BTCUSDT: BlackRock Enlists Goldman Sachs, Citigroup, UBS for Bitcoin ETF

The Blackrock added 5 additional Aps for distributions and ledge maintaining Bitcoing ETFs in the ishares Bitcoin trust. Namely, Goldman Sachs, Citadel group, ABN AMRO, Citi group and UBS.

Now totally 9 Aps for Black Rock to maintain the Bitcoing ETFs asset handling of $18 Billion.

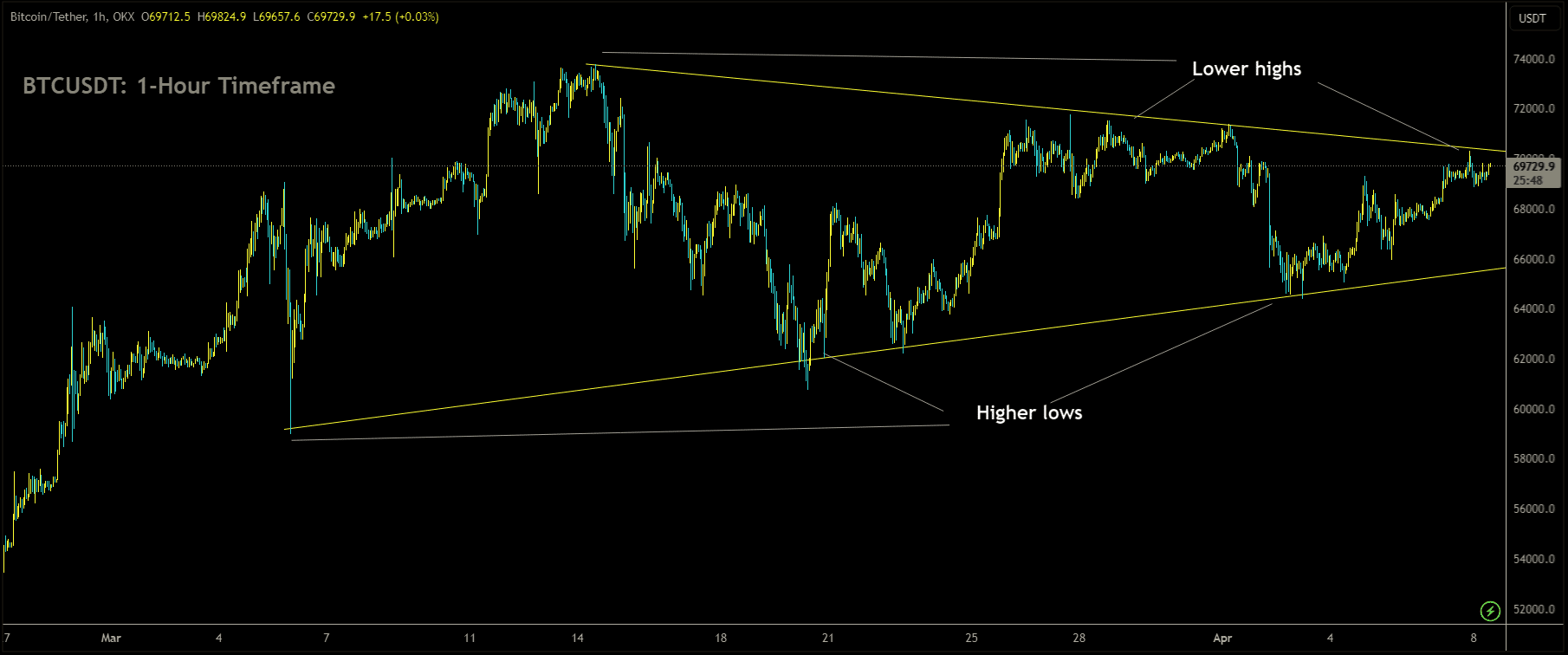

BTCUSDT Market Price is moving in Symmetrical Triangle and market has reached lower high area of the pattern

BlackRock (BLK) has expanded the roster of authorized participants (APs) for the iShares Bitcoin Trust (IBIT) by adding five new entities, bringing the total number of APs to nine. This move comes as the fund continues to attract significant investment from various investors, amassing billions of dollars in assets.

