CHF: SNB’s Jordan: Inflation Monitoring and Policy Adjustments Ahead

SNB Chairman Thomas Jordan said at Shareholder meeting today, inflation is cool down by our rate hikes, Inflation will be remain elevated at any time, Shocks are come at any time, we are focusing more on monetary policy settings, rate cuts are possible if data remain cool down in the market. Swiss Franc depreciated after the Dovish speech of SNB Chairman.

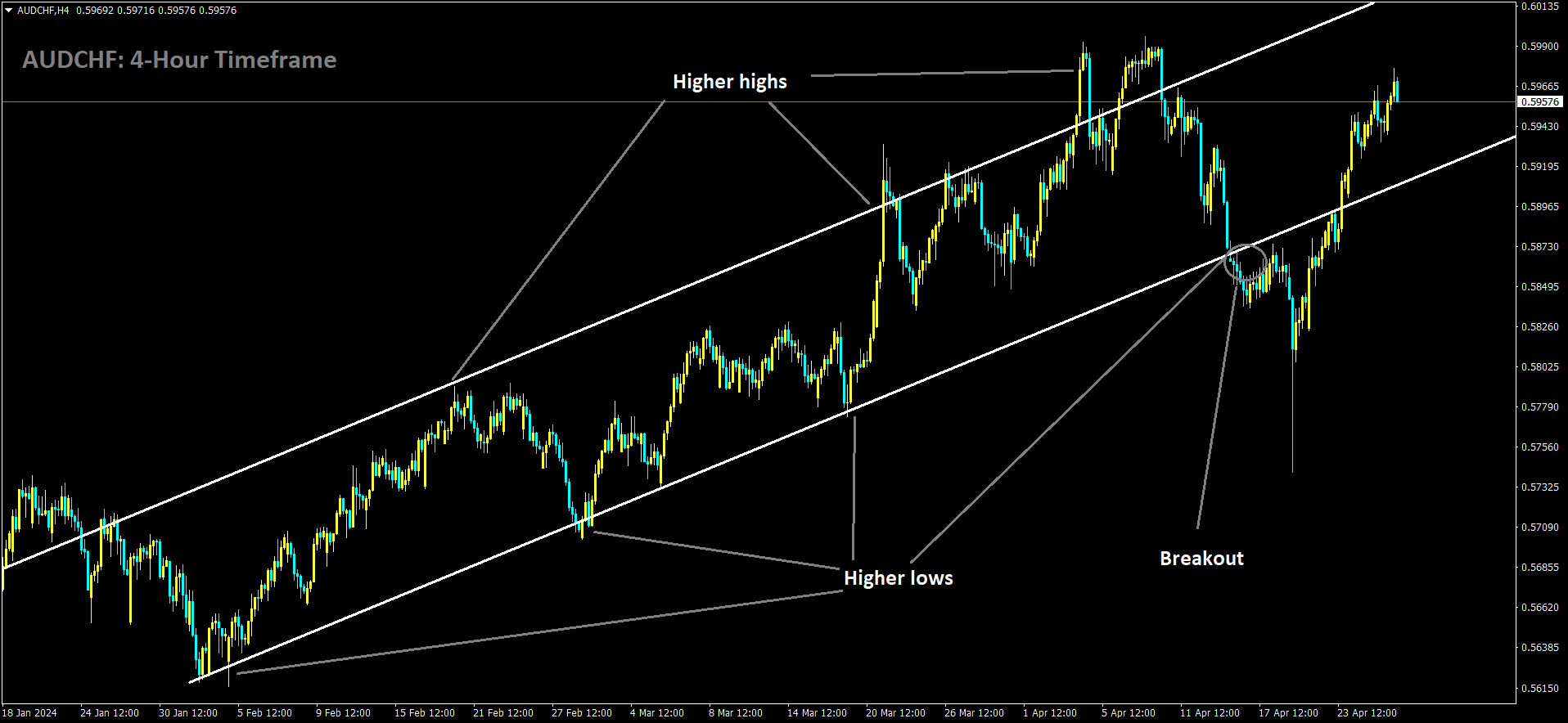

AUDCHF is moving in Ascending channel and market has rebounded from the higher low area of the channel

Swiss National Bank (SNB) Chairman Thomas J. Jordan addressed shareholders at the SNB’s General Meeting on Friday, highlighting the central bank’s commitment to closely monitoring inflation dynamics. He emphasized the SNB’s readiness to “adjust policy again when necessary,” indicating a proactive approach to maintaining economic stability.

