Mastering the Art of Forex Scalping: Strategies for Quick Wins in the Currency Market

The world of Forex trading is both exhilarating and daunting, especially when you’re aiming to master the rapid-fire strategy known as scalping. This high-frequency trading technique, if wielded with precision and savvy, can be a lucrative endeavor. However, it demands more than just a quick trigger finger; it requires a deep understanding of the market’s nuances, a robust set of strategies, and an iron-clad emotional discipline. In this comprehensive guide, we’ll dive into the art of Forex scalping, offering you tactical insights and strategies to help you notch up quick wins in the currency market. So, buckle up and get ready to turbocharge your trading skills!

Understanding Forex Scalping

What Is Forex Scalping?

Forex scalping is a trading strategy that involves making a large number of trades within a single day, aiming to capture small profits from each. This method relies on the belief that smaller, frequent wins can cumulatively amount to significant gains. Scalpers, as practitioners are known, operate on razor-thin margins and leverage high volumes to make their mark.

The Appeal of Scalping

The allure of scalping lies in its potential for immediate gratification. Unlike long-term strategies that can take months to bear fruit, scalping offers the possibility of daily returns. This immediacy, combined with the thrill of constant engagement with the market, makes scalping an attractive approach for traders looking for action and quick outcomes.

Strategies for Successful Scalping

1. Leverage and Risk Management

In the high-stakes game of scalping, understanding and managing your leverage is crucial. High leverage can amplify gains but also magnify losses. Successful scalpers meticulously manage their risk, often risking only a small percentage of their trading capital on a single trade.

2. Technical Analysis Mastery

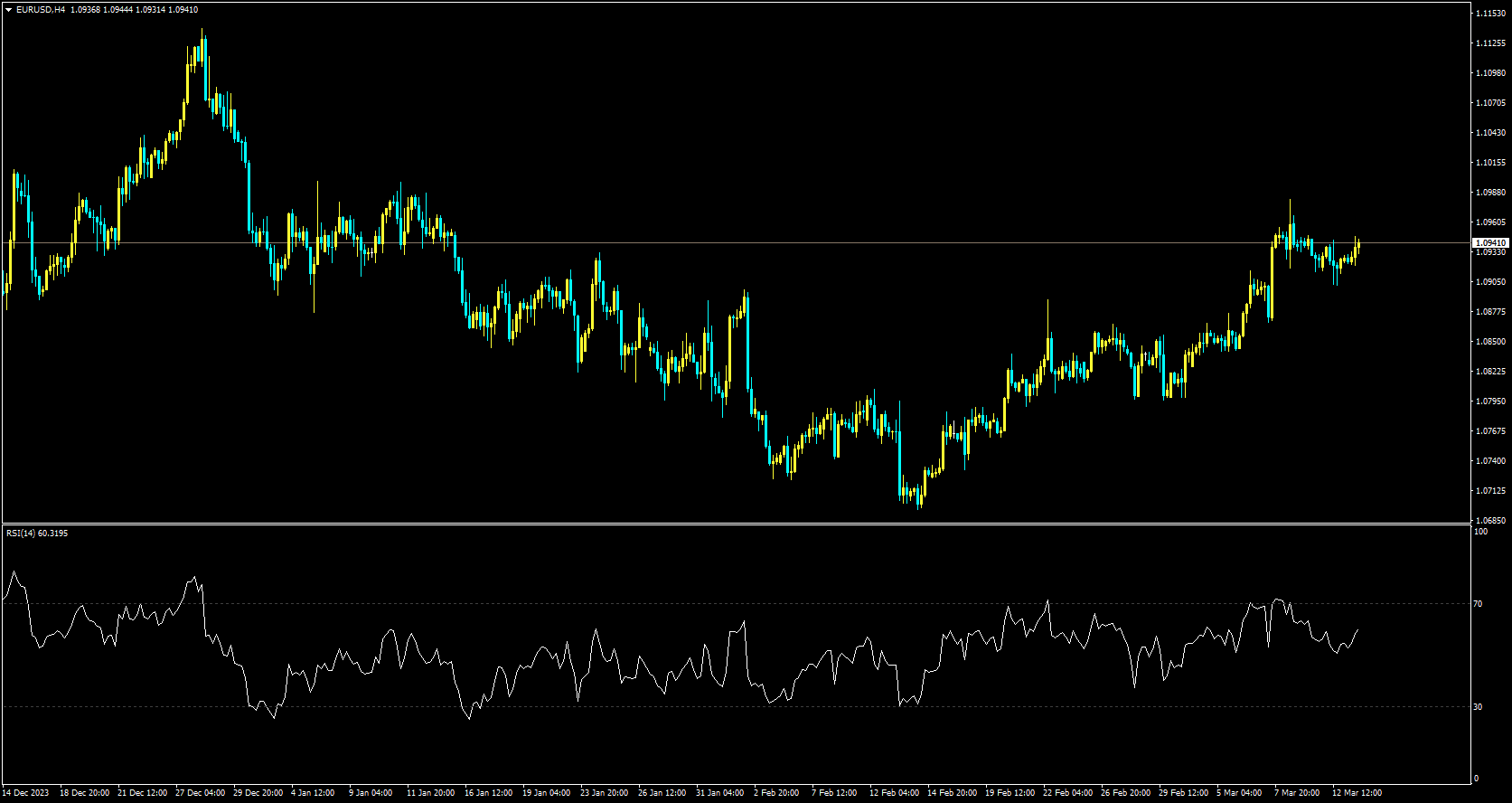

At the heart of scalping lies technical analysis. Scalpers become experts in reading charts, identifying patterns, and understanding indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

Mastery of these tools allows scalpers to make quick, informed decisions.

