Mastering the Art of Forex Swing Trading: Strategies for Capturing Market Moves

Forex swing trading stands as a pivotal strategy for traders aiming to capture gains in the currency market by holding positions from several days to weeks. This approach contrasts sharply with the high-speed world of day trading or the long-term horizon of investing, carving out a niche that allows traders to benefit from market “swings” or cycles. In this comprehensive guide, we’ll dive deep into the art of forex swing trading, unraveling strategies, tools, and tips to help you navigate and profit from the ebbs and flows of the market.

Understanding Forex Swing Trading

Before we leap into the strategies, let’s establish a foundational understanding of forex swing trading. This trading style is all about momentum, identifying when a currency pair is moving towards a particular direction and riding the wave until it shows signs of reversal. It’s a perfect middle ground for those who find day trading too frenetic and long-term investing too sluggish.

Why Choose Forex Swing Trading?

Forex swing trading offers several advantages. Firstly, it allows traders to take a step back, avoiding the noise and stress of intraday movements. This broader perspective enables more informed decisions based on overall trends rather than fleeting fluctuations. Secondly, it’s time-efficient. You don’t need to glue yourself to the screen; a few hours a week may suffice to monitor and adjust your positions.

The Key Components of Swing Trading

At its core, swing trading in the forex market revolves around three main components: technical analysis, fundamental analysis, and risk management. Technical analysis helps in charting and understanding market patterns, while fundamental analysis provides insight into the economic factors that influence currency movements. Risk management, perhaps the most crucial aspect, involves setting stop-loss orders and determining position sizes to protect your capital.

Crafting Your Swing Trading Strategy

financial moves

A successful swing trading strategy is a blend of meticulous analysis, disciplined execution, and continuous learning. Let’s break down the elements you need to consider when crafting your approach.