Jordan referenced the SNB’s recent decision in March to lower its main policy rate by 0.25 percentage points to 1.5%, a move that caught markets by surprise. Despite this adjustment, he expressed confidence in the SNB’s ability to effectively combat inflationary pressures.

Acknowledging the prevailing uncertainty in global economic conditions, Jordan emphasized the potential for unforeseen shocks to disrupt stability at any time. However, he reaffirmed the SNB’s unwavering focus on price stability as a cornerstone of its monetary policy framework.

Responding to critics who advocate for broadening the SNB’s mandate, Jordan cautioned against such proposals, labeling them as “dangerous.” He stressed the importance of maintaining the central bank’s current mandate, which prioritizes price stability, as essential for safeguarding Switzerland’s economic resilience.

CHF: Swiss franc unaffected by SNB’s Jordan remarks

The Swiss franc maintains its stability on Friday, with the USD/CHF pair showing little movement around 0.9118 during the European trading session.

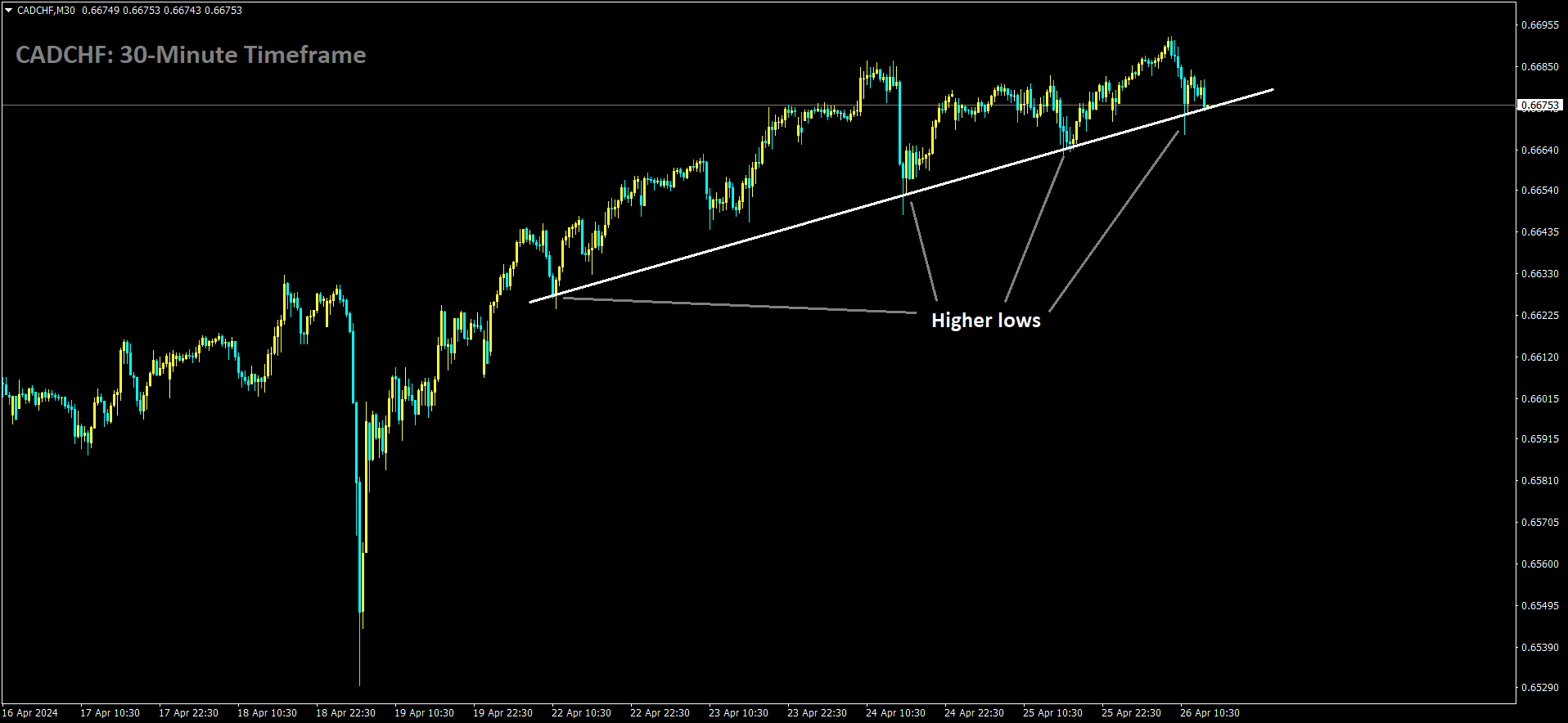

CADCHF is moving in Ascending trend line and market has reached higher low area of the pattern

Recent trends have depicted a volatile journey for the Swiss franc, notably reaching eight-year highs against the US dollar towards the end of 2023. However, 2024 has seen a significant reversal, witnessing a robust 8.2% surge of the US dollar against the Swiss currency. This depreciation of the franc aligns with the Swiss National Bank’s (SNB) objectives, as it bolsters the competitiveness of Swiss exports in the global market. The SNB’s strategic stance towards the franc’s value has remained consistent, with a preference for its depreciation to support export competitiveness and curb inflation, particularly when it approached the 0% to 2% target range.

