AUD: China’s Trade Balance: Exports Plunge in March

The China exports fell by 3.8% YoY in March month versus 10.6% printed in the February month, Imports increased by 2.0% in March month versus -3.9% printed in February month. USD terms, China Trade surplus shows 58.55B versus 70.20B is expected and 125.16B is previous reading. Australian Dollar moved down after the China Trade surplus data showing weaker readings.

AUDUSD is moving in Symmetrical Triangle and market has fallen from the lower high area of the pattern

In March, China’s Trade Balance, measured in Chinese Yuan terms, widened to CNY415.86 billion from the previous figure of CNY281.97 billion.

The data revealed a decline of 3.8% year-on-year (YoY) in exports for March, compared to a 10.6% decline seen in February. On the other hand, imports in China rose by 2% YoY during the same period, contrasting with the previous decline of 3.9%.

In terms of US Dollars, China’s trade surplus decreased in March. The Trade Balance stood at +58.55 billion, falling short of the expected +70.20 billion and the previous +125.16 billion.

The figures for exports (YoY) showed a decrease of 7.5%, missing the expected -3.0%, and lower than the previous 7.1%. Similarly, imports (YoY) registered a decline of 1.9%, below the expected 1.2%, and lower than the previous 3.5%.

Further insights from the data indicate that China’s exports denominated in USD saw a 1.5% YoY increase for the period of January to March. Similarly, imports denominated in USD also rose by 1.5% YoY for the same period. The USD-denominated trade balance for January to March stood at 183.66 billion.

In terms of trade with the United States, China’s trade surplus in March amounted to $22.94 billion, contributing to a total surplus of $70.22 billion for the period from January to March.

AUD: China’s March Trade Data Misses Forecasts by Wide Margins

The China exports fell by 3.8% YoY in March month versus 10.6% printed in the February month, Imports increased by 2.0% in March month versus -3.9% printed in February month. USD terms, China Trade surplus shows 58.55B versus 70.20B is expected and 125.16B is previous reading. Australian Dollar moved down after the China Trade surplus data showing weaker readings.

AUDJPY is moving in Ascending channel and market has fallen from the higher high area of the channel

According to customs data released on Friday, China’s exports experienced a significant decline of 7.5% year-on-year in March, while imports unexpectedly contracted by 1.9%. These figures fell well below market expectations by substantial margins, underscoring the challenges policymakers face in fortifying an uncertain economic recovery.

Market forecasts, as per a Reuters poll of economists, had anticipated a more modest decline in exports of 2.3%, attributing it to a high base comparison from the previous year. In the preceding months of January and February, outbound shipments had seen a notable increase of 7.1%. Similarly, expectations for imports were optimistic, projecting a growth of 1.4%, contrasting with the 3.5% expansion witnessed in the initial two months of the year.

In terms of trade surplus, China recorded $58.55 billion in March, falling short of the $70.2 billion surplus forecasted in the poll. This disparity between projections and actual data further emphasizes the volatility and uncertainty prevailing in China’s trade landscape.

AUD: China’s March Exports Plunge 7.5%, Imports Decline Amid Slowing Demand

The China exports fell by 3.8% YoY in March month versus 10.6% printed in the February month, Imports increased by 2.0% in March month versus -3.9% printed in February month. USD terms, China Trade surplus shows 58.55B versus 70.20B is expected and 125.16B is previous reading. Australian Dollar moved down after the China Trade surplus data showing weaker readings.

AUDCHF is moving in Ascending channel and market has reached higher low area of the channel

Customs data released on Friday revealed that China’s export sector experienced a contraction in March, reversing the growth trend observed in the initial months of the year and highlighting the uneven trajectory of the country’s post-pandemic recovery.

In March, exports declined by 7.5% compared to the same period a year earlier, while imports also saw a modest slip of 1.9%. Both figures fell short of market expectations, suggesting challenges in sustaining the pace of recovery.

During the January-February period, exports had demonstrated resilience, registering a notable increase of 7.1% year-on-year, accompanied by a 3.5% rise in imports.

China, as the world’s second-largest economy, reported a trade surplus of $58.55 billion in March, a notable decrease from the surplus of $125 billion recorded in the initial two months of the year.

The decline in exports was partly attributed to a higher base comparison with March 2023 when exports surged by 14.8% as the economy reopened following stringent COVID-19 measures.

