped below 50%, with the amount of expected rate cuts priced into swap contracts for this year falling to less than 65 basis points, as reported by Bloomberg. This indicates reduced market expectations for the Fed’s forecast of three 25-basis point rate cuts in 2024.

Analysts noted that the return of manufacturing growth and higher inflation readings from the sector contributed to a rise in 10-year Treasury yields by 10 basis points. The market anticipates that the ISM report will make Federal Reserve officials cautious about committing to significant policy easing.

Despite these developments, some analysts believe that mounting fiscal debt will compel the Fed to cut rates rapidly, which could offer significant bullish momentum to crypto prices. In the past, the Fed’s tightening measures, including rate hikes, contributed to substantial price declines in Bitcoin, such as the 80% crash observed in 2022.

Looking ahead, Bitcoin may experience continued volatility as several job reports are scheduled for release this week, including Friday’s nonfarm payrolls figure and the unemployment rate. Additionally, Bitcoin’s quadrennial mining reward halving is anticipated later this month.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/