In response to economic conditions, the SNB made the noteworthy decision to lower interest rates in March, marking a pivotal move as one of the first major central banks to do so. Although market expectations hint at further rate cuts in June and September, SNB President Jordan expressed a cautious tone in a recent speech, emphasizing the bank’s readiness to adjust monetary policy “if necessary” amidst global uncertainties.

Switzerland’s economic landscape has shown resilience, with stable inflation and overall economic health, allowing room for the SNB’s monetary maneuvering. The Credit Suisse Economics Expectations index corroborates this sentiment, showing a positive trajectory, reaching 17.6 in April after over two years of negative readings, indicating a shift towards optimism.

Market attention remains focused on the upcoming release of the US Core Personal Consumption Expenditures (PCE) Price Index, a key metric in the Federal Reserve’s inflation assessment. Forecasts anticipate a slight moderation to 2.6% year-on-year for April from the previous 2.8%, with monthly figures expected to hold steady at 0.3%. The trajectory of consumer inflation in the US plays a crucial role in shaping the Fed’s interest rate policies, with recent trends suggesting a delay in anticipated rate cuts due to mounting inflationary pressures.

CHF: SNB’s Jordan Alerts of Possible New Inflation Shocks

SNB Chairman Thomas Jordan said at Share holder meeting today, inflation is cool down by our rate hikes, Inflation will be remain elevated at any time, Shocks are come at any time, we are focusing more on monetary policy settings, rate cuts are possible if data remain cool down in the market. Swiss Franc depreciated after the Dovish speech of SNB Chairman.

