ETHUSDT: VanEck CEO: Transaction Fee More Significant Than Bitcoin or Ethereum ETFs

The VANECK Investment Firm CEO said the gas fees on Ethereum is higher when compared to Solana coin. Solana have 1 layer protocol when compared to Ethereum. Ethereum ETFs is unlike to approve by US SEC and no hearing made so far after the Filings. Ethereum has higher gas fees it has to be address and solved in upcoming versions.

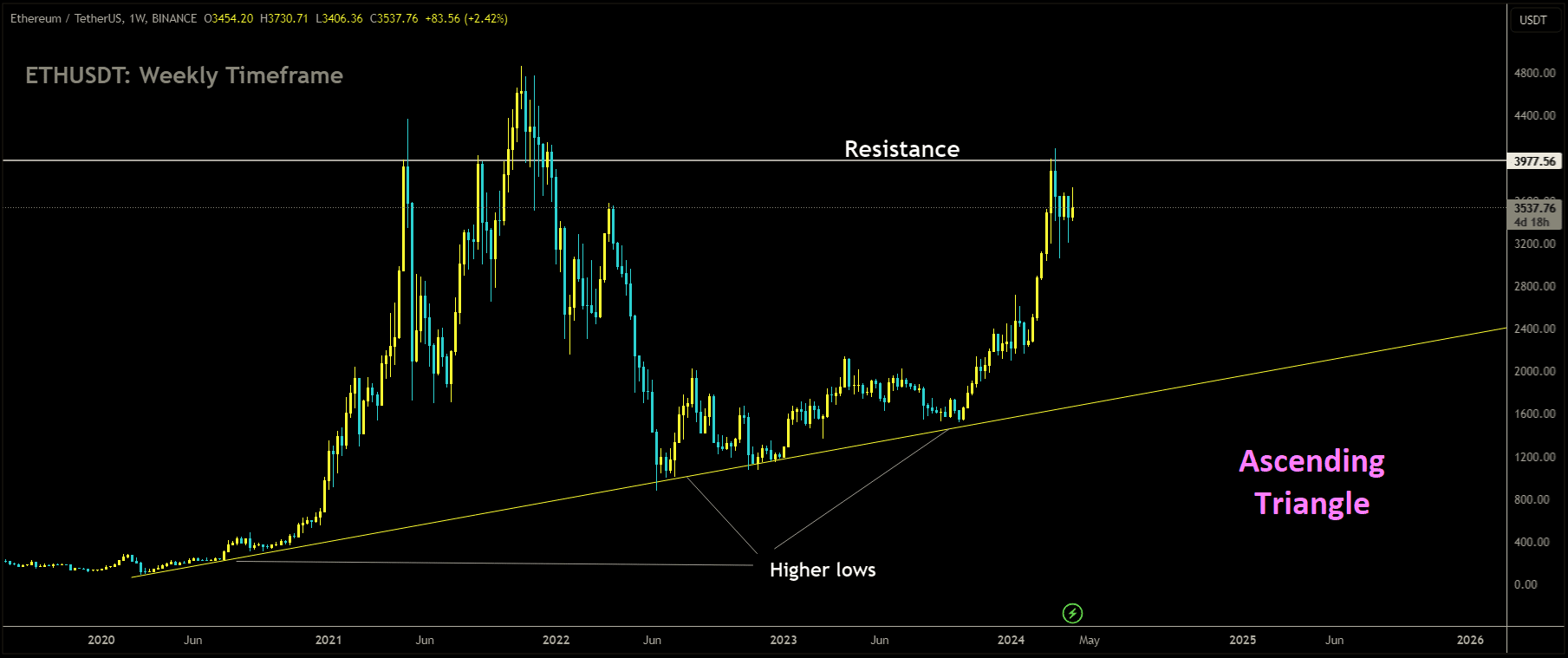

ETHUSDT is moving in Ascending Triangle and market has reached resistance area of the pattern

The CEO of VanEck, a renowned global investment firm that offers the Bitcoin Trust (HODL) among nearly a dozen spot bitcoin ETFs, has highlighted the importance of transaction fees within the cryptocurrency industry. Jan van Eck emphasized that the focus should shift towards transaction fees rather than solely on Bitcoin (BTC) and Ethereum (ETH) or their associated exchange-traded funds.

