JPY: Japan’s CPI rises 2.7% YoY in March vs. expected 2.7%

The Japan CPI Data came at March month is 2.7% YoY versus 2.8% printed in the previous month. The Japanese Yen moved higher against counter pairs after the data printed. The BoJ Governor Ueda said weakness Yen pushed inflation higher in the economy seen in the future then we will do rate hikes in the monetary policy settings.

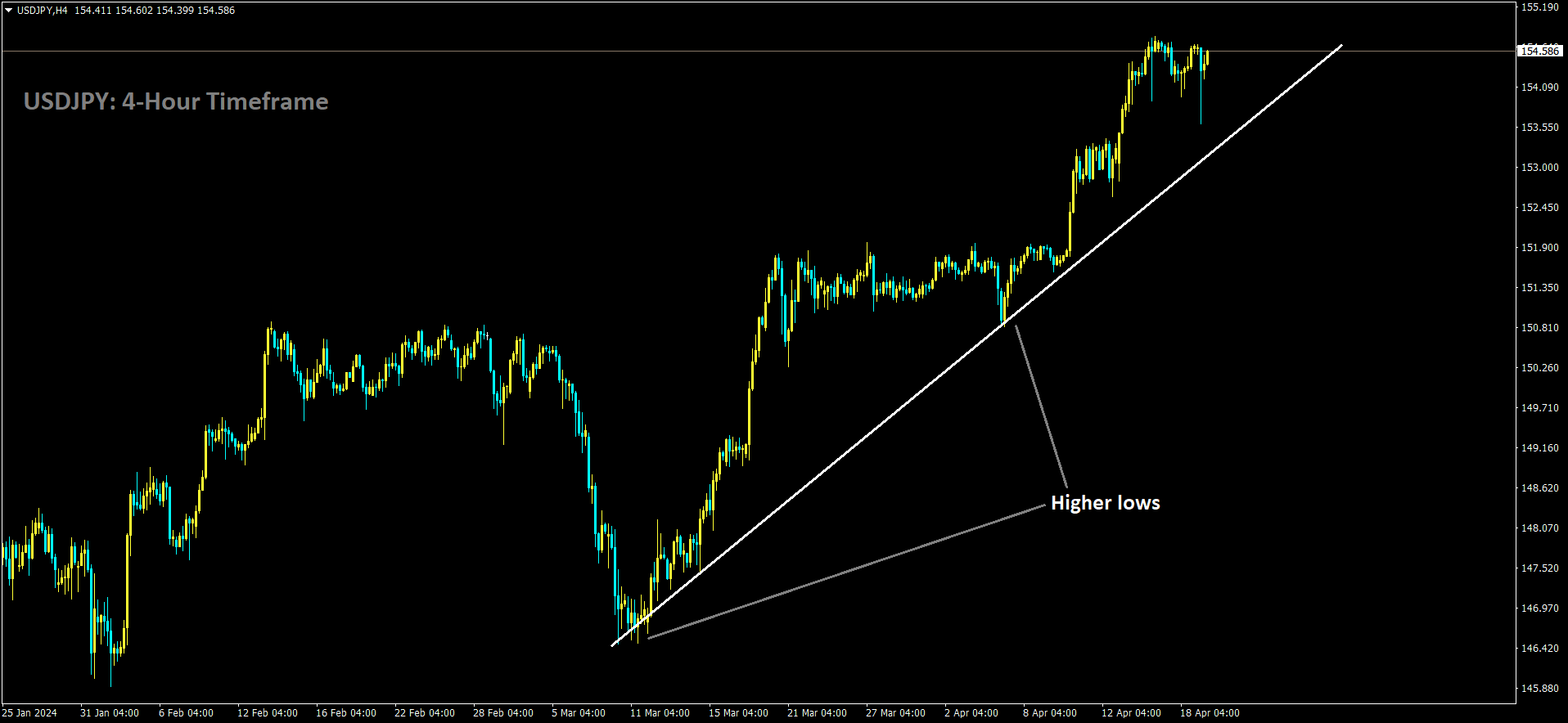

USDJPY is moving in Ascending trend line

In March, Japan’s National Consumer Price Index (CPI) showed a year-on-year increase of 2.7%, as reported by the Japan Statistics Bureau. This marks a slight decrease from the previous month’s 2.8% rise in February.