The newly added APs include renowned Wall Street banking giants such as Goldman Sachs, Citadel Securities, Citigroup, and UBS, along with clearing house ABN AMRO, as revealed in a prospectus submitted to the U.S. Securities and Exchange Commission (SEC). These entities join the existing list of APs, which includes Jane Street Capital, JP Morgan, Masquarie, and Virtu Americas.

Reports from CoinDesk in January had indicated that Goldman Sachs was actively seeking to play a pivotal role in the realm of bitcoin ETFs and was engaged in discussions with issuers regarding its potential participation as an AP.

Authorized participants play a crucial role in the ETF ecosystem by aiding in the creation of liquidity. They manage the supply of shares, ensuring balance in situations of shortage or surplus. Typically, large ETFs are supported by numerous APs. Despite being in existence for less than three months, IBIT has swiftly grown in size, boasting nearly $18 billion in assets under management as of the previous trading day’s close.

The involvement of Goldman Sachs in the IBIT as an AP is particularly noteworthy, given recent remarks from the bank’s wealth management chief investment officer. Just this week, the officer stated that Goldman Sachs perceives cryptocurrencies as having “no value” and expressed the bank’s lack of urgency in participating in the crypto space, despite significant moves by other traditional finance (TradFi) giants.

BTCUSDT: BlackRock Expands Bitcoin ETF APs with Goldman Sachs, Citigroup, UBS

The Blackrock added 5 additional Aps for distributions and ledge maintaining Bitcoing ETFs in the ishares Bitcoin trust. Namely, Goldman Sachs, Citadel group, ABN AMRO, Citi group and UBS.

Now totally 9 Aps for Black Rock to maintain the Bitcoing ETFs asset handling of $18 Billion.

