EURO: Lagarde Stresses Europe’s Need for Private Capital to Drive Innovation

ECB President Lagarde speech yesterday gives slight hawkish remarks on inflation side boosted Euro currency against USD. From 2008, US has grown 75% when compared to Europe area, Between 2019 and now, US has grown 6% but 0.60% due to Covid-19 crisis, Bank Crisis and Financial crisis. Inflation war is still not over in the Euro zone, Still has more way to come, this message shows whether ECB really do rate cut in the June month or not. So Euro currency rebounded from lows today.ECB President Lagarde asked Euro 600 billion to Private companies for stabilising climate change initiatives in this meeting.

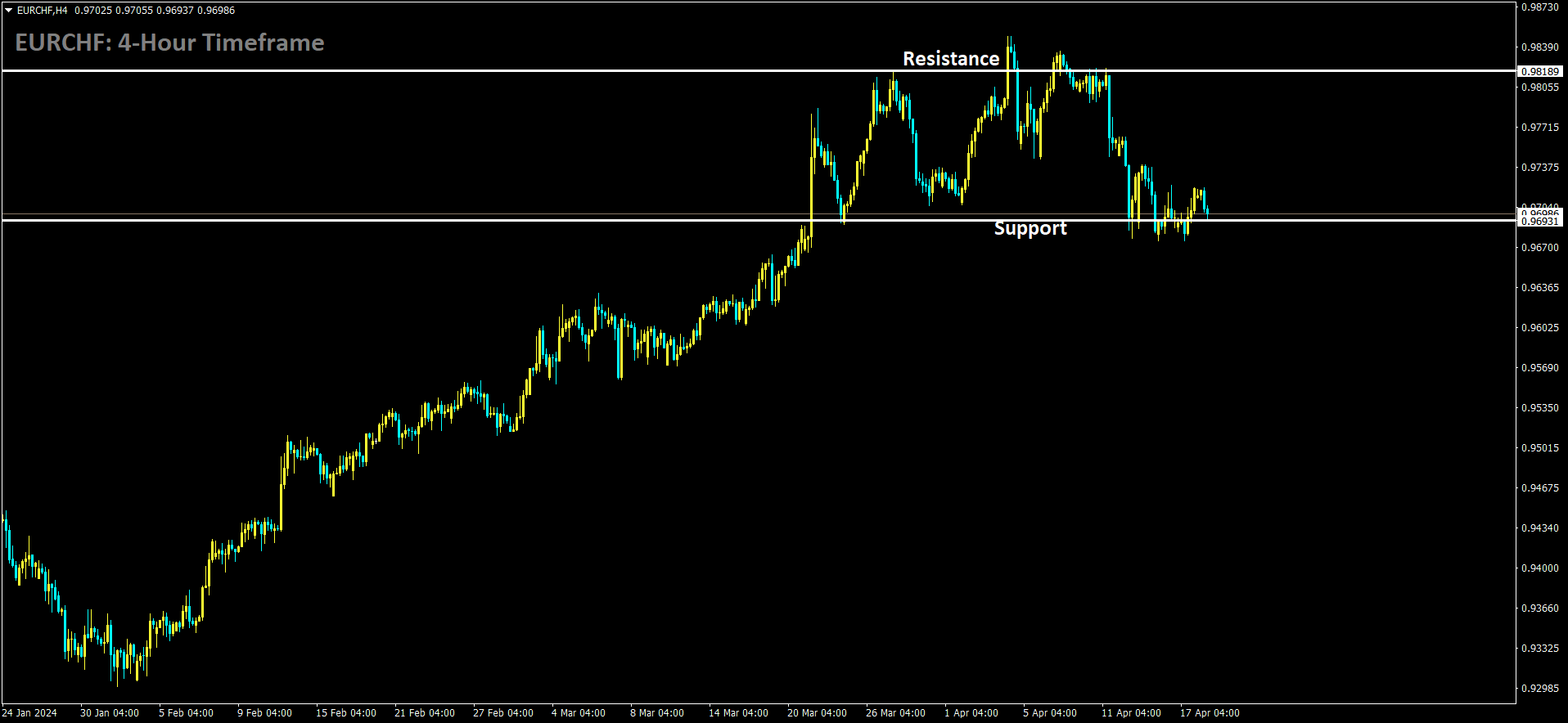

EURCHF is moving in box pattern and market has reached support area of the pattern