Breaking down the data, the National CPI excluding fresh food stood at a 2.6% year-on-year increase in March, down from the 2.8% recorded in the previous month. This figure fell short of market expectations, which had anticipated a 2.7% increase.

JPY: March core inflation in Japan decelerates, complicating BOJ’s stance with weak yen

The Japan CPI Data came at March month is 2.7% YoY versus 2.8% printed in the previous month. The Japanese Yen moved higher against counter pairs after the data printed. The BoJ Governor Ueda said weakness Yen pushed inflation higher in the economy seen in the future then we will do rate hikes in the monetary policy settings.

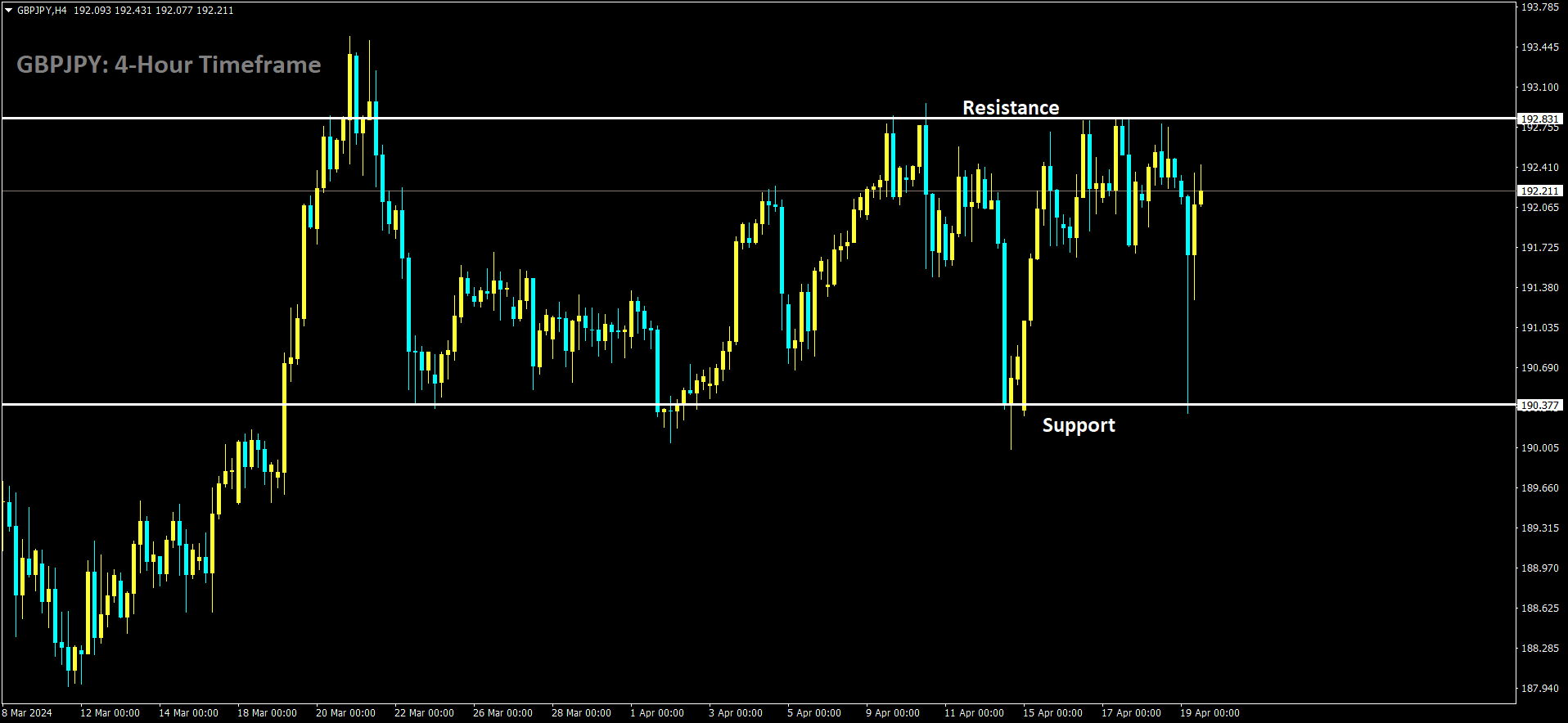

GBPJPY is moving in box pattern and market has rebounded from the support area of the pattern

