BTCUSDT: US Treasury’s Refinancing Announcement Crucial for Bitcoin Bull Run Revival

The US Treasury Secretary Janet Yellen is planned to sell the Government bonds worth Rs.700 billion in Treasury General account, it is positive for Riskier assets like Crypto and other financial markets. More Bond issuances makes Bond yield to move lower then it move upside for Crypto assets as per economists view.

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

The recent announcement by the US Treasury regarding refinancing initiatives is poised to provide a critical boost to high-risk assets, particularly cryptocurrency. This announcement is expected to act as a catalyst for a market rally, particularly if the Treasury General Account (TGA) is either maintained at or reduced below $750 billion.

The refinancing announcement outlines the 90-day borrowing requirements, with the balance to be retained in the TGA, set to mature on May 1. Market observers anticipate a potential decrease in gross bond issuance for the first time in two years, offering much-needed relief to the markets.

Over the past few weeks, activity levels in the cryptocurrency community have been lackluster, with leading cryptocurrency Bitcoin primarily trading within a range-bound pattern.

Crypto enthusiasts are eyeing a potential resurgence in the broader uptrend following the quarterly refinancing announcement (QRA). US Treasury Secretary Janet Yellen’s announcement aims to provide relief for riskier assets amid the post-COVID recovery efforts and the challenge of record debt, inflation, and higher interest rates.

Yellen’s announcement sheds light on the duration and size of bond issuance, as well as the balance held within the TGA. The debt issuance plan is expected to stimulate markets through the yield channel.

The realization of higher bond issuance typically leads to a decline in bond prices and an increase in yields, disincentivizing risk-taking in financial markets. Conversely, reduced issuance has the opposite effect.

The upcoming QRA is expected to provide relief, with lower financing needs in the second quarter due to tax payments filling federal coffers. This is anticipated to result in a decline in gross issuance of marketable treasury securities, marking a significant turnaround from the uptrend observed since the second quarter of 2022.

The focus of the market is shifting towards the announcement clarifying the TGA level, which plays a crucial role in facilitating tax revenue collection and managing public debt receipts.

The balance of the TGA is instrumental in influencing economic activity and market sentiment. Draining the TGA balance can lead to increased lending by commercial banks, promoting monetary easing across financial markets and the broader economy.

Crypto market experts anticipate a rally in risk assets, including cryptocurrency, if the TGA remains at or below the $750 billion target. Conversely, raising the TGA target could pose challenges for risk assets.

Crypto industry leaders foresee the potential for a renewed bull market, especially if the Treasury halts the issuance of long-term Treasuries, leading to a liquidity surge that could reignite the crypto bull run.

BTCUSDT: Bitcoin and Ether Suffer Amid U.S. Stagflation Concerns

The forthcoming action by the US Treasury Secretary Janet Yellen to sell government bonds worth Rs. 700 billion from the Treasury General Account is poised to have a favorable impact on riskier assets, including cryptocurrencies and other financial markets. This initiative is anticipated to stimulate market dynamics in a positive direction.