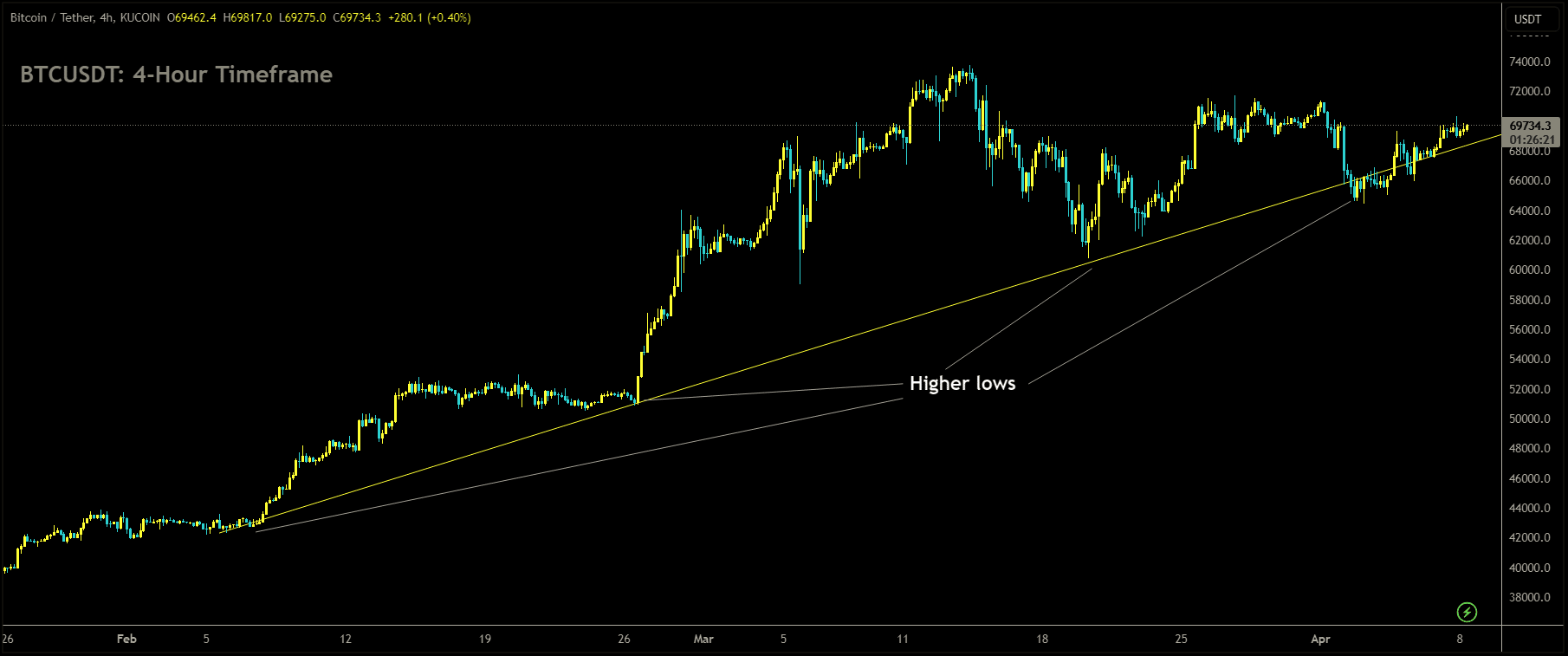

BTCUSDT Market Price is moving in Ascending channel and market has reached higher high area of the channel

BlackRock (BLK), a prominent investment management firm, has expanded the lineup of authorized participants (APs) for the iShares Bitcoin Trust (IBIT) by adding five additional entities. This move brings the total number of APs associated with the trust to nine, showcasing the growing interest in the fund among investors and the financial industry.

The newly added APs include renowned Wall Street banking giants such as Goldman Sachs, Citadel Securities, Citigroup, and UBS, along with clearing house ABN AMRO. This information was disclosed in a prospectus filed with the U.S. Securities and Exchange Commission (SEC). These entities now join the existing list of APs, which includes Jane Street Capital, JP Morgan, Masquarie, and Virtu Americas.

CoinDesk, a cryptocurrency news outlet, had previously reported in January that Goldman Sachs was actively exploring a significant role in the bitcoin ETF space and was engaged in discussions with issuers regarding potential participation as an AP.

Authorized participants play a critical role in the ETF ecosystem by facilitating liquidity. They help manage the supply of shares, ensuring balance in situations of scarcity or excess. Typically, large ETFs are supported by numerous APs. Despite being in existence for less than three months, IBIT has quickly gained traction, accumulating nearly $18 billion in assets under management as of the previous trading day’s close.

The involvement of Goldman Sachs as an AP for IBIT is particularly noteworthy, especially considering recent remarks from the bank’s wealth management chief investment officer. The officer stated that Goldman Sachs perceives cryptocurrencies as having “no value” and expressed the bank’s lack of urgency in participating in the crypto space, contrasting with the actions of other traditional finance (TradFi) giants.

BTCUSDT: BlackRock Enlists 5 New APs, Including Goldman Sachs, for Bitcoin ETF

The Blackrock added 5 additional Aps for distributions and ledge maintaining Bitcoing ETFs in the ishares Bitcoin trust. Namely, Goldman Sachs, Citadel group, ABN AMRO, Citi group and UBS.Now totally 9 Aps for Black Rock to maintain the Bitcoing ETFs asset handling of $18 Billion.