Choosing the Right Broker and Platform

Why Broker Choice Matters

Not all brokers are conducive to scalping. Some may have policies that limit the strategy’s effectiveness, such as wider spreads or restrictions on trading around news announcements. Choosing a broker that offers tight spreads and supports high-frequency trading is crucial for a scalper’s success.

The Importance of a Scalp-Friendly Platform

Similarly, the trading platform can make or break a scalper’s strategy. Platforms that offer rapid execution, real-time charting, and the ability to customize indicators are essential. Many scalpers prefer platforms that also provide automation capabilities, allowing them to execute strategies faster than any manual trader could.

Timing and Market Conditions for Scalping

Best Times to Scalp

Scalping opportunities are not uniform throughout the day. The best times to scalp are typically when the market is most liquid, such as during the overlap of the New York and London trading sessions. High liquidity reduces the spread, making it easier to enter and exit trades quickly and at desirable prices.

Understanding Market Conditions

Not all market conditions are suitable for scalping. Highly volatile markets can present both opportunities and risks for scalpers. While volatility can lead to significant price movements (and thus opportunities for profit), it can also increase the risk of loss. Successful scalpers learn to read the market and adapt their strategies accordingly.

Psychological Aspects of Scalping

The Need for Emotional Discipline

Perhaps more than any other trading strategy, scalping demands exceptional emotional control. The fast-paced nature of scalping can be both exhilarating and exhausting, with the potential for rapid gains or losses. Successful scalpers maintain a cool head, sticking to their strategies even in the heat of the moment.

Dealing With Losses

Dealing with losses is an integral part of scalping. Even the most successful scalpers will face losses; what sets them apart is their ability to quickly move on and not let a loss affect their next trade. This resilience is crucial for maintaining the consistency needed to be profitable in the long term.

Key Tools and Indicators for Scalpers

Essential Technical Indicators

Scalpers rely heavily on technical indicators to guide their trading decisions. Popular choices include the Stochastic Oscillator, Bollinger Bands, and Fibonacci retracements. These tools help identify potential entry and exit points, giving scalpers an edge in the fast-moving market.

The Role of Automated Trading Systems

With the advent of sophisticated trading software, many scalpers have turned to automated systems to enhance their strategies. These systems can monitor the market and execute trades at speeds impossible for humans, providing a significant advantage. However, reliance on automation also requires a deep understanding of the system’s mechanics to avoid costly mistakes.

Building a Scalping Strategy

Developing a Trade Plan

A successful scalping strategy begins with a solid trade plan. This plan should outline your objectives, risk tolerance, and specific criteria for entry and exit points. By sticking to a well-defined plan, scalpers can maintain discipline and consistency in their trades.

Continuous Learning and Adaptation

The currency market is constantly evolving, and strategies that work today may not be effective tomorrow. Successful scalpers commit to continuous learning, staying abreast of market trends, and adapting their strategies to new information and conditions.

Conclusion

Mastering the art of Forex scalping is no small feat. It requires a blend of technical skill, psychological fortitude, and an unwavering commitment to strategy and discipline. By understanding the nuances of the market, choosing the right tools and platforms, and continuously refining your approach, you can turn the fast-paced world of scalping into a profitable venture. Remember, the path to scalping success is paved with patience, persistence, and a keen eye for detail. Happy trading!

FAQs

1. Is Forex scalping suitable for beginners?

Forex scalping is generally considered more suitable for experienced traders due to its fast-paced and demanding nature. Beginners may find it challenging to keep up with the rapid decision-making required.

2. How much capital do I need to start scalping?

The amount of capital required can vary widely depending on your broker’s minimum deposit requirements and the level of risk you’re willing to take. However, it’s possible to start with a relatively small amount, often as low as a few hundred dollars, if leveraging is used wisely.

3. Can scalping be automated?

Yes, many traders use automated trading systems to scalp more efficiently. These systems can execute trades based on predefined criteria at a speed and frequency that would be impossible for a human trader.

4. How do I choose the best broker for scalping?

Look for brokers that offer low spreads, high leverage, and support for high-frequency trading. Reading reviews and comparing broker policies can also help identify the best fit for your scalping strategy.

5. How important is technical analysis in scalping?

Technical analysis is crucial for scalping as it helps traders make informed decisions quickly. Mastery of chart reading, indicators, and market patterns is essential for identifying profitable trading opportunities.