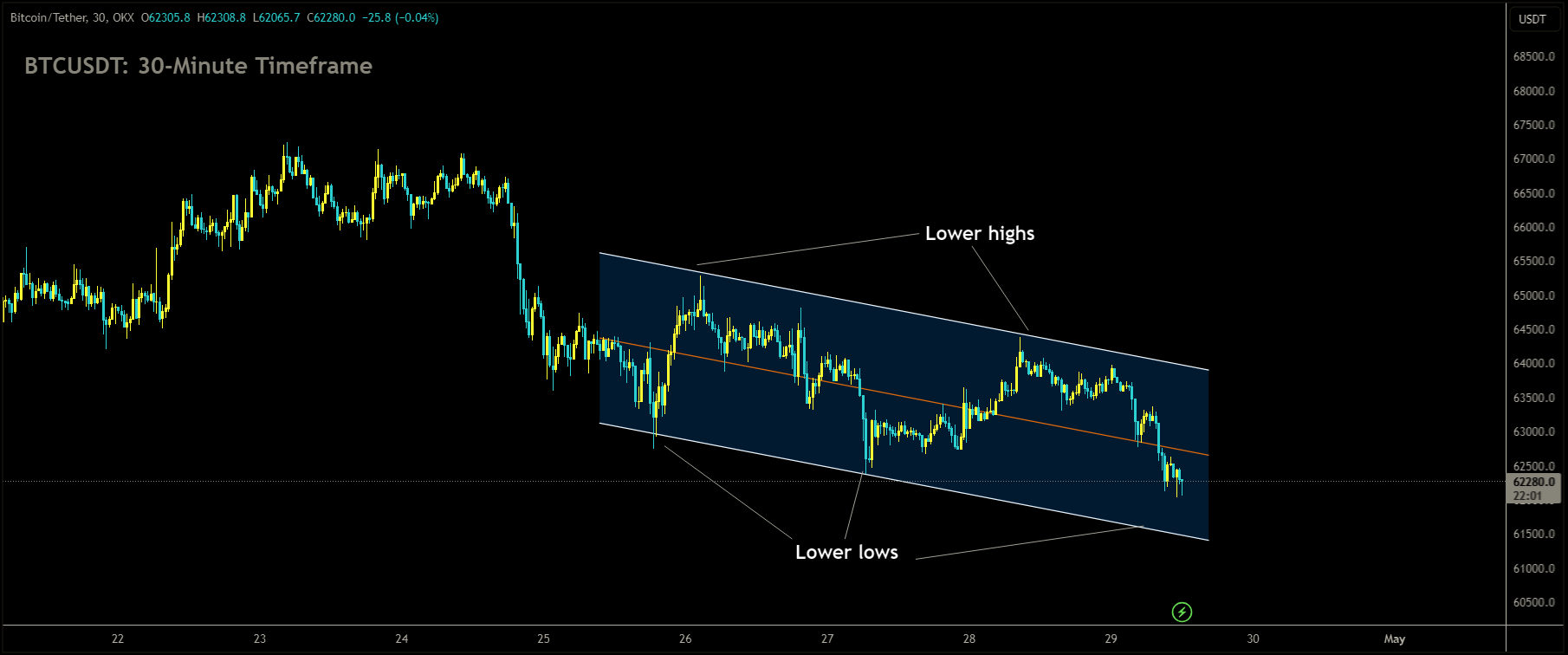

BTCUSDT is moving in Descending channel and market has fallen from the lower high area of the channel

The sale of government bonds is expected to increase the supply of bonds in the market. As a result, bond yields, which move inversely to bond prices, are likely to decrease. This downward movement in bond yields is viewed as advantageous for cryptocurrency assets and other riskier investments by economists.

Lower bond yields often prompt investors to seek higher returns elsewhere, such as in cryptocurrencies. Consequently, this influx of capital into the crypto market can drive up the prices of digital assets.

Economists suggest that the correlation between bond yields and cryptocurrency prices stems from investors’ search for alternative investment opportunities in response to changing market conditions. When bond yields decline, investors may allocate more funds to cryptocurrencies, leading to an upward movement in their prices.

In summary, the US Treasury’s plan to sell government bonds from the Treasury General Account is expected to exert a positive influence on riskier assets like cryptocurrencies. The resultant decrease in bond yields could potentially drive increased investment flows into the crypto market, contributing to upward price movements in digital assets.

Cryptocurrency markets are experiencing a downturn amid resurfacing concerns regarding U.S. stagflation, a scenario feared by risk asset investors.

Bitcoin (BTC), the foremost cryptocurrency by market capitalization, was hovering around $62,400 at the time of reporting, marking a 2.5% decline over the past 24 hours, according to data from CoinDesk Indices. Ether (ETH) followed suit, trading 3% lower at $3,200, while the CoinDesk 20 (CD20), representing the most liquid digital assets, showed a 2.6% decrease, settling at 2,197 points.

The current market sentiment is marked by uncertainty as it grapples with conflicting bullish and bearish narratives.

Analysts, such as those at QCP, have highlighted the looming threat of stagflation, characterized by high inflation coupled with low economic growth. QCP pointed out that recent economic indicators, including a weaker-than-expected U.S. GDP growth rate and a rise in the Core PCE inflation index, are indicative of this challenging economic environment.

The latest U.S. GDP report revealed a 1.6% annualized growth rate in the first quarter of the year, down from the previous quarter’s 3.4% growth. Concurrently, the personal consumption expenditures price (PCE) index, a key inflation metric for the Federal Reserve, showed a surge to a 3.4% annualized rate in the first quarter from 1.8% in the previous quarter.