However, the economy has faced headwinds, including challenges in the property sector due to a government crackdown on excessive borrowing, which has contributed to a slowdown.

Zichun Huang, a China economist at Capital Economics, noted that while export volumes might see slower growth due to cooling consumer spending in advanced economies, imports are expected to gain momentum as government spending boosts domestic demand.

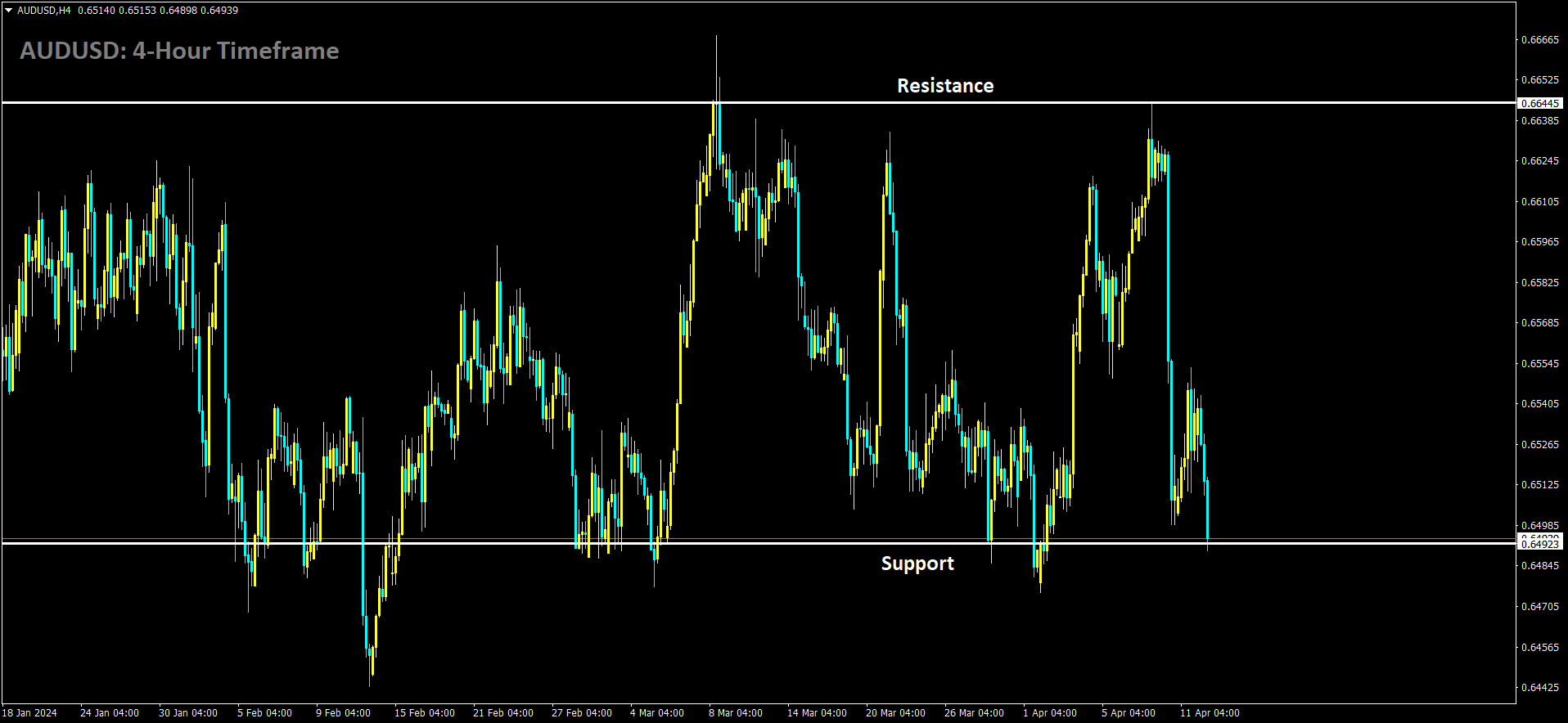

AUDUSD is moving in box pattern and market has reached support area of the pattern

Despite concerns about the impact of exports on meeting growth targets, recent data suggests a tempered approach from China. Rising exports of electric vehicles to Europe have raised concerns about competition with local manufacturers, prompting exporters to slash prices to maintain sales. However, sustained losses are limiting their ability to further reduce prices.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/