Speaking on CoinDesk’s “Markets Daily,” Jan van Eck expressed concerns about the unpredictable nature of transaction fees on the Bitcoin and Ethereum blockchains, which poses challenges for application development within these ecosystems. He emphasized that the significant development of 2023, often overlooked, is the availability of transaction costs at affordable rates through platforms like Solana or layer 2 solutions.

Van Eck explained that the high transaction fees on Bitcoin and Ethereum deter developers from building applications on these blockchains. He likened the fluctuating transaction fees to filling a car with gas, where costs can vary significantly, making it an unreliable choice for regular use.

Solana, often dubbed as an Ethereum competitor, offers a layer 1 protocol with lower costs and faster transaction speeds. Additionally, layer 2 solutions, such as Ethereum rollups and the Lightning network on Bitcoin, aim to address scalability issues and reduce transaction bottlenecks.

With the emergence of new solutions offering lower and more predictable transaction fees, Van Eck believes developers can now create more useful applications. He anticipates a shift towards building on databases with scalability, high uptime, and predictable costs, which he views as the most intriguing development in the cryptocurrency space.

Regarding the approval of ether ETFs, Van Eck expressed skepticism about their approval by the May deadline. Unlike the relatively responsive process for bitcoin ETF approvals, the U.S. Securities and Exchange Commission (SEC) has been less receptive to filings from prospective ether ETF issuers. Van Eck indicated that without receiving feedback on their S1 filing, it’s unlikely for ether ETFs to be approved without ensuring compliance with disclosure requirements.

ETHUSDT: VanEck CEO: Transaction Fee Outweighs Bitcoin or Ethereum ETFs

The VANECK Investment Firm CEO said the gas fees on Ethereum is higher when compared to Solana coin. Solana have 1 layer protocol when compared to Ethereum. Ethereum ETFs is unlike to approve by US SEC and no hearing made so far after the Filings. Ethereum has higher gas fees it has to be address and solved in upcoming versions.