Lagarde Highlights the Critical Role of Private Capital for Europe’s Green Transition and Innovation

European Central Bank President Christine Lagarde underscored the vital importance of private investments in driving Europe’s green transition and fostering innovation during a Council on Foreign Relations meeting held on Wednesday.

Addressing the pressing need for substantial financial support, Lagarde noted that approximately €600 billion annually is required to fuel climate change mitigation efforts in Europe. She stressed the pivotal role of private financial backing in facilitating these initiatives and catalysing sustainable economic development.

Lagarde also provided insights into the current state of the European economy, highlighting ongoing efforts in US-EU economic cooperation and addressing broader geopolitical challenges.

Eurozone Economic Outlook and Factors Influencing Inflation

Responding to queries regarding Europe’s management of inflation compared to the United States, Lagarde pointed out ongoing differences and highlighted Europe’s robust job market amidst economic uncertainties.

Expressing cautious optimism about the eurozone’s recovery trajectory, Lagarde predicted gradual improvements through 2024 despite significant disparities in economic growth between the eurozone and the United States.

She attributed these differences to various factors, including Europe’s historical challenges with crises such as the sovereign debt crisis and the lack of a fiscal union to complement its monetary framework. Lagarde also underscored the need for comprehensive structural reforms and better integration of the single market to bridge the productivity gap between Europe and the United States.

Strategies for Economic Independence and Addressing Global Challenges

Lagarde emphasised the potential for Europe to pursue a more autonomous economic path amidst ongoing global economic and geopolitical challenges. She advocated for the development of a robust, internally-focused financial infrastructure to support innovation and entrepreneurship within the continent.

Highlighting the urgent need for private investment in Europe’s green transition, Lagarde reiterated the continent’s unwavering political commitment to addressing climate change. She stressed that such initiatives require significant financial support, estimated at around €600 billion annually.

Global Economic Relations and Geopolitical Dynamics

Discussing broader global economic relations, Lagarde emphasised the importance of continued collaboration among trusted global partners and cautioned against protectionist policies. She addressed the complex issue of utilising frozen Russian assets to aid Ukraine, advocating for careful consideration of legal and financial stability implications.

Monetary Policy and Future Directions

Regarding potential changes to the European Central Bank’s inflation target, Lagarde reaffirmed her commitment to price stability and advocated for a steady approach to managing inflation rates. She also discussed the transformative potential of artificial intelligence (AI) and its implications for productivity and labour markets, highlighting both opportunities and risks associated with its widespread adoption.

EURO: EUR/USD Reverses Course on Lagarde’s Hawkish Remarks

ECB President Lagarde speech yesterday gives slight hawkish remarks on inflation side boosted Euro currency against USD. From 2008, US has grown 75% when compared to Europe area, Between 2019 and now, US has grown 6% but 0.60% due to Covid-19 crisis, Bank Crisis and Financial crisis. Inflation war is still not over in the Euro zone, Still has more way to come, this message shows whether ECB really do rate cut in the June month or not. So Euro currency rebounded from lows today.ECB President Lagarde asked Euro 600 billion to Private companies for stabilising climate change initiatives in this meeting.

