Swiss Franc: USD/CHF rises to 0.9070 on weak Swiss CPI

The Swiss CPI Data for the March month came at 1% well below the 1.3% expected data and 1.2% in February month. Now SNB target of 0-2% range is fulfilled by March month data. Further meetings may be rate cuts from SNB are possible have more chances, So Swiss Franc pulled down from highs after the data printed.

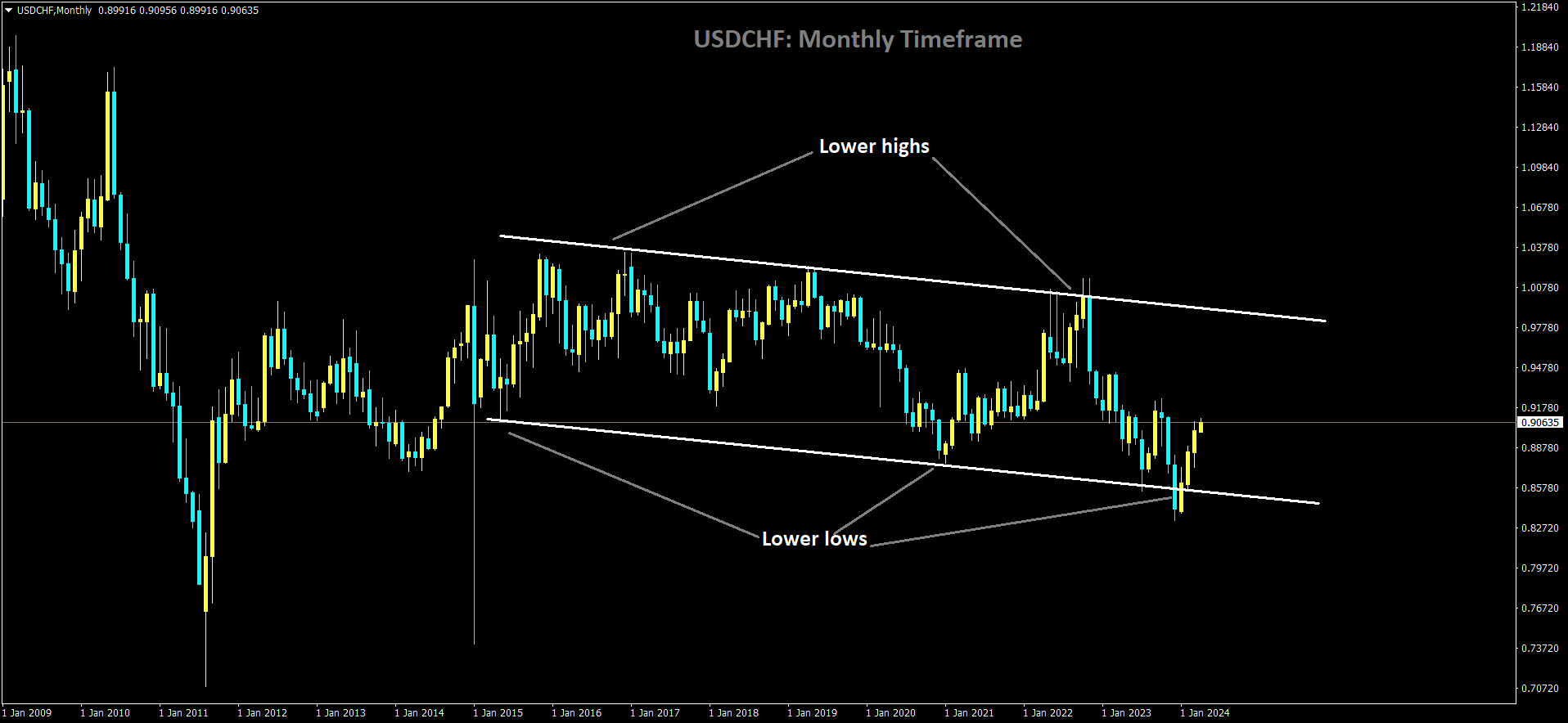

USDCHF is moving in Descending channel and market has rebounded from the lower low area of the channel

The Swiss Franc (CHF) has gained strength following the release of softer-than-expected Switzerland Consumer Price Index (CPI) data for March, which has heightened expectations of additional interest rate cuts by the Swiss National Bank (SNB).