Technical Analysis for Swing Traders

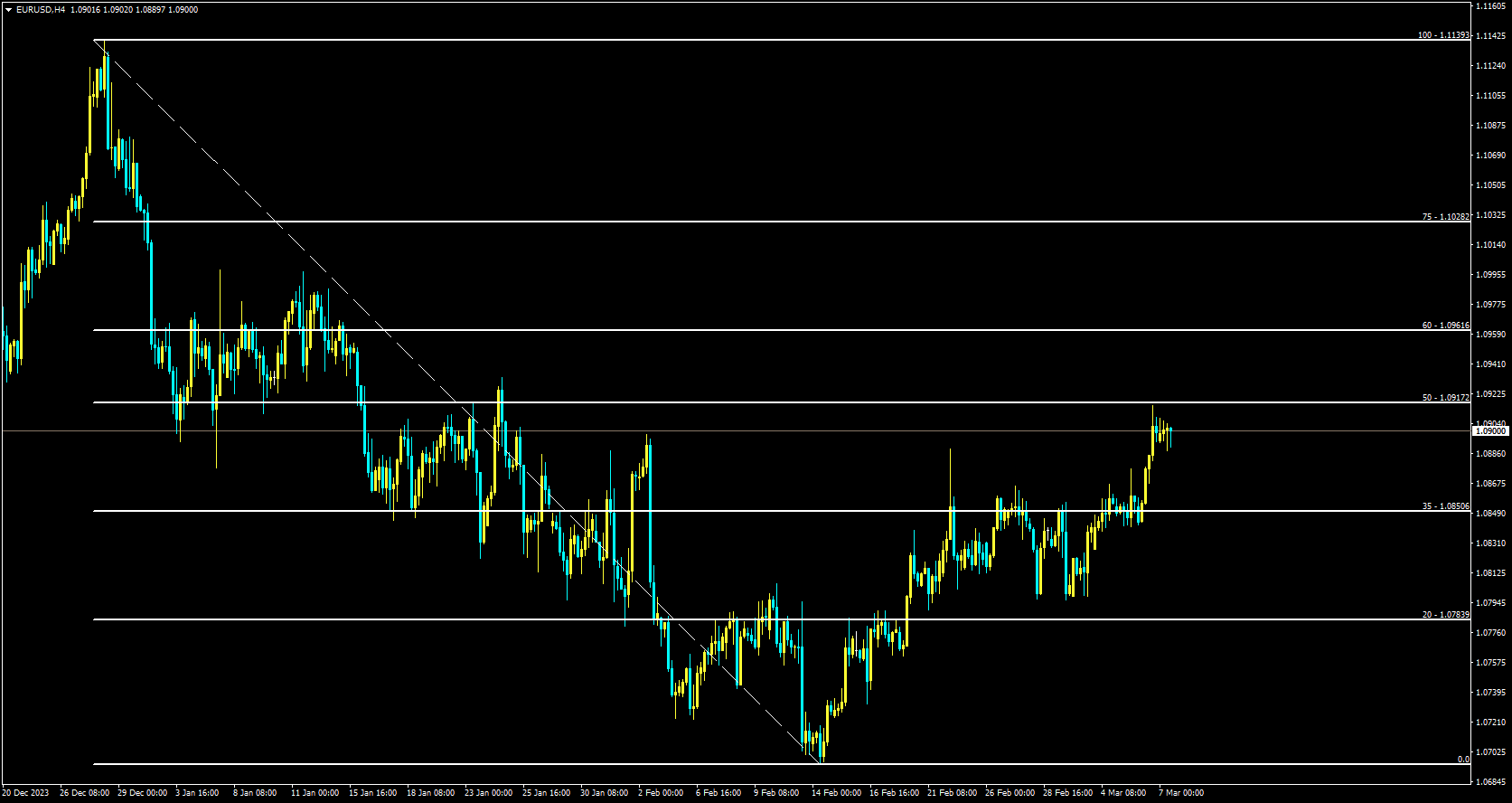

Technical analysis is the bread and butter of swing trading. It involves analyzing price charts, identifying support and resistance levels, and using indicators and patterns to forecast future movements.

Tools like moving averages, Relative Strength Index (RSI), and Fibonacci retracements are invaluable for spotting trends and timing entries and exits.

Incorporating Fundamental Analysis

While technical analysis takes the spotlight in swing trading, incorporating fundamental analysis can provide a significant edge. Keeping an eye on economic calendars for events like interest rate decisions or employment reports can help you anticipate market movements. Understanding the broader economic context adds depth to your strategy, allowing you to avoid potential pitfalls or capitalize on trend-confirming news.

Risk Management: The Unsung Hero

Proper risk management can be the difference between thriving and surviving in the forex market. It’s all about protecting your capital to trade another day.

Setting Stop-Loss and Take-Profit Levels

One of the first steps in risk management is setting stop-loss orders to limit potential losses. Equally important is determining take-profit levels to secure gains. These should be set based on technical levels and your trading strategy’s risk-reward ratio, ensuring that potential rewards justify the risks.

Position Sizing and Leverage

Another aspect of risk management is deciding how much capital to allocate to each trade. This decision should factor in the overall volatility of the currency pair and the size of your trading account to avoid overexposure. Leverage can amplify gains but also losses, so it’s crucial to use it judiciously.

Advanced Swing Trading Techniques

As you gain experience, there are several advanced techniques you can incorporate into your swing trading arsenal to further enhance your strategy.

Using Multiple Time Frame Analysis

Multiple time frame analysis involves looking at currency pairs across different time frames to get a comprehensive view of the market. This technique can help in identifying the primary trend on longer time frames while fine-tuning entry and exit points on shorter ones.

The Role of Price Action Trading

Price action trading is a technique that relies solely on historical price movements to make trading decisions. For swing traders, mastering price action can provide a clearer insight into market sentiment, offering clues beyond what indicators alone can reveal.

The Psychological Aspect of Swing Trading

The mental and emotional aspects of trading can significantly impact your success. Developing the right mindset and staying disciplined with your strategy are key.

Patience and Discipline

Swing trading requires patience to wait for the right trading opportunities and discipline to stick to your strategy even when emotions run high. Avoid the temptation to overtrade or deviate from your plan based on impulses.

Continuous Learning and Adaptation

The forex market is ever-evolving, and so should your swing trading strategy. Regularly review your trades, learn from your successes and failures, and stay informed about market developments to refine your approach.

Conclusion

Mastering the art of forex swing trading is a journey that combines strategy, discipline, and continuous learning. By understanding the nuances of technical and fundamental analysis, implementing robust risk management practices, and honing your psychological fortitude, you can navigate the complexities of the forex market and capture significant moves. Remember, every trader’s journey is unique, so adapt these strategies to fit your trading style and goals.

Now, let’s address some FAQs that might arise as you embark on your forex swing trading adventure.

FAQs

1. How much capital do I need to start forex swing trading?

- The amount of capital required can vary widely depending on your broker’s requirements, your risk management practices, and your financial goals. It’s possible to start with a relatively small account, but having more capital provides greater flexibility and risk diversification.

2. Can I swing trade with a full-time job?

- Yes, one of the advantages of swing trading is that it doesn’t require constant market monitoring. With proper planning and strategy, you can manage your trades alongside a full-time job.

3. How do I choose which currency pairs to trade?

- Focus on currency pairs that are liquid and have enough volatility to present trading opportunities, yet not so volatile that they present excessive risk. Major pairs like EUR/USD, GBP/USD, and USD/JPY are popular choices among swing traders.

4. What is the best time frame for forex swing trading?

- There’s no one-size-fits-all answer, but many swing traders find success with the daily and 4-hour charts. These time frames provide a good balance between seeing the bigger picture and identifying actionable trade setups.

5. How do I know when to exit a trade?

- Exiting a trade should be based on your trading strategy’s predetermined criteria, such as reaching a technical target, a stop-loss getting hit, or a fundamental change affecting your trade rationale. Consistency in following your exit strategy is crucial for long-term success.