BTCUSDT: Bitcoin Drops 8% in Five Days: 4 Reasons Behind the Decline

The Bitcoin prices are down over 8.80% in the past 5 days when compared to 10.31% down in the last month. This prices are down because of cutting the Tokens into two halves to increase the supply of Bitcoin in the Financial market. Middle east tensions and US Domestic data weighing on the Bitcoin prices to plunge in the market.

BTCUSDT is moving in Descending Triangle and market has fallen from the lower high area of the pattern

Over the past five days, the world’s largest cryptocurrency has experienced a significant downturn, plummeting by 8.81 percent, and over the course of the last month, it has fallen by 10.31 percent.

The Commerce Department’s Census Bureau recently released data indicating a 0.7% increase in retail sales for the previous month. Additionally, February’s figures were revised upward, revealing a stronger rebound of 0.9%, the largest gain in over a year, compared to the initially reported 0.6%.

Within the global cryptocurrency market, there has been a 4.1% decrease in the past 24 hours, resulting in a total market capitalization of approximately $2.29 trillion. The volume within the DeFi sector currently stands at $9.35 billion, constituting 7.92% of the entire cryptocurrency market’s 24-hour trading volume. Meanwhile, stablecoins contribute $110.24 billion, representing 93.37% of the total 24-hour trading volume in the cryptocurrency market, according to data from CoinMarketCap.

During the same period, Bitcoin’s market capitalization has declined to $1.239 trillion, with its dominance currently at 54.11%. Despite the downturn, Bitcoin’s trading volume in the past 24 hours increased by 6.23% to $44.77 billion.

Market analysts attribute the decline in Bitcoin prices to several factors. Firstly, there is anticipation surrounding the upcoming Bitcoin halving event, expected to reduce the token’s new supply by half around April 20. While historically, such events have led to price increases, doubts have emerged due to Bitcoin’s recent record highs.

Moreover, stronger-than-anticipated US retail sales figures for March have bolstered beliefs that the US Federal Reserve is unlikely to hastily reduce interest rates this year, influencing cryptocurrency markets.

Additionally, recent developments in Hong Kong have garnered attention, with the conditional approval of its first spot bitcoin and ether exchange-traded funds (ETFs), marking a significant move towards cryptocurrency adoption. This comes as Hong Kong positions itself as a digital asset hub amidst a ban on cryptocurrency in mainland China.

Furthermore, tensions between Iran and Israel have escalated, with Iran launching attacks in retaliation to incidents in Syria, heightening regional conflict. The impact of these geopolitical tensions on cryptocurrency markets remains to be seen, as digital assets are traded over the weekends, providing insights into potential market sentiment before traditional markets resume trading on Monday.

BTCUSDT: Bitcoin Price at $61k Ahead of Halving

The Bitcoin prices are down over 8.80% in the past 5 days when compared to 10.31% down in the last month. This prices are down because of cutting the Tokens into two halves to increase the supply of Bitcoin in the Financial market. Middle east tensions and US Domestic data weighing on the Bitcoin prices to plunge in the market.