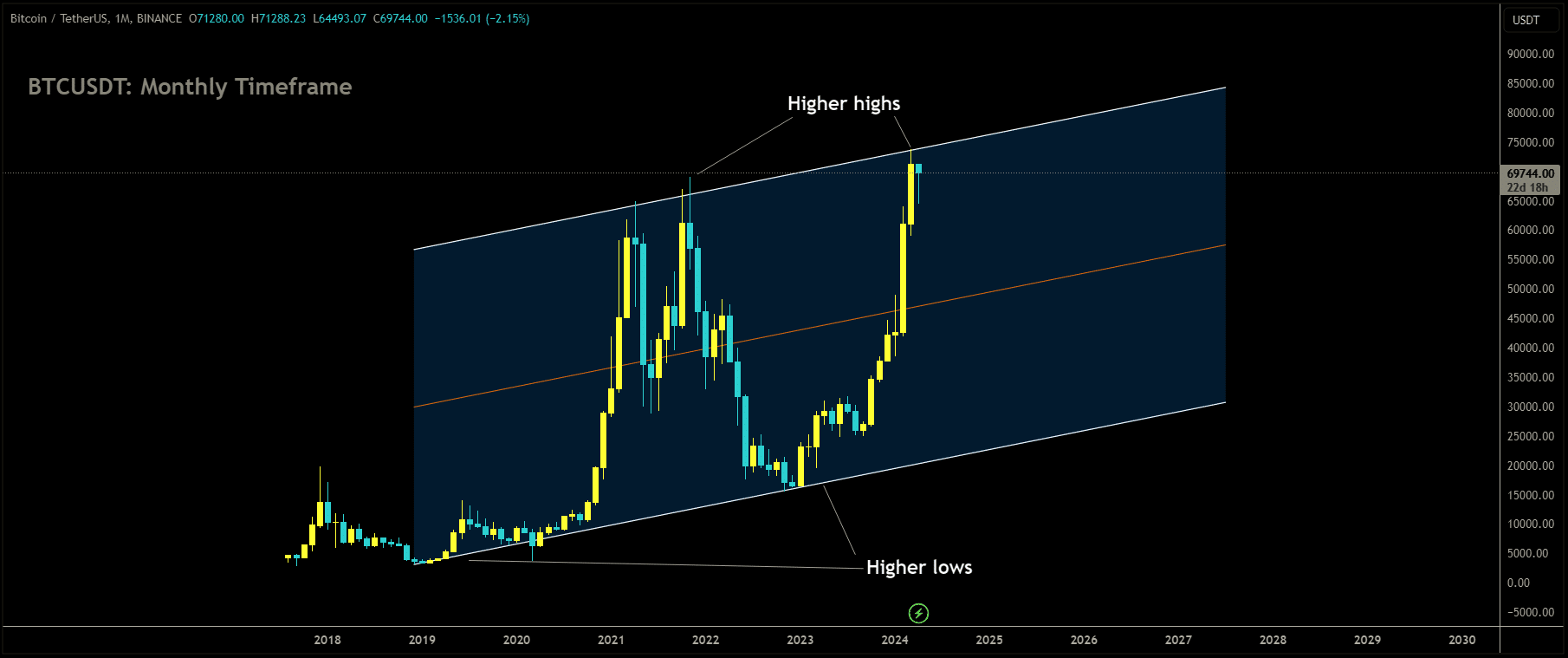

BTCUSDT is moving in uptrend line and market has reached higher low area of the pattern.

BlackRock, renowned as the world’s largest asset manager, has made a significant update to the list of Authorized Participants (APs) for its spot Bitcoin exchange-traded fund (ETF), IBIT. Launched on January 11, 2024, IBIT enables investors to access Bitcoin exposure without directly holding the digital assets.

In its latest prospectus, BlackRock has included five new Authorized Participants, expanding the total number of APs from four to nine. The fresh additions comprise ABN AMRO Clearing USA LLC, Citadel Securities LLC, Citigroup Global Markets, Inc., Goldman Sachs & Co. LLC, and UBS Securities LLC.

Authorized Participants play a pivotal role in ETF operations by facilitating the creation and redemption of ETF shares. They execute this process by transferring cash to and from the Trust Administrator through designated accounts. The augmented AP list is anticipated to enhance liquidity and accessibility for IBIT investors.

The existing Authorized Participants, delineated in the previous prospectus, consisted of Jane Street Capital, LLC, JP Morgan Securities LLC, Macquarie Capital (USA) Inc., and Virtu Americas LLC. Additionally, the prospectus stipulated that the Sponsor reserves the discretion to add further Authorized Participants as necessary.

The involvement of renowned financial institutions such as Goldman Sachs and Citigroup as Authorized Participants underscores the increasing mainstream acceptance of Bitcoin. It also reflects the rising demand for regulated investment instruments offering exposure to digital assets.

These inclusions come amid the impressive performance of both IBIT and Fidelity’s Wise Origin Bitcoin Fund (FBTC) since their inception. According to Bloomberg data, these two spot Bitcoin ETFs have surpassed 3,122 other funds by recording net inflows for 49 consecutive days—an accomplishment achieved by only 30 other ETFs in history.

The persistent investor demand for IBIT and FBTC is evident in their ability to attract inflows even during Bitcoin price declines. IBIT alone accounts for over half of BlackRock’s net flows year-to-date, surpassing inflows of any other among their 420 ETFs by twofold. Similarly, FBTC has contributed to 70% of Fidelity’s total inflows, attracting five times more investment than any other Fidelity ETF. This remarkable performance underscores the growing acceptance of cryptocurrencies as a legitimate asset class and highlights the escalating demand for regulated investment vehicles providing digital asset exposure.

As spot Bitcoin ETFs continue gaining traction, the expansion of the Authorized Participant list represents a positive development expected to further bolster the growth and stability of these funds.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/