The combination of sluggish economic growth and persistent inflationary pressures has dampened expectations of potential Federal Reserve rate cuts.

While the majority of traders on prediction market platform Polymarket still anticipate no rate cuts as the most probable outcome, there is a growing likelihood of at least one rate cut, with the probability rising to 29%. QCP also suggested that Janet Yellen’s fiscal strategy, involving the Treasury General Account (TGA) and the Reverse Repurchase Program (RRP), could inject up to $1.4 trillion in liquidity into the financial system, influencing all risk assets.

The upcoming quarterly refunding announcement by the U.S. Treasury holds significant importance for the continuation of the bitcoin bull market. This announcement, maintaining or reducing the current TGA balance of $750 billion, serves as a crucial signal to financial markets about the U.S. government’s fiscal stance, influencing economic stability and growth.

Additionally, the launch of bitcoin exchange-traded funds (ETFs) in Hong Kong on April 30 has garnered attention from traders. However, the news that mainland Chinese investors will not be able to trade these ETFs has tempered the initial bullish sentiment surrounding the launch.

BTCUSDT: Bitcoin and Ether prices decline amidst U.S. stagflation fears

Janet Yellen, serving as the United States Treasury Secretary, has announced plans to conduct an auction of Government bonds valued at Rs. 700 billion from the Treasury General Account. This strategic maneuver is anticipated to exert a favorable influence on various financial sectors, including riskier assets like cryptocurrencies. Economists posit that the augmentation of bond issuances commonly results in a reduction of bond yields. This downward trend in bond yields, economists argue, often coincides with upward movements in the prices of crypto assets. Thus, the impending auction is expected to stimulate positive developments across multiple financial markets.

BTCUSDT Market Price is moving in box pattern in market has reached support area of the pattern

Bitcoin (BTC), the foremost cryptocurrency by market capitalization, was observed to be trading near $62,400 at the time of reporting, marking a decline of 2.5% over a 24-hour period, according to data sourced from CoinDesk Indices. Ether (ETH) experienced a 3% decrease, settling at $3,200, while the CoinDesk 20 (CD20), which serves as a gauge for the most liquid digital assets, exhibited a 2.6% drop, recording 2,197 points.

The current market sentiment appears to be teetering on the edge as investors weigh conflicting narratives, debating the potential direction the market may take.

As noted in a recent analysis by QCP, the specter of stagflation—characterized by high inflation alongside low economic growth—is looming large. QCP emphasized the tangible risk posed by this economic phenomenon.

The latest U.S. GDP report highlighted that the world’s largest economy expanded at an annualized rate of 1.6% during the first quarter of the current year, following a growth rate of 3.4% in the preceding quarter. Meanwhile, the personal consumption expenditures price (PCE) index, considered as the Federal Reserve’s preferred inflation gauge, indicated a rise to a 3.4% annualized rate in the initial three months of the year, up from 1.8% in the final quarter of the previous year.

The convergence of slower economic growth and persistent inflationary pressures has further diminished the likelihood of Federal Reserve rate cuts.

While the majority of traders on the prediction market platform Polymarket anticipate no rate cuts as the most probable scenario, there is a growing probability of at least one rate cut, which has increased to 29% from 26% a week ago, and significantly higher than the 14% probability observed at the beginning of the month.

QCP also underscored the potential impact of Janet Yellen’s fiscal strategy, leveraging the Treasury General Account (TGA)—holding assets close to USD 1 trillion—and the Reverse Repurchase Program (RRP) with USD 400 billion. This strategy could potentially inject up to $1.4 trillion in liquidity into the financial system, thereby influencing the performance of all risk assets.

As highlighted in a recent analysis by CoinDesk’s Omkar Godbole, the upcoming quarterly refunding announcement by the U.S. Treasury will play a pivotal role in sustaining the ongoing bitcoin bull market. This announcement, which determines whether the current TGA balance of $750 billion is maintained or reduced, serves as a critical signal to financial markets, exerting a profound impact on economic stability and growth.

Meanwhile, the impending launch of bitcoin exchange-traded funds (ETFs) in Hong Kong on April 30 has attracted the attention of traders. However, the news that mainland Chinese investors will not have access to trade these ETFs has tempered the initial optimism surrounding the launch.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/