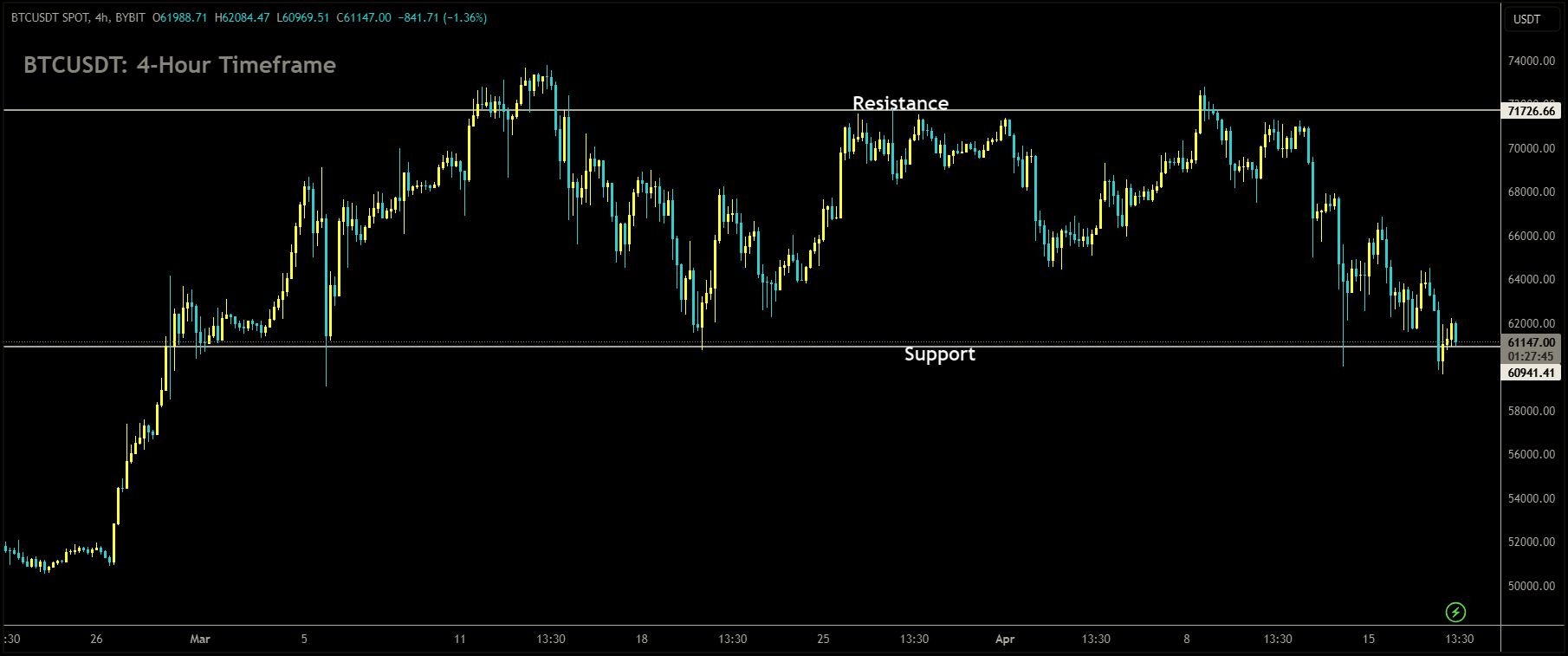

BTCUSDT is moving in box pattern and market has reached support area of the pattern

On Thursday, Bitcoin’s price experienced a decline, extending recent losses as cryptocurrency markets struggled amidst the backdrop of sustained higher U.S. interest rates, which dampened risk sentiment.

Attention remained focused on the impending halving event and its potential implications for Bitcoin’s long-term supply dynamics.

With the halving event on the horizon, set to coincide with the generation of block no. 840,000 on the Bitcoin blockchain, the countdown intensified, with less than 300 blocks remaining before the anticipated halving on or around April 20. This event will effectively halve rewards for miners, reducing the rate at which new Bitcoin is mined and reinforcing the narrative of Bitcoin’s scarcity supporting its price.

However, historical analysis suggests that while Bitcoin has experienced significant appreciation over the past 12 years, the direct correlation between halving events and immediate price gains is less clear. External factors such as interest rates and risk appetite, particularly in relation to U.S. technology stocks, have exerted considerable influence on Bitcoin’s price trajectory. While recent gains were largely attributed to the U.S. approval of spot exchange-traded funds, this momentum now appears to be waning, especially as the market anticipates a low-interest rate, high-liquidity environment to materialize later in 2024.

In the broader cryptocurrency landscape, prices continued to face downward pressure as traders adjusted their expectations for a June interest rate cut by the Federal Reserve, following robust inflation data and hawkish signals from Fed officials. Despite a slight retreat in the dollar, crypto prices failed to capitalize on this, as traders opted to secure profits following the greenback’s recent ascent to 5-1/2-month highs.

Other major cryptocurrencies mirrored Bitcoin’s decline, with Ethereum falling 3.3% to $3,009.41, while Solana and XRP experienced losses of 5% and 0.1%, respectively. Despite the diversified offerings within the crypto space, Bitcoin remains dominant, accounting for over 55% of the overall value in the cryptocurrency market.

BTCUSDT: Bitcoin Dips Below $60k Before Halving Adjustment

The Bitcoin prices are down over 8.80% in the past 5 days when compared to 10.31% down in the last month. This prices are down because of cutting the Tokens into two halves to increase the supply of Bitcoin in the Financial market. Middle east tensions and US Domestic data weighing on the Bitcoin prices to plunge in the market.

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

Bitcoin experienced a brief dip below the $60,000 mark, marking its first descent to this level in over a month, as volatility surged ahead of an impending software update within the blockchain—a development long heralded as a bullish catalyst for the cryptocurrency.

The original digital asset saw a notable decline, plunging as much as 5% to $59,888 before recuperating some losses. This dip comes amid an overall decline of approximately 18% since Bitcoin’s record high of $73,797 on March 14. Concurrently, other smaller tokens such as Ether, Solana, and Dogecoin also faced declines on Wednesday. Additionally, crypto-related stocks, including MicroStrategy, Coinbase, and Marathon Digital, registered lower trading activity.

The timing of this drop aligns with the anticipation surrounding a highly awaited code update within the Bitcoin network, expected to occur as early as Friday. Referred to as the halving, this quadrennial event is traditionally viewed as a positive driver for Bitcoin prices as it reduces the supply of new tokens introduced into the blockchain. However, concerns have arisen regarding whether the halving’s potential impact is already factored into the market dynamics, particularly against the backdrop of a risk-averse investment environment, which has contributed to an extended period of decline.

Nathanaël Cohen, co-founder of INDIGO Fund, remarked, People are looking to derisk as it remains to be seen if the halving will be a market-moving event or a non-event overshadowed by the ETF. There is an additional macro factor putting more pressure on risk assets (the Middle East tensions).

The recent downturn in Bitcoin’s value was exacerbated by a series of liquidations in long positions across digital assets, with approximately $780 million worth of bullish crypto wagers liquidated within a 24-hour period last Friday. Furthermore, the cryptocurrency experienced further decline as some investors adopted a risk-averse stance in response to Iran’s attacks against Israel.

Despite the recent market turbulence, some market participants maintain a largely bullish outlook for Bitcoin in the long term. Ravi Doshi, head of markets at the prime broker FalconX, noted, FalconX continues to see longer-dated call buying across our derivatives desk as our clients are expecting higher prices in the second half of the year.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/