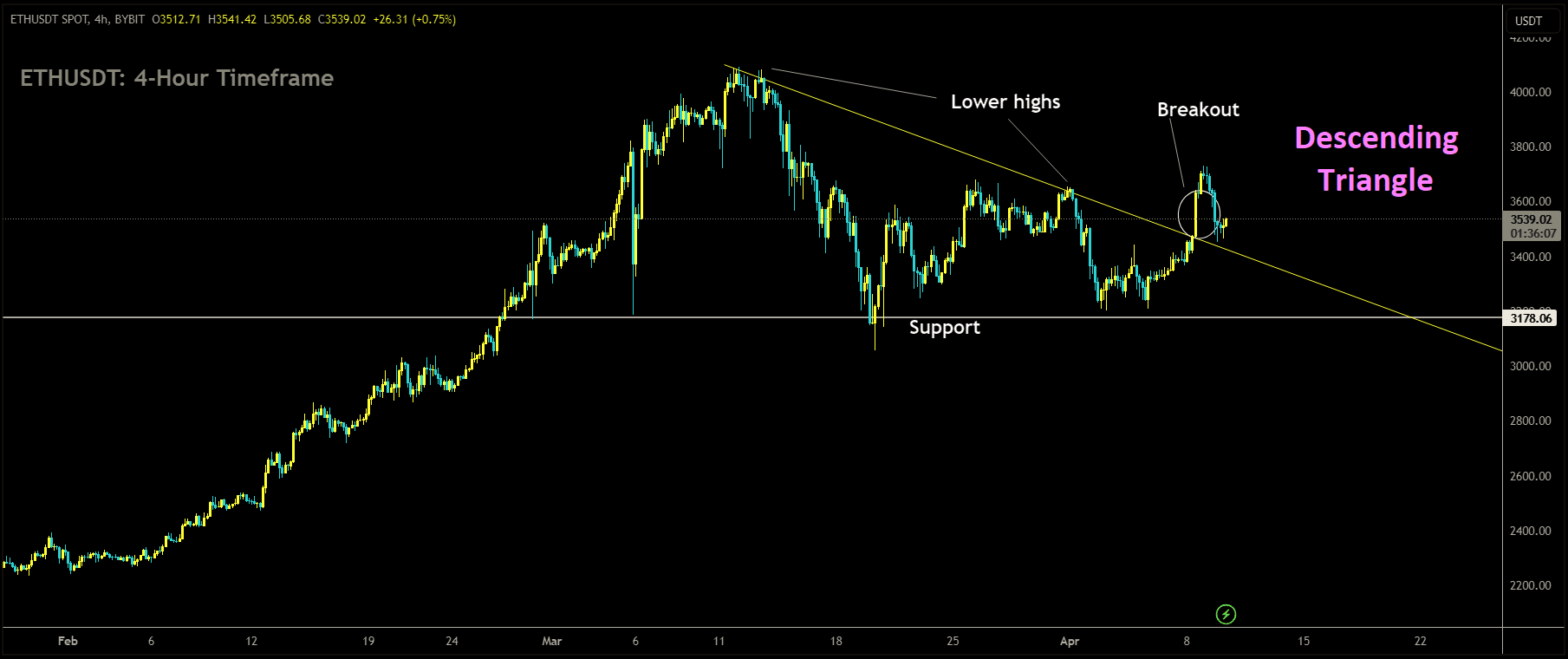

ETHUSDT has broken Descending Triangle in upside

The CEO of VanEck, a globally recognized investment firm renowned for its Bitcoin Trust (HODL) and nearly a dozen other spot bitcoin ETFs, has emphasized the importance of transaction fees in the cryptocurrency industry over the spotlight on Bitcoin (BTC) and Ethereum (ETH) or their corresponding exchange-traded funds.

Speaking on CoinDesk’s “Markets Daily,” Jan van Eck highlighted the challenge posed by unpredictable transaction fees on the Bitcoin and Ethereum blockchains, hindering application development within these ecosystems. He underscored the significance of transaction costs becoming accessible at affordable rates through platforms like Solana or layer 2 solutions.

Van Eck drew a comparison to the fluctuating transaction fees on Bitcoin and Ethereum, likening it to the inconsistency of filling a car with gas, which deters regular use. Solana, often touted as an Ethereum alternative, offers a layer 1 protocol with lower costs and faster transaction speeds. Additionally, layer 2 solutions, such as Ethereum rollups and the Lightning network on Bitcoin, aim to alleviate scalability issues and reduce transaction bottlenecks.

With the emergence of new solutions offering lower and more predictable transaction fees, Van Eck believes developers can now create more useful applications. He anticipates a shift towards building on databases with scalability, high uptime, and predictable costs, which he views as the most intriguing development in the cryptocurrency space.

Regarding the approval of ether ETFs, Van Eck expressed skepticism about their approval by the May deadline. Unlike the relatively responsive process for bitcoin ETF approvals, the U.S. Securities and Exchange Commission (SEC) has been less receptive to filings from prospective ether ETF issuers. Van Eck indicated that without receiving feedback on their S1 filing, it’s unlikely for ether ETFs to be approved without ensuring compliance with disclosure requirements.

ETHUSDT: Ethereum ETF Approval Dashed by SEC’s Crypto Crackdown

The VANECK Investment Firm CEO said the gas fees on Ethereum is higher when compared to Solana coin. Solana have 1 layer protocol when compared to Ethereum. Ethereum ETFs is unlike to approve by US SEC and no hearing made so far after the Filings. Ethereum has higher gas fees it has to be address and solved in upcoming versions.