In March, Japan’s core inflation eased, with an index tracking broader price trends falling below 3% for the first time in over a year, according to data released on Friday. The nationwide core consumer price index (CPI), excluding fresh food but including energy items, rose 2.6% from a year earlier, aligning with median market forecasts. This deceleration from February’s 2.8% increase was attributed to a slowdown in food price hikes but remained above the central bank’s 2% target.

Meanwhile, a key indicator of price gains, excluding fresh food and energy costs, closely monitored by the Bank of Japan (BOJ), moderated to 2.9% after a 3.2% rise in February. This marked the first time since November 2022 that the index dipped below 3%.

Analysts noted that while the slowdown in goods prices was within the BOJ’s expectations, factors like the yen’s depreciation and rising crude oil prices due to Middle East tensions were unexpected.

As the central bank shifts away from its long-standing super-easy monetary policy, markets are keenly observing hints regarding the timing of the next rate hike. The BOJ is anticipated to maintain short-term interest rates at its upcoming policy meeting on April 26, where it will also unveil updated CPI and GDP growth projections.

Further data expected next week is likely to indicate a deceleration in Tokyo-area core inflation, excluding fresh food prices, one month ahead of nationwide figures.

Ben McMillan, chief investment officer at IDX Advisors, suggested that strong economic data coupled with the potential for higher interest rates for an extended period should prompt investors to prepare for a new economic landscape.

While consumer inflation is projected to slow, the BOJ’s attention is focused on whether service prices, bolstered by increased wage growth, will begin to rise. BOJ Governor Kazuo Ueda hinted that the central bank might raise interest rates again if significant yen declines notably boost inflation. The BOJ maintains that achieving its 2% price target sustainably, alongside robust wage growth, is crucial for policy normalization.

JPY: March CPI in Japan meets forecasts; Core CPI falls short

The Japan CPI Data came at March month is 2.7% YoY versus 2.8% printed in the previous month. The Japanese Yen moved higher against counter pairs after the data printed.The BoJ Governor Ueda said weakness Yen pushed inflation higher in the economy seen in the future then we will do rate hikes in the monetary policy settings.

AUDJPY is moving in Ascending channel and market has rebounded from the higher low area of the channel

In March, Japan’s consumer price index (CPI) inflation followed expectations, maintaining its growth trajectory while showing a slight deceleration compared to the previous month. This occurred amidst softer spending trends, leading to core CPI inflation missing expectations.

The core CPI, excluding volatile fresh food prices, expanded by 2.6% year-on-year in March, as per official data released on Friday. This figure slightly undershot expectations of a 2.7% increase and marked a slight decline from the 2.8% growth observed in the preceding month.

Another significant metric, the core CPI excluding both fresh food and energy prices, which is closely monitored by the Bank of Japan (BOJ) as a gauge of underlying inflation, saw growth of 2.9% in March. This represented a decrease from the 3.2% rise recorded in February and marked its lowest pace of growth since November 2022, following a notable peak last year.

The headline CPI, which encompasses all goods and services, rose by 2.7% in March, aligning with expectations and maintaining stability compared to the prior month.

Over the past year, Japanese consumer inflation has gradually eased, moving closer to the Bank of Japan’s 2% annual target. This trend has been influenced by factors such as sluggish wage growth, a weak yen, and a slowdown in economic growth, which have tempered consumer spending.

USDJPY has broken Ascending Triangle in Upside

However, the trajectory of consumer inflation is expected to shift in the coming months, particularly due to significant wage increases secured by major Japanese labor unions this year. The BOJ’s decision to implement its first interest rate hike in 17 years in March, citing anticipated persistence in inflation as wages rise, further underscores this expectation. Yet, the path for future rate hikes by the central bank remains uncertain, suggesting that Japanese monetary policy is likely to remain accommodative in the near term.

In this context, expectations for inflation in Japan continue to be anchored by prevailing economic conditions and monetary policy dynamics.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/