GBP: Pound nears five-month low following dismal UK labor market report

The UK Pound moved down after the UK Unemployment rate rise to 4.2% in February month from 3.9% in Previous month and 4.0% expected. Employers laid off 156K workers in February month when compared to 86K printed in January month.

Labor market cooling down makes UK CPI is expected to cool down in the coming months and BoE may be do soon rate cuts in this year.

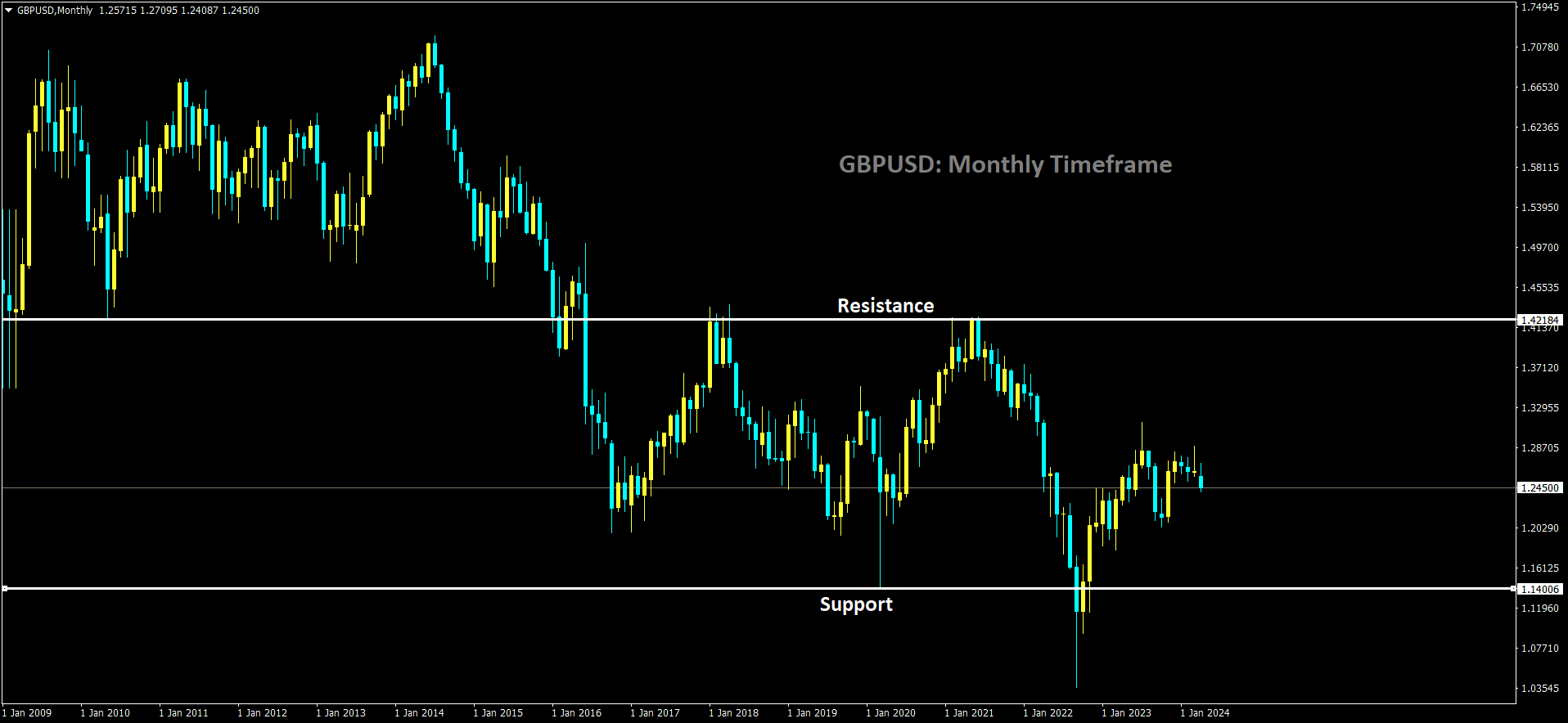

GBPUSD is moving in box pattern and market has rebounded from the support area of the pattern

Pound Sterling Trades Near Five-Month Low Amid Weak UK Labor Market Data

The Pound Sterling (GBP) continues to struggle in Tuesday’s London session, following a discouraging report from the United Kingdom Office for National Statistics (ONS) regarding labor market conditions in the three months leading up to February. The data revealed a significant uptick in the Unemployment Rate to 4.2%, accompanied by a staggering 156,000 job losses during this period.

This downturn in labor market conditions injects uncertainty into the economic outlook, potentially prompting Bank of England (BoE) policymakers to consider interest rate cuts earlier than previously anticipated. Typically, in such situations, job seekers and employees may have to settle for lower wage increases, leading to slower wage growth that facilitates a sustainable return of inflation to its target level.