The SNB has been leading the rate-cut cycle among developed economies, having reduced interest rates by 25 basis points (bps) to 1.5% during its monetary policy meeting on March 21.

According to the Federal Statistical Office of Switzerland, monthly consumer price inflation remained stagnant, contrary to expectations of a 0.3% increase. In February, price pressures had risen by 0.6%. Surprisingly, annual inflationary pressures grew at a slower pace of 1.0% compared to economists’ expectations of 1.3%, following a 1.2% increase in February.

Concurrently, the US Dollar (USD) has continued its decline, driven by disappointing United States Services PMI data for March, which has tempered economic outlook sentiments. The US Dollar Index (DXY), reflecting the USD’s value against six major currencies, has dropped to 104.12.

USDCHF is moving in Ascending channel and market has reached higher high area of the channel

The Institute of Supply Management (ISM) reported a decrease in the Services PMI to 51.4, falling short of expectations of 52.7 and the previous reading of 52.6. Notably, subindexes such as New Orders and Prices Paid witnessed significant declines.

Looking ahead, investors are eagerly awaiting the release of the US Nonfarm Payrolls (NFP) data for March, scheduled for Friday. It is anticipated that US employers added 200K workers, down from the previous reading of 275K.

CHF: Swiss CPI Inflation Hits 2.5-Year Low

The Swiss CPI Data for the March month came at 1% well below the 1.3% expected data and 1.2% in February month. Now SNB target of 0-2% range is fulfilled by March month data. Further meetings may be rate cuts from SNB is possible have more chances, So Swiss Franc pulled down from highs after the data printed.

GBPCHF is moving in Ascending channel and market has rebounded from the higher low area of the channel

In March, Switzerland’s annual consumer inflation rate saw a further decline, dropping to 1% from 1.2% in February, according to data released by the Swiss Federal Statistical Office.

This figure surprised market analysts who had expected an increase to 1.3%, marking the lowest CPI inflation rate since September 2021.

The prices of food and non-alcoholic beverages experienced a decline of 0.4% year-on-year (YoY) in March, compared to a rise of 0.8% in February. Similarly, the cost of healthcare and transportation both decreased by 0.5% YoY in March.

However, certain categories saw an increase in inflation rates. Housing and utilities experienced a slight acceleration with a 3.2% YoY increase compared to 3.1% YoY in February. Recreation and culture also saw a rise to 1.8% YoY from 1.7% YoY in February, while other goods and services experienced a 1.1% YoY increase compared to 1% YoY in February.

Reflecting a divergence in monetary policy between the Swiss National Bank (SNB) and the Federal Reserve. The SNB notably reduced its key interest rate by 25 basis points to 1.5% in March, marking the first major rate cut by a central bank since the onset of global disinflation in 2023.

Swiss Franc : Swiss inflation dips to 2-½-year low

The Swiss CPI Data for the March month came at 1% well below the 1.3% expected data and 1.2% in February month. Now SNB target of 0-2% range is fulfilled by March month data. Further meetings may be rate cuts from SNB is possible have more chances, So Swiss Franc pulled down from highs after the data printed.

