EURO: ECB May Slash Rates Over Three Times in 2024: Simkus

The ECB Governing Council member Gediminas Simkus said there will be a three rate cuts in this year. Due to Global shocks of Iran-Israel conflict Rate cuts from ECB may be delayed to July from June month. We do not delay on FED rate cut bets in this year. We have to see both growth and inflation in the Euro zone and rate cuts based on the ECB Policy settings.

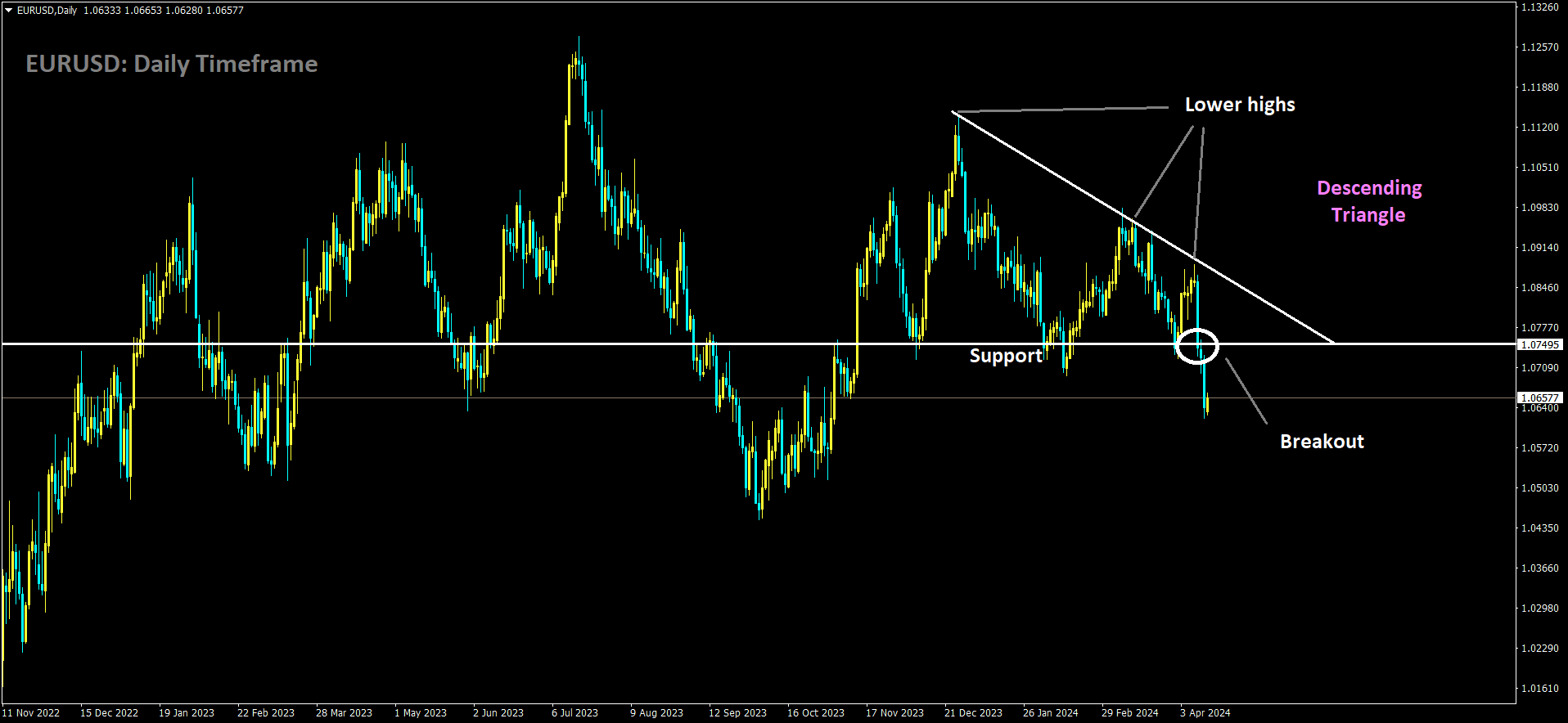

EURUSD has broken Descending Triangle in downside

European Central Bank policymaker Gediminas Simkus suggested on Monday that the bank could implement more than three interest rate cuts throughout 2024, particularly if the U.S. Federal Reserve delays its own rate adjustments. Simkus proposed the possibility of reducing the ECB’s 4% deposit rate in both June and July, indicating a dovish stance.