Further market turbulence is expected as the UK ONS prepares to release consumer and producer inflation data for March on Wednesday. Forecasts suggest a slight decline in the headline Consumer Price Index (CPI) to 3.1% from the previous 3.4%, while the core CPI, excluding volatile food and energy prices, is projected to decrease to 4.1% from February’s 4.5%. A potential decrease in inflation figures could fuel speculation about the BoE considering interest rate cuts starting from the August meeting.

In the day’s market movements, the Pound Sterling faces continued downward pressure, extending its decline to 1.2410. The sharp rise in the ILO Unemployment Rate to 4.2% and the notable increase in job losses to 156,000 underscore the challenges facing the UK labor market. However, there’s a slight silver lining as the Claimant Count Change for March came in lower than expected at 10.9K, signaling a modest improvement.

Despite the robust retail sales data from the United States and strong labor demand in March, market sentiment remains cautious due to escalating tensions in the Middle East. The Israeli military’s vow to respond to Iran’s recent attack, coupled with uncertainties surrounding the Federal Reserve’s interest rate policies, adds to the risk aversion in the market.

Amidst these developments, San Francisco Fed Bank President Mary Daly emphasized the need to maintain restrictive interest rates for a longer period, highlighting the ongoing efforts to ensure inflation returns to the desired target rate of 2%.

GBP: Sterling Steady at Five-Month Low Post UK Labor Data

The UK Pound moved down after the UK Unemployment rate rise to 4.2% in February month from 3.9% in Previous month and 4.0% expected. Employers laid off 156K workers in February month when compared to 86K printed in January month.

Labor market cooling down makes UK CPI is expected to cool down in the coming months and BoE may be do soon rate cuts in this year.

GBPCHF has broken Ascending channel in downside

Sterling remained at a five-month low against the dollar on Tuesday following the release of UK labor market data indicating a higher-than-expected rise in the unemployment rate.

The pound showed little movement against the dollar, holding at $1.24475 by the end of the session, after hitting its lowest level since November 17 earlier in the day. Against the euro, it stayed steady at 85.36 pence.

The Office for National Statistics reported that the UK’s unemployment rate for the three months ending in February climbed to 4.2%, up from 3.9% previously. However, the ONS cautioned that there was still some volatility in the data as it undergoes a survey overhaul. Economists surveyed by Reuters had anticipated a lower unemployment rate of 4% for February.

Regular wages excluding bonuses showed a growth rate of 6.0% compared to the same period a year earlier, slightly down from the 6.1% increase recorded in the November-to-January period.

Kenneth Broux, head of corporate research, FX, and Rates at Societe Generale, noted, “The labor market is clearly cooling. Wages take more time to react, but they’re also slowing.” He also suggested that the employment drop could influence Bank of England policymakers in favor of rate cuts, potentially impacting the pound’s performance against the dollar relative to the Federal Reserve’s stance.

Investor focus shifted to Wednesday’s inflation data, which would provide further insight into the BoE’s potential rate cut trajectory. Markets currently expect around 46 basis points of interest rate reductions by the BoE this year, with August being viewed as the most probable start date for policy easing, although not fully priced.

The unexpectedly high US inflation figure released last week has led to a further delay in expectations for the first Federal Reserve rate cut, with predictions shifting from June to September.

GBP: UK jobless rate spikes to 4.2% amidst job loss concerns

The UK Pound moved down after the UK Unemployment rate rise to 4.2% in February month from 3.9% in Previous month and 4.0% expected. Employers laid off 156K workers in February month when compared to 86K printed in January month.

Labor market cooling down makes UK CPI is expected to cool down in the coming months and BoE may be do soon rate cuts in this year.