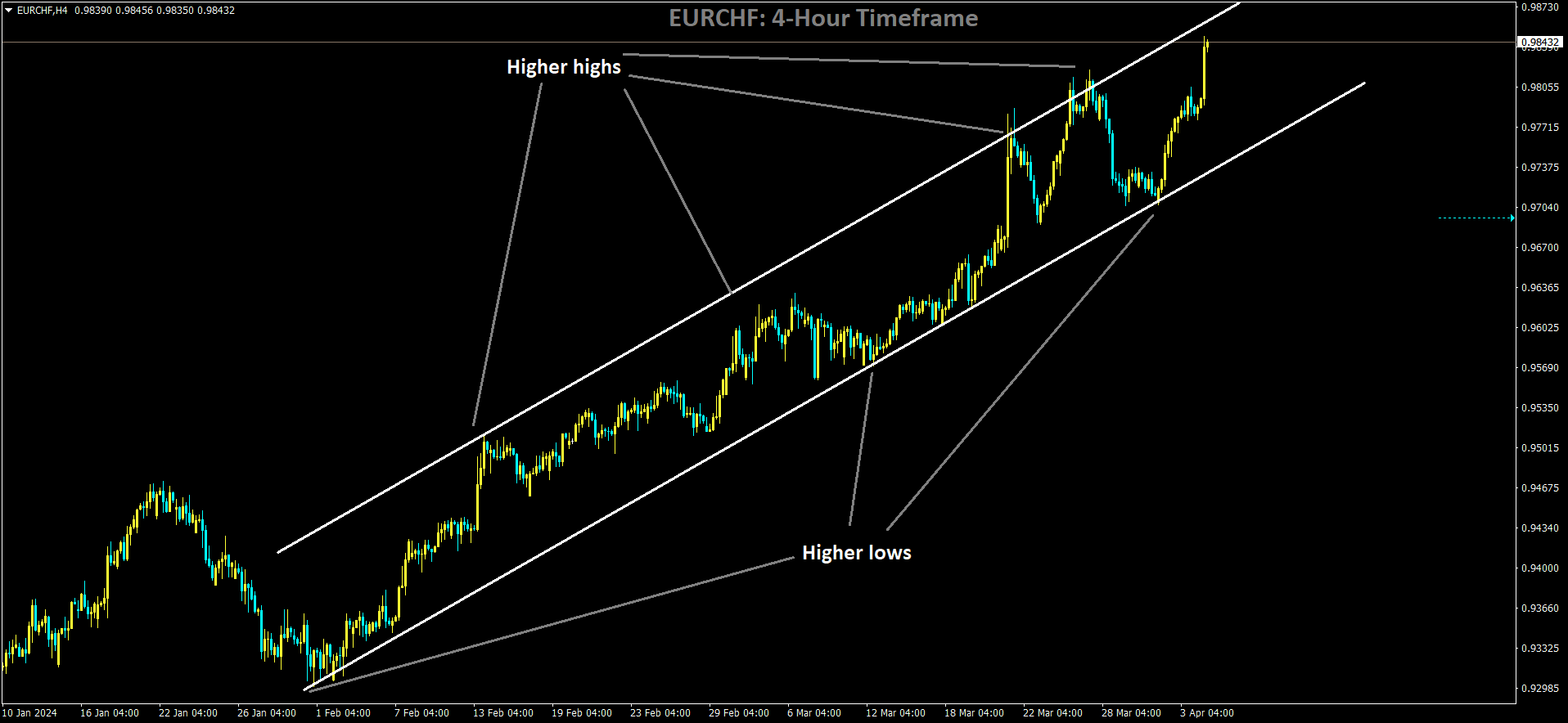

EURCHF is moving in Ascending channel and market has reached higher high area of the channel

In March 2024, Switzerland witnessed a deceleration in its annual inflation rate, which dropped to 1% from the previous month’s 1.2%. This figure fell short of market expectations, which anticipated a rate of 1.3%.

This decrease marked the lowest inflation reading since September 2021. The decline was primarily attributed to notable drops in prices for food and non-alcoholic beverages, which fell by 0.4% compared to a rise of 0.8% in February. Additionally, there was continued deflation in healthcare (-0.5% compared to the previous -0.4%) and transport (remaining unchanged at -0.5%).

Conversely, certain sectors saw a slight increase in inflation. Housing and utilities saw a modest uptick to 3.2% from 3.1%, while recreation and culture rose to 1.8% from 1.7%. Similarly, other goods and services experienced a marginal increase to 1.1% from 1%.

On a monthly basis, the Consumer Price Index (CPI) remained unchanged, following a 0.6% rise in February, missing market forecasts of a 0.3% increase.

Meanwhile, the core inflation rate, which excludes volatile items such as unprocessed food and energy, experienced a slight decline, dropping to 1% from the previous 1.1%.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/