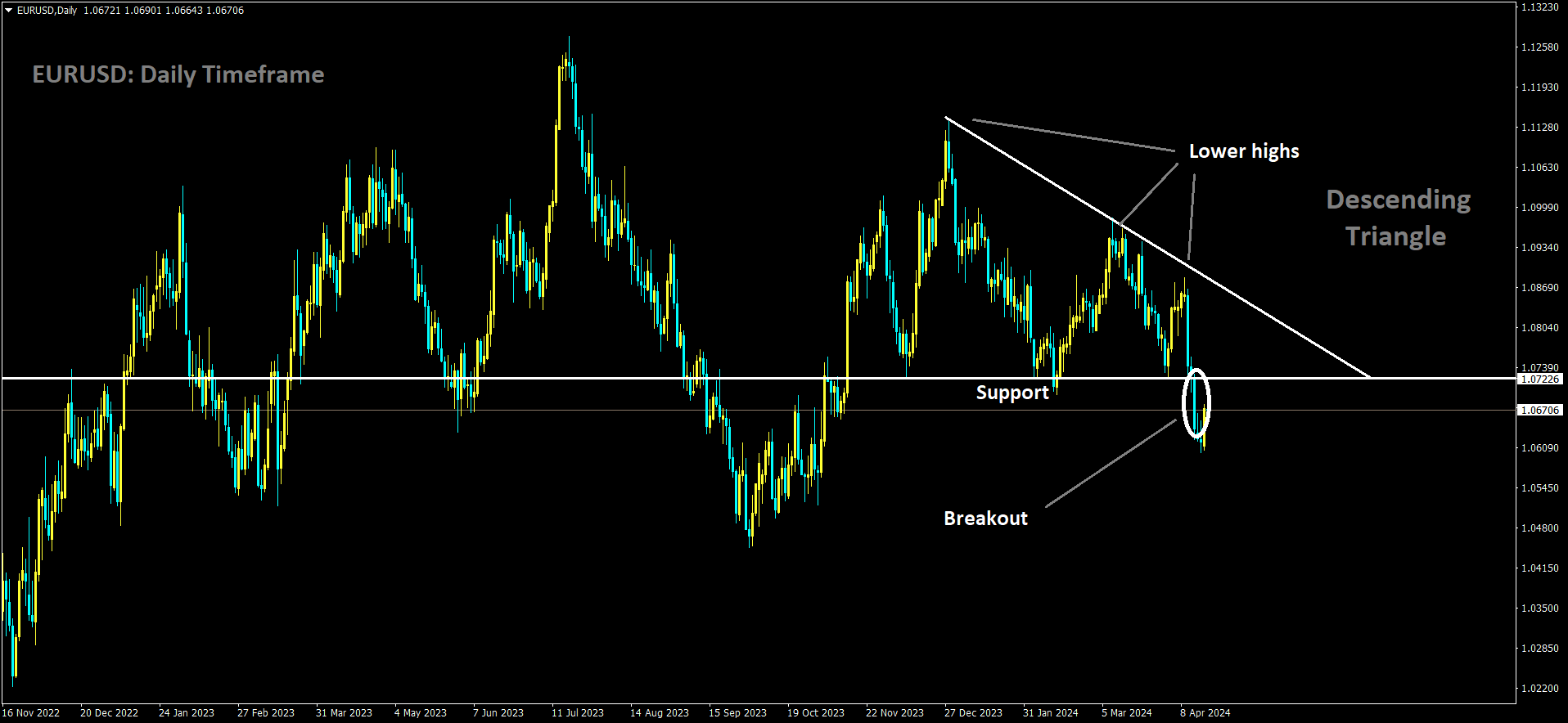

EURUSD has broken Descending Triangle in downside

EUR/USD remained relatively stable in the 1.0680s on Thursday, extending the reversal initiated earlier in the week after hitting April lows at 1.0601.

The recent bullish recovery, amounting to an increase of 80 pips within 36 hours, has sparked speculation about whether EUR/USD is undergoing a corrective phase or signaling a broader reversal, given the significant upward momentum.

The rebound in EUR/USD received an additional boost from remarks made by European Central Bank President Christine Lagarde during a speech in Washington on Wednesday. Lagarde emphasized that “The game (of fighting inflation) is not over,” while acknowledging, “Growth in Europe is mediocre, much slower than in the US. We’re clearly seeing timid signs of recovery.”