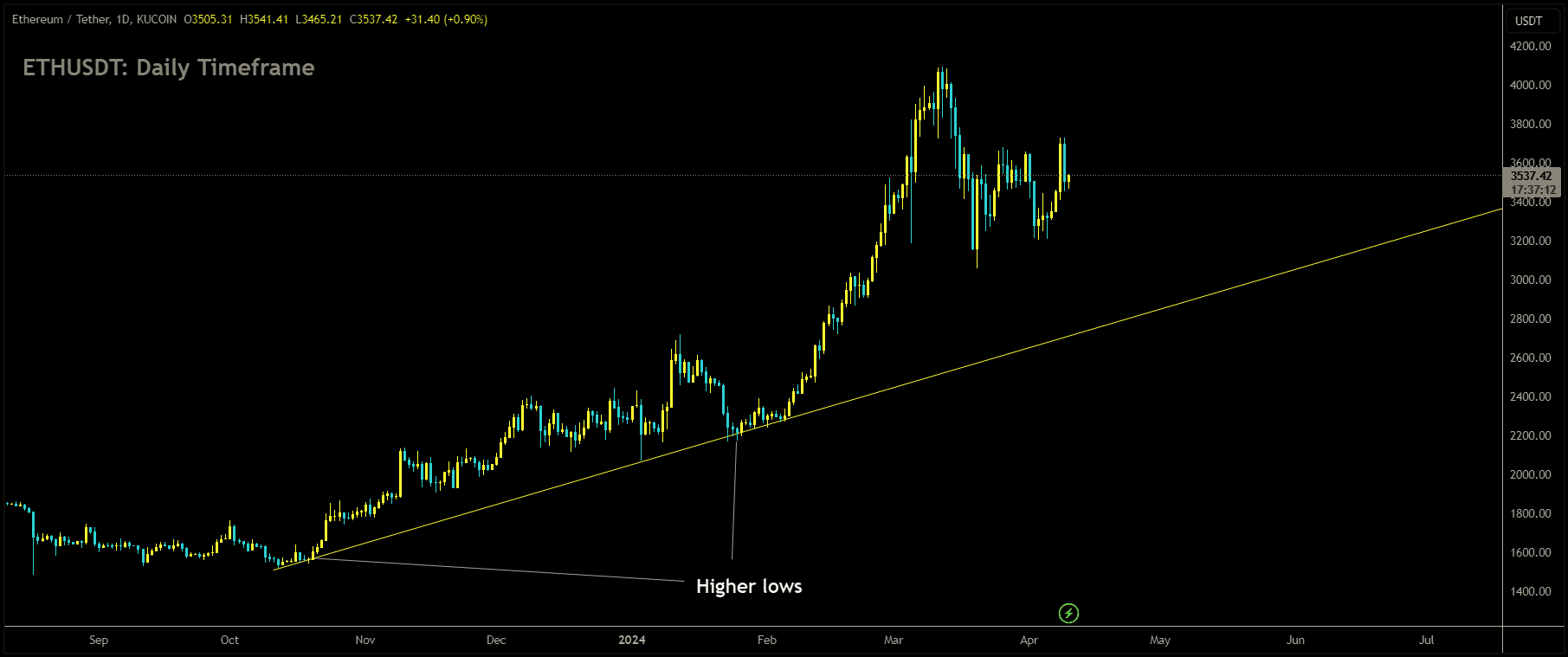

ETHUSDT is moving in uptrend line and market has rebounded from the higher low area of the pattern

Feeling optimistic about the possibility of a spot Ethereum ETF? Think again. According to issuers of spot Bitcoin ETFs, the U.S. Securities and Exchange Commission (SEC) is unlikely to grant approval for a spot Ethereum exchange-traded fund (ETF) anytime soon.

Ethereum, the second-largest cryptocurrency globally, has been a subject of speculation regarding a spot ETF approval, especially after SEC Chair Gary Gensler gave the green light to 11 spot Bitcoin ETF applications in January.

Companies like BlackRock, Fidelity, and VanEck, notable issuers of spot Bitcoin ETFs, have been eagerly awaiting an Ethereum product. However, recent sentiments suggest that some are now more cautious, unsure of a positive outcome.

During the Paris Blockchain Week crypto event, VanEck CEO Jan van Eck expressed skepticism about the chances of an Ethereum ETF approval. He indicated that VanEck, along with Ark Invest, could potentially face rejection in May, with other applications pending until October.

The SEC has until late May to complete its review of VanEck’s Ethereum ETF application, with several others in the queue, extending as far as October.

Unlike Bitcoin, which is widely considered a decentralized commodity, the regulatory status of Ethereum as a security is less clear. This ambiguity has posed challenges for Ethereum investors.

SEC Chair Gensler has refrained from making definitive statements on whether Ethereum is a security. However, the Commodity Futures Trading Commission (CFTC) has indicated that it considers Ethereum a commodity, potentially expediting the approval process if the SEC aligns with this definition.

CoinShares CEO Jean-Marie Mognetti echoed skepticism about gaining SEC approval for a proof-of-stake coin like Ethereum, predicting that approval is unlikely before the end of the year.

An Ethereum ETF approval would broaden exposure to the cryptocurrency, allowing new investors to indirectly invest in and trade Ethereum. However, potential Ethereum ETF issuers must hold sufficient ETH in custody to cover a 1:1 trading volume, which enthusiasts view as bullish, potentially making on-chain ETH scarcer.

While Ethereum futures ETFs have already been approved, approval for a spot ETF is not guaranteed. Historically, there was a two-year gap between the approval of the first Bitcoin futures ETF and the first Bitcoin spot ETFs.

Given this timeline and regulatory dynamics, it may be some time before the first spot Ethereum ETF is launched, assuming historical patterns persist.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/