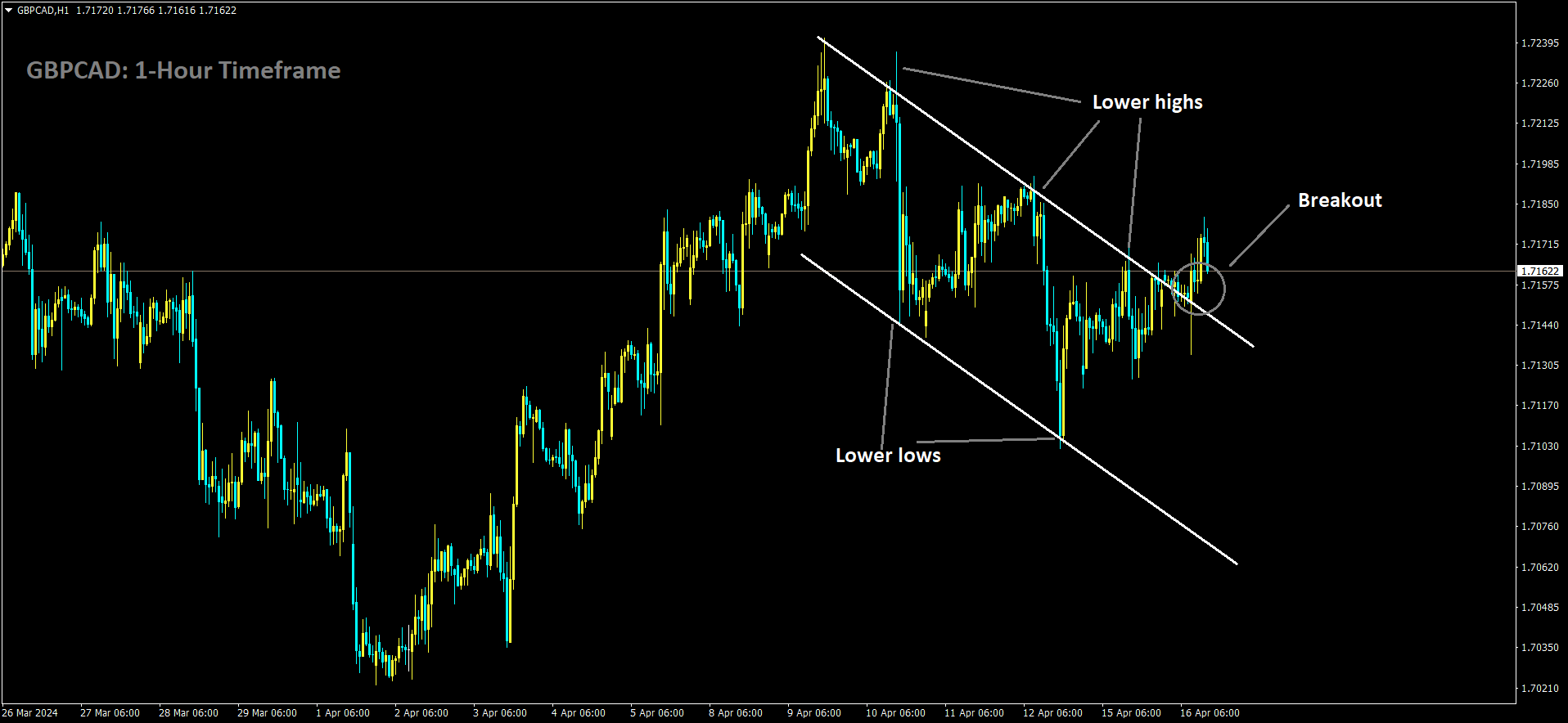

GBPCAD has broken Descending channel in upside

The Office for National Statistics (ONS) reported a greater-than-anticipated increase in unemployment figures for February, prompting concerns that employers are initiating layoffs due to elevated interest rates.

The unemployment rate surged to 4.2%, surpassing economists’ projections of 4%, signaling a cooling labor market influenced by heightened borrowing costs. Analysts observe that the trend reflects a reluctance among employers to recruit new staff and an uptick in redundancies.

Despite the rise in joblessness, regular pay growth excluding bonuses outpaced expectations, reaching 6% in the three months ending February. This data underscores the dilemma faced by the Bank of England regarding the appropriate timing for interest rate cuts. While the 6% pay growth represented a slight decline from the previous period’s 6.1%, it exceeded economists’ forecasts of 5.8%.

Yael Selfin, chief economist at KPMG UK, interpreted the latest ONS data as a signal for a potential interest rate cut by the Bank of England in the summer. She highlighted the significance of wage data as a key indicator of domestic inflationary pressure, noting that while regular pay growth eased slightly, the unemployment rate indicated a less constrained labor market.

Within specific sectors, the hospitality industry saw an average pay raise of 8.4%, while City workers secured an 8.1% increase. Adjusted for consumer price inflation, real wages experienced their fastest growth in two-and-a-half years, with real total pay and real regular pay rising by 1.8% and 2.1%, respectively.

The rise in the inactivity rate, which measures individuals not in employment and not actively seeking work, raised concerns among Bank of England officials. This trend reduces the workforce and compels employers to offer higher wages, thereby elevating costs and inflation.

![]()

Approximately 850,000 more working-age individuals are jobless due to factors such as long-term sickness or an inability to seek employment compared to pre-pandemic levels. Economists attribute this rise primarily to increased levels of long-term sickness among both younger and older workers.

Tony Wilson, director at the Institute for Employment Studies, described the job figures as unexpectedly poor, highlighting a significant decline in employment and a notable rise in unemployment. He expressed particular concern about the surge in economic inactivity, which currently exceeds pre-pandemic levels.

Ben Harrison, director of the Work Foundation at Lancaster University, characterized the UK workforce as “sicker and poorer,” emphasing its deviation from international norms.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/