Lagarde’s comments diverged slightly from those of some of her ECB counterparts, who have suggested that inflation is behaving as expected and is on a downward trajectory. This discrepancy introduces a degree of uncertainty regarding whether the ECB will indeed commence interest rate cuts in June, as anticipated by the markets. The potential maintenance of higher interest rates for an extended period could bolster the Euro by attracting more foreign capital inflows.

Echoing Lagarde’s sentiment about Europe’s sluggish growth, Rabobank FX Strategists highlighted the risk posed by slow growth in the Eurozone and persistent budgetary pressures, potentially weakening the Euro’s defenses. Rabobank’s analysis suggests a possible decline in EUR/USD to 1.0500, with downside risks prevailing.

EUR/USD experienced downward pressure at the beginning of April as expectations of a June interest rate cut by the Federal Reserve (Fed) faded amidst signs of sticky inflation and robust macroeconomic data. Federal Reserve Chairman Jerome Powell’s remarks on Tuesday suggested that higher interest rates would likely persist for a longer duration due to limited progress in addressing inflation.

The latest Federal Reserve Beige Book reiterated the slow progress in addressing inflation but noted slightly stronger-than-expected growth and employment figures. These factors indicate that the Fed may maintain relatively high interest rates (with the upper limit of the Fed Funds Rate at 5.5%) until inflationary pressures ease.

The CME FedWatch tool, reflecting market sentiment regarding Fed rate cuts, currently indicates only a 16% probability of a rate cut in June (down from over 70% a few weeks ago), while the likelihood of a cut by September stands at around 70%.

EURO: Lagarde Pushes for Private Capital in Europe’s Energy Transition

ECB President Lagarde speech yesterday gives slight hawkish remarks on inflation side boosted Euro currency against USD. From 2008, US has grown 75% when compared to Europe area, Between 2019 and now, US has grown 6% but 0.60% due to Covid-19 crisis, Bank Crisis and Financial crisis. Inflation war is still not over in the Euro zone, Still has more way to come, this message shows whether ECB really do rate cut in the June month or not. So Euro currency rebounded from lows today.ECB President Lagarde asked Euro 600 billion to Private companies for stabilising climate change initiatives in this meeting.