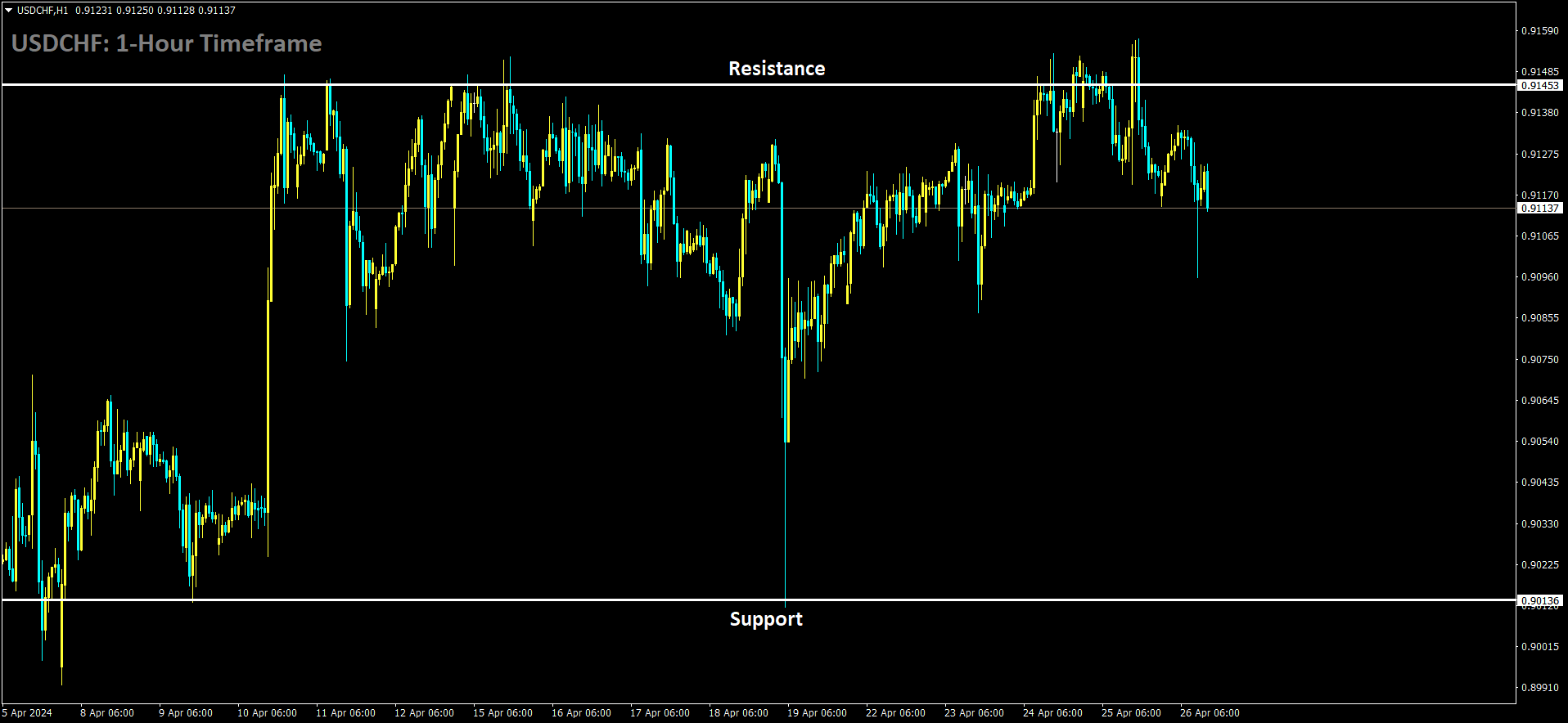

USDCHF is moving in box pattern and market has fallen from the resistance area of the pattern

Swiss National Bank (SNB) President Thomas Jordan issued a warning about the potential for new inflation shocks amidst ongoing global uncertainties, despite Switzerland’s commendable track record in maintaining price stability. Speaking at the central bank’s annual shareholder meeting in Bern, Jordan emphasized the need for vigilance in monitoring inflation trends and signaled readiness to adjust monetary policy as needed.

The SNB has been proactive in responding to economic challenges, initiating interest rate cuts in March ahead of other central banks, with further rate adjustments anticipated in June and September. However, Jordan cautioned that the favorable consumer-price outlook could face risks, highlighting the ever-present possibility of unforeseen shocks impacting the economy.

Jordan’s tenure at the SNB is set to conclude at the end of September, prompting discussions about his successor. While Vice President Martin Schlegel is a likely candidate, the transition has sparked calls for broader reforms within the institution.

Addressing concerns raised about the SNB’s operations, Barbara Janom Steiner, head of the supervisory Bank Council, affirmed the institution’s capability to fulfill its mandate without the need for significant reforms. She emphasized the importance of preserving the central bank’s independence and institutional framework to safeguard price stability and social cohesion.

The shareholder meeting also attracted attention from climate activists, protesting against the SNB’s investments in companies contributing to environmental degradation. Janom Steiner reiterated the SNB’s commitment to prioritizing equity capital over government payouts, citing the institution’s financial challenges stemming from recent losses.

Despite reporting a significant profit for the first quarter, uncertainties persist regarding the possibility of payouts due to potential losses from foreign-exchange assets. The SNB, although publicly listed, operates with limited shareholder influence over monetary policy decisions, with the majority of shares held by Swiss cantons and cantonal banks.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/