Speaking to reporters in Vilnius, Simkus emphasized that there is a greater than 50% probability of seeing more than three rate cuts within the year, considering three cuts to be a conservative estimate. While the ECB hinted at a rate cut for June during its recent policy meeting, ECB President Christine Lagarde clarified that the bank’s stance remains cautious due to uncertainties surrounding economic growth and inflation.

Market expectations for rate cuts in 2024 have diminished in recent weeks, with only three cuts priced in, following unexpectedly high U.S. inflation data. Simkus noted a possibility of a rate cut even in July, suggesting a potential non-zero probability.

Simkus downplayed the influence of Fed decisions on ECB policy, stating that the ECB makes independent decisions. However, he acknowledged that diverging rate trajectories between the two central banks could affect trade conditions and economic development in both regions.

While economic surprises are not expected to deter plans for a June rate cut, Simkus acknowledged that unexpected escalations in global political tensions could still impact the ECB’s decision-making process.

EURO: ECB’s Simkus: Over 50% Chance of 3+ Rate Cuts in 2024

The ECB Governing Council member Gediminas Simkus said there will be a three rate cuts in this year. Due to Global shocks of Iran-Israel conflict Rate cuts from ECB may be delayed to July from June month. We do not delay on FED rate cut bets in this year. We have to see both growth and inflation in the Euro zone and rate cuts based on the ECB Policy settings.