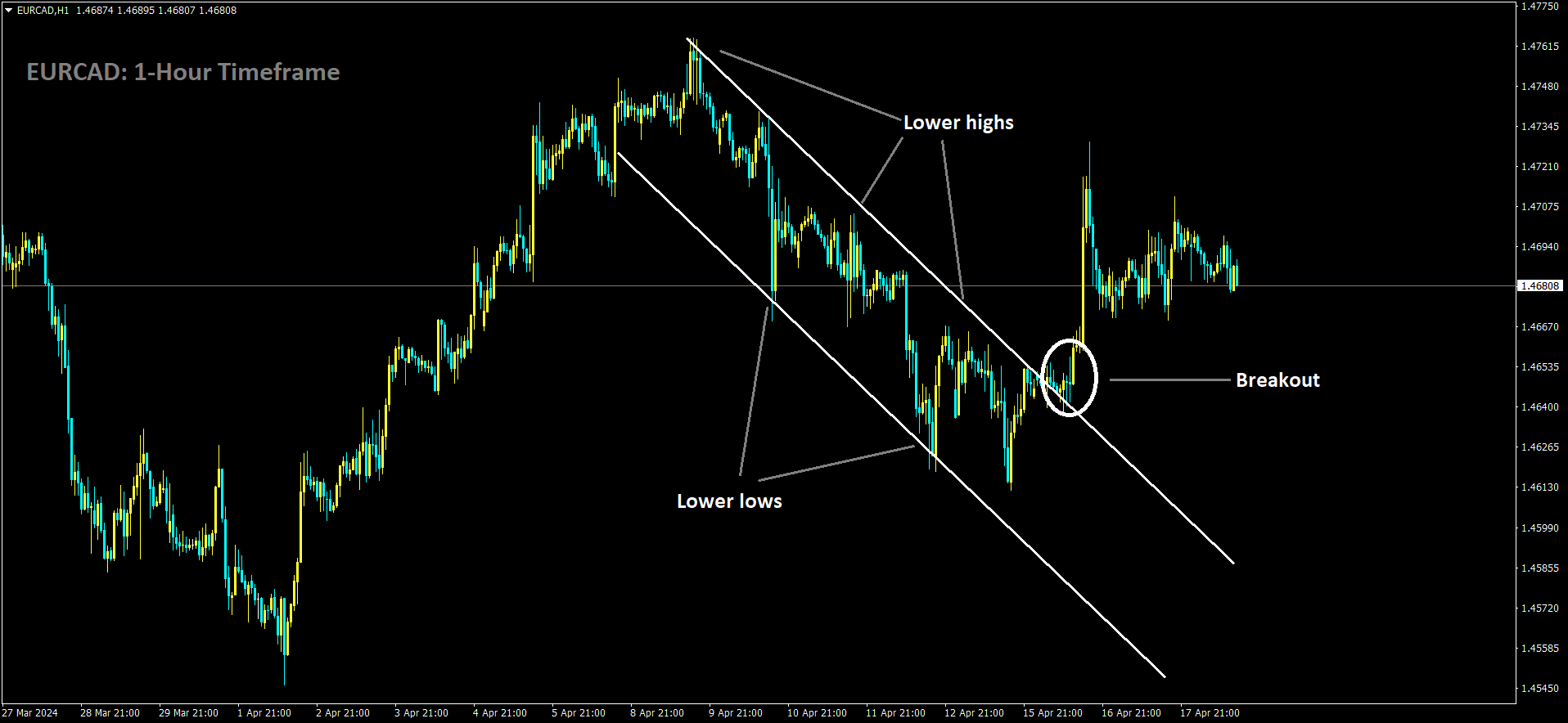

EURCAD has broken Descending channel in Upside

Lagarde, during a comprehensive discussion on the European economy and geopolitical challenges, emphasized the necessity of approximately €600 billion annually to bolster efforts in climate change mitigation. She stressed the pivotal role of private financial backing in supporting these initiatives.

Additionally, Lagarde delved into the current economic landscape of Europe, ongoing efforts in US-EU economic cooperation, and the broader implications of geopolitical challenges. Addressing inquiries about Europe’s inflation management compared to the United States, she noted the ongoing dynamics and emphasized the distinct nature of inflation in each region.

Highlighting the robust employment market amidst economic uncertainties, Lagarde expressed cautious optimism regarding the eurozone’s recovery trajectory, foreseeing gradual improvements through 2024.

Furthermore, Lagarde addressed the substantial economic growth disparity between the eurozone and the United States, attributing it to factors such as the sovereign debt crisis and lack of fiscal union in Europe. She underscored the urgent need for comprehensive structural reforms and enhanced integration of the single market to bridge the productivity gap.

Amidst ongoing economic and geopolitical crises, Lagarde envisioned opportunities for Europe to carve out a more autonomous economic path. She emphasized the development of a robust financial infrastructure to support innovation and entrepreneurship within the continent, particularly in addressing climate change.

Regarding global economic relations, Lagarde stressed the importance of continued collaboration among trusted global partners, cautioning against protectionist policies. She also addressed the utilization of frozen Russian assets to aid Ukraine, emphasizing the need for careful consideration due to legal and financial stability concerns.

On the topic of monetary policy, Lagarde reaffirmed her commitment to price stability and advocated for a steady approach to managing Europe’s inflation rates, resisting immediate changes to existing frameworks.

Lastly, discussing the role of artificial intelligence (AI) in shaping Europe’s future, Lagarde acknowledged its transformative potential while emphasizing the need to navigate associated risks cautiously.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/