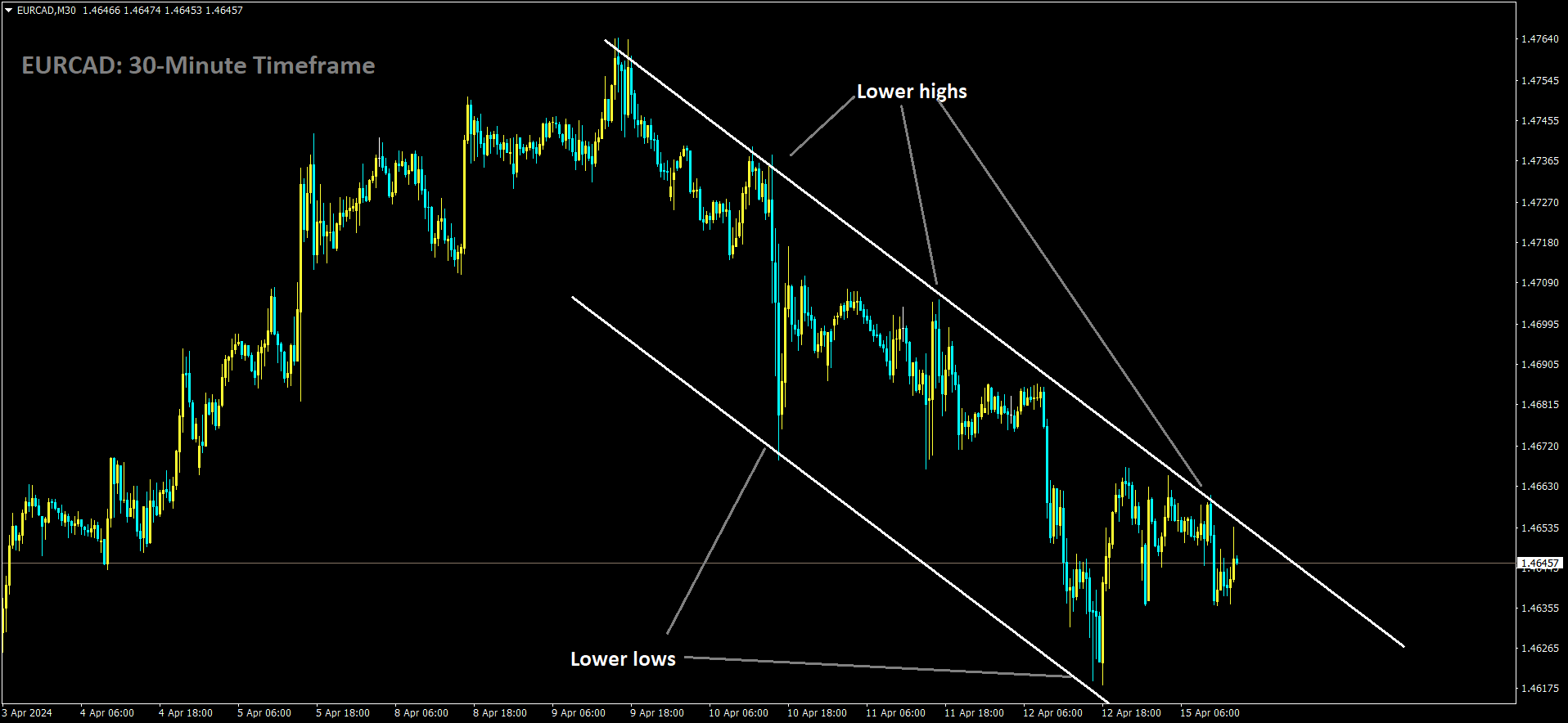

EURCAD is moving in Descending channel and market has reached lower high area of the channel

On Monday, Gediminas Šimkus, a member of the European Central Bank’s (ECB) Governing Council, expressed his views on the possibility of interest rate cuts this year, indicating a likelihood of more than three reductions. Šimkus emphasized that geopolitical tensions, particularly an escalation of the Israel-Iran conflict, might influence the timing of these rate cuts. He suggested that the ECB could potentially postpone the first rate cut from June to July in response to such external factors.

These comments from Šimkus underscore the ECB’s cautious approach to monetary policy adjustments amid uncertain geopolitical dynamics.

EURO: ECB’s Simkus Predicts 3 Rate Cuts in 2024, Possible 4th

The ECB Governing Council member Gediminas Simkus said there will be a three rate cuts in this year. Due to Global shocks of Iran-Israel conflict Rate cuts from ECB may be delayed to July from June month. We do not delay on FED rate cut bets in this year. We have to see both growth and inflation in the Euro zone and rate cuts based on the ECB Policy settings.

EURCHF has broken Ascending channel in downside

European Central Bank (ECB) Governing Council member Gediminas Simkus shared his outlook on borrowing costs, indicating a likelihood of at least three rate cuts this year.

Simkus expressed his views in Vilnius, stating, “I see a higher than 50% chance there will be more than three cuts this year.” He also mentioned the possibility of an interest rate cut in July, emphasizing the importance of the July decision in determining the trajectory of future rate adjustments.

His remarks came shortly after the ECB’s decision to maintain rates for the fifth consecutive meeting, signaling a readiness to start cutting rates soon due to cooling inflation. While policymakers seem aligned on initiating cuts at the next meeting in June, the path beyond that remains uncertain.

Currently, money markets are pricing in approximately 85 basis points of monetary easing in 2024, implying at least three quarter-point cuts with a 40% chance of a fourth.

Simkus also made the following points:

– Interest rates are expected to decrease both this year and next.

– There is no urgency to implement rate cuts exceeding 25 basis points.

– A clear deflation trend is observed, although domestic pressures on inflation persist.

Regarding the potential divergence between the ECB and the Federal Reserve, Simkus emphasized the economic independence of the two jurisdictions, stating that any interdependence is purely economic.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/